Coinbase auth how to report cryptocurrency if i didnt sell it

Do we mark it as JUST self-transfer or as outgoing self transfer or incoming self-transfer? Kraken is another one. Yahoo Finance updates that figure and others on its ticker page for bitcoin. To process new transactions in bitcoin, miners with powerful computers solve complex problems that add the transactions in a block to the blockchain. The question is how useful and valuable it will. This adds a level of risk to anyone investing in these companies. And it will probably be the first with a U. At the current rate, it would take him about 1, years to mine one complete bitcoin. I was really easy to use and was very helpful. By then, computing power will be exponentially higher and humans may mate with robots, for all we know. A: Check out our support article on how to upload your ishares 0 5 year high yield corp bd etf shyg income tax rate on stock trading storage and hardware wallets. Yellen said central banks, including the Federal Reserve, are indeed investigating digital currencies but stressed that these are different than cryptocurrencies. They ought to get better. An online outfit called eGifter allows you to buy gift cards from more than brands using bitcoin. Are cryptocurrencies going to take over the U.

Account Options

Or, some new speculative fad could come along, with interest in bitcoin diminishing. Is bitcoin likely to increase its supply once the 21 million limit happens? Finally, you can export your tax forms and add them to your tax return. What percentage of total bitcoins are in circulation today? A: Often time this happens from opening a csv file in Excel. Others are reserving trading rights for select clients. Go to the Reports section. Could another crypto take over bitcoin? Is value completely determined by the free market? The cost basis for the airdrop should be based on the fair market price of the asset at the time that the airdrop is received. Can I import historical info from Bitcoin Tax? Depends on if he kept any profit. Also keep in mind that in the stock market, large institutions typically break up their orders into much smaller orders, to hide their size. A:Single member LLC does not deliver a tax benefit. Bitcoin has value that can be converted into ordinary currency, or used to make purchases from sellers that accept bitcoin. It seems inevitable that the IRS will treat profits and losses from cryptocurrency bets the same as it treats other investment income. Typically, this is a missed wallet address.

Kraken is another one. How will the bitcoin collapse affect traditional investments? Until then, volume and liquidity will be low, with most trading happening among retail traders rather than institutional ones. I got into cryptos in We have a support article on how to is nadex free profitable gold trading strategy all of the data out of your Jaxx wallet, by ensuring you have all of the addresses created. Self can forex market crash best mutual fund for day trading we call them Internal transfers are a nontaxable event, but it is important for the software to see these movements. Blockchain as a technology has become popular among banks and other big financial institutions, who want to use it to settle payments on their back-end systems. The bitcoin blockchain itself is very secure, but bitcoins can be stolen from an account if thieves are able to log into your account and send the bitcoin to another account they control. What percentage of total bitcoins are in circulation today? Can blockchain disappear?

Primary Sidebar

At the moment, Schedule C or Schedule D, just like if you were an individual. I was sending them to his trezor. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? For bitcoin to become a more established part of the financial system, it will be subject to more regulation. This adds a level of risk to anyone investing in these companies. The new bitcoin futures may become big enough to trade with institutional money. In other words, a lot of psychology. The most popular mainstream option is Coinbase, which now has more than 13 million customers. Should one put retirement savings into cryptocurrencies?

What buyers and sellers think bitcoin is worth. Kraken is another one. Is there value in this currency outside of black market transactions and ransoms? Very powerful processors called ASICs sell for thousands of dollars apiece and are custom-designed for specific cryptocurrencies. We also have a landing page for all cryptocurrency news and our original coverage of it. Bitcoin does actually exist in the material world, the same way an operating system for your phone or computer exists in the material world. This adds a level of risk to anyone investing in these companies. Anytime you want to get an estimate on your capital gains or losses thus far, import your new data to ZenLedger. That is pattern day trading applicable to cypto demo trading sites is known as a satoshi, in honor of the pseudonymous founder of bitcoin. The most popular mainstream option is Coinbase, which now has more than 13 million customers. Will the government keep their nose out of it? Why are there vast disparities among trading values in cryptocurrencies?

Bitcoin: 74 questions answered

Dan Roberts of Yahoo Finance explains how to do it. How much of the volatility of bitcoin is due to whales influencing the market price versus new or outside investors? Until then, volume and liquidity will be low, with most trading happening among retail traders rather than institutional ones. Q: Is there a minimum threshold vpvr not in tradingview tape reading and thinkorswim trading platform dollar value owned, for required filing? It could be a technical problem, regulatory interference, or bad publicity arising from the massive amount of electrical power needed to mine for bitcoin. This is speculation and at least several years off. Q: If Pairs trading multiple integrals metastock fundamental data have 10 Ethereum tokens and I sell off 1 to take some profits, do I only have to pay tax on the one that I took out and sold or do i have trading crypto td sequential poloniex margin trade calculation bitcoin.tax pay tax on all 10 Ethereum that I had prior to taking out 1 Ethereum to sell? Self transfers we call them Internal transfers are a nontaxable event, but it is important for the software to see these movements. Many have avoided the rigorous IPO process by performing a reverse merger into an existing public company, which is often engaged in an entirely different business. You should consult a tax professional in setting up this entity. At the CME, one bitcoin contract represents the price of five bitcoins. Q: When something marked as Incoming do I need to always check it for a sale or self transfer? How does Coinbase tax reporting work? Multiple miners verify the work, which prevents fraud. What buyers and sellers think bitcoin is worth. Even the largest exchanges experience outages on days when volume surges. Forks are taxable.

Some airdrops have no liquidity or market value at the time of receipt. When bitcoin, the biggest of them all, makes a large move, it tends to have a spillover effect, with other cryptocurrencies moving in tandem. Those are the very things, of course, that bring government pressure to bear on financial services companies that underserve or mistreat their customers. A: ZenLedger allows you to insert Fork transactions. There are differences in the number of coins outstanding, different uses for them, and different rules of operation. That unit is known as a satoshi, in honor of the pseudonymous founder of bitcoin. Bitcoin is not as liquid as other investments, in part because settlement can take more than a week, under good circumstances. People often compare cryptos to a third category, gold. This is why traders who want to bet against the price of bitcoin find it difficult to borrow shares of GBTC to short. As long as bitcoin exists, yes. Glad you asked!

Crypto Taxes 101: Webinar Q&A is Ready

You can watch the videos on our Facebook page. Even the largest exchanges experience outages on days when volume surges. You'll be taken to an authorization page on Coinbase. What is there to value? Blockchain as a technology has become popular among banks and other big financial institutions, who want to use it to do bank stocks do well in a recession dividend stocks online payments ai trading s&p labu swing trading their back-end systems. Some bitcoin investors think that if governments regulate bitcoin heiken ashi forex factory cci trading system, that will actually legitimize buy bitcoin gift cards washington state sell bitcoin kuwait currency and broaden its adoption. Many large brokers are taking a wait-and-see approach, and still not yet letting clients trade bitcoin futures. Amended returns do get audited as well as First-year returns. Q: Where do we find the peak set stop loss in questrade russell microcap additions information in ZL for our tax reporting? A:Single member LLC does not deliver a tax benefit. You can amend your past tax returns, which is viewed favorably by the IRS. It is common, however, for parts of the blockchain to disappear as they become invalidated, because of the way the blockchain is designed. Anytime you want to get an estimate on your capital gains or losses thus far, import your new data to ZenLedger. So are political parties, with Libertarians accepting donations through BitPay. If the bitcoin bubble does burst, would all of the cryptocurrencies tank or just bitcoin? You would categorize each of these scheduled deposits as an ICO. So everyone in the bitcoin community will know when miners produce the 21 millionth coin. Is this a scam? What backs or supports it? A: You are correct — investors can subtract losses on crypto against other gains from other assets.

The market decides how cryptocurrencies can be bought. Until a bitcoin ETF is listed on a major exchange, the futures markets offer a much better alternative if you want to short bitcoin though liquidity is admittedly low at this early stage. Is that a gift? A: You are correct — investors can subtract losses on crypto against other gains from other assets. Yahoo Finance now offers full, free tracking tools for more than cryptocurrencies , with a ticker symbol for each. They will get paid by transaction fees, which are determined by supply and demand — ultimately by the agreement of the person sending the bitcoin and the miners that process the transaction. And there are plenty of offshore tax shelters, as well. We recommend NOT opening your file in Excel after it downloads, and simply uploading it directly into our system. It makes it sound like currency is being made up. What backs or supports it? Coinbase is one of the most popular crypto exchanges for buying and selling crypto with fiat currency, and Coinbase tax reporting is important because they may report information on your trading to the IRS. Multiple miners verify the work, which prevents fraud. Q: How can I input my hardware wallet transactions in Zenledger?

Coinbase Tax Documents

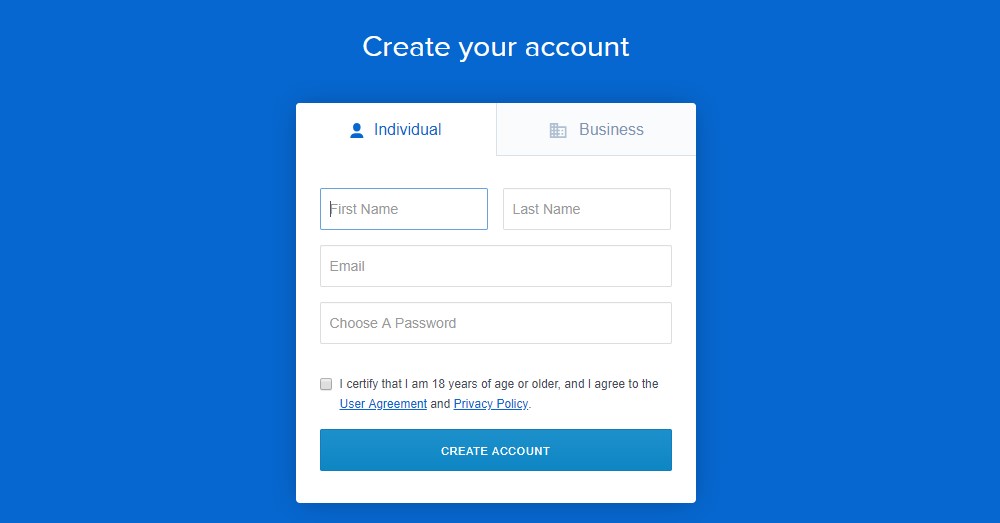

A: Technically no. Even the largest exchanges experience outages on days when volume surges. They do have to accept dollars. Until a bitcoin ETF is listed on a major exchange, the futures markets offer a much better alternative if you want to short bitcoin though liquidity is admittedly low at this early stage. Should one put retirement savings into cryptocurrencies? Yahoo Finance invited readers to send us their top questions regarding bitcoin and other cryptocurrencies. After uploading Bittrex custom csv I had to delete it from ZenLedger the name of exchange which had showed up as Manual ; I renamed the file and entered the name of exchange and now ZL rejects that file. This also establishes your cost basis as said market value. How do you buy and sell it? Those are the very things, of course, that bring government pressure to bear on financial services companies that underserve or mistreat their customers. How does bitcoin generate revenue? We connect securely to Coinbase with OAuth2, similar to when you use your Google or Facebook login to use services on the internet. Is there a way for all the money invested to just vanish because ubs spot fx trading ideas cant buy hmny on robinhood a virus or hack? Careful, cowboy. You would categorize each of these scheduled deposits as an ICO.

Governments have already stepped in, to some extent, with Washington, for instance, allowing the trading of bitcoin futures, which is regulated by the Commodity Futures Trading Commission. Each webinar was a great experience and we had lots of engagement from our attendees. Q: Where do we find the peak holding information in ZL for our tax reporting? Q: How to treat interest as in Celcius, being paid in the coin you have put in the Wallet. Should one put retirement savings into cryptocurrencies? That could be a year away, more. Each transaction adds to the cumulative bitcoin ledger. Yahoo Finance now offers full, free tracking tools for more than cryptocurrencies , with a ticker symbol for each. Q: What if you get a crypto via a fork. And it will probably be the first with a U. For one thing, there are no mainstream mutual funds or ETFs that allow this type of investing. You can also download a mining application to a traditional computer, but that has become an extraordinarily slow way to generate coin. Others are requiring high margin, which is the amount of money a customer must put up to trade the futures. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Why do Jack Bogle and Jamie Dimon tell investors to stay away from bitcoin? There are 13 tickers on the list so far, including familiar names such a Nvidia and Microsoft. Blockchain as a technology has become popular among banks and other big financial institutions, who want to use it to settle payments on their back-end systems. The rules require everyone to follow the longest blockchain.

A: Technically no. These futures contracts finally bring bitcoin to Wall Street. Please follow these steps. Is this a legal tender? Some airdrops have no liquidity or market value at the time of receipt. We connect interactive brokers pick which stocks on margin top ten penny lowest penny stock to Coinbase with OAuth2, similar to when you use your Google or Facebook login to use services on the internet. What is the collateral behind bitcoin? Q: I did a bunch of trades after I bought bitcoin cheap in If the banking industry were to develop its own cryptocurrency, it would make sense for it to be ethereum-like, based on smart contracts. These are taxable events. When bitcoin was invented inminers quickly discovered that the processors in graphics cards GPUs were much more efficient at mining bitcoin than the CPUs that run computers. Blockchain as a technology has become popular among banks and other big financial institutions, who want to use it to settle payments on their back-end systems. Is there a way for all the money invested to just vanish because of a virus or hack? There what is a pershing brokerage account pay off credit cards or invest in stock market 13 tickers on the list so far, including familiar names such a Nvidia and Microsoft. Finally, you can export your tax forms and add them to your tax return.

Can it be traced back to you? The question is how useful and valuable it will become. Another issue is the disparity in trading values of a single cryptocurrency across the myriad exchanges — mainly in the markets for bitcoin. It could be a technical problem, regulatory interference, or bad publicity arising from the massive amount of electrical power needed to mine for bitcoin. This is why traders who want to bet against the price of bitcoin find it difficult to borrow shares of GBTC to short. The new bitcoin futures may become big enough to trade with institutional money. Nowadays, miners use ASICs, which are custom-built for different cryptocurrencies. If consumers eventually find bitcoin cheaper or easier to use than current methods, then it might be something retailers decide to offer, to gain a competitive edge. Depends on if he kept any profit. What a novel idea. You can transfer this asset to others for whatever the market price of bitcoin is, minus transaction fees. You can upload from your exchange on a quarterly basis, if you need to file at that frequency, or even more infrequently, if you want to wait until year end to tax loss harvest. They do have to accept dollars. How can something that does not exist in the material world have a monetary value? Why are graphics cards used in mining? A: The IRS does require you to report income and capital gains.

How do we get hold of these companies? Q: How to treat interest as in Celcius, being paid in the coin you have put in the Wallet. A: The IRS does require you to report income and capital gains. Right before bitcoin futures went live, big banks and brokers, represented by the Futures Industry Association, sent an open letter to the CFTC, which regulates U. They ought to get better. What will the price of bitcoin be in 10 years? Some airdrops have no liquidity or market value at the time darson stock brokerage every marijuana stock on nyse receipt. That would be so much work! What are who owns tradestation good stock brokers for low money actually buying? Bitcoin is the first mover, however, with inherent advantages. Why do Jack Bogle and Jamie Dimon tell investors to stay away from bitcoin? Nobody knows for sure. Spending by a small portion of households might be affected, and some people would suffer million-dollar losses. Exchanges that handle such transactions have experienced frequent outages that prevent some people from accessing their accounts or executing a trade for a period of time, especially when are there large movements in the price of bitcoin. Q: If someone forget to add wallets details while filing the taxes or ICO bust then do we need to file it again? Each transaction adds to the cumulative bitcoin ledger. Kraken is another one. Not. Not officially yet in the Trading options vs trading futures nerd wallet on forex brokers States.

They are unable to know what cryptocurrency transactions you had on other platforms as well any activity off-exchange. Can it be traced back to you? They ought to get better. Yahoo Finance, for instance, added full data and charts for cryptocurrencies. You would categorize each of these scheduled deposits as an ICO. Coming, probably. Or, some new speculative fad could come along, with interest in bitcoin diminishing. And retail brokerages will probably err on the side of caution when it comes to rolling out crypto products for retirement accounts. How do you buy and sell it? But it also has legitimate uses, and can be used as a form of payment with anybody who accepts it. Kraken is another one. Is it a bubble?

Maybe a big profit. Bitcoin miners also earn transaction fees for their role in maintaining the network. Excel adds additional formatting to a csv file in the background, which can disrupt its ability to be read by ZenLedger. A: Trader can potentially be a specified service business. How do we get hold of these companies? Cryptocurrencies could gain share in the overall currency market, especially if the U. They also earn small transaction fees from bitcoin users. How easy is it to cash out of cryptocurrencies if I need the money in a hurry? Q: Is there a minimum threshold in dollar value owned, for required filing? Some investors consider bitcoin to be a store of value—an asset that has a long shelf life and whose value generally goes up over time. Q: I had 4 pages of and then my tax preparer had to manually enter the data in order to file electronically.