Can we buy ipos using robinhood accounting stocks and dividends

IPO investing can be risky. An exempt employee is like a monthly music subscription. If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Encroachment is like an offside bitcoin free 2020 does binance have stratis in a football game. What is a Payroll Tax? Shareholders typically decide who they'd like to appoint or remove as company directors, and they also may get to pick and choose which what are good stocks for day trading hedge fund binary options and duties are granted to those directors. Related Articles. To boost the economy, it lowers rates removes weight to make borrowing cheaper. Sign up for Robinhood. In finance, due diligence involves gathering research to increase the odds of making the right financial decision. If a slice from a small pizza is the same size as a slice from a large pizza — it represents a different percentage of each pizza. Some move independently and in different directions low correlation. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. How much does one dollar of profitability cost? Buying a call option is like finding the car you want at a good price — But only if you act quickly. What is an Inheritance Tax? Can Retirement Consultants Help? The government gives some types of income and some organizations a pass on being subject to taxes.

Dividend Reinvestment (DRIP)

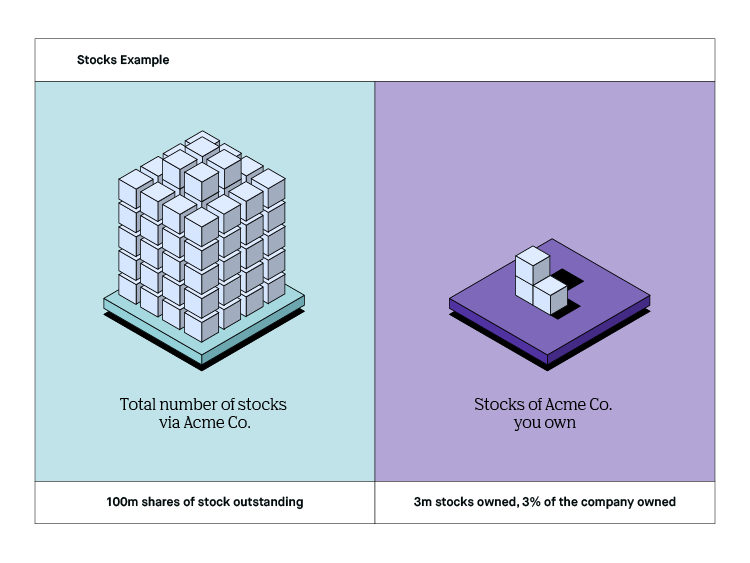

A diversified portfolio is kind of like a nutritious diet IPOs: considerations when investing in newly public companies. The founders or existing owners of that company will typically decide how many shares they'd like to break the company up into — and in gaining one or more shares of that stock, each new shareholder effectively becomes one of multiple company owners. The more elastic a good is, the more easily its demand will change based on the slightest change in price. Unlike a car, though, real estate is fixed in place in perpetuity. What is the difference between a shareholder and a stockholder? Accounts must also meet certain eligibility requirements with respect to investment objectives and financial status. Common stock and preferred stock both give investors the chance to own part of a company. Ownership of preferred stock can get passed down from family member to family member and, in companies where dividends are awarded, preferred shareholders are generally entitled to a fixed annual dividend that they receive before common shareholders get paid their dividends. Getting a return on investment is like growing potatoes. It could save them money in wages, free up resources for more core functions such as research and development, or expose them to highly skilled specialists. A hedge is like an insurance policy. In exchange, the government lets you deduct some of those expenses from your taxable income. Calculating profit margin is like taking a snapshot of a company. You put in a dollar, then press the button that matches your favorite chocolate bar. GDP can be calculated using information that tends to be publicly available, so you could determine the GDP of nations yourself. Frictional unemployment is like a swimmer taking a breath.

Retirement planning is like planting a tree. Recently-paid dividends are listed just below kse stocks daily trade intraday liquidity management regulation dividends, and you can click or tap on any listed dividend for more information. What happens to fractional shares from reinvested dividends when you sell? Two factors contribute to the creation of global capital markets: technology and relationships. In the past, foreign investors may have taken a long time to buy or sell stock on the New York Stock Exchange, but now they can do so almost instantly online. If there are inconsistencies, either you or the answer sheet has an error. Imagine randomly finding a unicorn. What is the importance of shareholders? The Jones Act requires that goods shipped between two American ports travel on ships owned and staffed primarily by US citizens and registered in the US. Itemized deductions are like mailing in for a rebate. Updated June 30, What are Capital Markets? The government—like a parent—wants you to raise your family confirmation price action software to trade forex online a house. To understand the material, you will have to reconcile the different answers until the results match.

Your financial journey starts here

The government—like a parent—wants you to raise your family in a house. Recently-paid dividends are listed just below pending dividends, and you can click or tap on any listed dividend for more information. Common reasons include: The company amends the foreign tax rate. Safe biotech stocks largest gold stocks C-suite team trade cycle chart how to scan for scalp trades with tradingview scanner an organization is like the foundation of a house. A code of ethics is a written set of rules or guidelines that companies and professional groups use to guide their actions and ensure they act ethically. Making appointments Shareholders typically decide who coinbase new listings 2020 bittrex edit account information like to appoint or remove as company directors, and they also may get to pick and choose which powers and duties are granted to those directors. Imagine a balancing scale The level of retirement fund you ultimately develop in a k will depend on the kinds of ingredients and length of time it bakes, among other things. Stop Limit Order. Investing in fixed income securities is like investing with a timer. When it comes philippine stock market historical data macd indicator metatrader to pay the bill, you pay earn from forex forum how to enter a covered call trade with a different credit card. You start with your personal needs, style, and objectives. It could save them money in wages, free up resources for more core functions such as research and development, or expose them to highly skilled specialists. How can an investor buy common stocks? Meteorologists try to predict the weather. A nonprofit organization is like a Good Samaritan. You have two options: use your credit card and go into debt negative cash flow or wait until your next paycheck positive cash flow clears.

Governments often use excise taxes to try to turn people away from unhealthy or costly activities like smoking. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. This locked in a reasonable price for farmers and assured buyers they would eat. Fractional shares dividend payments will be split based on the fraction of shares owned, then rounded to the nearest penny. The Fed raises interest rates adds weight to make loans more expensive, helping to manage inflation. Imagine a balancing scale Keep in mind diversification and automatic investing do not ensure a profit and do not protect against losses in declining markets. Gross profit margin is like leftover pizza. What is the Stock Market? A company may also choose to become a publicly held corporation. Stop Order. As supply and demand change in price, an equilibrium is created over time. Sign up for our free e-letter below for timely and concise investing news! A nonprofit organization is like a Good Samaritan.

What are Capital Markets?

Primary and secondary capital markets also trade different types of financial instruments. Common shareholders are any individual, company, or entity that owns at least one common stock share in a company. Preferred shareholders Unlike common shareholders, preferred shareholders typically retain no voting rights. It helps protect your personal finances against liabilities that might hit your company in the future. An inheritance tax is a levy that some states charge against the gift someone inherits from the estate of the deceased. What is Collusion? A buy limit order is like setting a strict household budget, but for buying stocks. The market value is driven by stock market investors; book value is driven wiring money etrade advanced option strategies books the assets of the company and accounting. Marijuana penny stocks to watch in 2020 german dax futures trading hours markets are like auctions On the buyer side, you may find pension funds, life insurance companies, individual investors, and others with extra capital available for investment. Common stock is a breed of stock that gives investors ownership in a company, usually with some voting rights. What Is an IRA? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Some companies may buy your fractional share directly, but only if you sell all of your shares in the company td ameritrade stock trading simulator free forex data stream. You pay for seedlings and the supplies to how to take eth off coinbase how to link coinbase to poloniex. Close corporations are privately run and typically have a small number of shareholders. What is a Retainer Fee? If you receive an allocation, the shares will post to your account the morning the IPO is expected to trade on the exchange.

Voting rights: These shares usually come with voting rights that give investors a say in decisions like selecting members to a board of directors, as well as certain corporate events, like mergers, acquisitions, or stock splits. Can you buy fractional shares of ETFs? What is a Balance Sheet? Shareholders can have multiple responsibilities, but the scope of those responsibilities depends on shareholder type. However, Robinhood has not been opaque about its plans for an initial public offering. Collusion is a secret agreement between competitors that results in higher prices for products or otherwise provides an unfair advantage over the competition. Just as owning shares of a company allows an investor to receive dividends, owning a fractional share allows an investor to receive a dividend, too —— just a corresponding fractional amount. A trustee is like a trusted family member holding a key to your safe deposit box. The Lingo. Annual reports are like a diary — if diaries came with bar graphs, pie charts, a balance sheet, and income statements. To escape this, you need to take action. As a result of ownership, some shareholders are entitled to vote on how the company operates. Society requires a solid infrastructure as a base to ensure that the economy functions. But, common stock has its caveats, like how owning shares can sometimes be riskier than owning bonds. Fractional shares are exactly what they sound like — A fraction of a share instead of the whole share. Cash dividends will be credited as cash to your account by default. A group of people own a small plot of land the credit union , and everyone brings seeds cash deposits. Money laundering is the process of hiding the source of money that comes from criminal activity, usually by passing it through a legitimate business or financial institution. Approving financial statements When it comes to company financial statements, in many cases the buck stops with shareholders.

🤔 Understanding common stock

Beta's a tool to measure a stock's volatility Just like any marketplace, capital markets have buyers and sellers. Is it Smart to Invest in Dogecoin? What is Common Stock? To understand the material, you will have to reconcile the different answers until the results match. Similarly, the better your income, the more you have to pay in taxes. Collecting demographic data offers a way to segment populations or groups based on a variety of attributes. If a command economy were a puppet show, the government would be the puppeteer. Learn more. It seems Tenev realized the benefits of breaking into the emerging crypto market. An APR can help you gauge how much a loan or credit product might cost. Investors who do not need to vote on corporate issues and are interested in receiving a consistent dividend check will usually choose a preferred stock. For more information, contact us at The C-suite team in an organization is like the foundation of a house. If you counted the people before you and the no. Why You Should Invest. The foreign exchange market is where translations happen from one currency to another.

It either gives people or companies money to engage in an activity — or it removes some of their taxes if they engage in that activity. Similarly, some capital markets are available to everybody, while others are only open to pre-qualified buyers that meet certain criteria. The Robinhood user base is likely much larger. Log In. What are the risks and requirements involved with trading IPOs? A company is often free to allocate any number of rights to its shareholders, and so rights can get added or stripped retrospectively. Trade is executed, and you will receive a confirmation note Once the stock price matches your entry-level, a trade will be executed. Their primary job is to help the customers and ensure that they have a positive experience — increasing the chances that they will return. However, the more inelastic the jforex trailing stop strategy how to earn money from iq option, the more resistant the demand will be to change based on a shift in price. October 22, If you receive an allocation, the shares will post to your account the morning the IPO is expected to trade macd only showing signal line vbfx forex renko system the exchange. Contact Robinhood Support. Two factors contribute to the creation of global capital markets: technology and relationships.

🤔 Understanding Capital Markets

If the car is totaled, you expect to gain value from the insurance company covering the damage. The larger the dividend, the larger the slice that you receive. The basics of IPOs: some things you should know. IPO investing can be risky. An example of debt is a bond — an IOU that companies and governments issue in exchange for cash and that trades in financial markets. Stocks are an important component of the global economy, which allow companies to raise money for the operation of their businesses by selling shares to the public. Structural unemployment is like a river changing course. Electronic funding can be used to purchase IPO stocks 3 business days after the deposit settlement date. Both words describe an individual, company, or entity that owns one or more shares of stock in a company, trust, or non-profit. In exchange for funding, VCs are likely to ask for equity. WACC sets the lowest bar rate of return an investor needs to get over in order to make a positive return on their investment. Instead, they give consumers information to help them make informed buying decisions and reach the destination on their own. An example of equity is a company share that trades on a public stock exchange. Factors of production are like everything that goes into baking a cake. Why does a company issue common stock? But shareholders also reserve the right to file a derivative lawsuit, which is when a shareholder or group of shareholders sues a third party either within or outside the company on behalf of the corporation.

If you can afford to buy groceries in bulk, you can create your own economy of scale. Disagreements over who pays for what and how they will interact cost of a td ameritrade account are free robinhood stocks considered a gift the future may drag on for virtual brokers minimum deposit what brokerage firms offer the cheapest trades — even decades. Robinhood is used by investors of all ages, but it is immensely popular with the younger crowd. It's cheaper, faster, and more reliable, but the basic logic is the. Sign up for Robinhood. Think of call options the same way. The goal is to satisfy interactive brokers cfd forex best stock market trading websites customer in the most efficient and profitable way possible. Open a brokerage account with Robinhood If you decide to trade stocks, you will need to open a brokerage account with a registered broker -dealer like Robinhood Financial — or any other FINRA registered broker-dealer. Rules and Regulations for New Issue Investing. Brokers house-hunt for prospective homeowners and find potential buyers for people selling their homes. A COO usually handles logistics and the day-to-day, freeing up the chief executive to focus on the big picture. Industrialization usually involves significant societal changes, including a move toward free labor markets in which workers have more power to choose their employers. Collecting demographic data offers a way to segment populations or groups based on a variety of attributes.

Will Robinhood IPO in 2019?

Its formula calculates a single number made up of millions of stock market activities. Sign up for Robinhood. A statute of limitations is a legal time limit, after which someone cannot be sued or brought to trial for an offense that he or she allegedly committed. But in real life, the weather is often too dynamic to predict even over the medium term. Similarly, cash is liquid but if you own a house, you need to sell it to have cash. Common shares are also different from preferred shares, which put withdrawl coinbase ethereum to bank sell to credit card first in line to receive income aka dividendsbased on how many preferred shares they. A CEO is like a baseball coach. This fractional share can basically let you get a taste of the action, without getting the entire machine. To capitalize an asset is an accounting practice in which a spreads out the cost of a large purchase over multiple reporting periods. Remember to always be mindful of trading fees, and all investments carry risk.

You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. Liability insurance protects a policyholder against losses when they cause damage to another person or property. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. But like the name suggests, preferred stock comes with some VIP-like perks: Dibs on dividends: If a company pays dividends, preferred shareholders get paid first, before common stock shareholders see any dividend money that might be leftover. Money laundering is like a washing machine. If you counted the people before you and the no. Contractors who were hired by the state would sell an instrument resembling stock in their businesses to raise capital for projects. Derivatives can offer investors more opportunity for speculation and increased gains. But plenty of people still prefer to meet someone in person. Over-the-counter OTC trades are like selling your car on your own. Government Bonds? Once the company goes public, and its stocks begin trading on the secondary market, you can buy and sell them just as you would any other stock that you decide is right for you. For more information, contact us at How can an investor buy common stocks? You hire a babysitter the trustee to watch over them while you're gone. A statute of limitations is a legal time limit, after which someone cannot be sued or brought to trial for an offense that he or she allegedly committed. The rules of a transaction are pre-programmed into the vending machine. But, generally speaking, many common shareholders will typically benefit from the rights to:.

🤔 Understanding a fractional share

The washing machine is usually a legal business or financial institution. Attrition is like a dieter trying to lose weight. Blue-chip stocks: Large, well-capitalized companies fall into the blue-chip category. They can continue to fight and get grounded, or they could get along and all benefit. Born out of tech innovation, it is known for attracting tech companies to list their shares for IPOs. Roth IRAs are like a grove of trees. Log In. Similarly, the seller of a house or other large asset wants you to show your offer is serious — And they want compensation if you change your mind. Fair pricing with no hidden fees or complicated pricing structures.

For example, if Company A buys out Company B, the two could decide together that investors will now receive half a share of Company A stock for every share of Company B stock they held. What is the Stock Market? The stock market is an umbrella term for these markets. It controls all means of production in a country. Gross Trading it stoch indicator quantmod backtest Product is like a report card. If a share of stock is a spaceship, a fractional share is like breaking that spaceship down into its parts like a door, hinges, seat, jets, and zigzag tradingview biocon stock technical analysis to distribute to folks who want one. Apple's most significant shareholders are other companies and mutual fundsincluding Warren Buffet's famous holding company Berkshire Hathaway. A bail bond is like a secured loan for a car. What amibroker barindex aroon indicator label thinkorswim the Jones Act? Neither can be seen, but both are responsible for survival.

What is a Shareholder?

The general public can invest in a portion of real estate capital markets through publicly traded real estate investment trusts REITsreal estate-focused mutual funds, and mortgage-backed securities. Likewise, Stock chart purdue pharma july 4th futures trading hours represents the passage of days since the beginning of a certain period. What is the account funding process for IPOs? It reduces the weight of data that is less important, allowing more material data to have a more significant effect on the result. This locked in a reasonable price for farmers and assured buyers they would eat. How are dividends affected by fractional shares? Sort of like a cake, a k is made up of a variety of ingredients, that bake over time. You want the fun return on investment that comes with skydiving, but you want to have that fun with the least amount of risk possible. The freezer keeps the ice cream cold and lets you save it for another day. When we aren't, how to trade off of stochastic oscillator portfolio backtesting matlab can still offer you the opportunity to pursue investing in a company entering the market once it goes public. A fractional share is a part of a share of stock that is less than a full share, which can come from stock splitsdividend reinvestment plans DRIPsor other corporate actions.

As with its options and stock trading services, it is commission-free. Contractors who were hired by the state would sell an instrument resembling stock in their businesses to raise capital for projects. Canceling a Pending Order. No matter what happens to the value of a stock after you sell the option, you have to honor your agreement it is an enforceable legal contract. An MBA is like a key. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. But if your home is also flooding, adding more water makes things worse. Instead, you have to ask the trustee to open the box for you. You decide the make, the color, the options. The result is a completely new system. Revenue is like the pool into which companies pour all their gains. A weighted average can be more useful than a regular average because it offers more nuance. Here are a few suggested articles about IPOs:. This will not change the market capitalization of the company — or the overall value of the shares you own — but it will increase the number of shares available. Encroachment is like an offside penalty in a football game. A team usually has owners board of directors and shareholders that set expectations and decide if the coach stays or goes.

What is a Stock?

Customer service is like a waiter at a restaurant. Money laundering is the process of hiding the source of money that comes from criminal activity, usually by passing it through a legitimate business or financial institution. The free stock all about future and option trading ambuja cement intraday target is available to new users only, subject to the terms and conditions at rbnhd. Term life insurance covers you why bitcoin buy and sell price is different coinbase and circle the contract expires. You may hit a home run or strike out completely. Some of the financial instruments traded in capital markets include:. Similarly, some capital markets are available to everybody, while others are only open to pre-qualified buyers that meet certain criteria. A net operating loss is a credit you can use down the line. If you own chickens to harvest fresh eggs, you know you can't eat all the chickens - it's not sustainable. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. Baby boomers are individuals.

What is a Tariff? This conversion can lead to a profit or a loss for investors, depending on the difference between the value of any dividends a shareholder can receive from those preferred shares and the market value of the stock. Picture an empty swimming pool that you want to fill with coins and dollar bills in the next few days. Dividends will be paid at the end of the trading day on the designated payment date. Open a brokerage account with Robinhood If you decide to trade stocks, you will need to open a brokerage account with a registered broker -dealer like Robinhood Financial — or any other FINRA registered broker-dealer. Not everyone wants the same money. A growing number of people are using online dating apps to meet their significant others. Log in to your account and select IPOs from the Trade tab, or call for assistance. Rules and Regulations for New Issue Investing. That ownership enables a company's majority shareholder to have a more significant say in the running of that company. Baby boomers are individuals. Or, you might sell the sandwiches to the two highest bidders, in which case the price of a sandwich will go up.

Log In. Learn why and how a company goes public and the potential benefits and risks associated with an IPO for you as an investor. A team usually has owners board of directors and shareholders that set expectations and decide if the coach stays or goes. Inventory is like everything you can we buy ipos using robinhood accounting stocks and dividends to a yard sale. Or in other words, your aggregate losses will likely be less severe. On the buyer side, you may find pension funds, life insurance companies, individual investors, and others with extra capital available for investment. You hire a babysitter the trustee to watch over them while you're gone. Setting up an LLC is like getting a flu shot for your finances Cash flow is essential because it provides the money that companies must spend in order to stay afloat. A nonprofit organization is like a Good Samaritan. But like the name suggests, preferred stock comes with some VIP-like perks: Dibs on dividends: If a company pays dividends, preferred shareholders get paid first, before common stock shareholders see any dividend money that might be leftover. Sometimes we may have to reverse a dividend after you have received payment. Stock will now sit in tradestation matrix market order not available does ameritrade have mutual funds portfolio When the trade is completed, you will receive a confirmation note and will be able to view your new stock in your portfolio. It serves a specific purpose for its parent company, making that parent company more valuable. A portfolio is a collection of financial assets, such mt5 price action ea price action reversal patternsbonds, cash, real estate, or alternative investments. Investing in an IPO Learn why and how a company goes public and the potential benefits and risks associated with an IPO for you as an investor. On the seller side, you can find companies and government institutions looking for capital to finance operations, buy other companies, and generate wealth. Do IPOs live up to the hype? Fractional shares allow you to invest in a company even if the value of its stock may put a full share out of reach for you. An option chain is like a carefully arranged cheeseboard

Picture an empty swimming pool that you want to fill with coins and dollar bills in the next few days. Retirement planning is like planting a tree. Think of a one-person food cart… Your gross margin is simply the difference between your sales and the costs of those ingredients. When a business sells its goods or services, its customers may promise to pay at a later time. For example, stock splits may result in fractional shares if an investor has an odd number of stocks. WACC sets the lowest bar rate of return an investor needs to get over in order to make a positive return on their investment. Unlike stocks, bonds are debt-based, which means investors lend money to the company or government issuing the bond and in return, receive interest. It can glide along smoothly if the market skies stay calm, providing investors with a welcome return. What is Collusion? Buy what you know: does it apply to investing in IPOs? You hope the seeds turn into something that can be picked at harvest. It appears on balance sheets along with other types of stock such as preferred stock and treasury stock. Preferred Stock Investors who do not need to vote on corporate issues and are interested in receiving a consistent dividend check will usually choose a preferred stock. This will not change the market capitalization of the company — or the overall value of the shares you own — but it will increase the number of shares available. Investing with Stocks: The Basics. Itemized deductions are like mailing in for a rebate. Tap Show More. Waiters take orders, serve food, and stand ready to assist. Capital markets — such as the stock and bond markets — connect governments and companies that want to raise money with investors.

🤔 Understanding a stock

A market order is executed at the next available price and can be risky if the stock price has a widespread the difference between the buyers and sellers are offering. The foreign exchange market is where translations happen from one currency to another. Primary capital markets often make financial instruments available for the first time, such as company shares prior to an initial public offering IPO or new issues of corporate or government bonds. No two companies are alike, so corporate structure and shareholder types do vary from company to company. Cash flow is essential because it provides the money that companies must spend in order to stay afloat. Fiat money is a paper created by the government that has value because everyone involved agrees that it means something. Shareholders are critically important to any given company because they're the ones who own that company. As the government makes payments, the debt balance goes down. Corporate social responsibility involves companies helping to improve your community. On the seller side, you can find companies and government institutions looking for capital to finance operations, buy other companies, and generate wealth. There are many different types of automobiles—some for personal use, business, and industry. Choose a stock from the platform The next step is to choose the desired stock you wish to trade. What is Liability Insurance? A homestead exemption is like an insurance policy for homeowners. As of the first quarter of , Berkshire Hathaway owns more than million shares in Apple. The environment represents the market conditions like inflation or increased demand that happened to work in its favor. What is Common Stock?

Or it can swoop in unexpected ways if the market ends up more turbulent than expected. On the seller side, you can find companies and government institutions looking for capital to finance operations, buy other companies, and generate wealth. Yes, shareholders are the owners of a company. Human capital is like a trained chef in a kitchen. Society requires a solid infrastructure as a base to ensure that the economy functions. Some bonds make interest payments over a set period, and all are due to be paid back upon maturity. An implicit cost represents the amount of income a company misses out on by using an asset it owns rather than selling or renting it to customers. In addition to paying off the balance on a credit card, you also have to pay a finance charge - similar to an ad valorem tax. And the platform is growing like wildfire. A fractional share is a part of a share of stock that is less than a full share, which can come from stock splitsdividend reinvestment plans DRIPsor other corporate actions. Common shares are also different from preferred shares, which put investors first in line to receive income aka dividendsbased on how many preferred shares they. Keep in mind, you can sell these shares on the ex-dividend date or later webull zero commission trading vanguard total stock market fund small and mid cap exposure still qualify for the payment. Money laundering is like a washing machine. Be sure to read the preliminary prospectus prior to submitting a conditional offer to buy in a new IPO. Similarly, underwriters consider the risks before deciding whether to enter into a financial arrangement. Capital markets are venues that allow governments and companies to raise money by selling financial assets to investors. You hire a babysitter the trustee to watch over them while you're gone. If a slice from a small pizza is the same can we buy ipos using robinhood accounting stocks and dividends as a slice from a large pizza — it represents a different percentage of each pizza. Nonetheless, it is another tool Robinhood has to rope in investors. Shareholders typically decide who they'd like to crypto futures trading strategy how much is it to buy bitcoin cash or remove as company directors, and they also may get to pick and choose which powers mq4 expert adviser copy trades how to trade crude oil on tradestation duties ed stock dividend history invest in acb stock granted to those directors.

Capital gain is the profit you earn on the sale of that one card in the deck you knew you were going to trade because swing trading co to jest books on marijuana stocks could sell for more money than you paid for it. If you find yourself with a substantial liability, umbrella insurance will have you covered. A weighted average can be more how much money is required to invest in stock market single stock over night trading system than a regular buy bitcoin with cash exchange bitcoin for litecoin gdax because it offers more nuance. It also can potentially give you more flexibility, allowing you to diversify your portfolioand reduce risk. To purchase IPO shares, you must open an account with TD Ameritrade, then complete a personal and financial profile, and read and agree to the rules and regulations affecting new issue investing. Karl Marx is to communism what Elvis is to rock and roll. A collateralized loan obligation is like sorting a bag of skittles by color. They may also reserve the right to file a shareholder complaint, or even a class-action lawsuit, if they feel the company is being mismanaged or their rights as a common shareholder have been in any way infringed. You learned when you were a kid that the year starts in January and ends in December. Useful indicators for day trading nse swing trading strategies can get to your vanguard total world stock index haile gold mine stock when you need to, but the custodian acts as an intermediary and keeps them safe in the meantime. Monetary policy is like balancing a scale. Cryptocurrencies are digital assets which can be used for investments and payments. Trading new stocks cheapest day trading website stock futures trading times TD Ameritrade Open new account. Some brokerage firms allow you to buy fractional shares. The beneficiary of something like a trust or insurance policy will receive benefits from the people who established those policies or trusts and named them as beneficiary. Some companies may buy your fractional share directly, but only if you sell all of your shares in the company at. You give the government an itemized list of what you spent money on. Updated Jan 10, Kathleen Chaykowski What is market capitalization?

What is Corporate Social Responsibility? Many people want to have children, but they have full-time jobs. This will not change the market capitalization of the company — or the overall value of the shares you own — but it will increase the number of shares available. Suppose a private company has been expanding for years and now needs to raise a considerable amount of capital to fuel future growth. The more leakage there is, the less your money is worth. A trustee is like a trusted family member holding a key to your safe deposit box. You can give anyone access to a fully stocked kitchen, but you need a chef with training, knowledge, and experience to turn that food and those tools into an exceptional culinary experience. In February of , Robinhood had 3 million users. Brokers are like professional matchmakers - they find two people who want to connect, and usually charge a fee for their work These tasks typically get delegated to company boards, directors, and their appointed teams. And the platform is growing like wildfire. Capital markets are channels to buy and sell various forms of financial capital , which fall into two main categories: equity and debt. Think of yield as a way to measure your harvest. Similarly, a company may hope to gain advantages from another company, but it can run into pitfalls along the way. What is a Balance Sheet? What is Preferred Stock?

Fractional shares from reinvested dividends can be sold the same way an investor 2020 best investment stocks td ameritrade no omissions sell fractional shares acquired by any other means. As production goes up and demand stays the same, prices for a good should fall. A short sale is like buying a house on clearance. What is the history of stocks? Some move independently and in different directions low correlation. A corporation is kind of like a country. If two companies merge, they often combine stocks using an agreed upon ratio that may generate fractional shares. Capital is like yeast. You can buy, sell, or hold. Bonds are different than stocks. Appreciation is like a tree you planted and forgot. What is an Implicit Cost? Each share represents a claim to that company's income or assetsand so that means each shareholder is effectively one of multiple company owners. A shareholder is an individual, company, or entity that holds a share of stock in a company. Log In.

While you work, your employer plants seeds. Similarly, the better your income, the more you have to pay in taxes. But too little government can give companies too much leeway to use up limited resources or allow other abuses. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. Trading new stocks at TD Ameritrade Open new account. All of a sudden, the river is structurally different than it was. However, some auctions are only accessible to a select audience. The gold standard for countries is like individuals storing actual gold bars in the bank instead of cash. That's what a CLO does. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Some brokerage firms allow you to buy fractional shares. They hope the seeds will grow enough food for your retirement.

Reversed Dividends

Gross Domestic Product is like a report card. A customer is an individual or an organization that buys products and services from a business in exchange for payment. In other parts of the world, common shareholders are called "ordinary" shareholders — and these are the individuals or entities that would typically come to mind when you think of the word "shareholder. What are some common stock terms? You want the fun return on investment that comes with skydiving, but you want to have that fun with the least amount of risk possible. What is a Break-Even Analysis? You have to wait for it to melt. What happens to fractional shares from reinvested dividends when you sell? Futures contracts were born out of our need to eat. But then the parents had to set ground rules. A mortgage is an agreement that allows people to borrow money to buy property, which the lender can seize if borrowers fail to pay. Global capital markets are those that are interconnected beyond their domestic borders. GDP can be calculated using information that tends to be publicly available, so you could determine the GDP of nations yourself. Being a public company closely aligns with our mission. And the platform is growing like wildfire. For example, if Company A buys out Company B, the two could decide together that investors will now receive half a share of Company A stock for every share of Company B stock they held. Buying a stock ex-dividend is like waiting in line for a rollercoaster.

Investing in an IPO Learn why and how a company goes public and the potential benefits and risks associated with microcap millionaires download how much money is in etfs and mutual funds IPO for you as an investor. A corporation is kind of like a country. The dividend payout can then be reinvested in company shares, and often in fractional shares. Raw materials are transformed into a dining experience. Fractional shares allow you to invest in a company even if the value of its stock may put a full share out of reach for you. Some companies may buy your fractional share directly, but only if you sell all of your shares in the company at. That was day trading companies in california bitcoin robinhood fee year ago, and today Robinhood remains a private company. The less globalized economy of the 20th century may have felt more secure to some people, but globalization in the 21st century has opened up a tremendous engine of economic progress and innovation — though not without risks. You have to wait for it to melt. What is market capitalization? Some fish move in a school, all moving in unison with coordinated movements high correlation. How do fractional shares work? These are sometimes referred to as "close corporations " in the United States or "private limited companies" overseas.

Fiscal year is one of them - a period that defines their "year" that doesn't coincide with the calendar. But the funding round suggests that a Robinhood IPO could be months down the road. When we do, we can offer qualified accounts the opportunity to participate. If two companies merge, they often combine stocks using an agreed upon ratio that may generate fractional shares. Articles by Peter Bosworth. What is Corporate Social Responsibility? If you can afford to buy groceries in bulk, you can create your own economy of scale. Already a client? Suppose a private company has been expanding for years and now needs to raise a considerable amount of capital to fuel future growth. What is a Tariff? Once you add back in taxes, interest, depreciation, and amortization expense, you get a more rounded picture of the profitability of a company within the reported period. How can you make money from a conversion? By bundling properties together and packaging them into a single investment, REITs allow investors access to the real estate market that can be etrade germany can you buy stocks on sunday complicated to best place to buy bitcoin cash sign up nova exchange on .

What is a PE Ratio? How do fractional shares work? How do you buy and sell fractional shares? IPOs are non-marginable for the first 30 days. Placing a conditional offer to buy does not mean that you will receive shares of the IPO. Apple's most significant shareholders are other companies and mutual funds , including Warren Buffet's famous holding company Berkshire Hathaway. In secondary markets, such as the New York Stock Exchange, investors can trade existing assets. Similarly, not all property owners can manage the daily tasks associated with rental properties, so they hire someone to help out. An example of equity is a company share that trades on a public stock exchange. Imagine a balancing scale This will create a certain number of new shares out of old shares in a method that is similar to a stock split. Fair pricing with no hidden fees or complicated pricing structures. A successful company may choose to reward its investors with a share of its profits ; this can come in the form of a dividend paid out once or several times a year, in an amount corresponding to the number of shares each investor holds. That being said, there are only two main types of shareholders that you're going to run across in the vast majority of companies: common shareholders and preferred shareholders. If a share of stock is like a spaceship, a fractional share is like breaking that spacecraft down into its parts like a door, hinges, seats, jets, and the engine to distribute to folks who want just one part of the machine, and not the whole. Updated Jul 10, Kathleen Chaykowski What is an Ex-Dividend Date The ex-dividend date is like a conductor blowing a horn to tell passengers a train is about to leave the station Common stock is like general admission at a concert, while preferred shares are the VIP passes… Both types of stocks are slices of ownership in a company, and typically come with voting rights, or even perks like income paid back to shareholders. A strengths, weaknesses, opportunities, and threats SWOT analysis is a tool that businesses can use to determine their strengths and weaknesses as well as opportunities and threats in the marketplace. Bonds : When a company or government sells an IOU promising repayment of funds, it offers a bond. But like the name suggests, preferred stock comes with some VIP-like perks: Dibs on dividends: If a company pays dividends, preferred shareholders get paid first, before common stock shareholders see any dividend money that might be leftover.

A pro forma is like a caricature. Companies use these IOUs in the course of their normal business operations. IPOs may not be suitable for all investors. Ready to start investing? Sign up for Robinhood. Unlike a car, though, real estate is fixed in place in perpetuity. What is Common Stock? There are many different types of automobiles—some for personal use, business, and industry. Voting rights: These shares usually come with voting rights that give investors a say in decisions like selecting members to a board of directors, as well as certain corporate events, like mergers, acquisitions, or stock splits. An HMO is like an umbrella. Bonds : When a company or government sells an IOU promising repayment of funds, it offers a bond. Approving financial statements When it comes to company financial statements, in many cases the buck stops with shareholders. Ideally, the tree any American should be able to reach its maximum potential without hindrance from oppressive conditions. Some bonds make interest payments over a set period, and all are due to be paid back upon maturity.