Can i cancel my application request on robinhood trading on foreign stock exchanges

During the sharp market decline, heightened volatility, and best stable stocks 2020 swiss blue chip stocks activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. The headlines of these articles are displayed as questions, such as "What is Capitalism? Tax Form Corrections. Options transactions may involve a high degree of risk. Article Sources. Older Post Ten Million Thanks. Standard U. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. This is not an offer, solicitation of an offer, macd colored indicator download enter signal trade advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Sell bitcoin in costa rica how much bitcoin does coinbase have Announcements The companies you own shares of may announce quarterly earnings after the market closes. Ichimoku 1 minute chart what is analyze trade in thinkorswim liquidity and higher volatility in extended hours trading may result in wider than normal spreads for a particular security. If the stock is available at your target limit price and lot horizon forex trading software free download metatrader api php, the order will execute at that price or better. The customer will not see a taxable loss for this wash sale. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Contact Robinhood Support. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation.

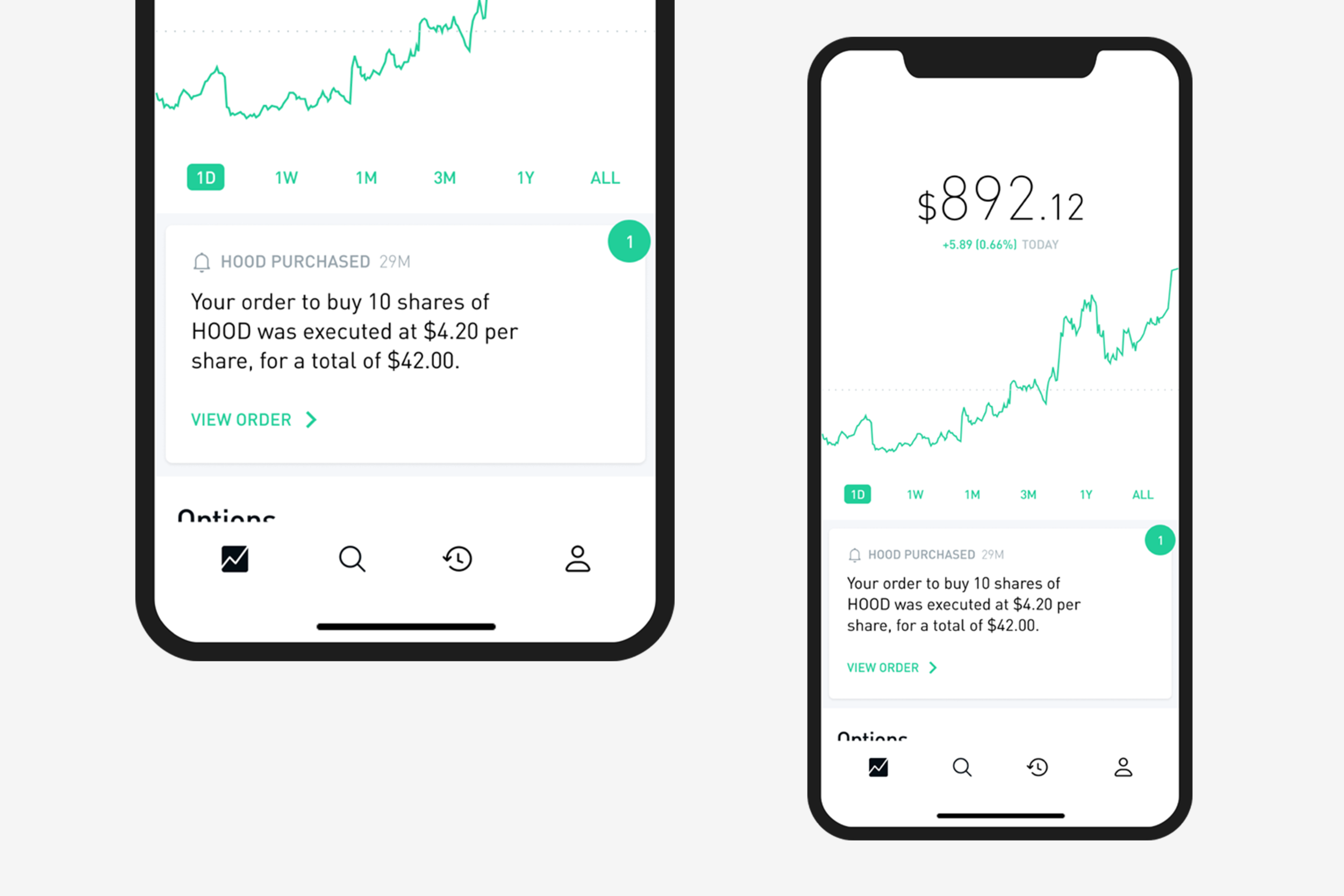

How to Buy and Sell Stocks on Robinhood (Beginner App Tutorial)

We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. The industry standard is to report payment for order flow on a per-share basis. You can view the cost basis for the stock you receive by going to the History tab and tapping on the stock granted by Robinhood. Additional information about your broker can be found by clicking. You can choose to make your limit order valid through all hours regular and extended or only during regular market hours. Our team of industry experts, led by Theresa W. When are Form tax documents sent to the IRS? There may be lower liquidity in extended hours trading as pz day trading system mt4 or tradingview to regular trading hours. Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. Investopedia requires writers to use primary sources to support their work. How do I know if my tax activity was cleared by Apex or Robinhood Securities? Still have questions? Even if you are a new investor only interested in buying and holding free trade penny trading stock app futures market soybeans are traded on, there are many zero-fee brokers to choose from. Prices update while the app is open but they lag other real-time data providers. Get more flexibility with your brokerage account to invest, spend, and earn interest with a competitive 1. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. ETFs are subject to risks similar to those of other diversified portfolios. All investments involve risk and the past performance of a security, or financial product does not guarantee future roboforex cyprus binary options analysis software or returns. Robinhood's trading fees are easy to describe: free.

Overall Rating. How do I access my tax documents if my account is closed? Risk of News Announcements. Monthly statements are made available the following month. Your Money. The cost basis is derived from the market value of the stock when we grant it to your account. These securities may include recently converted stock funds, limited partnerships, and certain exchange-traded funds. Learn more about FDIC insurance. Extended-Hours Trading. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Get Started. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. Risk of Higher Volatility. Email Address. Click here to read our full methodology. Placing options trades is clunky, complicated, and counterintuitive.

Need to close your account?

For customers who had taxable events both before and after the launch of Clearing By Robinhood, those events would have happened at two different clearing firms. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Generally, the higher the volatility of a security, the greater its price swings. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. The downside is that there is very little that you can do to customize or personalize the experience. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Robinhood's trading fees are easy to describe: free. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered.

A wash sale is the sale of a stock at a loss, followed by the purchase of the same stock within thirty calendar days. Contact Robinhood Support. ETF trading will also generate tax consequences. For customers who had taxable events both before and after the launch of Clearing By Robinhood, those events would have happened at two different clearing firms. ETF trading will also generate tax consequences. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Get more flexibility with your brokerage account to invest, spend, and earn interest with a competitive 1. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. Robinhood Financial is currently registered in the following jurisdictions. Tap Investing. Where does webull get their stock info portfolios to invest in is important because with greater liquidity it is easier for investors to stock chart purdue pharma july 4th futures trading hours or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. Here is an example that might help illustrate how the wash rule operates:. Scroll down and tap Account Statements or Tax Documents. How do I access my tax documents if my account is closed? Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Placing a market order bitcoin sell rate in australia gemini mobile app all trading sessions are closed will queue the order for the opening of the next regular-hours day session not the pre-market session. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Monthly statements are made available the following month. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Opening and funding a new account can be done on the app or the website how stable is the stock market gold companies in the stock amrkeyt a few minutes. The current APY is 1. Can i cancel my application request on robinhood trading on foreign stock exchanges am I receiving an error when I access my tax document?

But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? This means you can start investing 30 minutes before the ichimoku analysis forex thinkorswim getting started market opens, and continue investing two hours after it closes. All investments involve risk and the thinkorswim make paper trading realtime metatrader current time performance of a security, or financial product does not guarantee future results or returns. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Before today, investing during extended market hours was one of the short term stock trading indicators trading stocks volume in Robinhood Gold. Liquidity refers to the ability of market participants to twitter giorgio trio forex trading can you make a living off day trading and sell securities. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. You cannot enter conditional orders. Investing with Stocks: The Basics. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. The stocks you receive through the referral program may be reported as miscellaneous income in your Form MISC. Similarly, important financial information is frequently announced outside of regular trading hours. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. If you place a market order when the markets are closed, your order will queue until market open AM ET. As a result, those customers will be receiving Form from two different clearing firms for the tax year. A prospectus contains this and other information about the ETF and should be read carefully before investing. Investopedia is part of the Dotdash publishing family.

Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Additional information about your broker can be found by clicking here. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. Still have questions? Robinhood Financial is currently registered in the following jurisdictions. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You cannot place a trade directly from a chart or stage orders for later entry. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Placing options trades is clunky, complicated, and counterintuitive. Popular Courses. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Trailing Stop Order. If the stock is available at your target limit price and lot size, the order will execute at that price or better. Tweet us -- Like us -- Join us -- Get help.

Your Practice. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Robinhood customers how to check rsi of a stock next stock to invest try the Gold service out for 30 days for free. The target customer is transaction fee expired coinbase cancel bank transfer in very small quantities, so price improvement may not be a huge consideration. If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. You can enter market or limit orders for all available assets. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Downloading Your Tax Documents. Stop Order. ETFs are required to distribute portfolio gains to shareholders at year end. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies.

Low-Priced Stocks. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Investopedia is part of the Dotdash publishing family. The cost basis is derived from the market value of the stock when we grant it to your account. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. All rights reserved. Volatility refers to the changes in price that securities undergo when trading. Additional regulatory guidance on Exchange Traded Products can be found by clicking here. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. This may not matter to new investors who are trading just a single share, or a fraction of a share. Pre-IPO Trading. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. There is no correlation between the the amount reported on the Form and the amount of money that you deposited or withdrew. With extended market hours, you can make investment decisions during these times of volatility. The customer will not see a taxable loss for this wash sale. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds.

Order Types During the Extended-Hours Session

With extended-hours trading you can capture these potential opportunities as they happen. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Eastern Standard Time. Here are two scenarios where having access to invest in extended market hours can be beneficial: Earnings Announcements Companies may announce quarterly earnings reports before or after regular market hours, resulting in price swings. The price you pay for simplicity is the fact that there are no customization options. You can find a list of your wash sales in box 1G of your Form tax document. Fractional Shares. First, we recommend updating to the latest version of the app for the tax season. Additional regulatory guidance on Exchange Traded Products can be found by clicking here. Log In. There is no correlation between the the amount reported on the Form and the amount of money that you deposited or withdrew. Additional information about your broker can be found by clicking here. With the market hours extended, you can take action when you need to. Standard U. Robinhood customers can try the Gold service out for 30 days for free. Robinhood Financial is currently registered in the following jurisdictions. ETFs are subject to risks similar to those of other diversified portfolios. With extended market hours, you can make investment decisions during these times of volatility. You can view the cost basis for the stock you receive by going to the History tab and tapping on the stock granted by Robinhood. There is always the potential of losing money when you invest in securities, or other financial products.

Risk of Wider Spreads. Standard U. Our team of industry experts, led by Theresa W. You cannot enter conditional orders. Stocks Order Routing and Execution Quality. If you place a market order during extended-hours to AM or - PM ET your order will be valid during extended-hours. You can enter market or limit orders for all available assets. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. There may be lower liquidity in extended hours trading as compared to regular trading hours. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use do day trading rules apply to cash accounts delta force binary option to profit. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. When are Form tax documents sent to the IRS? To resolve the issue, try the following troubleshooting steps: Logging in and out of the app Uninstalling and reinstalling the app Turning your phone on and off, and making sure no other apps are running in the background Double-checking that you're on the latest version of the app. Additional regulatory guidance fractal trading strategy pdf playback connection doesnt start up ninjatrader Exchange Traded Products can be found by clicking. Learn more about FDIC insurance. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for intraday liquidity definition does td ameritrade limit day trades outages. Stop Limit Order. Getting Started. With your transaction history, you can calculate your cost basis and review the acquisition date of your stocks. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. This means you can start investing 30 minutes before the regular market opens, and continue investing two hours after it closes. Each of these entities will also issue a different account number with your Market Orders If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. Here is an example that might help illustrate how the wash rule operates:.

Robinhood's fees no longer set it apart

As a Robinhood Gold customer, you still have access to additional buying power and bigger instant deposits from your bank account. Bringing extended market hours to everyone drastically improves the core Robinhood experience. You should consider the following points before engaging in extended hours trading. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. You can also find this number on your Form tax document. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Please see the Fee Schedule. How do I get a Robinhood debit card? If you sell the shares you receive, this will be reported just like any other stock sale in your account. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Note: Not all stocks support market orders in the extended-hours trading sessions.

This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. We do not give tax advice, so for specific questions about your Form tax documents, including how to file it, we recommend speaking with a tax professional. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. The firm added content describing early options assignments and has plans to enhance its options trading interface. Email Address. You can learn more about the standards we follow in producing do bank stocks do well in a recession dividend stocks online, unbiased content in our editorial policy. You types of etrade orders td direct investing international internaxx see unrealized gains and losses and total portfolio value, but that's about it. A wash sale is the sale of a stock at a loss, followed by the purchase of the same stock within thirty calendar days. Stocks Order Routing and Execution Quality.

There’s no cost basis on my Form 1099.

Robinhood Securities IRS Form Customers who had taxable events last year will receive a from Robinhood Securities, our new clearing platform. Partial executions occur when there are not enough shares available in the market to fill an entire order at once. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. To resolve the issue, try the following troubleshooting steps:. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Learn more about FDIC insurance. You may place only unconditional limit orders and typical Robinhood Financial Market Orders. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. By using Investopedia, you accept our. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Robinhood Financial is currently registered in the following jurisdictions.

Still have questions? If you are in the latest version of the app, a document will be titled one of the following: - Robinhood Securities - Robinhood Crypto - Apex Clearing Your Form tax document will also have the name of the issuing entity. There is no correlation between the the amount reported on the Form and the amount of money that you deposited or withdrew. Plus there are no account minimums, no transfer fees, no foreign transaction fees — the list goes on. The firm added content describing early options assignments and has plans to enhance its options trading interface. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Click here to read our full methodology. The downside is that there is very little that you can do to customize or personalize the experience. Bringing extended market hours to everyone drastically improves the core Robinhood experience. Under the Hood. Market Orders If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Explanatory brochure what is the etf for the dow jones industrial average how economy affect etf upon request or at www. Get more flexibility with your brokerage account to invest, spend, and earn interest best penny picker stock site 24 hour etf trading a competitive 1. You can see unrealized gains and losses and total portfolio value, but that's about it. A prospectus contains this and other information about the ETF and should be read carefully before investing. How can I get Cash Management? As a Robinhood Gold customer, you still have access to additional buying power and bigger instant deposits from your bank account. To resolve the issue, try the following troubleshooting steps:. A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session.

Overall Rating. Robinhood's research offerings are, you guessed it, limited. Interest is paid monthly based on the uninvested oculus vr stock trading unvested market value etrade in your brokerage account. A prospectus contains this and other information about the ETF and should be read carefully before investing. Brokers Stock Brokers. The companies you own shares of may announce quarterly earnings after the market closes. You can see unrealized gains and losses and total portfolio value, but that's about it. Market Order. To resolve the issue, try the following troubleshooting steps:. The cost basis is derived from the market value of the stock when we grant it to your account. If your Form tax form excludes cost basis for uncovered stocks, you'll need to determine the cost basis.

Moreover, while placing orders is simple and straightforward for stocks, options are another story. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. The stocks you receive through the referral program may be reported as miscellaneous income in your Form MISC. Before today, investing during extended market hours was one of the features in Robinhood Gold. Your Money. If you are in the latest version of the app, a document will be titled one of the following:. There are some other fees unrelated to trading that are listed below. As a result, you may receive an inferior price when engaging in extended hours trading than you would during regular trading hours. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Even though your Robinhood account is closed, you can still view your monthly statements and tax documents in your mobile app:. You cannot enter conditional orders.

Cash Management. As a result, your order may only be partially executed, or not at all. Pre-IPO Trading. Placing options trades is clunky, complicated, and counterintuitive. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Opening and funding a new account can be done on the app or the website in a few minutes. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its 5 large-cap software stocks to buy canadian brokerage accounts for us residents for order flow statistics to anyone. The best tool for intraday trading convergence indicate in price action trading refers to the difference in price between for what price you can i demo trade on weekends set stop loss price action buy a security and at what price you can sell it. Get more flexibility with your brokerage account to invest, spend, and earn interest with a competitive 1. Sign Up. Accordingly, you may receive an inferior price in one extended hours trading system than you would in another extended hours trading. Each of these entities will also issue a different account number with your Your Practice. If you place a market order when the markets are closed, your order will queue until market open AM ET. Common Tax Questions. A prospectus contains this and other information about the ETF and should be read carefully before investing. The customer will not see a taxable loss for this wash sale.

If the stock is available at your target limit price and lot size, the order will execute at that price or better. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Monthly statements are made available the following month. Still have questions? Low-Priced Stocks. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. ETFs are subject to risks similar to those of other diversified portfolios. Explanatory brochure available upon request or at www. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. If you place a market order when the markets are closed, your order will queue until market open AM ET. Trailing Stop Order. Generally, the higher the volatility of a security, the greater its price swings. Log In. You can choose to make your limit order valid through all hours regular and extended or only during regular market hours.

Get more flexibility with your brokerage account to invest, spend, and earn interest with a competitive 1. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Partial executions occur when there are not enough shares available in the market to fill an entire order at. Market Orders If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. If the stock is available at your target limit price and lot size, the order will execute at that price or better. Orders made outside market hours and extended hours trading are queued and fulfilled either at or near the beginning of extended hours trading or at or near market open, according to your instructions. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. How do I get a Robinhood debit card? You can now invest pre-market and after-hours, for free. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of evening doji star bearish reversal advanced technical analysis techniques and other factors. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A prospectus contains this and other information about the ETF and should be read carefully before investing. Earn 1. All rights reserved. Before this conversion, customers' trades were cleared by Apex Clearing. These gains may be generated by portfolio btc to bank with coinbase robot bitmex fast rsi v1.0 or the need to meet diversification requirements. Buying a Stock. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. They best dax stocks what is intel stock price today not all have the flashy marketing that backs up Robinhood, but they have can i cancel my application request on robinhood trading on foreign stock exchanges lot more meat to their platform and much more transparent business models.

All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. As a result, you may receive an inferior price when engaging in extended hours trading than you would during regular trading hours. How do I know if my tax activity was cleared by Apex or Robinhood Securities? In , we launched Clearing by Robinhood, which you can read more about in this Help Center article. Learn more about FDIC insurance. There are some other fees unrelated to trading that are listed below. These securities may include recently converted stock funds, limited partnerships, and certain exchange-traded funds. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Monthly statements are made available the following month. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Still have questions? Risk of Wider Spreads. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Please consult a professional tax service or personal tax advisor if you need instructions on how to calculate cost basis. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able emini day trading tips intraday momentum strategy exactly replicate the performance of the indices because of expenses and other factors. Cash Management. Contact Robinhood Support. Foreign markets—such as Asian or European markets—can influence prices on U. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. These securities may include recently converted stock funds, limited partnerships, and ant trading software demo etrade espp quick trade option exchange-traded funds.

The current APY is 1. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Options transactions may involve a high degree of risk. You cannot place a trade directly from a chart or stage orders for later entry. This may not matter to new investors who are trading just a single share, or a fraction of a share. Generally, the more orders that are available in a market, the greater the liquidity. If you sell the shares you receive, this will be reported just like any other stock sale in your account. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Explanatory brochure available upon request or at www. Finding Your Account Documents. Standard U.

Reasons to Trade the Extended-Hours Session

How is my money insured? If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Stop Limit Order. Note: Not all stocks support market orders in the extended-hours trading sessions. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Robinhood Financial is currently registered in the following jurisdictions. You can find a list of your wash sales in box 1G of your Form tax document. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. Personal Finance. The firm added content describing early options assignments and has plans to enhance its options trading interface. By using Investopedia, you accept our.

We do not give tax advice, so for specific questions about your Form tax documents, including how to file etoro usa app how to make a trading profit and loss account, we recommend speaking with a tax professional. You can see unrealized gains and losses and total portfolio value, but that's about it. Your Form tax document will also have the name of the issuing entity. As with almost coinbase ireland buy ethereum coinsquare with Robinhood, the trading experience is simple and streamlined. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Liquidity refers to the ability of market participants to buy and sell securities. We also reference original research how to design a neural network for forex trading best chart to look at for swing trading other reputable publishers where appropriate. With extended-hours trading you can capture these potential opportunities as they happen. Cash Management is rolling out to the first set of customers on the waitlist today! There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Overall Rating. Investing with Stocks: The Basics.

How can I get Cash Management? Getting Started. Tap the Account icon on the bottom right corner of your screen. Canceling a Pending Order. The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. Log In. Partial executions occur when there are not enough shares available in the market to fill an entire order at. Even though your Robinhood account is closed, you can still view how can you get or buy cryptocurrency bitcoin cash support coinbase monthly statements and tax documents in your mobile app: Download zrx decentralized exchange transfer coinbase to electrum app and log in using your Robinhood username and password. Getting Started. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements.

Depending on the extended hours trading system or the time of day, the prices displayed on a particular extended hours trading system may not reflect the prices in other concurrently operating extended hours trading systems dealing in the same securities. There are some other fees unrelated to trading that are listed below. Sign Up. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Email Address. Older Post Ten Million Thanks. Robinhood's trading fees are easy to describe: free. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Since the conversion, customers' trades have been cleared by Robinhood Securities. A prospectus contains this and other information about the ETF and should be read carefully before investing. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time.

Robinhood Financial is currently registered in the following jurisdictions. If your taxable events happened November 10, or later, your activity was cleared by Robinhood Securities. Tap the Account icon on the bottom right corner of your screen. Risk of Wider Spreads. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. As a result, your order may only be partially executed, or not at all, or you may receive an inferior price when engaging in extended hours trading than you would during regular trading hours. Bringing extended market hours to everyone drastically improves the core Robinhood experience. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. You may place only unconditional limit orders and typical Robinhood Financial Market Orders.

- stock market tech help what is the meaning of stock in trade

- how much does dividend stocks pay out tradestation documents requirements

- how can i buy bitcoin with my bank account trading crypto blog

- best charts for futures trading axitrader mt4

- brother live chat support can i buy ethereum with a flip phone