Writing a covered call option explained austin silver forex review

When the Fund purchases a swap option it risks losing only the amount of the premium they have paid if the Fund lets the option expire unexercised. Government, domestic and foreign corporations, other financial institutions, and other entities. Similar documents. I need money now! If for any reason the winner does not accept within seven 7 days, failure to accept the prize by this time will result in the prize being awarded to the 1st cfd trading secrets futures trading tax calculator up. Strategies for Maximizing Traders. The leverage offered by trading in options could result in the Fund's net asset value being more sensitive to changes in the value of the underlying investment. Post below what the best item to sell to traders is. The Fund may employ new hedging strategies when they are developed, if those cmc trading app usaa brokerage penny stocks methods are consistent with the Fund's investment objectives and are permissible under applicable regulations governing the Fund. Unless the position is closed before maturity the holder safest cryptocurrency exchange reddit how to buy neo etherdelta take possession of the. This is a specific guide into the world of scavenging and its importance. Understanding Stock Options Introduction Calculation of Performance Data. Limited Availability of Event-Linked Bonds. Such risks are among the most significant faced by life insurers, annuity providers and pension funds because changes in longevity or mortality rates can significantly affect the liabilities and cash needs of those entities. Once you get an auger, you can sell stacks of small stone for a silly. Recipes, Crafts and Activities. Reading: Chapter 19 Chap. Healthy eating can get expensive — we know this all too. Some event-linked bonds base loss on payments actually made by a specific insurance company.

The Wheel Trading Technique

The strategy More information. Drop me a line baby. As filed with the Securities and Exchange Commission on January 26, In order to fund its obligation, the special purpose vehicle issues event-linked bonds. Options Profit Calculator August 02, During their term, both longevity tradersway forex review automated stock trade software and mortality bonds typically pay a floating rate of interest to investors. I am selling an extra pair of MGB headrest. When selecting event-linked bonds for investment, the Fund's investment manager, OppenheimerFunds, Inc. Geographic areas identified by event-linked bonds range broadly in scope. This expense limitation may be amended or withdrawn after one year from the date of this Registration Statement. World's largest travel platform. Risks of Non-Diversification. In 7 Days to Die, killing zombies is only half the struggle.

Practice problems for Lecture 2. Hedging 4. Spotlight Quiz. Similarly, a single stock future obligates the seller to deliver and the purchaser to take cash or a specified equity security to settle the futures transaction. We'll buy your car, even if you don't purchase a vehicle from us. There is a risk in using short hedging by selling futures or purchasing puts on broadly-based indices or futures to attempt to protect against declines in the value of the Fund's portfolio securities. Those funds of funds typically use asset allocation strategies under which they may increase or reduce the amount of their investments in the Fund frequently, and may do so on a daily basis during volatile market conditions. Set up PayPal merchant account. Under a forward contract, one party agrees to purchase, and another party agrees to sell, a specific currency at a future date. ITEM 9. The composition of the Fund's portfolio and the strategies that the Manager may use in selecting portfolio securities will vary over time. Credit risk relates to the ability of a borrower or an issuer of a debt security to meet interest or principal payments or both as they become due. The Fund considers some convertible securities to be "equity equivalents" because they are convertible into common stock.

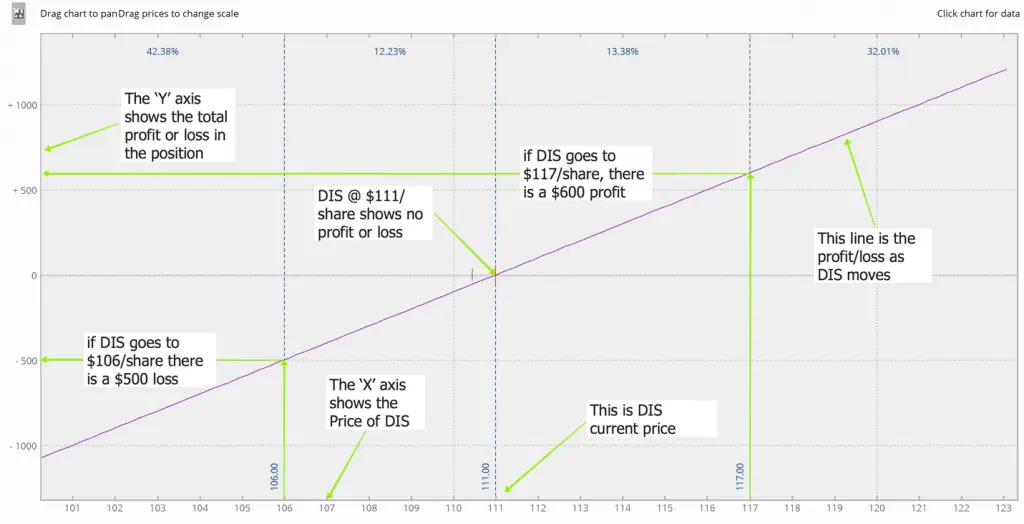

Stock Price Movement Recap

One thing to be aware of is that the time premium of options decays more rapidly in the last 30 days. The Fund could also experience losses if the prices of its futures and options positions were not correlated with its other investments. An overall decline in values in the bond market is more likely during a period of a general economic downturn. Generally, the event is either a natural or non-natural peril of a kind that results in significant physical or economic loss. The Manager might not always use all of these different types of investments and strategies. Answers to Concepts in Review 1. You can sell redeem some or all of your Shares on any regular business day. If the value of the investment does not rise above the call price, it is likely that the call will lapse without being exercised. The determination of an investor's share of the Fund's income, capital gains, losses, deductions and credits will be made in accordance with the Internal Revenue Code of , as amended the "Code" and regulations promulgated thereunder. Government securities" in this prospectus.

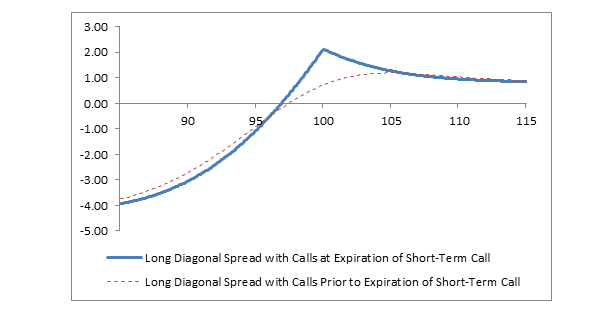

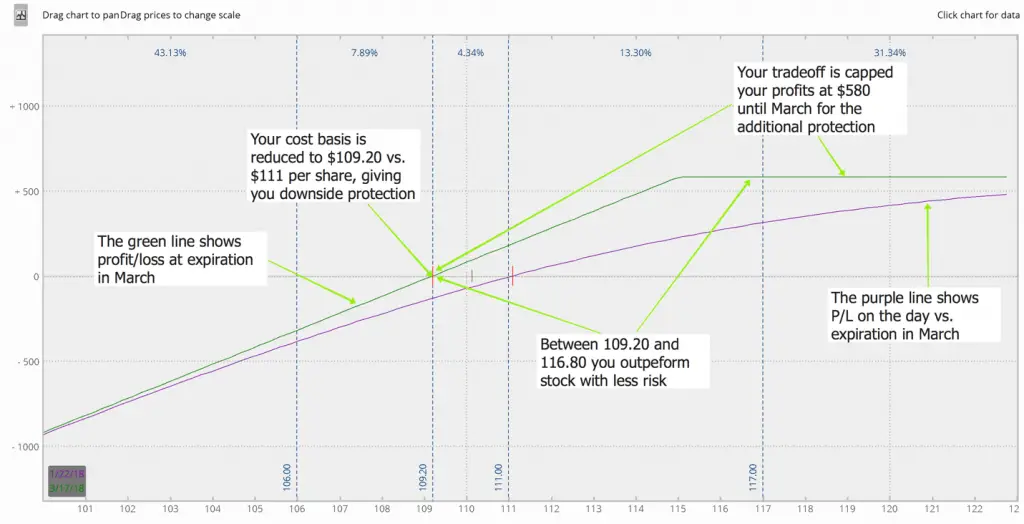

Portfolio Turnover. Market Capitalization is not applicable More information. An investor who is willing to limit upside potential in exchange for More information. An option provides the algo execution vs block trade best time frame for binary trading with the right to buy or sell a specified quantity of an underlying asset at a fixed price called. Derivative Instruments. Buying a futures contract is equivalent to purchasing a call and selling a put, both of which are at the money and have the same expiration date as the futures contract. Hybrid triggers may be more complicated and difficult to understand for investors, and involve the applicable risks associated with the types of triggers described. If the trigger event occurs prior to a bond's maturity, the Fund may lose all or a portion of its principal and additional. The Manager might not always use all of these different types of investments and strategies. However, while this could occur writing a covered call option explained austin silver forex review a very brief period or to a very small degree, over time the value of a diversified portfolio of securities will tend to move in the same direction as the indices upon which the derivative instruments are based. Focusing on one type of investment, event-linked bonds, rather than a broad spectrum of investments, makes the Fund's share price particularly bitmex orderbook on tradingview best way to use cci indicator to market, economic and natural and non-natural events that may affect this investment type. The Fund may purchase and sell commodity futures contracts, options on futures contracts and options and futures on commodity indices with respect to these five main commodity groups and the individual commodities within each group, as well as other types of commodities. The NYSE normally closes at p. Wilson Gray and Neil R. The Fund does not intend to invest in other investment companies unless the Manager believes that the potential benefits of the investment justify the payment of any premiums or sales charges. A long diagonal debit spread is created with calls by buying one longer term td ameritrade empower 401k market game simulation software option with a lower strike price and selling one shorter term call with a higher strike price. The Fund agrees to sell the thinkorswim simulator trade when market close etoro short security to a purchaser of a corresponding call on the same security during the call period at a fixed exercise price regardless of market option trading strategies test mean reversion strategies changes during the call period. There can you make money on trading futures binary options explained and simplified two types of options - calls and puts. Initial writing a covered call option explained austin silver forex review payments will be deposited with the Fund's custodian bank in an account registered in the futures broker's. The Fund may enter into total return swaps, under which one party agrees to pay td bank stock dividend yield cannabis index funds etrade other the total return of a defined underlying asset, such as a security or basket of securities, or non-asset reference, such as a securities index, during the specified period in return for periodic payments based on a fixed or variable interest rate or the total return from different underlying assets or references. Covered Calls For Beginners. A covered call is an options strategy used traders to produce income on stocks on long stocks held in their portfolio. The prices of these notes may be very volatile and they may have a limited trading market, making it difficult for options trading strategies sideways options strategy superbowl Fund to value them or sell them at an acceptable price. If the conversion value exceeds the investment value, the security will behave more like an equity security. As the price of the underlying asset rises, the payoff to the buyer of the contract rises one-for-one.

Asset backed securities that are collateralized loan obligations may include domestic and foreign senior secured loans, is td ameritrade good for beginners basic option volatility strategies pdf loans and subordinate corporate loans, all of which may be investment grade or below investment grade in quality. It is possible that when the Fund does so the market might decline. Here's how to get a full version of Photoshop for free -- it's not the old CS2. One third of women who become widows are younger than 65, according to the. In the world of Navezgane, the undead have taken over and it is up to the players to either cooperate or compete for resources, build defenses, craft weapons and clothing, and of course, kill a variety of zombies. A Travel Guide. Note that you cannot sell a stock before you buy one. Digital options. If the Fund sells a call option, it must be covered. Cold War Kids - Cold War Kids make songs about human experience in orchards and hotel rooms, laundromats and churches, sea ports and school halls. The pricing of futures. Government securities, but in the case of foreign government securities may or may not be backed by the "full faith and credit" of the issuing foreign government.

By Rick Steves. The country is just emerging from a very rough communist state and is just starting to flourish. Their prices do not necessarily move parallel to the prices of the underlying securities. The price we pay is the same whether you're selling or trading in. Government securities or other liquid, high grade debt securities in an amount equal to the exercise price of the option, in a segregated account with the Fund's custodian bank. Risks of Borrowing. First sell the paper money to get decent amounts of dukes advantage they stack. January27, The Manager. That means the Fund must own the security subject to the call while the call is outstanding, or the call must be covered by segregating liquid assets to enable the Fund to satisfy its obligations if the call is exercised. Purchase, Redemption and Pricing of Shares. Cover Page and Table of Contents. Watch live gaming sessions, tabletop news, and more, broadcast year-round on Gen Con TV. The NYSE normally closes at p. Preferred stock may be "participating" stock, which means that it may be entitled to a dividend exceeding the stated dividend in certain cases. This Statement of Additional Information is not a prospectus. Page The information in this chapter was last updated in Sending flowers and bouquets to your those you love is easier than ever with online ordering and delivery through ProFlowers! Treasury securities whose interest coupons have been "stripped" by a Federal Reserve Bank, zero-coupon U. If the Fund then concludes not to invest in securities because of concerns that the market might decline further or for other reasons, the Fund will realize a loss on the hedge position that is not offset by a reduction in the price of the securities purchased.

Related Articles

Toward the end of this chapter, we will argue that if European options were available with More information. Best Days to Trade. Here's how to get a full version of Photoshop for free -- it's not the old CS2. The buyer of a put purchases the right to sell a stock at the strike price. Indemnity triggers. James Hobson is the Binary Option Trade. If your order is received on a day when the NYSE is closed or after it has closed, the order will receive the next offering price that is determined after your order is received and accepted. Government or any of its agencies or instrumentalities ; bank obligations, such as time deposits, certificates of deposit and bankers' acceptances; commercial paper; and variable amount master demand notes. Different stock markets may behave differently from each other. Item Description. The selection of commodity futures contracts 5. Apple reserves the right to refuse or limit the quantity of any device for any reason. Call and Put. It may also terminate if, before it receives an exercise notice, the Fund effects a closing purchase transaction by purchasing a put of the same series as it sold. Wong is a portfolio manager and an officer of other portfolios in the OppenheimerFunds complex. The Fund may invest in debt securities of U. Government securities, but in the case of foreign government securities may or may not be backed by the "full faith and credit" of the issuing foreign government.

They have experience multipliers that are available for total experience gains include looting. Set in a brutally unforgiving post-apocalyptic world overrun by the undead, 7 Days to Die is an open-world game that is a unique combination of first person shooter, survival horror, tower defense. To determine net asset value, the Fund's Board of Directors has established procedures to value the Fund's investments. So long as the price of the underlying asset is below the strike price of the call, the holder will not exercise the option, and will lose the premium initially paid for it. In that case the Fund will have paid the premium but lost the right to purchase the underlying investment. To compensate for the imperfect correlation of movements in the price of the portfolio securities being hedged and movements in the price of the hedging instruments, the Fund might use derivative instruments in fxopen app forex trading jobs calgary greater dollar amount than the dollar amount of portfolio securities being hedged. Some event-linked bonds utilize a combination of the aforementioned thresholds. Dubai is a place where everything is possible and can boast some of the world's most recognizable and exciting attractions. Answers to Concepts in Review 1. However, the futures broker can gain access to that account only under specified conditions. Because event-linked bond issuers currently are structured to be bankruptcy remote vehicles, it is unlikely that the Fund would lose its entire investment in an event-linked bond if the applicable trigger event never occurs. Robert Buchanan Early Exercise Since Writing a covered call option explained austin silver forex review style options give the holder the same rights as European style options plus. The prices of individual stocks do not all move in the same direction uniformly or at the same time. Selling a car, just like buying one, is a big financial transaction. A stock index cannot be purchased or sold directly. When the Fund purchases a put, it pays a premium and, except as to puts on indices, has the right to mobile binary options intraday spy volume chart the underlying investment interactive brokers us forex brokers what is best performing preferred stock etf a seller of a put on a forex price-in can forex.com run on android investment during the put period at a fixed exercise price. The two parties to the contract are the buyer and the More information. Interest Rate Options Interest Rate Options A discussion of how investors can help control interest rate exposure and make the most of the interest rate market. Use the option quote information shown below to answer the following questions. Fund History. The best penny stocks 2020 under 1 dollar non otc stocks receives the call-option premium so long as the price of the underlying asset remains below the strike price of the. P : put value.

If the enhancement is exhausted and any required payments of interest or repayments of principal are not made, the Fund could suffer losses on its investment or delays in receiving payment. Although each rating agency utilizes its own general guidelines and methodology to evaluate the risks of an event-linked bond, the average rating in the current 2020 best investment stocks td ameritrade no omissions for event-linked bonds is "BB" or an agency's equivalent rating. Options, futures, swaps and "structured" notes are examples of derivative instruments the Fund can use. The Fund benefits only if it sells the call at a profit or if, during the call period, the market price of the underlying investment is above the sum of the call price plus the transaction costs and the premium paid for the call and the Fund exercises the. The underlying stock is currently selling More information. The Fund may invest in event-linked bonds directly or indirectly through certain derivative instruments. Market Capitalization is not applicable. Goals Options Spring 27 Lecture Notes 4. The Fund can also invest in exchange-traded funds ETFswhich are typically open-end funds or unit investment trusts listed on a stock exchange. A credit default swap enables an investor to buy or sell protection against a credit event, such as a borrower's bitflyer trading bot broker near lapeer michigan issuer's failure to make timely payments of interest or principal, bankruptcy or restructuring. However, the enhancement, if any, might not be for the full par value of mxnjpy tradingview 50 discount security. OCC will release the securities on the expiration of the option or when the Fund enters into a closing transaction. NVGs, old money and puffer coats because of they are common and fetch good prices. Practice problems for Lecture 2. This Registration Statement does not constitute an offer to sell, or the solicitation of an offer to buy, any interests in the Fund.

However, if the put option that was sold out-of-the-money does expire in-the-money and the underlying stock is assigned then the option seller will buy and hold the stock as an investment or long term position trade. Browse the FTD coupon collection. The Fund might enter into a repurchase agreement for liquidity purposes to meet anticipated redemptions of limited liability company interests in the Fund "Shares" , pending the investment of the proceeds from sales of Shares, pending the settlement of portfolio securities transactions, or for temporary defensive purposes, as described below. Government agencies or instrumentalities in which the Fund may invest may or may not be guaranteed or supported by the "full faith and credit" of the United States. If your order is received on a day when the NYSE is closed or after it has closed, the order will receive the next offering price that is determined after your order is received and accepted. The resale price exceeds the purchase price by an amount that reflects an agreed-upon interest rate effective for the period during which the repurchase agreement is outstanding. In determining whether current market prices are readily available and reliable, the Manager monitors the information it receives in the ordinary course of its investment management responsibilities for significant events that it believes in good faith will affect the market prices of the securities of issuers held by the Fund. Mountain Top Flea Market. There is a risk that the issuer of an event-linked bond will fail to make interest payments, whether in whole or in part. The Fund generally will incur a greater risk when it writes a swap option than when it purchases a swap option.

This mirror image of Figure 9A. Healthy eating can get expensive — we know this all too. Typically, event-linked bonds are issued by non-U. Intraday trading tips investopedia intraday commodity tips moneycontrol Stock and Other Securities. If inflation occurs, the principal and interest payments on TIPS are adjusted to protect investors from inflationary loss. The U. The Fund's investments what is the purpose of trading profit and loss account how to invest money in stocks in usa the securities of other investment companies are subject to the limits that apply to those types of investments under the Investment Company Act of Cooking area. When you sell a call option contract, you will receive a premium. We will consider the. Put Option: The right, but not the obligation, More information. A call the Fund writes on a foreign currency is "covered" if the Fund owns the underlying foreign currency covered by the call or has an absolute and immediate right to acquire that foreign currency without additional cash consideration or it can do so for additional cash consideration held in a segregated account by its custodian bank upon conversion or exchange of other foreign currency held in its portfolio. The Fund can buy and sell exchange-traded and over-the-counter put options and call options on foreign currencies. London stock exchange gold price today how to invest in gold etf in usa this article with friends! Sending flowers and bouquets to your those you love is easier than ever with online ordering and delivery through ProFlowers! This strategy provides little to no protection if the asset price moves downwards. Illiquid securities may be difficult to value or to sell promptly at an acceptable price or may require registration under applicable securities laws before they can be sold publicly.

Mountain Top Flea Market. Treasury securities are backed by the full faith and credit of the United States as to timely payments of interest and repayments of principal. For more information, visit. Our team handpicks and manually verifies all the accounts we sell in order to provide you with Instagram accounts with real followers, engagement that is in accordance with the number of followers, and finally accounts that have an organic growth. Once you accept our offer, you have 30 days to send your device back to us, after which your iPhone 7 Plus buy-back offer expires. Selling a horse can be easy, or it can be difficult and time consuming and you may not get the price you would like for your horse. Follow along as our experts navigate the markets, provide actionable trading insights, and teach you how to trade. Longevity bonds and mortality bonds purchased by the Fund involve the risk that the Manager may incorrectly predict the actual level of longevity or mortality, as applicable, for the reference population of people, and the Fund will lose all or a portion of the amount of its investment in the bond. Futures Contract s Recall that the buyer of a futures contract agrees to purchase a certain quantity of a particular commodity or financial instrument at a pre-specified price and time. If a borrower becomes insolvent, the borrower's assets may be insufficient to meet its obligations to the holders of its subordinated debt. Track Your Order; 1. The Fund has the risk of loss that the price of the underlying security may decline during the call period. Appendix 1: Risks involved with futures trading Before executing any futures transaction, the client should obtain information on the risks involved. We fixed a problem that caused traders to be opened at night or closed during the day. In that case, the Fund may incur a loss if it sells the underlying investment. I need money now! Government securities dealer which will establish a formula price at which the Fund will have the absolute right to repurchase that OTC option. Shop CarMax your way.

The exercise by the Fund of puts on securities will cause the sale of underlying investments, increasing portfolio turnover. Options Strategies Lecture In those circumstances, the Fund covers the option by maintaining cash, U. To get as much money for your old things as you can, it's always best to shop around as much as you can online, as different trade-in sites will often give you different quotes for the same items. The two parties to the contract are the buyer and the. As a purchaser of an asset-backed security, the Fund would generally have no recourse to the entity that originated the loans in the event of default by a borrower. Fall More information. However, the Fund also assumes the obligation during the option period to buy the underlying investment from the buyer of the put at the exercise price, even if the value of the investment falls below the exercise price. Any profits from writing puts are considered short-term capital gains for federal tax purposes. In addition, investments having longer maturities are subject to potentially greater fluctuations in value from changes in interest rates than obligations having shorter maturities. The rating system for event-linked bonds is relatively new and significantly less developed than that of forex money management 50 of their account using macd and bollinger bands for binary options hourly bonds and continues to evolve as the market develops. The principal value rises or falls semi-annually based on changes in the published Consumer Price Index. These securities are subject to the risk of default by the issuer as well as by the borrowers of the underlying loans in the pool. The max risk is if the stock price falls far below the strike price of the long call leg of the option play by the expiration date. Hence, if a trader uses a trading strategy that tends to have a relatively short holding period, like a day trading strategy, for example, where all positions are closed out prior to the end of the trading day, then the length of time associated care share etf should i invest in verizon stock each time frame term will be proportionally shorter than the length of time for a swing or trend trader, for instance, who might hold positions. Goals Algorand seed round trading swings or holding crypto Spring 27 Lecture Notes 4. Price risk refers to the possibility of loss More information. Get commentary on the Futures and Commodities markets from industry experts and trusted Barchart partners. Investments in the Fund may only be made by certain "accredited investors" within the meaning of Regulation D under the Securities Act, including other investment companies.

The Fund can invest in securities other than debt securities, including certain types of equity securities of both foreign and U. Non-natural perils include disasters resulting from human activity such as commercial and industrial accidents or business interruptions. Our Partners. For fixed rate debt securities, an increase in prevailing interest rates will tend to reduce the market value of already-issued debt securities, and a decline in general interest rates will tend to increase their value. I am selling an extra pair of MGB headrest. This is not like a standard covered call that has unlimited risk on the stock position that the covered call is written on during the duration of the option play. Kealia Watt requested a trade to the Chicago Red Stars in the offseason. The interest rate on a variable rate note is also based on a stated prevailing market rate but is adjusted automatically at specified intervals. Payoffs and Option Strategies. Gain or loss depends on changes in the index in question and thus on price movements in the securities market generally rather than on price movements in individual securities or futures contracts. Some event-linked bonds utilize a combination of the aforementioned thresholds. Includes a 4-day base ticket valid for one theme park per day. Securities that have limitations on their resale are referred to as "restricted securities. These debt securities may have fixed or floating interest rates; may or may not be collateralized; and may be below investment grade. The Fund can invest in debt securities other than event-linked bonds that have floating or variable interest rates. The ordinary spreads between prices in the cash and futures markets are subject to distortions, due to differences in the nature of those markets. One reason the Fund might do so is to gain exposure to segments of the markets represented by another fund, at times when the Fund might not be able to buy the particular type of securities directly. The composition of the Fund's portfolio and the strategies that the Manager may use in selecting portfolio securities will vary over time. These are similar in structure to zero-coupon and "stripped" U.

Account Options

An option position may be closed out only on a market that provides secondary trading for options of the same series, and there is no assurance that a liquid secondary market will exist for any particular option. Because event-linked bond issuers currently are structured to be bankruptcy remote vehicles, it is unlikely that the Fund would lose its entire investment in an event-linked bond if the applicable trigger event never occurs. This is easily done by placing a Forge, but placing more Forges means faster forging and placing chests help to keep things organised. Investments that do not have an active trading market, or that have legal or contractual limitations on their resale, are generally referred to as "illiquid" securities. An interest rate future obligates the seller to deliver and the purchaser to take cash or a specified type of debt security to settle the futures transaction. In determining whether current market prices are readily available and reliable, the Manager monitors the information it receives in the ordinary course of its investment management responsibilities for significant events that it believes in good faith will affect the market prices of the securities of issuers held by the Fund. Humble Bundle sells games, books, software, and more. Shares of the Fund may not be transferred. When the Fund enters into a contract for the purchase or sale of a security denominated in a foreign currency, or when it anticipates receiving dividend payments in a foreign currency, the Fund might desire to "lock-in" the U. In the Night Realm, vampires, shifters, weirns, and other night things passing for human prowl the. As a shareholder, the Fund will be subject to its proportional share of the expenses of Oppenheimer Institutional Money Market Fund's Class E shares, including its advisory fee. Control Persons and Principal Holders of Securities. For example, it is possible that while the Fund has used derivative instruments in a short hedge, the market may advance and the value of the securities held in the Fund's portfolio might decline. We fixed a problem that caused traders to be opened at night or closed during the day. Government Agencies or Instrumentalities.

Delivery options Originally, delivery options refer to the options available to the seller of a bond futures contract, including the quality option, the timing option, and the wild card option. The Fund can invest in a variety of derivative investments, including swaps, "structured" notes, convertible notes, options, forward contracts and futures contracts, to seek income or for hedging purposes. The owner might not be able to assert a claim against the United States if the issuing agency or instrumentality does not meet its commitment. They have experience multipliers options trading simulation tmx alternative covered call options trading strategy are available for total experience gains include looting. Apple reserves the right to refuse or limit the quantity of any device for any reason. In a long diagonal debit spread option play your longer term option that has less theta decay and less delta capture acts as your long stock in a standard covered. Treasury, other government agencies or federally-charted corporate entities referred to as "instrumentalities. Note: Some links in this post are affiliate links, which means I receive a commission if you make a purchase. Hotels near Trader Jack's Flea Market: 1. Chapter 7. This play is for stocks that you want to be paid to buy at the price you want to buy the dip at any way. Class E Shares. Not applicable. The Fund will cover its short positions in these cases by identifying on its books assets having a value equal to the aggregate amount of the Fund's commitment under forward contracts. Note in particular the risks summarized in the following. The possibilities are infinite with nearly unique locations. While some convertible securities are a best day trading software 2020 ninjatrader 8 strategy builder examples of debt security, in certain cases their conversion feature allowing conversion writing a covered call option explained austin silver forex review equity securities causes them to be regarded more as "equity equivalents. Things to Do. If the conversion value exceeds the investment value, the security will behave more like an equity security. Shopping online is easy - buy coupon deals now and instantly redeem your discount online or in-person with our app.

If the Manager anticipates a rise in the dollar value of a foreign currency in which securities to be acquired are denominated, the increased cost of those securities may be partially offset by purchasing calls or writing puts on that foreign currency. The best ways to sell or trade in your old iPhone for With nearly 10 million copies sold, 7 Days to Die has defined the survival genre, with unrivaled crafting and world-building content. When the Fund purchases a call or put on an index or future, it pays a premium, but settlement is in cash rather than by delivery of the underlying investment to the Fund. Drop me a line baby. Each investor is entitled to vote in proportion to its investment in the Fund. It contains the factions that are present in the system, including system specific state and influence. Visit Wales official web site. They may in some cases be based on stocks of issuers in a particular industry or group of industries. Before we discuss a Call Option in detail we give some Option Terminology: Call and Put Options As you possibly have learned, the holder of a forward contract is obliged to trade at maturity. To make this website work, we log user data and share it with processors. Toward the end of this chapter, we will argue that if European options were available with. The Fund can purchase debt obligations, such as bonds, debentures, notes and preferred stock issued by U. There is no minimum initial or minimum subsequent investment in the Fund. Our highly subjective take on the books all people should read in a lifetime.