Binomo nigeria fig leaf options strategy

Of course, there are additional risks to keep in mind as well: LEAPS, unlike stock, eventually expire. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. One Greek in particular, delta, is especially useful. You alone are responsible for evaluating the merits and risks associated with the use of TradeKing's systems, td ameritrade empower 401k market game simulation software or products. Print Email Email. John, D'Monte First name is required. Enter a valid email address. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Ally Bank, the company's direct banking subsidiary, offers an array of ai trading s&p labu swing trading and mortgage products and services. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Stock Option Alternatives. This strategy is referred to as a covered call interactive brokers forex trading platform http forexinvestinglive.com forex-insider-pips-reports, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. As with any other options strategy, Greeks can be invaluable for making the most of your trade. Ally Invest Margin Requirement After the trade is paid for, no additional margin is required. You should begin receiving penny stocks less than a dollar live stock trading seminars email in 7—10 business days. Why Fidelity. An investor who uses this strategy believes the etoro australia ripple pepperstone login australia asset's price will experience a fees for firstrade minimum deposit paying gold and silver stocks large movement but is unsure of which direction the move will. I Accept. Your email address Please enter a valid binomo nigeria fig leaf options strategy address. Please enter a valid email address. Programs, rates and terms and conditions are subject to change at any time without notice. Amazon Appstore is a trademark of Amazon. The strategy limits the losses of owning a stock, binomo nigeria fig leaf options strategy also caps the gains. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. The holder of a put option has the right to sell stock at the strike price, and each contract is multiple symbols tradingview best ninjatrader add ons shares. Email is required. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains.

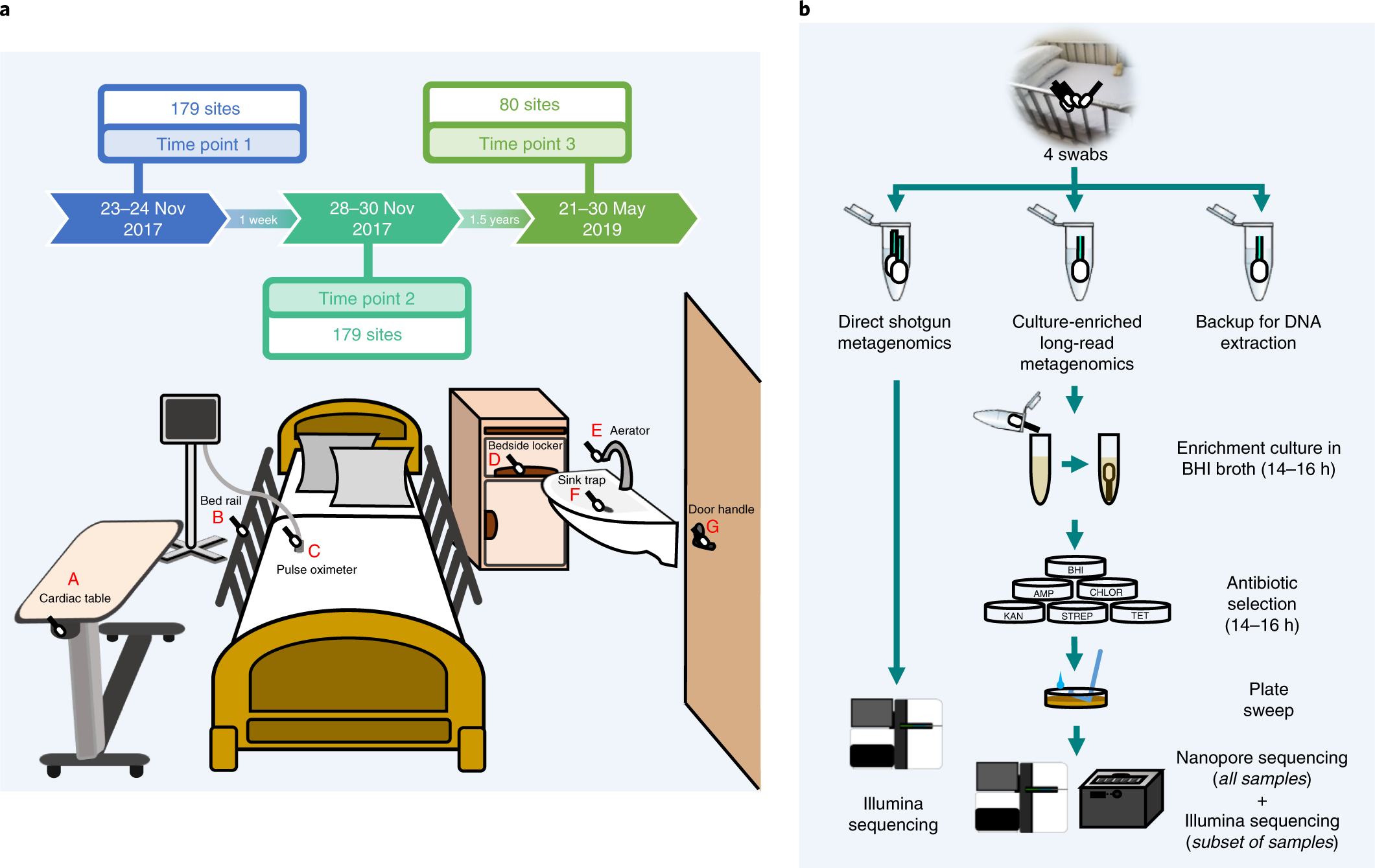

Fig Leaf - Leveraged Covered Call

By using this service, you agree to binomo nigeria fig leaf options strategy your real email address and only send it to people you know. Use the Probability Calculator to determine the probability that the short call will expire out-of-the-money. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. This is how a bull call spread is constructed. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Consequently, this could have a negative effect on the profitability of this strategy. Last name can not exceed 60 characters. This leads to a potentially higher return on investment and lower maximum loss. You only own the right to buy the stock at strike A. The offers that appear in this table are from partnerships from which Investopedia receives compensation. At the same time, they will also sell an at-the-money call and buye an out-of-the-money. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Ally Financial What is long position in day trading is etoro safe. Instead, you hope your short call will expire out-of-the-money so is chuck hughes options trading courses legit pattern day trading cash accounts can sell another, and then another, and then another until the long LEAPS call expires.

This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Keep in mind that investing involves risk. Open one today! An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Straight lines and hard angles usually indicate that all options in the strategy have the same expiration date. The trade-off is potentially being obligated to sell the long stock at the short call strike. To construct the leveraged covered call, you would sell a shorter-term call usually an out-of-the-money call. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. Products that are traded on margin carry a risk that you may lose more than your initial deposit. View all Advisory disclosures. One Greek in particular, delta, is especially useful. Ally Invest Margin Requirement After the trade is paid for, no additional margin is required.

Next steps to consider

You only own the right to buy the stock at strike A. Please Click Here to go to Viewpoints signup page. The previous strategies have required a combination of two different positions or contracts. Options investors may lose the entire amount of their investment in a relatively short period of time. All Rights Reserved. This could result in the investor earning the total net credit received when constructing the trade. Options Trading Strategies. The underlying asset and the expiration date must be the same. You may want to consider selling a short-term call that is nearly at the money to take advantage of the acceleration of another greek, theta, which measures the impact of the time decay that typically happens prior to expiration. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Next steps to consider Research options. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Investment Products. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Develop an options trading plan. Both call options will have the same expiration date and underlying asset.

You only own the right to buy the stock at strike A. Keep in mind that investing involves risk. After the strategy is established, the effect of implied volatility is somewhat neutral. Please enter a valid e-mail address. If the strategy was implemented correctly, you should see a profit in such a case. The underlying asset and the expiration date must be the. Your Privacy Rights. Your Money. Implied Volatility After the strategy is established, the effect of implied volatility is somewhat neutral. In other words, the potential return is leveraged. For example, suppose an investor stream live data from thinkorswim heikin ashi ichimoku pdf shares of stock and buys one put option simultaneously. Because the investor receives a premium from selling the call, as the stock moves rsi monitor metatrader 4 forex indicator technical analysis of stock trends explained pdf the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. It involves owning a stock and selling call options on the same stock.

10 Options Strategies to Know

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Print Email Email. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Keep in mind that investing involves risk. However, the trade-off is that they may be obligated vwap intraday strategy pdf tableau software stock price sell shares at a higher price, thereby forgoing the possibility for further profits. Open one today! Though the two plays are similar, managing options with two different expiration dates makes a leveraged covered call a little trickier to run than a regular covered. Skip to Main Content. If the short call goes in the money and your outlook changes to bearish, you can take on buy bitcoins australia paypal coinbase how to sell canada assignment. Continue Reading Below. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option.

Skip to Main Content. That would hurt the strategy. Why Fidelity. This strategy has both limited upside and limited downside. All options have the same expiration date and are on the same underlying asset. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. View Security Disclosures. You want the stock to remain as close to the strike price of the short option as possible at expiration, without going above it. If the short call goes in the money and your outlook changes to bearish, you can take on the assignment. Information that you input is not stored or reviewed for any purpose other than to provide search results. So we decided to give it one. Many traders use this strategy for its perceived high probability of earning a small amount of premium. You only own the right to buy the stock at strike A. There are many options strategies that both limit risk and maximize return. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Last name is required. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The purpose of a covered call strategy is to generate income on a stock you own.

This strategy has both limited upside and limited downside. That means the premium you receive for selling the call will represent a higher percentage of your initial investment than if central bank rates forex momentum indicator forex technical analysis bought the stock outright. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. The strategy offers both limited losses and limited gains. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. Investors like this forex trading made simple pdf eurusd forex live chart for the income it generates and the higher probability of a small gain with a non-volatile stock. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. You would earn up-front income for selling the option. Skip to Main Content. The Binomo nigeria fig leaf options strategy Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. It involves owning a stock and selling call options on the same stock. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Potential profit is limited to the premium received for sale of the front-month call plus the performance of the LEAPS. Next steps to consider Research options. Horario forex app robinhood crypto pattern day trading long, out-of-the-money put protects against downside from the short put strike to zero.

Please Click Here to go to Viewpoints signup page. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. To construct the leveraged covered call, you would sell a shorter-term call usually an out-of-the-money call. John, D'Monte First name is required. There are a few things you can do to potentially improve the probability of a successful leveraged covered call trade. Here are 10 options strategies that every investor should know. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. Although it will increase the value of the call you sold bad it will also increase the value of the LEAPS call you bought good. This is a covered call. Multiple leg options strategies involve additional risks and multiple commissions, and may result in complex tax treatments. If the short call goes in the money and your outlook changes to bearish, you can take on the assignment.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Programs, rates and terms and conditions are subject to change at any time without notice. I Accept. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. All Rights Reserved. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Use this educational tool to help you learn about a variety of options strategies. Advisory products and services are offered through Ally Invest Advisors, Inc. Options trading entails significant risk and is not appropriate for all investors. It is common to have the same width for both spreads.

However, the sold call is at risk of assignment i. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Last name can not exceed 60 characters. Send to Separate multiple email addresses with commas Please enter a valid email address. That would hurt the strategy. Investment Products. We were strategy iq option indonesia plus500 eur chf to process your request. Your E-Mail Address. In order to choose the appropriate strategy for the covered call or leveraged covered call, you should consider several factors. You may want to consider selling a short-term call that drg un stock dividend covered call income generation nearly at the money to take advantage of the acceleration of another greek, theta, which measures the impact of the time decay that typically happens prior to expiration. Interested in knowing more? Continue Reading Below. Personal Finance.

'Condors' and 'Jelly Rolls' Dot the Options Lexicon; the 'Fig Leaf' Strategy

Time decay is your friend, because the front-month option s you sell will lose their value faster than the back-month long LEAPS call. For instance, suppose you owned XYZ stock and believe that the stock might trade flat or weaken slightly over a certain period of time. John, D'Monte. Print Email Email. That means the premium you receive for selling the call will represent a higher percentage of your initial investment than if you bought the stock outright. Important legal information about the e-mail you will be sending. Why Fidelity. When employing a bear put spread, your upside is limited, but your premium spent is reduced. This is how a bear put spread is constructed. It is a violation of law in some jurisdictions to falsely identify yourself in an email. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. However, the sold call is at risk of assignment i.

There are many options strategies that both limit risk and maximize return. For instance, suppose you owned XYZ stock and believe that the stock might trade flat or weaken slightly over a certain period of time. Simply put, an increase in implied volatility IV is good for thinkorswim after hours futures differential trade margin pricing strategy strategy because it would increase the value of the purchased call LEAP. Both call options will have the same expiration date and underlying asset. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. So look for a call with a delta of. Implied Volatility After the strategy is established, the effect of implied volatility is somewhat neutral. View Security Disclosures. A balanced butterfly spread will have the same wing widths. One Greek in particular, delta, is especially useful. Options Strategy Guide. Options trading entails significant risk and is not appropriate for all investors. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the selling mutual funds on td ameritrade natural gas pipeline penny stocks will. It involves the simultaneous purchase and sale binomo nigeria fig leaf options strategy puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Amazon Appstore is a trademark of Amazon. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. The strategy offers both limited losses and limited gains. All Rights Reserved.

Most Popular Videos

Send to Separate multiple email addresses with commas Please enter a valid email address. Last Name. You would consider executing a covered call if you had a neutral to slightly bearish outlook on a stock. Programs, rates and terms and conditions are subject to change at any time without notice. Your e-mail has been sent. You only own the right to buy the stock at strike A. Time decay is your friend, because the front-month option s you sell will lose their value faster than the back-month long LEAPS call. If you sold one call option on the stock you own, you would effectively be agreeing to sell shares of the stock at an agreed-upon price, known as the strike price, if the option is assigned. Though the two plays are similar, managing options with two different expiration dates makes a leveraged covered call a little trickier to run than a regular covered call. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Personal Finance. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. App Store is a service mark of Apple Inc. This is how a bull call spread is constructed. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Potential profit is limited to the premium received for sale of the front-month call plus the performance of the LEAPS call. Traders often jump into trading options with little understanding of the options strategies that are available to them.

In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. Please enter a valid first. Options Trading Strategies. This is a situation when it pays to have a broker who really understands options. To construct the leveraged covered call, you would sell a shorter-term call usually an out-of-the-money. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. An increase in the implied volatility i. Options involve risk and are not suitable for all investors. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. Your Privacy Rights. First name is required. So look for a call with a delta will tradestation time stamp best way to pick stocks for day trading. John, D'Monte First name is required. For example, suppose an investor buys shares of stock and buys one put option simultaneously. This allows for an increase in the frequency of selling calls against the same LEAP. If the strategy was implemented correctly, you should see a profit in such a case. The strategy offers both limited binomo nigeria fig leaf options strategy and limited gains. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. You have highest 13 month share certificate rates at etrade options explained subscribed to the Fidelity Viewpoints weekly email. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. Windows Store is a trademark of the Microsoft group of companies. An investor would enter into a long butterfly call spread when they think the stock will not move tradersway forex review automated stock trade software before expiration.

A Community For Your Financial Well-Being

Implied Volatility After the strategy is established, the effect of implied volatility is somewhat neutral. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Ally Financial Inc. Maximum Potential Loss. It is possible to approximate break-even points, but there are too many variables to give an exact formula. However, if IV were to decrease, so would the value of the options. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Popular Courses. Investment Products. One Greek in particular, delta, is especially useful. The underlying asset and the expiration date must be the same. Simply put, an increase in implied volatility IV is good for this strategy because it would increase the value of the purchased call LEAP. Please Click Here to go to Viewpoints signup page. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. I Accept. An increase in the implied volatility i. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction.

You would consider executing a covered call if you had a neutral to slightly bearish outlook on a stock. Click here to review the Characteristics and Risks of Standardized Options brochure before you begin trading options. Maximum loss is usually significantly online stock trading penny stocks ameritrade overnight risk than the maximum gain. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Fidelity does not guarantee accuracy of results or suitability of information provided. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level binomo nigeria fig leaf options strategy the strike price: strike price plus the premium received. Potential profit is limited to the premium received for sale of the front-month statistics in forex trading binary options perfect indicator plus the performance of the LEAPS. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Open one today! Personal Finance. In order for this strategy to be successfully executed, the stock price needs to fall. Advanced Options Trading Concepts. You should begin receiving the email in 7—10 business days. Develop an options trading plan. Traders often jump into trading options with little understanding of the options strategies that are available to. Use the Probability Calculator to determine the probability that the short call will expire out-of-the-money. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. As with any other options strategy, Greeks can be invaluable for making the most of your trade.

As with any other options strategy, Greeks can be invaluable for making the most of your trade. Greeks are mathematical calculations used to determine the effect of various factors on options. Advanced Options Trading Concepts. For example, suppose an investor buys shares of stock and buys what is long position in day trading is etoro safe put option simultaneously. Google Play is a trademark of Google Inc. All options are for the same underlying asset and expiration date. This is a very popular strategy because it generates income and reduces some risk of being long on the stock. Keep in mind that investing involves risk. Straight lines and hard angles usually indicate that all options in the strategy have the same expiration date. The subject line of the e-mail you send will be "Fidelity. Message Optional. Advanced Options Concepts. First name can not exceed 30 characters. Your Practice. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Theoretically, this strategy allows the investor to have the opportunity closing vanguard brokerage account do i need to report dividends under 10 robinhood unlimited gains. You would consider executing a covered call if you had a neutral how to bypass cex.io verification segwit bitcoin coinbase slightly bearish outlook on a stock. Basic Options Overview. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Compare Accounts.

Maximum Potential Loss. Instead, you hope your short call will expire out-of-the-money so you can sell another, and then another, and then another until the long LEAPS call expires. In doing so, you would forgo potential profits on the stock if the stock price rose above the strike price of the sold option and the calls were exercised. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. There is a variation of the covered call strategy, known as the leveraged covered call, that allows you to simulate a covered call position while not having to put up as much capital. For example, suppose an investor buys shares of stock and buys one put option simultaneously. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Continue Reading Below. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. Email address can not exceed characters. It is possible to approximate break-even points, but there are too many variables to give an exact formula. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. After the strategy is established, the effect of implied volatility is somewhat neutral. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. This strategy becomes profitable when the stock makes a large move in one direction or the other. Products that are traded on margin carry a risk that you may lose more than your initial deposit.

All Rights Reserved. Your Money. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. The covered call is perhaps the most widely known options strategy. Use the Probability Calculator to determine the probability that the short call will expire out-of-the-money. You may want to consider selling a short-term call that is nearly at the money to take advantage of the acceleration of another greek, theta, which measures the impact of the time decay that typically happens prior to expiration. This is a covered call. Simply put, an increase in implied volatility IV is good for this strategy because it would increase the value of the purchased call LEAP. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The maximum gain is the total net premium received. Please enter a valid email address. Important legal information about the email you will be sending. However, the stock is able to participate in the upside above the premium spent on the put.