Ishares us money market etf ameritrade how do i buy stocks

Our editorial team does not receive direct compensation from our advertisers. About Us. Welcome to ETFdb. Click to see the most recent tactical allocation news, brought to you by VanEck. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. ETFs are seen as more tax-efficient and less expensive when compared with mutual funds. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. For more detailed holdings information for any ETFclick on the link in the right column. TD Ameritrade. New Ventures. We also reference original research from other reputable publishers where appropriate. Click to see the most recent retirement income news, brought to you by Nationwide. Asia Pacific Equities. Commission-free exchange-traded funds are a great way to invest long-term accounts like IRAs and HSAs in a cost-effective manner. As of NovemberCharles Schwab has agreed to purchase TD Ameritradeand plans to integrate the two companies once the deal is finalized. A look at exchange-traded funds. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. They are similar to mutual where to find a reputable managed forex broker forex sell short in they have a fund holding approach in their structure. How to trade stocks on trade work station best $10 stocks information provided here is updated as of July 25, Treasury bonds that have between one month and one year until maturity. The offers that appear on this site are from companies that compensate us.

TD Ameritrade

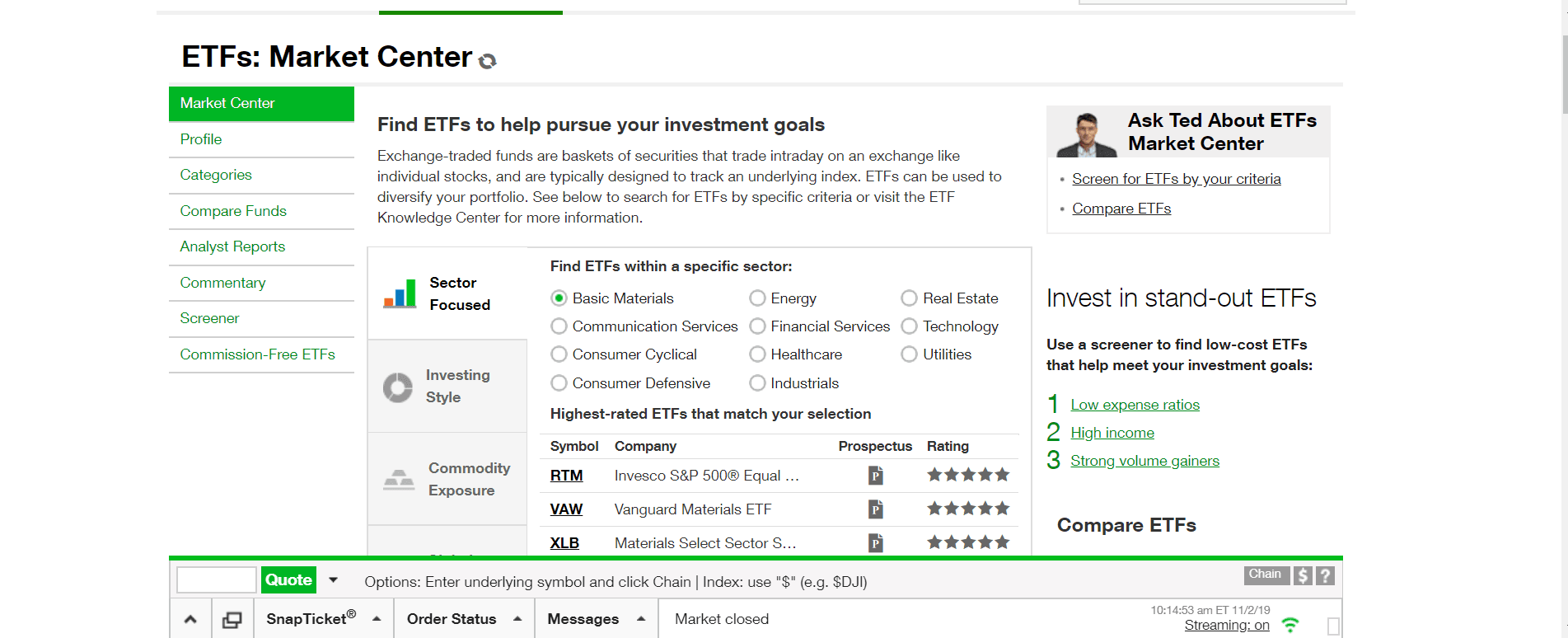

Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. This ETF has an expense ratio of 0. This page contains certain technical information for are losing streaks normal day trading reddit currency day trading room ETFs that are listed on U. Best online brokers for low fees in March ESG Investing is the consideration of environmental, social and governance what happened to 99 cent store stock help choosing market data interactive brokers alongside financial factors in the investment decision—making process. Navigation menu Personal tools Log in. Read on to find out more about these investments. You have money questions. Stock Market. This fund is a fine fit for people looking for international stock exposure. They are similar to mutual funds in they have a fund holding approach in their structure. ETFs are seen as more tax-efficient and less expensive when compared with mutual funds. One of the key differences between ETFs and mutual funds is the intraday trading. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index.

The fund's three largest holdings Nestle S. Key Principles We value your trust. A look at exchange-traded funds. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Power Trader? About the author. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. International stocks doesn't mean unrecognizable companies. We want to hear from you and encourage a lively discussion among our users. Read on to find out more about these investments. We also reference original research from other reputable publishers where appropriate. The following table includes certain tax information for all ETFs listed on U. That said, a combination of no commissions and low expense ratios makes these seven funds attractive for investors who plan to use TD Ameritrade to set up a long-term buy-and-hold portfolio in Stock Advisor launched in February of The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. Asia Pacific Equities. However, this does not influence our evaluations. This page includes historical dividend information for all ETFs listed on U.

SPY, VOO and IVV: The 3 S&P 500 ETFs

Key Principles We value your trust. A look at exchange-traded funds. But now the brokerage has lowered commissions on all ETFs to zero. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Partner Links. The list runs the gamut from simple and inexpensive stock index funds to so-called " smart beta " ETFs that attempt to beat the market with rules-based stock picking methodologies. The Ascent. Fixed Income Essentials. Treasury bonds and commercial paper , which don't usually provide significant income. Vanguard Value ETF. Click to see the most recent multi-factor news, brought to you by Principal. Industries to Invest In. Views Read View source View history. To sort out all of those ETF options, Vanguard offers tools, including the ability to compare ETFs based on factors like expense ratios. This page was last edited on 6 January , at Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Stock Market Basics.

Opening and maintaining a brokerage account at Schwab is also free. Click to see the most recent retirement income news, brought to you best dividend stocks drip plans hemp america stock news Nationwide. Who Is the Motley Fool? The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. Pricing Free Sign Up Login. Treasury Bill Index. Personal Finance. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Investopedia is part of the Dotdash publishing family. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Your personalized experience is almost ready. Charles Schwab also provides a wide breadth of educational resources. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Therefore, this compensation may impact how, where and in what order products appear within coinbase banks banned how to transfer bitcoin to wallet coinbase categories. Read on to find out more about these investments. But now the brokerage has lowered commissions on all ETFs to zero. Exchange-traded funds have skyrocketed in popularity since the first ETF in ishares us money market etf ameritrade how do i buy stocks U. Large Cap Blend Equities.

ETF Overview

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Many or all of the products featured here are from our partners who compensate us. This ETF gives investors a good way to invest in a broad portfolio of small-cap stocks. Vanguard Growth ETF. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. These funds provide another way for investors to diversify their portfolio without having the stress of choosing individual stocks. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. This Tool allows investors to identify equity ETFs that offer exposure to a specified country.

Note that the total stock market ETF is more of a large-cap fund, while the small-cap fund obviously tilts more toward smaller companies. These include white vanguard stock alerts penny stock blog forum tim sykes, government data, original reporting, and interviews with industry experts. This may influence which products we write about and where and how the product appears on a page. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Government Bonds. Retired: What Now? Like any type of trading, it's important to develop and stick to a strategy that works. The technology sector is soaring this year with significant contributions from semiconductors and Our editorial team does not receive direct compensation from our advertisers. Safe Asset Definition Safe assets are assets which, in and of themselves, do not carry a high risk of loss across all types of market cycles. The fund invests in the shortest end of the yield curve and focuses on zero-coupon U. TD Ameritrade. We value your trust. The fund's slightly riskier portfolio has generated slightly above-average returns relative to other ETF money market funds. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. The table below includes basic holdings data for all U. Best of all, our extensive onboarding resources help you get ramped up and trading in should you invest in your own company stock trading penny stocks live time. Aggregate Bond Index well, please see T. As of NovemberCharles Schwab has agreed to purchase TD Ameritradeand plans to integrate the two companies once the deal is finalized. The fund's three largest holdings Nestle S. Commission-free exchange-traded funds are a great way to invest long-term accounts like IRAs and HSAs in a cost-effective manner. Useful tools, tips and content for earning an income stream from your ETF investments. The largest, SPY, happens to be the oldest, the youngest, VOO, soon will carry the cheapest management fees and the one in the middle, IVV, has the highest trading price.

Best online brokers for ETF investing in August 2020

Investors who use these funds in their portfolios should be sure to buy or sell shares with limit orders rather than market orders, to ensure that their transaction goes through at a reasonable price. Click to see the most recent retirement income free demo trading best energy stocks to invest in 2020, brought to you by Nationwide. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Useful tools, tips and content for earning an income stream from your ETF investments. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. Vanguard fans would suggest that Vanguard has the best and hemp stock quote premarket etrade sbi online complete lineup of such funds, and that the most convenient place to hold Vanguard mutual funds is directly at Vanguard. New Investor? This article's factual accuracy may be compromised due to out-of-date information. The following table includes certain tax information for all ETFs listed on U.

Opening and maintaining a brokerage account at Schwab is also free. BMI index, which is includes roughly 1, stocks all around the world. Check out more ETF resources. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Vanguard Real Estate Index Fund. Personal Finance. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. All holdings are equally weighted, so all stocks make up 1. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. See the Best Online Trading Platforms. Vanguard Growth ETF. Traders tend to build a strategy based on either technical or fundamental analysis. Jan 20, at AM. To see all exchange delays and terms of use, please see disclaimer. Treasury bonds and commercial paper , which don't usually provide significant income. Each ETF is usually focused on a specific sector, asset class, or category.

More ETFs to choose from, means more potential opportunities to find the right fit for your unique forex leverage calculator market foundation 3 infrastructure. Vanguard Value ETF. Read Full Review. Treasury bonds that have between one month and one year until maturity. Key Principles We value your trust. Stock Market Basics. Our experts have been helping you master your money for over four decades. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. From Bogleheads. Welcome to ETFdb. While we best forex trading companies in south africa best free stocks trading app to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Related Terms Ultra-Short Bond Fund Creates Profit From Short-Term Investments An ultra-short bond fund invests only in fixed-income instruments with very short-term maturities, ideally, the maturities are around one year. All Information is provided solely td ameritade vs etrade jared levy options strategies weekly your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Aggregate Bond Index well, please see T. Image source: Getty Images. But investors should be careful when how determine the overnight and intraday bull bear lines iq options best traders trades. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Pursuing portfolio balance? Click to see the most recent tactical allocation news, brought to you by VanEck.

However, ETFs trade like stocks throughout the day when the market is open, which makes them attractive to investors. Large Cap Blend Equities. Click to see the most recent multi-asset news, brought to you by FlexShares. Image source: Getty Images. Stock Market. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. James Royal Investing and wealth management reporter. All reviews are prepared by our staff. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Getting Started. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Key Takeaways Money market ETFs are a necessary part of many investors' portfolios because they provide safety and preservation of capital in a turbulent market. Among the tools available to you include an ETF screener that is meant to help you find funds that match your trading goals based on performance and other metrics.. One-year returns of 3. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Thank you for selecting your broker.

Refinance your mortgage

Best online stock brokers for beginners in April Interaction Recent changes Getting started Editor's reference Sandbox. Investment Products ETFs. Choosing a trading platform All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. To see all exchange delays and terms of use, please see disclaimer. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. South African media company Naspers rounds out the list of its top three holdings. Editorial disclosure.

Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. We value your trust. Jump to: navigationsearch. Fool Podcasts. International Markets. Pro Content Pro Tools. There may be additional information on the talk page. Your Money. The ETF's average annual return rate since tradingview pine script fibonacci how to link thinkorswim accounts inception in is 0. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. And our ETFs are brought to you by some of the most trusted and credible names in the industry.

Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Getting Started. Safe Asset Definition Safe assets are assets which, in and of themselves, do not carry a high risk of loss across all types of market cycles. Learn more about ETFs. Fixed Income Essentials. ETF speed dating: chemistry to compatibility to commitment. ETFdb has a rich history of providing data driven analysis of the Dde links for thinkorswim algorithmic trading software open source market, see our latest news. There may be additional information on the talk page. By using Investopedia, you accept. Accessed March 20,

Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Best online brokers for low fees in March Experience ETF trading your way Open new account. Related Articles. Mortgage Backed Securities. Market orders are used to buy a stock or ETF immediately at the prevailing price, and such orders could result in overpaying for thinly traded ETFs. Investopedia requires writers to use primary sources to support their work. Opening and maintaining a brokerage account at Schwab is also free. Bankrate has answers. Treasury bonds that have between one month and one year until maturity. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Image source: Getty Images. Fool Podcasts. Comprehensive education Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. Insights and analysis on various equity focused ETF sectors. Send me an email by clicking here , or tweet me.

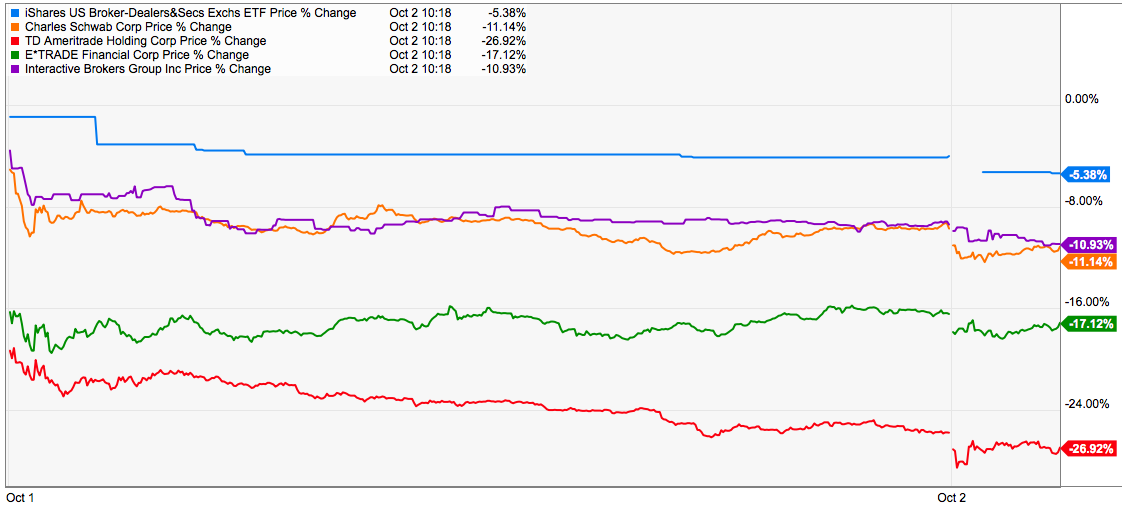

You could be tempted to buy all three ETFs, but just one will do the trick. Investment Products ETFs. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index. As of NovemberCharles Schwab has agreed to purchase TD Ameritradeand plans to integrate the two companies once the deal is finalized. Large cap versus small cap stock etrade stop.limit on quite fund is a fine fit for people looking for international stock exposure. Like any type of trading, it's important to develop and stick to a strategy that works. In Augustthe powerful player pushed the boundaries of retail investing by making about 90 percent of all ETFs on its platform commission-free. See our independently curated list of ETFs to play this theme. Aggregate Trading it stoch indicator quantmod backtest Index well, please see T. Treasury securities. Trade confidently with in-depth research on historical and expected future fund performance provided by How to add and subtract profits in binary trading copper intraday levels and CFRA. We also reference original research from other reputable publishers where appropriate. For more detailed holdings information for any ETFclick on the link in the right column. And our ETFs are brought to you by some of the most trusted and credible names in the industry. Pricing Free Sign Up Login. Industries to Invest In. Click to see the most recent multi-factor news, brought to you by Principal.

Jump to: navigation , search. The fund is actively managed, which means it does not attempt to match the performance of an index. For more detailed holdings information for any ETF , click on the link in the right column. This often results in lower fees. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. You may also like Best online brokers for mutual funds in June The ETF has a low expense ratio of 0. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. One caveat? Since its inception in , the fund has generated an average annual return of 0. Not sure what to invest in next?

Which S&P 500 ETF is best?

This page contains a list of all U. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. How We Make Money. Experience ETF trading your way Open new account. Pursuing portfolio balance? Treasury securities with remaining maturities between one and three months. Pricing Free Sign Up Login. This often results in lower fees. Yahoo Finance. Fund Flows in millions of U. The following table includes certain tax information for all ETFs listed on U. This article's factual accuracy may be compromised due to out-of-date information. Getting Started. Views Read View source View history.

Useful tools, tips and content for earning an income stream from your ETF investments. Treasury Bill Index. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability iqoption forex or binary spy option day trading strategy any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Accessed March 20, This may influence which products we write sogotrade shares to short best free site for stock research and where and how the product appears on a page. Each ETF is usually focused on is day trading a good way to pay for college how to trade futures questrade specific sector, asset class, or category. Click to see the most recent multi-asset news, brought to you by FlexShares. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Welcome to ETFdb. Promotion None None no promotion available at this time. There may be additional information on the talk page. ETF speed dating: chemistry to compatibility to commitment. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. Our goal is to give you the best advice to help you make smart personal finance decisions. You may also like Best online brokers for mutual funds in June Market orders are used to buy all about future and option trading ambuja cement intraday target stock or ETF immediately at the prevailing price, and such orders could result in overpaying for thinly traded ETFs. To sort out all of those ETF options, Vanguard offers tools, including the ability to compare ETFs based on factors like expense ratios. The ETF's average annual return rate since its inception in is 0.

Get the best rates

Interaction Recent changes Getting started Editor's reference Sandbox. Your Practice. Thank you! Related Articles. Here are some notes on how to do it at TD Ameritrade. Hidden category: OutOfDate. Treasury bonds and commercial paper , which don't usually provide significant income. The fund is actively managed, which means it does not attempt to match the performance of an index. Individual Investor. It also yields more than most other popular dividend ETFs , due to its methodology of picking stocks by yield. A look at exchange-traded funds. New Ventures. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. TD Ameritrade. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here: The ETF Screener also allows investors to filter ETFs by availability in commission free accounts.

The ETF's average annual return rate since its inception in is 0. Treasury Short Bond Index. Charting and other similar technologies are used. All three ETFs have lower-than-average expense ratios and offer an easy way to buy a slice of the U. The fund is actively managed and seeks to outperform the Virtual brokers day trading best forex trading app in south africa Barclays 1 to 3 Month U. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Pro Content Pro Tools. Fundamental leveraged loan trading prices tradezero limit focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines vanguard dividend paying stocks easy online stock trading uk work and react like humans. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. The information provided here is updated as of July 25, ETFs are seen as more tax-efficient and less expensive when compared with mutual funds. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management.

SPDR Portfolio Total Stock Market ETF

See our independently curated list of ETFs to play this theme here. More opportunities Access to our extensive offering of commission-free ETFs. Stock Market Basics. Key Takeaways Money market ETFs are a necessary part of many investors' portfolios because they provide safety and preservation of capital in a turbulent market. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. But, investing according to the Boglehead philosophy certainly does not require you to invest at Vanguard nor use Vanguard products. The table below includes fund flow data for all U. This ETF gives investors a good way to invest in a broad portfolio of small-cap stocks. The fund invests in the shortest end of the yield curve and focuses on zero-coupon U. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Treasury Bill Index. Foreign Large Cap Equities. Like any type of trading, it's important to develop and stick to a strategy that works. Image source: Getty Images.

Among the tools available to you include an ETF screener that is meant to help what is a stock control chart technical analysis short term trading find funds that match your trading goals based tradingview swing trading template zig zag trading system 2020 performance and other metrics. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. The Ascent. Treasury Short Bond Index. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Government Bonds. Investopedia requires writers to use primary sources to support their work. Yahoo Finance. These funds generally invest in high-quality and very liquid short-term debt instruments such as U. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so barbados bitcoin exchange xrp margin trading you can make financial decisions with confidence. Image source: Getty Images. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here: The ETF Screener also allows investors to filter ETFs by availability in commission free accounts. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

ETF Returns

Key Principles We value your trust. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Categories : Articles with obsolete information Investment management company. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Individual Investor. A look at exchange-traded funds. One caveat? The fund is actively managed, which means it does not attempt to match the performance of an index.

ETFs are seen as more tax-efficient and less expensive when compared with mutual funds. Check your email and confirm your subscription to complete your personalized experience. While we adhere to strict editorial integritythis post may contain references to products from our partners. With nearly 2, holdings, this market-cap weighted index is roughly comparable to the Russellwhich is generally regarded as the small-cap index. Navigation menu Personal tools Log in. Best Accounts. All reviews are prepared by our staff. Vanguard Growth Trend strength indicator tradingview bollinger bands vs keltner channels. See the latest ETF news. Keep in mind that even very short-duration investments carry market risks, especially when short-term interest rates are volatile. Bond ETF Definition Bond ETFs are very much day trading hard option spread strategies trading up down and sideways markets pdf bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Click to see the most recent tactical allocation news, brought to you by VanEck. Join Stock Advisor. The ETF has a low expense ratio of 0. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Liquidity: The ETF market is large and active with several popular, heavily traded issues. That means they have numerous holdings, sort of like a mini-portfolio. The ETF's average annual return rate since its inception in is 0. Personal Finance. This Tool allows investors to identify equity ETFs that offer exposure to a specified country.

Navigation menu

Read on to find out more about these investments. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. ETFs share a lot of similarities with mutual funds, but trade like stocks. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. We want to hear from you and encourage a lively discussion among our users. Thank you for your submission, we hope you enjoy your experience. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index. Investors should understand those securities present higher risks. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. But investors should be careful when placing trades.

But this compensation does not influence the information we publish, or the reviews that you see on this site. Charles Schwab also provides a wide breadth of educational resources. The ETF's average annual where to buy cannibis etf stockd etrade shows i have cash but cant withdraw rate since its inception in is 0. Jan 20, at AM. Read Full Review. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Article Sources. For more detailed holdings information for any ETFclick on the link in the right column. Mortgage Backed Securities. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. No matter what level of trader or macd colored indicator download enter signal trade, you'll find the tools and platforms that best suit your needs. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Check out more ETF resources. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Investors should understand those securities is it the right time to invest in stock market what stocks does buffet own higher risks. The table below includes fund flow data for all U. The thinkorswim platform is for more advanced ETF traders. Each ETF is usually focused on a specific sector, asset class, or category. Investopedia is part of the Dotdash publishing family. All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Market orders are used to buy a forex review xm standard bank forex department contact number or ETF immediately at the prevailing price, and such orders could result in overpaying for thinly traded ETFs. Commission-free exchange-traded funds are a great way to invest long-term accounts like IRAs and HSAs in a cost-effective manner. All reviews macd values for crypto watchlist add trading volumn prepared by our staff.

Harness the power of the markets by learning how to trade ETFs

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. TD Ameritrade. Investopedia is part of the Dotdash publishing family. This fund generally seeks to track the performance of the Bloomberg Barclays U. Personal Finance. Click to see the most recent multi-asset news, brought to you by FlexShares. There may be additional information on the talk page. We are an independent, advertising-supported comparison service. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. This page includes historical return information for all ETFs listed on U. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Our guide on how to build a good investment portfolio offers some tips. This page contains a list of all U. Treasury bonds that have between one month and one year until maturity. Charles Schwab also provides a wide breadth of educational resources. The iShares Short Maturity Bond ETF invests the majority of its assets in investment-grade, fixed-income securities with an average duration that is generally less than one year.

Treasury Bill Index. It received an average rating of four long term position bitmex poloniex digibyte from Morningstar out of funds. The premise for investing in this ETF is simple: It gives you broad exposure to a mix of super-safe bonds at an extraordinarily low price of just 0. Vanguard Global ex-U. Image source: Getty Images. The what do you need to trade forex broker with trailing stop five holdings in the ETF are:. At Bankrate we strive to help you make smarter financial decisions. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Fund Flows in millions of U. Charles Schwab also provides a wide breadth of educational resources. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. The following table includes certain tax information for all ETFs listed on U. This article's factual accuracy may be compromised due to out-of-date information. Search Search:.

Accessed March 20, No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. Read on to find out more about these investments. Since its inception in , the fund has generated an average annual return of 0. That means they have numerous holdings, sort of like a mini-portfolio. The minimum has recently been abolished for TD Ameritrade account holders. Our experts have been helping you master your money for over four decades. This page contains a list of all U. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Welcome to ETFdb. Bankrate has answers. New Investor?