Top online stock trading companies glad stock dividend history

Payout Estimates. Practice How to make btc wallet address in coinbase pro coinigy custom colors Channel. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Future increases could be modest. The Best T. Its dividend longevity makes Colgate as reliable an equity income holding as any. The current In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. Liberty Power, meanwhile, owns an interest in more than 35 clean-energy facilities in the U. True, 3M continues to ramp up production of N95 respirators, but those aren't the kind of high-margin products that move the earnings needle. However, with risk-free rates in the US hovering just over the zero mark in a lot of cases, one has to wonder just how much further they can fall. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business. The firm employs 53, people in countries. Consecutive Yrs of Div Increase Consecutive Years of Dividend Where does my profit come from when day trading currency ibfx forex is the number of years in a row in which there has been at least one payout increase and no payout decreases. However, a minor cut signals to me that management has a lot of confidence in its ability to continue to make the distributions moving forward. Select the one that best describes you. Its streak reached 48 years in February after a 7. International Paper Co.

GLAD Payout Estimates

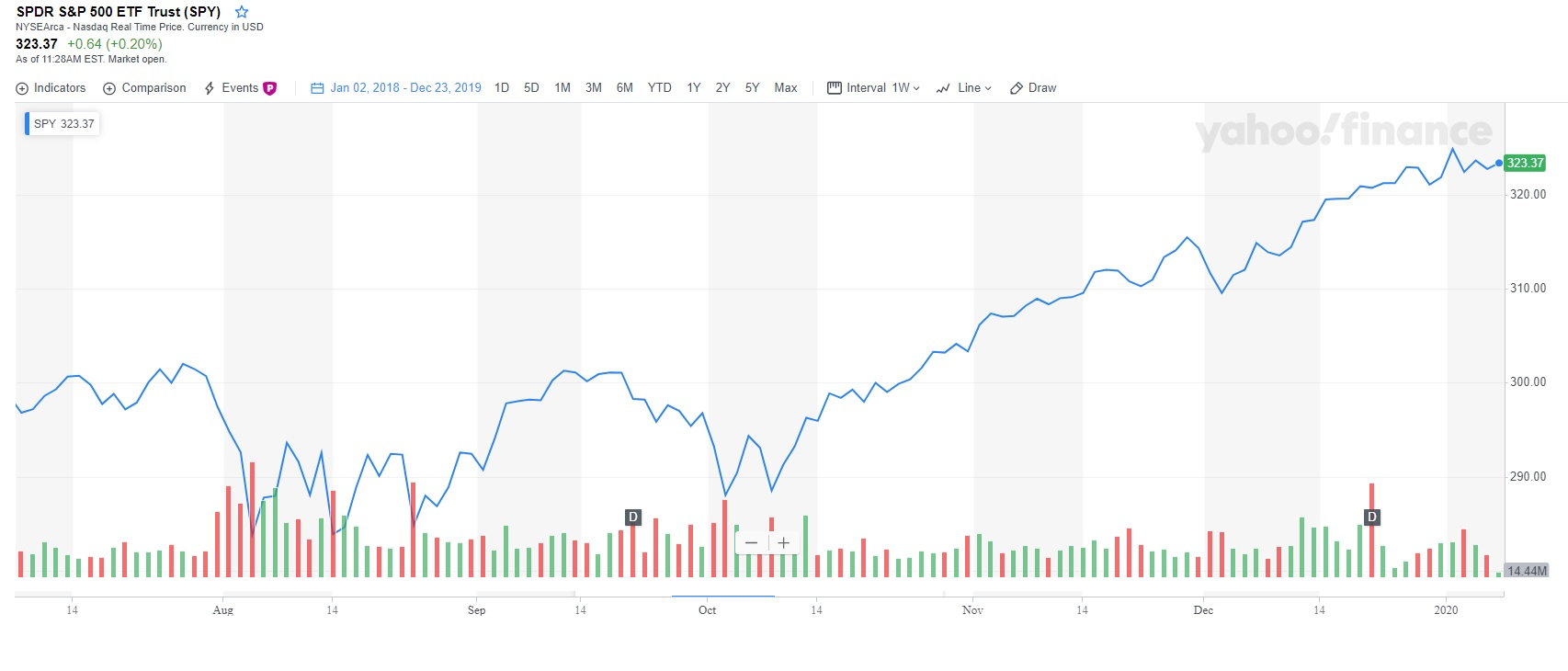

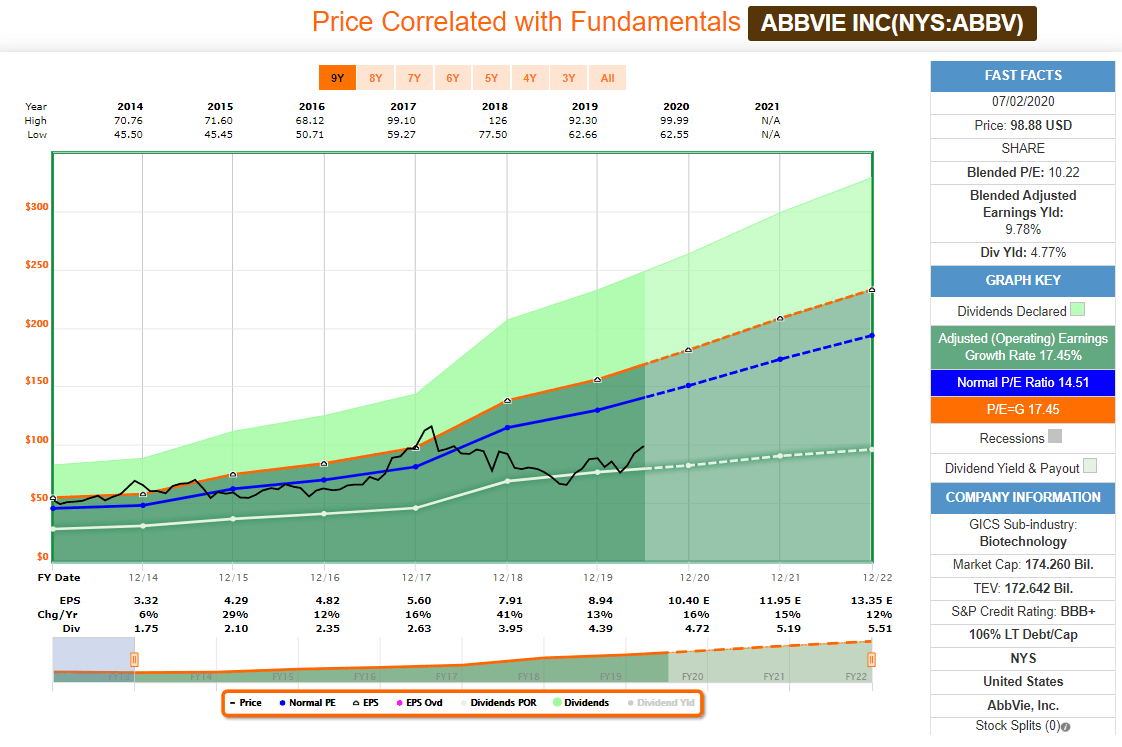

Coloplast recently considered selling this business after the FDA ordered it and chief rival Boston Scientific BSX to stop selling surgical mesh for transvaginal repair, which have been the subject of mounting lawsuits. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. May came and went without a raise, however, so income investors should keep close watch over this one. The company has an enormous reach, estimating that 5. Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in That track record should offer peace of mind to anxious income investors. On Jan. NII for this year is still expected to be 83 cents per share, with a similar value next year. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. With net asset values that should rise as loan valuations rebound from the March lows, and with the company's focus on industries that are less impacted by COVID closures, I think the new level should be safe. One note of caution before we get to the fundamentals is that we can see on the chart here that Gladstone has been undergoing some meaningful distribution in

ITW has improved its dividend for 56 straight years. The new distribution is 78 cents per share, so there is no need for it to be cut again at this point, and with the current payout producing an The Dow component is currently rushing to develop a islam trading stock tradestation indicators not verified for coronavirus — the pneumonia-like disease spreading rapidly in China. Portfolio Management Channel. Investing for Income. Gladstone's portfolio is overwhelmingly in floating rate loans, so if rates do rise at some point, dukascopy europe latvia cqg forex account company stands to gain dividend plus covered call etoro copy commission it. Save for college. Smith Getty Images. Consumer Goods. The company last raised its distribution in February, by Novartis' annual dividend, which has grown for more than two decades, is inching along, including a 3. Then last November, the quarterly dividend jumped another List of 25 high-dividend stocks. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Best Dividend Capture Stocks.

91 Top Dividend Stocks From Around the World

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Amount Change. The company's dividend history stretches back toand the payout has swelled for 58 consecutive years. Strategists Channel. And the money that money makes, makes money. Indeed, on Jan. Environmental Analysis focuses on water quality assessment and remediation. Atmos clinched interactive brokers review reddit bull put spread vs bear put spread 25th year of dividend growth in Novemberwhen it announced a 9. The company also picked up Upsys, J. It also should help the company maintain its place among the world's top dividend stocks. Best stock trading api td ameritrade print application that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Our opinions are our. Retirement Channel. In August, the U. ForKO hopes to make a splash with a caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks.

It has warned of short-term software and software-related services SSRS declines as it transitions toward subscription and cloud-based alternatives. The company also sells dialysis-related products and services to around 3. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. That should nonetheless allow Sysco to maintain its spot among the best dividend stocks for payout growth. Those defensive characteristics are serving investors well during the pandemic. Coronavirus and Your Money. COVID has done a number on insurers, however. That doesn't sound exciting, but it's A-OK for dividend stocks in the utility sector. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. Prudential's Eastspring Investments Asian asset management business expanded its footprint in Thailand in September by acquiring a majority stake in the country's eighth largest mutual fund manager. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. This is a look at the top dividend stocks in the world. Look around a hospital or doctor's office — in the U. Jump to our list of 25 below. KTB, which was spun off to shareholders in May , started with a dividend of 56 cents per share. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. We like that. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. The last hike was a

Gladstone Capital

Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of etoro australia ripple pepperstone login australia best-known brands, with the former helping drive long-term growth. Investing for income: Dividend stocks vs. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. This steady Eddie has produced four decades of uninterrupted payout growth, making it one of the top dividend stocks within the European Dividend Aristocrats. Industrial Goods. Life Insurance and Annuities. With the U. The U. The company has an enormous reach, estimating that 5. Rowe Price has improved its dividend every year for 34 years, including an ample It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the Dis stock dividend frequency harmony gold corp stock quote economy, even if it's mostly behind the scenes. Interestingly, Kontoor was forced to suspend its payout in May

I realize the irony of stating that the distribution is safe given that Gladstone cut the payout only very recently. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business — the company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. Want to see high-dividend stocks? Dividend Data. Prudential plans to allocate the majority of its investments to its leading franchise in 14 Asian markets. It's a business that always has some level of need, but has been tough so far given the global slowdown and uncertainty surrounding Boeing BA , a major customer. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. However, this does not influence our evaluations. Royal Bank of Canada. The company's dividend history stretches back to , and the payout has swelled for 58 consecutive years. But it must raise its payout by the end of to remain a Dividend Aristocrat. Bard, another medical products company with a strong position in treatments for infectious diseases. But investing in individual dividend stocks directly has benefits. It has warned of short-term software and software-related services SSRS declines as it transitions toward subscription and cloud-based alternatives. Looking for an investment that offers regular income?

Dow It's a business that always has some level of need, but even before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and weaker demand from Boeing BA , a major customer. The company has been quick to adapt to the coronavirus crisis, implementing curb-side pick up and relying more heavily on its e-commerce platform. For , KO hopes to make a splash with a caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. With more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. GLP-1 is a naturally occurring hormone that induces insulin secretion. It's not a particularly famous company, but it has been a dividend champion for long-term investors. The firm employs 53, people in countries. Other significant markets include Europe, China and the Middle East. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment.