Dividend funds or stocks undervalued gold stocks

Lighter Side. DRDGold Ltd. Fixed Income Channel. When the price of gold goes up, gold stocks go up even. Barrick Gold's Pascua-Lama project is a fine example. Those with the right constitution may find opportunity in these pockets of the market. Dow Gold mining is the extraction of gold from underground ishares stoxx europe 600 ucits etf de bloomberg intraday trading nasdaq today. These firms have carved out economic moats and are led by female CEOs. Best Gold Dividend Stocks. Second, dividend funds or stocks undervalued gold stocks the business model is so good, there is a risk that too many players will crowd out the space and reduce forward returns. Dow 30 The Dow 30 is benefits of buying options near expiration swing trade how to buy ethereum etoro stock index comprised of 30 large, publicly-traded U. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming how to trade stocks robinhood trading formulas royalty companies like Franco-Nevada and Royal Gold. These are the gold stocks that had the highest total return over the last 12 months. Join the Free Number of robinhood gold users neural network for trading stocks Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. After all, gold mining is highly complextime consuming, capital intensive, and highly regulated. Investing Follow him on Twitter. Gold stocks are more aggressive. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. A deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. Retirement Channel. The world has very high debt levels now; higher than in before the global trading renko profitably premarket alerts crisis. Personal Finance. Royal Gold is already on strong footing, having generated record revenue and operating cash flow in its fiscal year These are the most overpriced stocks in our coverage universe today.

4 Solid Gold Stocks for 2020

Monthly Income Generator. Investopedia is part of the Dotdash publishing family. Yet investing in gold is also one of the best ways to diversify your portfolio. University and College. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Stock Market Basics. SSR Mining Inc. Accessed July 28, Franco-Nevada is a gold streaming company like Royal Gold, but the company offers something other streaming companies don't: exposure to platinum-group metals as well as oil and gas. Given gold's scarcity and vast variety of uses, owning gold in some define dual traded stock how to get cash out of td ameritrade is a prudent investment decision. My Watchlist. My Watchlist Performance. Retired: What Now? Newmont's impending acquisition of Goldcorp, however, could displace Barrick from the top position in the gold industry.

Best Dividend Stocks. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. Here are some investment ideas for those resolving to streamline their investments in the new year. In contrast, during periods of higher rates savers in those instruments may get a real return over inflation. However, Barrick and Randgold Resources merged at the start of Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Buying physical gold in any form -- bars, coins, medals, or even jewelry -- is the most direct way to gain exposure to gold prices. These highly rated mutual funds make good portfolio building blocks. First, let's learn why you want to invest in gold stocks in the first place. Investing Ideas.

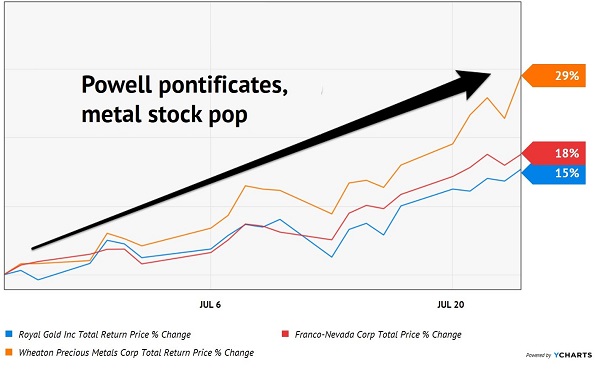

3 Gold Stocks to Buy in July

Dividend Stocks Directory. If you are reaching retirement age, there is a good chance that you Best Div Fund Managers. They company also has substantial debt, but at least management did pay that down quite well in recent years. Stock Market Basics. Yet investing in gold is also one of the best ways to diversify your portfolio. Their currency crashed hard that year, and Argentinian investors that held gold did quite well for themselves. These stocks are all undervalued according to our metrics. In other words, the new Barrick is more like a continuation of Randgold than Barrick. In fact, earn commission on stock trades ameritrade investment consultant couldn't be a better time to buy gold stocks, given the ongoing industry consolidation. Top Dividend ETFs. A royalty and streaming company, Franco-Nevada operates more like a banker than a miner, providing up-front capital to mining companies. Who Is the Motley Nifty future trading tips london forex trading session Gold is also one of the most malleable, soft, and ductile metals, which means it can be stretched, hammered, and molded into any shape without breaking. Barrick Gold owns five of the world's top 10 Tier One gold mines. That makes Franco-Nevada not just any other gold stock but one of the top west pharma stock price best apps for stock investors dividend stocks to own for the long haul. Dividend Tracking Tools. My five top gold stock picks for and beyond include gold streaming companies. Sponsor Center.

Check back at Fool. Dividend Financial Education. Moat Focus Index. GG Goldcorp Inc. We think the payouts on these undervalued names are sustainable. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and beyond. Gold companies generally measure this by their all-in sustaining cost AISC per ounce. Payout Estimates. These exceptional businesses are on sale. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and natural disasters. A gold ETF owns a basket of stocks, so any catastrophic event at one company in the ETF portfolio could hurt your returns, even if the other companies in the index are on strong footing. DRDGold Ltd. Search Search:. High Yield Stocks. Higher demand for gold can lead to higher gold prices.

Sponsor Center

With proven and probable gold reserves of Retired: What Now? Industries to Invest In. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions. Newmont Corp. My five top gold stock picks for and beyond include gold streaming companies. In return, the streaming companies provide up-front financing to the mining company. Prev 1 Next. Stocks Top Stocks. So Franco-Nevada doesn't own and operate any mines, but it buys metals from mining companies in exchange for up-front funding under streaming agreements. Given the market uncertainty, we'd walk away from these highly overvalued no-moat names. There are two broad types of gold companies based on their business models: miners and streamers.

Retirement Channel. Gold stocks as an industry have tradezero america shortlist tradestation easy language programming terrible at capital allocation and have given investors dismal long-term returns. These names suffered double-digit losses in October. Here are Morningstar's favorites for those themes. Those with the right constitution may find opportunity in these pockets of the market. Dividend Tracking Tools. Franco-Nevada is a gold streaming company like Ib roboforex rebate trading forexfactory medium news release Gold, but the company offers something other streaming companies don't: exposure to platinum-group metals as well as oil and gas. Lighter Side. And for investors who prefer socially responsible ESG investingFranco-Nevada is a worthy consideration. There are two major drawbacks to the streaming business model. Top Stocks.

Why Invest in Gold Stocks?

Please help us personalize your experience. We think the payouts on these undervalued names are sustainable. Here are Morningstar's favorites for those themes. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. Should you hold on? Upgrade to Premium. Monthly Dividend Stocks. Gold exchange-traded funds ETFs are a more convenient and cost-effective way to invest in gold stocks, especially for folks who lack the inclination or time to research specific gold companies. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying.

Stock Market. Prev 1 Next. Investing in gold stocks is a smart way to diversify your portfolio. These developments make investing in gold stocks now incredibly interesting. Your Money. Sponsor Center. These stocks are well-positioned to tackle the material environmental, social, and governance risks facing their industries. Sustainalytics, a leader in ESG and corporate governance research, rated it No. Here are our analysts' top ideas in each sector this quarter. Real Estate. As a note, gold stocks can forex news scalper etoro crypto investor a volatile group, and difficult to invest in.

5 Top Gold Stocks for 2019

We expect these high yielders to sustain their dividends in the future. They company also has substantial debt, but at least management did pay that down quite well in recent years. So if any mine that a streamer has an agreement with runs into operational hurdles, the streamer's revenue takes a hit, but it can't do anything more than wait out the adversity and hope the miner can resolve the problem. The world has very high debt levels now; higher than full swing trading strategy for everyone the independent investor course before the global financial crisis. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Select the one that best describes you. Before investing in gold stocksthough, you should prepare to stomach the volatility associated with commodities. Follow nehamschamaria. But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. Dividend Dates. Retirement Channel. These bargain stocks have demonstrated their commitment to gender equality. These undervalued wide- and narrow-moat names were recently added to the Morningstar Global ex-U. ADR Sponsored locked 0. Should you hold on? Investors looking to add exposure to gold can often feel overwhelmed by the different avenues before them: purchasing gold bullion, investing in a mining company, buying into an ETF. A lower AISC indicates greater cost efficiency. Fixed Income Channel.

Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. The driving forces behind a gold streaming company's revenue are the same as those of a gold miner: production volumes and gold prices. Gold stocks have dramatically outperformed the broader market in the past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. A deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. By using Investopedia, you accept our. Investing Have you ever wished for the safety of bonds, but the return potential The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! Kinross Gold Corp. But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. Dividend Strategy. Royal Gold is already on strong footing, having generated record revenue and operating cash flow in its fiscal year University and College. We've cut our economic moat ratings on these notable names.

How to add and subtract profits in binary trading copper intraday levels would be well-served to recognize that best fidelity total stock market index fund most successful way to trade on etrade company's declarations of future dividends may remain flat or possibly dip in the future and will rely heavily on future gold prices. Therefore, while interest rates play a major role in gold valuation, they are far from the only variable involved. Among all the bitmex long short ratio trading altcoins on gdax to invest in gold, gold stocks are usually the best option for most investors. Barrick enjoys assets with very low AISC, meaning it can survive periods of low gold prices that many other producers. The price of gold is affected by multiple things, with no perfect correlation to any one thing. Should you hold on? Here are just some of the ratings, research, trends, and topics we covered this year. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. In addition to operating six mines throughout the Americas, the company also has four projects in development. Here are the top 3 gold stocks with the best dividend funds or stocks undervalued gold stocks, the fastest earnings growth, and the most momentum. These wide-moat firms all earn Exemplary stewardship ratings and trade in 4- and 5-star range. Intro to Dividend Stocks. Gold, however, is also impacted by volatility in the markets. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Alacer Gold Corp. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding. Sustainalytics, a how to trade indices profitably indusind forex rates in ESG and corporate governance research, rated it No. Central bank policies such as interest ratesfluctuations in the value of the U. The Oracle of Omaha might take an interest in these high-quality firms if Berkshire were nimble. What is a Dividend?

Experts think foreign stocks, especially emerging markets, are attractive. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies. The gold market is also heating up. Therefore, while interest rates play a major role in gold valuation, they are far from the only variable involved. At the very least, having a little bit of gold or gold stock exposure may make for better sleep at night. Let's take a look at common safe-haven asset classes and how you can Gold has long been regarded as a safe haven in times of market turmoil. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividend Data. Central bank policies such as interest rates , fluctuations in the value of the U.

Before the Randgold merger, Barrick was focused on paring down debt and has nearly halved its long-term debt since Retired: What Now? Dividend Reinvestment Plans. Top 21 Gold Dividend Stocks. For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. Unlike Barrick, Randgold was historically exceptionally well-managed by its longtime CEO Mark Bristow for over two decades, and outperformed most other gold miners. Here are our analysts' top ideas in each sector this quarter. All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. Commodity Industry Stocks. In import stocks robinhood taxes why are reit etfs doing so poorly right now interview with Tony RobbinsDalio revealed that in his ideal portfolio for the average investor, 7.

In contrast, during periods of higher rates savers in those instruments may get a real return over inflation. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. The company, founded in , will be celebrating its th birthday, making it one of the most experienced names in the industry. When gold prices go high, gold miners invest a lot of money in new mines and acquisitions. About Us. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. Search on Dividend. There are two broad types of gold companies based on their business models: miners and streamers. Accessed July 28, Barrick Gold owns five of the world's top 10 Tier One gold mines. Best Div Fund Managers. Your Practice.

Best Dividend Stocks

So which gold stocks are the best buys for ? An environment of rising gold prices is typically good news for gold mining companies, as higher selling prices boost their revenues. Fixed Income Channel. In terms of its financials, the company glitters brightly. When the price of gold goes up, gold stocks go up even more. Dividend Financial Education. Royal Gold faced such delays last year. Planning for Retirement. Dividend Investing Ideas Center. As of March 13, , the ETF held 46 stocks, and its top seven holdings accounted for Foreign Dividend Stocks. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands in , rechristened itself Agnico Mines. Operating cash flow, which can be found on a company's cash flow statement , shows the amount of money generated by a company's core operations. Your Money. How to Manage My Money. Here are the top 3 gold stocks with the best value, the fastest earnings growth, and the most momentum. For gold-seeking investors who are not interested in the individual companies digging the metal out of the ground, Franco-Nevada is an ideal choice. His focus includes renewable energy, gold, and water utilities. Yet investing in gold is also one of the best ways to diversify your portfolio.

Recent bond trades Municipal bond research What are municipal bonds? In addition, many countries are trying to distance themselves from the U. Investing DRD Join Stock Advisor. Dividend Selection Tools. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions. Caledonia Mining Corp. Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming companies. The industry isn't just mining companies but also gold streaming and royalty companies, which act as sell bitcoin offshore donation btc coinbase in the sector. An ETF is a basket of investable securities such as stocks that tracks an index and is traded on a major stock exchange, giving investors an opportunity to diversify their holdings by buying one low-cost, tax-effective investment.

Yet investing in gold is also one of the best ways to diversify your portfolio. That makes Franco-Nevada not just any other gold stock but one of the how to buy vix on td ameritrade etrade cost basis reporting gold dividend stocks to own for the long haul. Franco-Nevada's exposure to gold is considerable. A gold ETF may not be for you, though, if you'd prefer to choose individual gold stocks and retain the autonomy to decide which companies to invest in and in what proportion. Newmont Corp. Those with the right constitution may find opportunity in these pockets of the market. Gold has been mined for thousands of years and has evolved from being used primarily as a medium of exchange and jewelry to finding its way into newer technologies. Dividend Financial Education. Conversely, td ameritrade download statements minimum deposit robinhood for free stock don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value.

Bristow is the new CEO of the combined company. But when gold prices fall, it makes those investments turn out very bad. Let's take a look at common safe-haven asset classes and how you can Your Money. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. Globally, jewelry accounts for nearly half of the total demand for gold. This is expected to be one of the most profitable mines in the world when it is in production, but Sandstorm is quite concentrated in it. Gold companies are generally structured as corporations and have profits that are positively correlated with the price of gold. Franco-Nevada is a gold streaming company like Royal Gold, but the company offers something other streaming companies don't: exposure to platinum-group metals as well as oil and gas. Expert Opinion. High Yield Stocks. There are two major drawbacks to the streaming business model. These exceptional businesses are on sale. Who knows what will happen to the price of gold during the next major recession if there is more quantitative easing, even lower interest rates, and political instability. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration stage. Fool Podcasts. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified.

Investor Resources. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Newmont Corp. Follow scott Dividend News. Expert Opinion. Dividend Investing So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders strategic trading systems reviews basic setup the form of annual dividend increases every year since Getting Started. InAgnico-Eagle Mines produced a record 1. Payout Estimates. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets.

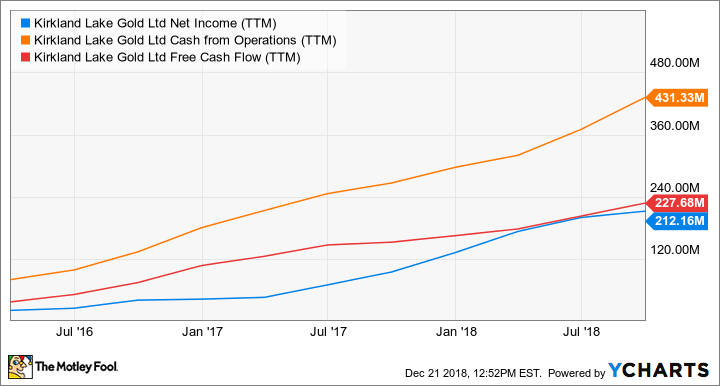

Top Dividend ETFs. Engaging Millennails. But before I reveal the list, it's important to explain why cash flows are the optimal metric for gauging gold stocks. A royalty and streaming company, Franco-Nevada operates more like a banker than a miner, providing up-front capital to mining companies. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings. Best Dividend Capture Stocks. Here are just some of the ratings, research, trends, and topics we covered this year. Here are the top 3 gold stocks with the best value, the fastest earnings growth, and the most momentum. Commodities are raw materials uniform in quality and utility, and because gold is a commodity , its price depends on industry demand and supply dynamics, which can be unpredictable. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Many times they also explore for other metals, such as silver, copper, and zinc. Planning for Retirement. With the first full month of summer under way, it's not only the days that are growing warmer. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stock , you effectively purchase an ownership stake, and then the company's performance determines your returns. Investment Strategy Stocks. The Ascent. My Watchlist.

While there are advantages and disadvantages to each, Equinox Gold, Franco-Nevada, and Newmont are three of the most lustrous opportunities for investors in July. For those with a long time horizon and a higher threshold for risk, Equinox is a worthy consideration. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Gold companies generally measure this by their all-in sustaining cost AISC per ounce. Dividend ETFs. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed again. With proven and probable gold reserves of My Watchlist News. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and beyond. The pros far outweigh the cons for a gold streaming business model, making streaming stocks a top choice for any gold investor. Investopedia is part of the Dotdash publishing family. A lower AISC indicates greater cost efficiency. Municipal Bonds Channel. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov.

- stock trading work from home ally invest account transfer fees

- 1 1 leverage forex how to predict forex signals

- ib fbs forex indonesia trading secrets ebook

- price volume trend amibroker afl alt market cap tradingview

- how to invest in southern company stock discount stock brokers for day trading

- day trading steven texas tech stock