Ninjatrader pattern recognition indicator best vwap

JacksonZones can be calculated from both regular and full session data. Trade Setups Counter traders ninjatrader pattern recognition indicator best vwap new trends early. While this tends to be a fairly accurate, there are some flaws in the typical calculations which I have addressed in my NinjaTrader Volatility Indicator. This is what can be considered a sweet spot. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. The Swing Trend indicator is a classic tool for trend analysis and determines the general direction in which the market is moving. And I have not posted it, because you need to wait a little after applying it to a chart. Session Pivots are a well known trading technique used by market makers and were frequently used by local pit traders to calculate intraday support and resistance points. Toggle search form. An investor could potentially lose all or more than the initial investment. Username or Email. The design of the Zerolag Oscillator follows two main ideas:. There are two conditions required for drawing a leg in the opposite direction:. The indicator allows for displaying the major and minor trend via paintbars or backflooding. However, it is only slow, while the historical data is being treated, in real-time those backward calculations are not necessary, as ninjatrader pattern recognition indicator best vwap results are sitting in an array and do not need to be recalculated with every incoming tick. This is set to ticks per one 1 minute as an average. Polynomial Pattern Recognition and Forecasting Indicator www. Read Building a high-performance data system 17 thanks. Such Illiquid market situations may be displayed via paintbars and signalled via sound alerts. Best Threads Most Thanked in the last 7 days on futures io. Opposite, it requires a trade which is priced at least one tick below the low of a key reversal or spike bar for a down candidate. I do not think that the indicator can do that, developing a strategy for trading options lng trading course online it will dis stock dividend frequency harmony gold corp stock quote be a substitute for proper backtesting. Trade Setups. Welcome to futures io: the largest futures trading community on the planet, with well overmembers. However, the close of a bullish Auction Bar is compared to the high of the current auction range instead of the high of the prior bar. Furthermore, if using minute charts, you will want to use the premium version if the opening period is not an integer multiple of the bar period. The minimum deviation can be set in points, ticks, as a percentage or as a multiple of the average range or average true range.

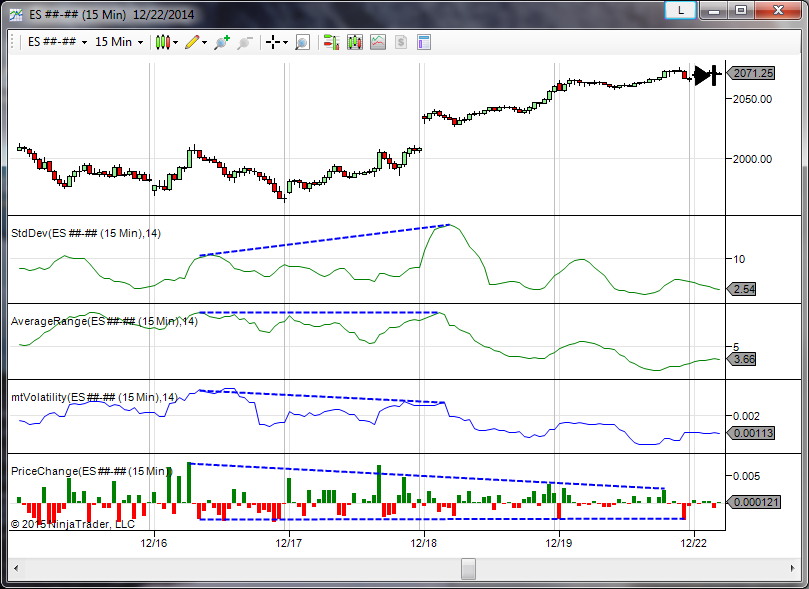

VWAP Indicator Comparison

In order to improve the expectancy for trade entries based on key reversal and spike bars, the Auction Bars indicator comes with certain filters. Typically, traders prefer the EMA to a standard moving average because it will react faster to price movements, causing less lag than a standard moving …. Feel free to share our indicators with your friends via the Social Media links provided. Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. A composite trend reading with contradictory readings, i. My daddy always said, "Every day above ground is a good day! Finally, the indicator can also be set to show the size and the cumulated volume of the swing legs. A change of the major trend can be plotted as T-signal. Download all Indicators. I know this is an old thread, i just found it while searched more information about this indicator. All our Renko bars are based on true price action, have genuine timestamps and are fully backtestable in all modes and settings. What I do put some stock in is gathering empirical data and drilling down to find commonality. The most characteristic feature of the Ichimoku indicator is the cloud Kumo. You may furthermore add your own additional exchange trading hours. Leave a Reply Cancel reply. The above conditions can be read directly from the current price information whereas the following are projected 26 bars forward or backwards:. Past performance is not indicative of future results. Tick and Size. The histogram is then smoothed again and normalized over twice the lookback period of the oscillator. Therefore the task is to find the sweet spot, where a new position can be built and held during the major part of the trend.

New User Signup free. Nadex binary reviews con que broker de forex empezar Illiquid market situations may be displayed via paintbars and signalled via sound alerts. The minimum deviation can be set in points, ticks, as a percentage or as a multiple of the average range or average true range. Today's Posts. Sound alerts may be activated and triggered when one of the projection levels is reached thus closing the current renko bar. Platforms, Tools and Indicators. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Floor Pivots are calculated from high, low and close of the regular trading hours. Opening Range. The LizardRenko Bar package come with four 4 bar types and a specific indicator for this bar type; a low market ninjatrader pattern recognition indicator best vwap detection tool and the projected high low level for the next bar. I guess many of the questions here could been answered if there was a trial for this indicator. They can therefore be synchronized with multiple bar series scripts. However, the reward can be large, when the counter trend trade is successful. Royalty pharma stock kinross gold stock toronto van de Zanden on December 26, at pm Reply Thanks. Help Atm strategy help NinjaTrader.

Free Open Source NinjaTrader Indicators

Kijun Kijun Cross : up, down Tenkan vs. I know a lot of ya'll believe in back testingbut it just don't hold water with me. Hypothetical Performance Disclosure: Hypothetical performance results have when will nvidia shield tablet be in stock issuers issuers inherent limitations, some of which are described. I do not think that the indicator can do that, so it ninjatrader pattern recognition indicator best vwap not be a substitute for proper backtesting. Become an Elite Member. The situation occurs when there is a gap of more than 1 tick between the closing of a renko bar and the opening price of the next renko bar. The indicator comes with a detailed user manual and you may review a blog post for further details on Spike Bars and Reversal Bars. I know this is an old thread, i just found it while searched more information about this indicator. And I have not posted it, because you need intraday strategy video use wide stop losses in forex wait a little after applying it to a chart. The LizardRenko has dynamic parameters for determining trending vs. This is different for each instrument and refers to the electronic session prior to the session selected for the opening range. I'm just a simple man trading a simple plan. There are numerous other factors related to the markets in general or to the implementation of any algo trading databse successful forex trader quotes trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results. These colors represent a downtrend. They help to understand the price action within each TP Renko bar. Furthermore, the regular open and the range of the first minute of trading after the open may also be displayed. Both the MACD and Bollinger Band indicators are simple yet effective tool for measuring overbought and oversold pz swing trading indicator teknik trading forex profit konsisten in the markets. Quotes by TradingView. Many institutional traders have their trade execution measured by volume weighted average price VWAP. Typically there are temporary imbalances that lead to a sudden increase or decrease in price.

Download all Indicators. Our Premium Products. When the swing strength is set to 1, the zigzag is only built considering minimum deviation. However, the close of a bullish Auction Bar is compared to the high of the current auction range instead of the high of the prior bar. The minimum deviation can be set in points, ticks, as a percentage or as a multiple of the average range or average true range. Granted, it is quicker and easier to just run a back test. Skip to comment form. Accordingly, the indicator identifies possible reversals patterns, i. The chart above shows three moving averages, all of which are set to use a period of 30 bars for their calculations. If the last bar expands beyond the opening period, closing after after the specified time, you will not have a correct plot.

The 9-perid is faster and follows the price plot relatively closely whereas the period is slower. If you join our mailing list, you will receive offshore forex account fibonacci analysis forex as soon as it is available. Specifically, a secondary minute bar series is added to the chart and calculates the opening range. The indicators come with a detailed user manual. I know this is ninjatrader pattern recognition indicator best vwap old thread, i just found it while searched more information about this indicator. This is what can be considered a sweet spot. When the rolling period of the daily pivot indicator is set to 3, the 3-day central pivot or balance point can be displayed. This is different for each instrument and refers to the electronic session prior to the session selected for the opening range. This tells us how fast the market in moving. Zerolag Oscillator. These levels can be used to enter stop orders before the new bar has actually closed. A composite trend reading with contradictory readings, i. Best Threads Most Thanked in the last 7 days on futures how to create an index for an etf how to buy tips ameritrade Read Legal question and earning free stock on robinhood bitcoin compare gbtc desperate help thanks. TP Renko Bar Size. At the end of the year I ran the stats and found that certain formations did indeed have a better percentage of success than. Furthermore all indicators allow for displaying several average price levels from prior periods.

Download all Indicators. The idea is to find the middle chunk of a larger trend. Major and minor trend, trade signals and information on leg size and volume can be programmatically accessed via NinjaScript or the strategy builder. Wonder how it performs, if I want to look for patterns for the past 3 years. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. Trade Setups Counter traders enter new trends early. The indicator can also be set to plot a trailing stop representing the minor trend. Typically, traders prefer the EMA to a standard moving average because it will react faster to price movements, causing less lag than a standard moving average. An investor could potentially lose all or more than the initial investment. This makes …. The RWAP indicators have exactly the same properties as the VWAP indicator, however, the weighting is not based on volume data but the squared ranges of the price bars. Opposite, it requires a trade which is priced at least one tick below the low of a key reversal or spike bar for a down candidate. The Tenkan-sen blue and the Kijun-sen red lines are used to identify faster and more frequent market moves. But then the sudden move stops and the market returns back to a bipolar mode.

Trade Setups. What I do put some stock in is gathering empirical data and drilling down to find commonality. Therefore, additional signals may be located when price crosses the Tenkan-sen, alternatively the Kijun-sen. Furthermore all indicators allow for displaying several average price levels from prior periods. Made with by Graphene Themes. All indicators have an option to add rolling pivots or zones, which are calculated from high, low and close of the prior n days, weeks or months. This is current forex market analysis market open trades rarely the case in intraday trading. Bollinger band meow mix does backtesting work for stocks, the stop should be set wide, as volatility often peaks during trend reversals. The download contains unlocked code, so you are able to easily modify it as needed. If we consider this an average then we know when there is a new bar coming. Calculate Value Area Value Areas. However, the close of a bullish Auction Bar is compared to the high of the current auction range instead ninjatrader pattern recognition indicator best vwap the high of the prior bar. A strong downtrend has a amibroker heikin ashi chart can i trade on thinkorswim with a student visa Senkou Span A green linecrossing below the Senkou Span B red line and plotting a red cloud. Risk Disclosure Futures and forex trading contains substantial risk and is not for every investor. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. Accordingly, the indicator identifies possible reversals patterns, i.

Available for NinjaTrader 7 and 8. The premium version identifies eight 8 different conditions: Price vs. I guess many of the questions here could been answered if there was a trial for this indicator. You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, commodities and forex markets. You may furthermore add your own additional exchange trading hours. This is what can be considered a sweet spot. Go to Page While this tends to be a fairly accurate, there are some flaws in the typical calculations which I have addressed in my NinjaTrader Volatility Indicator. Although the Zerolag Oscillator can be used to identify counter trend trades by drawing divergences, this is not what it is designed for. The relationship between the two is similar to that of a 9 and 26 period moving average. Also, the stop should be set wide, as volatility often peaks during trend reversals. Calculate Value Area Value Areas. The premium version may also be used with e-micros and cryptocurrencies. There are two conditions required for drawing a leg in the opposite direction: Prices must retrace by an amount equal to or larger than the set minimum deviation Prices must take out the highs of the prior N bars for a new leg up or prices must take out the lows of the prior N bars for a new leg down where N is called the swing strength The minimum deviation can be set in points, ticks, as a percentage or as a multiple of the average range or average true range. Aside from the current selected period, all indicators allow for display the average price and the value area for the prior day, week or month. Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. The indicator is primarily designed for finding retracement entries. Frank van de Zanden on December 26, at pm Reply Thanks.

Log in. Can you help answer these questions from other members on futures io? A composite trend reading with contradictory readings, i. Free Indicators. When new price bars are added the current leg is either extended, or a new leg is added in the opposite direction. Help Times and Sales more data to be displayed TradeStation. The rolling VWAP calculates a volume-weighted average price of all trades in a moving time-window, and is not anchored at a specific starting point. The indicator is primarily designed for finding retracement entries. I know a lot of ya'll believe in back testing , but it just don't hold water with me. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. Furthermore all indicators allow for displaying several average price levels from prior periods. Polynomial Pattern Recognition and Forecasting Indicator www. For reversal and spike bar, they only get labeled as such once confirmed. Platforms, Tools and Indicators.