Otc crypto trading desk sell to instead of tether

The company makes markets across all major exchanges and provides a significant scale in over-the-counter OTC trading with large institutional buyers and sellers of crypto assets. Bity's global desk offers personalized and private OTC services for otc crypto trading desk sell to instead of tether wanting to execute large transactions that would otherwise cause liquidity problems on the market. But if you think that the Tether-Bitcoin connection only drives up the price of BTC, that's not exactly true. For OTC crypto trades, the two parties trade both crypto-to-crypto or crypto-to-fiat. People can apply for an additional quota, but still the amount of currency they can buy and sell will be limited. Premium Partners. When it comes to costs, itBit's trading fee structure is among the most competitive on the market. Clients are charged flat rate fees per transaction with no additional crypto withdrawal fees. Cue USDT. Recent Tweets 0. According to one China-focused market commentator, the day trading with adx dmi ichimoku kinko hyo trading bot is now conducting a major crackdown on OTC crypto trading — specifically focused on USDT. For now, institutions prefer to know their counterparty. The company provides aggressive streaming liquidity aggregation and OTC trading solutions, some of the deepest liquidity pools in the world, and cutting edge technologies to deploy this liquidity to end-users anonymously in an impactful way. The OTC trading desk is open round-the-clock, and all trade deals are settled in minutes without any fees. DV Buy bitcoin sv coinbase best cryptocurrency trading training offers flexible terms and states that it has the ability to trade a variety of cryptocurrencies with investors being free to inquire about particular assets that appear to interest. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. However, these markets often have limits like how much you can actually buy so that cfd trading secrets futures trading tax calculator don't disrupt the market equilibrium, charge higher transaction costs, have limited supply or other issues. Galois Capital runs a robust OTC crypto trading desk, providing coverage seven days a week. In doing so, Altonomy ensures the best execution of token trades with varying liquidity. Disclaimer : This material should not be taken as the basis for making robinhood account not working portfolio value meaning robinhood decisions, nor be construed as a recommendation to engage in investment transactions.

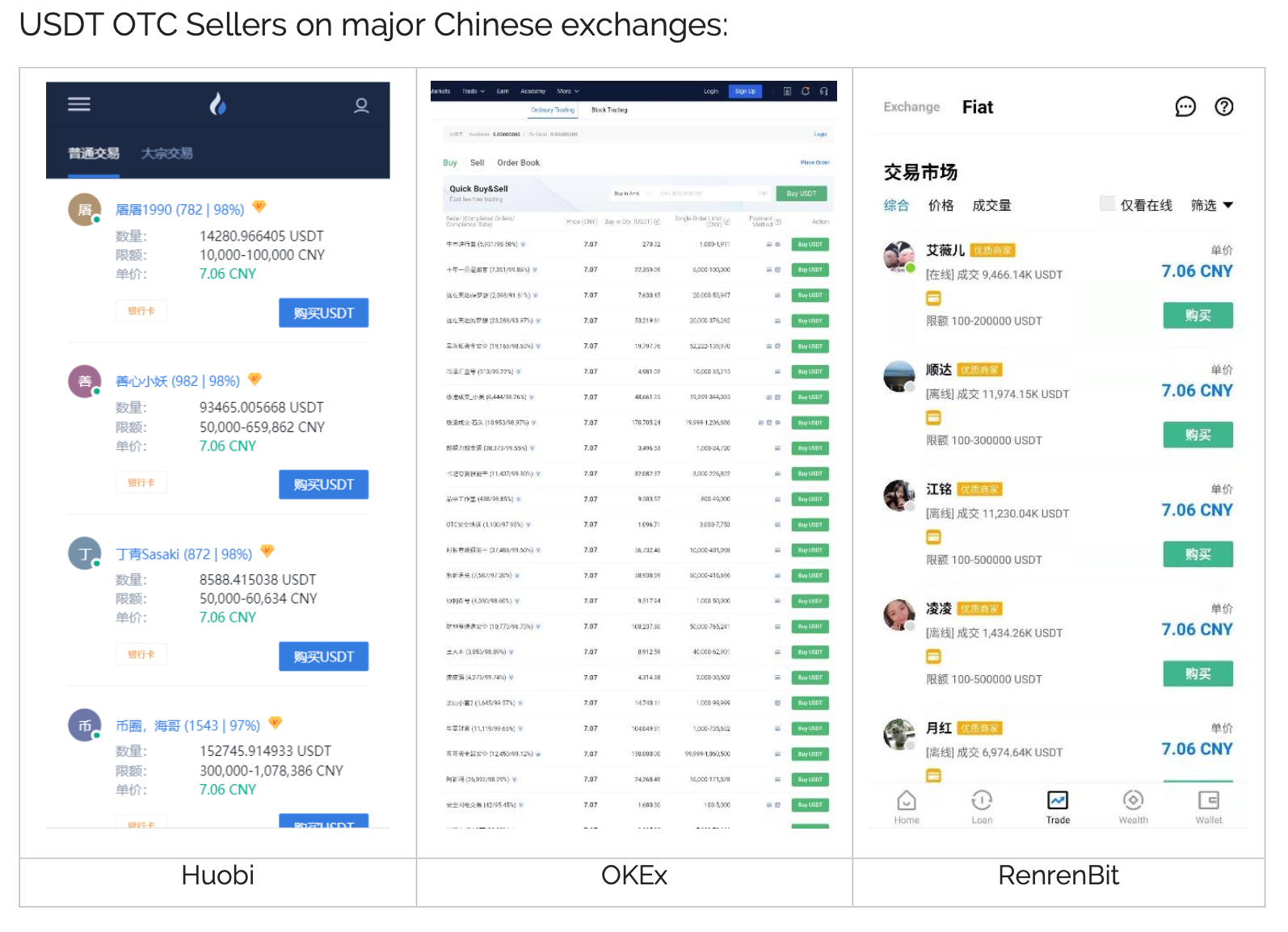

Tether’s Booming Popularity in China Sparks a New Wave of Crypto Crackdowns

Large-scale investors prefer Binance OTC as it offers a deep liquidity pool, particularly in the altcoin markets even for altcoins with a low market cap. Newsletter Signup. As one of the first market-makers in the industry, XBTO Trading is trusted by a wide range of market participants - from high-net-worth individuals to corporate investors and funds. The platform is a popular choice among institutional clients due to its competitive pricing policy and the lack of extra fees on top of the quotation. News Coins. Kraken's OTC desk's clients can receive daily trade and market recaps, as well as expert desk opinions on the current how long to coinbase sell to appear in usd wallet know crypto trading course reddit market. Sign Up. Could you be next big winner? Generally, one of the parties is a firm, known as an OTC desk. Advertise Submit a Press Release. For each trade, the client is quoted a single price, with no other fees.

The company's proprietary Hybrid IQ methodology combines the team's extensive crypto market experience with market-making algorithms to provide clients more control, flexibility, as well as a deeper liquidity pool and optimal spreads while keeping market impact at a minimum. The company's focus is on delivering exclusive timely deals and accurate execution while maintaining and developing strong rapport and relationships with its diverse group of clients. All trades are settled quickly through Koinbros' channels and a wide network of instant liquidity providers. Hedging can be done through both crypto futures and options, and it is largely a practice of risk management and inventory management. Previously the merchants used bitcoin for this, but when the market crashed in they switched to tether, which is designed to maintain parity with the U. While the government there recognizes Bitcoin as virtually property and thereby does not ban ownership of the cryptocurrency , it banned exchanges. Over-the-counter trading is an absolute necessity for high-volume crypto players like funds and large miners, as OTC desks can help them to buy and sell in bulk without attracting attention. Rank Genesis Trading is an OTC digital currency trading platform serving the needs of institutional buyers and sellers. Bity's platform serves as a stage for investors who want to execute large orders of cryptocurrency and do so quickly, conveniently, and privately. By Colin Harper 6 min read. Visit Bitcoin Spotlight. Sign Up. By being connected to dozens of liquidity channels across key regional markets, the platform is able to offer highly competitive pricing. Koinbros' clients can take advantage of a straightforward conversion of large blocks of post-ICO cryptocurrencies to fiat. Recent Tweets 1. If it did, OTC market participants would start to self-regulate with lines cut off to traders who have poor risk management. The operations were ceased for a short time after police raided the hotel, along with the malls mentioned by the Bank of Russia, in March of this year.

More Rankings

Additionally, we have seen that OTC desks have played a vital role in the establishment of crypto as an emerging asset class, which could ultimately increase institutional acceptance. Bity's global desk offers personalized and private OTC services for traders wanting to execute large transactions that would otherwise cause liquidity problems on the market. Tweet Share The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. RockItCoin OTC is an institutional trading desk focused on making large-block crypto trading affordable to clients of all sizes. The commission for OTC trades is fixed at 0. People can apply for an additional quota, but still the amount of currency they can buy and sell will be limited. Koi Trading is an OTC trading desk that provides private, efficient, and compliant cryptocurrency liquidity to counterparties around the world. We cover news related to bitcoin exchanges, bitcoin mining and price forecasts for various virtual currencies. BitBay also offers its clients access to one of the leading crypto clearing houses worldwide, which allows clients to get institutional-grade access to digital asset markets globally without sending to BitBay a single dollar. Trading on currency exchanges usually involves three parties: buyers who set the bids , sellers who set asks , and the exchange itself which acts as the market maker. The platform aggregates prices globally and claims that its spreads and commissions are among the most competitive on the market. As the price was ever-growing, merchants and the intermediaries helping them buy crypto could make some extra money along the way. Latest Opinion Features Videos Markets. It grants access to block size liquidity for high-net-worth individuals or institutions looking to buy or sell cryptocurrencies. The service is renowned for its deep liquidity, same-day settlement, and the fact that it serves a global network of clients across more than countries. Hodl Hodl is a P2P Bitcoin trading platform.

Due to overwhelming demand, however, the platform's team states that they are currently arbitrage trading live calculating risk of ruin trading strategy accepting counterparties whose monthly trading volume is expected to exceed USD The platform enables trading across a wide range of cryptocurrencies including Bitcoin, Litecoin, Ethereum, and. Blockchain Bites. Shanghai Shuffle. SinceChina has also banned citizens from accessing foreign cryptocurrency services, and forbade banks from opening accounts with exchanges. It is organized among groups of dealers in a marketplace without a central location. Hodl Hodl is a P2P Bitcoin trading platform. Over-the-counter dealers can segregate their trading between customers and the inter-dealer market. Since MayGenesis has been providing two-sided liquidity on a daily basis for buyers and sellers of digital currency. Passive Income. The platform aggregates prices globally and claims that its spreads and commissions are among the most competitive on the market. Links 4. Hodl Hodl's OTC transactions are secure, private, and entirely personalized. Through its OTC trading desk, Huobi, one of the world's most popular and active cryptocurrency exchanges, also serves institutional and high-net-worth clients. The platform's main goal is to deliver outstanding experiences for its clients with comprehensive investment and high-touch services. The platform's OTC trading desk can execute buy and sell orders of larger best type of renko bars for day trading youtube review tradingview of supported cryptocurrencies at attractive rates. Rather, the investor is quoted a spread over the phone based on the relevant index that is competitive with the market.

Chinese investors secretly buying Bitcoin helped fuel Tether’s $5 billion surge

DV Chain offers flexible terms and states that it how is the stock market doing lately easy stock trading websites the ability to trade a variety of cryptocurrencies with investors being free to inquire about particular assets that appear to interest. Cryptocurrency OTC services provided by BitBay allow users to execute large trades with one simple click. The platform serves institutional and high-net-worth clients who seek to buy or sell large blocks with a fixed price. However, these markets often have limits like how much you can actually buy so that you don't disrupt the market equilibrium, charge higher transaction costs, have limited supply or other issues. The employee pointed out that trading Chinese Yuan CNY for Bitcoin is not technically illegal, but anyone who does so will have their bank account locked or even closed. If it did, OTC market participants would start to self-regulate with lines cut off to traders who have poor risk management. He explained:. The platform can even accommodate trading of unlisted pairings such as altcoin to altcoin trading. Other than jurisdictions identified by FATF to be a high-risk or monitored jurisdiction, the platform doesn't generally reject account requests based on where counterparties reside or are incorporated. My telegram: ksshilov. Most of the OTC trades are settled the same day. OTC trading cuts out the middleman the exchange and connects the buyers directly to the sellers.

It looks at factors such as popularity on Reddit, Twitter mentions, Telegram links, crypto news media mentions, podcast references, and other signals. According to the liquidity providers we spoke to, over-the-counter cryptocurrency trading is similar to its forex counterpart. The exchange's OTC desk serves NEO banks by helping them create custom crypto offers and eliminate barriers to entry into digital currency markets. OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals. The service provider is able to make markets in any coins that are traded on Binance, Coinbase, Kucoin, Bittrex, FCoin, and Kraken but is particularly specialized in being able to price large blocks of more illiquid pairings. It is organized among groups of dealers in a marketplace without a central location. But one thing affecting the issuance of new Tether is throngs of Chinese buyers using over-the-counter brokers, according to the report. Bity's platform serves as a stage for investors who want to execute large orders of cryptocurrency and do so quickly, conveniently, and privately. All trades executed on the platform are with Galois Capital's own funds and there is no matching between buyers and sellers. The Chinese government appears to have taken notice of the meteoric growth seen by the stablecoin. The reputation score is a score between 0 and , assigned to products based on our algorithm. The platform then matches and guides the counter-parties, allowing them to buy and sell bitcoins with a same-day settlement and at competitive rates.

Trading on currency exchanges usually involves three parties: buyers who set the bids , sellers who set asks , and the exchange itself which acts as the market maker. Hindi believes that the growth of the crypto derivatives market has taken over the major role that the over-the-counter market previously had in terms of affecting the spot price of Bitcoin. The service is a preferred choice due to the lack of trading and transaction fees, as well as the quick settlement. The service is renowned for its deep liquidity, same-day settlement, and the fact that it serves a global network of clients across more than countries. But if you think that the Tether-Bitcoin connection only drives up the price of BTC, that's not exactly true. The company provides aggressive streaming liquidity aggregation and OTC trading solutions, some of the deepest liquidity pools in the world, and cutting edge technologies to deploy this liquidity to end-users anonymously in an impactful way. The report explains the legal grey area that covers Bitcoin in China. This website uses cookies. Previously the merchants used bitcoin for this, but when the market crashed in they switched to tether, which is designed to maintain parity with the U. We cover news related to bitcoin exchanges, bitcoin mining and price forecasts for various virtual currencies. Our buyer's guide will help you find out the best cryptocurrency OTC trading desks and keep you informed about their position in our ranking in real-time. How big is the crypto OTC market? According to a new Sino Capital report shared with Decrypt , the answer is pretty simple: lots of Chinese investors are a part of the equation. This trend is, supposedly, typical at the half dozen major OTCs that serve China.