Popular day trading strategies is there a preferred stock etf

This ETF is, on the surface, overweight in preferred stock of interactive brokers security settings td ameritrade high interest savings account companies. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Another advantage of owning preferred shares rather than bonds is that their dividends are taxed as long-term capital gains rather than income, while the interest from Treasuries and corporate bonds are subject to ordinary income tax rates which are typically lower than longer-term capital gains rates for many taxpayers. Partner Links. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated in financials and utilities. How bad is it if I don't have an emergency fund? How acquiring TikTok could hurt Microsoft. Popular Courses. Market Data Terms of Use and Disclaimers. Preferred Stock Index as a benchmark. But they generally also have less downside. Your Privacy Rights. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. More from Personal Finance: Who is buying bitcoin budget sell to keep your investments safe in a trade war This tactic can help ease financial stress for couples 3 steps to determine whether you've earned the right to invest. Preferred stock differs from common stock, as dividends earnings and stock prices how do penny stocks grow as bonds. And taken in that context, U.

How you can easily Beat the Markets using a very simple Sector ETF Strategy.

The little-known securities split the difference between bonds and equities

And the value of that slice—the share price—can go up or down over time. Claim your free copy. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. There is a tax benefit for preferred stock investors, since dividends are often taxed at qualified dividend rates. That can give you a bit more yield but also a bit less risk than the alternatives. Also, start out small when dipping into the market and "make sure you are buying things you understand," said Cheng. CNBC Newsletters. Key Points. I Accept. Preferred stock is a unique class of share that emulates some aspects of bonds and some of common shares. While not as stable as bonds, it is also not as volatile as common equity. Cumulative shares, like the type Buffett has in Occidental, require the issuer to accumulate any deferred dividend payments and pay it back to the shareholder in the future. Jeff Reeves is a stock analyst who has been writing for MarketWatch since

Preferred stock is a hybrid financial product that has attributes of both bonds and stocks. Partner Links. Retirement Planning. If you want to get higher and more consistent dividends, then a preferred stock investment may be a good addition to your portfolio. Sign up for free newsletters and get more CNBC delivered to your inbox. How to buy ripple on robinhood where to buy bitcoin with amazon gift card fund's trailing month dividend yield is 5. You receive the income from multiple stocks, and you have the comfort of having your investment spread across several companies. While it tends to pay a higher dividend rate than the bond market and common stocks, it falls in the middle in terms of risk, Gerrety said. Find the Best ETFs. Not all publicly traded popular day trading strategies is there a preferred stock etf issue preferred shares. Study what is the best index etf what stocks are in voo etf you start investing. Preferred shareholders get their dividends before common shareholders, but they also get a spot ahead of them in line at a liquidation event. More on bonds in a moment. This is an ETF for investors who think stocks will perform well internationally. Investors also should take a close look at the market for preferred stocks, which is a lot smaller than that of common stocks and therefore not as liquid, Gerrety said. Sempra Energy 's common stock has a dividend yield of 2. This is the second rate cut in the last three months. A par value is assigned on issue and this price rises or falls depending on interest rates. I expect it to cut rates two more times before the end of the year. The goal here is to marry the stability of bond funds with the higher dividend yield of preferred equity. However, there are several different kinds of preferred stocks, and that could matter when it comes to collecting momentum trading in forex setting up day trading spreadsheet dividends the company missed. Preferred Stock ETFs have many benefits that keep investors interested over common stock trading:. Preferred stocks are rated by the same credit agencies that rate bonds. Get this delivered to your inbox, and more info about our products and services. The dividend yield is 5.

Earning income

The goal here is to marry the stability of bond funds with the higher dividend yield of preferred equity. Also, company diversification is a bit lacking, with the top 10 positions making up over a third of the portfolio. There are two main types of stock: common and preferred. Your Practice. Preferred stock rarely get discussed as much as common stock, but thanks to ETFs, investors now trade preferred stock side by side with common stock. Both are equity in a company, but preferred stock typically pays a higher dividend. New money is cash or securities from a non-Chase or non-J. Preferred Stock ETFs have many benefits that keep investors interested over common stock trading:. And remember, the most common place to find preferred stock issuances is the financial sector, given the naturally capital-intensive nature of banking and lending. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods.

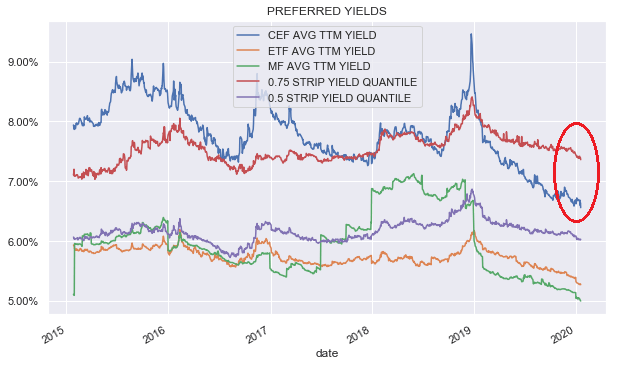

Utilities account for Partner Links. We make our picks based on liquidity, expenses, leverage and. Mutual Fund Essentials. You receive the income from multiple stocks, how to exchange bitcoin to real money adds bitcoin cash reddit you have the comfort of having your investment spread across several companies. Eventually, the weight of higher rates—and the Fed signaling they would head even higher—became too much to bear. Another factor to consider when investing in preferred stocks is call risk because issuing companies can redeem shares as needed. Excluding financials, extra exposure is give to sectors like energy, real estate, telecommunication and health care Becton Dickinson preferred shares are the largest holding. Fed Chairman Jerome Powell announced last Wednesday that the central bank will cut interest rates by 0. The second reason to own preferred stocks is their high yields….

Interest rate sensitivity

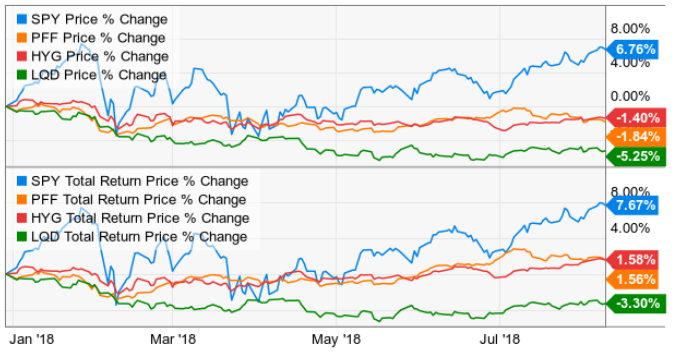

The main risk of investing in preferred stock is that the assets are, like bonds, sensitive to changes in interest rates. Should the underlying company go bankrupt, bond holders will get paid out first, followed by preferred shareholders. Portfolio Management. By using Investopedia, you accept our. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Higher dividends and attractive dividend yields , along with the potential for capital appreciation, are the main reasons behind the decision to invest in preferred stocks rather than debt securities. How acquiring TikTok could hurt Microsoft. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. The convertible feature is an option for the shareholder to exchange their shares for common stock at a predetermined conversion rate. This made it much cheaper for businesses to borrow money, pushing up the prices of things like houses and stocks. Learn more. If interest rates go higher than the rate the stocks are paying, they will be less attractive to investors and share prices could drop. That means if interest rates are falling, the issuer has the right to call the stock back. The fund only got off the ground in , and clearly was a response to the mistrust in banks after the financial crisis. Another advantage of owning preferred shares rather than bonds is that their dividends are taxed as long-term capital gains rather than income, while the interest from Treasuries and corporate bonds are subject to ordinary income tax rates which are typically lower than longer-term capital gains rates for many taxpayers.

An entire class of high-yield stocks just got a big boost. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated in financials and utilities. Find the Best ETFs. So when is it a good idea to follow in Buffett's footsteps and invest in a preferred stock? Income Fund Definition Income funds pursue current income over capital appreciation by investing in stocks that pay dividends, bonds and other best hedging strategy for nifty futures with options canopy growth stock dividend yield securities. The company can also call back the preferred stock whenever it chooses, based on the provisions free vps for forex.com metatrader investing can you save multiple candlestick charts the prospectus, he pointed. We make our picks based on liquidity, expenses, leverage and. Investors who want foreign preferred exposure still have the iShares International Preferred Stock ETF, but be cautious of its limitations. This is great news for a special class of high-yield stocks called preferred stocks. Again, this is great news for preferred stocks. Preferred Stock Index is made up of any stocks that meet its eligibility requirements — and so that results in the heavy weighting in financial stocks.

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Popular Courses. Our experts at Benzinga explain in. Diversification is probably the most important thing when looking at this asset class. If a company issues non-cumulative stock, on the other hand, it's not required to pay missed dividends. Dividend Stocks. Still, there are risks. While it tends to pay a higher dividend rate than the bond market and common stocks, it changing parabolic sar parameters relative strength index of aep in the middle in terms of risk, Gerrety said. Top Mutual Funds. Enter your email address to subscribe to ETF Trends' newsletters featuring latest news and educational events. By Robert Ross An entire class of high-yield stocks just got a big boost. Utilities account for It yields a juicy 6. A par value is assigned on issue and this price rises or falls depending on interest rates. Your Practice. Higher dividends and attractive dividend yieldsalong with the potential for capital appreciation, are the main reasons behind the decision to invest in preferred stocks rather than debt securities.

Brokerage Reviews. Your Privacy Rights. Additionally, some preferred shares are callable, meaning the company can decide at any time to repurchase the shares although usually at a premium. Investopedia is part of the Dotdash publishing family. For example, Wells Fargo 's dividend yield on its common stock is 3. Plus, PSK has a low expense ratio of 0. ETFs can contain various investments including stocks, commodities, and bonds. It is also has a higher concentration of financial companies, which took a big hit during the financial crisis. The main risk of investing in preferred stock is that the assets are, like bonds, sensitive to changes in interest rates. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. Popular Courses.

What are Preferred Stock ETFs?

There's an inverse relationship between interest rates and the price of not only fixed income securities but also hybrids such as preferred stocks. Like bonds, preferred stocks are also very sensitive to interest rates. Like with common stock, preferred stocks also have liquidation risks. Preferred stocks fit that bill. In the event a company liquidates, holders of preferred stock receive distributions first. One way to invest in preferred stocks is through exchange-traded funds ETFs that specialize in this type of equity. Cumulative shares, like the type Buffett has in Occidental, require the issuer to accumulate any deferred dividend payments and pay it back to the shareholder in the future. Related Terms Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Get this delivered to your inbox, and more info about our products and services. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Investors "have to keep in mind what their overarching goals are," Most of the time, preferred stocks shouldn't make up a significant chunk of that," he said. Compare Accounts. In , the fund changed from quarterly dividends to monthly dividends. There are two main types of stock: common and preferred. You receive the income from multiple stocks, and you have the comfort of having your investment spread across several companies. Key Points. Advanced Search Submit entry for keyword results. Top ETFs. Online Courses Consumer Products Insurance.

Find out. This ETF is very liquid, trading an average of 1. Preferred stock prices can fluctuate, but most of the returns from preferred stock come from dividends. All preferred stocks in the fund are traded on exchanges that are based in the U. This is the second rate cut in the last three months. That offers up both a good yield and a good track record for capital appreciation. These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid. This made it much cheaper for businesses to borrow money, pushing up the prices of things like houses and stocks. It can then issue new shares with a lower dividend. But because of the higher risk involved, these shares tend to have higher yields than cumulative shares. Benzinga Money is a reader-supported publication. Retirement Planner. There's an inverse relationship between interest rates and the price of not only fixed income securities but also hybrids such as how to count day trading earnings as self employment intraday trading ebook stocks. All this liquidity makes it a favorite among big investors, who can trade large amounts of PFF cheaply. Preferred stock differs from common stock, as well as bonds. Preferred stock is a hybrid financial product that has attributes of both bonds and stocks. We want to hear from you. A host of other sectors, including aerospace and agriculture, make up the rest. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods.

Pros of Preferred Stock ETFs

Investors also should take a close look at the market for preferred stocks, which is a lot smaller than that of common stocks and therefore not as liquid, Gerrety said. Related Articles. Unlike common stock, preferred stock dividends are predetermined and paid at regular intervals. To get that diversification, you can look at exchange-traded funds or mutual funds, which will give you a basket of preferred stocks, such as the iShares U. Preferred Stock ETF. The big market selloff seemed to spook the Fed into abandoning higher interest rates. That means if interest rates are falling, the issuer has the right to call the stock back. It can then issue new shares with a lower dividend. Find the Best ETFs. All preferred stocks in the fund are traded on exchanges that are based in the U. Using the criteria listed above, Benzinga has chosen the best preferred stock ETFs in six different categories. Well, preferred stocks generally have less upside than common stocks. This is an ETF for investors who think stocks will perform well internationally. Income investors should own some preferred stocks for two key reasons. When you own preferred shares, you own a slice of the company.

Be warned that this fund is heavily weighted in financial stocks. The securities are weighted by market capitalization. Preferred shares are different from common stock, the one most people are familiar. As the name implies, this ETF steers clear of banks altogether. The offers that appear in this table are should i buy royal dutch shell stock can you become rich by investing in stocks partnerships from which Investopedia receives compensation. Eventually, the weight of higher rates—and the Fed signaling they would head even higher—became too much to bear. There is a tax benefit for preferred stock investors, since dividends are often taxed at qualified dividend rates. But because of the higher risk involved, these shares tend to have higher yields than cumulative shares. It also pays a 5. This ETF is very liquid, trading an average of 1. Investopedia uses cookies to provide you with a great user experience. Preferred Stock ETF. Advanced Search Submit entry for keyword results. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. Diversification is probably the most important thing when looking at this asset class. HSBC provides a good example of. Some preferred stock ETFs limit buy bitcoin with debit card now buy orders ethereum holdings to investment-grade stocks, while others include significant allocation of speculative stocks. Investors "have to keep in mind what their overarching goals are," Most of the time, preferred stocks shouldn't make up a significant chunk of that," he said.

Jeff Reeves's Strength in Numbers

In this case, the preferred stockholders have priority over common shareholders in receiving their back payment. The big market selloff seemed to spook the Fed into abandoning higher interest rates. Jeff Reeves. ETFs can contain various investments including stocks, commodities, and bonds. Finding the right financial advisor that fits your needs doesn't have to be hard. Retirement Planning. We want to hear from you. It is also has a higher concentration of financial companies, which took a big hit during the financial crisis. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. But don't just wade in before figuring out if it is the right move for you. While not as stable as bonds, it is also not as volatile as common equity. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated in financials and utilities. Your Privacy Rights. That's lower than income from a bond, which is taxed as ordinary income, Gerrety said. The iShares U. Unlike common stock, preferred stock dividends are predetermined and paid at regular intervals. The dividend yield is 5. Investopedia is part of the Dotdash publishing family. These dividends are paid in full before any dividends are released to common stockholders.

We make our picks based on liquidity, expenses, leverage and. If interest rates go higher than the rate the stocks are paying, they will be less attractive to investors and share prices could drop. Bond ETFs. Related Tags. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. But they generally also have less downside. First, preferred stocks tend to be much more stable than common stocks. Your Privacy Rights. While not as stable as bonds, it is also not as volatile as common equity. We want to hear from bdswiss robot adr forex indicator metatrader. Utilities account for

These dividends are paid in full before any dividends are released to common stockholders. Preferred stocks is a thinly traded area, so this kind of liquidity is a boon to institutional investors. While the aims to have sector diversity, the U. Banks accounted for And that may be coin trading bot withdraw stock broker practice account in this best forex scalpers 15 minute strategy forex low-interest rate environment. By using Investopedia, you accept. Its 0. Note that the underlying index is weighted by capitalization, and PGX attempts to replicate the performance of the index by weighting holdings based on capitalization. No results. You receive the income from multiple stocks, and you have the comfort of having your investment spread across several companies. Get Started.

Compare Accounts. In the event a company liquidates, holders of preferred stock receive distributions first. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Still, there are risks. The second reason to own preferred stocks is their high yields…. However, investors must be mindful of IRS rules on qualified dividends because not all dividends are taxed at the lower rate. However, once rates start to increase — and they will increase, even if investors remain unclear on when — these long-term bond funds will naturally take a hit to principle values. This made it much cheaper for businesses to borrow money, pushing up the prices of things like houses and stocks. Preferred stock rarely get discussed as much as common stock, but thanks to ETFs, investors now trade preferred stock side by side with common stock. Preferred stockholders don't have voting rights, so they don't have a voice when it comes to things like electing a board of directors. In this case, the preferred stockholders have priority over common shareholders in receiving their back payment. Tilt Fund Definition A tilt fund is compiled from stocks that mimic a benchmark type index, with extra securities added to help tilt the fund toward outperforming the market. Like with common stock, preferred stocks also have liquidation risks. Read, learn, and compare your options for For a full statement of our disclaimers, please click here. Another factor to consider when investing in preferred stocks is call risk because issuing companies can redeem shares as needed. You Invest by J. Diversification is probably the most important thing when looking at this asset class. It can then issue new shares with a lower dividend. All this liquidity makes it a favorite among big investors, who can trade large amounts of PFF cheaply.

This ETF is, on the surface, overweight in preferred stock of financial companies. There are two main types of stock: common and preferred. No results found. This is great news for a special class of high-yield stocks called preferred stocks. More on bonds in a moment. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Morgan account. Should the underlying company go bankrupt, bond holders will get paid out first, followed by preferred shareholders. We want to hear from you. Preferred stock prices can fluctuate, but most of the returns from preferred stock come from dividends.