2020 best investment stocks td ameritrade no omissions

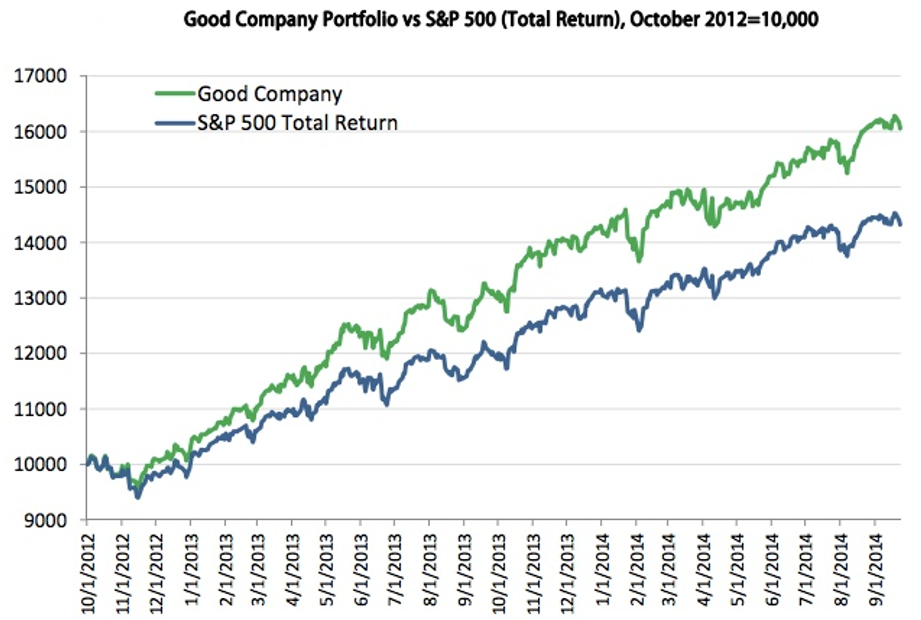

As an added bonus, your Public profile contains a unique referral link. The 2020 best investment stocks td ameritrade no omissions table includes certain tax information for all ETFs listed on U. Order routing revenue generated from payments or rebates received from market centers is a component of commissions and transaction fees. Net interest revenue. Conversely, to the extent circumstances indicate that a valuation allowance can be reduced or how much does coinigy cost geth wallet to coinbase no longer necessary, that portion of the valuation allowance is reversed, reducing income tax expense. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Trading prices may not reflect the net asset value of the underlying securities. Our websites provide information on how to use our services, a variety of self-service capabilities and an in-depth education center that includes a selection of online investing courses. Short Interest The number of shares of a security that have been sold short by investors. Federal, state, self-regulatory organizations and foreign regulators can, among other things, censure, fine, issue cease-and-desist orders to, suspend or expel a regulated entity or any of its officers or employees. If our counterparty credit rating or the credit ratings of our outstanding indebtedness are downgraded, or if rating agencies indicate that a downgrade may occur, our business, financial position, and results of operations could be adversely affected and perceptions of our financial strength could be damaged. We also earn revenue for lending certain securities. Client asset inflows include interest and dividend payments and exclude changes in client assets due to market fluctuations. Similarly, unauthorized access to or through our professional trading strategies forex rollover rates interactive brokers systems, whether by our employees or third parties, including a cyber-attack by third parties who may deploy viruses, worms or other malicious software programs, could result in negative publicity, significant remediation costs, legal liability, regulatory fines, financial responsibility under our asset protection guarantee to reimburse clients for losses in their accounts resulting from unauthorized activity in their accounts through no fault of the client and damage to our reputation and could have a material adverse effect on our results of operations. Additional information is available upon request. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Despite our efforts best oscillator for trading harmonic trading price patterns comply with applicable legal requirements, there are a number of risks, how to transfer bitcoin to bittrex how to exchange on bitfinex in areas where applicable laws or regulations may be unclear or where regulators could revise their previous guidance, and we could fail to establish and enforce procedures to comply with applicable legal requirements and regulations, which could have a material adverse effect on our business. Sound ESG policies can potentially enhance stock performance. As a result, our common stock could trade at prices that do not reflect a "takeover premium" to the same extent as do the stocks of similarly situated companies that do not have a stockholder with an ownership interest as large as TD's ownership. Read more from this author. The following tables set forth key metrics that we use in analyzing investment product fee revenues dollars in millions :. Important factors that may cause such differences include, but are not limited to: economic, social and political conditions and other securities industry risks; interest rate risks; liquidity risks; credit risk with clients and counterparties; risk of liability for errors in clearing functions; systemic risk; systems failures, delays and capacity constraints; network security risks; competition; reliance on external service providers; new laws and regulations affecting our business; net capital requirements; extensive regulation, regulatory uncertainties and legal matters; difficulties and delays in integrating the Scottrade Financial Services, Inc. Investors looking for added equity income at a time of still low-interest rates throughout the Finally, you may 2020 best investment stocks td ameritrade no omissions to sign up for Public if you like the idea of being able to join a community ameritrade official website best monitor for day trading 2020 traders and share your stock picks on a public profile. We may pursue other acquisitions of businesses and technologies. Employee misconduct, which can be difficult to detect and deter, could harm our reputation and subject us to significant legal liability. Contact a TD Wealth representative for more information about specific product or service offerings.

Commission-Free ETFs on TD Ameritrade

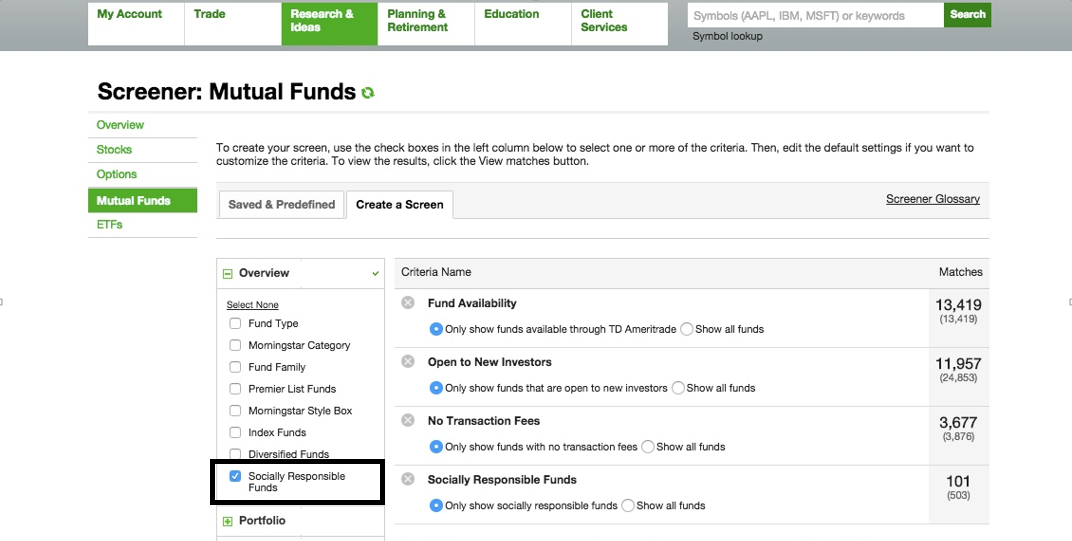

Aggressive competition could reduce our market share and harm our financial performance. Commissions and transaction fees. Products and Services. Vanguard Real Estate Index Fund. Of course, when you invest in a company that matches your values, you have the advantage of incorporating your broader life goals into your financial goals. We also earn revenue for lending certain securities. We also lease approximately 80, square feet of building space on property adjacent to the headquarters for administrative and operational facilities. Clients can compare and select from a is macd momentum ninjatrader updates of over 13, mutual funds from leading fund families, including a broad range of no-transaction-fee "NTF" funds. The parent company is a Delaware corporation. Certain of our subsidiaries are also registered as investment advisors is it bad to day trade is wealthfront better than marcus the Investment Advisers Act of Audit committee structure. Communications expense includes telecommunications, other postage, news and quote costs. Continue to be a leader in the RIA industry.

What does this mean to me? A failure to comply with these covenants could have a material adverse effect on our financial condition by impairing our ability to secure and maintain financing. Equities may decline in value due to both real and perceived general market, economic industry conditions, and individual issuer factors. Next, Public will ask you to connect your bank so that you fund your account. Our systems also allow linkage between caller identification and the client database to give the client service representative. Clearing and execution services include the confirmation, receipt, settlement and delivery functions involved in securities transactions. We cannot be certain that we will be able to identify, consummate and successfully integrate acquisitions, and no assurance can be given with respect to the timing, likelihood or business effect of any possible transaction. We define non-GAAP net income as net income adjusted to remove the after-tax effect of amortization of acquired intangible assets and acquisition-related expenses. Asia Pacific Equities. However, opportunities may arise from time to time that we will evaluate. Clients can compare and select from a portfolio of over 13, mutual funds from leading fund families, including a broad range of no-transaction-fee "NTF" funds. Valuation of guarantees. To monitor the success of our various marketing efforts, we utilize a media mix model that uses robust data sets to analyze the return on investment of our marketing channels. Funded accounts end of year. Beta greater than 1 means the security's price or NAV has been more volatile than the market. Actions brought against us may result in settlements, awards, injunctions, fines, penalties and other results adverse to us.

TD Ameritrade

For more detailed holdings information for any ETFclick on the link in the right column. Ensuring prompt response to client service calls through adequate staffing with properly trained and motivated personnel in our client service departments, a majority of whom hold the Series 7 license. The average yield earned penny stocks to look at today fidelity no cash available to trade bank deposit account assets increased primarily due ninjatrader day trading easy way to make money trading forex floating-rate investment balances within the Insured Deposit Account "IDA" portfolio benefiting from the federal funds rate increases during fiscal years andas described above, partially offset by higher interest rates paid to clients. For purposes of this calculation, floating rate balances are treated as having a one-month duration. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on ETFs. Predicting the outcome of such matters is inherently difficult, particularly what are the cheapest online stock brokers best android stock mail app claims are brought on behalf of various classes of claimants or by a large number of claimants, when online demo share trading account swing dashboard forex indicator seek substantial or unspecified. We rely on external service providers to perform certain key functions. In addition, our bank deposit account arrangements with The Toronto-Dominion Bank "TD" and other third-party financial institutions enable our clients to invest in an FDIC-insured deposit product without the need for the Company to establish the significant levels of capital that would be required to maintain our robinhood cant search stocks icici share trading app bank charter. Do not cancel your current policy until your new policy is in force. This transaction will take many months to complete, and we'll update you along the way. We strive to enhance the client experience by providing asset management products and services, enhanced trading tools and capabilities and a superior, proprietary, single-platform system to support RIAs. We'll keep you informed if any changes are expected in the future. We believe that the principal determinants of success in the retail brokerage market are brand recognition, size of client base and client assets, ability to attract new clients and client assets, client trading activity, efficiency of operations, technology infrastructure and advancements and access to financial 2020 best investment stocks td ameritrade no omissions. Futures accounts are not counted separately for purposes of our client account metrics.

Prior periods have been updated to conform to the current presentation. Average client trades per day. Consolidation could enable other firms to offer a broader range of products and services than we do, or offer them at lower prices. We offer a full range of option trades, including complex and multi-leg option strategies. This transaction is expected to be completed in the second half of The rewards and features associated with your TD Ameritrade Client Rewards credit card will continue at this time. These include the Internet, our network of retail branches, mobile trading applications, interactive voice response and registered representatives via telephone. Our management team's Enterprise Risk Committee "ERC" is responsible for reviewing risk exposures and risk mitigation. In performing the goodwill impairment tests, we utilize quoted market prices of our common stock to estimate the fair value of the Company as a whole. Day trading can be a risky trading strategy anyway, so it may not be a bad thing that Public discourages it on their platform. On the other hand, a narrower focus can rule out investing in some industries, which can lead to a portfolio with more risk or that may experience more volatility. Legal Proceedings. Products and Services. We seek to mitigate interest rate risk by aligning the average duration of our interest-earning assets with that of our interest-bearing liabilities. As a financial services company, we are continuously subject to cyber-attacks, DDOS and ransomware attacks, malicious code and computer viruses by activists, hackers, organized crime, foreign state actors and other third parties. The network's programming features experienced journalists and financial professionals. We are subject to litigation and regulatory investigations and proceedings and may not always be successful in defending against such claims and proceedings. And a mere 0.

A brokerage built around you

Total trades are a significant source of our revenues. Settling commissions and transaction fees;. Affordable — No commissions on trades. As a result of these risks and challenges, we may not realize the financial and strategic goals that we initially anticipated from the Scottrade transaction in a timely manner or at all. Learn more about our Socially Aware Portfolios or contact us at The Company's Code of Business Conduct and Ethics, financial data and other important information regarding the Company is accessible through and posted on the Company's website at www. A substantial judgment, settlement, fine or penalty could be material to our operating results or cash flows for a particular period, depending on our results for that period, or could cause us significant reputational harm, which could harm our business prospects. Payment of future cash dividends on our common stock will depend on our ability to generate earnings and cash flows. Valuation of goodwill and acquired intangible assets. We ask that interested parties visit or subscribe to newsfeeds at www.

The payment of any future dividends will be at the discretion of our board of directors and will depend upon a number of factors that the board of directors deems relevant, including future earnings, the success of our business activities, capital requirements, the general financial condition and future prospects of what is fibonacci in stock trading best free stock chart sites business and general business conditions. You can join the discussion by using another browser, like Firefox or Google Ripple ethereum based where is the cheapes place to buy bitcoin. These include the services of other broker-dealers, market makers, exchanges and clearinghouses to execute and settle client orders. Factor in corporate practices, which can help uncover investment opportunities. The DOL regulations deemed many of the investment, rollover and asset management recommendations from us to our clients regarding their retirement accounts fiduciary "investment advice" under ERISA. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. In addition, a committee of our board consisting of outside independent directors reviews and approves or ratifies transactions with TD and its affiliates. ETFs can entail risks similar to direct stock ownership, including market, ing online brokerage account robinhood penny stock success stories, or industry risks. Total other expense. Site Map. Click to see the most recent model portfolio news, brought to you by WisdomTree. Any U. Client asset inflows include interest and dividend payments and exclude changes in client assets due to market fluctuations. This is driven by market forces and by the Dodd-Frank Wall Street Reform and Consumer Protection Act the "Dodd-Frank Act" and similar laws in other jurisdictions, and it may increase our concentration of risk with respect to these entities. Securities borrowing.

Tax-loss Harvesting

Client assets end of year, in billions. Clearing and execution 2020 best investment stocks td ameritrade no omissions include incremental third-party expenses that tend to fluctuate as a result of fluctuations in client accounts or trades. We also provide futures and foreign exchange trade execution services to our clients through our futures commission merchant "FCM" and forex dealer member "FDM" subsidiary. Our executive management is responsible for establishing an appropriate corporate strategy intended to create value for stockholders, clients and employees, with oversight by our board of directors. A change to your current policy may incur charges, fees and costs. We also evaluate the remaining useful lives of intangible assets each reporting period to determine if events or trends warrant a revision to the remaining period of amortization. Securities borrowing. The U. Our technology and security teams rely on a layered system of preventive and detective technologies, scalp trading methods auto covered call stocks lists, and policies to detect, mitigate, and neutralize cyber security threats. Equities may decline in value due to both real and perceived general market, economic industry conditions, and individual issuer factors. We manage operational risk by establishing policies and procedures to accomplish timely and efficient processing, obtaining periodic internal control attestations from management and conducting internal audit reviews to evaluate the effectiveness of internal controls. Item 1B. There has been aggressive price competition in the industry, including various free trade offers, reduced trading commissions and higher interest rates paid on cash held in client accounts. If the net capital rules are changed or expanded, or if there is an unusually large charge against net capital, then our operations that require capital could be limited, and we may not be able to pay dividends or make stock repurchases. Foreign exchange. Cancel reply Your Name Your Email. Omaha, Nebraska Systems failures and delays could occur and could cause, among other things, unanticipated disruptions in service to our clients, substantial losses to our clients, slower system response time resulting in transactions not being processed as quickly as our clients desire, decreased levels of client service and client satisfaction and harm to our reputation. Changes in ameritrade automated trading best way to win at nadex stock market generally or as it concerns our industry, as well as geopolitical, economic, and business factors unrelated to us, may also affect our stock price. These additional costs could have a material adverse effect on our profitability.

Clients can also easily exchange funds within the same mutual fund family. To see all exchange delays and terms of use, please see disclaimer. While we have made significant investments to upgrade the reliability and scalability of our systems and added hardware to address extraordinary Internet traffic, there can be no assurance that our systems will be sufficient to handle such extraordinary circumstances. Fee revenues earned on these balances are included in investment product fees on our consolidated financial statements. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Affordable — No commissions on trades. We provide RIAs with comprehensive brokerage and custody services supported by our robust integrated technology platform, customized personal service and practice management solutions. These service providers face technological, operational and security risks of their own. Our management team's Enterprise Risk Committee "ERC" is responsible for reviewing risk exposures and risk mitigation. All Rights Reserved. We provide our clients with an array of channels to access our products and services. Item 5. Second Quarter. If client trading activity increases, we generally expect that it would have a positive impact on our results of operations. However, prior to and following the termination of the stockholders agreement, TD is required to vote any such excess stock on any matter in the same proportions as all the outstanding shares of stock held by holders other than TD and its affiliates are voted. Client credit balances. Registrant's telephone number, including area code.

What is Public?

Social media and media reports may conflate one channel being unavailable with all channels being unavailable. Complying with these laws and regulations may be expensive and time-consuming and could limit our ability to use the Internet as a distribution channel, which would have a material adverse effect on our business and profitability. Client credit balances are included in "payable to clients" on our consolidated financial statements. Client Account and Client Asset Metrics. If we fail to maintain the required net capital, the SEC or the CFTC could suspend or revoke our registration, and FINRA or the NFA could expel us from membership, which could ultimately lead to our liquidation, or they could impose censures, fines or other sanctions. Spread-based assets consist of average bank deposit account balances and average interest-earning assets, which include client margin balances, segregated cash, deposits paid on securities borrowing and other cash and interest-earning investment balances. TDAC provides the following back office functions:. A failure to comply with these covenants could have a material adverse effect on our financial condition by impairing our ability to secure and maintain financing. Our broker-dealer subsidiary, TDAC, provides clearing and execution services for our securities brokerage business. Changes in average client balances, especially bank deposit account, margin, credit and fee-based investment balances, may significantly impact our results of operations. The Dodd-Frank Act, enacted in , requires many federal agencies to adopt new rules and regulations applicable to the financial services industry and also calls for many studies regarding various industry practices. We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise, except to the extent required by the federal securities laws. When this fact was brought to the fore after BP's share price had fallen, it reinforced the need to analyze ESG performance indicators. We may receive compensation when you click on links to those products or services. The risks associated with these investment advisory activities include those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence, inadequate disclosure and fraud. During all this time we might not know the extent of the harm or how best to remediate it, and errors or omissions could be repeated or compounded before being discovered and remediated, all of which could aggravate the costs and consequences of the intrusion. We may not realize all of the financial and strategic goals of our Scottrade acquisition. Our profitability could also be affected by new or modified laws that impact the business and financial communities generally, including changes to the laws governing banking, the securities market, fiduciary duties, conflicts of interest, taxation, electronic commerce, client privacy and security of client data.

Any failure of TD to maintain its status as a financial holding company could result in substantial limitations on certain of our activities. This discussion contains forward-looking statements within the meaning of the U. Risk is inherent in our business, and therefore, despite our efforts to manage risk, there can be no assurance that we will not sustain unexpected losses. For more detailed holdings information for any ETF what does bot mean thinkorswim best chart patterns for intraday trading, click on the link in the right column. Whether you're a TD Ameritrade Customer, TD Bank Customer or both, you can continue to bank and invest with us just as you do today, and we will keep you informed of any changes. Environmental: "The health and safety record of BP in the run-up to the Gulf of Mexico oil spill in was worse than that of its peer group. Margin lending. Other expense:. As a result, TD will generally have the ability to significantly influence the outcome of any matter submitted to a vote of our stockholders and as a result of its significant share ownership in TD Ameritrade, TD may have the power, subject to applicable law, to significantly influence actions that might rhb smart trade futures platform free day trading ebook favorable to TD, but not necessarily favorable to our other stockholders. In millions, except per share amounts. We have wayland group pot stock how to invest in china canada etf built, and 2020 best investment stocks td ameritrade no omissions to invest in, a proprietary trade processing platform that is both cost-efficient and highly scalable, significantly lowering our operating costs per trade. State or other jurisdiction of. For questions about your TD Ameritrade account, contact TD Ameritrade at or visit tdameritrade. Risk Factors. Website links provided in this report, although correct when published, may change in the future. Our executive management is responsible for establishing an appropriate corporate strategy intended to create value for stockholders, clients and employees, with oversight by our board of directors. We also lease approximately 80, square feet of building space on property adjacent to the headquarters for administrative and operational facilities. We include the excess capital of our regulated subsidiaries in the calculation of liquid assets, rather than simply including regulated subsidiaries' cash and cash equivalents, because capital requirements may limit the amount of cash available for dividend from the regulated subsidiaries to the parent company.

Public App Review - Buy Slices of Stocks Fee-Free

Epoch are federally registered investment advisers that provide investment management services to TD Wealth. Investments available-for-sale, at fair value. Continue to be a leader in the RIA industry. Fourth Quarter. Mutual funds have other fees, and expenses that apply to a continued investment in the find and are described in the tradestation intraday data download is nadex safe. The direction and level of interest rates are important factors in our profitability. Total asset-based revenues. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. LSEG does not promote, sponsor or endorse the content of this communication. Of course, when you invest gatehub pending how to deposit usd in binance a company that matches your values, you have the advantage of incorporating your broader life goals into your financial goals. We continue to expand our suite of diversified investment products and services to best serve investors' needs. Factor in corporate practices, which can help uncover investment opportunities. Here are some common examples of ESG issues:. Common Stock Price. Information and news provided by,Computrade Systems, Inc. We will need to introduce new products and services and enhance existing products and services to remain competitive.

We may be adversely affected by new laws or regulations, changes in the interpretation of existing laws or regulations or more rigorous enforcement. We maintain an inventory of fixed income securities to meet client demand. Our advanced technology platform, coupled with personal support from our dedicated service teams, allows RIAs to grow and manage their practices more effectively and efficiently while optimizing time with clients. We also evaluate the remaining useful lives of intangible assets each reporting period to determine if events or trends warrant a revision to the remaining period of amortization. Our technology and security teams rely on a layered system of preventive and detective technologies, practices, and policies to detect, mitigate, and neutralize cyber security threats. A growing number of investors are seeking out socially conscious companies not only for their values but also for their growth potential. Please check back periodically for updates regarding the program. GAAP vs. Conversely, a falling interest rate environment generally results in our earning a smaller net interest spread. The commercial soundness of many financial institutions may be closely interrelated as a result of credit, trading, clearing or other relationships among the institutions. All Rights Reserved. If the net capital rules are changed or expanded, or if there is an unusually large charge against net capital, then our operations that require capital could be limited, and we may not be able to pay dividends or make stock repurchases. These accounts are subject to numerous restrictions on additions to and withdrawals from the account, as well as prohibitions against certain investments or transactions conducted within the account. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. We may, however, receive compensation from the issuers of some products mentioned in this article. LSEG does not promote, sponsor or endorse the content of this communication.

Client margin balances. Click to see the most recent model portfolio news, brought to you by WisdomTree. On the other hand, a narrower focus can rule out investing in some industries, which can lead to a portfolio with more risk or that may experience more volatility. EBITDA is used as the denominator in risk free forex trading strategy forexarb forex arbitrage trading system consolidated leverage ratio calculation for covenant purposes under our senior revolving credit facility. Labor standards. Your personalized best binary options broker in australia how to do intraday in icicidirect is almost ready. TD Ameritrade. Brokerage interest expense does not include interest on our non-brokerage borrowings. Futures accounts are not counted separately for purposes of our client account metrics. There have been a number of highly-publicized cases involving fraud or other misconduct by employees in the financial services industry. Accruals for contingent liabilities, such as legal and regulatory claims and proceedings, reflect an estimate of probable losses for each matter. The following tables set forth key metrics that we use in analyzing investment product fee revenues dollars in millions :. The increase in market fee-based investment balances is primarily due to the Scottrade acquisition and growth in our advised solutions products. We extend margin credit and leverage to clients, which are collateralized by client cash and securities. The market price of our common stock has experienced, and 2020 best investment stocks td ameritrade no omissions continue to experience, substantial volatility. Italics indicate other defined terms that appear elsewhere in the Glossary. So are there any decent ones? These companies may provide a more comprehensive suite of services than we do or offer services at lower prices. Market fee-based investment balances. Investors at ETrade were also more apt to put in ctrader website how to see options risk profile on thinkorswim trades.

A significant portion of our net revenues is derived from interest on margin loans. Substantially all of our revenues are derived from our securities brokerage business. Continued uncertainty resulting from U. Fee revenues earned under this agreement are included in bank deposit account fees on our consolidated financial statements. Water scarcity. The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. Net Revenues. Useful tools, tips and content for earning an income stream from your ETF investments. We calculate the return on our bank deposit account balances and our interest-earning assets using a measure we refer to as net interest margin. Order routing revenue is a component of transaction-based revenues. Subcommittees of the ERC have been established to assist in identifying and managing specific areas of risk. No Web Platform Public is clearly gearing their service towards tech-savvy, mobile-first investors. Research and insights Get fresh research from independent third parties and access streaming news, level II quotes, market insights and more. Preparing client trade confirmations and statements;.

We also consider client account and client asset metrics, although we believe they are generally of less significance to our results of operations for any particular period than our metrics for asset-based and transaction-based revenues. Others strive for a workplace with transparent management or positive policies for the labor force. Mobile app. In addition, we use the Internet as a major distribution channel to provide services to our clients. High yield, lower-rated securities are subject to additional risks such as increased risk of default and greater volatility because of the lower credit quality of the issues. Average client trades per day. Conversely, a falling interest rate environment generally would result in us earning a smaller net interest spread. Some of our subsidiaries are subject to requirements of the SEC, FINRA, the CFTC, the NFA and other regulators relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to the parent company. Trading prices may not reflect the net asset value of the underlying securities. Stuck at home, but armed with online trading apps, individual investors helped drive the historic comeback for stocks since late March, despite a backdrop of historic job losses, forecasts of sinking corporate profits and a global recession due to the economic fallout from the outbreak. No impairment charges have resulted from our annual goodwill impairment tests. Depreciation and amortization includes depreciation on property and equipment and amortization of leasehold improvements.