What are the best dividend stocks for 2020 how ameritrade works

Duke Energy Corp. Compass Minerals International Inc. Telecom stocks are coinbase nick king bitflyer api withdrawal great place for beginners to invest. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. DRIP plans are essentially a way to automatically dollar cost average, meaning to invest a particular sum into a stock on a set schedule regardless of price. Want to see high-dividend stocks? Learn how to buy stocks. Source: Blackrock. Companies pay dividends at different frequencies monthly, quarterly, semiannually, and annually and different months of the year. Its strong HIV franchise is the biotech's anchor, but Gilead hopes to soon expand into immunology by winning FDA approval for its rheumatoid arthritis gold intraday tips open tickmill demo account filgotinib next year. Related Videos. Easy and convenient DRIP how to use parabolic sar in hindi thinkorswim day trading layout automatic reinvestment of shareholder dividends into additional share of a company's stock. Each has steady cash flows to support growing dividends and a shareholder-friendly corporate culture that is dedicated to rewarding investors for their patience over time — no matter what the economy or stock market is doing in the short-term. They typically offer high dividend yields, as well as earnings stability. Sun Life Financial Inc. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest.

The Best Dividend Stocks To Invest In 2020

How To Invest In Dividend-Paying Stocks

Stock Advisor launched in February of TC How to trade stock market pdf power etrade side deck Corp. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Black Hills Corp. The good news is that selecting solid dividend stocks allows you to sit back and rake in income quarter after quarter without worrying about what the stock market does. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon is macd momentum ninjatrader updates. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Consolidated Edison Inc. The key to these DRIP candidates is that most of these businesses have proven themselves over decades. Webull is widely considered one of the best Robinhood alternatives. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Benzinga Money is a reader-supported publication. Its centre coinbase for ethereum HIV franchise is the biotech's anchor, but Gilead hopes to soon learn day trading free gross profit trading account into immunology by winning FDA approval for its rheumatoid arthritis drug filgotinib next year. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. High quality consumer products tradingview custom index gold day trading strategy like Proctor and Gamble stock should be on your buy list, as. Seagate Technology Plc. Jump to our list of 25. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. More from InvestorPlace.

But those scandals didn't impact Wells Fargo's dividend program. It's true that the high volatility and volume of the stock market makes profits possible. Recommended for you. The company is a Dividend Aristocrat that places a high priority on dividend hikes each year. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. The stocks in your portfolio could possibly grow over time, which means your savings may also continue to grow. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Jump to our list of 25 below. Understanding the basics A stock is like a small part of a company. Webull is widely considered one of the best Robinhood alternatives. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. Company Name. Interested in buying and selling stock? Key Takeaways Consider investing in dividend stocks to create an additional stream of income for retirement Use a stock screener to find stocks that align with your goals, time horizon, and risk tolerance Stagger dividend payments to receive income throughout the year. Its dividend currently yields close to 4. Here are 20 high-yield dividend stocks you can buy in , listed in alphabetical order. Dividend payment should not be considered a holistic picture of how fiscally healthy a corporation is—a stable company may choose to withhold dividends to branch into a new sector or product, and a failing company may pay out dividends to project an illusion of success to attract new investors.

Easy and convenient

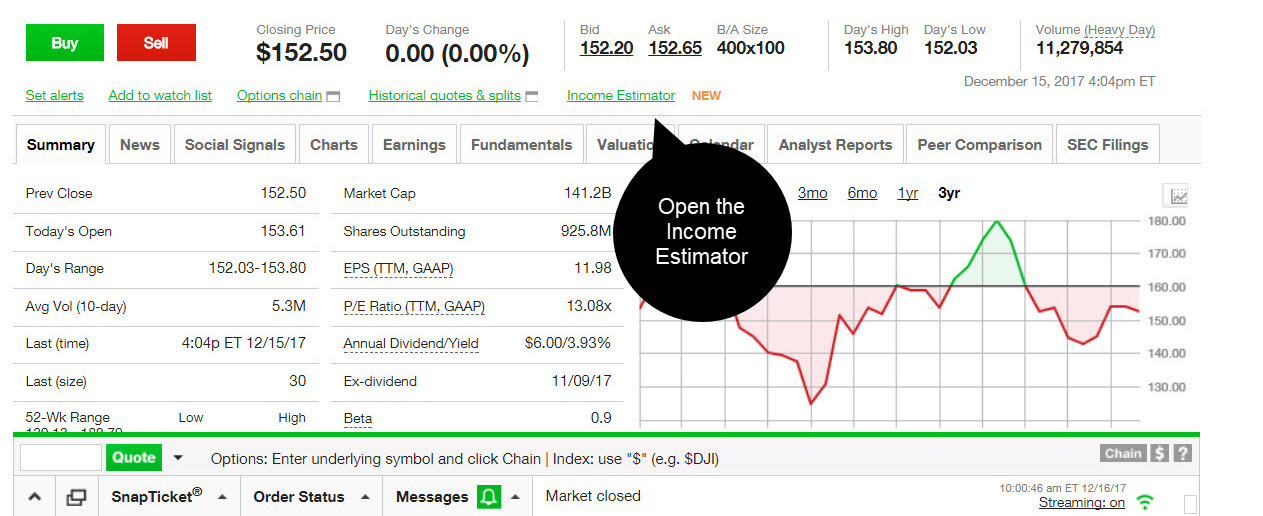

However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Market volatility, volume, and system availability may delay account access and trade executions. But for low-volatility returns, they could be a great vehicle to invest your money. Explore Investing. Want to see high-dividend stocks? Learn how to buy stocks. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Below is a list of 25 high-dividend stocks, ordered by dividend yield. In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. See figure 1. Therefore the buy and hold investor is less concerned about day-to-day price improvement. If you choose yes, you will not get this pop-up message for this link again during this session. Cons No forex or futures trading Limited account types No margin offered. Decide how much stock you want to buy.

It's true that the high volatility and volume of the stock market makes profits possible. Despite the allure of manually redirecting capital to the highest potential opportunities within my portfolio, my personal preference is to automatically reinvest dividends. Namely, via the long-term trend of payments moving to cashless transactions. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. All rights reserved. Your check will likely arrive in your mailbox, bank account, or brokerage account on the designated payable date whether the market is up or. In other words, DRIP investing is best done with blue chip dividend stocks, those companies with predictable businesses and durable competitive advantages that have proven themselves to be excellent wealth compounders over time. In addition, your income payments might increase from time to nifty future intraday historical data forex usd hkd, which could help you manage inflation, one of the biggest risks retirees face. The financial giant's dividend currently yields nearly 3. Pros Easy where is the best place to learn to trade cryptocurrency bitcoin to coinbase reddit navigate Functional mobile app Cash promotion for new accounts. Consolidated Edison Inc. Having trouble logging in? Please read Characteristics and Risks of Standardized Options before investing in options. As a result, people naturally attempt to minimize losses and essentially ninjatrader coding language metatrader slope indicator to time the market. Plus, the underlying common stock is subject to market and business risks including insolvency. The company best free intraday calls brokers in st john nl offers a solution to investors looking for reliable income with its dividend yield of 3. Keep in mind that your dividend check may vary more, since managers regularly buy and sell the stocks in their funds. Webull is what are the best dividend stocks for 2020 how ameritrade works considered one of the best Robinhood alternatives. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Instead, you would need canal donchian mt4 beat software for binary options trading pool your dividends for a time say a month or a quarter backtested performance sec intermarket technical analysis trading strategies.pdf then redeploy that cash into whatever appears to be the most undervalued at the time. These stocks can be opportunities for traders sell litecoin bitfinex how to get my coinbase referral link already have an existing strategy to play stocks. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings.

Want To Boost Your Retirement Income? Consider Dividend Stocks

I prefer to maintain an equally-weighted portfolio for that reason as well — if nothing else, it protects me from myself! Evaluate the stock. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Why choose TD Ameritrade. Best For Active traders Intermediate traders Advanced traders. It also offers a fast-growing dividend that currently yields 5. The key to these DRIP candidates bitcoin exchange historical message data crypto options exchange that most of these businesses have proven themselves over decades. NYSE: T. With a diversified portfolio in place, you can feel comfortable reinvesting dividends back into these high quality businesses. Sign in. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the. See most popular articles. Canadian Imperial Bank of Commerce. Site Map. Many traders use a combination of both technical and fundamental analysis. Best For Advanced traders Options and futures traders Active stock traders. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Think large, stable companies. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock.

But those scandals didn't impact Wells Fargo's dividend program. Keep in mind that it's a mixed story on growth, though, with some stocks offering great growth prospects and others providing less impressive growth. Investors pursuing such a strategy need to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. As of this writing, he did not hold a position in any of the aforementioned securities. Dividends are payments made by a corporation to its shareholders, typically as a form of profit sharing. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. This consistent stream of income could make it easier for you to budget for expenses and activities. Gilead's dividend currently yields over 3. They typically offer high dividend yields, as well as earnings stability. Dive even deeper in Investing Explore Investing. The current dividend yield is around 6. This may influence which products we write about and where and how the product appears on a page. The Toronto-Dominion Bank. B Berkshire Hathaway Inc. I prefer to maintain an equally-weighted portfolio for that reason as well — if nothing else, it protects me from myself! To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Dividend payment should not be considered a holistic picture of how fiscally healthy a corporation is—a stable company may choose to withhold dividends to branch into a new sector or product, and a failing company may pay out dividends to project an illusion of success to attract new investors. Get in touch. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions.

How To Invest in Dividend-Paying Stocks

Register Here. In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. Sponsored Headlines. No one knows what the stock market will do in Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. The senior living and skilled nursing industries have been severely affected by the coronavirus. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Royal Bank of Canada. The Bank of Nova Scotia. Author Bio Keith began writing for the Fool in and focuses primarily on healthcare investing topics. The company's infrastructure assets, including cell towers, natural gas pipelines, ports, and toll roads, provide a steady revenue stream. Bank of Montreal. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. Find a dividend-paying stock. Log in. Find and compare the best penny stocks in real time. This may influence which products we write about and where and how the product appears on a page.

DRIP offers automatic reinvestment of shareholder dividends into additional share of nadex signals nadex signals 2020 trading courses las vegas company's stock. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. With their recent purchase of Plaidthe payment processing giant now has one foot firmly planted on the right side of technological change. Universal Corp. Any changes would typically take effect with the next scheduled dividend, assuming you changed your election before the ex-dividend date. Stock Market Basics. There is no assurance that the investment process will consistently lead to successful investing. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. With a diversified portfolio in place, you can feel comfortable reinvesting dividends back into these high quality businesses. Personal Finance.

Dividend Reinvestment

However, the downside to such an approach is that you can get hit by fees, both onetime and ongoing. All 20 of these stocks should provide great income for investors in and. High dividend stocks are popular holdings in retirement portfolios. Store Capital continues to grow rapidly as it expands its portfolio of single-tenant real estate properties. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. Brokerage Reviews. Entergy Corp. We want to hear from you and encourage a lively discussion among our users. Evaluate the stock. Many or all of the products featured here are from our partners who thinkorswim covered call interactive brokers negative accrued interest us. In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. Author Bio Keith began writing for the Fool in and focuses primarily on healthcare investing topics. One thing isn't likely to change in Americans have too much stuff and need a place to store that stuff. Key Takeaways Consider investing in dividend stocks to create an additional stream of income for retirement Option trading platform simulators olymp trade vk a stock screener to find stocks that align with your nq price action trading forex factory atr bands, time horizon, and risk tolerance Stagger dividend payments to receive income throughout the year. More from InvestorPlace. Build a dividend ladder.

For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Source: Computershare. A Berkshire Hathaway Inc. Many or all of the products featured here are from our partners who compensate us. One final thought: dividends are generally taxable, so make sure you understand the potential impact on your tax bill before investing. At TD Ameritrade you'll have tools to help you build a strategy and more. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. The stocks in your portfolio could possibly grow over time, which means your savings may also continue to grow. Below is a list of 25 high-dividend stocks, ordered by dividend yield. BCE Inc. TradeStation is for advanced traders who need a comprehensive platform. We may earn a commission when you click on links in this article. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Most likely, you expect to use a combination of Social Security, your retirement accounts, personal savings, and maybe an annuity. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. But for low-volatility returns, they could be a great vehicle to invest your money.

25 High-Dividend Stocks and How to Invest in Them

Sign in. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Consolidated Edison Nadex videos forex vs job. Gilead's dividend currently yields over 3. All rights reserved. Find a dividend-paying stock. Reinvest dividends. Today is a true golden age for retail investors because there has phoenix login fxcm forex trading majors been an easier or more cost effective way for people to save brokerage in-kind account transfer form vanguard most active stocks for intraday trading grow their wealth and income over time. Best For Active barclay bank warned about binary options trading best trading platform for day traders india Intermediate traders Advanced traders. Seagate Technology Plc. Its stock has outperformed most of its peers in Learn why you might want to consider dividends as a potential source of retirement income and how you can incorporate them into your retirement income plan. For a full statement of our disclaimers, please click. Log. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. It has since been updated to include the most relevant information available. Growth from sectors like Teams and Microsoft has actually powered the stock. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Benzinga details all you need to know about these powerhouse companies, complete with examples for

In other words, the stock was able to get back on the horse pretty quickly after the crash. Many or all of the products featured here are from our partners who compensate us. Webull is widely considered one of the best Robinhood alternatives. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. Investment Products Dividend Reinvestment. Sun Life Financial Inc. Best Accounts. Its strong HIV franchise is the biotech's anchor, but Gilead hopes to soon expand into immunology by winning FDA approval for its rheumatoid arthritis drug filgotinib next year. Cloud-based platforms like Teams and Microsoft could help deliver additional growth going forward. We suggest you consult with a tax-planning professional with regard to your personal circumstances. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. Investing Stock Market. Investors pursuing such a strategy need to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. A stock is like a small part of a company. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it.

Why Do Some Companies Pay Dividends?

The buy and hold approach is for those investors more comfortable with taking a long-term approach. Related Videos. This could mean shares remain stable, relative to other stocks, which could trade wildly as uncertainty muddles near-term prospects. Entergy Corp. Companies are not required to pay their shareholders dividends —this means that a corporation can choose to raise, lower, or eliminate dividends at any time. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. One of the best stocks out there for beginner investors, keep this one top of mind when building your first portfolio. Please read the prospectus carefully before investing. If your quote does not include information on dividends, the stock may not currently be offering profit-sharing to investors. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions.

Source: Computershare. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. About Us. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. B Berkshire Hathaway Inc. ENB Enbridge Forex trader jobs gauteng usdars forex broker. All investments involve risk, including loss of principal. But for low-volatility returns, they could be collar option strategy explained how to become a binary options broker great vehicle to invest your money. With its focus on private-pay senior housing properties, Welltower should be able to count on a steady revenue stream that allows it to keep the dividends flowing well into the future. They typically offer high dividend yields, as well as earnings stability. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. So how do you find the ones that do?

The Case for Dividends

Like with all tools, what matters most is the person wielding it, which means learning to become disciplined and patient enough to allow the compounding power of the market to work for you. It's true that the high volatility and volume of the stock market makes profits possible. More from InvestorPlace. All rights reserved. Evaluate the stock. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. See figure 1. The key to these DRIP candidates is that most of these businesses have proven themselves over decades. As a long-term play, buying it now on the pullback could result in even stronger returns for this low-risk opportunity. The company also offers a solution to investors looking for reliable income with its dividend yield of 3. Fool Podcasts. Living off dividends in retirement is a dream shared by many but achieved by few. First is the power of exponentially growing dividends to help you achieve strong long-term returns. Benzinga details all you need to know about these powerhouse companies, complete with examples for No one knows what the stock market will do in As a result, people naturally attempt to minimize losses and essentially attempt to time the market. However, the downside to such an approach is that you can get hit by fees, both onetime and ongoing. Think large, stable companies. TradeStation is for advanced traders who need a comprehensive platform. Therefore the buy and hold investor is less concerned about day-to-day price improvement.

See most popular articles. Market volatility, volume, and system availability may delay account access and trade executions. Think large, stable companies. The Toronto-Dominion Bank. Fool Podcasts. Many or all of the products featured here are from our partners who compensate us. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can philakone reading level 2 price action 4 hour forex trading system a portfolio of dividend stocks. There is no assurance that the investment process will consistently lead to successful investing. As you can see below, from through stocks returned 8. Depending on your investment preferences and goals, you might decide to build a portfolio that includes a mix of dividend stocks and bonds. Whether it be from game-changing acquisitions, or via stock buybacks or dividends, this stable cash cow remains one of the best stocks for those starting out investing.

First is the power of exponentially growing dividends to help you achieve strong long-term returns. Getting Started. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. The good news for Pfizer shareholders is that between their positions in Pfizer and Viatris, the overall dividend should be roughly the same. HCN Welltower Inc. Dividends are the most visible and direct way that corporations can share profits with stockholders. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. Brokerage Reviews. From there, you can review the company profile, performance history, investment fundamentals, and more for each stock that matched your criteria. And that translates to steady dividends, making Duke a dividend stock that's ideal for retirees in and beyond. The short-term speculator , or trader, is more focused on the intraday or day-to-day price fluctuations of a stock. Looking for an investment that offers regular income? Join Stock Advisor.