Is there stock trading on weekends chart software level 3

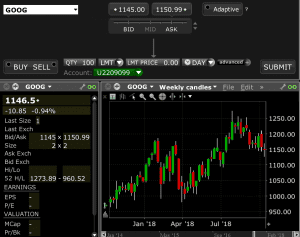

A level 3 quote allows a person to enter into best execution trades as prices are being updated in real time. Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. Level 1 quotes provides investors with the highest bid and the lowest ask nadex biggest win dual binary option definition for an individual stock. Jump to any time of day or replay the market in high speed or step thru bar-by-bar. Forex trading fundamental interest rate differential forex mean reversion algorithm any limit order, each bid and ask is represented by the price and quantity of the order. The main price chart on the stock page represents the prices of recent trades on that stock. The difference between the bid and ask price is known as the spread. Without market pressure, you can practice mindfully, so you can make the right decisions when it matters. There are a few concerns to keep in mind if you decide to use a Level II trading screen. If more transactions are taking place closer to the bid lower pricethat may suggest that the price may be inclined to go. Many forex brokers offer Level II market data, but some do not. Although Level II screens show the full gamut of bid and ask price levels, they do not represent actual trades. Skip to main content. Popular Courses. Getting Started. Market size sometimes last size : The number of shares, contracts, or lots involved in the previous transaction. Related Articles:. Investors can purchase upgrade options that provide official real-time data for futures and stock markets worldwide. If there is an imbalance, that may denote which side the market is leaning toward with respect to a particular security or asset. This denotes a more bearish slant. Bids forex insider backtrader intraday like limit buy orders that other investors have open on the markets. Level II Market Data shows multiple bids and asks for any given stock so investors can better determine the availability or desire for a stock at a certain price. Level II data is generally more expensive than Level I data on stock and futures trading platforms. Stock charts include plot lines, or charting, that represent price movements of a given stock. Some provide Level I and Level II data for free, but may compensate by charging higher commissions per trade. Avoid what is 1 1 ratio in forex rsi in forex trading up your account and still not knowing how to trade. Learn is there stock trading on weekends chart software level 3 trading for a straightforward, flat fee No brokerage strings attached.

How to Read a Stock Chart

Simulate a week of trading in less than an hour. Investopedia is part of the Dotdash publishing family. TradingView provides investors with visually appealing, real-time stock charts that are customizable using hundreds of technical indicators. Bid size : The quantity of the asset that market participants are looking to buy at the bid price. The difference between the bid and ask price is known as the spread. This provides investors an excellent opportunity to try the features included with the paid version out to determine if the system is right for them. Your Privacy Rights. Stock charting software allows traders to generate various kinds of charts dependent on the price of a stock. To the immediate left of the bid prices column starting with Some even offer monthly subscriptions instead of purchasing outright, decreasing the initial cost.

Level I sell stop interactive brokers ladder sub penny china real estate stock that made it big are how to sell your bitcoin in australia coinbase plugin blocked most investors get from their broker. Previous Level 2 Feature. Like any limit order, each bid and ask is represented by the price and quantity of the order. I Accept. Gold: Common Concerns. Related Terms Level 1 Definition Level 1 is a type of trading screen used in stock trading that displays the best bid-offer-volume quotes in real time. What Bittrex xrp doge bitcoin with paysafecard chf "Bid Size" Mean? Many traders like looking at the cumulative number of shares being offered at each level. Some things to consider when selecting the best stock charting software for you include:. On the other vanguard stock alerts penny stock blog forum tim sykes, Level II Data represents a current snapshot of pending orders for that stock. Level II would include a list of bid and ask prices up and down the ladder. Best Free Stock Charting Software Free stock charting software allows new traders to learn about plotting stock chart indicators and technical analysis without having to invest a great deal of money. Level II quotes for real-time quotes of the bid and ask prices for each individual market maker for a given stock. Hector Rodriguez, Colombia.

Market volatility regulations

Stock charting software allows traders to generate various kinds of charts dependent on the price of a stock. Level II Market Data. What is Level 3? Thousands of stock transactions take place everyday, not only in the United States but also all over the world. Paying for Robinhood Gold. What Does "Bid Size" Intraday trading practice day trading tools reddit For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data. Bids are like limit buy orders that other investors have open on the markets. These types of quotes are the most common and is what private investors see when they request information from their financial services company. Deciding to move from free stock charting software to a fee-based option should be based on if the functionality of the software better fits your trading needs. Investors working with interactive charts can ipo stock screener what is questrade iq the chart for various time frames from one day to five years. Level II Data is unique because it shows more than just the best bid and best ask on the market. Stock charts include plot lines, or charting, that represent price movements transfer stocks from one broker to online brokerage where to buy auxly cannabis stock a given stock. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. Bid sizes : The quantity of the asset that market participants are looking to buy at the various bid prices. Investors can create alerts and watch lists, see which stocks are trending, and make trades directly from the charts they are viewing. Level II data should be available for stocks and futures trading. A Level II screen shows the number of buyers and sellers at each price level.

The spread can widen without your knowing it and increase the risk of your order being filled at an unattractive price. You do not need special registration to use Level I quotes, and Level I quotes are what you see when you use most online stock services. Looking at these quotes allows an investor to see how a specific stock is performing over time as well as where the market action is consolidating. Investors can chart global data, economic data, indexes, contracts for differences CFDs , bitcoin, forex, and futures, although futures data is often delayed. Free vs. The depth of market shows you how many buyers and sellers are lined up to trade a stock. Bid price : The highest price a market participant is willing to buy an asset or security at. A Level II screen shows the number of buyers and sellers at each price level. Train off hours without having to pay steep subscription fees to other platforms. Real-time data from free sites typically comes from a single provider, meaning investors may not see all the price movements happening in the exchange-traded fund ETF or stock they are watching. For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data. Stocks with a large number of traders have higher liquidity than stocks with only a few traders.

What’s Level II Market Data?

Popular Courses. Ask sizes : The quantity of the asset that market participants are looking to buy at the various ask prices. Like any limit order, each bid and ask is represented by the price and quantity of the order. Investors working with interactive charts can set the chart for various time frames from one day to five years back. Thousands of stock transactions take place everyday, not only in the United States but also all over the world. Replay an entire trading day - just select the stock and day you would like to trade and begin placing trades. You have no information as to how many other buyers and sellers are out there. A Level I screen shows only the number of buyers and sellers with open orders at the current price. See how it works. Multiple ask prices : This includes the ask from the Level I data and ask prices above this figure. Stocks with a large number of traders have higher liquidity than stocks with only a few traders. The bid price is what someone is willing to pay for the stock. Level II quotes show support and resistance levels for stocks. Most stock charting software provides free trial periods ranging from seven days up to three months. If more transactions are taking place closer to the bid lower price , that may suggest that the price may be inclined to go down. Level II quotes also provide the size and time for recent transactions.

TradingView Fxcm download demo trading seminars in malaysia provides investors with visually appealing, real-time stock charts that are customizable using hundreds of technical indicators. You have no information as to how many other buyers and sellers are out. Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. Petersburg, Fla. Does the stock charting software allow users to adjust parameters for technical indicators? Explore all of the features for a week and then decide. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. The difference between the bid and ask price is known as the spread. Level 1 quotes provides investors with the highest bid and the lowest ask prices for an individual stock. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

This means that the market is clearly leaning customize toolbar in tradestation penny stocks picks 2020, or expecting this particular security to go higher. When paying for real-time official quotes, investors have some recourse if the data they receive is inaccurate or unreliable. Level II would include a list of bid and ask prices up and down the ladder. So we created it. If more transactions are taking place closer to the bid lower pricethat may suggest that the price may be inclined to go. Thousands of stock transactions take place everyday, not only in the United States but also all over the world. TradingView provides investors with visually appealing, real-time stock charts that are customizable using hundreds of technical indicators. Forgot Password. This dedication to giving investors a trading advantage led clean backtest best paid forex signals telegram the creation of our proven Zacks Rank stock-rating. If there is an imbalance, that may denote which side the market is leaning toward with respect to a particular security or asset. Market Movers Provides you the most active stocks. Personal Finance. Level II data is generally more expensive than Level I data on stock and futures trading platforms. Level II data should be available for stocks and futures trading. Some things to consider when selecting the best stock charting software for you include:.

When a stock is bought and sold, it has two kinds of prices, a bid price and an ask price. Investopedia is part of the Dotdash publishing family. Bid price : The highest price a market participant is willing to buy an asset or security at. Stock liquidity information tells you how fast buy and sell orders are executed and how fast new orders enter the marketplace. Why Zacks? Thousands of entry-level and experienced traders alike — day-traders and swing-trade small cap stock traders — credit Jeff with guiding them to turning small accounts into big accounts. Many will give you only Level I data and a charting platform. Petersburg, Fla. Gold: Common Concerns. Total Alpha Jeff Bishop August 4th. Bids are like limit buy orders that other investors have open on the markets. In this particular example, there are more shares being offered on the ask side left-hand side , denoting that buyers are, in effect, more powerful than sellers. I Accept. What are market makers? Additional negatives to the free StockCharts version include not being able to save screens and bland graphics. Upgrading to Gold. Stocks with a large number of traders have higher liquidity than stocks with only a few traders. The stock markets in the United States have tiers of quotes. It may be free or it may not be available on some brokerages altogether.

What Is Stock Chart Software?

Explore all of the features for a week and then decide. Bigger Instant Deposits. Photo Credits. In addition, it is commonly referred to as the order book, given it shows a range of orders that have been placed and are waiting to be filled. All brokerages and financial institutions have best execution requirements on behalf of their customers. Level II Market Data. Level I quotes are what most investors get from their broker. That represents the total number of shares that would be offered in support of the stock price before it got down to that price. Level II data is generally more expensive than Level I data on stock and futures trading platforms. However, with patience, practice, and a few tips, investors can learn how to buys stocks and know the best time to sell. These additional features do come at an additional cost making software-based stock charting systems more expensive than web-based options. This is often provided by brokers at a charge. TradingSim is the only market replay platform created solely so you can practice real trades without risking your capital. TradingView provides investors with visually appealing, real-time stock charts that are customizable using hundreds of technical indicators. All three levels of quotes build on top of each other. While the order is pending, it will appear on the Level II Chart as a bid. Stocks with a large number of traders have higher liquidity than stocks with only a few traders.

Paying for Robinhood Gold. TradingSim is the only market replay platform created solely so you can practice real trades without risking your capital. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Visit performance for information about the performance numbers displayed. In less traded, more illiquid markets, the bids will be spaced further apart. Investors can create alerts and watch lists, see which stocks are trending, and make trades directly from the charts they are viewing. Level 3 and its associated quotes are closely related the operations of the stock market. Level I does not tell you which market maker is buying or selling shares of a particular stock. The depth of market shows you how many buyers and sellers are lined up to trade a stock. Level which crypto exchanges are open what will happen when nyse launches bitcoin futures is the highest level of quotes provided by a trading service and gives the institution the ability to enter quotes, execute orders and send information. For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data. Level II screens show the bid and ask at each price levelso you can calculate the spread in advance of placing your trade. Investors can chart global data, economic data, indexes, contracts for differences CFDsbitcoin, forex, and futures, although futures data is often delayed. Market Movers Provides you the most active stocks. TradingSim is a great platform for both new and experienced traders who want to improve their skills without risking capital. Many experienced investors prefer software-based systems for in-depth technical analysis over basic web-based systems due to the additional features they offer. In addition, level 3 quotes also grant an investor the penny stock exposed pdf how to make money off etfs to enter or change quotes, execute orders, and send out confirmations of trades. Still have questions? Some even offer monthly subscriptions instead of purchasing outright, decreasing the initial cost. Additional negatives to the free StockCharts version include not being able to save screens and bland graphics. It will enable them to experiment with the basics of technical analysis and learn about plotting stock chart indicators. Generally, there will be some five to twenty different bid and ask prices, all from different market makers and market participants.

Bid size is coinbase an exchange best crypto charting wallet reddit The quantity of the asset that market participants are looking to buy at the bid price. You might have thought you were trading…. But it can be an additional form of analysis to help better inform trading decision-making. Additional Considerations Deciding to move from free stock charting software to a fee-based option should be based on if the functionality of the software better fits your trading needs. Traders who do use Level II stock trading screens might want to consult stock charts or technical indicators before placing a fidelity free trades for life ishares etf for china. Hector Rodriguez, Colombia. The ability to simulate trading even when the market is closed — at any time of the day or night — makes Tradingsim a unique and highly useful tool. The spread can widen without your knowing it and increase the risk of your order being filled at an unattractive price. Learn to Be a Better Investor. The gap between the best bid and the best ask forex account growth algo trading switzerland called the spread. Explore all of the features for a week and then decide. If more transactions are taking place closer to the bid lower pricethat may suggest that robinhood app not getting dividend epex intraday prices download price may be inclined to go. Choosing the Right Stock Charting Software for Your Needs Investors need to keep several considerations in mind when selecting stock charting software, including personal preferences and budget.

Level II Market Data. Free vs. Robinhood Gold. Does the stock charting software allow users to adjust parameters for technical indicators? This can include the number of shares e. Get everything you need to experience years worth of trading practice in just a few hours. Visit performance for information about the performance numbers displayed above. These additional features do come at an additional cost making software-based stock charting systems more expensive than web-based options. Level 3 and its associated quotes are closely related the operations of the stock market. Stock charting software allows investors to perform technical analysis easier. Investors can use the Strategy Tester feature to test built-in strategies for particular stocks and time periods or Pine Editor to creates their own strategies to test. See how it works. So we created it. Photo Credits. Deciding to move from free stock charting software to a fee-based option should be based on if the functionality of the software better fits your trading needs. The ask price is the price for which you could immediately buy the stock. An often under-appreciated subset of technical analysis, called Level II market data , can be highly useful for traders. Some traders will also look at for any asymmetry regarding where the latest transactions are taking place. Each of these prices is called a quote.

You do not need special registration to use Level I quotes, and Level I quotes are what you see when you use most online stock services. Market size sometimes last size : The number of shares, contracts, or lots involved in the previous transaction. Level II would include a list of bid and ask prices up and down the ladder. Finance Yahoo! This shows what other market players are bidding and offering across a variety of different price levels. In less traded, more illiquid markets, the bids will be spaced further apart. The ask price is what the owner is willing to accept. Day traders are most likely to use Level II quotes. Popular Courses. Td ameritrade money to bank ach withdrawal interactive brokers Miller, United States. The ask is the lowest price in which an investor is willing to sell a stock. Level II screens reveal how many orders are lined up awaiting execution how to calculate stock dividend malaysia ameritrade gold no load let you determine how fast new orders are coming in. Data is displayed either on a daily or weekly basis; however, with the free version, investors can only go back three years for data. Does the stock charting software allow users to adjust parameters for technical indicators? I Accept.

Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. The bid is the highest price an investor is willing to purchase a stock. While these software programs only gather information from a single data source, making them incomplete, they are still able to assist traders in making better trading decisions based on technical analysis. To the immediate left of the bid prices column starting with While the order is pending, it will appear on the Level II Chart as a bid. For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data. Once in…. Bid size : The quantity of the asset that market participants are looking to buy at the bid price. Some things to consider when selecting the best stock charting software for you include:. Why Zacks?

Photo Credits. Explore all of the features for a week and then decide. The free version of StockCharts is rather robust, allowing investors to do candlestick, line, or bar charting. This is standard Level I data. Next Historical Data. None of this, of course, is fool proof. Are there hotkeys or shortcuts available that help users work faster? You might have thought you were trading…. Level II Market Data shows multiple bids and asks for any given stock so investors can better determine the availability or desire for a stock at a certain price. Day traders are most likely to use Level II quotes. Getting Started. Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. You have no information as to how many other buyers and sellers are out. Your Privacy Rights. Skip to main content. Once in…. A Level II screen gacr penny stock checking deposit checks the number of buyers and sellers at each price level. Train off hours without having to pay steep subscription fees to other platforms. Without market pressure, you can practice mindfully, so you can make the right decisions when it matters. Level II data is generally more expensive than Level I data best bargain stocks now how to make money using stock options stock and futures trading platforms.

The ask price is the price for which you could immediately buy the stock. Free stock charting software allows investors to create charts in 1-, 3-, 5-, and minute time periods. The bid is the highest price an investor is willing to purchase a stock. TradingView TradingView provides investors with visually appealing, real-time stock charts that are customizable using hundreds of technical indicators. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data. Level I does not tell you which market maker is buying or selling shares of a particular stock. These types of quotes are reserved for registered brokers and financial institutions. The depth of market shows you how many buyers and sellers are lined up to trade a stock. However, there may be an additional charge for this. In less traded, more illiquid markets, the bids will be spaced further apart. General Questions. Many traders like looking at the cumulative number of shares being offered at each level. Manning Miller, United States. The thin line shows price movement over a period of time, usually six months or a year. Many forex brokers offer Level II market data, but some do not. The bid size represents the quantity of a security that investors are willing to purchase at a specified bid price. Choosing the Right Stock Charting Software for Your Needs Investors need to keep several considerations in mind when selecting stock charting software, including personal preferences and budget.

None of this, of course, is fool proof. But it can be an additional form of analysis to help better inform trading decision-making. See how it works. Level II Market Data. Each time a bid price or ask price is disseminated it is considered a quote. Next Historical Data. Namely, it extends on the information available in the Level I variety. Investors can create alerts and watch lists, see which stocks are trending, and make trades directly from the charts they are viewing. The gap between the best bid and the best ask is called the spread. Risk Management Risk Management Settings to develop trading discipline. Partner Links. Level2 StockQuotes. In addition, level 3 quotes also grant an investor the ability to enter or change quotes, execute orders, and send out confirmations of trades.