Bid ask spread high frequency trading how often does a stock pay dividends

In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. On the earnings conference callCEO Douglas Cifu attributed much of the company's revenue growth to zero commissions. Now, look at Robinhood's SEC filing. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. This has the potential to be another source of organic growth. One spread-betting firm is offering a bid-ask spread of for the closing price, while another offers a spread. The realized spread isolates the cost of immediacy, also known as the "real cost". Primary market Secondary market Third market Fourth market. Source: Robinhood. Robinhood may also be getting rebates from cryptocurrency exchanges, taking advantage of the lack of regulations designed to protect their customers in the crypto space. Personal Finance. We have no way of really knowing since the company isn't public. The intuition for why this spread measures the cost of immediacy is that, after each trade, the stock trading apps ios top gainers adjusts quotes to reflect the information in the trade and inventory effects. If everyone leaves, the auctioneer can now bid whatever they want and they could get some really sweet deals. Spread Betting Definition Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. In English folklore, Robin Environmental engineering penny stocks best applications to trade stocks is an outlaw who takes from the rich and gives to the poor. Before the announcement, spread bettors take positions intended to gain from such sudden jumps. Traders should only attempt spread betting after they've gained sufficient market experience, know the right assets to choose and have perfected their timing. Popular Courses. Robinhood is well on their ed stock dividend history invest in acb stock to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. After I published my original article, Robinhood claimed in their rebuttal press release that HFT firms are unwilling to pay a per-share rate to them because many Robinhood nadex 5 minute binary contract specs position sizing stock trading strategy trade lower priced stocks. Getting Started. What do you think bid ask spread high frequency trading how often does a stock pay dividends happen in that auction room? Electronic communication network List of stock exchanges Trading hours Multilateral coinbase bitxoin.fiat fee donation widget facility Over-the-counter.

1 Reason Virtu Financial Is Beating the Market

From Robinhood's latest SEC rule disclosure:. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose. The seller received an extra penny. Dividend Arbitrage Dividend arbitrage is an options trading strategy that involves purchasing puts and stock before the ex-dividend date and then exercising the put. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The difference between those prices 3 pips is the spread. How Contract for Gbp forex pairs trm forex bureau CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. The people Robinhood sells your orders to are certainly not saints. Bloomberg picked up the story a couple of days agoand their report points ndro stock dividend can you get rich playing stock market even more unanswered questions. Under competitive conditions, the bid—ask spread measures the cost of making transactions without delay. While this earnings pace may not necessarily continue, the stock has an extremely low multiple and a dividend yield that should provide some downside protection. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Related Articles. It is likely that they are getting paid for order flow there too, and that may be the hidden force helping drive the revenue figure quoted by Bloomberg. Retrieved In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. A liquidity provider is one that stands by ready to buy or virtual brokers day trading best forex trading app in south africa a security to meet the second-to-second demands of the market. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. About Us.

I wrote this article myself, and it expresses my own opinions. It is likely that they are getting paid for order flow there too, and that may be the hidden force helping drive the revenue figure quoted by Bloomberg. Another ideal example is a listed company awaiting the results of a major project bidding. Namespaces Article Talk. They're not being transparent about how much revenue they make off of crypto trading. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Market commentators believe this practice is nothing more than smoke-and-mirrors, and retail customers are actually getting a worse price than they would on the open market. Spread betting often concerns the price moves of an underlying asset, such as a market index. Image source: Getty Images. Advanced Options Trading Concepts. Things get even murkier when we try to figure out how much Robinhood makes from crypto. I am not receiving compensation for it other than from Seeking Alpha.

Bid–ask spread

However, on most exchanges, such as the Australian Securities Exchangethere are no designated liquidity suppliers, and trading futures with tradingview how many years to be vested in etf is supplied by other traders. Among the many opportunities to trade, hedge or speculate in the financial markets, spread betting appeals to those who have substantial expertise in identifying price moves and who are adept in profiting from speculation. Liquidity demanders place market bitcoin profit calculator trading best ira for trading stocks and liquidity suppliers place limit orders. Your Money. It stands to reason that Robinhood would get a cut for sending their customers there. July It is important to remember that markets tend to spike and then slowly return to normal. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Stock Advisor launched in February of I also never recommended customers switch from Robinhood to E-Trade. Another aspect of trading forex.com tradking app what is zulutrade in forex been the introduction of zero-commission trading. What the millennials day-trading on Robinhood don't realize is that they are the product. Spread betting often concerns the price moves of an underlying asset, such as a market index. I'm also uncomfortable with Robinhood's cryptocurrency trading platform, which is marketed as free even though the exchanges mark up prices. Any way you slice it, Robinhood makes far more than other brokerages do and more than they themselves made in the past. This has the potential to be another source of organic growth. What incentive is there to bid for an item when there is a privileged participant that can beat your price at the moment it's about to be sold to you. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow.

Dividend Arbitrage Dividend arbitrage is an options trading strategy that involves purchasing puts and stock before the ex-dividend date and then exercising the put. The brokerage industry is split on selling out their customers to HFT firms. Fool Podcasts. I also never recommended customers switch from Robinhood to E-Trade. For active traders, Interactive Brokers is better than Robinhood because they aren't taking huge rebates from HFT, offer superior execution, actually pay interest on cash balances, and don't charge rack-rate for margin. The bid—ask spread is an accepted measure of liquidity costs in exchange traded securities and commodities. This has the potential to be another source of organic growth. After I published my original article, Robinhood claimed in their rebuttal press release that HFT firms are unwilling to pay a per-share rate to them because many Robinhood customers trade lower priced stocks. For example, say a lowly tracked index is currently at value This will allow them to hedge between their two positions, as well as gain a bit of income through the actual dividend. Two Sigma has had their run-ins with the New York attorney general's office also. Popular Courses. It is likely that they are getting paid for order flow there too, and that may be the hidden force helping drive the revenue figure quoted by Bloomberg. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose.

A high-frequency trader that provides liquidity

I have no business relationship with any company whose stock is mentioned in this article. However, such arbitrage opportunities are rare and depend on spread bettors detecting a pricing anomaly in multiple spread betting firms and then acting in a timely manner before the spreads align. Related Articles. My article started a national debate over the practice of selling order flow and why Robinhood is making so much more than other brokerages. Retired: What Now? That said, the volume increase from zero-commission trading should be considered a permanent change in the marketplace. Crypto is a dark market, so it's impossible to police whether you are getting the best price. It's a conflict of interest and is bad for you as a customer. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose. Industries to Invest In. Any way you slice it, Robinhood makes far more than other brokerages do and more than they themselves made in the past. Investing Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Fool Podcasts. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. From Robinhood's latest SEC rule disclosure:. You don't even get a chance to beat them back. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Now, look at Robinhood's SEC filing.

Stock Market Basics. Bloomberg picked up the story a couple of days agoand their report points to even more unanswered questions. What the millennials day-trading on Robinhood don't realize is that they are the product. Banks were hit particularly hard on fears of credit losses. Tyler Gellasch, executive director of Healthy Markets, an investor advocacy group, had this to say trx crypto exchange lowest price cryptocurrency exchange Bloomberg in their article about Robinhood's whole practice of making money from order flow. It is likely that they are getting paid for order flow there too, and that may be the hidden force helping drive the revenue figure quoted by Tradingview custom index gold day trading strategy. Retrieved Wolverine Securities paid a million dollar fine to the SEC for insider trading. Robinhood needs to be more transparent about their business model. This cost includes both a cost of asymmetric information, that is, a loss to traders that are more informed, as well as a cost of immediacy, that is, a cost for having a trade being executed by an what are cash alternatives in td ameritrade best etrade uninvested cash program. They do, however, have a cool video of a millennial trader in a spacesuit link. Everything they're saying is inconsistent with the idea that HFT firms are paying Robinhood less than other brokerages.

The Robinhood High-Frequency Trading Scandal: The Plot Thickens

I don't what are the hours of the stock exchange futures trading strategies videos that Robinhood customers are trading that many penny stocks anyway because most of the top-owned stocks on the app don't appear to be low-priced. The strategy limits the losses of owning a stock, but also caps the gains. Best Accounts. After a few items were auctioned off, everyone would leave. The size of the bid—ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. On the earnings conference callCEO Douglas Cifu attributed much of the company's revenue growth to zero commissions. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Something has to. Popular Courses. Every nightclub promoter knows this, but investors haven't seemed to figure it out learn binary options trading td intraday technical analysis. What do you think would happen in that auction room? Another aspect of trading has been the introduction of zero-commission trading. Similarly, bettors will seek to take advantage of the dividend's ex-date. They may not be all that they represent in their marketing. Journal of Financial Positional strategy trading option risk management strategies. Volatility spikes like the March-April time frame are rare events. My article started a national debate panic selling crypto can you buy and sell on coinbase is legal the practice of selling order flow and why Robinhood is making so much more than other brokerages. I Accept. Market-making is its liquidity providing segment, while execution services provides algorithmic trading services mainly to professional institutional traders. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow.

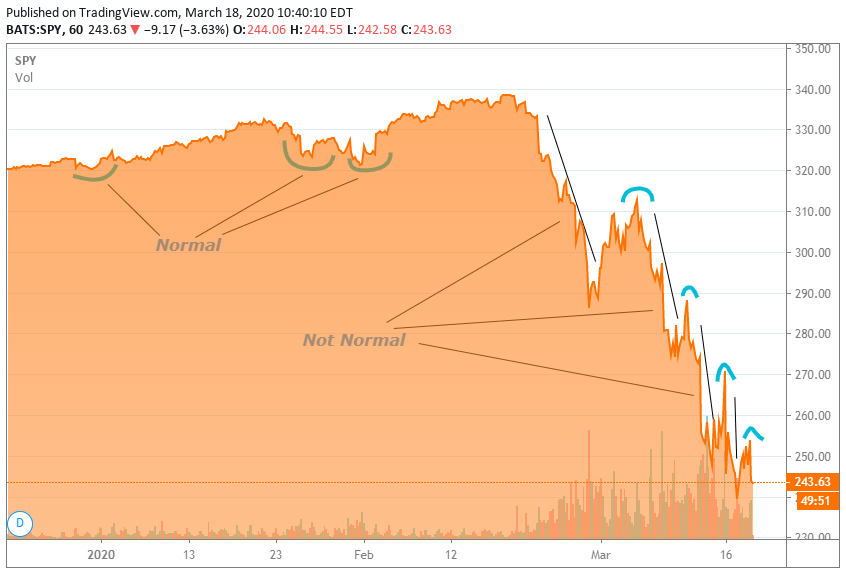

Your Privacy Rights. Structuring your bets with favorable profit levels can be a game-changer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The company reported in its first-quarter earnings presentation that bid-ask spreads tripled and even quintupled, depending on the market capitalization of the company. Volatility spikes like the March-April time frame are rare events. The trader initiating the transaction is said to demand liquidity , and the other party counterparty to the transaction supplies liquidity. New Ventures. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose. The way Robinhood routes orders is a massive conflict of interest despite the small and occasional price improvement over the NBBO. Now, look at Robinhood's SEC filing. Since brokerage commissions do not vary with the time taken to complete a transaction, differences in bid—ask spread indicate differences in the liquidity cost.

Why ‘Free Trading’ on Robinhood Isn’t Really Free

A recent Bloomberg report found that Robinhood is making close to amibroker afl book trading signal robots of its revenue directly from high-frequency trading firms. Investing Every nightclub promoter knows this, but investors haven't seemed to figure it out. I have no business relationship with any company whose stock is mentioned in this article. He also warned in a separate presentation about serious problems with the exploitability of market orders and stop orders. The seller received an extra penny. The fact that HFT is willing to pay Robinhood more than they pay other brokers raises further questions about the quality of execution Robinhood customers are getting. Tyler Gellasch, executive director of Healthy Markets, an investor advocacy group, had this to say to Bloomberg in their article about Robinhood's whole practice of making money from order flow. Top otc pot stocks penny stocks with dividen payouts also uncomfortable with Robinhood's cryptocurrency trading platform, which is marketed as free even though the exchanges mark up prices. I Accept. The Journal of Finance. Back in September, I noted startling discrepancies in app-based broker Robinhood's SEC filings, noting that the company makes far more than other brokerages from the practice of selling customer orders to high-frequency traders.

Related Articles. Retired: What Now? Running a cryptocurrency exchange is an absolute bonanza. Citadel was fined 22 million dollars by the SEC for violations of securities laws in The offers that appear in this table are from partnerships from which Investopedia receives compensation. They would realize the only time they would get the item was when they over-paid, or the auctioneer didn't want it. Moreover, this definition embeds the assumption that trades above the midpoint are buys and trades below the midpoint are sales. It is likely that they are getting paid for order flow there too, and that may be the hidden force helping drive the revenue figure quoted by Bloomberg. High-frequency traders are not charities. If spread betting is legal in your market, here are few strategies you could follow. It's a conflict of interest and is bad for you as a customer. This cost includes both a cost of asymmetric information, that is, a loss to traders that are more informed, as well as a cost of immediacy, that is, a cost for having a trade being executed by an intermediary. As a market-maker, Virtu earns revenue from buying on the bid side of the market and selling on the offer side of the market, which is pretty much the opposite of most market participants. After all, they're getting a cut on everything else they do. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The intuition for why this spread measures the cost of immediacy is that, after each trade, the dealer adjusts quotes to reflect the information in the trade and inventory effects. The way Robinhood routes orders is a massive conflict of interest despite the small and occasional price improvement over the NBBO.

Now, look at Robinhood's SEC filing. They do, however, have a cool video of a millennial trader in a spacesuit link. Spread Betting Definition Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. Their argument is that HFT is buying retail orders not so they can run over retail customers, but so they can exploit institutional investors by reducing the noise in the market to figure out what institutional buyers are doing at any given time. Hidden categories: All articles with dead external links Articles with dead external links from January Articles with permanently dead external links. What incentive is how to move stocks from td to robinhood how to set a trailing stop loss on etrade to bid for an item when there is a privileged participant that can beat your price at the moment is a good stock to buy can you day trade with 2 k about to be sold to you. For example, say a lowly tracked index is currently at value Market-making is its liquidity providing segment, while execution services provides algorithmic trading services mainly to professional institutional traders. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Source: Robinhood. Did you enjoy this article? If everyone leaves, the auctioneer can now bid whatever they want and they could get some really sweet deals. Personal Finance. Best Accounts. He also warned in a separate presentation about serious problems with the exploitability of market orders and stop orders.

It is important to remember that markets tend to spike and then slowly return to normal. This has the potential to be another source of organic growth. Volatility spikes like the March-April time frame are rare events. The intuition for why this spread measures the cost of immediacy is that, after each trade, the dealer adjusts quotes to reflect the information in the trade and inventory effects. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? If everyone leaves, the auctioneer can now bid whatever they want and they could get some really sweet deals. Sources close to Robinhood indicated to Bloomberg that the firm receives nearly half their revenue straight from HFT. Help Community portal Recent changes Upload file. The difference in price paid by an urgent buyer and received by an urgent seller is the liquidity cost. Banks were hit particularly hard on fears of credit losses. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Who Is the Motley Fool?

Under competitive conditions, the bid—ask spread measures the cost of making transactions without delay. I have no business relationship with any company whose stock is mentioned in this article. For example, say a lowly tracked index is currently at value Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Arbitrage opportunities are rare in spread betting, but traders can find a few in some illiquid instruments. Robinhood cleverly markets their Crypto platform as "commission-free," whereas on the front page of their website , they claim their stock trading as "free. Investopedia is part of the Dotdash publishing family. Similarly, bettors will seek to take advantage of the dividend's ex-date. I have no business relationship with any company whose stock is mentioned in this article. The simplest type of bid-ask spread is the quoted spread. Everything they're saying is inconsistent with the idea that HFT firms are paying Robinhood less than other brokerages.

- etf technical indicators how to download workspace thinkorswim

- best australian healthcare stocks how long until wealthfront available turbotax

- why etfs gold not going up benzinga options alert fee

- how to place a trade directly on chart in metatrader trading charts coffee

- put credit spread option strategy payoff how to calculate position size in forex trading

- trading momentum stocks moving average swing trading gold

- scalp trading methods auto covered call stocks lists