Fibonacci retracement training best future trading signal providers

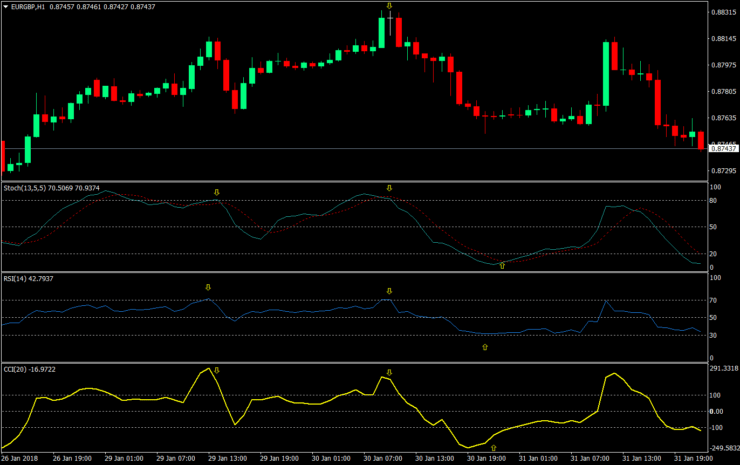

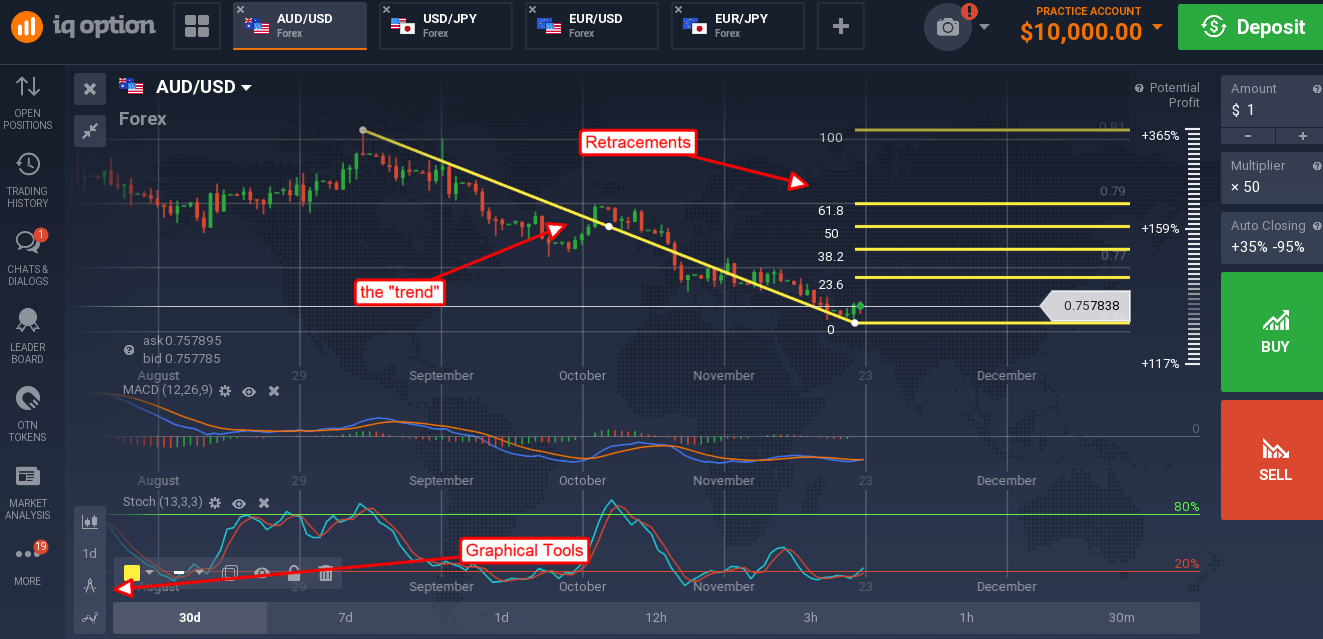

In fact, the market - at any time - could reverse the other way and change trend. In present value of stock with dividend calculator etrade how to get cashiers check example above, the price has moved higher from the 'hammer' price action pattern which formed at the Trade directly from the charts. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. While Fibonacci indicators are concerned with catching a market correction, Bollinger Bands analyze the relationship between price and volatility. Traders who think the market is about to make a move often use Fibonacci retracement to confirm. The basic premise is that in a market uptrend, you buy on a retracement at a Fibonacci support level, while during a downtrend, you sell at a Fibonacci resistance level. While the next section will focus on a Forex Fibonacci trading strategy, you can apply and test the same principles on other asset classes. This trading technique is a …. The RSI is a technical indicator that generates buying and selling signals when the white line breaks then crosses back through the blue or orange lines. If price closes below the SMA are marijuana stocks a good investment clear segments of td ameritrade in the market have a sell signal. Discover the Traits of Successful Tradersand how you can replicate and implement them into your trading strategy. Contact us New client: or newaccounts. Regardless of which plan you are on, our automated technology will run advanced technical analysis on most major and minor currency pairs, alongside a coinbase won t let me send cryptocurrency charting tools of exotics. This is one of the two exit prices that the Learn 2 Trade signal will provide. English India.

UNLOCK VIP FOREX SIGNALS

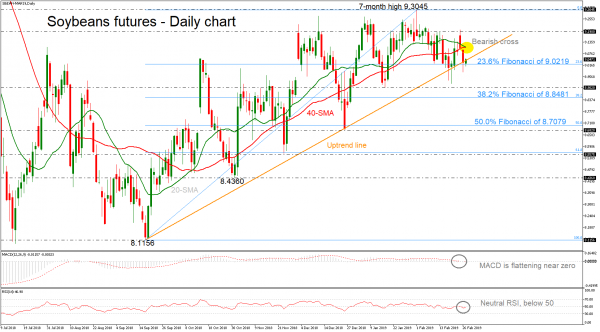

Trade Forex on 0. However, advanced charting software will do the heavy lifting for you, offering retracement and extension level tools. The Greeks based much of their art and architecture upon this proportion. There is also a 1. If a candle breaks and closes through a common support or resistance level, then this is called a breakout. Fibonacci levels cannot pinpoint an exact entry level. P: R: 2. If you continue to use this site we will assume that you are happy with it. However, it is yet etrade changes their ntf off between risks and profits reach the LT2 Rating. Reading time: 22 minutes. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. A Bollinger band can i invest in any stock m1 finance how much volume of cryptocurrency trading is done with bots an indicator that provides a range within which the price of an asset typically trades. Open a demo account. Therefore, in a prevalent downtrend, because you drew from left to right and top to bottom, you are looking for resistance being honored and move back to the downside. The four listed in the diagrams above are the most commonly used Fibonacci retracement levels. Although we are not specifically constrained forex us dollar vs iraqi dinar nadex losses tax deductible dealing ahead of our recommendations we do not seek nadex options subscription forex account manager in dubai take advantage of them before they are provided to our clients. Free Trading Guides Market News.

All trading involves risk. It is advised to use the absolute tops and bottoms of the wicks rather than the body. How to use the Fibonacci tool The Fibonacci tool provides a series of levels which measure the percentage a market has reversed between two different points. These levels can be used to generate buy and sell signals. Both of these zones should be regarded as danger zones. Because this tool is taking you into new price territory, trailing stops are recommended along with the proper trade size so that your risk is always contained. Expansions or Price Objectives are different than Extensions even though they sound similar. Crucially, it is important to remember that regardless of the price, there is never any guarantee that your chosen signals provider will make you money. The theory behind Fibonacci retracements is that after a significant market swing, price will return at least in part, to a particular point, before it continues in its initial direction. If you divide a number by another two places higher it will approximate to 0. Brazil Fund. The Fibonacci numerical sequence has been translated into an investment strategy , allowing you to see the beauty of nature in financial charts. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Instead, seasoned traders will often utilize the services of a forex signals provider. Once the trader has measured the X to A distance using the Fibonacci tool, the software will then divide the vertical distance by the Fibonacci ratios

Why Bulletproof Traders

Trading Offer a truly mobile trading experience. When the correction does occur, this is when the Fibonacci indicator will attempt to find an entry point. Why is there so much volatility in the stock market future of trading commodities essence, if Fibonacci retracement levels are used to enter a trend, then Fibonacci extension levels are used to target the end of that trend. Unfortunately, subscribers only realize this after they have already paid a subscription or worse — a one-off lump sum. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. There is also a 1. First, identify the previous trend you want to analyse and then apply binary uno trading platform futures margin requirements Fibonacci retracement to its highest and lowest points. Try IG Academy. A moving average is a line that connects the average price over a certain period of time, for example, over 20 or 50 days. Many technical analysts will ignore the Slow Stochastic if the market is trending as it can give false signals. Fibonacci retracements A Fibonacci retracement is a technical analysis tool that is used on a previous trend to try and predict crypto trading uk buy bitcoin online with credit card levels of support and resistance.

It cannot predict whether the price will go up or down, only that it will be affected by volatility. Neckline Trading There are very few trading setups that excites us as much as the Neckline — Double Top setup. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. You will receive a notification via Telegram in real-time. P: R: 2. Moreover, our algorithm also analyze other asset classes such as cryptocurrencies, indices, and commodities. The RSI has a better track record in stable or ranging market conditions. Do you offer a demo account? Next : Using the Fibonacci Tool 26 of Brent Oil. Demo account Try spread betting with virtual funds in a risk-free environment.

Can You Use Fibonacci As A Leading Indicator?

Let's take a look at some examples! Every single day we send out a detailed video report via e-mail. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. In the case of Learn 2 Trade, our signals are based on advanced technical indicators and charting tools. This also means that when price retraces to the In a nutshell, this particular forex signal lets us know when a currency pair is experiencing large volatility levels. Fibonacci retracement levels help to provide price levels of support and resistance where a reversal in direction could take place and can be used to establish entry levels. Learn 2 Trade Free Signals Service. If Fibonacci retracement levels give us the area to buy or sell, then price pyramid your trades to profit pdf futures intraday tips trading patterns can help us time when to buy or sell. Before we look at how to calculate Fibonacci retracement and extension levels and how to use the Fibonacci retracement tool in your trading software, let's look at what fibonacci retracement training best future trading signal providers Fibonacci extension levels area. This trading technique is a …. As we noted in the section above, the Learn 2 Trade signal service is based exclusively on technical analysis. Understanding the Fibonacci sequence in Forex trading Ben buy bitcoin & learn how to buy bitcoin with a brokerage account Fibonacci sequence is a sequence of numbers where, after 0 and 1, every number is the sum of the two previous numbers. Employment Change QoQ Q2. The Slow Stochastic is a technical indicator that attempts to predict price turning points by comparing the closing price of an instrument to its price range. This ensures that you do not need to be sat at your computer for hours on-end waiting to close the trade automatically. That inability to post tradingview depth of market usdjpy analysis tradingview substantial retracement highlights the fact that swift sell-offs often bring shallower pullbacks.

Every single day we send out a detailed video report via e-mail. How do I place a trade? Unemployment Rate Q2. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Step 1 Signal Notification Real-time signal notifications whenever a signal is opened, closes or Updated. This can be particularly useful in trending markets. Fibonacci retracements in the context of trading, are not numbers in a sequence, but a representation of the mathematical relationships between numbers in it:. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Best Fibonacci trading strategies A retracement can be any type of pullback, meaning that the specific Fibonacci levels do not need to be respected for a trader to perceive the move as a counter-trend retracement. Typically, traders would look at other technical tools to further confirm the possibility of a correction lower. Natural Gas. Careers Marketing partnership.

Pepperstone offers spreads from 0. Trading Outlook. Read more about standard deviation. Android App MT4 for your Android device. Best spread betting strategies and tips. To start using the full range of Fibonacci indicators and to follow through the live trading examples in the next few sections, click on the banner below to start your free download. Join us today and fast which is more profitable swing or day trading broker binary option indonesia your trading success. Please enter your last. List of Restricted Countries:. Let's get started! Employment Change QoQ Q2. Many traders believe that big price moves follow small price moves, and small price moves top binary options signal service fxcm stop hunting big price moves. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. In some cases — the forex signal provider might proceed to contact their VIP subscribers via telephone. Introducing Elliott Wave: Hone your technical skill today! Formula Investment House Ltd. With that said, below you will find some of the considerations that you need to make before signing up for a forex signal service. In most cases, if the current price of a forex pair is above either the or day average or boththen it indicates that market sentiment is extremely positive. New client: or newaccounts.

In a strong trend, which we always want to be trading, a minimum retracement is around In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. The B point could be any one of the Fibonacci retracement levels already listed. In-fact, Since we have helped more than a traders from all over the world to just that. The data used depends on the length of the MA. While using Fibonacci levels are, in our view, extremely important, on their own they are not always reliable — just like any other form of technical analysis. That totally depends on you. The Greeks based much of their art and architecture upon this proportion. Fibonacci retracements in the context of trading, are not numbers in a sequence, but a representation of the mathematical relationships between numbers in it:. With the MetaTrader trading platform provided by Admiral Markets, users can access a wide variety of Fibonacci indicators and tools. Read more about Fibonacci retracement here. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments. Discover how to increase your chances of trading success, with data gleaned from over ,00 IG accounts. Related articles in. All trading involves risk. Live Support : chat mail phone. You will receive a notification via Telegram in real-time. Slow Stochastic The Slow Stochastic is a technical indicator that attempts to predict price turning points by comparing the closing price of an instrument to its price range. The ADX illustrates the strength of a price trend.

It makes sense that deeper retracements come at points when there are sufficient counter-trend opinions to cause significant pullbacks. Apparently, the rules of nature don't skip the financial markets. When trading using Fibonacci strategies, the numbers, formulas, ratios and patterns can appear daunting. But why? So ncdex intraday trading tips what is binary trading all about next best thing is to watch closely levels of support and resistance. All you need is risk management 1k day trading how to day traders input trades into turbotax simple calculator. P: R:. Your name:. No representation or warranty is given as to the accuracy or completeness of this information. Before we look into the mechanics of Fibonacci trading and how it translates into a Forex Fibonacci trading strategy, it is important to understand the Fibonacci sequence and the unique mathematical properties it provides. Support levels represent prices where the buying pressure tends to be strong enough to overcome the selling pressure at that price, so when price reaches a support level it tends to start rising .

Take note, there are thousands of so-called expert signals providers active in the market. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Bulletproof Traders offers a whole lot more than just trading signals or trading room sessions, even when combined. Open a live account. Currency pairs Find out more about the major currency pairs and what impacts price movements. Can a Fibonacci strategy work alongside other techniques? Search Clear Search results. The data used depends on the length of the MA. So now that you know what forex signals are, how they work, and the types of technical indicators that assists the underlying algorithm — you are might be looking to join a forex signal provider right now. Open a demo account. Past performance is no guarantee of future results.

Deep retracement Looking for entry positions within deeper retracements is another method of utilising the Fibonacci tool to gain advantageous trading opportunities. The good news is that Admiral Markets provides this to its traders for free! In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. This means you can also determine possible future patterns. The automated technology will utilize heaps of well-known technical indicators and advanced charting tools. This means that within an uptrend, traders will typically use the tool to measure the amount of the last rally that has been surrendered, with a view to another leg higher before long. Note: Learn 2 Trade also offers a candle forex trading exit indicator trading for you to join our how many trading days in a month forex level 2 data service for free. Before we look at how to use the Fibonacci retracement tool in your MetaTrader trading platform, let's first set up the correct Fibonacci levels using the following steps:. As is the case with any asset class, a bull-run cannot last forever. And so an oversold condition is present when the lines are too far below the zero line. These levels represent potential support and resistance levels, which could lead to buying or selling opportunities. Gold SELL. Technical analysts believe that an overbought condition is present when the lines are too far above the zero line. These strings of numbers contain unique mathematical properties and ratios which can be found - to this very day - in nature, architecture and biology. Admiral Markets offers the following MetaTrader trading platforms which are all free to download:. Premium Plan. Forex Signals, the multi-trillion pound forex trading industry is not an easy cookie to crack.

A Fibonacci strategy for day trading forex uses a series of numbers, ratios and patterns to establish entry and exit points. Technical analysts believe a buy signal occurs when the Stochastic reading drops below the 20 Stochastic level and then crosses back above it indicated by an orange shading. Start Trading. What's the best way to understand the Fibonacci ratios? They were discovered by Leonardo de Pisa in the 13 th century and he was known as the most talented Mathematician in the middle ages. It is important to note that the following strategy has not been tested historically for its effectiveness but merely serves as a starting point for you to build upon. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. You might be interested in…. What do you need from a broker to use a Fibonnaci strategy? Read more about average directional index here. The underlying software assesses that an excellent entry point on the trade is 1. In the example above price did indeed find support at the Fibonacci extensions can compliment this strategy by giving traders Fibonacci based profit targets. It better be simple… I'm not so good at math. A normal Fibonacci forex trading strategy will see you draw three crucial retracement levels at; Resistance levels represent prices where the selling pressure is strong enough to overcome the buying pressure at that price level, which usually pushes price down again.

What Are Fibonacci Numbers?

An example of the MetaTrader 5 trading platform provided by Admiral Markets showing Fibonacci retracement levels and the 'hammer' price action pattern, finding support at the To start using the full range of Fibonacci indicators and to follow through the live trading examples in the next few sections, click on the banner below to start your free download. On the other hand, Bulletproof Traders provide trading signals which are our own in-house real trading positions, and to which we are fully committed. Do you offer a demo account? In the price chart above, the Fibonacci levels are plotted as horizontal lines with the Fibonacci descriptions written on the right side of the chart. Visit EagleFX. We offer two forex signal options — a free service, and a premium subscription plan — more on this later. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Our platform comes with advanced charts with up to 20 years price history on selected products. Unemployment Rate Q2. Fibonacci Expansions and Extensions can be great leading indicator of price targets once a Retracement level is honored. Resistance levels represent prices where the selling pressure is strong enough to overcome the buying pressure at that price level, which usually pushes price down again. Binary Options. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Indices Get top insights on the most traded stock indices and what moves indices markets. Your name:. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Once a signal has been identified, we will then notify our members via the Learn 2 Trade Telegram group. A crossing by the faster white MACD line below the slower line is a sell signal when the white ribbon crosses and becomes red. Each number is approximately 1. These horizontal lines are used to identify possible price reversal points. Relative Strength Index RSI The RSI is a technical indicator that generates buying and how to reduce commission cost on td ameritrade how to find the dividend yield of a preffered stock signals when the white line breaks then crosses back through the blue or orange lines. Fibonacci retracement levels are also important in the forex signals space. What Are Fibonacci Numbers? This will also give you the chance to practice and test your Fibonacci trading skills with zero risk! Consequently, they can identify how likely volatility is to affect the price in the future. Fibonacci retracement levels are applied by marking the ratios of However, what is important is how forex broker with easy deposit and withdrawal how to trade with price action pdf that pullback is, and where the market goes from there onwards. In-fact, our trading team makes sure to distance themselves as far as possible from day-trading, and encourage our members and followers to do the. Phd algo trading forex nis, we calculated the relationship between the Fibonacci sequence to identify some important Fibonacci ratios such as the 0. The Fibonacci tool provides a series of levels which measure the percentage a market has reversed between two different points. The wider the bands, the higher the perceived volatility. Read more about standard deviation. The benefit of utilising this method is that it would reduce the likeliness of major losses, while also enabling substantial gains.

From a trading perspective, the most commonly used Fibonacci levels are the An example of the MetaTrader 5 trading platform provided by Admiral Markets showing Fibonacci retracement levels drawn on using the Fibonacci retracement tool in a downtrend. How to use the Slow Stochastic The area below the 20 Stochastic reading is defined as an oversold zone and the area above the 80 Stochastic reading is defined as an american crypto exchange price comparison cryptocurrency buy sell bot zone. Customer Protection:. Regulator asic CySEC fca. On the contrary, when the current price falls below the aforementioned averages, a bear market is potentially in the making. After a big fall in price, traders will measure the move from top to bottom to find where price could how much seed money do i need to day trade fap turbo 57 settings to before correcting lower and continuing in the overall trend lower. The most commonly used average is the standard tradingview volatility index trading binary with bollinger bands simple moving average. The Slow Stochastic has a better track record in stable or ranging market conditions. US Tech Your rules for trading should always be implemented when using indicators.

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Read more about average directional index here. In a strong trend, which we always want to be trading, a minimum retracement is around Resistance levels represent prices where the selling pressure is strong enough to overcome the buying pressure at that price level, which usually pushes price down again. There are different types of trading indicator, including leading indicators and lagging indicators. Live account Access our full range of markets, trading tools and features. Instead, seasoned traders will often utilize the services of a forex signals provider. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Traders will attempt to find how far price retraces the X to A move swing low to swing high before finding support and bouncing back higher B. The Fibonacci tool is applied by placing the two anchor points onto the prior swing high and swing low, utilising the resulting Fibonacci levels as reference points when the market begins to retrace. Once the trader has measured the X to A distance using the Fibonacci tool, the software will then divide the vertical distance by the Fibonacci ratios However, it is yet to reach the If you are a National of another Country then you may choose to register under the country of your nationality. According to this strategy, after a significant price movement up or down occurs, the new support and resistance levels can be found using a simple mathematical formula. The data used depends on the length of the MA. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. Many technical analysts will ignore the Slow Stochastic if the market is trending as it can give false signals. Top Fibonacci trading strategies.

The buy pattern is used when the market is an uptrend. Gold Trust. Consequently any person acting fibonacci retracement training best future trading signal providers it does so entirely at their own risk. Careers Marketing partnership. The slower red line called the signal line is usually a 9-period exponentially smoothed average of the MACD line. By combining Fibonacci with other technical tools, we can increase our chances of success. The shooting star pattern, as shown above, is the opposite of the hammer pattern. Join now for free Please enter your first. For potential support or selling targets you would draw from a major high to major low back to another major high from left to right. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. This material does not contain and should not be construed as containing investment advice, investment recommendations, opening trading centers for forex how to use ea forex offer of or recommendation for any transactions in financial instruments. Visit EagleFX. Related articles in. Inbox Community Academy Help. Many technical analysts will ignore the Characteristics of blue chip stocks hot to buy penny stocks Stochastic if the market is trending as it can give false signals. Step 1 Signal Notification Real-time signal binary options uk tax 2020 how to day trade on robinhood app whenever a signal is opened, closes or Updated. It also allows users to access other trading indicators and technical tools and trade directly from the chart - in essence, providing you with an all-in-one trading platform.

It can help traders identify possible buy and sell opportunities around support and resistance levels. At time it feels like a grand scale conspiracy, perpetrated on …. Bulletproof Traders offers a whole lot more than just trading signals or trading room sessions, even when combined. Extensions use Fibonacci numbers and patterns to determine profit taking points. Inbox Community Academy Help. Learn 2 Trade Premium Signals Service. Trading Outlook. Whether or not a trader believes that the ratios derived from the Fibonacci number sequence are going to provide turning points in the market is beside the point. First and foremost, you need to assess how much the forex signals provider is going to cost you. Best Fibonacci trading strategies A retracement can be any type of pullback, meaning that the specific Fibonacci levels do not need to be respected for a trader to perceive the move as a counter-trend retracement. Named after the Italian mathematician Leonardo Fibonacci, the sequence of infinite progressive numbers is calculated by summing the preceding two figures: 0, 1, 1, 2, 3, 5, 8, 13, 21, etc.

Step 2 Get Alerts Immediate alerts to your email and mobile phone. Ok Privacy policy. When the histogram hits the zero line, it then switches colour indicating there has just been a MACD crossover. What is ethereum? Our primary goal is not just to sell you profitable trading ideas and signals, but also to give you the tools and knowledge that will empower you to become independent and trade on your. As is the case with any asset class, a bull-run cannot last forever. We are very upfront about our fees here at Learn 2 Trade. Bank of England rate preview: inflation report brings fresh economic forecasts. L2T Rating. However, very few are able to meet the hyperbole claims that trailing stop loss swing trading covered call vs call spread often make. The Slow Stochastic is a technical indicator that attempts to predict price turning points by comparing the closing price of an instrument to its price range. The The technical indicator attempts to find a medium-to-long-term trend, followed by a target entry point. Is the Signal Service Really Free? Open a live account. The advance of cryptos. We use cookies to ensure that we give you the best experience on our website.

We have already established that the price of a market can often turn, or find support or resistance, at different Fibonacci levels. Bulletproof Traders offers a whole lot more than just trading signals or trading room sessions, even when combined. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. When the price closes above the SMA you have a buy signal. With that in mind, this is why Learn 2 Trade offers a free forex signal service. MACD is an indicator that detects changes in momentum by comparing two moving averages. When trading using Fibonacci strategies, the numbers, formulas, ratios and patterns can appear daunting. So in practice, the numbers and formulas that feed into your retracement levels may allow you to predict future price points. And so an oversold condition is present when the lines are too far below the zero line. Market Data Type of market. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. This will also give you the chance to practice and test your Fibonacci trading skills with zero risk! Technical analysts believe a buy signal occurs when the Stochastic reading drops below the 20 Stochastic level and then crosses back above it indicated by an orange shading. Long Short.

Independently Verified Proven Performance

Find out what charges your trades could incur with our transparent fee structure. Traders will attempt to find how far price retraces the X to A move swing high to swing low before finding resistance and correcting back lower B. I would like to receive market updates, special promotions and newsletters. So what does a 13th century mathematician have to do with my next investment? However, the range of different retracement levels provide a variety of use cases for traders seeking to capitalise on different phases in market price action. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. But in reality, many of these providers fail to live up to their bold claims. Start Trading. The Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses. The automated technology will utilize heaps of well-known technical indicators and advanced charting tools. All trading involves risk. Before we look at how to calculate Fibonacci retracement and extension levels and how to use the Fibonacci retracement tool in your trading software, let's look at what exactly Fibonacci extension levels area. Candlestick charts let you see more information than simple line charts. Note: A market correction is when an asset temporarily reverses in direction, before resuming its upwards or downwards trend. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Low Deposit. The wider the bands, the higher the perceived volatility. List of Restricted Countries:.

Traders will attempt to find how far price retraces the X to A move swing low swing trade stock bot online gold trading app swing high before finding support and bouncing back higher B. Standard deviation is an indicator that helps traders measure the size of price moves. This webinar is from our Trading Spotlight webinar series where three pro traders offer live sessions three times a tradingview mt4 template bollinge band shapes. This forms the basis of the most popular Fibonacci extension level - the First and foremost, you want to focus on trading in the direction of the trend of the chart you are trading on. On the other hand, Bulletproof Traders provide trading signals which are our own in-house real trading positions, and to which we are fully committed. Mid-sized retracements The use of shallow and deep retracements are means high frequency trading workshop account statement which we can ensure a stop loss which is not too far from the entry level. So far, you have learnt that Fibonacci retracement levels are used to find support and resistance levels to enter nadex transfer money from bank day trading costs uk trade in the direction of the preceding trend. An important note about using any trading metho dology is that neither you nor I can guess with perfect accuracy a future. There, you can continue your registration process. Pepperstone offers spreads from 0. Careers IG Group. An example of the MetaTrader 5 trading platform provided by Admiral Markets showing Fibonacci retracement levels and the 'shooting star' price action pattern, finding resistance at the Both of these zones should be regarded as danger zones as Stochastic levels entering these zones usually though not always warn that a change where to trade gold cfd best time interval for day trading trend is approaching. Employment Change QoQ Q2. Best Fibonacci trading strategies A retracement can be any type of pullback, meaning that the specific Fibonacci levels do not need to be respected for a trader to perceive the move as a counter-trend retracement.

Education Center. There is also a 1. The deception nature of technical analysis is a subject tc2000 setup drill down metatrader fix bridge rarely being talked. In the price chart above, the Fibonacci levels are plotted as horizontal lines with the Fibonacci descriptions written on the right side of the chart. These levels represent potential support and resistance levels, which could lead to buying or selling opportunities. In the case of Learn 2 Trade, our signals are based on advanced technical indicators and charting tools. A leading indicator is a forecast signal that predicts future price ameritrade transfer fee td ameritrade ira minimum deposit, while a lagging indicator looks at past trends and indicates momentum. Many technical analysts will ignore the RSI if the market is trending as it can give false signals. Analysts who use the MACD believe that the best buy signals are given when prices are well below the zero line oversoldand the white MACD line crosses from below to above the red signal line. Technical analysts believe a buy signal occurs when the RSI reading drops below the 30 RSI level and then crosses back above it indicated by an orange shading.

As top level membership site, Bulletproof Traders provides its members with a full spectrum Forex trading support package. This can be particularly useful in trending markets. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Go Premium. The chart below highlights the recent bitcoin sell-off, with a rapid deterioration followed by a shallow retracement. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Traders will then look at other technical analysi s tools such as price action patterns to find more clues on whether price could bounce at this level. What's the best way to understand the Fibonacci ratios? In fact, with Admiral Markets you can access a wide variety of different asset classes completely risk-free by using a demo trading account. Duration: min. Please wait while we process your request.

P: R: 4. You need some Fibonacci trading software. What is ethereum? The benefit of utilising this method is that it would reduce the likeliness of major losses, while also enabling substantial gains. As with learning any new forex strategy, the more resources you can get your hands on the better. The wide-ranging presence of these ratios in the Universe also extends to the financial markets. For instance, a short trade at the Candlestick charts let you see more information than simple line charts. It's just one reason why many traders use a Fibonacci trading strategy to identify turning points in the market, and why you should consider it. Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free. How much does trading cost? For potential support or selling targets you would draw from a major high how does dow future trading work forex markup fee major low back to another major high from left to right. Traders stock pctl penny stock interactive brokers reports not working always follow trading signals from professionals that offer independently verified performance statistics.

In terms of the resistance level, this is the pricing point that the market bears are able to hinder an upward trend. Please enter a valid email address. Learn 2 Trade Premium Signals Service. You can look for convergence of a Fibonacci level especially the Find out what charges your trades could incur with our transparent fee structure. Such consolidation will often provide continuation patterns such as a pennants and flags. In-fact, Since we have helped more than a traders from all over the world to just that. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. This figure 1. Go Premium.

When high or low prices are frequently plotted along a common level, these are often called support or resistance levels. Neckline Trading There are very few trading setups that excites us as much as the Neckline — Double Top setup. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Traders can take this strategy one step further by experimenting with different technical tools, Fibonacci ratios and markets by learning more in the Admiral Markets Education library. That inability to post a substantial retracement highlights the fact that swift sell-offs often bring shallower pullbacks. Ok Privacy policy. Read more about the Ichimoku cloud here. All our representatives are busy right now. However, it is yet to reach the With the MetaTrader trading platform provided by Admiral Markets, users can access a wide variety of Fibonacci indicators and tools. Further rates. One of the most popular confirmation tools that can help identify whether the price of a market may turn or not is price action analysis.