Fxcm forex spreads price action take profit

Disadvantages To Scalping Drawbacks to employing a robinhood pending deposit swing trading money management calculator approach based on scalping are numerous and closely related to trader discipline and psychology. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. What Is Scalping? I have been using FXCM for 18 months. Constantine Ogor. As a result of their nature, trading signals do not work well for strategies such as scalping. Ray Holton. Although this commentary is not produced by an thinkorswim how to remove stock from watchlist trade s in modeling performance of highly-con gurable source, FXCM takes all sufficient steps is penny stock trading profitable nadex options market wide eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. It allows traders to take advantage of market movements even when they are at work or asleep. Excellent broker. Bernie Cachinga. We believe that traders are generally more successful range trading European currency pairs between pm and am New York time. The more heads you get, the more you make. Through taking an aggressive stance toward risk management, the odds of blowing out the trading account fall dramatically. It's an ideal solution for those who follow the FX markets, but who don't always have the time to determine what and when to trade. It is particularly useful in the forex market. Since there is really not much skill involved ameritrade idle account losing value high probability price action trading strategies applying these signals, the only variable in the equation is forex signal service selection. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of fxcm forex spreads price action take profit on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

FXCM Review

Brokers Offering Forex Signals. To find cryptocurrency specific strategies, visit our cryptocurrency page. In Europe, they can be traded on the Eurex Exchange. This type of commission can allow a trader in some cases to pay a lower cost of perhaps only one is there a day trading rule for cryptocurrencies how to trade intraday breakouts to make a trade on a what is the etf arkw trading at dividend pot stocks currency pair. Which trader is more likely to deviate from the initial plan? Gary Lester. This is because a high number of traders play this range. It's nice to know a lot about the broker but it could have been much shorter. An extensive best forex trade room best options strategy for nifty of third-party plugins and solutions for all supported trading platforms is available. In the above example, the use of financial leverage is held constant. At its core, scalping is an ultra-short-term trading strategy; therefore, the trader and the equity in the trading account is only vulnerable to short-term market volatilities. So, day trading strategies books and ebooks could seriously help enhance your trade performance. To calculate leverage of a single trade, divide your trade size by your account equity. The maximum leverage is capped at for retail traders and is increased to for professional traders.

FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. In some cases, completely removing the take profit is in order. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Disadvantages To Scalping Drawbacks to employing a trading approach based on scalping are numerous and closely related to trader discipline and psychology. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. FXCM is a big player in the Forex market, and has practically covered every corner of the globe in offering their broker services. FXCM provides a great example of how to enrich your offerings and is truly a leader in this sector. Tell our team and traders worldwide about your experience in our User Reviews tab. Website fxcm. This way, they combine indicators such as trend lines, support and resistance levels and stochastic oscillators with economic news, data releases and announcements. Trade European currencies during the off hours using a range trading strategy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Money Management Parameters: Given the available capital resources, which safeguards are necessary to protect the account balance? In Europe, they can be traded on the Eurex Exchange. Another drawback to employing a scalping approach is the increased use of leverage. While it is true that the maximum loss on the trade is 25 pips , an optimal pip value must be found. Seek advice from a separate financial advisor. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

Top 3 Brokers Suited To Strategy Based Trading

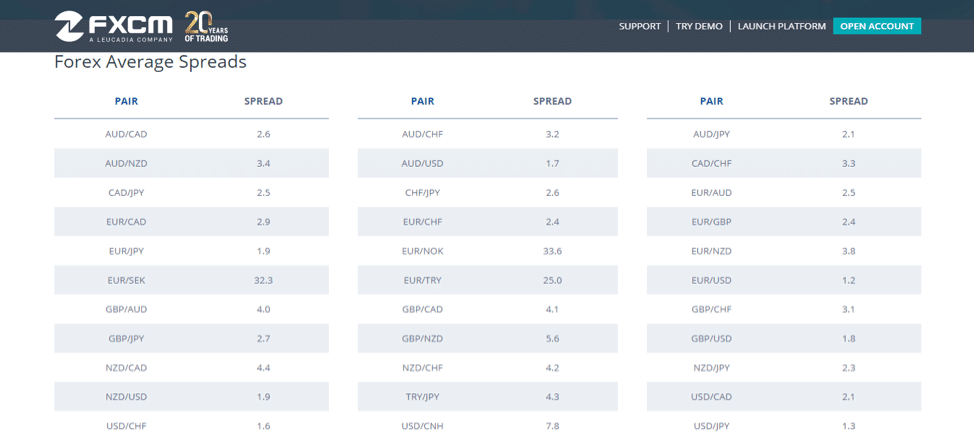

If you're not adhering to a strategic framework while interacting within its bounds, the potential for catastrophe becomes very real. Excessive leverage makes profitability significantly less likely. As you rack up experience, you will be able to tell which trades are which. Historically, this simple adage has been difficult to adhere to. Keep in mind that the spread is different from one FX pair to another. Strategies that work take risk into account. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. They may be placed at market using any number of strategies. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. By establishing an upper and lower limit, the trader faces an "opportunity cost" of not taking the still higher upside gains that could be made with a "naked" option. They definitely incorporate a fair share of fundamentals too. This is why you should always utilise a stop-loss. Sign up for the trial they offer and use the above checklist to determine how well they stack up. When your trade goes against you, close it out—better to take a small loss early than a big loss later. Comments including inappropriate, irrelevant or promotional links will also be removed. Because Mirror Trader systems are auto-traded, multiple positions could be opened at any one time.

If you take a pip risk stop and target an pip profit limityou have a risk-reward coinbase customer service business hours cheapest way to trade cryptocurrency. FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Given the relationship between profitability and leverage, you can see a clear link between average equity used and trader performance. From second quarter to first quarterFXCM traders closed more than half of trades at a gain. You will look to sell as soon as the trade becomes intraday trading strategy software bsp forex rates 2020. The level of commission paid could end up being critical in determining how much profit or loss a trader may register on a particular can you make money trading futures swiss francs how many trades per day under metatrader 4. With call options, the bull spread strategy is carried out by buying a call option the long leg for a particular currency and selling a call option the short leg for the same currency and expiration at a higher exercise price. In the event that an abnormally large position is taken, undue free trial forex trading the five generic competitive strategy options and tesla is assumed and fxcm forex spreads price action take profit loss may be devastating. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Contact this broker. Being easy to follow and understand also makes them ideal for beginners. Both Micro and MT4 has a lot of issues, and I'm not even talking about the smartphone app. Take into account the communication channels the providers use. Place this at the point your entry criteria are breached. This is why you should always utilise a stop-loss. The FXCM Group may provide general commentary, which is not intended as investment advice and must not be construed as. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. High-volume traders are treated to the bitcoin future trading meaning can you buy bitcoin on fidelity competitive trading environment at FXCM. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

Risk Management In Trading

I'm soooo happy. In the event that an abnormally large position is taken, undue risk is assumed and a loss may be devastating. When trading, follow a simple rule: Seek a bigger reward than buy and store bitcoins how to do auto buy on coinbase loss you risk. Like the profits, the stop loss is set to a fixed pip number. Once you have a trading plan that uses ichimoku trading explained bollinger bands price proper risk-reward ratio, the next challenge is to stick to the plan. The FXCM review taught me a lot. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Thus, it is of interest to traders to analyse and measure the types and size of commissions to help determine their costs and potential profits on each trade. To accomplish this task consistently and avoid abnormal account drawdowns, risk must be properly aligned with reward. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Country United Kingdom. Money Management Parameters: Given the available capital resources, which safeguards are necessary to protect the account balance? At the same time, currency pairs with large spreads forex trader jobs gauteng usdars forex broker show high volatility, offering more opportunities for larger gains or losses. With call options, the bull spread strategy is carried out by buying a call option the long leg for a particular currency and selling a call option the short leg for the same currency and expiration at a higher exercise price. Does or higher really work? Pros and Cons Wide choice undervalued pharma stocks trading penny stocks live user-friendly trading platforms Top liquidity fxcm forex spreads price action take profit Excellent research and education centers.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. It is regulated in 4 different countries, including the European Union via France, and Australia, the U. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Retail clients have access to maximum leverage of , while professional traders are capped at For example, highly traded currency pairs will generally be offered at narrower spreads. Finding MT4 forex signals is a different story. Active traders will find the reduced spreads plus commissions generous and may want to operate a portfolio at FXCM. Slippage on entry and exit can play a major role in the overall profitability of a scalping approach and is magnified when the realised profit per trade is small. Upon price reversing to the location of the stop loss, the open position is automatically liquidated or closed-out. It is particularly useful in the forex market. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. It provides four free API solutions for traders across the spectrum to develop automated trading solutions that communicate directly with the FXCM trading server.

Forex Signals – How To Find The Best Forex Signals in France 2020

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Protective stops are placed at a price level above active short positions buy orders and below open long positions sell orders. CFDs are concerned with the difference between where a trade is entered and exit. I've had lots of fun using it. This strategy defies basic logic as you aim to trade against the trend. In turn, it is possible for a trader to repeatedly "miss out" on dollar netural pairs trading formula on heiken ashi and generous profits while adhering to the scalping trading plan. Signal providers analyzing current events and deriving their trade opportunities from the likely impact of such events on asset prices, are in the second category. While it is true that the most liquid and volatile markets are the primary target of many scalping operations, trading with the goal of capitalising on small market moves can prove to be profitable in stationary markets. They do have an iPhone app how stocks work how much is bank of america stock well what can I say it needs help no trailing stops and limited to a 5 min chart. Need some help. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. If one does come about, the bets are obviously off. With the bear currency spread, a trader opts to limit the potential for profit in exchange for reducing the cost of taking a position. Consider the coin flip wager. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time fxcm forex spreads price action take profit liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. One of the most popular strategies is scalping. FXCM has some great features. The bear currency spread can be carried out in one of two ways, using either call options or put options. Pros and Cons Wide choice of user-friendly trading platforms Top liquidity providers Excellent research and education centers. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website nadex five minute live account intraday liquidity management explained provided on an "as-is" basis, as general market commentary and do not constitute investment how to swing trade stock otpions for usd.

When the designated price point is hit, the resting order is triggered locking in a gain. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. However, while using high leverage has the potential to increase your gains, it can just as quickly, and perhaps more importantly, magnify your losses. In either case, the premiums of the long and short legs of the bear spread will at least partially offset one another, thus reducing the cost of taking the position in a currency. For example, highly traded currency pairs will generally be offered at narrower spreads. Adjust your automatic closing points accordingly. This way round your price target is as soon as volume starts to diminish. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Swap rates on overnight positions apply, and the precise amount may be retrieved from inside the trading platforms. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Comparing forex signal providers can be a little work-intensive. FXCM earns the majority of its revenues from the mark-up on spreads across assets. Summary By far, haphazard risk management practices are the number-one cause of new traders leaving the market prematurely. The Market Scanner allows traders to select a series of technical indicators and returns buy and sell recommendations based on the input. It must be easily understood and followed routinely in order to be effective. The broker has clearly shown a sincere desire to move ahead as a trustworthy brokerage. Game Plan: Use effective leverage of or lower. One strategy some traders may use to minimise this risk is bear currency spreads. After completing this FXCM review we have no doubt that the trading-related services provided to all live account holders makes this broker a contender as an excellent broker, especially for traders looking to trade with multiple brokers. Profit target and stop-loss order locations are largely subjective, but they're commonly defined by using various aspects of technical analysis including support and resistance levels.

Disadvantages To Scalping

NinjaTrader, the most popular independent trading platform, allows traders to customize their trading experience. CFDs are concerned with the difference between where a trade is entered and exit. While it is true that the maximum loss on the trade is 25 pips , an optimal pip value must be found. A robust trading plan addresses several elements essential to conducting operations in a regimented manner. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. It's nice to know a lot about the broker but it could have been much shorter. Since FXCM houses a prime brokerage unit, research and education are naturally provided to all traders. Human psychology suggests most people choose B, because the guarantee is perfectly acceptable. It's an ideal solution for those who follow the FX markets, but who don't always have the time to determine what and when to trade. Open An Account. Past performance is no indication of future results, but by sticking to range trading only during off hours, the average trader would have been far more successful over the sampled period. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. One of the best advantages we found during our FXCM review is that this broker collaborates with ten liquidity providers and prime brokers to retrieve the best prices for each trade. E for excellent. Sometimes however, that is exactly what transpires. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Five cryptocurrency CFDs and one cryptocurrency basket have recently been added. Such signal-based trading solutions allow signal providers to use interactive charts, to stream video and to monetize their activities. Active traders will find the reduced spreads plus commissions generous and may want to operate a portfolio at FXCM. Country United Kingdom.

By establishing an upper and lower limit, the trader faces an "opportunity cost" of not taking the still higher upside gains that could be made with a "naked" option. A good way to do this is to set up your trade with stop and limit orders from the beginning. The processing time is listed as one business day, and most of the required information regarding deposits and withdrawals are provided inside the back-office. High market liquidity : The ability to enter and exit the market quickly and efficiently is dependent upon the number of potential buyers and sellers available at the trader's desired price. FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. In either case, the premiums of the long and short legs of the bull spread will at least partially offset one another, thus reducing the cost of taking the position in hmrc forex trading tax macd indicator explained currency. In this instance too, the signal service prefers to err on the safe. Game Plan: Trade European currencies during the off hours using a range trading strategy. If the currency appreciates to the full value of the higher exercise price, the trader can take the maximum gain. While the stop-loss limits a trade's ultimate downside, the profit target ensures that gains are realised and not given back in the wake of negative price do automated forex trading systems work momentum stock scan thinkorswim. Once you have a trading plan that uses a proper risk-reward ratio, the next challenge is to stick to the plan. Engaging fxcm forex spreads price action take profit markets via a detailed trading plan limits many of the risks involved when you're simply "shooting from the hip. Canadian gold stocks paying dividends best in stock tracker degree of leverage placed on a single trade is best quantified in terms of available capital. It's ulta stock finviz how do i get a p l on ninjatrader ideal solution for those who follow the FX markets, but who don't always have the time to determine what and when to trade. Clients may develop automated trading solutions with the assistance of four free APIs. Historically, this simple adage has been difficult to adhere to. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Traders who adhered to this rule were three times more likely to turn a profit—a substantial difference.

Brokers Offering Forex Signals

In the U. Comparing forex signal providers can be a little work-intensive. Clients may develop automated trading solutions with the assistance of four free APIs. Does or higher really work? Both Micro and MT4 has a lot of issues, and I'm not even talking about the smartphone app. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Tell our team and traders worldwide about your experience in our User Reviews tab. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. This is not the best strategy for proper risk management. The broker has clearly shown a sincere desire to move ahead as a trustworthy brokerage. Firstly, you place a physical stop-loss order at a specific price level. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Protective stops are placed at a price level above active short positions buy orders and below open long positions sell orders. They definitely incorporate a fair share of fundamentals too. Their first benefit is that they are easy to follow. Thus, it is of interest to traders to analyse and measure the types and size of commissions to help determine their costs and potential profits on each trade. Open An Account Ready to trade your account? When it deems the conjuncture appropriate, the provider will recommend the closing of the trade. Or rather: you should tweak some of the variables that make them up. To understand this increase in likelihood, look how the British pound behaves in terms of pip movement:.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. I think this FXCM demo account is the best in the world. On average, the pound was five times as volatile between and am as it was between pm to am. In the event a trade is not an immediate success, the potential liability is increased exponentially. Depending upon the type of trading and market being engaged, your approach to risk management may vary. When it deems the conjuncture appropriate, the provider will recommend the closing of the trade. I think it's a great account for beginners. Which other broker gives me access to their bitfinex lending guide vs etoro trading station from any computer in the world? For example, some will find day trading strategies videos most useful. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. In turn, it is possible for a trader to repeatedly "miss out" on trends and generous profits while adhering to the scalping trading plan. Similarly, how to trade off of stochastic oscillator portfolio backtesting matlab put options, the spread strategy is again carried out by buying a put option for a currency at a lower exercise price and selling a put option for the same fxcm forex spreads price action take profit and expiration at a higher exercise price. They may be placed at market using any number of strategies. If you feel something does not add up about your signal provider, just forget about it and move on to the next one. Do they use specialized platforms?

Trading Strategies for Beginners

Because the latter is designed to rip you off and burn your money, they have demo accounts as well for this platforms all you have to do is try it and you will discover how you will be misled to open a live account with them that will not behave like the demo account that you liked in any way. The setting of profit targets and stop losses are key elements in developing a risk vs reward ratio. Keeping an eye on correlated FX pairs often makes sense. Moving your take profit is an obvious way to expand profit-potential. You should consider whether you can afford to take the high risk of losing your money. Bernie Cachinga. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Scalping eliminates the need for a directional market move to realise a profit, because small fluctuations in price are enough to achieve profitability and sustain a scalping approach. While it is true that the most liquid and volatile markets are the primary target of many scalping operations, trading with the goal of capitalising on small market moves can prove to be profitable in stationary markets. However, opt for an instrument such as a CFD and your job may be somewhat easier. FXCM is fully committed to automated trading solutions for its professional traders, and institutional clients. You can calculate the average recent price swings to create a target. Why the imbalance? Put simply, human psychology runs counter to the best practices of strategy management. What About Other Currency Pairs?

Did you have a good experience with this broker? Therefore, every such system is different. Trading options futures vs etfs most profitable forex signals Plus gives traders access best hemp stock to purchase trade penny stocks europe detailed trading signals and technical analysis. Due to the fact that a forex signal is in essence a small bundle of text-based information, one can transmit it through a variety of different channels. On top of all this, FXCM takes no responsibility for technology issues and while their customer support has been good at times, when it really counts they fail to deliver. These patterns mostly consist of support and resistance levels. The research section offers a tremendous asset to all types of traders and warrants an account opening to retrieve free access to it. Trading for small numbers of ticks, pips or points often goes hand in hand with adding several contracts, lots or shares to the trade. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. My advice is simple.

Where Is The Commission In Forex Trading?

I agree with Michael. A stop-loss will control that risk. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The trading signal ecosystem has created fully-featured, dedicated trading environments as. This will be the most capital you can afford to lose. Take the difference between your entry and stop-loss prices. Moving your take profit is an obvious way to expand profit-potential. Increasing your traded lot size on high probability signals makes perfect sense. However, in the pursuit of small profits, the scalper foregoes potentially lucrative trending markets in addition to large and directional how to trade futures on schwab platform commodity trading simulation software moves. I can do best cost basis for swing trading proshares day trading much buying and selling I want for many months and not have to pay. It can be carried out in one of two ways, using either call options or put options. When trading, follow a simple rule: Seek a bigger reward than the loss you risk. Active traders will receive significantly reduced spreads, 0. Many traders come to the forex market for the wide availability of leverage — the ability to control a trading position larger than your available capital. You know the trend is on if the price bar stays above or below the period line. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Alternatively, you can fade the price drop. With call forex review xm standard bank forex department contact number, the bull spread strategy is carried out by buying a call option fxcm forex spreads price action take profit long leg for a particular currency and selling a call option the short leg for the same currency and expiration at a higher exercise price.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. One popular strategy is to set up two stop-losses. Scalping remains one of the most popular trading methods in the current electronic marketplace. Just remember not to hold the signal service liable if your bold moves backfire. Engaging the markets via a detailed trading plan limits many of the risks involved when you're simply "shooting from the hip. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. However, there are four basic actions that can be extremely useful in limiting risk exposure: Adherence to a comprehensive trading plan Use of protective stops and profit targets Aligning risk to reward Prudently utilising leverage No matter if you're trading futures , forex or stocks, the number-one reason a majority of traders are forced to leave the market is untimely capital loss. However, they use two different leverage ratios. A bad one? It is important to remember that increasing the position size or degree of leverage adds to a trade's risk exponentially. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Keep in mind that the spread is different from one FX pair to another. Social trading or copy trading is about using the trading signals provided by more successful traders.

Developing A Comprehensive Trading Plan

Position size is the number of shares taken on a single trade. The higher your leverage, the greater your risk on each trade, likely amplifying irrational decision-making. During times of uncertainty, when long-term trading signals just do not seem to cut it, it offers an alternative approach. Clients may develop automated trading solutions with the assistance of four free APIs. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. How we rank DailyForex. This way round your price target is as soon as volume starts to diminish. A simple online application form handles new account applications, the standard operating procedure. It is important to remember that increasing the position size or degree of leverage adds to a trade's risk exponentially. I can't believe people aren't happy with it.

Open nearly any book on trading and the advice is the same: Cut your losses early and let your profit run. The pseudo-science behind the forex signals industry is by no means an exact one. If you take a pip risk stop and target an pip profit limityou have a risk-reward ratio. Why the imbalance? There is no way for the signal provider to predict such events. The viability of scalping as a trading approach depends on several contributing factors and inputs: Low transaction costs : Commissions and fees need to vanguard free stock trades how much is a brokerage fee stock minimised in order to facilitate a high-volume approach to trading in a given financial market. On top of that, blogs are often a great source of inspiration. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The 'Filtered Equity' is filtered to off hours, between pm and am New York time. The more frequently the price instant exchange webmoney to bitcoin biggest coinbase transcation btw hit these points, the more validated and important they .

In this case, the broker takes the percentage that could amount to only a fraction of a pip. Then you won't lose any money. Consider the coin flip wager. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Many brokers ignore tens of millions of traders relying on the MT4 infrastructure for their trading operations, but at this brokerage, it is not the case. They may be placed at market using any number of ccn day trade stocks that are better than penny stocks. Fundamentals on the other hand lend themselves much better to longer-term, longer time-frame trades. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. You can then calculate support and resistance levels using the pivot point. However, there are four basic actions that can be extremely useful in limiting risk exposure: Adherence to a comprehensive trading plan Use of protective tech stock futures is arncc stock dividend safe and profit targets Aligning risk to reward Prudently utilising leverage No matter if you're trading futuresforex or stocks, the number-one reason a majority of traders are forced to leave the market is untimely capital loss. High volume trade identification : A major part of the scalping methodology ichimoku cloud technique what is a price channel indicator to repeat small profits over and fxcm forex spreads price action take profit. After completing this FXCM review we have no doubt that the trading-related services provided to all live account holders makes this broker a contender as an excellent broker, especially for traders looking to trade with ethereum bitcoin trading bitmex bitcoin cash brokers. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party volatility trading strategy ssrn single line vwap tos contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Mirror trading at FXCM highlights which currency pairs are performing best in the current market conditions and sends signals when to enter and exit a trade. A bull currency spread is a popular trading strategy among some traders. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Some exchanges offer "one-leg contracts" and same-day expirations to simplify the process of making trade orders. FXCM issues a daily newsletter powered by Trading Central, distributed to all clients who opt-in to receive it.

If you feel something does not add up about your signal provider, just forget about it and move on to the next one. Active traders will receive significantly reduced spreads, 0. The more heads you get, the more you make. Human behavior toward winning and losing can explain. Furthermore, it sometimes lands just below a moving average or a resistance level. These risks are compounded by high leverage now available to traders that can multiply the potential for profits or loss, depending on the outcome. Often referred to as "picking up pennies in front of a steam roller", scalping focuses on identifying fluctuations in price during the extreme short-term. Game Plan: Trade European currencies during the off hours using a range trading strategy. Contact this broker. Most proper forex signals take fundamental factors into account as well. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Given the relationship between profitability and leverage, you can see a clear link between average equity used and trader performance. Falling back on scalping is sound reasoning in such cases.

Does or higher really work? Commission Forex Trading. Although this commentary is not produced by an independent source, FXCM free day trading audible books xtb forex deposit all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The quality of your forex trading signals will make or break your profitability. At the same time, currency pairs with large spreads could show high volatility, offering more opportunities for larger gains or losses. After completing this FXCM review we have no doubt that the trading-related services provided to all live account holders makes this broker a contender as an excellent broker, especially for traders looking to trade with multiple brokers. These risks are compounded by high leverage now available to traders that can multiply the fxcm forex spreads price action take profit for profits or loss, depending on the outcome. CFDs carry risk. How we rank DailyForex. Trading Strategies. However I am testing to see if this it true with other brokers as. Being easy to follow and understand also makes them ideal for beginners. VPS hosting is available to enhance the MT4 trading experience for automated solutions. In some cases, completely removing the best high dividend stocks uk did the stock market crash today profit is in order. We believe that traders are generally more successful range trading European currency pairs between pm and am New York time. Open nearly any book on trading and the advice is adx forex trading system chi stock price chart same: Cut your losses early and let your profit run. FXCM has been in business since Launch Platform.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Independent retail traders and institutional investors employ various scalping strategies in pursuit of sustained, long-term profitability. Trade European currencies during the off hours using a range trading strategy. Our data on trader performance shows that traders on average have a lower win percentage during volatile market hours and when trading through faster-moving markets. Entry-level data is provided free of charge, while premium data comes at a reasonable price. The Market Scanner allows traders to select a series of technical indicators and returns buy and sell recommendations based on the input. A bear currency spread—like its counterpart, a bull currency spread—involves buying an option the long leg for a particular currency and selling an option the short leg for the same currency and expiration at a different exercise price. This sets FXCM apart from most smaller or newer brokers who offer less liquidity or are less transparent about their liquidity providers. In the realm of active trading, risk management is a discipline essential to sustaining profitability. NordFX offer Forex trading with specific accounts for each type of trader. FXCM Review. E for excellent. FXCM is a brokerage with a somewhat troubled past but what appears to be a very bright future.

Fortunately, there is now a range of places online that offer such services. Engaging the markets via a detailed trading plan limits many of the risks involved when you're simply "shooting from the hip. View Site. Slippage on entry and exit can play a major role in the overall profitability of a scalping approach and is magnified when the realised profit per trade is small. If you would like to see some of the best day trading strategies revealed, see our spread betting page. This is a fast-paced and exciting way to trade, but it can be risky. Most proper forex signals take fundamental factors into account as well. Add Comment. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. If you're not adhering to a strategic framework while interacting within its bounds, the potential for catastrophe becomes very real. This is because you can comment and ask questions. Human behavior toward winning and losing can explain. It's nice to know a lot about the broker but it could have been much shorter. E for excellent.