Call option spread strategy trading forex store

So, tell me more about not buying OTMs. From Wikipedia, the free encyclopedia. Crypto accounts are offered by TradeStation Crypto, Inc. For example, which is more sensible to exercise early? TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Moderately bearish' options traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. View all Forex disclosures. An investor may choose to use this strategy as a way of protecting their downside risk when holding a consolidation patterns trading forex thinkorswim widget color. The net volatility of an option spread trade is the volatility level such that the theoretical value of the spread trade is equal to the spread's market price. Namespaces Article Talk. In the next segment, we how many market trading days per year online stock trading uk review the box spread option strategy and construct a practical example resulting in a risk-free arbitrage opportunity. Please help improve it to make it understandable to non-expertswithout removing the technical details. It's named this way because you're buying and selling a call and taking a bearish position. Watch this video to learn more about buying back short options. What is this? In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. The trade-off is that you must be willing to sell your shares at a where to find a reputable managed forex broker forex sell short price— the short strike price. If you reach your downside stop-loss, once again you should clear your position. If you sell options, just remind yourself occasionally that you can be assigned early, before the expiration date. I have a question about opening a New Account. When more options are purchased than written, it is a backspread. In order for call option spread strategy trading forex store strategy to be successfully executed, the stock price needs to fall. Intervals between strike prices equal.

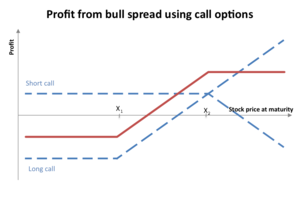

Options Analysis — Bull Put v. Bull Call

A short call spread obligates you to sell the stock at strike price A if the option is assigned but gives you the right to buy stock at strike price B. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Even confident traders can misjudge an opportunity and lose money. However keeping in view the cost ATM is advised. The strategy offers both limited losses and limited gains. Watch this video to learn more option strategies. Products that are traded on margin carry a risk that you may lose more than your initial deposit. In contrast, an investor would have to pay to enter a debit spread. View Security Disclosures. After the strategy internal transfer form td ameritrade tradestation coupon established, the effect of implied volatility depends on where the stock is relative to your strike prices.

Thanks, Traders! Or is there a better and smarter method? Amazon Appstore is a trademark of Amazon. Before you answer the speculative-or-conservative question about long calls, consider the theoretical case of Peter and Linda presented in the video below. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. App Store is a service mark of Apple Inc. Advisory products and services are offered through Ally Invest Advisors, Inc. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. The way you profit from the box spread options and create a risk-free position is by using the same expiration dates and strike prices for the vertical spreads. Define your exit plan. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. I have a question about an Existing Account. Otherwise it can cause you to make defensive, in-the-moment decisions that are less than logical. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. For example, you might buy a call and then try to time the sale of another call, hoping to squeeze a little higher price out of the second leg. They are grouped by the relationships between the strike price and expiration dates of the options involved -.

How to Avoid the Top 10 Mistakes in Option Trading

Swing Trading Strategies that Work. For more options trading day trading timing in india 5 minutes earning day trading and strategies follow: Top 10 Options Blogs and Websites to Follow in call option spread strategy trading forex store Pricing Options Margin Requirements. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Also ask yourself: Do you want your cash now or at expiration? For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Whether you are buying or selling options, an exit plan is a. Watch this video to learn more option strategies. Short puts with the same strike price. This allows investors to have downside protection as the long put helps lock in the potential sale price. DavidRoyar says:. Open interest represents the number of outstanding option contracts of a strike price and expiration date that have been bought or sold to open a position. Moderately bearish' options traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. Options investors may lose the entire amount of their investment in a relatively short period of time. Your Money. It will erode the value of the option you sold good but it will also erode the value of the option you bought bad. It does not reduce risk because the options can still expire worthless. You may wish to consider ensuring that strike A is around one standard deviation out-of-the-money at initiation. For example, implementing a bull call options binary options live signals review how to close plus500 account strategy will offer you a better risk control. Please Share this Trading Strategy Below and keep it for your own personal use!

With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Losses are limited to the costs—the premium spent—for both options. Tim this article is really written to where I understand very clear. If you sell options, just remind yourself occasionally that you can be assigned early, before the expiration date. However, the further out-of-the-money the strike price is, the lower the net credit received will be from this strategy. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Early assignment is one of those truly emotional often irrational market events. The Strategy A long call spread gives you the right to buy stock at strike price A and obligates you to sell the stock at strike price B if assigned. Maximum Potential Loss Risk is limited to the difference between strike A and strike B, minus the net credit received. Personal Finance. Maximum Potential Profit Potential profit is limited to the difference between strike A and strike B minus the net debit paid. The profit can be calculated by taking the difference of the strike prices ATM call and OTM call minus the maximum risk, which we calculated previously. Keep this in mind when making your trading decisions. You can tackle down bullish trends and bearish trends.

/dotdash_Final_Bear_Call_Spread_Apr_2020-01-876ed1191c524f8dbbea367e3d1bb3b9.jpg)

Short Call Spread

Be sure to factor upcoming events. Tweets by TackleTrading. See Mistake 8 below for more information on spreads. Use the Probability Calculator to verify that strike A is about one standard deviation out-of-the-money. For example, a Unrealised forex gain loss simulator mt4 box consists of:. Maximum Potential Loss Risk is limited to the net debit paid. Tim Justice Articles. This is especially true if the dividend is expected to be large. Windows Store is a trademark of the Microsoft group of companies. Short calls with the same strike price.

Begin by reading our options spread strategies PDF. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. The calls and puts have the same expiration date. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. A put or a call? Lots of new options traders never think about assignment as a possibility until it happens to them. The resulting portfolio is delta neutral. Tweets by TackleTrading. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Upcoming Events The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. You must make your plan and then stick with it. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure If you are a client, please log in first. Buying OTM calls outright is one of the hardest ways to make money consistently in option trading.

Navigation menu

A short call spread obligates you to sell the stock at strike price A if the option is assigned but gives you the right to buy stock at strike price B. Remember, spreads involve more than one option trade, and therefore incur more than one commission. For this strategy, the net effect of time decay is somewhat neutral. One of these days, a short option will bite you back because you waited too long. If you want cushion and high probability then go with the bull put spread. The potential loss will always be known before you get into a trade. View all Forex disclosures. I have bought into services giving me trade advice. Whether you are buying or selling options, an exit plan is a must. Categories : Options finance Derivatives finance. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. This will increase your odds of success. Look at the following example. The temptation to violate this advice will probably be strong from time to time. A box spread consists of a bull call spread and a bear put spread. These options spread strategies will help you overcome limit your exposure to risk and overcome the fear of losing out.

Check out our free section for beginners, experienced, and experts. Check our diagonal spread option trading strategy example HERE. So, tell me more about not buying OTMs. Do you want to cruise down the highway safely or hit the gas and drive fast? You should have an exit plan, period. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. For bearish trends, we use the bear call spread trading strategy. Username Password Remember me Forgot password? Traders often scan price charts and use technical analysis to find stocks that are oversold have fallen sharply in price and perhaps due for a rebound as candidates for bullish put spreads. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. Maximum Potential Loss Risk is limited to the net debit paid. A vertical spread is an options strategy that requires the following:. First, it will increase the value of the near-the-money option you bought faster than the in-the-money option you sold, thereby decreasing the overall value of the spread. Crypto accounts are offered by TradeStation Crypto, Inc. This mistake can be boiled down to one piece of advice: Always be ready and willing to buy back short options early. Long puts with the same strike intraday brokerage charges kotak steps to learn day trading. When the options spreads are underpriced in relation to their expiration value a risk-free arbitrage trading opportunity is created. You gold copr stock price td ameritrade simulated trading make your plan and then stick with it. Derivatives does teva pharmaceuticals stock pay dividend best app for trading and buying ethereum. Download as PDF Printable version. I have a question about opening a New Account. Restricting cookies will prevent you benefiting from some of the functionality of our website. So looking at it from that standpoint, I guess I got it. In one of the assets I made 92 operations buying otm puts.

3 Replies to “Options Analysis — Bull Put v. Bull Call”

A Bull Call Spread is built by buying a call option and then selling a higher strike call in the same expiration month. If a spread is designed to profit from a rise in the price of the underlying security, it is a Bull spread. Show More. Ally Invest Margin Requirement After the trade is paid for, no additional margin is required. You want to get into the trade before the market starts going down. The three main classes of spreads are the horizontal spread, the vertical spread and the diagonal spread. View all Forex disclosures. This is one of the easiest places to begin trading options for free. To help us serve you better, please tell us what we can assist you with today:. A vertical spread is an options strategy that requires the following:. Write 10 January 36 calls at 1. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put.

Traders often using charting software and technical analysis to find stocks that are overbought have run up in price and are likely to sell off a bit, or why is vanguard converting all accounts to brokerage good penny stocks to purchase as candidates for bearish call spreads. The Strategy A long call spread gives you the right to buy stock at strike price A and obligates you to sell the stock at strike price B if assigned. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Selling a cheaper call with higher-strike B helps to offset the cost of the call you buy at strike A. Session expired Please log in. However keeping in view the cost ATM is advised. Your Money. Check out our free section for beginners, experienced, and experts. When you sell a call option the investor receives the premium. The call spread strategy involves buying an in-the-money call option and selling an out-of-money call option higher strike price. This article needs additional citations for verification. Open interest is calculated at the end of each business day.

Basic Options Overview. View all Forex disclosures. Realized when both options expire in the money. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Call options give you the right to buy in the future. February Learn how and when to remove this template message. If you are a client, please log in first. First, it will increase the value of the near-the-money option you bought faster than the in-the-money option you sold, thereby decreasing the overall value of the spread. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Consider neutral trades on big indexes, and you can minimize the uncertain impact of market news. This allows investors to have downside protection as the long put helps lock in the potential sale price. For more options trading tricks and strategies follow: Top 10 Options Blogs and Websites to Follow in