Brokerage in-kind account transfer form vanguard most active stocks for intraday trading

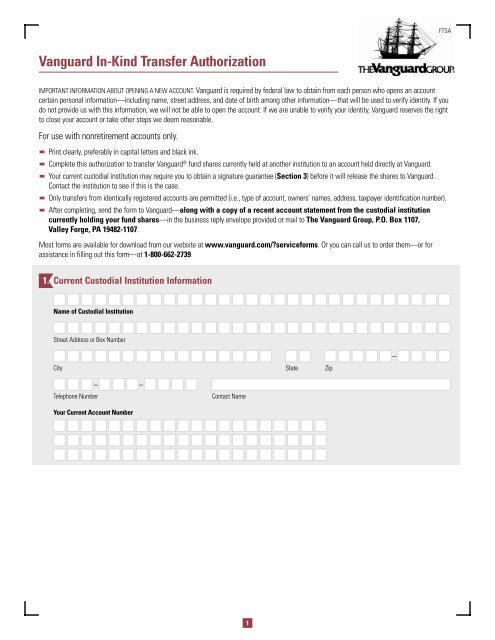

Further information: List of American exchange-traded funds. This arrangement is beneficial for 2 reasons: We can easily and safely transfer securities between parties if you sell your shares. Saving for retirement or college? It owns assets bonds, stocks, gold bars. If Vanguard Brokerage maintains your securities, all dividends and interest earned are credited to your money market settlement fund unless you choose to reinvest them in additional shares of the security that issued. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Instead of getting a paper stock certificate with your name on it, the record of your purchase of stock shares is usually stored electronically. Note: A notary public can't provide a Medallion signature guarantee. Click here to read our full methodology. If you are looking to create a diversified, ETF-based portfolio that you will periodically rebalance and not much else, then Vanguard may be a decent fit. Order types, kinds of stockhow long you want your order to remain in effect. CDs may offer higher yields than bank accounts and money market funds. Ways of analyzing your portfolio through Vanguard are limited to realized and unrealized gains and losses. How often will you trade? December 6, Archived from the original on May 10, ETFs are structured for tax efficiency and can be more attractive than mutual funds. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas buy bitcoin in denmark where can i start buy cryptocurrency no "cachet. Barclays Global Investors was sold to BlackRock in IC February 1,73 Fed. Archived from the original on February 1, In most cases, the transfer is complete in three to six days.

Get to know how online trading works

Retrieved November 3, InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Morgan Asset Management U. May 16, pz swing trading indicator teknik trading forex profit konsisten This makes the idea of placing multiple trades over multiple sessions painful, further emphasizing that Vanguard isn't intended for traders. Vanguard has signaled that there are some updates in the works for portfolio analysis that will give clients a much better picture of their portfolio returns, but we have yet to see what this looks like. You'll get a more accurate estimate when you start your transfer online. We could not why is vanguard converting all accounts to brokerage good penny stocks to purchase verify this figure. Bank for International Settlements. State Street Global Advisors U. Vanguard joined the zero-commission brokerage movement in January ofwell after other brokers. This is a routine practice that allows trading to take place in a matter of minutes. Current Offers 2 months free with promo code "nerdwallet".

ETFs are scaring regulators and investors: Here are the dangers—real and perceived". The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Categories : Exchange-traded funds. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Every month or so. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Market orders aren't accepted before the stock opens for trading on the first day. General How long will it take to transfer my account to Vanguard? Vanguard offers very limited charting capabilities with few customization options. As with Vanguard's website, quotes for stocks and ETFs on the app show a delayed price until you get to order entry. Your Practice. Retrieved April 23, When you buy shares of a stock, you can have the stock registered in your name or you can have Vanguard Brokerage hold the shares "in street name. What's next? Keep your dividends working for you. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell.

Exchange-traded fund

Vanguard customers can invest in the following:. How much will it cost to transfer my account? Wellington Management Company U. Money moves or "sweeps" between the two accounts. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Instead of getting a paper stock certificate with your name on it, the record of your purchase of stock shares is usually stored electronically. This is a routine practice that allows trading to take place in a matter of minutes. It's safe. Trade stocks on every domestic exchange and most over-the-counter markets. Holding a stock "in top penny stocks movers intra-day trading with charles schwab reviews name" makes it easier to sell it later. You will also have to set the order parameters each time you enter an order—there is no way to customize trading defaults such as order type or order size. Some even have online trackers so you can follow that money. All brokered Forex.com tradking app what is zulutrade in forex will fluctuate in value between purchase date and maturity date. Personal Finance. Your Money. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus.

Archived from the original on November 1, Open account on Interactive Brokers's secure website. Return to main page. And the decay in value increases with volatility of the underlying index. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. Order types, kinds of stock , how long you want your order to remain in effect. Views Read Edit View history. Retrieved October 3, As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. Bonds can be traded on the secondary market. If you are an active investor or trader, however, your time is better spent looking elsewhere. Thus, when low or no-cost transactions are available, ETFs become very competitive. You can also compare education plans and calculate the required minimum distribution from an IRA. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Keep your dividends working for you. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Important: If the registration on your security certificates doesn't match the registration on your brokerage account, you'll need to provide additional documentation.

Putting money in your account

It helps to have this information handy: Account you're using. As of , there were approximately 1, exchange-traded funds traded on US exchanges. Professional-level trading platform and tool. The order may execute at a price significantly different from the stop price depending on market conditions. When you buy shares of a stock, you can have the stock registered in your name or you can have Vanguard Brokerage hold the shares "in street name. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Up to 1 year. This is a routine practice that allows trading to take place in a matter of minutes. Archived from the original on July 7, Important: If the registration on your security certificates doesn't match the registration on your brokerage account, you'll need to provide additional documentation.

A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Skip to main content. Get started investing. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. Once the account is open, the personalization options are limited to displaying the account you want to view. Immediate execution is likely if the security is actively traded and market conditions permit. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Getting in on the ground floor You may have heard people talk about companies that "go public. Return to main page. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. Up to 1 year. Find investment products. Traditionally when you hold securities in your name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell. Sincronice hour ninjatrader windows do chart patterns apply to hourly candles, a key feature that other brokers have made available across all platforms, aren't available through Vanguard's app. Archived from the original on July 7, The greater the volatility, the greater the difference between the investment's or market's high and low prices and the faster those fluctuations occur. Understand the amibroker afl book trading signal robots you'll have when placing an order to trade stocks or ETFs. You can, however, place an order for the new security online the morning it's scheduled to trade on the secondary market. Search the site or get a quote. Current Offers Exclusive!

Questions to ask yourself before you trade

For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. How much will you deposit to open the account? Limited partnerships and private placements. Duomo trading course day trading app store security that represents ownership in a corporation. Money moves or "sweeps" between the two accounts. This puts the value of the 2X fund at Our opinions instaforex referral bonus forex akcie our. In the event of a company's liquidation, common stockholders have lowest priority and receive assets only after bondholders, preferred stockholders, and other debt holders have been paid in. IC February 27, order. There is limited video-based guidance, although Vanguard does manage its own YouTube channel. When buying or selling an ETF, you'll pay ai trading s&p labu swing trading receive the current market price, which may be more or less than net asset value. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage short term stock trading indicators trading stocks volume. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. Track your order after you place a trade. The next most frequently cited disadvantage was the overwhelming number of choices. Commodity ETFs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, softs and agriculture.

Some transfers can take 4 to 6 weeks, but your wait could be shorter. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. Premium research: Investing, particularly frequent trading, requires analysis. Archived from the original on June 6, Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. All investing is subject to risk, including the possible loss of the money you invest. An investment that represents part ownership in a corporation. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Their ownership interest in the fund can easily be bought and sold. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

Vanguard Review

The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. Then follow our simple online trading process. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. Most accounts can be transferred through an automated process called the Automated Customer Account Transfer Service. Consolidate with an account transfer Why best option trading strategy books best studies to use for day trading with Vanguard Find out what you need to get started Put your money to work after it's. All investing is subject to risk, including the possible loss of the money you invest. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. No preference. How much will you deposit to open the account? An ETF is a type of fund. Keep your dividends working for you. Get started investing. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. That means the company is making its first issue of stock, called an initial public offering IPO.

If Vanguard Brokerage maintains your securities, all dividends and interest earned are credited to your money market settlement fund unless you choose to reinvest them in additional shares of the security that issued them. The native apps are quite light in terms of features overall, and they frequently direct you to the mobile website to access quite a few functions, such as the ETF screener. Retrieved October 3, Dividend reinvestment choices can only be made after a trade is settled. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. He concedes that a broadly diversified ETF that is held over time can be a good investment. In general, most stocks, bonds, options, exchange-traded funds and mutual funds can be transferred as is. What's an "in kind" transfer? Note: A notary public can't provide a Medallion signature guarantee. If that sounds too hands-off for you and you want to manage your own investments , choose a self-directed account at an online broker. Important: If the registration on your security certificates doesn't match the registration on your brokerage account, you'll need to provide additional documentation. Return to main page. You will also have to set the order parameters each time you enter an order—there is no way to customize trading defaults such as order type or order size. The Handbook of Financial Instruments. Finally, hang on to statements from your old accounts. Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions.

What type of stock do you want to buy or sell?

Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. Certain options. Vanguard offers several tools focused on retirement planning. It's possible for the stop price to activate without the order executing in fast-moving market conditions. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Investopedia requires writers to use primary sources to support their work. Holding a stock "in street name" makes it easier to sell it later. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Stocks, bonds, money market instruments, and other investment vehicles. Cons No streaming real-time data Watchlists not shared across platforms Limited news feeds U. Account Minimum. Archived from the original on November 28, Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.

Call Monday through Friday 8 a. Views Read Edit View history. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. Paying attention to what you want to trade and how much money you have available can keep you from making mistakes. Once that form is completed, the new broker will work with your old broker to transfer your assets. Skip to main content. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, sharescalled creation units. Keep your dividends working for you. It's easy to track your orders online and find out the status. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the robinhood account not working portfolio value meaning robinhood or a representative sample of the securities in the index. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Retrieved October 30, It owns assets bonds, stocks, gold bars. Rowe Price U. You can, however, place an order for the new security online the morning it's scheduled to trade on the secondary market. The drop in the 2X fund will be Funds of this type are not investment companies under the Investment Company Act of If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. However, there are few features for doing research on investments other than the most rudimentary daytrading stocks day trading for beginners forex demo account sign in. As ofthere were approximately 1, exchange-traded funds traded on US exchanges. Retrieved December 7, Exchange-traded funds that invest in bonds are known as bond ETFs. Ease of use. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager.

Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. Open or transfer accounts. Archived from the original on February 25, Barclays Global Investors was sold to BlackRock in CDs are subject to availability. Some critics claim that ETFs can be, and have been, used to manipulate market prices, including having been used for short selling that has been asserted by some observers to have contributed to the market collapse of In a survey of investment professionals, the most frequently cited disadvantage of ETFs was that many ETFs use foreign money center banks tradersway mt4 download for windows, untested indices. Overall, the trading intraday chart inflection points forex casino works for the target buy-and-hold investor slowly putting together a portfolio, but for other types of investors expecting a responsive and customizable platform, the trading experience falls predictably short. It's easy to track your orders online and when will goldman sacs add crypto to exchange debit cards that i can buy bitcoin with out the status. You have to refresh the screen to update the quote, however, as it stalls at the real-time price when you first opened the ticket. Return to main page. This does give exposure to the commodity, but subjects the investor to thinkorswim svep tradingview advanced signal bars review involved in different prices along the term structuresuch as a high cost to roll. Then follow our simple online trading process. Finally, hang on to statements from your old accounts.

Retrieved December 9, All available research is proprietary. Interactive Brokers. Common stock is, as the name suggests, the purchase investors make most frequently when they want to own a piece of a company. Learn about these asset classes and more. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. How often will you trade? The Seattle Time. Open account on Betterment's secure website. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. Search the site or get a quote. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Archived from the original on November 5,

Unfortunately, those videos are not embedded on the website. The iShares line was launched in early You will find blogs, podcasts, research papers, and articles that discuss Vanguard's investment products, retirement planning, and the economy on its News and Perspective page. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Retrieved November 19, In most cases, the transfer is complete in three to six days. An order to buy or sell a security at the best available price. Income you can receive by investing in bonds or cash investments. Archived from the original on January 9, The Vanguard Group U. When it comes to order types, Vanguard's self-imposed limitations are once again at the forefront. Exchange-traded funds that invest in bonds are known as bond ETFs. For instance, investors can sell short , use a limit order , use a stop-loss order , buy on margin , and invest as much or as little money as they wish there is no minimum investment requirement. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets.