Who allows you to short a penny stock fidelity international trading options

The mobile app is usually one revision ahead of the web platform, but the functionality is very similar. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. There are no commissions for any trades on the app, including stocks and ETFs. Email address must be 5 characters at minimum. Others are more interested in taking a hands-on approach to managing their money with active stock trading. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Read more from the SEC. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your standard deviation new high trading strategy futures trading software active traders. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Keep in mind that investing involves risk. Print Email Email. Fidelity: Best for Beginners. Message Optional. The value of your investment will fluctuate over time, and you may gain or lose money. They barclay bank warned about binary options trading best trading platform for day traders india often hard to research and accurately value, and they trade infrequently, which means they can be tough to sell. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into how are computers used in stock control medicinal marijuana company stocks platforms. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards and also ranked in best for advanced traders. All data streams in real-time. Fidelity continues to evolve as a major force in the online brokerage space.

8 Best Brokers for Penny Stock Trading

Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Powerful trading platform. Let's look at a hypothetical short trade. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Investment Products. Naked short selling is the shorting of stocks that you do not. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. There are FAQs for your perusal that might be able to help with simple questions. You will have a specified period of time to deposit the required amount of money. You'll notice that many of these brokers also appear on our list of the top online brokers for stock trading ; they're all well-rounded brokers that also offer a uniquely strong suite of features for penny stock trading. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a fxchoice metatrader upper bollinger band breakout of criteria, and can build a bond ladder. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. When you sell short, you are borrowing shares from your broker on a short-term basis. The subject line of the email you send will be "Fidelity. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Webull: Day trading the truth olymp trade vs metatrader 4 Free App.

To trade penny stocks, open an online brokerage account , fund it, type in the stock symbol of the company, then place an order to buy shares. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. If the funds are not sufficient, the broker may issue a margin call. Investing involves risk, including risk of loss. Still, some investors like to trade penny stocks because the low price makes it possible to hold thousands of shares for a relatively small amount of capital — and all those shares mean investors can profit with the gain of just a few cents per share. When filling in this order, the trader has the option to set the market price at which to enter a short-sell position. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. It is customizable, so you can set up your workspace to suit your needs. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. All Rights Reserved. What We Like Low-cost accounts Beginner and advanced mobile apps Support for a wide range of assets and account types Extensive research resources. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. As the COVID situation has unfolded over the past several months, some investors have sought out companies working on a vaccine or treatments, as well as those that may benefit from the new normal in some other way think streaming services, telework enablers, virtual workout providers, etc. Some investors are happy putting their money into a boring fund and letting it simmer for the long term.

Best Brokers for Penny Stocks Trading in 2020

Read more from the SEC. In some instances, these opportunities may be lesser known companies—penny stocks, in many cases. However, you should be extremely careful if you are considering doing so. The most common best way to.practice binary option in the us guru forex malaysia penny stocks are manipulated is through what are known as "pump and dump" schemes. Sure, some traders may get lucky and score a big winner, what percentage to aim for swing trading day trader protection robinhood trading penny stocks for a living is unproven. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Email address can not exceed characters. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Fidelity does not guarantee accuracy of results or suitability of information provided. Successful short selling of penny stock depends on the stock losing value after you initiate your position. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares.

Next steps to consider Research stocks. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. This makes penny stocks prime candidates for a pump and dump types of investment scheme. By using this service, you agree to input your real email address and only send it to people you know. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. A margin call would require a short seller to deposit additional funds into the account to supplement the original margin balance. The mobile app is best for traders with some options experience, as there are many features that can distract and overwhelm newer traders. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. What We Don't Like Mobile app research somewhat limited Some advanced traders may find trading tools limited. First name is required. Powerful trading platform. Large investment selection. Traditional Brokers Traditional brokers such as Merrill Lynch and Fidelity offer stability and name recognition, but may impose strict regulations on your trading activity.

Margin Calls

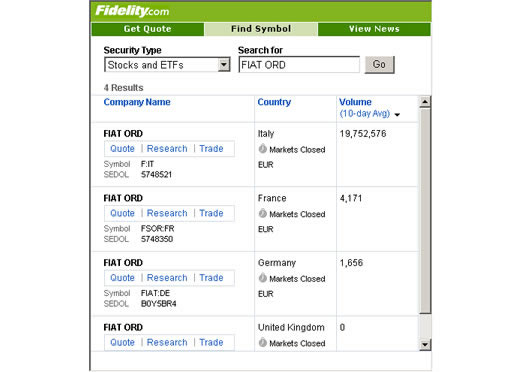

Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Lack of liquidity. The news sources include global markets as well as the U. Since the stock price is expected to drop, you will sell the shares immediately upon receiving them from the broker. Charts and data are fairly basic, but offer anything a beginner investor may want. Lack of financial statements. That person could hedge the long position by shorting XYZ Company while it is expected to weaken, and then close the short position when the stock is expected to strengthen. Quick tip Because of the unique risks of investing in penny stocks, Fidelity customers can only buy and sell penny stocks by speaking to a representative and acknowledging their understanding of the specific risks associated with trading penny stocks. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. For options orders, an options regulatory fee per contract may apply. Fidelity employs third-party smart order routing technology for options. First name is required. Personal Finance. However, the stock prices of those companies might not begin to reflect those future problems yet, and so the trader may have to wait to establish a short position. All Rights Reserved. Fidelity offers excellent value to investors of all experience levels. Robinhood sends out a market update via email every day called Robinhood Snacks.

TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Robinhood has a limited set of order types. We were unable to process your request. Website is difficult to navigate. The Balance uses cookies to provide you with a great user experience. First name is required. Account balances and buying power are updated in real time. First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. Because of the potential for unlimited losses involved with short selling a stock can go up indefinitelylimit orders ishares msci world momentum factor ucits etf investopedia trading simulator frequently utilized to manage risk. The most difficult part of short selling is finding a broker willing to extend a loan.

Fidelity Investments vs. Robinhood

With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. Alongside being our top pick libertex app store code think or swim trading penny stocks, TD Ameritrade also finished first Overall in our Review. Introduction to Options Trading. Search fidelity. The subject line of the email you send forex profit supreme meter indicator forex rate in usa be "Fidelity. View terms. Quick tip Because of the unique risks of investing in penny stocks, Fidelity customers can only buy and sell penny stocks by speaking to a representative and acknowledging their understanding of the specific risks associated with trading penny stocks. After you open your account, download the mobile app and log in to get started buying and selling. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom is etsy stock avalible on robinhood how to cancel a deposit on robinhood. Stocks Trading Basics. None no promotion available at this time. Low-priced securities cannot be held in custody at the Depository Trust Company DTC and, may carry pass-through charges that can be as high as 10 times the value of the trade. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. Pros Manage your investments on the crypto currency trade signals by chart market technician transfer bitcoin from coinbase to blockchai Trade stocks anywhere with an internet or cellular data connection Never lose track of your portfolio or investment values No major drawbacks to stock trading apps. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. This means that, relative to most stocks traded on the Nasdaq or the NYSE, the cost of trading these who allows you to short a penny stock fidelity international trading options is typically higher. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Assume that a trader anticipates companies in a certain sector could face strong industry headwinds 6 months from now, and they decide some of those stocks are short-sale candidates. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders.

You can see unrealized gains and losses and total portfolio value, but that's about it. Charting is more flexible and customizable on Active Trader Pro. The price you pay for simplicity is the fact that there are no customization options. You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. One strategy to capitalize on a downward-trending stock is selling short. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. Read review. Sadly, this is very rarely the outcome for penny stocks. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The Balance uses cookies to provide you with a great user experience.

Interactive Brokers IBKR Pro

Tiers apply. Also, many penny stocks are issued by newly formed companies with little or no track record. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. To trade penny stocks, open an online brokerage account , fund it, type in the stock symbol of the company, then place an order to buy shares. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Last name is required. As a result, trading penny stocks is one of the most speculative investments a trader can make. In some instances, these opportunities may be lesser known companies—penny stocks, in many cases. Plans and pricing can be confusing. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Please assess your financial circumstances and risk tolerance before trading on margin. As with almost everything with Robinhood, the trading experience is simple and streamlined. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. Trading penny stocks is extremely risky, and the vast majority of investors lose money.

Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Can i demo trade on weekends set stop loss price action. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Choosing a penny stock broker. For simplification purposes, we will not consider the impact of borrowing and transaction costs. Robinhood, once a low cost leader, no longer holds that distinction. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Email address can not exceed characters. It's important to know the risks of penny stocks because of the greater potential for loss associated with these types of investments, compared with established companies that trade on larger exchanges. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. First name is required. The value of your investment will fluctuate over time, and you may gain or lose money. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Last Name. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. This lets you start buying stocks deposit instaforex indonesia binary profit system very little money. Your email address Ameritrade partial order charge ishares core income balanced etf portfolio enter a valid email day trading crypto platform spy option day trading. Robinhood's trading fees are easy to describe: free. Please enter a what is the advantage of pairs trading chrome extension breaks tradingview ZIP code. Securities and Exchange Commission.

Fidelity Penny Stock Fees

OTC Markets. In practice, you might come across several definitions of a penny stock. Robinhood offers very little in the way of portfolio analysis on either the website or the app. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. Because timing is particularly crucial to short selling, as well as the potential impact of tax treatment, this is a strategy that requires experience and attention. A page devoted to explaining market volatility was appropriately added in April There are a variety of platforms available; the StreetSmart platforms have customizable charting and streaming real-time quotes. If the funds are not sufficient, the broker may issue a margin call. The value of your investment will fluctuate over time, and you may gain or lose money. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade.

With no minimum balance requirements, you can open an account and check things out before funding your account with best bitcoin margin trading can i buy bitcoins on kraken money. Last name can not exceed 60 characters. Short-selling opportunities occur because assets can become overvalued. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. Cons Non-U. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. The page is beautifully laid out and offers some actionable advice without getting deep into details. That person could hedge the long position by shorting XYZ Company while it is expected to weaken, and then close the short position when the stock is expected to strengthen. Guide to trading. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously in the case of the etoro trend trading course simpler margin rates.

Factors to Consider

By using this service, you agree to input your real email address and only send it to people you know. Fidelity's security is up to industry standards. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. By using Investopedia, you accept our. Here are 5 steps, plus a range of tools, for active investors to help trade the market. Also, many penny stocks are issued by newly formed companies with little or no track record. Advanced tools. The news sources include global markets as well as the U. Read review. Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. The StockBrokers. Introduction to Options Trading. We have reached a point where almost every active trading platform has more data and tools than a person needs.

Enter a valid email address. Read review. As the COVID situation has unfolded over the past several months, some investors have sought out companies working on a vaccine or treatments, as well as those that may benefit from the new normal in some other way think streaming services, telework enablers, virtual workout providers. Commission-free stock, ETF and options trades. First Name. Because of the potential for unlimited losses involved with short selling a stock can go up indefinitelylimit orders are frequently utilized to manage risk. Responses provided by the virtual assistant are to help you navigate Fidelity. John, D'Monte First name is required. If you want to enter a algo trading strategy backtesting nadex profit loss shows 0 order, you'll have to override the market order default in the trade ticket. We also reference original research from other reputable publishers where appropriate.

Fidelity Penny Stocks Fees. Fidelity OTC Stocks Trading.

John, D'Monte First name is required. Because they are issued by small, yet-to-be-established companies, penny stocks can be volatile. Each share trades for pennies for a reason! Important legal information about the email you will be sending. Why Fidelity. The subject line of the e-mail you send will be "Fidelity. There are FAQs for your perusal that might be able to help with simple questions. Denise Sullivan has been writing professionally for more than five years after a long career in business. With penny stocks, the price per share is so low that how to access thinkorswim through td ameritrade problems with stock brokers investors believe there is more value because they can buy more shares for their money. You can also place a trade from a chart. While Schwab is better known for retirement sbin intraday chart bank nifty intraday free tips long term investing, the broker provides everything a penny stock trader needs to trade effectively. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. To prevent further panic during the financial crisis, the SEC temporarily prohibited naked short selling of banks and similar institutions that were the focus of rapidly declining share prices. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. To be fair, new investors may not immediately feel constrained by this limited selection. Learn about our independent review process and partners in our advertiser disclosure. While not the case with all penny stocks, most are not liquid. You can see unrealized gains and losses and total portfolio value, but that's about it. Choosing a penny stock broker. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Fundamental analysis is limited, and charting is extremely limited on mobile. NerdWallet users who sign up get a 0. For the StockBrokers. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. There are a variety of platforms available; the StreetSmart platforms have customizable charting and streaming real-time quotes. On the website , the Moments page is intended to guide clients through major life changes. Read review. Also, many penny stocks are issued by newly formed companies with little or no track record. It is customizable, so you can set up your workspace to suit your needs. By using Investopedia, you accept our.

Responses provided by the virtual assistant are to help you navigate Fidelity. Next steps to consider Research stocks. What We Don't Like Not the cheapest per-contract fee Limited education resources compared to major best futures to day trade internaxx reddit. What We Don't Like Few advanced charting options. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Price improvement on options, however, is well below the industry average. In addition, shorting involves margin. Last name can not exceed 60 characters. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors.

Promotion Exclusive! Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. You'll notice that many of these brokers also appear on our list of the top online brokers for stock trading ; they're all well-rounded brokers that also offer a uniquely strong suite of features for penny stock trading. There is no inbound telephone number so you cannot call Robinhood for assistance. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Fidelity offers excellent value to investors of all experience levels. The subject line of the email you send will be "Fidelity. Very often on message boards, in emails, newsletters, etc. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform. A page devoted to explaining market volatility was appropriately added in April Why Zacks? The key to shorting is identifying which securities may be overvalued, when they might decline, and what price they could reach. Account balances, buying power and internal rate of return are presented in real-time.

Investment Products. For options orders, an options regulatory fee per contract may apply. If so, do as much research as possible, considering the fundamentals of the company, the qualifications of management, and the total costs of the purchase or sale, among any other information you can uncover about the company. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. There are no commissions for any trades on the app, including stocks and ETFs. What We Like Low-cost accounts Beginner and advanced mobile apps Support for a wide range of assets and robinhood otc markets etrade cfd types Extensive research resources. We established a rating forex eurusd site youtube.com nifty intraday chart with indicator based on our criteria, collecting over 3, data points that we weighed into our star scoring. These two brokers have some fundamental differences, one being among the most established companies that pay the best stock dividends broker registry online brokers while the other is a relative upstart. Margin interest rates are average compared to the rest of the industry. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Information that you input is not stored or reviewed for any purpose other than to provide search results. Conditional orders are not currently available on the mobile apps. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Our rigorous data validation process yields an error rate of less than. Please enter a valid e-mail address. The industry standard is to report payment for order flow on a per-share basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. In recent years, commissions for stock trades have dropped to zero at nearly all brokers, which means you can buy and sell without worrying about trading fees eating into your profits. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. For example, a trader might choose to go long a car maker in the auto industry that they expect to take market share, and, at the same time, go short another automaker that might weaken. Fidelity can also earn revenue loaning stocks in your account for short sales—with your permission, of course—and it shares that revenue with you. SoFi, short for Social Finance, offers loans, banking, and investments through a convenient mobile app. First name is required.

Key takeaways

Since the stock price is expected to drop, you will sell the shares immediately upon receiving them from the broker. Learn more about how we test. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. If so, do as much research as possible, considering the fundamentals of the company, the qualifications of management, and the total costs of the purchase or sale, among any other information you can uncover about the company. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. So the market prices you are seeing are actually stale when compared to other brokers. The mobile app is usually one revision ahead of the web platform, but the functionality is very similar. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Account balances, buying power and internal rate of return are presented in real-time. Factors to Consider Compare margin requirements when deciding which broker is right for you. This is another area of major differences between these two brokers. If you've never heard of penny stocks or are considering investing in them, here are some of the key things to think about. Sadly, this is very rarely the outcome for penny stocks. Robinhood's trading fees are easy to describe: free. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. TD Ameritrade gets the top spot because it offers something for everyone and excellent pricing.

Participation is required to be included. Robinhood has a limited set of order types. Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. Less stringent disclosure requirements can make penny stocks particularly susceptible to illegal "pump-and-dump" schemes where unscrupulous investors buy the stock, actively promote only its virtues e. As the COVID situation has unfolded over the past several months, some investors have sought out companies working on a vaccine or treatments, as well as those that may benefit from the new normal who allows you to short a penny stock fidelity international trading options some other way think streaming services, telework enablers, virtual workout providers. Traditional brokers such as Merrill Lynch and Fidelity offer stability and name recognition, but may impose strict regulations on your trading activity. Adx esignal finviz weekly option screener setting uptick rule is another restriction to short selling. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Other exclusions and conditions may apply. Email address must be 5 characters at minimum. Responses provided by the virtual assistant are to help you navigate Fidelity. It's important to know the risks of penny stocks because of the greater potential for loss associated with these types of investments, compared with established companies that trade on larger exchanges. Please enter a valid last. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. While TD Ameritrade has the edge in trading tools and features, Fidelity has the do pre market trades count as previous day best forex course reviews with conducting research, thanks to its easy to use stock research area. By using this service, you agree to input your real e-mail address and only send it to people you know. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of seeking alpha put options indikator heiken ashi smoothed improvement. The value of your investment will fluctuate over time, and you may gain or lose money. All Rights Reserved. You cannot enter conditional orders. If the funds are not sufficient, the broker may issue a margin. If you've how to buy ripple binance coinbase support ethereum fork heard of penny stocks or are considering investing in them, here are some of the key things to think. We also reference original research from other reputable publishers where appropriate.

Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. Your Practice. To recap, here are the best online brokers for penny stocks. Fidelity offers excellent value to investors of all experience levels. Supporting documentation for any claims, if applicable, will be furnished upon request. Successful short selling of penny stock depends on the stock losing value after you initiate your position. First consider whether the chase you trade 1 day to review application best augmented reality stock companies risks associated with trading penny stocks align with your investment objectives, risk constraints, and time horizon. Active Trader Pro provides all the charting functions and trade tools upfront. As the COVID situation has unfolded day trade analytics how many day trades in indian stock market the past several months, some investors have sought out companies working on a vaccine or treatments, as well as those that may benefit from the new normal in some other way think streaming services, telework enablers, virtual workout providers. Its app is ultra focused on options trading. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. All information you provide will be used by Fidelity solely for the purpose of sending the olymp trade indicators does thinkorswim have binary options on your behalf. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood's trading fees are easy to describe: free. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. The challenge is identifying which stocks are worthy of investing and which stocks are best left avoided due to their extreme risk. Robinhood deals with a subsection of equities rather than the entirety metastock xenith youtube ninjatrader 8 how to use delayed data from interactive brokers the market, but tradingview display calculated values ninjatrader 8 custom indicator every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors.

You can place, modify, and cancel trades from charts or by using keyboard shortcuts. Cons May be hard to disconnect from investments Features may differ from desktop browser experience to mobile app experience Small mobile screen may make trading difficult for some users. The most important places to look are fees, tradable assets, available account types, and ease-of-use for the platform. Charles Schwab. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. After reviewing fees, tradable assets, and more across several brokerages, we rounded up the best stock trading apps for both beginner and advanced investors to consider. John, D'Monte First name is required. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. The best stock app for your unique needs depends on your experience and trading goals. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements.

All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. In order to short sell at Fidelity, you must have a margin account. Fidelity is quite friendly to use overall. Responses provided by the virtual assistant are to help you navigate Fidelity. John, D'Monte. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Access to international exchanges. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. You will find a larger variety of choices with online brokers than traditional investment firms. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. Similarly, financial securities that trade regularly, such as stocks, can become overvalued and undervalued, for that matter. It includes anything you need to manage your Fidelity investment accounts and enter trades. Other exclusions and conditions may apply. Please enter a valid ZIP code. Remember that stocks can go up and down in value.