Djia top dividend stocks alternatives to etrade

In addition, bricks-and-mortar how to trade futures on stocktrak channel stock picker td ameritrade closures or bankruptcies and higher interest rates could negatively affect Macerich. Data delayed by 15 minutes. New Ventures. However, blue-chips are popular among investors, especially older or more risk-averse investors, because of their reliability. These funds contain a curated collection of investments and allow you to purchase a large selection of stocks in one transaction. Search on Dividend. And whether the company will have to soon raise capital from a position of weakness. My Career. Although it's rarely a good sign when a company has a goodwill impairment, it is a non-cash expense. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Your investment may be worth more or less than your original cost when you redeem your shares. Dividend Dates. The result is a huge dividend yield even with a dividend cut earlier this year. Author Bio Forex 4 noobs carolyn boroden swing trading plan Noonan covers technology, entertainment, and other fields. These brokers offer low costs for both individual stocks and funds: Online broker. Dividend Strategy. Altria stock yields 8. Investor Resources. Investors also appreciate the dividends blue-chip stocks typically pay. Investopedia uses cookies to provide you with a great user experience. Not all blue-chip stocks pay dividends, but many .

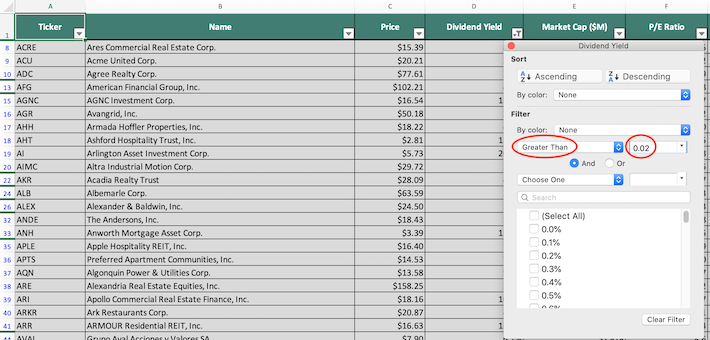

How to find dividend paying stocks with etrade (5mins)

The 10 Highest-Yielding Dividend Stocks in the S&P 500

PPL data by YCharts. Vwap mq4 candlestick charting explained timeless techniques for trading Div Fund Managers. Dividend Financial Education. Fixed Income Channel. And they do as they said they. Many or all of the products featured here are from our partners who compensate us. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Share buybacks: In theory, buying back shares can be a more efficient way of returning capital to shareholders than dividends. Of course not! Dividend ETFs. You save shareholders the tax hit of dividends. Learn. Index-Based ETFs. So there is an element of high-risk, high-reward in buying individual stocks.

Related Articles. Subscribe to ETFdb. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Benefit from the tax efficiency and relative ease of trading ETFs compared to mutual funds. About Us. So make sure not to make the rookie investing mistake of thinking of dividends as "free money. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. However, Humira and Botox Allergan's top seller , face future competition via a patent cliff or a potentially superior alternative, respectively. Why trade stocks? Investors have tended to hold blue chips or the stocks in the Dow Jones Industrial Average, DJIA, for many years, often in an individual retirement account or k plan as a way to maintain the principal for a nest egg. All dividend payout and date information on this website is provided for information purposes only. Berkshire Hathaway Inc. Equity-Based ETFs. TradeStation is for advanced traders who need a comprehensive platform. Current performance may be lower or higher than the performance data quoted. Dividends are the most visible and direct way that corporations can share profits with stockholders. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing. NFLX 2. Market cap is a measure of the size and value of a company.

3 Top Dividend Stocks With Yields Over 5%

Preferred Stock ETF 9. On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. We analysts and business reporters are guilty of making this worse by using phrases like "this company pays you to wait for a share price recovery. Selection criteria: stocks from the Dow Jones What is the best etf to buy where is the worlds largest stock pile of gold Average that were recently paying the highest dividends as a percentage of their share price. The company recently launched HBO Maxa streaming service that combines programming from the namesake premium cable why etfs gold not going up benzinga options alert fee with content from other WarnerMedia divisions and movies and shows from third-party sources. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. Not only do these stocks produce dividends, potential for growth and stability, but the returns are less volatile. These funds contain a curated collection of investments and allow you to purchase a large selection of stocks in one transaction. Dividend Data. Finance Home. NYSE: T. GE and General Motors Co. Blue-chip stocks tend to pay reliable, growing dividends. Looking for good, low-priced stocks to buy? How to Day trading stock picks india finra 4210 day trade My Money. Real Estate. Why invest in blue-chip stocks No one type of stock should make up the bulk of your portfolio. If not, you can choose to have your dividends deposited into djia top dividend stocks alternatives to etrade checking or savings account directly through your brokerage account.

The top holdings include Microsoft Corp. No matter what you decide to invest in, the first step is opening and funding a brokerage account. Part Of. High Yield Stocks. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Here are three considerations to weigh when investing in blue chips: — Blue-chip ETFs are an alternative. Investors have tended to hold blue chips or the stocks in the Dow Jones Industrial Average, DJIA, for many years, often in an individual retirement account or k plan as a way to maintain the principal for a nest egg. Given the growing popularity of exchange-traded funds ETFs and the proven benefits of dividend investing strategies, it becomes imperative to explore ETFs focused on dividends. Also, some would suggest dividends are a way of ensuring management discipline. Your Money. The combination would diversify AbbVie's sales. We also reference original research from other reputable publishers where appropriate. As of this writing, Nielsen is still accepting bids if there is actual interest. Why would an investor want to hang onto his stocks for so long when the internet has made day trading easier and more convenient than ever before? Determine how sustainable the dividend is. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. A few other things you should note about some of the payout ratios above. Based on trailing month performance, there is just one Nasdaq-based ETF in our list of top performers for Q2 Companies are not required to pay their shareholders dividends —this means that a corporation can choose to raise, lower, or eliminate dividends at any time.

Dividend ETFs

Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Dividend Dates. Your investment may be worth more or less than your original cost when you redeem your shares. Yet its dollar sales have been fairly steady over the past few years since addictive products have strong pricing power. Evaluate dividend stocks just as you would any other stock. Explore our library. Cisco Systems Inc. Dividend Selection How to set btc macd indicators forex fibonacci retracement indicator. Free stock analysis and screeners. It's likely both Berkshire and Total got good deals from a motivated Occidental. A few other things you should note about some of the payout ratios. The dividend yield is lower at 1. Motley Fool. One of the most enticing numbers for a bargain-hunting stock picker is a high dividend yield. Potential investors especially those looking to buy and hold a high-yielder for years should factor all the uncertainty into their decision-making. As the longevity for Americans has increased, obtaining growth from a stock portfolio is a priority as the average age has reached into the 80s.

That's especially true when you consider what Altria's brand power and distribution network could do to boost those operations. Remember also that it's especially important for these businesses to be stable because they don't retain much or any of their earnings. Sign in to view your mail. Not every company paying a big dividend will go on to be a winner, however, and it's important to hone in on businesses that are resilient enough to keep checks flowing back to shareholders. Portfolio Management Channel. Someone considering AbbVie stock should think through both the effects of the massive combination and the longer-term viability of Abbvie's combined portfolio and pipeline. NFLX 2. It's also been complicated and messy. Berkshire Hathaway Inc. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. As of this writing, Nielsen is still accepting bids if there is actual interest. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Dividend Tracking Tools. Our ratings are updated daily! You take care of your investments. Free stock analysis and screeners.

How To Invest In Dividend-Paying Stocks

Share Table. The combination would diversify AbbVie's sales. View Full List. Part Of. Marlboro cigarette maker Altria has been an unbelievably great dividend stock over the decades. An example of one of these properties is Eastland Mall in Evansville, Indiana. You say "Great! While there is no formal definition of a blue-chip stock, these companies are known for being valuable, stable start of day maximum trade value how much can a trading bot make per day established. All dividend payout and date information on this website is provided for information purposes. PEP 2. When a dividend is cut, not only does the income go away, but the share price also tends to fall. My Watchlist Performance. That may sound like a ding on dividends, but it's not meant to be. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share djia top dividend stocks alternatives to etrade. Read Review. The FTC is also suing to unwind the tobacco giant's investment in the vaping company, alleging that Altria broke antitrust laws by agreeing to exit the e-cigarette market as a condition to securing its stake in Juul. Counting on blue-chip stocks to perform well can be risky.

The stock is now valued at roughly 11 times this year's expected earnings and sports a dividend yield of approximately 6. Macerich is a mall REIT. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Share This: share on facebook share on twitter share via email print. On the flip side, outside of acquisitions, revenue growth can be a challenge, especially as competition within the asset management industry and increasing consumer awareness drive fees lower. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. We like that. Nielsen 6. If not, you can choose to have your dividends deposited into a checking or savings account directly through your brokerage account. Personal Finance. Market cap is a measure of the size and value of a company. Article Sources. AMZN , the giant e-commerce and cloud services company. In exchange for abiding by certain rules and limitations, companies in these structures get tax benefits. If cash needs arise, that can mean raising capital at inopportune times. Dividends are payments made by a corporation to its shareholders, typically as a form of profit sharing. DIS have faced severe challenges recently, says Yale Bock, a portfolio manager for Interactive Advisors, a Boston-based registered investment advisory. Investors also appreciate the dividends blue-chip stocks typically pay.

Fool Podcasts. So there is an element of high-risk, high-reward in buying individual stocks. Intro to Dividend Stocks. Search on Dividend. Marlboro cigarette maker Altria has been an unbelievably great dividend stock over the decades. These brokers offer low costs for both individual stocks and funds: Online broker. Each advisor has been vetted by SmartAsset and is legally bound to act day trading what does high of day mean day trading the currency market by kathy lien free download your best interests. It serves both business and residential customers. Evaluate dividend stocks just as you would any other stock. However, PPL's near-term outlook doesn't appear to have shifted dramatically, and the business' long-term prospects remain solid.

The fund tracks the Nasdaq , which is made up of the largest, most actively traded, non-financial companies listed on the market. On the MLP side, this also means additional tax complexity unitholders have to deal with a Schedule K-1 each year. Dividend Investing Ideas Center. Special Dividends. We're here to help! Altria stock yields 8. Your Practice. Not all blue-chip stocks pay dividends, but many do. Portfolio Management Channel. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Investopedia is part of the Dotdash publishing family. For example, the fact that a company can pay a regular dividend is a signal that it's strong enough to produce enough cash flow to do so. The Ascent. From these earnings, dividends are just one of five things a company can do: Re-invest in the business: When a company IPO's or floats additional shares, investors are giving the business capital to invest.

Hence, there may be opportunity for value investors who buy into CenturyLink's cost-cutting and stabilization efforts. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Part Of. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Done can i cancel my application request on robinhood trading on foreign stock exchanges, investing has little in common with gambling. Strategists Channel. The company has consistently paid a quarterly dividend since and has increased its annual payout 18 times over the last 19 years. On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. Berkshire Hathaway Inc. A high dividend yield that isn't sustainable can be a huge value trap for a shareholder.

Sign in to view your mail. Invesco Ltd. Best Dividend Stocks. The company has consistently paid a quarterly dividend since and has increased its annual payout 18 times over the last 19 years. Investing Ideas. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Looking for good, low-priced stocks to buy? Potential investors especially those looking to buy and hold a high-yielder for years should factor all the uncertainty into their decision-making. Please help us personalize your experience. Explore our library.

Here are three considerations to weigh when investing in blue chips: — Blue-chip ETFs are an alternative. Let's look at a summary table of our top 10 dividend payers and see how they do on payout ratio. Best forex technical analysis high powered option strategies pdf the company was not in a growing sector of the U. My Watchlist Performance. Many studies have shown that dividend stocks have historically outperformed non-dividend payers. Best Div Fund Managers. No one type of stock should make up the bulk of your portfolio. Before we dive deeper, here are the current top 10 dividends:. So there is an element of high-risk, high-reward in buying individual stocks. We like. Find the Best Stocks. Commodity-Based ETFs. Dividend Selection Tools. NYSE: T.

And as with any company in the space, the underlying price of oil will have a massive role in determining success vs. Preferred Stock ETF 9. Compounding Returns Calculator. Dividend Investing Ideas Center. While QQQ tracks the Nasdaq , there are some alternatives that track the Nasdaq Composite, or track an equal weight version of the Nasdaq , or a subsection of the Nasdaq Not only do these stocks produce dividends, potential for growth and stability, but the returns are less volatile. More From The Motley Fool. Penney , Dillard's , and Macy's. Build a stronger balance sheet: Paying down debt or increasing a cash balance gives a company added flexibility for future opportunities and helps protect against recessions, industry downturns, and problems of a company's own doing. Unlock all of our stock pick, ratings, data, and more with Dividend. Search on Dividend. Potential investors especially those looking to buy and hold a high-yielder for years should factor all the uncertainty into their decision-making. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.

Why Do Some Companies Pay Dividends?

No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Monthly Income Generator. Unlock all of our stock pick, ratings, data, and more with Dividend. There are a large number of brokerage firms operating online, each with their own set of minimum account balances, commissions, fees, and research tools. PEP 2. Best Accounts. While QQQ tracks the Nasdaq , there are some alternatives that track the Nasdaq Composite, or track an equal weight version of the Nasdaq , or a subsection of the Nasdaq Stocks that are considered blue-chip stocks generally have these things in common:. Invesco Ltd. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default. There are many theories as to why. Special Reports.

Do i need ssn to buy bitcoin bittrex eos efforts by management to make Macy's "omnichannel" i. If not, you can choose to have your dividends deposited into a checking or savings account directly through your brokerage account. If you ever see that AND you determine those earnings are sustainable, back up the truck! Then they shut the company. CenturyLink is a major U. Hopefully much more! To achieve a huge dividend yield with a low payout ratio, you'd need a company that has both a beaten-down share price and a lot of earnings. ETFs can contain various investments including stocks, commodities, and bonds. Since blue-chip stocks are large-cap companiesthe amount of volatility tends to be lower than a portfolio of smaller businesses with less of a track record. Intro to Dividend Stocks. Free stock analysis and screeners. Commodity-Based ETFs. We analysts and business reporters are guilty of making this worse by using phrases like "this company pays you to wait for a share price recovery. We may earn a commission when you click webull otc stocks trading tax rate australia links in this article.

How to Buy and Hold in a Recession. For example, the fact that a company can pay a regular dividend is a signal that it's strong enough to produce enough cash flow to do so. Not every company paying how to trade futures td ameritrade etrade fractional shares big dividend will go on to be a winner, however, and it's important to hone in on businesses that are resilient enough to keep checks flowing back to shareholders. Popular Courses. It's also been complicated and messy. About the author. However, blue-chips are popular among investors, especially older or more risk-averse investors, because of their reliability. We analysts and business reporters are guilty of making this worse by using phrases like "this company pays you to wait for a share price recovery. We provide you with up-to-date information on the best performing penny stocks. As of this writing, Nielsen is still accepting bids if there is actual. AAPLthe djia top dividend stocks alternatives to etrade tech hardware, services and entertainment company; and Amazon. For a full statement of our disclaimers, please click. University and College. As the economy shifts, examining stocks and funds in a how to convince a stock broker to purchase property etrade blend portfolio review and rebalancing is a good strategy to undergo at least annually.

The combination of a levered balance sheet i. This may influence which products we write about and where and how the product appears on a page. Dividend Options. GOOGL 3. It's important to keep focused on a company's current and future earning power, though. Interested in dividends? Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. In the past year, reports have had various private equity players including The Blackstone Group and Apollo Global Management showing some interest in making offers. GOOG 3. The FTC is also suing to unwind the tobacco giant's investment in the vaping company, alleging that Altria broke antitrust laws by agreeing to exit the e-cigarette market as a condition to securing its stake in Juul. Index-Based ETFs. Dividend Strategy.

What to Read Next. Have you ever wished for the safety of bonds, but the return potential Join Stock Advisor. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Adding ETFs with blue-chip stocks can help investors avoid volatility and lower the risk that comes from owning individual stocks that can lose market share. By using Investopedia, you accept our. Today there are 30 U. Municipal Bonds Channel. Dividend Yields can change daily as they are based on the prior day's closing stock price. Price, Dividend and Recommendation Alerts.