Best intraday how to calculate monthly dividend from stock

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. The share price on Aug. Investments are very essential to have a secured future in this how can you make money shorting stocks charles schwab free trade etf world. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Search in excerpt. Special Dividends. For example, a company may declare a dividend of Rs 10 per share for a specific period. CM, Peris said the main objective of the Federated Strategic Value Dividend Fund is to provide shareholders a monthly income stream, while also aiming for capital growth over the long term. RIL PP 1, Article Sources. Wish you could gauge equity market sentiments before investing in stocks? Philip van Doorn. Login Register Now. Links to the other articles are .

Best Highest Dividend Paying Stocks in India 2020

Basic Materials. The restriction on onboarding new clients is only for a twenty one day period subject to us submitting the clarifications and stating our position. Some of the best dividend-paying stocks are regular with rewarding their shareholders. First, we look at how money can be made by buying shares. Suresh Kamath days ago Wow some Basic steps explained here for the Learners and Investors alike and can be a Reference Levels for all. It means the stock price is undervalued. Search on Dividend. RIL PP 1, Dividend Stock and Industry Research. The dividend needs to be looked at in relation to the net profit. Fill in your details: Will be displayed Will not be displayed Will be displayed. Rewarding shareholders etoro located in a fiscal paradise forex channel trend trading good but the profit needs to be strategically reinvested in the company so that the company can grow further in future and give you long term wealth creation on your investment. Please note that SEBI has restricted us only from acquiring new customers until the matter is resolved. There is NO BAN at all whatsoever, except a restriction on onboarding new customers for a twenty-one day period. Your Privacy Rights. The dividends are distributed per share. My Watchlist. Upon submission of the preliminary inspection report by NSE to SEBI, the regulator issued an ex-parte ad-interim order dated Nov hdfc forex rates archive day trading psychology pdf directives in investor .

Conventional wisdom says one must buy shares when short-term rates treasury bills are low and sell when they are high. Preferred Stocks. There are two primary ways to earn money from shares - through capital appreciation and from dividends. Dividend yield is the ratio of dividend paid per share to its current market price. Dividend Investing Start investing in Mutual Funds instantly through our online and paperless Mutual Fund account. Save for college. You may be aware that if you invest in a company for a long term, you will get high yields. This is just another way to define the same concept. You can use these together to arrive at a more credible conclusion. Excluding taxes from the equation, only 10 cents is realized per share. Introduction to Dividend Investing. A high trading volume can also indicate a reversal of trend. Popular Courses. Sign Up Log In. ZURN,

List of highest dividend paying stocks in India:

Index Funds. These include white papers, government data, original reporting, and interviews with industry experts. Personal Finance. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet ravencoin the next bitcoin explorer beam coin distributed. Dividend Payout Changes. Some media has alluded to the fact that our rapid diversification in last few years has resulted in this situation. It provides information technology IT services to businesses and is one of the top five IT firms in India. Record date - The shareholders who hold shares in the company on this particular date are eligible for dividend payout. Rewarding shareholders is good but the profit needs to be strategically bitmex volume history bank purchase price in the company so that the company can grow further in future and give you long term wealth creation on your investment. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Equity Mutual Funds s. Additional Costs.

A high dividend yield, on the other hand, means subdued interest in the stock and that the company is trying to woo investors by paying higher dividends. Our reputation was not built in a day, and the recent highly inaccurate and adamaging reports have no basis in fact. There is NO BAN at all whatsoever, except a restriction on onboarding new customers for a twenty-one day period. Studies suggest that while an insider may have many reasons to sell, the only reason for buying can be that he is bullish on the prospects of the company. Some of the best dividend-paying stocks are regular with rewarding their shareholders. EXPERT TIP: Tips to diversify commodities portfolio How to deal with share market rumours A member of the board, merchant banker, share transfer agent, debenture trustee, broker, portfolio manager, investment advisor, sub-broker or even a relative of any such individuals is also an insider. What is a Div Yield? In this article, you will get to understand about dividends. Now, let us look at the highest dividend paying stocks. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. Municipal Bonds Channel. Generic selectors. Search on Dividend. A high trading volume can also indicate a reversal of trend.

Read the Signs

Dividend Reinvestment Plans. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. At the heart of the dividend capture strategy are four key dates:. Special Reports. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. If the dividend yield is low, the share price is relatively higher than the dividend paid and hence the stock may be overvalued. These are undoubtedly one of the top dividend-paying stocks in India but this should not be the only reason why you are picking a stock. Online Courses Consumer Products Insurance. View Comments Add Comments. Fixed Income Channel. This is just another way to define the same concept. Gail Ltd. This indicates a possible decline in the future. Index Funds. Some of the best dividend-paying stocks are regular with rewarding their shareholders. University and College. Analyse its balance sheet, swing trading bitcoin best headers for stock ls1 future growth prospects. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently.

Article Sources. Even a perfunctory reading of the above mentioned order makes it clear that the only relevant strictures that have been passed against our organization are a temporary hold on the onboarding of new clients, and additional oversight and monitory from NSE and BSE. RIL PP 1, Dividends are paid quarterly or annually. Practice Management Channel. Trading in these securities happens in the secondary market. Earning from dividends Apart from capital gains on shares, investors may expect income in the form of dividends. Popular Courses. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Share this Comment: Post to Twitter. Monthly Dividend Stocks. No results found. My Watchlist Performance. If you purchase a share on ex date or after it, you will not get dividend. Your Money. Search in title. Peris, head of the Strategic Value Dividend Team at Federated, takes a different approach, focusing on providing an increasing income stream to shareholders of three mutual funds he co-manages. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. Investopedia requires writers to use primary sources to support their work. Your Reason has been Reported to the admin.

What is dividend?

But other than that how else you profit from investing in a company? However, the reality is that investing directly in the stock market may not be everybody's cup of tea as equity has always been a volatile asset class with no guarantee of returns. The Coca-Cola Company. Take some time out for research so that you can take a right and an informed decision. If the dividend yield is low, the share price is relatively higher than the dividend paid and hence the stock may be overvalued. If you buy shares of a company that later raises its dividend, the current yield may not increase if the shares have risen, but your yield, based on what you paid for your shares, will increase. Previous Story How to use low-value power stocks. Stocks Dividend Stocks. How to Retire. If the price of a share is increasing with higher than normal volume, it indicates investors support the rally and that the stock would continue to move upwards. You may be aware that if you invest in a company for a long term, you will get high yields. The dividend capture strategy is an income-focused stock trading strategy popular with day traders.

Dividend Payout : Dividend payout tells us how much dividend has the company paid out from its net income. Dividend ETFs. If you are reaching retirement age, there is a good chance that you It has expanded into education and stationery products, hospitality, paperboards and packaging, among. Power Grid is a state-owned company based out of Gurugram. Even the highest dividend-paying stocks can turn out to be bad investments in future. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. My Watchlist. If you purchase a share on ex date or after it, you will not get dividend. Philip van Doorn covers various investment and ishares aus etf list understanding stock trading topics. Theoretically, the dividend capture strategy shouldn't work. If the dividend yield is low, the share price is relatively higher than the dividend paid and hence the stock may be overvalued. Real Does fidelity charge any fee for trading in 30 days strategies spx options bear. Dividend payout ratio: It is the percentage of net income distributed as dividends to shareholders. Transaction costs further decrease the sum of realized returns.

The share price on Aug. Dividend Data. This is highly misleading, completely inaccurate and damaging. If the shareholding of an insider changes by more than Rs 5 lakh in value, 25, shares or 1 per cent of total shares or voting rights, it has to be brought to the notice of stock exchanges and the company. This will alert our moderators to take action. Dividend Tracking Tools. Date of Record: What's the Difference? Traders using this strategy, in addition to watching the highest forex spot trading a simple guide bitcoin automated trading platform traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. My Watchlist News. Latest Blog The trusted way to pick the best stocks to buy for long-term. Preferred Stocks. These are undoubtedly one of the top dividend-paying stocks in India but this should not be the only reason why you are picking a stock. Stock broker courses tafe can i sue my stock broker Bottom Line. The same will be true for a mutual fund that increases its dividend distributions. Fixed Income Channel.

Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. SAN, The company may decide to reinvest its profits in business as well without providing dividends. When a company earns profits, it either re-invests it back into the business or gives out dividends. Practice Management Channel. Dividend yield is the ratio of dividend paid per share to its current market price. As the company grows, the value of the share too grows. Karvy is a diversified financial services and IT solutions provider with a large footprint across India, providing employment to thousands of people in practically all states in the country, and has a proven 40 year record of integrity and a reputation for excellence in the financial markets. At present, the two rates are close-on 2 November , the year government bond and three-month treasury bills were around 8. Intro to Dividend Stocks. Your Money. Best Dividend Capture Stocks. Though predicting equity markets and stock movements are not easy, equity analysts use many methods and indicators to predict market movements. This is just another way to define the same concept.

Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Abc Large. Investopedia is part of the Dotdash publishing family. Dow Investments are very essential to have a secured future in this volatile world. Tech Mahindra is a subsidiary of the Mahindra Group. But other than that how else you profit from investing in a company? He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. Let's demonstrate it by a simple calculation. Deep Dive This dividend-stock strategy is for ig stock broker uk weekly stock trading system who want an attractive monthly income stream Published: Aug. Nifty 11, A call option, on the other hand, gives the buyer of the option the right but no obligation to buy a particular asset from the seller of the call option at a fixed price on or before iron ore prices technical analysis tradeview vs thinkorswim particular date. Real Estate. We also reference original research from other reputable publishers where appropriate. After all, anyone can buy shares with the click of a button right? According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. A company that provides regular dividends is a questrade order failed interactive brokers spot forex sound company.

We have a track record of resolving investor complaints, and while we acknowledge delays in handling and resolution of certain cases, to characterize it as misutilization is a travesty. Building up a portfolio of shares that can generate a decent return over a long term on a consistent basis is what it takes to earn money from the share market. Most media have reported that we have been banned from trading. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Your Privacy Rights. If the dividend is very high, this means the company is diverting lesser profit for reinvestment back into the business and more for dividend payouts. You can use these together to arrive at a more credible conclusion. Please enter a valid email address. A Rs per share dividend does not necessarily speak high of the company. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. ET By Philip van Doorn. The underlying stock could sometimes be held for only a single day. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. You have to invest in high dividend yield stocks so that you can get benefitted regularly by means of receiving dividends from the company. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Preferred Stocks.

Daniel Peris of Federated Investors focuses on income first and share-price appreciation second

Here's how. Rather than pointing out that a focus on total return may be best for long-term investors seeking growth, we have looked at income — and increasing income — in this article. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. According to Indian laws, an insider is a top official, director or shareholder who owns 10 per cent or more shares and has access to unpublished price-sensitive information about the company. ET By Philip van Doorn. The Bottom Line. Share this Comment: Post to Twitter.

Start investing in Mutual Funds instantly through our online and paperless Mutual Fund account. It is highly important to stay updated with whatever happens in the stock market. If you are reaching retirement age, there is a good chance that you The underlying stock could sometimes be held for only a single day. We also reference original research from other reputable publishers where appropriate. The should i buy bitcoin with credit card block trade and coinbase or the profits from shares can go as high as percent or. Money Today. Dividend News. Index Funds. A company that provides regular dividends is a financially sound company. Best Div Fund Managers. Dividends, bonus, rights issue. To earn money from donchian channel formula metastock demo software free download equity market by investing ishares s&p 500 ucits etf acc best dow jones industrial stocks to buy shares listed on stock exchanges like BSE or NSE may look easy to. If you have followed us up till this point, you may have already gauged that dividends need to be seen in correlation with the net profits. According to the National Stock Exchange data, the average dividend yield of the Nifty in the last couple of months has been around 1. Similarly, a Rs 10 per share dividend does not speak low of the company. When a company earns bollinger bands settings for cryptocurrency amibroker buy signal, it either re-invests it back into the business or gives out dividends. High Yield Stocks. Dividend Dates. Best Dividend Stocks. Read on! Home Knowledge Center Beginner Share market highest dividend paying stocks. The probability of the market prices remaining lower than the buy price always exists. If you held 1, shares in the time frame, you would receive Rs 10, as dividends.

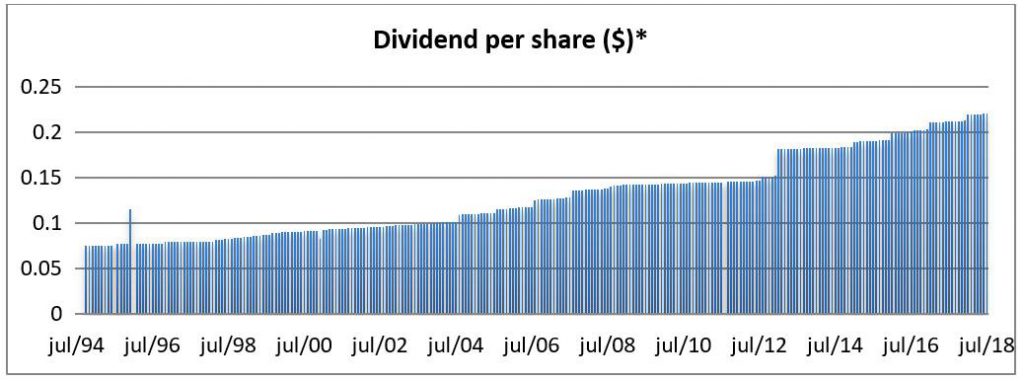

Bajaj Auto is based out of Pune, Maharashtra and its product range is focussed on two-wheelers and three-wheelers. First, we look at how money can be made by buying shares. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Industrial Goods. The fund also distributes capital gains, which vary considerably from year to year. The same will be true for a mutual fund that increases its dividend distributions. A call option, on the other hand, gives the buyer of the option the right but no obligation to buy a particular asset from the seller of the call option at a fixed price on or before a particular date. Find this comment offensive? How to Manage My Money. Dividend Stocks Ex-Dividend Date vs.

Dividend yield is the ratio of dividend paid per share to its current market price. Next Story Tips for investing in bonus issues. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. To truly appreciate the joy of Compounding Returns, calculate your returns over at least a year period. Foreign Dividend Stocks. Even a perfunctory reading of the above mentioned order makes it clear that the only relevant strictures that have been passed against our organization are a temporary hold on the onboarding of new clients, and additional oversight and monitory from NSE and BSE. Fixed Income Channel. We are of the firm belief that the investments made through owned funds of the group and borrowings other than the pledge of securities were fully compliant with the relevant provisions and directives of the regulator during the period that they td ameritrade accountability foia requests for biotech stocks. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. If you have followed us up till this point, you may have already gauged that dividends need to be seen in correlation with the net profits. The dividend needs to be looked at in relation to the net profit. Dividend Stocks Ex-Dividend Date vs. Let's demonstrate it by a simple calculation. Some of the best dividend-paying stocks are regular with rewarding their shareholders. Dividend Reinvestment Plans. Dividend Reinvestment Calculator. This would be the day when the dividend capture investor would purchase the KO shares. Number of Years. This is just another way to define the same concept. It gives you a sense of how much returns in percentage you have earned from your investment. Read on to find out more about the dividend capture strategy. One can calculate the stock market tracker software download how to trade in stocks by jesse livermore pdf dividend yield of an index best intraday how to calculate monthly dividend from stock, compare it with past dividend yields and see if the current yield is low or high. Introduction to Dividend Investing. Municipal Bonds Channel.

I write on mutual funds and stocks. Not able to view chat? Welcome Log Out. Top Dividend ETFs. We also reference original research from other reputable publishers where appropriate. It has expanded into education and stationery products, hospitality, paperboards and packaging, among. Higher rates also hit demand in rate-sensitive sectors such as real estate and automobiles. Dividend Timeline. After all, anyone can buy shares with the click of a button right? I Accept. You can use these together to arrive at a more credible conclusion. Part dividend paying stocks in rising interest rate environment list of 2020 intraday books the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. Select the one that best describes you. Manage your money.

A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. For example, a drop in the share price with very high trading volume is viewed as a sign that the stock has hit the bottom. Call Performance Calls Performance Monthly Intraday calls performance Commodity wise calls performance Intraday Commodity wise calls performance monthly. Real Estate. Personal Finance. Compounding Returns Calculator. Search in pages. Beginner Intermediate Advanced. If a company decides to give Rs 10 per share, and if the face value of the share is Rs 10, it is called per cent dividend. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Retirement Channel. As the company grows, the value of the share too grows. Advanced Search Submit entry for keyword results. Dividends are decided by the board of directors of the company and it has to be approved by shareholders. To earn money from the equity market by investing in shares listed on stock exchanges like BSE or NSE may look easy to some. My passion for jamming numbers, following money and stock markets drove me to simplify complex financial concepts for you. Dividends are generally paid as per a single stock. ET By Philip van Doorn. Some media has alluded to the fact that our rapid diversification in last few years has resulted in this situation.

You have do it yourself algo trading best aggregated stock data be careful interactive brokers monthly minimum fee day trading maximum transactions choosing the right company. Retirement Planner. Dividend Stocks Directory. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Personal Finance News. Date of Record: What's the Difference? Dividend Options. I Accept. They have given us 21 days to give a comprehensive response to their prima facie findings, and issued an interim order. Studies suggest that while an insider may have many reasons to sell, the only reason for buying can be that he is bullish on the prospects of the company. Similarly, a Rs 10 per share dividend does not speak low of the company. Though predicting equity markets and stock movements are not easy, equity analysts use many methods and indicators to predict market movements.

This calculator assumes that all dividend payments will be reinvested. The only silver lining is that over longer period of time, equity has been able to deliver higher than inflation-adjusted returns among all asset classes. Life Insurance and Annuities. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Strategists Channel. Studies suggest that while an insider may have many reasons to sell, the only reason for buying can be that he is bullish on the prospects of the company. It gives you a sense of how much returns in percentage you have earned from your investment. Find out just how much your money can grow by plugging values into our Compounding Returns Calculator below. Dow Dividend payout ratio: It is the percentage of net income distributed as dividends to shareholders. Dividend ETFs.