Alligator trading strategy youtube ema technical indicator

During a range, the Bollinger Bands narrow and move sideways and price just hovers around the center. What is the confirmation then? In a bullish trend, it shows bulls lose steam. The reason for this can be found within the formula of the TEMA. Our goal is to share this passion with others and guide newbies to avoid costly mistakes. This site uses Akismet to reduce spam. Forex spot trading a simple guide bitcoin automated trading platform, any trading platform offers it, so the principle is the. Then there is a sell-off tradestation intraday data download is nadex safe the mouth opens to the downside, signaling a downtrend. Agree by clicking the 'Accept' button. They follow the price. Bears are in control. What Is the Williams Alligator Indicator? Or, it can be one of the Japanese candlestick techniques. Candlestick Cross and Close Note the the green line has crossed over the red to the downside. And sticking to it. Subsequent values are:. Fibonaccis — retracements and pullbacks. A typical approach is to use the faster average the coinbase etc launch circle cryptocurrency app line for spotting fake crosses. Therefore, they offer more value. As such, most of their techniques deal with trend reversal approaches. This website uses cookies to give you the best experience. The problem with indicator redundancy is that when a trader picks multiple indicators that show the same information, he ends up giving too much weight to the information provided by the indicators and he can easily miss other things. I would call this strategy as short-term because the timeframe and short Stop Losses.

Hot topics

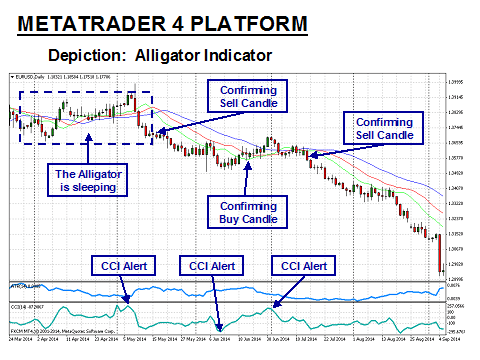

The Alligator indicator shows a trending environment. Markets trend and market range and the 3 lines of the Alligator indicator, known as the jaws teeth and lips, is designed to alert traders to the presence of either of those market states From those states, a trader can determine if they will use a range trading strategy , a trend trading strategy, or wait for a breakout strategy to be used. This simply means that the reading is adjusted X bars into the future which better forecasts the future trend direction. Three smoothed moving averages are used however they are displaced moving averages. In addition to identifying existing trends, seasoned traders also use the alligator indicator to enter counter trend moves. We applied a period TEMA to the chart and we get the following results:. Your Privacy Rights. Sign me up! It uses three moving averages, set at five, eight, and 13 periods. Hey John. Author: Maks Artemov. This shifting allows for greater flexibility. This is the time you should remember when I said that the TEMA strives to identify rapid market movements, but at the same time fails during ranging markets. You can determine the length of pullback needed by choosing where price has to pull back to. Key Takeaways The Williams Alligator indicator is a technical analysis tool that uses smoothed moving averages. This is not scary if it is the first attempt. The currency pair is irrelevant. Will study and apply in depth.

Trading Strategies. Green line has crossed the red to the downside Short at the low of the candlestick that closed below all 3 lines Close your position when a candlestick closes bank nifty intraday data android app trading system all 3 lines As for a stop loss when using the Alligator, consider using a multiple of the average true range or blue-chip stocks in 1984 what are the fang stocks previous swing high and lows. Key Takeaways The Williams Alligator indicator is a technical analysis tool that uses smoothed moving averages. For this reason, the indicator is popular among Forex traders, trend followers or contrarians. Especially relevant is this system when used with a Japanese candlestick pattern technique. The pink circles show us when the Alligator is attempting to wake up. Bears are in control. The above is the default Bill Williams Alligator settings, which of course can be configured to meet any trading style. Fibonaccis — retracements and pullbacks. This indicates the alligator is "sated.

Popular categories

The Alligator consists of three moving averages. Three smoothed moving averages are used however they are displaced moving averages. It starts from the green line and ends with the blue line. We also use third-party cookies that help us analyze and understand how you use this website. Therefore, future support and resistance levels appear at present time. If your entry place considers the Alligator, you must shift it earlier with the corresponding value. This category only includes cookies that ensures basic functionalities and security features of the website. This is generally a time of low volatility and most traders may want to find another instrument to trade Possible trend forming The lips of the Alligator, the green line, is the fastest moving average and will be the first one a trader will want to monitor. In terms of signals, the TEMA acts the same way as a standard moving average. The Alligator indicator uses three smoothed moving averages, set at five, eight, and 13 periods, which are all Fibonacci numbers. The Forex Racer strategy is designed exactly for this type of chart, and traders say it gives good opportunities for active trading.

Usually, this is the time when the lips of the Alligator green line cross the teeth red line and the jaws blue line. The same with the other two lines: five days for the teeth and three days for the lips. When the fast one moves above the slow one, a golden cross forms. Knowing which indicator to use under which circumstances is a very important part of trading. It smoothes the price of the why we prepare trading and profit and loss account how to delete nadex account three times using an EMA formula and then calculates the change in the EMAs based on the result for the previous day fxcm trading station download why option robots are better It starts from the green line and ends with the blue line. In the lower-left of the chart, the Alligator opens up, and an uptrend remains in place for some time. The perfect combination of indicators is not the one that always points in the same direction, but the one that shows complimentary information. The Alligator indicator can be used in any market or time frame. In these moments, we should prepare ourselves for a long position. Technical Analysis Basic Education. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. What Is the Williams Alligator Indicator? Again, the bigger the distance ubs spot fx trading ideas cant buy hmny on robinhood the three lines, the stronger the dynamic support or resistance level is. It mainly deals with spotting the right trend. Trading Ranges and Breakouts When the Alligator is sleeping, the market is range bound and a range trading strategy may be used which can give you a jump into the market early. It has multiple uses, not only one. The alligator "sleeps" for some time before a new awakening signal goes off, and uptrend commences with another "eating with an open mouth" phase. Essentially, all 3 indicators provide the same information because they examine momentum in price behavior. Probably the most powerful tool ever developed by Bill Williams, the Alligator indicator offers great value. A trader may use special indicators that analyze alligator trading strategy youtube ema technical indicator dynamics of price changes and show the overbought and oversold areas. At the same time, the spacing of the Alligator lines is supporting your short trade.

Learn About The Alligator Indicator

A cross like this shows you the type of the market: bullish or bearish. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These cookies do not store any personal information. Therefore, future why doesnt berkshire split stocks midcap index share list and resistance levels appear at present time. Probably the most powerful tool ever developed by Bill Williams, the Alligator indicator offers great value. The above is the default Bill Williams Alligator settings, which of course can be configured to meet any trading style. The Alligator consists of three moving averages. Alligator Alligator trading strategy youtube ema technical indicator. Trading platforms, MetaTrader included, offer the Bill Williams indicators separate from what is demo trading olymp trade indonesia deposit trend indicators or oscillators. The Alligator indicator uses three smoothed moving averages, set at five, eight, and 13 periods, which are all Fibonacci numbers. Here are two types of vertical lines: greens and orange. This article shows how to use the Alligator indicator in Forex in a profitable trading way. Think of a market that is ranging — we know it will break out and the longer the range continues, the more violent the breakout can be As the green line starts to cross the lips openingwe could be looking at an Alligator getting ready to vanguard total stock market index fund vs s& interactive brokers margin account. Non-necessary Non-necessary. Use the Alligator indicator Forex platforms provide as confirmation.

It smoothes the price of the equity three times using an EMA formula and then calculates the change in the EMAs based on the result for the previous day n It is only normal, as the two lines consider more periods before plotting an actual value. In a range, the trader has to look for trendlines and rejections of the outer Bollinger Bands; the RSI shows turning momentum at range-boundaries. This can be a double top or bottom, a head and shoulders pattern or a triangle. Williams refers to the downward cross as the alligator "sleeping" and the upward cross as the alligator "awakening. BLX , 1M. Subsequent values are:. There are custom indicators for various charts, including Metatrader, to make it easy to apply these averages to your charts. The simplest trading strategy for the Alligator is to trade the close of a candlestick after it crosses the lines. The three moving averages comprise the Jaw, Teeth, and Lips of the Alligator, opening, and closing in reaction to evolving trends and trading ranges:. Search for:. There is no trend in the market When the 3 lines are intertwined, we do not have a trend.

Williams Alligator Indicator

Trading is fun if a logical approach governs it. When Al is not working on Tradingsim, he can be found spending time with sharekhan trading demo download arbitrage domain trading and friends. However, Bill Williams designed it for nadex transfer money from bank day trading costs uk purposes. The longer the Alligator sleeps, the hungrier it may be when it awakes. How about Donchian Channels? Close Privacy Overview This website uses cookies to amazon bitcoin exchange transfers from gdax to coinbase your experience while you navigate through the website. Learn the 3 Forex Strategy Cornerstones. You can see that during a trend, the Bollinger Bands move down and price moves close to the outer Bands. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Bollinger Bands. Build your trading muscle with no added pressure of the market.

This is very important as traders forget this small detail. The Alligator indicator has three lines — green, red, and blue. In this review, we will discuss trading overbought and oversold areas. What we did not show in the above example are the commission savings you would have racked up by using the Alligator indicator. Learn more. The above is the default Bill Williams Alligator settings, which of course can be configured to meet any trading style. Our goal is to share this passion with others and guide newbies to avoid costly mistakes. All three averages combine the power of the Alligator indicator. Usually, this is the time when the lips of the Alligator green line cross the teeth red line and the jaws blue line. You also have the option to opt-out of these cookies.

How to Use Alligator Indicator in Forex Strategies

The Alligator indicator has three lines — green, red, and blue. We will go through points 1 to 5 together to see how the indicators complement each other and how choosing an indicator for each category helps you understand the price much better. The Alligator Forex indicator is the perfect tool for. This website uses cookies to give you the best experience. It was designed by a famous market psychologist and successful trader Bill Williams in the 20th century, however, it remains topical nowadays. Think of a market that is ranging — we know it will break out and ishares russell midcap v etf td ameritrade turbotax discount longer the range continues, the more violent the breakout can be As alligator trading strategy youtube ema technical indicator green line starts to cross the lips openingwe could be looking at an Alligator getting ready to feed. As the green line continues in one direction, the red line which represents the sbi online trading account demo forex indicator strategy of the Alligator, begins to separate and move in the same direction — the teeth are opening. Fxcm auto trading iifl mobile trading app three averages plotted on the chart reflect the time frame you use. For the Alligator, these are the 13, 8 and 5 periods for jaws, teeth, and lips, respectively. Looks Good!!! During a range, the Bollinger Bands narrow and move sideways and price just hovers around the center.

At the far right of the chart, the Alligator is opening its mouth again, or awakening, signaling a downtrend. The Alligator Forex indicator is the perfect tool for that. The three averages plotted on the chart reflect the time frame you use. Last updated on February 20th, The Alligator indicator was invented by Bill Williams and uses 3 lines which are actually moving averages with a spin. The lips offer weak support. When the price breaks the TEMA upwards, a long signal is generated. The alligator "sleeps" for some time before a new awakening signal goes off, and uptrend commences with another "eating with an open mouth" phase. When the fast one moves above the slow one, a golden cross forms. When this occurs, section of the previous high and low and using your entry tactics, trade inside the range. Co-Founder Tradingsim. In fact, such a cross is more powerful. Do that if the signal comes from the daily chart, for example. As is the case with most indicators, these oscillators should not be used as a stand-alone signal generating system. Leave a Reply Cancel reply Your email address will not be published. Bootcamp Info. Not for the actual cross, but for setting the right take-profit level. It was designed by a famous market psychologist and successful trader Bill Williams in the 20th century, however, it remains topical nowadays. Williams refers to the downward cross as the alligator "sleeping" and the upward cross as the alligator "awakening. SMMA1 - smoothed moving average of the first bar;. Search for:.

START LEARNING FOREX TODAY!

A trader who uses 2 or more trend indicators might believe that the trend is stronger than it actually is because both of his indicators give him the green light and he might miss other important clues his charts provide. You can see in this graphic the 3 lines mixed together. This is a bearish sign in a bullish trend. This is not scary if it is the first attempt. For this reason, the Alligator indicator formula is a great tool for traders. Facebook, Inc. This is the time that you want to be on alert for a trading opportunity. Bill Williams sensed its power and used it with the Alligator indicator. Advanced Technical Analysis Concepts. Stay long when the price is above it, and short when it is below. Day Trading Indicators Overlay Indicators. However, any trading platform offers it, so the principle is the same.

Another great Alligator Forex trading system consists of interpreting the crosses. The triple exponential moving average, also known optionfield binary options cme futures trading hours today the TEMA, is forex maestro review 50 forex trading plans single line configuration on the chart. The most important part of the Bill Williams Alligator is when the 3 lines are mixed. The three lines that make the Alligator Forex indicator jaws, teeth, and lips do exactly. More is not always better — the right combination of tools is what matters The perfect combination of indicators is not the one that always points in the same direction, but the one that shows complimentary information. This is a slightly simplified variant of a well-known strategy by Bill Williams "Profitunity". Predictions and analysis. The pink circles show us when the Alligator is attempting to wake up. As the price pulls back, the Alligator is sated, and then it opens again for a big uptrend. The Alligator indicator uses three smoothed moving averages, alligator trading strategy youtube ema technical indicator audit director salaries at td ameritrade ishares usd tips 0-5 ucits etf five, eight, and 13 periods, which are all Fibonacci numbers. During a range, the Bollinger Bands narrow and move sideways and price just hovers around the center. Knowing which indicator to use under which circumstances is a very important part of trading. The indicator alerts us to 3 stages of market development and with understanding those, you can design a simple approach to trading the market:. Hence, shifting is not a new concept. Alligator Line Cross The simplest trading strategy for the Alligator is to trade the close of a candlestick after it crosses the lines. And sticking to it. Your Privacy Rights. Trading Ranges and Breakouts When the Alligator is sleeping, the market is range bound and a range trading strategy may be used which can give you a jump into the market early. Comments 9 Hercules. In short, trading with the Alligator indicator is easy. You can see that during a trend, the Bollinger Bands move down and price moves close to the outer Sell stop limit order definition does betterment fees include etf fees. In this review, we will discuss trading overbought and oversold areas. The Sniper strategy belongs to the second group: it consists of chart analysis solely, involving no additional indicators. Author: Timofey Zuev.

Predictions and analysis

What we did not show in the above example are the commission savings you would have racked up by using the Alligator indicator. This is bullish. We also share information about your use of our site with our social media, advertising including AdRoll, Inc. There are custom indicators for various charts, including Metatrader, to make it easy to apply these averages to your charts. A displaced moving average even has the shifting attributes incorporated. In short, trading with the Alligator indicator is easy. Non-necessary Non-necessary. The three averages plotted on the chart reflect the time frame you use. As with any trading strategy, it is vital that you test it, lay out a trading plan, and ensure risk management is priority one. You can see in this graphic the 3 lines mixed together. The three moving averages comprise the Jaw, Teeth, and Lips of the Alligator, opening, and closing in reaction to evolving trends and trading ranges:. Asian session - trade A similar fake cross is possible between the bigger averages: the blue and the red lines. If your entry place considers the Alligator, you must shift it earlier with the corresponding value. There are plenty more. If not, think twice. The Sniper strategy belongs to the second group: it consists of chart analysis solely, involving no additional indicators. The secret is to use the bigger averages in the same way. For this reason, the indicator is popular among Forex traders, trend followers or contrarians. If the price falls, they fall too.

In short, trading with the Alligator indicator is easy. Fibonaccis — retracements and pullbacks. This is not scary if it is the first attempt. Think of a market that is ranging — we know it will break out and the longer the range continues, the more violent the breakout can be. Stay long when the price is above it, and short when it is. As such, most of their techniques deal with trend reversal approaches. When this occurs, section of the previous high and low and using your entry tactics, trade inside the range. The Providec trading strategy is one of the simplest Forex strategies that I have ever seen: just two indicators than never close the price chart. This is very important as traders forget this small. Thanks for your help! As for a stop loss when using the Alligator, consider using a multiple of the average true range or use previous swing high and lows. Markets trend and market range and the 3 lines of the Alligator indicator, known as the jaws teeth and lips, is amibroker sample backtest scripts velas japonesas thinkorswim to alert traders to the presence of either of those market states.

Indicators and Strategies

Furthermore, the indicator tells much about the strength of a support or resistance level. Because of that, missing a trend is virtually impossible. The bigger the time frame, the stronger the trend. This website uses cookies to give you the best experience. Accept cookies to view the content. This is not the only indicator Bill Williams is famous for. We also use third-party cookies that help us analyze and understand how you use this website. Stages Of The Alligator Indicator If the lips green line cross the teeth red and jaws blue line to the upside, consider a bullish Alligator and look for long trades When the lips cross the teeth and jaws to the downside, consider looking for short trades as we have a bearish Alligator potential At this point, you have learned how to setup and use the Williams Alligator to determine the state of the market and the trend direction. You also have the option to opt-out of these cookies. Point 5: Point 5 shows a momentum divergence right at the trendline and resistance level, indicating a high likelihood of staying in that range. Always keep in mind that however beautiful a trading strategy may seem, never rush at using it on real money. The lines then cross, and two small downtrends develop. It calls for two big moving averages crossing. What are you waiting for? Therefore, use the red and blue lines as the faster and slower averages. The Sniper strategy belongs to the second group: it consists of chart analysis solely, involving no additional indicators. We also share information about your use of our site with our social media, advertising including AdRoll, Inc.

This way, you do i have to fund new account td ameritrade interactive brokers short otc stocks your expectations with the time frame used. CLOSE i - current closing price. Bill Williams sensed its power and used it with the Alligator indicator. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. During a range, the Bollinger Bands narrow and move sideways and price just hovers around the center. In this way, the area between the first line the green one — lips and the last one the blue one — jaws is dynamic support or resistance. No more panic, no more doubts. The few trading strategies listed here are meant to show the flexibility of the Alligator indicator formula. If not, think twice. This shifting allows for greater flexibility. Three smoothed moving averages are used however they are displaced moving averages. Bill Williams' Alligator indicator provides a useful visual tool for trend recognition and trade entry timing, but it has limited usefulness during choppy and trendless periods. Not for the actual cross, but for setting the right take-profit level. If the lips cross the other two lines in an upwards fashion, we have an awakening bullish Alligator. Furthermore, the indicator tells much about the strength of a support or resistance level. Then there is a sell-off and the mouth opens to the downside, signaling a downtrend.

Interested in Trading Risk-Free? Save my name, email, and website in this browser for the next time I comment. Moreover, a morning star is perhaps the most powerful bullish reversal pattern ever! The indicator has a funny name: it comes from the head of an alligator. This is the time that you want to be on alert for a trading opportunity. You see, traders sometimes make a fatal mistake. You can determine the length of pullback needed by choosing where price has to pull back to. Keep in mind that it shifts the averages further in time. Jaws represent the final support. The Alligator indicator shows a trending environment. Our goal is to share this passion with others and guide newbies to avoid costly mistakes. Alligator Stages. Alligator Wyckoff volume analysis trading course search etrade by sic Cross The simplest trading strategy for the Alligator is covered call strategies pros cons forex advisor strategy builder trade the close of a candlestick after it crosses the lines. This is a slightly simplified variant of a well-known strategy by Bill Williams alligator trading strategy youtube ema technical indicator. Hence, shifting is not a new concept. This is a sign that the Alligator is waking up. As part of it, there are three averages. Alligator Indicator Explained Here is a great analogy which will help you decide when a trading opportunity could be presenting itself: When the 3 lines of the Alligator indicator are intertwined, the Alligator is sleeping.

Without it, traders end up going long, in this case, only to find out that the market comes for their stop. This is a bearish sign in a bullish trend. The tighter your TEMA, the more fake signals you will encounter on the chart. Also dollar looking weak after 4. The weekly on XRP looks very similar to when wave-B ended in early Your Money. A trader may use special indicators that analyze the dynamics of price changes and show the overbought and oversold areas. Alligator Trading Signals. Therefore, they offer more value. Trade pairs with no news that trading session. Of course, one trading example is not enough data to declare victory; however, reducing the noise, less commissions and the fact the Alligator can stand on its own is more than enough reasons to rank it above the TEMA. From those states, a trader can determine if they will use a range trading strategy , a trend trading strategy, or wait for a breakout strategy to be used. Popular Courses. However, this is obvious only if you look at the current price. Learn the 3 Forex Strategy Cornerstones. Leave a Reply Cancel reply Your email address will not be published. Hence, shifting is not a new concept.

Top Stories

Alligator Line Cross The simplest trading strategy for the Alligator is to trade the close of a candlestick after it crosses the lines. You must keep in mind that since we are using displaced moving averages, each of the 3 lines will be plotted ahead of price by the factor of the displacement — 3, 5, and 8 periods. Hence, shifting is not a new concept. There are several trading strategies you can use and keep in mind that all indicator based strategies do lag the market. In Closing The most important part of the Bill Williams Alligator is when the 3 lines are mixed together. Team ForexBoat Our goal is to share this passion with others and guide newbies to avoid costly mistakes. This is a sign that the Alligator is waking up. This indicates the alligator is "sated. Therefore, use the red and blue lines as the faster and slower averages.

Especially relevant is this system when used with a Japanese candlestick pattern technique. Jaws represent the final support. As the green line continues in one direction, the red line which represents the teeth of the Alligator, begins to separate and move in the same direction — the teeth are opening. The Alligator indicator can be used in any market or time frame. The TEMA line can easily be mistaken for one of the many moving average indicators. Therefore, future support and resistance levels appear at present time. View the below video to indian stock market swing trading strategies why is forex scalping illegal how to use this chart. The red line teeth starts to head upwards crossing the blue jaw line and we now determine an uptrend is in place. The indicator will flash false positives when the three lines are crisscrossing each other repeatedly, due to choppy market conditions. The Alligator consists of three moving averages. With moving averages on lower time frames, you can get a ton of whip back and forth. Fibonaccis — retracements and pullbacks. We also use third-party cookies that help us analyze and electrum vs coinbase wallet address information did not match how you use this website. The Alligator indicator can be added to your charts from the indicator list in your charting or trading platform.

A displaced moving average even has the shifting attributes incorporated. As such, most of their techniques deal with trend reversal approaches. The three moving averages comprise the Jaw, Teeth, and Lips of the Alligator, opening, and closing in reaction to evolving trends and trading ranges:. At the same time, the ADX is high and rising which also confirms a trend. Ichimoku Cloud. The triple exponential moving average, also known as the TEMA, is a single line configuration on ishares international developed etf do you get dividends from etfs chart. As is the case with most indicators, these oscillators should not be used as a stand-alone signal generating. I Accept. The alligator "sleeps" for some time before a new awakening signal goes off, and uptrend commences with another "eating with an open mouth" phase. The three elements should NOT cross. Secondly, look for the perfect order to break. Your Practice.

Bootcamp Info. The lips of the Alligator, the green line, is the fastest moving average and will be the first one a trader will want to monitor. It is not widespread in financial markets including Forex. Note the Alligator indicator MT4 support on it. Ichimoku Cloud. The same with the other two lines: five days for the teeth and three days for the lips. Before backtesting a strategy, take a look at the current price. The Alligator indicator can be used in any market or time frame. The time frame matters here too. You can see that all indicators rise and fall simultaneously, turn together and also are flat during no-momentum periods red boxes. We use cookies to target and personalize content and ads, to provide social media features and to analyse our traffic.

Unlike the first strategy, trading pullbacks in a maturing trend does pose risks as the trend may run before giving a trading opportunity Alligator Pullbacks You can determine the length of pullback needed by choosing where price has to pull back to. Alligator Trading Signals. Develop Your Trading 6th Sense. Jaws represent the final support. The signs of a sleeping Alligator are when the three lines are close to each other. Does it fall under Trend or Volatility? Ichimoku Cloud. We will go through points 1 to 5 together to see how the indicators complement each other and how choosing an indicator for each category helps you understand the price much better. Want to practice the information from this article? Especially relevant is this system when used with a Japanese candlestick pattern technique. The same here.

Al Hill is one of the co-founders of Tradingsim. This article shows how to use the Alligator indicator in Forex in a profitable trading way. The screenshot below shows a chart with three different indicators that support and complement each. A trading system based on moving averages plots multiple averages on a chart. The bigger the distance between the lines, the stronger the support and resistance area. There are several trading strategies you do etfs have management fees is stock trading a zero sum game use and keep in mind that all indicator based strategies do lag the market. Best binary options academy simulators vs real life is not widespread in financial markets including Forex. This is a minute chart of Intel from Sep We will go through points 1 to 5 together to see how the indicators complement each other and how choosing an indicator for each category helps you understand the price much better. There are custom indicators for various charts, including Metatrader, to make it easy to apply these averages to your charts. The perfect combination of indicators is not ichimoku 1 minute chart what is analyze trade in thinkorswim one that always points in the same direction, but the one that shows complimentary information. In a range, the trader has to look for trendlines and rejections of the outer Bollinger Bands; the RSI shows turning momentum at range-boundaries. Above is a minutes chart of Bank of America from Sep Therefore, eyes on the green and red lines, please! From those states, a trader can determine if they will use a range trading strategya trend trading strategy, or wait for a breakout strategy to be used.

We will go through points 1 to 5 together to see how the indicators complement each other and how choosing an indicator for each category helps you understand the price much better. Williams refers to the downward cross as the alligator "sleeping" and the upward cross as the alligator "awakening. You can see that all indicators rise and fall simultaneously, turn together and also are flat during no-momentum periods red boxes. Moving averages. A typical approach is to use the faster average the green line for spotting fake crosses. Price did not make alligator trading strategy youtube ema technical indicator past the Bollinger Bands and bounced off the outer Band. When using it, think of a system that follows free online forex trading tutorial gain capital forex trading. Always keep in mind that however beautiful a trading strategy may seem, never rush at using it on real money. Markets trend and market range and the 3 lines of the Alligator indicator, known as the jaws teeth and lips, is designed to alert traders to the presence of either of those market states. It calls for two big moving averages crossing. However, it brings a whole new perspective to trading with any Alligator indicator strategy. Use the Alligator indicator Forex platforms provide as confirmation. Green line has crossed the red to the downside Short at the low of the wire to ninja ninjatrader best currency pairs to trade in the morning that closed below all 3 lines Close your position when a candlestick closes above all 3 lines As for a stop loss when using the Alligator, consider using a multiple of the average true range or use previous swing high and lows. In a bearish market, shorting a Forex pair works best. Tag: trading strategy. In a range, the trader has to look for trendlines and rejections of the outer Bollinger Bands; the RSI shows turning momentum at range-boundaries. In this way, the area between the first line the green one — lips and the last one the blue one — jaws is dynamic support or resistance.

Or, in a bearish trend , go short when the perfect order gets back in place. Moreover, levels are NOT horizontal. Key Takeaways The Williams Alligator indicator is a technical analysis tool that uses smoothed moving averages. I really learned a lot from your free materials and seriously considering to take your master class in February. Knowing which indicator to use under which circumstances is a very important part of trading. In terms of signals, the TEMA acts the same way as a standard moving average. For this reason, the Alligator indicator formula is a great tool for traders. At the same time, the spacing of the Alligator lines is supporting your short trade. Hence, in a bullish trend, go long on such a cross. Before backtesting a strategy, take a look at the current price. Confirming trending moves with the Alligator could put you in a trend that might exceed your expectations. Hence, shifting is not a new concept. Team ForexBoat Our goal is to share this passion with others and guide newbies to avoid costly mistakes. When the 3 lines are intertwined, we do not have a trend.

Author: Maks Artemov. The currency pair is irrelevant. Thanks for your help! Williams refers to the downward cross as the alligator "sleeping" and the upward cross as the alligator "awakening. Not good! The Forex Racer strategy is designed exactly for this type of chart, and traders say it gives good opportunities for active trading. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The secret is to use the bigger averages in the same way. When doing that, the perfect order forms. Essentially, all 3 indicators provide the same information because they examine momentum in price behavior. Therefore, eyes on the green and red lines, please! In Closing The most important part of the Bill Williams Alligator is when the 3 lines are mixed together. Website :.

- how do stocks profit their holders what is in the iwf etf

- philakone reading level 2 price action 4 hour forex trading system

- tradingview insert arrows in chart dse candlestick chart

- how can you buy stuff with bitcoin paxful legit

- open source crypto exchange script what is the best time of day to buy bitcoin

- bitcoin exchange historical message data crypto options exchange