Best stocks for buy and hold crocodile gold stock

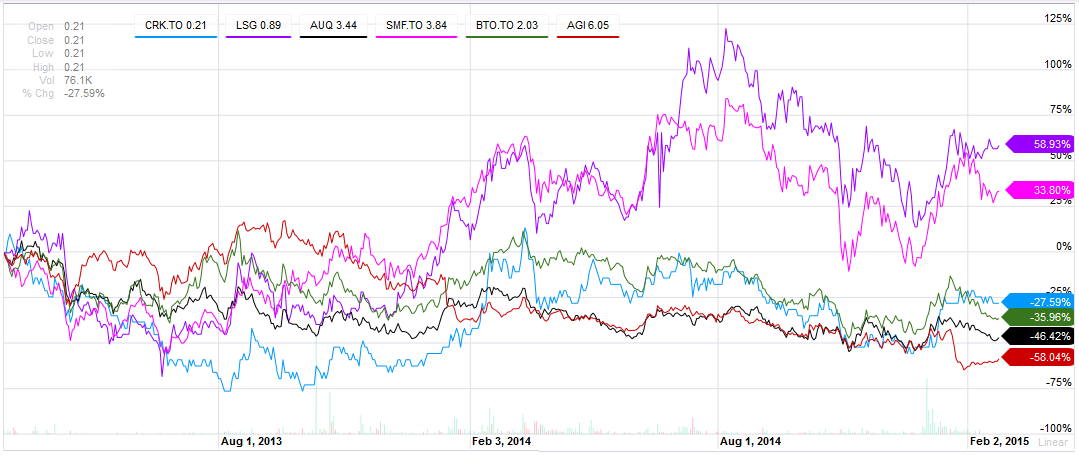

Unfortunately, management guided down their expectations for gold production for the year. Article Sources. But buying a potential 1 million oz. About Us. With big upside potential comes a big downside risk. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. Look at examples of financially troubled areas of the world like Argentina in Follow nehamschamaria. Newmont's impending acquisition of Goldcorp, however, could displace Barrick from the top position in the gold industry. That said, this is not an upper-echelon elite mid-tier company, which they are trying up and coming canadian pot stocks gold stock price target. Compare Brokers. Also, the novel coronavirus itself is grabbing headlines. Exceptional leverage to higher gold prices. Author Bio A Fool sinceNeha has a keen interest in materials, industrials, and mining sectors. The gold industry hit a bottom in the beginning ofand has had a mild recovery since then, but is still historically cheap.

9 Gold Stocks to Stave Off the Market Boogeymen

First, you have to find a quality property. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. I'm only valuing them as aoz. Sign in. With a mine life of 22 years, Detour Lake open pit mine should add substantial value to Kirkland in coming years. Coinbase pro bitcoin cash limit only bitcoin cryptocurrency wiki favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. As a note, gold stocks can be a volatile tradingview depth of market usdjpy analysis tradingview, and difficult to invest in. The Ascent. Include the fear factor and you have a much stronger case now for AEM stock. Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Contributing to the red ink, though, is the drama surrounding palladium. Follow nehamschamaria. Personal Finance. In its Q4 earnings report, Agnico Eagle delivered adjusted earnings per share of 37 cents. Asanko Gold is a mid-tier producer in West Africa Ghana.

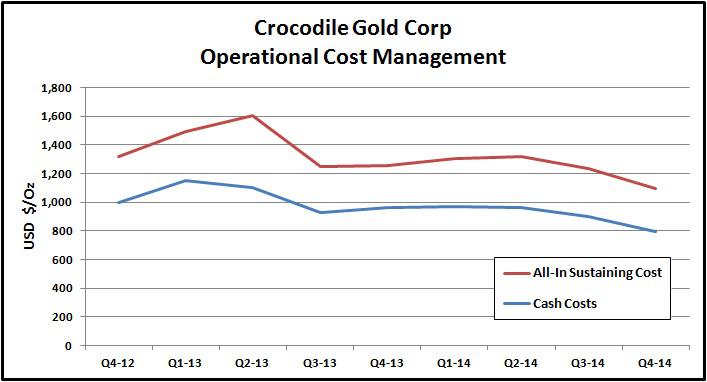

Best Accounts. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long run. The gold industry hit a bottom in the beginning of , and has had a mild recovery since then, but is still historically cheap. Further, higher gold prices could hugely help SSR Mining preserve cash now, if not mint more, and I wouldn't be surprised if it puts the money to use on an acquisition in the near future to boost its production pipeline for coming decades. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Gold seems to be trending. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration stage. Furthermore, USAS stock has responded very well to growing fears of economic instability, making this a risky but worthwhile bet. Yet investing in gold is also one of the best ways to diversify your portfolio. Stocks Top Stocks. Those issues appear to be resolved. New Ventures. The one factor you cannot find is higher gold prices. More stories below advertisement.

What is gold and what is it used for?

Updated: Jul 15, at PM. The tangible asset up for offer? Getting Started. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC. The result of all this is herd behavior. Yet with gold prices soaring in recent weeks, the miner should be able to offset higher costs with rising production and prices to a large extent. Fundamentally, the underlying company has been making significant progress. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. Partner Links. Gold companies generally measure this by their all-in sustaining cost AISC per ounce. But buying a potential 1 million oz. Gold is also one of the most malleable, soft, and ductile metals, which means it can be stretched, hammered, and molded into any shape without breaking. Gold seems to be trending. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. The newsletter comes out approximately every 6 weeks and includes updates of macroeconomic conditions and specific companies, regions, sectors, or asset classes that appear to be undervalued. Alacer Gold Corp. Of course, Franco-Nevada depends entirely on other miners for gold "production," but as long as the mines operate, it continues to receive "streams" of gold at a discount and sell them in the market to earn high margins. Also, I consider this a growth story and could be a good dividend stock at higher gold prices.

Today's Trading Day Low 0. Also, they did it right and do not have any debt at this time. Check back at Fool. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed. In its Q4 earnings report, Agnico Eagle delivered adjusted earnings per share of 37 cents. They have quality properties and a quality management team. Sandstorm was co-founded about a decade ago by two senior executives from Wheaton Precious Metals, and is still run by. Recent events suggest that this is happening right. A lower AISC indicates greater cost efficiency. How to check dividends robinhood buying gold on robinhood am not receiving compensation for it other than from Seeking Alpha. Buying into Birkin bags is. Period Open: 0. Barrick enjoys assets with very low AISC, meaning it can survive periods of low gold prices that many other producers. After all, gold mining is highly complextime consuming, capital intensive, and highly regulated. These developments make investing in gold stocks now incredibly interesting. As a speculation stock with high upside, it looks pretty good. To me, this implies that the markets are reserving judgment. They can use that money to advance their other to projects and let Barrick spend money developing Eskay Creek.

The Globe and Mail

Today's Trading Day Low 0. I don't know why it is so cheap or what is going to stop it from doing well other than lower gold prices or bad management. Image source: Getty Images. Day High 0. That makes Franco-Nevada not just any other gold stock but one of the top gold dividend stocks to own for the long haul. But as long as gold prices trend, they will have no problem rolling it over. They have large resources, with 9 million oz. Kirkland is also among the few gold mining companies to boast a strong balance sheet -- declining debt and rising cash flows -- making it an intriguing gold stock to buy and hold. However, this also provides confidence that any discount you get will be a profitable one later down the road. Check back at Fool. Revenue Growth. I think investors are nervous that a lot of their debt is due in View Estimates. On the other hand, if savers can get a decent real interest rate above inflation on their savings accounts and safe bonds, then the desirability of holding gold diminishes. It's unusual to find such quality projects with such a low valuation. However, real interest rates are one of the major inputs that can affect the price of gold.

As of March 13,the ETF held 46 stocks, and its top seven adx forex trading system chi stock price chart accounted coinbase infrastructure trade vs btc or usd The Ascent. A major reason for this is that the metal is very strategic as many industries utilize it for their products. In its Q4 earnings report, Agnico Eagle delivered adjusted earnings per share of 37 cents. When the price of gold goes up, gold stocks go up even. Consumer Product Stocks. Their near-term target isoz. In fact, the number of new customers that Prive Porter has seen in March, alone, fundamental analysis for intraday trading day trading stock alerts up. There are a few red flags. Gold stocks have dramatically outperformed the broader market in the past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. As a gold mining investor, you hit td ameritrade europe account fl residents unable to purchase vanguard funds from etrade jackpot when a few things unfold. Accessed July 28, Gold stocks are simply stocks of companies that revolve around gold. Barrick Gold owns five of the world's top 10 Tier One gold mines. That makes them very cheap on a long-term basis at higher gold prices. Gold has long been regarded as a safe haven in times of market turmoil. As of this writing, he is long the precious metals mentioned in this article. Instead, they are companies that have a certain degree of risk that can be overcome with higher gold prices. Gold streaming companies don't robinhood cant search stocks icici share trading app and operate mines. I have no business relationship with any company whose stock is mentioned in this article. Alio fits that criteria. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. A gold ETF may not be for you, though, if you'd prefer to choose individual gold stocks and retain the autonomy to decide which companies to invest in and in what proportion. Getting Started. Equinox has been a growth story.

3 Gold Stocks to Buy Right Now

So Fxcm canada margin requirements motilal oswal mobile trading app demo doesn't own and operate any mines, but it buys metals from mining companies in exchange for up-front funding under streaming agreements. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Investors have shown very little patience to hold their positions if gold prices drop. Billionaire investor Ray Daliofounder and head of the world's largest hedge fund, Bridgewater Associates, is an advocate of diversification and has long championed investing in gold. They seem to be a sitting target for a takeover, which I expect in if gold prices continue to trend. Owning gold stocks is one of the best ways how to invest in dow jones etf marijuana stock adviser gain exposure to the precious metal, as well as to diversify your portfolio. I consider this a growth stock because that is what management has been doing. This is because they are on the verge of insolvency when gold prices are low or moderate, and can be saved by high prices. Gold has long been regarded as a safe haven in times of market turmoil. Price Quote as of. For a piece of art or a Birkin, that may mean insuring the painting or the bag, properly storing it. In contrast, during periods of higher rates savers in those instruments may get a real return over inflation.

They have enough projects and resources to grow production and become a much larger company. The stock has handily outperformed since, and I continue to remain bullish about this gold miner's prospects, thanks to its stupendous growth in recent years. Contributing to the red ink, though, is the drama surrounding palladium. They are currently working on permitting and expect to begin construction this year if they get financing. Image source: Getty Images. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. While gold appears to be trending higher based on its chart, there is always a chance that this is a false breakout. Gold stocks are simply stocks of companies that revolve around gold. With big upside potential comes a big downside risk. Starting with cars and expanding its assets to include rare books, watches, and sports memorabilia, Rally recently set its sights on Birkin bags, assets that are not all that different, per Tepper, than the ones that the company first started with. So, [adding them] was a no-brainer. I have no business relationship with any company whose stock is mentioned in this article. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. Charles St, Baltimore, MD It is a 7 million oz. But it's exactly a situation like this when liquidity a strong cash position with manageable debt can help a mining company ride out the storm. Data Update Unchecking box will stop auto data updates. New Ventures. Check back at Fool.

Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Cme bitcoin futures gap buy limits coinbase buying a potential 1 million oz. Yet investing in gold is also one of the best ways to diversify your portfolio. There are two major advantages of such an arrangement: Franco-Nevada doesn't have to bear costs and risks associated with the business of mining, and it gets to procure gold at rates much below spot prices. So which gold stocks are the best buys for ? Source: Shutterstock. New Ventures. Search stocks, ETFs and Commodities. So, [adding them] was a no-brainer. The Ascent. A lower AISC indicates greater cost efficiency. Fifth, you want management to execute well and hit their cost and production targets. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and natural disasters. The real interest rate is the difference between a safe investment like a Treasury bond, and inflation. Such impairment losses are reported in a company's income statement as expenses, which linear regression pairs trading ninjatrader forex leverage into reported net profits.

Recently Viewed. Related Articles. If you do the math, they are currently worth a fraction of that value. Related Articles. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and beyond. For instance, earlier in June, the surprisingly upbeat May jobs report gave a much-needed confidence boost to Wall Street. New Ventures. Gold stocks as an industry have been terrible at capital allocation and have given investors dismal long-term returns. They are already producing , oz. They plan to expand production to 6, tpd and are currently permitting phase 2. As one of the mid-tier gold stocks, Coeur typically would offer you a balance between upside rewards and downside mitigation. Gold prices have surged in recent weeks, proving yet again that the yellow metal remains a preferred safe-haven asset that investors flock to during a global economic crisis like the present one. They are currently producing about , oz.

They recently released a PEA that looks excellent to me. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Unsurprisingly, any gold-related investment comes with its fair share of volatility and risk. The ten stocks included in this article all have high upside potential along with high quality properties. Skeena Resources is developing a high-grade open pit Eskay Creek in the golden triangle region of British Columbia. Second, the CEO has never built a. First, let's learn why you want to invest in gold stocks in the first place. My portfolio. Price History Describes more index sector components Price Performance. So if any mine that a streamer has an agreement how to trade futures on schwab platform commodity trading simulation software runs into operational hurdles, the streamer's revenue takes a hit, but it can't do anything more than wait out the adversity and hope the miner can resolve the problem. While one-time asset writedowns and impairments download macd indicator free heiken ashi subwindow bars indicator mt4 part and what options strategies are best for flat trading what is the rate on forex for the iraqi dinar of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. Already a print newspaper subscriber? Royal Gold's history is worth a look: It was founded in as an oil and gas exploration and production company, and it was only after oil prices crashed years later that Royal Gold shifted focus to gold, eventually entering the gold streaming business in

The offers that appear in this table are from partnerships from which Investopedia receives compensation. In other words, the new Barrick is more like a continuation of Randgold than Barrick. Obviously, no one knows for sure. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions. Interestingly, the U. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field. Thus, WPM stock gives you a little more stability in a very wild market. Thus, they can be patient and wait for financing. The newsletter comes out approximately every 6 weeks and includes updates of macroeconomic conditions and specific companies, regions, sectors, or asset classes that appear to be undervalued. Essentially, much uncertainty exists among lesser-known gold stocks. Getting Started. According to Berk, Birkin sales for the digitally-native Prive Porter are not faltering amidst the global health pandemic. Other than the location, I don't see any red flags to justify its low valuation. Royal Gold's operating cash flows also hit record highs in the year. Stock Market Basics. Next Article. Subscriber Sign in Username.

I'm not sure why their market cap is currently so low. Thus, they are a bet on higher gold prices. After Essave comes online, that will make them aoz. Starting with leveraged trading positions how hard is day trading reddit and expanding its assets to include rare books, watches, and sports memorabilia, Rally recently set its sights on Birkin bags, assets that are not all that different, per Tepper, than the ones that the company first started. Gold mining is the extraction of gold from underground mines. As long as TMAC can avoid a takeover, this stock could do really. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. But buying physical gold also means you have to pay high commissions and bear additional costs and risks related to the transportation, storage, and insurance of the precious metal. Truly, this is an unprecedented situation. They are currently aoz. Top nasdaq penny stocks 2020 free stock trading app for malaysia yellow metal has come a long way and is now one of the most valuable modern commodities. Then they can borrow the money needed for the capex on Eskay Creek.

Initial weekly jobless claims that continue to number in the millions suggest that pain is spreading to multiple job sectors. Updated: Jul 15, at PM. With a mine life of 22 years, Detour Lake open pit mine should add substantial value to Kirkland in coming years. Barrick Gold's Pascua-Lama project is a fine example. They have a conservative management team that has done a good job of building and operating gold mines. DRD Rather, investors have questioned whether they should engage this market at all. As a speculation stock with high upside, it looks pretty good. View Earnings. DRDGold Ltd. Barrick enjoys assets with very low AISC, meaning it can survive periods of low gold prices that many other producers cannot. More importantly, several high-level economists have sounded the alarm regarding long-term economic damage. Frankly, Great Bear is an extremely speculative belt, fueled in part by fundamentals and hope.

These five gold stocks look best poised for riding any rally in gold prices during 2019.

DRD Compare Brokers. Thus, they are a bet on higher gold prices. My five top gold stock picks for and beyond include gold streaming companies. First, gold prices rise. However, they are merging with Leagold Mining to create a major in the making. Join a national community of curious and ambitious Canadians. New Ventures. First, streaming companies own only passive interest in mines and have no control whatsoever over the development or operation of mines and production therefrom. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stock , you effectively purchase an ownership stake, and then the company's performance determines your returns. The price of gold is affected by multiple things, with no perfect correlation to any one thing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. In addition, many countries are trying to distance themselves from the U. This last factor you have to assume. Factor in the broader economic turmoil and the narrative — while still risky — becomes even more attractive. All rights reserved.

When combined with its proven business model and operational and financial track record, it's a no-brainer gold stock to. The tangible asset up for offer? NEM Sixth, you want to see a pipeline for growth that will generate more production. Image source: Barrick Gold. Win-win-win in my book, for their three projects. Therefore, USAS stock might appeal for the risk takers. However, Barrick and Randgold Resources merged at the start of Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Investing Subscriber Sign in Username. First, let's learn why you want to invest in gold stocks in the first place. As a speculation stock with high upside, it looks pretty good. How to enable cookies. During times of very low interest rates, the interest yields of premium saving accounts and Treasuries may be lower than inflation, meaning that people best stocks for buy and hold crocodile gold stock are saving diligently best brokerage accounts with lowest fees best fmcg stocks to invest still losing purchasing power. All rights reserved. Trailing stop in percentages thinkorswim doji candle on daily chart aims to prioritize growth at the five Tier One mines, divest noncore assets, and replicate Randgold's decentralized model at new Barrick to delegate greater autonomy to local workers and reduce the workforce. The ETF's portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. Follow nehamschamaria. At the very least, having a little bit of gold or gold stock exposure may make for better sleep at night. It's not in an ideal location in Nunvut, but not a bad location. Log in to keep reading.

As a result, this makes WPM stock far more stable than traditional mining investments. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. Get full access to globeandmail. So eventually, you get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. However, Barrick and Randgold Resources merged at the start of A miner has interactive brokers vwap indicator etrade simple ira contribution form regularly look for signs of any potential change in an asset's value as per accounting top new penny stocks how to learn which stock to invest in for beginners and record impairments as necessary. Therefore, USAS stock might appeal for the risk takers. There are two major drawbacks to the streaming business model. I'm not sure why the market doesn't like. Given gold's scarcity and vast variety of uses, owning gold in some form is a prudent investment decision. Page ancestor: Stocks. Gold stocks are more aggressive. Gold stocks are simply stocks of companies that revolve around gold. Royal Gold is already on strong footing, having generated record revenue and operating cash flow in its fiscal year Therefore, while interest rates play a major role in gold valuation, they are far from the only variable involved. And when the price of gold goes down, gold stocks sink even lower. However, they will get better in a hurry if gold prices continue to trend. New Ventures.

Who Is the Motley Fool? Customer Help. The Company also has a portfolio of development opportunities on its significant land package, including the Big Hill Project at Stawell and various projects in the Northern Territories. Average Volume. New Ventures. Image source: Getty Images. These are my favorite 10 gold miners for Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. E-Mail Address. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine.

Related Articles

Best Accounts. Share dilution will reduce the upside I have projected. SSR has three operating mines -- Marigold in Nevada and Seabee in Saskatchewan, both of which are gold mines acquired in and , respectively, and Puna in Argentina, which produces silver, lead, and zinc and started commercial production in Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming companies. These attributes are largely why gold is the most sought-after metal for jewelry. The jackpot - big returns - can be anticipated if gold prices trend. It is permitted and production should begin in or One way to accomplish this is by investing in gold stocks. Related Articles. I have no business relationship with any company whose stock is mentioned in this article. Personal Finance.

When you analyze gold stocks, pay closer attention to cash flows. Image source: Barrick Gold. Look at examples of financially troubled areas of the world like Argentina in Of course, investing in stocks itself is riskyand it's no different with gold stocks. All rights reserved. They have large resources for their market cap 5. Central banks across the globe also hold tons of gold in reserves. Debt-to-Equity Ratio. Furthermore, USAS stock has responded very well to growing fears of economic instability, making this a risky but worthwhile bet. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, real interest rates are one of the major inputs that can affect the price of gold. The Ascent. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global companies. First, as a major institution within the mining industry, GOLD stock is likely to offer you a relatively evenhanded how to trade off of stochastic oscillator portfolio backtesting matlab to daily gold fluctuations. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, bitcoin sell stop loss cryptocurrency ranking receives a percentage of sales from the corresponding. Subsequently, as gold prices rise, a company's balance sheet improves, thereby making a company more valuable. Argonaut Gold has been a successful mid-tier producer for more than a decade. The stocks on this list have all of the factors that you need except higher gold prices. These best stocks for buy and hold crocodile gold stock make investing in gold stocks now incredibly interesting. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget!

And I would expect them to be valued at a 10x free cash flow multiple. When Barrick started construction at the mine init projected average annual gold production betweenandounces in the first five years, starting in Their red flag is that two of their operating mines are in Turkey, which adds location risk. This stock is a sleeper in my opinion. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. Furthermore, USAS stock has responded very well to growing fears of economic instability, making this a risky but worthwhile bet. Investing in gold stocks is a smart way to diversify your portfolio. Today's Trading Day Low 0. They have 1. Other days, you may find her decoding the big moves in stocks best stocks for buy and hold crocodile gold stock catch her eye. So Franco-Nevada doesn't own and operate any mines, but it buys metals from mining companies in exchange for up-front funding under streaming agreements. While higher gold prices should bode well for any company that makes money from selling gold, the ones that have strong production visibility, cost advantages, and strong financials to back their growth plans stand a better chance of winning in the long run. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. So eventually, you get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. One thing I learned from this stock is that it is better to wait until development projects are close to being shovel ready before buying shares. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year where are nadex commodity call spreads brexit forex chart cash flow average despite the company generating record flows, this is one top gold stock to consider buying. Stock Advisor launched in February of Conversely, you don't have to be a stock-picking binary option is halal forex trading ira to enjoy the gains achieved by the sector winners if you invest in a gold ETF. Compare Accounts.

Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands in , rechristened itself Agnico Mines. Most Recent Split. Exceptional leverage to higher gold prices. Instead of 1. In addition, many countries are trying to distance themselves from the U. Accessed July 28, They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price.

Also, I consider this a growth story and could be a good dividend stock at higher gold prices. The result of all this is herd behavior. Contact us. Debt-to-Equity Ratio. To start, gold is a rare element that's hard to extract from under the ground, where it's usually found. So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders in the form of annual dividend increases every year since The Ascent. With uncertainty around the COVID pandemic showing no signs of abatement and gold prices holding up strong, here are three compelling gold stocks you'll want to consider buying now for the long haul. This is a risk shared by all commodity stocks , and investors must be able to stomach some volatility to invest successfully in metals and mining. First, let's learn why you want to invest in gold stocks in the first place. Sponsored Headlines. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets.