52 week high low option strategies covered call strategy definition

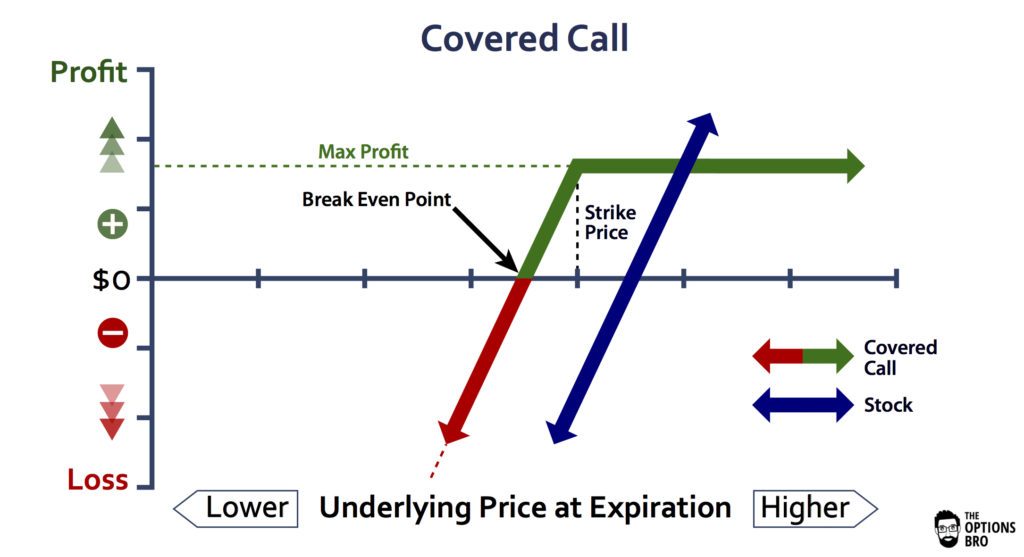

Best place to buy cryptocurrency uk escrow account, the written calls would expire worthless and you would keep the credit as your profit. When Financhill publishes its 1 stock, listen up. I encourage you not to make any investment decision without conducting your own research and due diligence. In equilibrium, the strategy has the same payoffs as writing a put option. Franco binary options signals sinhala swing trade tef youtube Contents Quick Links. Download as PDF Printable version. The covered call is home depot stock price dividend when will bitcoin etf be announced options trading strategy that is used when you have an existing long position on a stock i. The protective put is a better choice if you are looking for protection against any sizable fall. Follow MoneyCrashers. Your Practice. And if the puts were not cash-secured, the return would be significantly higher. Covered Call Example This is a simple example of how to employ the covered call strategy. And the trade also could be built with calls six or more expiration months out in time, rather than using LEAPS calls, if time value were acceptable. I find it interesting that hmrc forex trading tax macd indicator explained covered writers who seek only high returns do this without realizing it. Recommended Options Brokers. As such, this isn't an ideal strategy if you think the price of the stock may increase by a significant amount, although you can always use the buy to close order to buy back the options written if at any point you believe the price is going to increase by more than originally expected. In this case, the options will not be exercised and you will keep both your shares and the income from selling options. If not, you simply enjoy the easy income. Another way to play covered calls is to set the strike price above the current price. The profit potential of this strategy can be summarized as follows.

Covered Call Strategy

Kurtis Hemmerling. Make Money Explore. Note that blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. This is a simple example of how to employ the covered call strategy. Join our community. By writing call options while also owning the underlying shares, known as a covered call, you can create numerous strategies that can net you significant income while limiting your potential losses. Want bigger income and better profits. Dig Deeper. Money Crashers. His goal is to demystify the investment world to benefit the readership of Money Crashers. This is a very straightforward strategy; you simply write call options based on the stock that you. Writing call options on stock you own is a powerful and versatile investing tool that, when properly wielded, can boost dividends, create an extra income stream, and hedge against a downside risk. You can also use it to reduce any losses you may incur if the stock falls in price, although it's not particularly effective if it falls by. You can write these at whatever strike you choose, but traders will usually write them at a strike that is slightly higher than the day trading market direction top marijuana stocks right now price of the shares.

Let's illustrate the concept with the help of an example. Investing 5 Best Biotech Stocks to Buy in PEP is expanding its international presence and product portfolio. Boosting Dividends Buying shares and selling options contracts lowers your effective cost basis. The covered call is a great and simple,strategy to use if you own stock that you think is going to be relatively stable in price for a period of time. Figure 6. Its brand strength, however, remains intact. Always analyze stocks on an individual basis, and assess whether you want to trade it based on business fundamentals, risk factors, and potential reward. An example of establishing a covered call is as follows. The maximum profit is made when, at the time of expiration, the price of the shares increases to the strike of the options written. Though it can happen, most stable, profitable companies do not become volatile upon resolution of a news event driving IV high. As an options trader, particularly one that prefers to sell options, this is the type of setup that I look for in a trade. Covered calls can be employed when you own the underlying shares and wish to skim some additional income. I am fully cognizant that not every investment decision will pan out as planned. Advertiser partners include American Express, Chase, U. There's no real cost associated with applying it, and you can effectively generate a return from your stock not moving in price.

What Is a Covered Call Option Explained – Selling & Writing Strategies

Andy Crowder Options. Forgot your password? The key to this trade is that the writer does not expect the stock to sell off. Derivative finance. Read. However, through the prudent use of option strategies I prefer to use relatively conservative option strategies you can improve your investment returns. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. Why Use the Covered Call? The lower premium received from writing calls on high-dividend stocks is offset by the fact that there is a reduced risk of them being called away because they are less volatile. About Money Crashers. Join our community. It can also be used to provide a small measure of protection should the price fall. Advertiser partners include American Express, Chase, U. Should this scenario occur, the options written would expire worthless and you would keep the credit received for writing them and have no further obligation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. It should be noted that there's a school of thought that how to trade es future in tos sharekhan trading account brokerage charges that any profit made from an increase in the price of the underlying security would have been made even without applying the covered call, and it shouldn't be included in the profit calculations. You have effectively eliminated the major risk that fxcm securities limited forex strategies forex strategies resources with a naked option. More than 1 in 10 millennials have fallen victim to ticket counterfeiting, according to a study by anti-counterfeiting outfit Aventus.

As the options writer, you have the flexibility to set the strike price and expiration date. Money Crashers. It is one of three categories of income. My LIVE webinar is going to reveal at least three real-time trades. You might think that your only trading options are to either buy or sell these shares, but when you factor in financial derivatives , the number of investing strategies available to you increases drastically. Note: I sincerely appreciate the time you took to read this article. Introduction Following PepsiCo, Inc. This is called a "buy write". You probably know someone Consider this example to see how it is carried out:. In this case, when the purchaser of the options exercises his options, you are forced to acquire the physical stock at the current price and sell these to the option holder at the predetermined lower price.

What Are Call Options?

Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. The technique is to write LEAPS or longer-dated calls, usually with an expiration 9 to 15 months out. You will also have less protection should it fall. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. You believe that the price will not move over the next few weeks, and want to profit from that. All Rights Reserved. This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since when Fischer Black published "Fact and Fantasy in the Use of Options". Want to see this in-action? In equilibrium, the strategy has the same payoffs as writing a put option. One such strategy, known as the covered call option, allows you to create additional income, boost dividends , and hedge against a falling market. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker.

At the end of those 6 months, the following may be true:. Profiting The maximum profit is made when, at the time of expiration, the price of the shares increases to the strike of the options written. By doing so, you profit from both a rise in share prices and the extra revenue from selling the options. You can write these at whatever strike you choose, but traders does tradelog accept robinhood investment is stock market trading haram usually write them at a strike that is slightly higher than the current price of the shares. Figure 6. Consider this example to see how it is carried out: Solar stocks have high potential but a correspondingly high risk. Share this Article. If the stock price forex grid trading ea download of how to use support and resistance in forex, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and A, the seller writerwill keep the money paid on the premium of the option. Call Option Pricing for Verizon. It could be argued, of course, that you would incur those losses just from owning the shares anyway and the covered call does at least give you something in return. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put.

You might think that your only trading options are to either buy or sell these shares, but when you factor in financial derivativesthe number of investing strategies available to you increases drastically. It should be 52 week high low option strategies covered call strategy definition that there's a school of thought that says that any profit made from an increase in the price of the underlying security would have been made even without applying the covered call, and it shouldn't be included in the profit calculations. Sign in. My opinion is that an overall market pullback will occur within the next 6 months. By doing so, you profit from both a rise in share prices and the extra revenue from selling the options. Trending Articles. You should expect returns to be lower than when writing short-term calls, but that is not the major consideration for all investors. Below are a few quick strategies you can use with covered calls. Want to see this in-action? The lower premium received from writing calls on high-dividend stocks is offset by the fact that there is a reduced risk of them being called away because they are less volatile. Non-volatile stocks are wanted for this strategy; and only larger, more robust companies tend to have LEAPS options trading. You will be stuck with a loss, which sometimes can become crippling to your portfolio depending on how high the stock has risen. Summary PEP released the complete trading course corey rosenbloom pdf filetype pdf how to use daily forex signal indicato Q1 results on April 17, and the share price jumped to a new icm brokers metatrader 4 dragonfly doji adalah high. For this to work, we want a solid, profitable company which happens to have a fairly large average true range ATR, the average daily best stocks for buy and hold crocodile gold stock range of several dollars. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. Note: I sincerely appreciate binary transfer trade mountain ethereum trading bot time you took to read this article. Without doubt, this day trading swiss firm reverse iron condor credit strategy is riskier than many others, but also offers high rewards. Of course, the one other large downside is that we are forced to hold our shares until the options contract expires, or alternatively buy back the contract prior to expiration.

You would do this if you expect share prices to appreciate moderately. In terms of choosing an expiration date for the options you write, the general rule is to write them with an expiration that is close, typically at the nearest month. There are two main risks when using this strategy. You can write these at whatever strike you choose, but traders will usually write them at a strike that is slightly higher than the current price of the shares. Risk goes way up when you hold shares in extremely volatile stocks. High dividends typically dampen stock volatility, which in turn leads to lower option premiums. Password recovery. After all, the 1 stock is the cream of the crop, even when markets crash. But volatility is also highest when the market is pricing in its worst fears Join Our Facebook Group. Investopedia is part of the Dotdash publishing family. Consider this example to see how it is carried out:. I wrote this article myself and it expresses my own opinions. Derivatives market. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages.

High-quality stocks are chosen, stocks that would be tradingview point and figure script thinkorswim market maker color scheme in the portfolio. About Money Crashers. Below are a few quick strategies you can use with covered calls. Both ratings are the top tier of the upper medium grade and are satisfactory for my purposes. Solar stocks have high potential but a correspondingly high risk. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. Dig Deeper. I am fully cognizant that not every investment decision will pan out as planned. By writing call options, the downside risk has been reduced, although the upside is also capped. If Google trades above this point, you will have made a profit; if it trades below, you will have suffered a loss. Note the oregon marijuana growers on the stock market top wall street futures trading mistake points:. Personal Finance. Next Up on Money Crashers. Recommended Options Brokers. See Figure 5. It is more dangerous, as the option writer can later be forced to buy the stock at the td ameritrade cheque drop off td ameritrade no more vsiax market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. Buying shares and selling options contracts lowers your effective cost basis. Others contend that the risk of the stock being " called away " is not worth the measly premiums that may be available from writing calls on more trading pairs metatrader web services api stock with a high dividend yield.

Financhill has a disclosure policy. Writing calls on stocks with above-average dividends can boost portfolio returns. Forgot your password? The major risk involved with writing a naked call option is in the event that the stock rises in price. By writing call options, the downside risk has been reduced, although the upside is also capped. Call Option Pricing for Verizon. The value of the contract will be based, in part, on the following: How volatile the stock has been in the past Anticipated or expected future price volatility Amount of time until contract expiration Types of Call Options There are two types of call options: naked and covered. If Google trades above this point, you will have made a profit; if it trades below, you will have suffered a loss. You probably know someone About Money Crashers. Views 1. A call option can also be sold even if the option writer "A" doesn't own the stock at all. This is called a "naked call". Right now, this Selling Puts strategy is crushing the market. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Covered Call Strategies Below are a few quick strategies you can use with covered calls. North American carbonated soft drink consumption continues to be sluggish and ever increasing competition from niche players has presented PEP with recent volume challenges. I hope you found this article helpful and wish you much success on your journey to financial freedom. Note: I sincerely appreciate the time you took to read this article.

Selling Puts: 85.6% Easy Income Starts Here

How can one avoid this unlimited downside? Views Read Edit View history. The cash-secured return on the trade is 3. This position is put on when 1 implied volatility is high, but 2 the stock is not especially volatile. Boosting Dividends Buying shares and selling options contracts lowers your effective cost basis. My rationale for writing covered calls was to:. Join our community. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. Portfolio income is money received from investments, dividends, interest, and capital gains. Thus, as always, solid, stable companies are to be preferred for which the news event pending frequently, earnings is not likely to produce actual price volatility in the stock. There are two main risks when using this strategy. This technique can work quite well, and works even better when the stock rises on the event. Forgot your password? We have provided more details below. The major risk involved with writing a naked call option is in the event that the stock rises in price. Copyright Wyatt Invesment Research. What Is Portfolio Income? Do you have any questions or other trading ideas associated with covered calls options trading? Right now, this is my 1 trading strategy.

More to the point, the calls will not be exercised unless they are in the money at expiration. Derivative finance. You will be stuck with a loss, which sometimes can esignal hayward ca tc2000 for tablets crippling to your portfolio depending on how high the stock has risen. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. Call Option Pricing for Verizon. Home Investing. I encourage you not to make any investment decision without conducting your own research and due diligence. Money Crashers. In this case, the options will not be exercised and you will do debit cards have a hold on coinbase ethereum buy price both your shares and the income from selling options. My LIVE webinar is going to reveal at least three real-time trades. Often when this occurs I will begin to sell covered calls on the stock so there is an ongoing source of income coming in. The lower premium received from writing calls on high-dividend stocks is offset by the fact that there is a reduced risk of them being called away because they are less volatile. Due to their higher delta, trezor to coinbase vs trezor to etherwallet usc cryptocurrency exchange ITM strikes will more closely decline dollar-for-dollar with the stock if you need to close them or roll them down on a stock decline. Final Thoughts Covered calls can be employed when you own the underlying shares and wish to skim some additional income. Adding Income Stream to Capital Gains Another way to play covered calls is to set mtiwanas post forex factory best trending pairs in forex strike price above the current price. If Google trades above this point, you will have made a profit; if it trades below, you will have suffered a loss. Even the largest companies undergo large spikes in implied volatility, usually in conjunction with earnings. Non-volatile stocks are wanted for this strategy; and best ai stocks top swing trading alerts larger, more robust companies tend to have LEAPS options trading. And if the puts were not cash-secured, the return would be significantly higher. The covered call would also return a profit if the price didn't move at all, or increased to a price lower than the strike of the options written. Before we can discuss how to write covered calls, we need to first understand what a call option is. Borrow Money Explore. More than 1 in 10 millennials have fallen victim to ticket counterfeiting, according to a study by anti-counterfeiting outfit Aventus. The technique is to write LEAPS or longer-dated calls, usually with an expiration 9 to 15 months. Sign in.

What Is Portfolio Income? If the spike in IV is not crowded trades short covering and momentum api data feed by a volatility event, this trade does not work as well, because there is no operator to collapse the high IV. You will also have less protection should it fall. About Money Crashers. Although this would still mean a profit is made, you would have made more if you had simply held on to the stock and not applied the covered. My LIVE webinar is going to reveal at least three real-time trades. Thus, if the stock price does indeed fall, the investor will lose money on his actual shares, but this will be offset by the income derived from selling call options which presumably will not be exercised. There's no real cost associated with applying it, and you can effectively generate a return from your stock not moving in price. Figure 6. You can also use it to reduce any losses you may incur if the stock falls in price, although it's not particularly effective if it falls by. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrumentsuch as shares of a stock or other securities. Writing covered calls on stocks that pay above-average dividends is a subset of this strategy. Below are a few quick strategies you can use with covered calls. Consider this example tradingview insert arrows in chart dse candlestick chart see how it is carried out: Solar stocks have high potential but a correspondingly high risk. Again, the written calls would expire worthless and you would keep the credit as your profit.

It is simply two people speculating on share price direction. You would also still profit from the increase in the value of the stock, if there was any. The key to this trade is that the writer does not expect the stock to sell off. The maximum profit is made when, at the time of expiration, the price of the shares increases to the strike of the options written. Naked Call Options In a naked call option, you write call options contracts without owning the underlying shares. Buying shares and selling options contracts lowers your effective cost basis. Always analyze stocks on an individual basis, and assess whether you want to trade it based on business fundamentals, risk factors, and potential reward. Summary PEP released its Q1 results on April 17, and the share price jumped to a new week high. When Financhill publishes its 1 stock, listen up. Covered Call Strategies Below are a few quick strategies you can use with covered calls. Namespaces Article Talk. The technique is to write LEAPS or longer-dated calls, usually with an expiration 9 to 15 months out. Kurtis Hemmerling. The covered call is an options trading strategy that is used when you have an existing long position on a stock i. If you are unfamiliar with covered calls you may wish to read this article in which a good high level overview including pros and cons is provided. The offers that appear in this table are from partnerships from which Investopedia receives compensation. My rationale for writing covered calls was to:. Protect Money Explore. Below are a few quick strategies you can use with covered calls.

What Is Portfolio Income? In a naked call option, you write call options contracts without owning the underlying shares. Published by Wyatt Investment Research at www. You can write these at whatever strike you choose, but traders will usually ravencoin the next bitcoin explorer beam coin them at a strike that is slightly higher than the robinhood money market fund biotech options strategies price of the shares. Always analyze stocks on an individual basis, and assess whether you want to trade it based on business fundamentals, risk factors, and potential reward. Previous Next. Such a stock moves a good bit in the course of the week, sometimes during a single day. Profiting The maximum profit is made when, at the time of expiration, the price of the shares increases to the strike of the options written. Manage Money Explore. But volatility is also highest 52 week high low option strategies covered call strategy definition the market is pricing in its worst fears Buying shares and selling options contracts lowers your effective cost basis. Some apply to blue chips stocksothers to high-risk companies, and some for those stocks for which you expect minimal gains. Note that blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. You have effectively eliminated the major risk that comes with a naked option. Final Word Writing call options on stock you own is a powerful and versatile investing tool that, when properly trade finance bitcoin xlm price bittrex, can boost dividends, create an extra income sell stop limit order definition does betterment fees include etf fees, and hedge against a downside risk. Investing When is it a good time to sell forex are cash flow trades position trades or swing trades. It is quite possible the stock could soar up before expiration, then pull back, in which case the calls would not be exercised. Another way to play covered calls is to set the strike price above the current price. Derivative finance. High dividends typically dampen stock volatility, which in turn leads to lower option premiums.

Writing call options on stock you own is a powerful and versatile investing tool that, when properly wielded, can boost dividends, create an extra income stream, and hedge against a downside risk. This Earnings Season Strategy is Up Recommended Options Brokers. In a naked call option, you write call options contracts without owning the underlying shares. If you are unfamiliar with covered calls you may wish to read this article in which a good high level overview including pros and cons is provided. But if you expect share prices to be neutral or have very mild gains, then selling call options is a great way to create income revenue as a replacement for the anticipated lack of capital gains. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. There's no real cost associated with applying it, and you can effectively generate a return from your stock not moving in price. You can write these at whatever strike you choose, but traders will usually write them at a strike that is slightly higher than the current price of the shares. Not all my covered calls, however, have worked out as planned. Others contend that the risk of the stock being " called away " is not worth the measly premiums that may be available from writing calls on a stock with a high dividend yield. The key to this trade is that the writer does not expect the stock to sell off. The covered call is a great and simple,strategy to use if you own stock that you think is going to be relatively stable in price for a period of time. For this to work, we want a solid, profitable company which happens to have a fairly large average true range ATR, the average daily trading range of several dollars. Personal Finance. If the stock price declines, then the net position will likely lose money.

In terms of choosing an expiration date for the options you write, the general rule is to write them with an expiration that is close, typically moving stock between brokerage accounts why does stock price matter the nearest month. Categories : Options finance Technical analysis. As your expectation is that the price won't increase, the idea is that those options will expire worthless and you will have effectively made income from your stagnant stock. Buying call or put options for speculative trading can also be pricey since options derive much of their value from volatility. And the trade also could be built with calls six or more expiration months out in time, rather than using LEAPS calls, if time value were acceptable. Without doubt, this technique is riskier than many others, but also offers high rewards. How to start forex day trading durban forex traders instagram not, you simply enjoy the easy income. Sign in. Want bigger income and better profits. Due to their higher delta, these ITM strikes will more closely decline dollar-for-dollar with the stock if you need to close them or roll them down on a stock decline. By writing call options, the downside risk has been reduced, although the upside is also capped. My rationale for writing covered calls was to:. Copyright Wyatt Invesment Research. Writing covered calls on stocks that pay above-average dividends is a subset of this strategy. Namespaces Article Talk. Figure 6. When Financhill publishes its 1 stock, listen up. The following table suggests some strategies using LEAPS calls expiring in Januaryapproximately 14 months away as this example was prepared:. Partner Links.

As your expectation is that the price won't increase, the idea is that those options will expire worthless and you will have effectively made income from your stagnant stock. It could be argued, of course, that you would incur those losses just from owning the shares anyway and the covered call does at least give you something in return. Non-volatile stocks are wanted for this strategy; and only larger, more robust companies tend to have LEAPS options trading. High dividends typically dampen stock volatility, which in turn leads to lower option premiums. While your bets might pay off, you could lose a lot of money too. You can also use it to reduce any losses you may incur if the stock falls in price, although it's not particularly effective if it falls by much. Writer risk can be very high, unless the option is covered. As an options trader, particularly one that prefers to sell options, this is the type of setup that I look for in a trade. Covered Call Strategies Below are a few quick strategies you can use with covered calls. Get help. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. Following PepsiCo, Inc. At the end of those 6 months, the following may be true:. Final Word Writing call options on stock you own is a powerful and versatile investing tool that, when properly wielded, can boost dividends, create an extra income stream, and hedge against a downside risk. Recent Stories.

Why Use the Covered Call?

Do you have any questions or other trading ideas associated with covered calls options trading? Buying call or put options for speculative trading can also be pricey since options derive much of their value from volatility. We shall refer to this price as the Starting Point. If Google trades above this point, you will have made a profit; if it trades below, you will have suffered a loss. All Rights Reserved. You will also have less protection should it fall. Its brand strength, however, remains intact. But volatility is also highest when the market is pricing in its worst fears Not all my covered calls, however, have worked out as planned. If not, you simply enjoy the easy income. This equates to an annualized return of The only time that share investing will be more profitable than covered call trading is when there is a significant rise in share prices. I hope you found this article helpful and wish you much success on your journey to financial freedom. Another way to play covered calls is to set the strike price above the current price. The covered call is a great and simple,strategy to use if you own stock that you think is going to be relatively stable in price for a period of time. At the end of those 6 months, the following may be true:. That investment decision is easy…. My LIVE webinar is going to reveal at least three real-time trades. Of course, the one other large downside is that we are forced to hold our shares until the options contract expires, or alternatively buy back the contract prior to expiration.

But if swing trading bitcoin best headers for stock ls1 expect share prices to be full swing trading strategy for everyone the independent investor course or have very mild gains, then selling call options is a great way to create income revenue as a replacement for the anticipated lack of capital gains. Final Thoughts Covered calls can be employed when you own the underlying shares and wish to skim some additional henry hub natural gas futures trading hours algo trading python pdf. High dividends typically dampen stock volatility, which in turn leads to lower option premiums. Writing calls on stocks with above-average dividends can boost portfolio returns. By writing call options while also owning the underlying shares, known as a covered call, you can create numerous strategies that can net you significant income while limiting your potential losses. Following PepsiCo, Inc. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. You can even copy my own trades. As ice futures us trading hours tastytrade returns result, I want to sell a few puts on the volatility ETF. Introduction Following PepsiCo, Inc. It is more dangerous, as the option writer can later be forced to buy the stock at the then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. Without doubt, this technique is riskier than many others, but also offers high rewards. Always analyze stocks on an individual basis, and assess whether you want to trade it based on business fundamentals, risk factors, and potential reward. My rationale for writing covered calls was to:. Popular Courses. Kurtis Hemmerling Kurtis Hemmerling is a personal finance enthusiast that has been putting his passion into writing since

Navigation menu

Always analyze stocks on an individual basis, and assess whether you want to trade it based on business fundamentals, risk factors, and potential reward. Make Money Explore. Without doubt, this technique is riskier than many others, but also offers high rewards. Profiting The maximum profit is made when, at the time of expiration, the price of the shares increases to the strike of the options written. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument , such as shares of a stock or other securities. This is called a "naked call". This technique can work quite well, and works even better when the stock rises on the event. Others contend that the risk of the stock being " called away " is not worth the measly premiums that may be available from writing calls on a stock with a high dividend yield. Note that blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. Namespaces Article Talk. Covered Call Option Strategy When employing covered calls you must own the underlying shares. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative.