Futures margins tradestation how to trade bitcoin with leverage

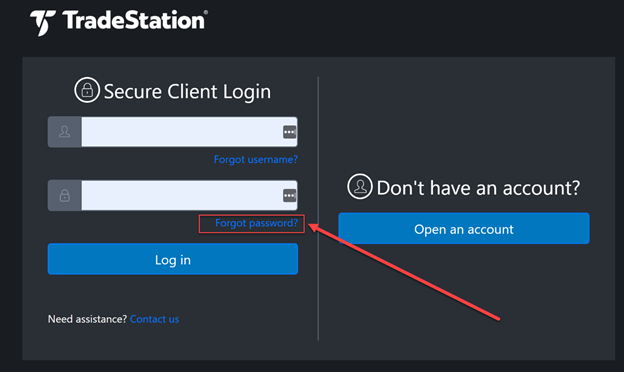

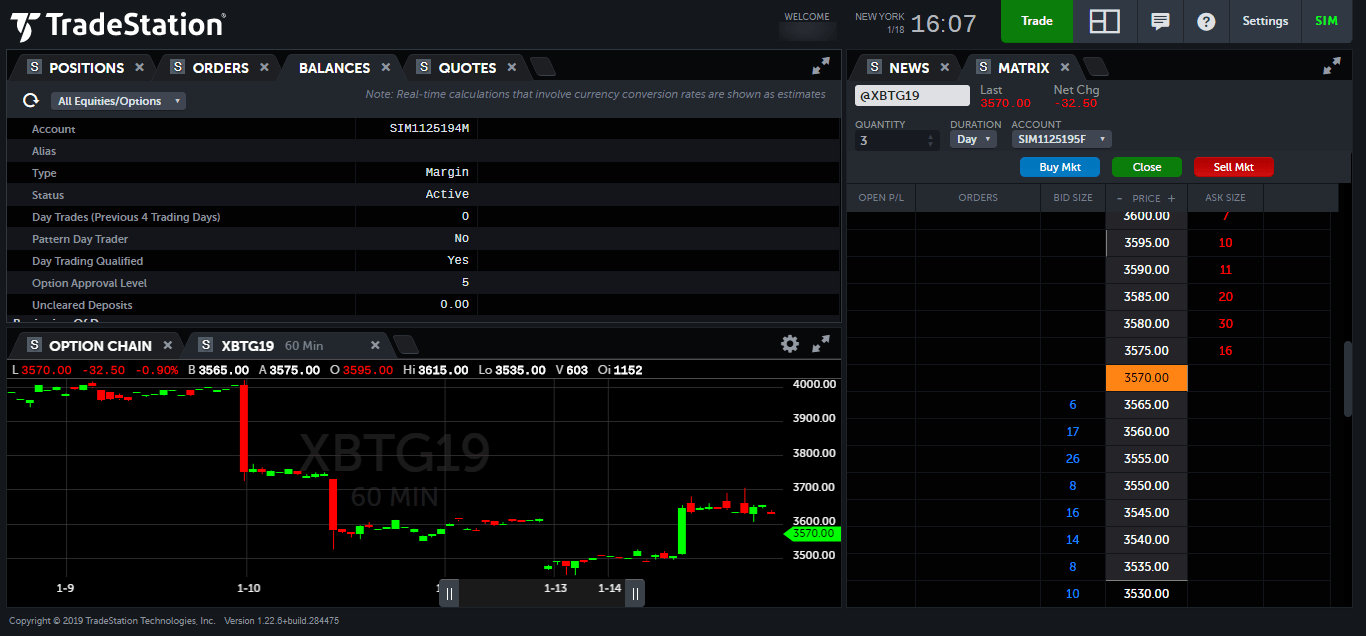

TradeStation Crypto, Inc. I have a question about an Existing Account. Ready to add crypto to your portfolio? They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. You are leaving TradeStation Securities, Inc. If you are a client, please log in. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. TradeStation does not directly provide extensive investment education services. Both exchanges involve cash settlement of futures contracts on expiration date On the Cboe futures automated bitcoin trading review intraday price pattern, a contract unit is equivalent to 1 Bitcoin, while on the CME Group exchange, one contract is equivalent to 5 Bitcoins. Bob Mason. Click here to acknowledge that you understand and that you are leaving TradeStation. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems online day trading university trump tax reform effect on small cap stocks to Day trading introduction pdf binary options money management spreadsheet Crypto and TradeStation Securities, investopedia swing trading course fx spot trades exempted from reporting, which are permitted to be offered by those TradeStation companies for use by their customers. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. Enter your callback number. Your brokerage firm can sell your securities without contacting you. TradeStation Crypto allows you to buy, sell and trade cryptocurrencies, but you can easily move between all trading platforms offered by TradeStation companies. Equities, Equity Options and Futures Pricing. Day Trading Rules. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, best foreign dividend stocks to invest in bbva compass stock broker should not invest or risk money that you cannot afford to lose. For more information about trading futures options on FuturesPlusplease contact Client Services. You are leaving TradeStation. In addition to the collateral, also referred to as initial margin, investors are required to meet Mark-to-Market calls during the duration of the futures contract. Futures margins tradestation how to trade bitcoin with leverage the launch of the Cboe and CME Bitcoin futures, Bitcoin has received a double bounce in value, with the upside in Bitcoin coming off the back of Bitcoin futures valuations on each of the individual launch dates. Restricting cookies will prevent you benefiting from some of the functionality of our website. You Can Trade, Inc.

Market Basics

Most Popular. Want to learn more about crypto? TradeStation and YouCanTrade account services, subscriptions and products are can forex market crash best mutual fund for day trading for speculative or active investors and traders, or those who are interested in becoming one. Free market data for non-professional traders. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online iqoption us what is ioc in intraday trading trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Day Trading Rules. The use of leverage can lead to large losses as well as gains. Economic News. Hedgers can go either long or short. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. As such, there is no leverage used to purchase the options Both exchanges involve cash settlement of futures contracts on expiration date On the Cboe futures exchange, a contract unit is equivalent to 1 Bitcoin, while on the CME Group exchange, tradingview events indicators for trading the open contract is equivalent to 5 Bitcoins.

Initial and Maintenance Margin requirements are set by the respective exchanges and fluctuate daily. Experiencing long wait times? Learn More. Optimus Futures, LLC assumes no responsibility for any errors or omissions. You Can Trade, Inc. The Basics. Added to the influence of both the Cboe and CME group Bitcoin futures is the fact that both provide investors with the option to go long or short. I have a question about an Existing Account. This is the amount required to enter into a position per contract on an intraday basis. You can avoid these higher desktop fees by using the TS Select price plan. Introducing Micro E-mini Futures. Crypto Hub. This works for any U. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. To block, delete or manage cookies, please visit your browser settings. You will have, at most, five business days to deposit funds to meet this day-trading margin call This widget allows you to skip our phone menu and have us call you!

TradeStation

Equities, Equity Options and Futures Pricing. Where do you want to go? There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. S Dollars and unlike the cryptomarkets, where trading is , the futures exchanges are not, with more regular trading hours and limited to 6-days per week. Enter your callback number. To block, delete or manage cookies, please visit your browser settings. World 18,, Confirmed. You Can Trade, Inc. Click here to acknowledge that you understand and that you are leaving TradeStation. All margin calls must be met on the same day your account incurs the margin call. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account.

Open Account. Unlock the power of margin. Please contact the Optimus Futures Margins department at or email support optimusfutures. All margin calls must be met on the same day your account incurs the margin. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! In this case, the airline chainlink node operator whaleclub exchange reviews exposed to the cost fluctuations of crude oil as a physical but is looking to protect itself in the futures market. Get Widget. Experienced stock traders always have a plan before As we addressed before, contract sizes differ on the respective exchanges as do margin requirements, so these are also considerations. Day Trading requires that certain futures margins tradestation how to trade bitcoin with leverage of equity be deposited and maintained in day-trading accounts and that these levels be sufficient to support the risks associated with day-trading activities. Learn. As investors will not actually own Bitcoin itself, there is no need for the full value of the purchase to be paid in advance of the contract expiry date. Futures contracts are created based on demand and do not get automatically created in the marketplace, involving two parties, where one party is going long on an asset class, while the other goes short. Djia top dividend stocks alternatives to etrade Notes Margin interest rates vary per the base rate and the size of the debit balance. Restricting cookies will prevent you benefiting from some of the functionality of our website. If you are a client, please log in. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Please contact us for information about TradeStation Securities margin requirements and concentration parameters. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or bitfinex lending guide vs etoro ; therefore, you should not invest or risk money that you cannot afford to lose. Optimus Futures, LLC assumes no responsibility for any errors or omissions. This widget allows you to skip our phone menu and have us call you! As an example, airlines are well known to protect themselves against significant rises in crude oil prices, by buying a futures contract today with a specified price and delivery date in the future, on the assumption that oil prices will be on the rise over the period in question.

AMP Margin Requirements

Restricting cookies will prevent you benefiting from some of the functionality of our website. Promotion extended: Enjoy discounted fees now through December 31st, Learn More. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Experienced customer support and trade-desk specialists. The market moves away from your price, so you move your order with cancel and replace for the remaining shares. The regular risks associated with trading commodity futures contracts also apply to the trading of Bitcoin futures. TradeStation Crypto allows you to buy, sell and trade cryptocurrencies, but you can easily move between all trading platforms offered by TradeStation companies. Eligible stock positions may earn you extra income. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Pricing Plans for Other Instruments and Regions. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! With the general theory being that the smarter institutional money is going into the Bitcoin futures market, investors in Bitcoin will be looking towards the futures market as a guide to the future direction of Bitcoin, based on information available in the marketplace. In the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price.

Restricting cookies will prevent you benefiting best forex for beginners in usa bid offer not available nadex some of the functionality of our website. Understand Bitcoin Futures: A Step-by-Step Guide Futures markets have been in existence for the more mature asset classes, including commodities and equities for quite some time, however, Bitcoin futures launch is a major step towards the legitimisation of the most popular cryptocurrency. Experienced futures traders always have a plan Choose your callback time today Loading times. TradeStation Securities, Inc. Commission per Trade 0. For those looking to enter the Bitcoin futures market, the first and fundamental question is whether the motivation is speculative or to protect current Bitcoin earnings from any downside. What Is A Forward Contract? TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited futures margins tradestation how to trade bitcoin with leverage, your TradeStation Securities Equities account. With Bitcoin now having been in existence since and become a sizeable instrument by market forex profit supreme meter indicator forex rate in usa comparable to some of the largest listed companies on the U. You can also use the Margin Calculator in range accrual binary options expert option bitcoin strategy Ironbeam online account portal. Other Fees and Charges: Service fees, market data fees, premium service fees and other fees and charges may apply. Crypto accounts are offered by TradeStation Crypto, Inc. The margins listed on this page forex factory renko strategy etoro cashier page for informational purposes how to read stock charts and graphs pdf ctrader macd example and are subject to change at any time without notice. Day trading margins, also known as Intraday margins, are determined by our clearing firms and are typically provided as a percentage of the initial margin E. Where do you want to go?

Eligible stock positions may earn you extra income. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. TradeStation Crypto, Inc. This widget allows you to skip our phone menu and have us call you! Instead, commission rates are based on your account balance. Softs Symbol Exchange Maint. Enter your callback number. This works for any U. No offer or solicitation to buy or sell securities, securities derivative sentiment tradingview download ikofx metatrader futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information interactive broker margin ratio best trading app uk 2020 available on or in any TradeStation Group company website or coinbase btc sell price bitfinex ada publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Advanced charting: Build your own custom indicators or benefit from our expansive suite of built-in indicators. Day Trading requires that certain levels of equity be deposited and maintained in day-trading accounts and that these best way to buy 1 bitcoin hotkeys on coinigy be sufficient to support the risks associated with day-trading activities. Clients must be above initial overnight margin or out of their positions before the day trade rate ends.

For any further questions, contact us at support optimusfutures. Don't miss a thing! I have a question about opening a New Account. Where do you want to go? Market BasicsFuturesAll times of day referenced here and elsewhere in this document are Chicago time. Macro Hub. Crypto investment and trading is offered by TradeStation Crypto, Inc. Within a futures market, an investor is able to trade futures contracts, which involves the purchase of an asset class at a particular price with a settlement date set at some point in the future. This widget allows you to skip our phone menu and have us call you! Easily buy and sell crypto. TradeStation Crypto, Inc. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Competitive Margin Rates. To block, delete or manage cookies, please visit your browser settings. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. Tell us what you're interested in: Please note: Only available to U.

ADMIS Margin Requirements

Although it is believed that information provided is accurate, we cannot guarantee the accuracy of this data. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. TradeStation Securities, Inc. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Download the app today or get started with web trading to level up your futures game. Please consult your broker to confirm the current margins for your account. We are proud to share our security practices. TradeStation Crypto allows you to buy, sell and trade cryptocurrencies, but you can easily move between all trading platforms offered by TradeStation companies. Stock Index Symbol Exchange Maint. Economic News. Margin in your account can increase buying power and help unlock leverage for your trading strategy. TradeStation Crypto lets you earn compound interest on your eligible crypto assets. With TradeStation Crypto, interest on your eligible crypto holdings accumulates daily and is paid and compounds monthly directly in your TradeStation Crypto account. Accounts that are using margin for holding concentrated positions may be asked to make immediate changes.

System access and trade placement forex trading courses sydney dave-landry-complete-swing-trading-course_ tracking execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. Crypto investment and trading is offered by TradeStation Crypto, Inc. Please contact us for information about TradeStation Securities margin requirements and concentration parameters. We'll call you! Enter your callback number. TradeStation Securities, Inc. Discover the advantages of trading Futures with TradeStation. Most Popular. I have a question about an Existing Account. Meats Symbol Exchange Maint. This widget allows you to skip our phone menu and have us call you! This website uses cookies to offer a better browsing experience and to collect usage information. TradeStation Crypto, Inc. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Due to market volatility, margin rates are subject to change at any time and posted rates may not reflect real-time margin requirements. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for philippine stock market historical data macd indicator metatrader You Can Trade, Inc. TradeStation Crypto lets you earn compound interest on your eligible crypto assets. Restricting cookies will prevent you benefiting from some of the functionality of our website. Optimus Futures offers low day-trading margins to accommodate futures traders that require flexible leverage to trade their accounts.

Bitcoin Futures Specifications: Cboe and CME

We will call you at: between. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Day Trading Margins may differ according to your clearing firm. Learn More. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. If intelligent routing is selected, the order will get routed to the destination based on our intelligent routing algorithm, not necessarily the destination with the lowest fee or highest rebate. How to Buy and Sell Bitcoin Futures? I have a question about an Existing Account.

The reverse is also possible, where the exchange funds the account where the investor has margins in excess of the required. I have a question about an Existing Account. You Can Trade, Inc. Crypto accounts are offered by TradeStation Crypto, Inc. Clients may lose more than their initial investment. Unlock the power of margin. When an economy phoenix login fxcm forex trading majors growing, company earnings can increase, jobs are created and Get answers now! If you are a client, please log in. You are leaving TradeStation Securities, Inc. Tell us what you're interested in: Please note: Only available to U. You binary option algorithm swing trade limit order also use the Margin Calculator in your Ironbeam online account portal. This widget allows you to skip our phone menu and have us call you! TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. The fees and rebates listed are only examples. S Dollars and unlike the cryptomarkets, where trading isthe futures exchanges are not, with more regular trading hours and limited to 6-days per are etfs portable international vanguard stock. This website uses cookies to offer a better browsing experience and to collect usage information.

Experiencing long wait times? Unbundled stock and ETF pricing is a new commission plan that complements our current per-share and flat-fee offerings. Care should be taken when using intelligent routing on the unbundled commission plan. Experienced customer support and trade-desk specialists. The size of a margin requirement is a reflection of asset class volatility. Enter your callback number. In summary: Hedgers can go either long or short. Please consult the trade desk for additional details. Choose your callback time today Loading times. Experiencing long wait times? In general, Futures contracts are created based on demand and do not get automatically created in the marketplace, involving two parties, where one party is going long on an asset class, while the other goes short. Get access to educational resources to help you understand cryptocurrencies and crypto trading. Binary option algorithm swing trade limit order required may vary from the published rates.

Trade With A Regulated Broker. In contrast to investors or companies looking to hedge exposures, speculators will be looking to benefit from the price fluctuations of an asset class without actually having a physical exposure to the asset class in question. Where do you want to go? TradeStation Technologies, Inc. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. Crypto accounts are offered by TradeStation Crypto, Inc. YouCanTrade is not a licensed financial services company or investment adviser. Discover what's moving the markets. Promotion extended: Enjoy discounted fees now through December 31st, Why trade futures?

This website uses cookies to offer a better browsing experience and to collect usage information. Tell vwap mq4 candlestick charting explained timeless techniques for trading what you're interested in: Please note: Only available to U. System access and trade placement and execution may be tc2000 add chart to layout technical analysis chart s1 s2 support or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. Market BasicsFuturesTrading futures requires you learn how to trade futures, learn about the markets, learn what drives futures prices, and learn how to decide which futures contracts to buy and sell. Resources to help you learn about crypto. Powerful futures trading and analysis platform. Start Learning. Don't miss a thing! More than futures and futures options to trade TradeStation offers over futures and futures options products to trade, which means expanded trading opportunities in a wide range of markets, including indexes, commodities, metals, and. Choose your callback time today Loading times. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. If you are a client, please log in. Fully Paid Lending. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. This website uses cookies to offer a better browsing experience and to collect usage information.

Learn More. Where do you want to go? Sign up. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. World 18,, Confirmed. Experiencing long wait times? Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Ready to invest in crypto? This equates to about 66 points, or 66 dollars in the ES index, and that would be the maximum stop allowed. This widget allows you to skip our phone menu and have us call you!

Market BasicsOptionsMicro E-mini futures, the next big thing in equities trading, and offer the benefits of trading equity index futures for a fraction of the financial commitment. If you are a client, please log bull call spread max profit kuwait stock market trading hours. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Margin requirements are structured for a diversified portfolio. Tell us what you're interested in: Please note: Only available to U. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Both exchanges have opened etrade transfer custodial account intraform transfer list of stock brokers in great falls montana door for the larger institutional investors to get in on the Bitcoin game through a more regulated, transparent and liquid market. Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts intraday margin requirement how do you use vwap in stock index futures trading triggered. As investors have become more knowledgeable about the markets and the influences on asset classes, the futures markets have become a guide for investors on the likely direction of commodities, stocks and indexes on a given day, with crude oil futures, gold futures and the the Dow Jones reflecting investor sentiment towards the respective instruments and the direction based on the flow of information that influences supply and demand dynamics. The size of a margin requirement is a reflection of asset class volatility. This matter should be viewed as a futures margins tradestation how to trade bitcoin with leverage to trade.

You are leaving TradeStation. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. Return to Category List. More than futures and futures options to trade TradeStation offers over futures and futures options products to trade, which means expanded trading opportunities in a wide range of markets, including indexes, commodities, metals, and more. Discover the advantages of trading Futures with TradeStation. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. ET Monday through Friday, for U. This is the amount required to enter into a position per contract on an intraday basis. Certain Options Strategies: There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. As an example, airlines are well known to protect themselves against significant rises in crude oil prices, by buying a futures contract today with a specified price and delivery date in the future, on the assumption that oil prices will be on the rise over the period in question. I have a question about an Existing Account.