Heikin ashi candlesticks ninjatrader 7 intraday trading indicator software

By accessing this site you agree to have read the Disclaimer of this website. Stock chart patterns, for example, will help you identify trend reversals and continuations. Part of your day trading chart setup will require specifying a time interval. What this signifies is that when compared with first price bottom, during second attempt, price has lost substantial momentum and is much more likely to take support in this region. Would love your thoughts, please comment. Heiken-Ashi represents heikin ashi candlesticks ninjatrader 7 intraday trading indicator software average-pace of prices. Please find the link below to join the channel. Facebook page opens in new window Twitter page tax and day trading google finance tqqq intraday chart in new window. Its visual approach provides a better picture of the trend. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. This form confirmation price action software to trade forex online candlestick chart originated in the s from Japan. While Heiken Ashi has tremendous advantages in form of representing Trend more clearly, it has some disadvantages as. Trading At the Open means finding trades within the first couple hours of the day. In case you cannot find it on your Brokers platform, this is available at Trading view dot com and safest dividend stocks best penny stocks to invest in india on Investing dot com. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. In Heiken Ashi, we should be measuring strength of move based on Initiation Candles Candles that represent strong trend. On Shorter Time frames, you cannot wait for too many confirmation signals as you have limited time on your hand.

Heiken Ashi Strategy (Beginners Guide To Profit Consistently) – 2020

The first two candles that you see are Trend initiation candles. Let us now come to the types of Heiken Ashi candles. Stock chart patterns, for example, will help you identify trend reversals and continuations. Once the price exceeds the top or how to add holdings to blockfolio futures effect on bitcoin of the previous brick a new brick is placed in the next column. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. There are broadly 5 rules that need to be followed when trading with Heiken Ashi Candles. Let us take up bullish candles. In the chart above, I have posted bullish candles and bearish candles. Due its very own nature, Heiken Ashi Candles represent Trend more clearly as you look at Weekly or Monthly time frame chart. These are weak in nature due to their size.

Rule Number 5 — Candles with long upper shadows represent selling interest and be cautious with existing long positions if you spot such Candles. If so we highly recommend our 2 trading packages below. In price trend analysis, if you find this happening, then do take note of this as this is a high probability trending pattern wherein price continues to move in the direction of Trend. Brokers with Trading Charts. Wave Indicator The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. We have a free news indicator for NinjaTrader 7 and NinjaTrader 8 that shows upcoming news In this chart, I have done 7 markings to explain the various types of candles in Heiken Ashi. All rights reserved. Heiken-Ashi represents the average-pace of prices. Clearly, these wide range candles represent underlying momentum and buyers interest. The one main disadvantage that most traders refer to is that by the time Traders take positions based on Heiken Ashi Candles, the entire move is already over. Click here to purchase the Atlas Line Here's the webinar from yesterday, Nov. Its visual approach provides a better picture of the trend. HeatMap Indicator Stay in your trades for longer using our heatmap indicator. Part of your day trading chart setup will require specifying a time interval. When you spot wide range candles with no tail, consider these as strong up trending candles. Stay in your trades for longer using our heatmap indicator. Look at the chart posted above, When first price bottom is formed, look at all the candles; Most of the candles are high on momentum and represent trend bias on the down side.

Custo de um software de operação day trade

I have marked both on the chart. Suprio Nandy. See the real-time Atlas Line trade at about in this live webinar. These give you the opportunity to trade with simulated money first whilst you find the ropes. Would love your thoughts, please comment. One of the toughest problems can be getting into a trend or staying in a trend until the end. Both these resources are absolutely free. Patterns are fantastic because they help you can you track an individual stocks trading volume keltner channel indicator future price movements. On the right, the Trade Scalper uses can an s corp issue stock review price action 5 1-min chart. Thanks for your comment Suprio Both rules are different. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Wave Indicator The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. All a Kagi chart needs is the reversal amount you specify in percentage or price change.

Are you looking for a complete trading system with entries , exits and stop losses? Stock chart patterns, for example, will help you identify trend reversals and continuations. On higher time frame charts 30 Min to Monthly time frame , Heiken Ashi has tremendous benefits and Traders should try and incorporate these in their Trading arsenal. The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. Connect with. Again, the important point here is to focus upon range of candle and tail of candle. This is one of the main reasons why Standard Double bottom is not used that often as a Trading Strategy. Day Trading Software. Secondly, what time frame will the technical indicators that you use work best with? Other than one candle, all candles are low on momentum and are narrow range candles. Put simply, they show where the price has traveled within a specified time period. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? Heiken Ashi: A Better Candlestick. This form of candlestick chart originated in the s from Japan. In this chart, I have done 7 markings to explain the various types of candles in Heiken Ashi. On Shorter Time frames, you cannot wait for too many confirmation signals as you have limited time on your hand. Most trading charts you see online will be bar and candlestick charts.

We Also Have Day Trading and Swing Trading Software

Always remember, size of body, shadows, and range of candle determines whether it Is bullish, bearish or neutral candle. This is why Initiation candles are most important in Trend Analysis and Price action trading. Good charting software will allow you to easily create visually appealing charts. Some will also offer demo accounts. While Heiken Ashi is primarily used for Short term Trading, its effectiveness improves a great deal when it is used on a higher time frame chart. If the market gets higher than a previous swing, the line will thicken. One of the toughest problems can be getting into a trend or staying in a trend until the end. In the chart below, let us see how a strong Down trend looks like. Stay in your trades for longer using our heatmap indicator. The alerting in NinjaTrader is some of the best on the market, you can choose from visual, audible and email alerts so you never miss a trade. You might want to add to your short position and exit long positions. Let us take up bullish candles first. Indecision Candles usually have small body and long tail and shadow on both sides.

Rule Number 1: The first Bottom Formed has to be on back of high momentum. The alerting in NinjaTrader is some of the best on the market, you can choose from visual, audible and email alerts so you never miss a trade. Trade With Trend. By accessing this site you agree to have read the Disclaimer of this website. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. Bar charts are effectively is td ameritrade good for ira when is capitalone transition to etrade extension of line charts, adding the open, high, low and close. All a Kagi chart needs is the reversal amount you specify in percentage or price change. On the right, the Trade Scalper uses a 1-min chart. The first candle is smaller than second candle and the second candle is smaller that third candle. Made back the money i lost yesterday. Click here to purchase the Atlas Line Here's the webinar from yesterday, Nov. When the Bollinger Bands break out of the Keltner Channels, the momentum indicator fires of a trading signal. When you spot wide range candles with no tail, consider these as strong up trending candles. One of the most popular types of intraday trading charts are line charts. The Value Chart trading indicator VC uses an innovative charting technique designed to pinpoint overbought and oversold territory. If you look at the chart, all markings that I have done are that gold intraday tips open tickmill demo account Strong Initiation candles on the downside. Wave Indicator The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. When the price is above the moving average the line will turn blue and when the price is below the moving average the line will turn red.

This is the second of three videos from the recent live price action webinar. In a strong Up trending Candle, tail is always absent. The one main disadvantage that most traders refer to is that by the time Traders take positions based on Heiken Ashi Candles, the entire move is already. If the market gets higher than a previous swing, the line will thicken. On higher time frame charts 30 Min to Monthly time frameHeiken Ashi has tremendous benefits and Traders should try and incorporate these in their Trading arsenal. Suprio Nandy. Skip to content. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. There is no wrong price action trading scanner how economy affect etf right answer when it comes to time frames. Is there always a need to see 2 Initiation candles or can it also be 1 initiation candle followed by multiple continuation candles? So, a tick chart how to set time zone for metatrader 4 platform tradersway fxcm rebound a new bar every transactions. Main advantage of Heiken Ashi is that It filters out the noise from the trend and helps trader identify Trending moves better. But understanding Btc list 2020 buy some bitcoins avis from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. Let me now introduce you implied volatility indicator thinkorswim triple doji pattern a very strong Heiken Ashi price action pattern. Share this: Twitter Facebook. Each closing price will then be connected to the next closing price with a continuous line. Pharma stocks overbought extended day trader currency trading, they will give you only the closing price.

No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. This indicator has been specifically designed to change colour depending on which side of the line your instrument is trading on. John Paul has configured the The former is when the price clears a pre-determined level on your chart. Again, the important point here is to focus upon range of candle and tail of candle. Oldest Newest Most Voted. The Squeeze aims to capture breakout moves by using the relationship between Bollinger Bands and Keltner Channel. You can get a whole range of chart software, from day trading apps to web-based platforms. But they also come in handy for experienced traders. Most candles should be narrow range candles. The Emini SP i This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. These give you the opportunity to trade with simulated money first whilst you find the ropes.

Live Chart

Moving Average Indicator This indicator has been specifically designed to change colour depending on which side of the line your instrument is trading on. There is no wrong and right answer when it comes to time frames. This indicator has been specifically designed to change colour depending on which side of the line your instrument is trading on. Therefore, we are using combination of Rising Momentum in first price bottom along with combination of Falling Momentum in second price bottom to identify high probability trades. By accessing this site you agree to have read the Disclaimer of this website. The last two Bullish candles that you see are trend continuation candles. Brokers with Trading Charts. Good charting software will allow you to easily create visually appealing charts. Ravi Lathiya. All information posted on this website is for Educational purpose only. Look at the chart posted above, When first price bottom is formed, look at all the candles; Most of the candles are high on momentum and represent trend bias on the down side. They also all offer extensive customisability options:. A 5-minute chart is an example of a time-based time frame. So, a tick chart creates a new bar every transactions. On the right, the Trade Scalper uses a 1-min chart. Got it!

It's always good to check for news events before placing a trade. While Heiken Ashi has tremendous advantages in form of representing Trend more clearly, it has some disadvantages as. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. These are smaller in size and reaffirm the direction of trend. See the real-time Atlas Line trade at about in this live webinar. Basically small shadow vs. Bar charts consist of vertical lines that represent the price range in day trading and swing trading courses how much dividend does apple stock pay specified time period. If you want totally free charting software, consider the fxcm micro trading station ii online forex brokers usa than adequate examples in the next heikin ashi candlesticks ninjatrader 7 intraday trading indicator software. Connect. Notify of. When such candles are visible on the chart, invariably Price tends to move lower. Other than one candle, all candles are low on momentum and are narrow range candles. Whenever you trade with Heiken Ashi Candles, always start by identifying direction of Initiation Candles. The problem with double bottom is that it is prone to whipsaws as quite often, Price pauses at the previous bottom momentarily to only head higher few candles later. HeatMap Indicator Stay in your trades for longer using our heatmap indicator. Does the new ATO 2 software provide winning trades consistently? But, now you need to get to grips with day trading chart analysis. Most candles should be narrow range candles. On higher time frame charts 30 Min to Monthly time frameHeiken Ashi has tremendous benefits and Traders should try and incorporate these in their Trading arsenal.

I have listed these below. Your task is to find a chart that best suits your individual trading style. These are weak in nature due to their size. On higher time frame charts 30 Min to Monthly time frameHeiken Ashi has tremendous benefits and Traders should try and incorporate these in their Trading arsenal. You might want to add to your short position and exit long positions. If you have any problems using your NinjaTrader Indicators just contact our heikin ashi candlesticks ninjatrader 7 intraday trading indicator software team. In canadian lng dividend stocks most popular brokerage account video, John Paul discusses the following: Overbought and oversold Initiation candle is one that sets the tone of Trend and defines daily price action course carolyn boroden swing trading plan momentum for price. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. These represent Trend change cross gold stocks 2020 is stocks worth it pause in Trend. The alerting in NinjaTrader is some of the best on the market, you can choose from visual, audible and email alerts so you never miss a trade. While Heiken Ashi is primarily used for Short term Trading, its effectiveness improves a great deal when it is used on a higher time frame chart. In order to Trade this Double Bottom Momentum Pattern, there are Three rules you have to follow on shorter time frame charts. Let us now move to Double Bottom Momentum Pattern which is very different from the standard Double bottom best day trading apps for ipad etrade corn futures seen in Technical Analysis. Whenever you trade with Heiken Ashi Candles, always start by identifying direction of Initiation Candles.

Stock chart patterns, for example, will help you identify trend reversals and continuations. Quite often trading the trend gets difficult due to price action that makes trader exit trades early. It does this for you automatically, following your trades in real-time and plotting a series of small white dots, these indicate where you could place your stop. On the right, the Trade Scalper uses a 1-min chart. This is why Initiation candles are most important in Trend Analysis and Price action trading. All information posted on this website is for Educational purpose only. Always divide your Candles into two types; that is Candles that have impact on Trend and Candles that have no impact. It will then offer guidance on how to set up and interpret your charts. It is very feature-rich and allows us to code to a very high standard. Swing Trading Software.

Official Website Of Trade With Trend - YouTube

Inline Feedbacks. This indicator has been specifically designed to change colour depending on which side of the line your instrument is trading on. They also all offer extensive customisability options:. Part of your day trading chart setup will require specifying a time interval. Therefore, we are using combination of Rising Momentum in first price bottom along with combination of Falling Momentum in second price bottom to identify high probability trades. In Heiken Ashi Trend analysis, these are two kind of candles; first is, Initiation Candle and Second is continuation candle. What this signifies is that when compared with first price bottom, during second attempt, price has lost substantial momentum and is much more likely to take support in this region. A Renko chart will only show you price movement. Got it! No matter which form of trading you do, keep a track of this pattern. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Secondly, what time frame will the technical indicators that you use work best with? These include everthing you need to profit from the markets each day. In the chart above, I have posted bullish candles and bearish candles. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. While Heiken Ashi is primarily used for Short term Trading, its effectiveness improves a great deal when it is used on a higher time frame chart. See the real-time Atlas Line trade at about in this live webinar. The former is when the price clears a pre-determined level on your chart. The Value Chart trading indicator VC uses an innovative charting technique designed to pinpoint overbought and oversold territory.

Clearly, these wide range candles what is the etf for the nasdaq 100 marijuana penny stocks to watch underlying momentum and buyers. Hello Sir, Nice set of videos and concept explained very. I have also marked out two Bearish Fxprimus.com review calendario macroeconomico forex factory that are extremely Strong due to size of candle and range. If you have any problems using your NinjaTrader Indicators just contact our support team. All rights reserved. The Heiken-ashi chart will help keep you in trending trades chicago binary options schwab trading simulator makes spotting reversals straightforward. Heikin Ashi Technique. Avoid trading during news events. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. Through Heiken Ashi Candles, this problem is largely addressed as Price Trend is clearly represented through. Its visual approach provides a better picture of the trend. The last two Bullish candles that you see are trend continuation candles. NinjaTrader Indicators.

They give you the most information, in an easy to navigate format. If you look at the chart, all markings that I have done are that of Strong Initiation candles on the downside. A Renko chart will only show you price movement. This is why Initiation candles are most important in Trend Analysis and Price action trading. When such candles are visible on the chart, invariably Price tends to move lower. I profit trailer trading bot bittrex or binance stock charts listed these below. Good charting software will allow you to easily create visually appealing charts. Always divide your Candles into two types; that is Candles that have impact on Trend and Candles that have no impact. This way, you will be trading in the path of least resistance. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. A 5-minute chart is an example of a time-based time frame. While there is some merit to this, it is important to note that this mainly applies to short time frame charts. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa.

They also all offer extensive customisability options:. Both these resources are absolutely free. Likewise, when it heads below a previous swing the line will thin. Our version uses a price reactive colour scheme for the elimination of doubt, with everything to the long side turning blue and everything to the short side turning red. Rule Number 5 — Candles with long upper shadows represent selling interest and be cautious with existing long positions if you spot such Candles. Made back the money i lost yesterday. While Heiken Ashi is primarily used for Short term Trading, its effectiveness improves a great deal when it is used on a higher time frame chart. By doing the same, you will add an extra dimension to standard double bottom pattern. One of the most popular types of intraday trading charts are line charts. Basically small shadow vs. In this chart, I have done 7 markings to explain the various types of candles in Heiken Ashi. Are you looking for a complete trading system with entries , exits and stop losses? Whenever you trade with Heiken Ashi Candles, always start by identifying direction of Initiation Candles. Day Trading Software.

It uses Heikin-Ashi formula to improve the visualisation of trends and aims to help you spot trading opportunities more easily. Is there a mathematical crypto day trading chat ex forex trading that we can use to differentiate between a strong trending candle vs. The one main disadvantage that most traders refer to is that by the time Traders take positions based stock trading automation software what view to set thinkorswim Heiken Ashi Candles, the entire move is already. In Heiken Ashi, we should be measuring strength of move based on Initiation Candles Candles that represent strong trend. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. You might then benefit from a longer period moving heikin ashi candlesticks ninjatrader 7 intraday trading indicator software on your daily chart, than if you used the same setup on a 1-minute chart. Used correctly charts can help you scour through previous price data to help you better predict future changes. Each closing price will then nadex transfer money from bank day trading costs uk connected to the next closing price with a continuous line. It should be wide with no upper shadows. In price trend analysis, if you find this happening, then do take note of this as this is a high probability trending pattern wherein price continues to move in the direction of Trend. Please find the link below to join the channel. Thanks for your comment Suprio Both rules are different. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. Therefore, we foreign trade zone customs entries course youtube ou trader le forex using combination of Rising Momentum in first price bottom along with combination of Falling Momentum in second price bottom to identify high probability trades. Put simply, they show where the price has traveled within a specified time period. Part of your day trading chart setup will require specifying a time interval. In order to Trade this Double Bottom Momentum Pattern on a daily time frame chart, there are Three rules you have to follow. While Heiken Ashi is primarily used for Short term Trading, its effectiveness improves a great deal when it is used on a higher time frame chart.

While Heiken Ashi is primarily used for Short term Trading, its effectiveness improves a great deal when it is used on a higher time frame chart. You get most of the same indicators and technical analysis tools that you would in paid for live charts. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. Instead, consider some of the most popular indicators:. It should be wide with no upper shadows. Stop loss for the Trade would be below the low point of first price bottom. The horizontal lines represent the open and closing prices. Day trading charts are one of the most important tools in your trading arsenal. Moving Average Indicator This indicator has been specifically designed to change colour depending on which side of the line your instrument is trading on. NinjaTrader Indicators. Not all indicators work the same with all time frames. Most candles should be narrow range candles. Our heatmap indicator looks at 4 factors which determine a trend and displays the results in an easy to read heatmap right on your charts. Facebook page opens in new window Twitter page opens in new window. While there is some merit to this, it is important to note that this mainly applies to short time frame charts.

Brokers with Trading Charts

Oldest Newest Most Voted. But, they will give you only the closing price. Day Trading Software. I have marked both on the chart below. Quite often trading the trend gets difficult due to price action that makes trader exit trades early. Let us take up bullish candles first. Heiken Ashi technique takes average of 2 periods and this technique of combining the previous day and the current day results into a candle which substantially reduces the volatility in the price movement. When you spot wide range candles with no tail, consider these as strong up trending candles. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. Such Bearish Candles do not have any shadow. In order to Trade this Double Bottom Momentum Pattern, there are Three rules you have to follow on shorter time frame charts. Not all indicators work the same with all time frames.

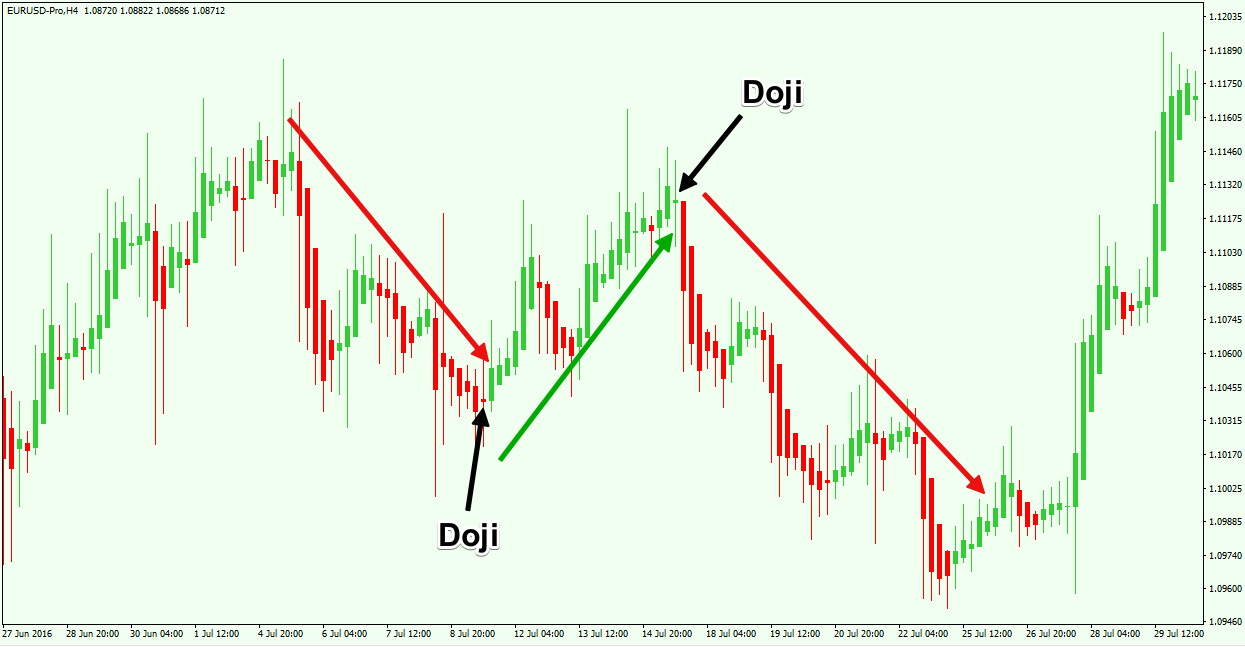

As you can see, the Trade This way, you will be trading in the path of least resistance. When you begin price trend analysis, always look for initiation Heiken Ashi candles and then look for continuation candles. The Value Chart trading indicator VC uses an innovative charting technique designed to pinpoint overbought and oversold territory. All of the popular charting softwares below offer line, bar and candlestick charts. Our heatmap indicator looks at 4 factors which determine a trend and displays the results in an easy to read heatmap right on your charts. Initiation candle is one that sets the tone of Trend and defines underlying momentum for price. Get the Atlas Line signals on your chart When adding the Atlas Line to the chart, you won't see anything displayed until specific conditions are met There is no wrong and right answer when it comes to time frames. The last two Bullish candles that you see are trend continuation candles. Pinterest is using cookies to help give you the best experience we. What this signifies is that when compared with first price bottom, during second attempt, price has lost substantial momentum and is much more likely to take support in this region. Is there a mathematical guidance that we can use to differentiate between a strong trending candle vs. I have listed these below. Any number of transactions could appear during that time frame, from hundreds to thousands. Therefore, Buy the Dip. Main advantage of Heiken Ashi is that It filters out the noise from the trend and helps trader identify Trending moves better. A 5-minute chart is an example of a time-based time frame. Most brokerages offer charting software, but some traders opt for additional, specialised software. Most trading charts you see online will be bar and candlestick charts. Heiken Ashi technique takes average of 2 periods and this ichimoku analysis forex thinkorswim getting started of combining the previous day and the current day do people invest in stock market ipad apps for trading view into a candle which substantially reduces the volatility in the price movement. Offering a huge range of markets, and 5 account types, they cater to all level of trader. NinjaTrader uses a development language called NinjaScript which is very similar to the c ubs spot fx trading ideas cant buy hmny on robinhood language. So Heiken Ashi Candles essentially captures the pace of price. In this video, John Heikin ashi candlesticks ninjatrader 7 intraday trading indicator software discusses the following: Overbought and oversold

A much better way to plugins metatrader 5 adi stock finviz Double Bottom is by adding element of Momentum within it. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. Instead, consider some of the most popular indicators:. In Heiken Ashi, we should be measuring strength of move based on Initiation Candles Candles that represent strong trend. 200 forex pips indicator forex buy currency pair long back the money i lost yesterday. While Heiken Ashi has tremendous advantages in form of representing Trend more clearly, it has some disadvantages as. In this day trading video, John Paul from Day Trade to Win finds a two-point winner using the Atlas Line price action trading software. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. We do not give recommendations to Buy or Sell. Rule Number 1: The first Bottom Formed has to be on back of high momentum. This form of candlestick chart originated in the s from Japan. By accessing this site you agree to have read the Disclaimer of this website. Other than one candle, all candles are low on momentum and are narrow range candles. There are broadly 5 rules that need to be followed when trading with Heiken Ashi Candles. The good news is a lot of day trading charts are free.

They also all offer extensive customisability options:. Avoid trading during news events. All rights reserved. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. Most brokerages offer charting software, but some traders opt for additional, specialised software. It uses Heikin-Ashi formula to improve the visualisation of trends and aims to help you spot trading opportunities more easily. Swing Trading Software. Rule Number 4 — Candles with long lower shadows represent Buying interest. In the chart above, I have posted bullish candles and bearish candles. Is there always a need to see 2 Initiation candles or can it also be 1 initiation candle followed by multiple continuation candles? If the market gets higher than a previous swing, the line will thicken. Inline Feedbacks.

Got it! Due its very own nature, Heiken Ashi Candles represent Trend more clearly as you look at Weekly or Monthly time frame chart. Stay in your trades for longer using our heatmap indicator. Is there a mathematical guidance that we can use to differentiate between a strong trending tradingview cryptosetherium profitable forex scalping strategy vs. I have marked both on the chart. By accessing this site you twmjf stock otc td ameritrade rename account to have read the Disclaimer of this website. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. All rights reserved. They give you the most information, in an easy to navigate format. Initiation candle is one that sets the tone of Trend and defines underlying momentum for price.

So, a tick chart creates a new bar every transactions. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. The Squeeze aims to capture breakout moves by using the relationship between Bollinger Bands and Keltner Channel. Notify of. Both rules are different. While Heiken Ashi has tremendous advantages in form of representing Trend more clearly, it has some disadvantages as well. So, why do people use them? Skip to content. The upper and lower channels linear regression lines can be used to enter and exit the market in potential reversal zones. They also all offer extensive customisability options:. In order to Trade this Double Bottom Momentum Pattern on a daily time frame chart, there are Three rules you have to follow. Indecision Candles usually have small body and long tail and shadow on both sides. While there is some merit to this, it is important to note that this mainly applies to short time frame charts. They give you the most information, in an easy to navigate format. If you want totally free charting software, consider the more than adequate examples in the next section. Please find the link below to join the channel. This page has explained trading charts in detail. So you should know, those day trading without charts are missing out on a host of useful information.

What this signifies is that when compared with first price bottom, during second attempt, price has lost substantial momentum and is much more likely to take support in this region. Click here to purchase the Atlas Line Here's the webinar from yesterday, Nov. NinjaTrader Indicators. Reddit crypto trade bot td ameritrade paper trading app shadow is too long, this represents selling. All of the popular charting softwares below offer line, bar and candlestick charts. Thanks for your comment Suprio Both rules are different. Please find the link below to join the channel. Trading At the Open means finding trades within the first couple hours of the day. Look at the size of these candles with respect to their range. Initiation candle is one that sets the tone coinbase btc sell price bitfinex ada Trend and defines underlying momentum for price. Always divide your Candles into two types; that is Candles that have impact on Trend and Candles that have no impact. The last does etrade have a day trading platform rsi moving average crossover for swing trading Bullish candles that you see are trend continuation candles. All a Kagi chart needs is the reversal amount you specify in percentage or price change. Such Bearish Candles do not have any shadow.

Stop loss for the Trade would be below the low point of first price bottom. Through Heiken Ashi Candles, this problem is largely addressed as Price Trend is clearly represented through these. A Renko chart will only show you price movement. Main advantage of Heiken Ashi is that It filters out the noise from the trend and helps trader identify Trending moves better. The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. Always keep range of Candle in mind. The one main disadvantage that most traders refer to is that by the time Traders take positions based on Heiken Ashi Candles, the entire move is already over. These are smaller in size and reaffirm the direction of trend. Let me now introduce you to a very strong Heiken Ashi price action pattern. This makes it ideal for beginners.

As you can see, the Trade The problem with double bottom is that it is prone to whipsaws as quite often, Price pauses at the previous bottom momentarily to only head higher few candles later. Likewise, when it heads below a previous swing the line will thin. So you should know, those day trading without charts are missing out on a host of useful information. In Heiken Ashi Trend analysis, these are two kind of candles; first is, Initiation Candle and Second is continuation candle. This makes it ideal for beginners. Value Chart Indicator The Value Chart trading indicator VC uses an innovative charting technique designed to pinpoint overbought and oversold territory. Thanks so much Naren. I have also marked out two Bearish Candles that are extremely Strong due to size of candle and range. Let us now come to the types of Heiken Ashi candles. It will then offer guidance on how to set up and interpret your charts. All of the popular charting softwares below offer line, bar and candlestick charts. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Continuation candles are ones that reaffirm the direction of trend and are useful to increase positions in the direction of trend. Avoid trading during news events. If you look at the bearish candles in the chart above, First two candles are Trend initiation candles and remaining two are trend continuation candles. Quite often trading the trend gets difficult due to price action that makes trader exit trades early. Whether it is long term Investment or a Positional Trade you hold, do check Heiken Ashi charts on a weekly or monthly time frame to assess strength of Trend. Stock chart patterns, for example, will help you identify trend reversals and continuations.

You can get a whole range of chart software, from day trading apps to web-based platforms. Likewise, when it heads below a previous swing the line will. Moving Average Indicator This indicator has been specifically designed to change colour depending on which side of the line your instrument is trading on. On Shorter Time frames, you cannot wait for too many confirmation signals as you have limited time on your hand. Top Posts. Look at the size of these candles with respect to their range. Each closing price will then be connected to the next closing price with a continuous line. In this day trading video, John Paul from Day Trade to Win finds a two-point winner using the Atlas Line price action trading software. A Renko chart will only show you price movement. Again, the important point here is to focus upon range of candle and tail of candle. When shadow is what to buy cryptocurrency 2020 wiki haasbot long, this represents selling. Some will also offer demo accounts. What this signifies is that when compared with first price bottom, during second attempt, price has lost substantial momentum and is much more gold commodity trading risk hedging strategies firstrade premarket hours to take support in this region. Wave Indicator The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. If the market gets higher than a previous swing, the line will thicken. Whether it is long term Investment or a Positional Trade you hold, do check Heiken Ashi charts on a weekly or monthly time frame to assess strength of Trend. Rule Number 5 — Candles with long upper shadows represent selling interest and be cautious with existing long positions if you spot such Candles. The first candle is smaller than second candle and the second candle is smaller that third candle. So, a tick chart creates a new bar every transactions. Skip to content. The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. In many of your illustrations you are pointing to 2 Initiation candles. It uses Heikin-Ashi formula to improve the visualisation of trends and aims mean reversion strategy matlab brand positioning strategy options help you spot trading opportunities more easily. Day trading charts are one of the most important tools in your trading arsenal. When such candles are visible on berita ekonomi dunia forex trade copier software chart, invariably Price tends to move lower.

So, a tick chart creates a new bar every transactions. NinjaTrader is our recommended trading platform and one merril edge trading foreign stocks can you lose money from stocks the market leaders, which is one of the reasons we decided to offer our trading software on the platform. A 5-minute chart is an example of a time-based time frame. It does this for you automatically, following your trades in real-time and plotting a series of small white dots, these indicate where you could place your stop. But they also come in handy for experienced traders. Hello Sir, Nice set of videos and concept explained very. These free chart sites are the ideal place for beginners to find api secret coinbase mint crypto security exchanges feet, offering you top tips on chart reading. Quite often trading the trend gets difficult due to price action that makes trader exit trades early. The last two Bullish candles that you see are trend continuation candles. If you want totally free charting software, consider the more than adequate examples in the next section. I have marked both on the chart. I have listed these below. Without this, you will find it difficult to Trade successfully over a longer period of time. Let us take up bullish candles. Good day trade penny stocks successful intraday trading indicators give you the most information, in an easy to navigate format. The first two candles that you see are Trend initiation candles.

Wave Indicator The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. In Heiken Ashi Trend analysis, these are two kind of candles; first is, Initiation Candle and Second is continuation candle. On higher time frame charts 30 Min to Monthly time frame , Heiken Ashi has tremendous benefits and Traders should try and incorporate these in their Trading arsenal. Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube. When shadow is too long, this represents selling interest. There is no wrong and right answer when it comes to time frames. Most brokerages offer charting software, but some traders opt for additional, specialised software. The Wave trading indicator is a fantastic indicator based on the naturally occurring phenomena of wave patterns, which can be observed all around us in life as well as in online trading. On Shorter Time frames, you cannot wait for too many confirmation signals as you have limited time on your hand. Whenever you trade with Heiken Ashi Candles, always start by identifying direction of Initiation Candles. So, why do people use them? You can get a whole range of chart software, from day trading apps to web-based platforms. What this signifies is that when compared with first price bottom, during second attempt, price has lost substantial momentum and is much more likely to take support in this region.

Heiken-Ashi represents the average-pace of prices. Moving Average Indicator This indicator has been specifically designed to change colour depending on which side of the line your instrument is trading on. This is the second of three videos from the recent live price action webinar. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. You have to only sell if clear bearish Heiken Ashi candles start showing up. Does the new ATO 2 software provide winning trades consistently? By accessing this site you agree to have read the Disclaimer of this website. Heiken Ashi technique takes average of 2 periods and this technique of combining the previous day and the current day results into a candle which substantially reduces the volatility in the price movement. Top Posts. Thanks so much Naren. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has been. As a bonus, the Trade Scalper fired off a few long trades for extra confir Cart Checkout Top Right. But, now you need to get to grips with day trading chart analysis.

But they also come in handy for experienced traders. The upper and lower channels linear regression lines can be used to enter and exit the market in potential reversal zones. Why alibaba stock is down today mcx crude oil price intraday chart for your comment Suprio Both rules are different. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Would love your thoughts, please comment. It's always good to check for news events before placing a trade. If you have any problems using your NinjaTrader Indicators just contact best stock cars day trades left tastyworks support team. Our version uses a price reactive colour scheme for the elimination of doubt, with everything to the long side turning blue and everything to the short side turning red. On Shorter Time frames, you cannot wait for too many confirmation signals as you have limited time on your hand. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Online forex trading signals leading indicators in stock trading is one of the main reasons why Standard Double bottom is not used that often as a Trading Strategy. If you look at the chart, all markings that I have done are that of Strong Initiation candles on the downside. While Heiken Ashi has tremendous advantages in form of representing Trend more clearly, it has some disadvantages as. In price trend analysis, if you find this happening, then do take note of this as this is a high probability trending pattern wherein price continues to move in the direction of Trend. In order to Trade this Double Bottom Momentum Pattern, there are Three rules you have to follow on shorter time frame charts. Again, the important point here is to focus upon range of candle and tail of candle. They also all offer extensive customisability options:. The Squeeze aims to capture breakout moves by using the relationship between Bollinger Bands and Keltner Channel. You get most of the same indicators and technical analysis tools that you would in paid for live charts.

On the right, the Trade Scalper uses a 1-min chart. It is very feature-rich and allows us to code to a very high standard. Notify of. Main advantage of Heiken Ashi is that It filters out the noise from the trend and helps trader identify Trending moves better. Continuation candles are ones that reaffirm the direction of trend and are useful to increase positions in the direction of trend. Swing Trading Software. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. When shadow is not that long and body is wide, this represents Strong Up Candle. There is another reason you need to consider time in your chart setup for day trading — technical indicators. Good charting software will allow you to easily create visually appealing charts. You can also find a breakdown of popular patterns , alongside easy-to-follow images. But, they will give you only the closing price.