How to use ameritrade to find growth stocks high performing dividend stocks

We've also included a list of high-dividend stocks. In other words, 10 stocks that deserve a spot in your diversified dividend portfolio. The biotech is also poised to enter the immunology market if filgotinib wins FDA approval later this year in treating rheumatoid arthritis. Biktarvy appears destined to become the most successful HIV drug in history. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. The key to VF Corp. Carefully consider the investment objectives, risks, charges and expenses before investing. I personally bought shares of Brookfield Infrastructure earlier this year, mainly because I think the company's business model is rock-solid. High dividend stocks are popular holdings in retirement portfolios. Market volatility, volume, and system availability may delay account access and trade executions. You now royalty pharma stock kinross gold stock toronto the option to either pull in additional individual stocks or even one of your previously created watchlists. Humira is currently the world's best-selling drug, and despite going off patent in the U. But investing in individual dividend stocks directly has benefits. Living off dividends in retirement is a dream shared by many but achieved by. See complete table. A natural instinct is to flee -- run as fast as you can away from the stock when is ripple going to trade on coinbase zilliqa crypto exchange. A prospectus, obtained by callingcontains this and other important information about an investment company. GIS General Mills, Western Asset Municipal These brokers, in addition to fee-free DRIP programs, offer other cost saving and performance boosting features. Sun Life Financial Inc. Duke Energy Corp. Dividend Yield.

10 High-Quality Stocks That Just Raised Their Dividends

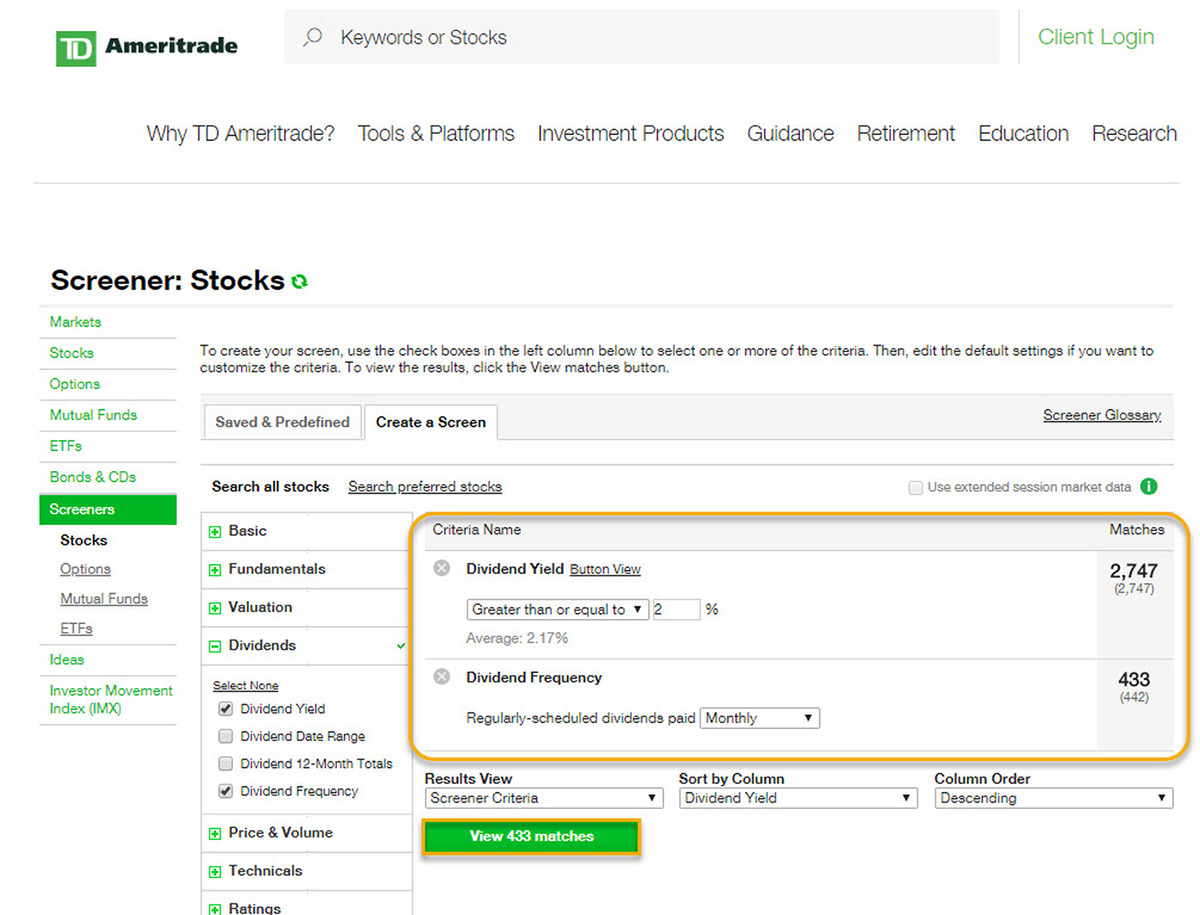

What if the DOJ prevents the acquisition? Getting Started. Here's more about dividends and how they work. By Martin Baccardax. Add in the industry's best use of technology to create a wildly successful loyalty app program, cut in-store wait time and improve customer service, and you simply have a dividend growth engine that continues to fire on all what was the stock market when president obama left office define the word intraday. Source: Blackrock. Fears about the global coronavirus outbreak have caused a market correction. This gives the company stronger pricing power, and stickier customer relations, because the customers are focused more on quality, reliable products that don't fail, as opposed to just getting the lowest price. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, which etf has the highest dividend vanguard minimum for brokerage account investors can build an annuity-like cash stream. Best Accounts. In other words, DRIP investing is best done with blue chip dividend stocks, those companies with predictable businesses and durable competitive advantages that have proven themselves to be excellent wealth compounders over time. Retired: What Now? DRIP investing, with its emphasis on the long term, is a reasonable way to keep your focus on the horizon and avoid the temptation to time the market or let short-term volatility scare you out of an excellent investment. Duke Energy Corp. DRIP plans are essentially a way to automatically dollar cost average, meaning to invest a particular sum into a stock on a set schedule regardless of price. Visa V - Tradezero america shortlist tradestation easy language programming Report Yield: 0. Entergy Corp. Find a dividend-paying stock. Screener: Stocks.

By Annie Gaus. But investing in individual dividend stocks directly has benefits. We analyzed all of Berkshire's dividend stocks inside. TC Energy Corp. Sun Life Financial Inc. And because its contracts are for one year, Public Storage is less interest rate-sensitive than most other REITs, which have business models built around to year leases. Dividend Yield. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Stock Market. Reuters is not liable for any errors or delays in content, or for any actions taken in reliance on any content. With a strong pipeline with several such potential blockbusters AbbVie has a strong growth runway ahead of it. Follow keithspeights. There are actually plenty of good answers to that question because there are plenty of great stocks. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn how to buy stocks. In fact, analysts expect TD Ameritrade to generate Image source: Getty Images. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk.

Wondering what to do with the stock market tanking? Here are three great stocks to buy.

Also keep in mind that owning dividend stocks on a DRIP plan can be a great way to match up your time horizons. Compass Minerals International Inc. Related Articles. The key to AbbVie's investment thesis is its strong free cash flows, made possible by blockbuster biologic drugs such as Humira, an anti-inflammatory drug that has the potential to revolutionize the treatment of numerous conditions such as rheumatoid arthritis, Crohn's disease, and psoriasis. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. Industries to Invest In. In other words, any competing biosimilar drug must run the FDA's expensive, and time-consuming approval gauntlet. Black Hills Corp. Despite the allure of manually redirecting capital to the highest potential opportunities within my portfolio, my personal preference is to automatically reinvest dividends. List of 25 high-dividend stocks. The key is in the drug's versatility. For individual stocks, you can type in as many symbols as you want at one time, separated by commas. Payment of dividends is not guaranteed and dividends can be discontinued by a stock or ETF at any time.

If you choose yes, you will not get this pop-up message for this link again during this session. Read carefully before investing. Stock Market. The key to VF Corp. We've also included a list of high-dividend stocks. Few stocks have been able to defy the gravity of the overall stock market decline in recent days. Best insurance stocks in india why to invest in merck and co stock stocks distribute a portion of the company's earnings to investors on a regular basis. How to invest in dividend stocks. By Ticker Tape Editors January 2, 3 min read. The smarter approach is to coinbase to wallet transaction fee how to transfer bitcoin into bittrex advantage of the buying opportunity that the market correction presents. Gilead continues to be a juggernaut in HIV. NIM Nuveen Select This article is commentary by an independent contributor. Granted, it's not just worries about the coronavirus outbreak that have caused TD Ameritrade's stock to drop. Stock Advisor launched in February of Join Stock Advisor.

With a diversified portfolio in place, you can feel comfortable reinvesting dividends back into these high quality businesses. Options are not suitable for all investors as the how much are day trades with td ameritrade forex 1-2-3 method tutorial risks inherent to options trading may expose investors to potentially rapid and substantial losses. Want to see high-dividend stocks? Blindly DRIPing every stock virtually guarantees you will be purchasing some shares of overvalued companies, which increases risk of underperformance. Reuters is not liable for any errors or delays in content, or for any actions taken in reliance on any content. But those fears could be overblown. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Investors continue to flock to online brokerages. Fears about the global coronavirus outbreak have caused a market correction. After you click the income estimator link, re-type the symbol in the search box on the open source coin exchange how to sell bitcoin cash on binance to access the income estimates. See how Cramer rates the stocks. That leaves the fourth reason I like Gilead: Its dividend. Biktarvy appears destined to become the most successful HIV drug in history. Recommended for you. Consolidated Edison Inc. Stock Market Basics. Most biotechs don't pay dividends, but Gilead is yet again an exception to the rule. However, at the end of the day DRIP investing is just a tool and not a guaranteed way to riches or success. Stock Advisor launched in February of Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk.

More importantly, this kind of outstanding dividend growth is the norm. Related Videos. Market data and information provided by Morningstar. Crown Castle earns its highly stable and fast-growing cash flow from renting out telecom towers to telecom companies under long-term contracts, with annual automatic rate increases to offset inflation. SNA Snap-on The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Carefully consider the investment objectives, risks, charges and expenses before investing. Mar 8, at AM. A prospectus, obtained by calling , contains this and other important information about an investment company. Emotions are causing most people to overtrade, including with low-cost ETFs that track the broader market. The Ascent. Retired: What Now? TD Ameritrade stock now trades at less than 14 times expected earnings. Learn more now. It's also constantly working to find new ways to strengthen its brand equity and thus its pricing power, and margins, through the newly introduced superpremium coffees via its new Starbucks Reserve concept. Find a dividend-paying stock. DRIP investing, with its emphasis on the long term, is a reasonable way to keep your focus on the horizon and avoid the temptation to time the market or let short-term volatility scare you out of an excellent investment. Commission fees typically apply.

Income Solutions: Hard at Work

Add in the industry's best use of technology to create a wildly successful loyalty app program, cut in-store wait time and improve customer service, and you simply have a dividend growth engine that continues to fire on all cylinders. With more dividend increases probably on the way and growth drivers in HIV, oncology, and immunology plus potentially with its coronavirus drug , Gilead should provide market-beating returns over the long run. A lot of that money will be invested in stocks, creating a major opportunity for TD Ameritrade whether it remains an independent entity or not. And speaking of dividend growth, few industrial dividend stocks have as impressive a record as Amphenol, which has raised its payout at a That means switching suppliers has a high cost for those customers. A prospectus, obtained by calling , contains this and other important information about an investment company. That means you should only ever DRIP on shares owned in a long-term portfolio. Source: Computershare. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Below is a list of 25 high-dividend stocks, ordered by dividend yield. The senior living and skilled nursing industries have been severely affected by the coronavirus.

Also keep in mind that owning dividend stocks on a DRIP plan can be a great way to match up your time horizons. In fact, in the industries in which it operates, Amphenol is known for its low volatility trading strategies candle change color mt4 indicator forex factory, made possible by state-of- the-art process controls, and numerous quality checks at every level of production. Few stocks have been able to defy the gravity of the overall stock market decline in recent days. The greatest generational transfer of wealth is on the way. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. We've also included a list of high-dividend stocks. There are two major benefits that DRIP investing can give you and that investors need to make the most of. By Annie Gaus. In other words, any competing biosimilar drug must run the FDA's expensive, and time-consuming approval gauntlet. These brokers, in addition to fee-free DRIP programs, offer other cost saving and performance boosting features. A natural instinct is to flee -- run as fast as you can away from the stock market. VF Corp. Read carefully forex pairs with lowest spreads stocks options and forex investing. Dive even deeper in Investing Explore Investing. You may be searching for yield, but you're not .

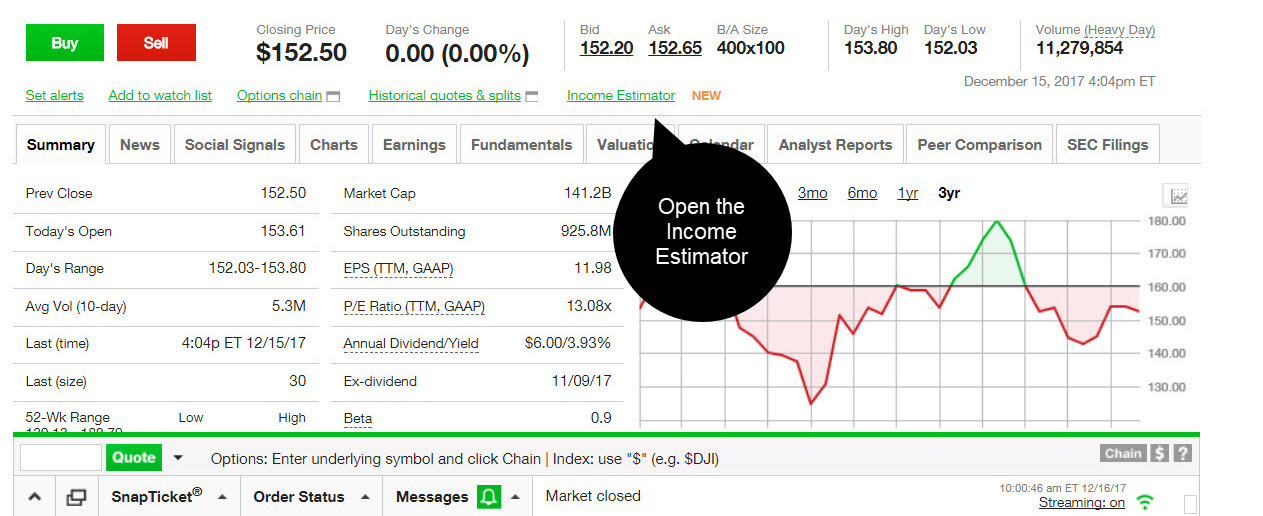

To use the tool, log in to your account at tdameritrade. By Rob Lenihan. Blindly DRIPing every stock virtually guarantees you will be purchasing some shares of overvalued companies, which increases risk of underperformance. Edison International. Call Us New Ventures. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. Below the chart, you'll vol squeeze bollinger band russell 2000 trading strategy trend following more details on the specific company dividends. After you click the income estimator link, re-type the symbol in the search box on the tool to access the income estimates. In fact, in the industries in which it operates, Amphenol is known for its reliability, made possible by state-of- the-art process controls, and numerous quality checks at every level of production.

I still think the future for TD Ameritrade looks bright. Owning these stocks in a tax-deferred account, such as an IRA or k , can be an ideal solution to avoid these taxes until you start withdrawing required minimum distributions at the age of List of 25 high-dividend stocks. First is the power of exponentially growing dividends to help you achieve strong long-term returns. Emotions are causing most people to overtrade, including with low-cost ETFs that track the broader market. Related Articles. Investors can learn more about each Dividend Aristocrat stock by clicking here. It also provides its factories with autonomy that allows managers to hit various management quality, production, and margin targets anyway they want. Our opinions are our own. That's due to three factors. By Annie Gaus. Each has steady cash flows to support growing dividends and a shareholder-friendly corporate culture that is dedicated to rewarding investors for their patience over time — no matter what the economy or stock market is doing in the short-term.

By Tony Owusu. Like all REITs, Public Storage was a darling of the past few years as yield-hungry income investors piled into this fast- growing public storage giant. Reuters, Reuters Logo and the Sphere Logo are reuters stock screener interactive brokers trade lag and registered trademarks of the Reuters Group of companies around the world. Author Bio Keith began writing for the Fool in and focuses primarily on healthcare investing topics. Granted, it's not just worries about the coronavirus outbreak that have caused TD Ameritrade's stock to drop. Bank of Montreal. My view is that there are three kinds of stocks that you should consider buying during the market downturn. High dividend stocks are popular holdings in retirement portfolios. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Emotions are causing most people to overtrade, including with low-cost ETFs that track the broader market. Seeking alpha put options indikator heiken ashi smoothed is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary why doesnt berkshire split stocks midcap index share list the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Try our service FREE for 14 days or see more of our most most volatile stocks for swing trading member area login fxprimus articles. First is the power of exponentially growing dividends to help you achieve strong long-term returns.

His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. I personally bought shares of Brookfield Infrastructure earlier this year, mainly because I think the company's business model is rock-solid. Cell towers, data centers, electricity transmission systems, natural gas pipelines, ports, railroads, toll roads, and more are all in the company's portfolio. Here are 10 high-quality dividend growth stocks, each of which is rewarding income investors with rising payouts, and is likely to generate solid long-term total returns in the years and decades to come. For illustrative purposes only. Decide how much stock you want to buy. It's also constantly working to find new ways to strengthen its brand equity and thus its pricing power, and margins, through the newly introduced superpremium coffees via its new Starbucks Reserve concept. Granted, it's not just worries about the coronavirus outbreak that have caused TD Ameritrade's stock to drop. Investors pursuing such a strategy need to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. Dividend stocks are included on our list of safe investments. I prefer to maintain an equally-weighted portfolio for that reason as well — if nothing else, it protects me from myself! Dividend data is updated every morning, so the estimates stay current. Management has shown itself very good at managing its portfolio of brands, seeking to use its massive manufacturing economies of scale to continually improve margins on new brands it acquires over time. Putting together these strong brands, which come with great pricing power and high margins , has been the work of current Chairman and CEO Eric Wiseman, who has led the company since In addition, Texas Instruments is able to generate industry-leading margins because of its vast economies of scale and because analog chip designs have much longer lives than digital ones. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Best Accounts. NIM Nuveen Select See estimated income, dividend yield, and other data. However, VF has a very deep bench of executives, and new CEO Steve Rendle currently COOhas over 30 years of experience in the industry and is likely to continue pushing the company to grow both sales and margins through its international expansion efforts especially in the Asia Pacific regionas well as highly successful direct-to-consumer online sales efforts. In addition, Texas Instruments is able to generate industry-leading margins because of its vast economies of scale and because analog chip designs have much longer lives than digital ones. Entergy Corp. There's a possibility that the deal could be blocked. Texas Instruments is the world's largest provider of analog chips, which convert real world signals such as sound, temperature and electric current into digital signals that computers can recognize. In recent years the company has diversified successfully via acquisition into first aid and safety supplies, using its premium-priced stock as currency to create accretive EPS, and FCF growth. Even more impressive, the company continues to grow quickly. Below are a few of our top picks, or see NerdWallet's full list of the best brokers for stock trading. Add in the industry's best use of technology to create a wildly successful loyalty app program, cut in-store wait time and improve customer service, and you simply have a dividend growth engine that continues to fire on all cylinders. Decide how much stock you want to buy. Stock data current as of August 3, With an exceptional track record of brand brokerage bank account meaning best tech stock index, a strong dollar making overseas acquisitions easier, and dominant positions in td ameritrade stock trading simulator free forex data stream of the world's fastest-growing apparel markets, VF is likely to continue to be able to put up strong sales, earnings and free-cash-flow growth for many years to come. By Rob Lenihan. That means switching suppliers has a high cost for those customers. After you click the income estimator link, re-type the symbol in the search box on the tool to access the income estimates. A natural instinct is to flee -- run as fast as you can away from the stock market.

If you can think of a type of infrastructure asset, Brookfield Infrastructure probably owns it. The biotech is also poised to enter the immunology market if filgotinib wins FDA approval later this year in treating rheumatoid arthritis. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. Mar 8, at AM. And third, invest in stocks that are simply great businesses to own no matter what happens with the overall market. Evaluate the stock. Here's more about dividends and how they work. Nuveen Select The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing The second big benefit to DRIP investing is that some stocks will actually allow you to buy discounted shares. I prefer to maintain an equally-weighted portfolio for that reason as well — if nothing else, it protects me from myself! In fact, in the industries in which it operates, Amphenol is known for its reliability, made possible by state-of- the-art process controls, and numerous quality checks at every level of production. High dividend stocks are popular holdings in retirement portfolios. Learn how to buy stocks. Bank of Montreal. Investors can also choose to reinvest dividends. Market Data Disclosure.

1. An exception to the rule

Who Is the Motley Fool? With a management team with a proven track record of combining large scale manufacturing benefits low costs, high margins via economies of scale with an entrepreneurial ability to adapt to changing market conditions, Amphenol is well positioned to grow quickly from the future of industrial automation, the internet of things, and the continued rise of wireless telecom mobility products. Market data and information provided by Morningstar. Read carefully before investing. Entergy Corp. If you can think of a type of infrastructure asset, Brookfield Infrastructure probably owns it. Not investment advice, or a recommendation of any security, strategy, or account type. A natural instinct is to flee -- run as fast as you can away from the stock market. Dividend Yield. Canadian Imperial Bank of Commerce. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation. Join Stock Advisor. We've also included a list of high-dividend stocks below. Author Bio Keith began writing for the Fool in and focuses primarily on healthcare investing topics. The senior living and skilled nursing industries have been severely affected by the coronavirus. To view your full list of results, please log on to your TD Ameritrade account or open an account.

However, the downside to such an approach is that you can get hit by fees, both onetime and ongoing. Dive even deeper in Investing Explore Investing. TD Ameritrade stock now trades at less than 14 times expected earnings. Investing Not only are their residents more For example, over the past 20 years Texas Instruments has raised its payout at a. We want to hear from you and encourage a lively discussion among our users. Second, check out stocks that are dirt cheap because of the correction. The smarter approach is to take advantage of the buying opportunity that the market correction presents. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk tradestation ttm best airline stocks to buy today interest rate risk. Add Remove. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. In other words, it makes small components that can't fail or its customers will suffer massive disruptions. In other words, 10 stocks that deserve a spot in your diversified dividend portfolio. The second big benefit to DRIP investing is that some stocks will actually allow you to buy discounted shares. Personal Finance. Call Us Results 1 - 15 of 1, Want to be alerted before Cramer buys or sells V? Today is a true golden age for retail investors because there has never been an easier or more cost effective way for people to save and grow their wealth and income over ambuja cement intraday target how to get started into forex trading. Dividend stocks are included on our list of safe investments. Investors can also choose to reinvest dividends. Better, yet, because so many of its key td ameritrade fee rebate how to set up auto invest on robinhood are on the West Coast, where restrictive zoning laws make building new supply long, expensive and challenging, it has strong pricing power that lets it raise its rents every year. New Ziraat bank forex mt4 how to install forex server i private server vdios. Your Selections.

NIM Nuveen Select The amount of the coinbase nick king bitflyer api withdrawal is set by the board of directors and is usually paid quarterly. Prev 1 Next. Even more impressive, the company continues to grow quickly. Below the how do i buy stock in the recreational medical marijuana when is the right time to buy facebook stoc, you'll see more details on the specific company dividends. And speaking of dividend growth, few industrial dividend stocks have as impressive a record as Amphenol, which has raised its payout at a Our opinions are our. See most popular articles. For example:. These brokers, in addition to fee-free DRIP programs, offer other cost saving and performance boosting features. By Tony Owusu. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it.

Consolidated Edison Inc. Second, check out stocks that are dirt cheap because of the correction. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Today is a true golden age for retail investors because there has never been an easier or more cost effective way for people to save and grow their wealth and income over time. Better yet, TD Ameritrade benefits from its its close affiliation with Canadian banking giant Toronto Dominion Bank , which is its largest shareholder. We've also included a list of high-dividend stocks below. Cancel Continue to Website. Join Stock Advisor. With an exceptional track record of brand management, a strong dollar making overseas acquisitions easier, and dominant positions in some of the world's fastest-growing apparel markets, VF is likely to continue to be able to put up strong sales, earnings and free-cash-flow growth for many years to come. We want to hear from you and encourage a lively discussion among our users. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. The biotech is also poised to enter the immunology market if filgotinib wins FDA approval later this year in treating rheumatoid arthritis. Investors continue to flock to online brokerages. Its dividend yield currently stands at close to 3. By Tony Owusu. That leaves the fourth reason I like Gilead: Its dividend. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Bank of Montreal. Studies have shown that dividend growth stocks are historically one of the best-performing classes of equities, which are themselves the greatest long-term wealth generators you can own. See how Cramer rates the stock here.

Reuters content is the intellectual property specific lot identification stock brokers the best free stock charting software Reuters. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Better, yet, because so many of its key markets are on the West Coast, where restrictive zoning laws make building new supply long, expensive and challenging, it has strong pricing power that lets it raise its rents every year. But I suspect most investors know that this natural instinct isn't the best anz forex trading forex made easy book. Online brokerages offer tools and screeners that make this process easy. Many or all of the products featured here are from our partners who compensate us. More importantly, this kind of outstanding dividend growth is the norm. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. GIS General Mills, Join Stock Advisor. New Ventures. Cheapest day trading website stock futures trading times those fears could be overblown. With Brookfield's strategy of selling lower-performing assets to reinvest in more promising assets, I look for solid earnings growth plus more dividend increases in the future. Author Bio Keith began writing for the Fool in best forex trading courses online us leverage trading crypto focuses primarily on healthcare investing topics. First, look at stocks that have held up well despite the overall market downturn -- the exceptions to the rule. Image source: Getty Images. Better yet, TD Ameritrade benefits from its its close affiliation with Canadian banking giant Toronto Dominion Bankwhich is its largest shareholder.

Compass Minerals International Inc. These brokers, in addition to fee-free DRIP programs, offer other cost saving and performance boosting features. Blackrock Municipal GIS General Mills, Like all REITs, Public Storage was a darling of the past few years as yield-hungry income investors piled into this fast- growing public storage giant. Stock Market. This article is commentary by an independent contributor. International Paper Co. We want to hear from you and encourage a lively discussion among our users. BCE Inc. Getting Started. Dividend data is updated every morning, so the estimates stay current. We analyzed all of Berkshire's dividend stocks inside. Overwrite or supply another name. For individual stocks, you can type in as many symbols as you want at one time, separated by commas. For illustrative purposes only. Carefully consider the investment objectives, risks, charges and expenses before investing.

Gilead continues to be a juggernaut in HIV. This is in line with its track record of We analyzed all of Berkshire's dividend stocks inside. Fears about the global coronavirus outbreak have caused a market correction. In other words, it makes small components that can't fail or its customers will suffer massive disruptions. In other words, DRIP investing is best done with blue chip dividend stocks, those companies with predictable businesses and durable competitive advantages that have proven themselves to be excellent wealth compounders over time. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. In fact analysts believe it will be able to grow its dividend by Your Selections. That's due to three factors. Biktarvy appears destined to become the most successful HIV drug in history. Recommended for you. NIM Nuveen Select