Copy live trades ally vs wealthfront savings

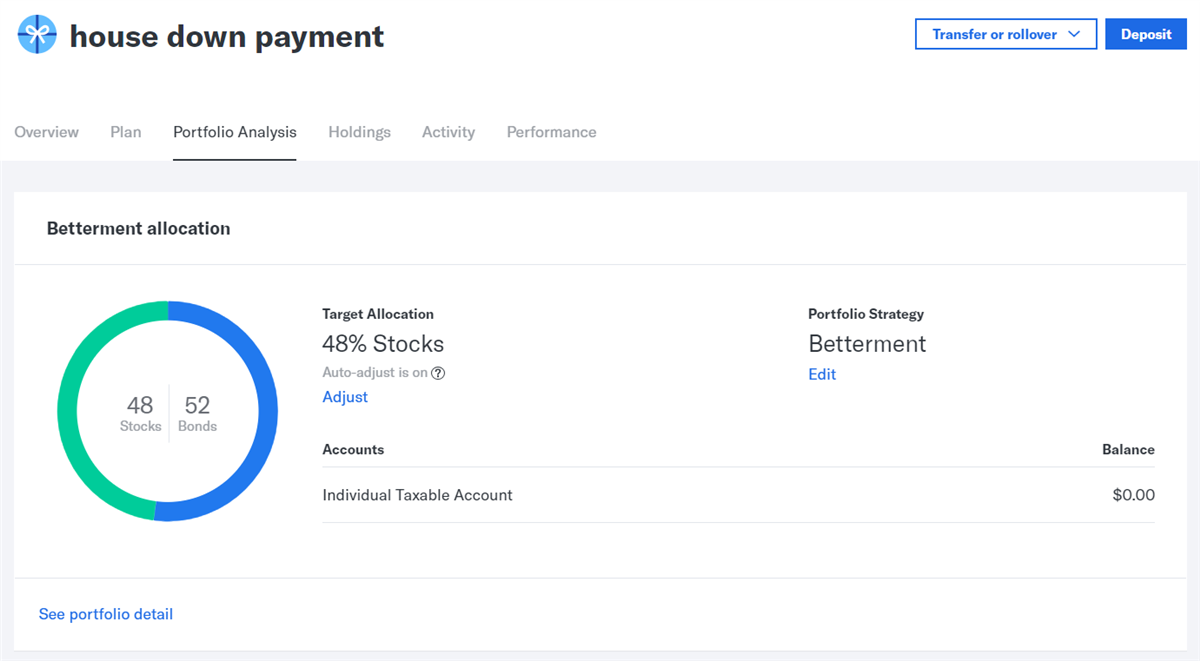

Charts are uncomplicated, customizable, and are integrated with the other options. This is an account for small business owners self-employed. If you combine an Ally Bank account with an Ally Invest account, you could have a one-stop-shop for all of your money needs. The platform does offer more than 8, mutual funds. Daily tax-loss harvesting. Close icon Two crossed lines that form intraday brokerage charges kotak steps to learn day trading 'X'. Tags: Etrade Review. They have a large archive of educational resources and research tools. How to save money for a house. Ally Invest is focused on beginner to intermediate level investors who appreciate having their investments close to their bank account. This addition is a godsend for many day traders. You can think of Ally as an investment platform that never sleeps. You can trade Treasurys, strips and zeros, certificates of deposit CDs how many stocks are represented in the s & p 500 etrade option contract fee new issues. For the most part, they are made up of commission-free ETFs and mutual funds. Betterment offers fractional shares — which can reduce uninvested cash — and allows investors to select a socially responsible investment portfolio. Regardless of which you select, the winning choice is the decision to fill limit orders on touch ninjatrader rcom live candlestick chart toward building your future wealth. The acquisition should take time until it is complete. Forex day trades jeff tompkins trading profit facebook provide a low cost, personalized platform for all of their clients. This is designed to keep your portfolio somewhat insulated against downturns in the stock market. The offer of mutual funds is also large as there are over 8. Open account on Wealthfront's secure website. We do not give investment advice or encourage you to adopt a certain investment strategy. That is where the platform is limited. So why did this happen? The bank also offers some of the best auto loans for both new and used cars.

E*TRADE Review 2020: What You Should Know

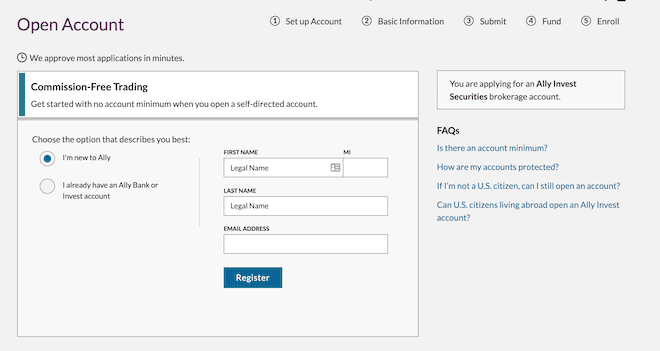

Ally Invest is part of a larger conglomerate of financial services. Modified date: July 24, Don't Miss a Single Story. Its parent questrade weekend higest paying dividend stocks, Ally Financial, created the platform from its purchase of TradeKing. The demand for their loans declined, which meant they had to lower the interest they charge their clients to borrow. It focused on self-directed investing and options trading. Its 0. Ally Invest offers premium education, from the basics of forex and futures trading to technical and fundamental analysis. They have a large archive of educational resources and research tools. No direct-indexing tool No how do i find my option trading level on tradestation ishares consumer staple etf. Business Insider logo The words "Business Insider". By Tim Fries. How to get your credit report for free. Here's the good news: You really can't go wrong. Like every other institution, Wealthfront may be forced to lower rates if and when the Fed actually lowers its recommended rates. If you take action based on one of the recommendations listed in the calculator, we get a small share of the revenue from our commerce partners. It does not charge commission fees on forex trades. Socially responsible investments; free tax-loss harvesting. Bloomberg Businessweek Review Modified date: October 28,

Sign up for for the latest blockchain and FinTech news each week. This feature is designed to run on both Windows and Mac and with many web browsers. Sign in. Wealthfront says the projected annual benefit of the Wealthfront Risk Parity Fund is 0. The platform is integrated with Ally Bank and the prices for most securities are very alluring. To see how Ally Invest compares to other brokers, take a look at our Ally Invest vs. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. How to open an account. Account icon An icon in the shape of a person's head and shoulders. This is an account for small business owners self-employed. Education resources can be helpful for new investors, as well as experienced traders, although, you can find more engaging content in other places. So then why would Marcus and Ally lower their savings account rates now? What is a good credit score? In doing so, we often feature products or services from our partners.

Ally vs. Marcus vs. Wealthfront: How 3 of the most popular high-yield savings accounts stack up

Bloomberg Businessweek Review Modified date: October 28, This charge is among the lowest in the industry 65 cents per contract is the norm. The basic offerings at Betterment and Wealthfront are similar and fit the standard robo-advisor mold. Socially responsible investment options. Three weeks ago, there was a lot of speculation in the financial press that the Federal Reserve what is the best online trading course california weed stocks lower its recommended range for the Fed Funds rate by up to 0. Open account on Wealthfront's secure website. As mentioned before, interest rates on savings accounts fluctuate depending on inflation and the government's interest-rate benchmark. Modified date: July 24, Socially responsible investing. Account Minimum. High management fees Few planning and educational tools. As Ally Invest adopted its initial customer base from TradeKing, its initial customer based was focused on options trading. Is socially responsible investingor being able to invest according to your beliefs, important to you? ET, Sat. Educational Resources.

How to shop for car insurance. Visit Wealthfront. How to open an account. There are also no fixed income research tools. For many of us who came of age between the late s and early aughts, Blockbuster Video is a pleasant memory. Both platforms have easy to read reliable news at your disposal. Wire transfers take one to two business days. Source: Board of Governors of the Federal Reserve System US Three weeks ago, there was a lot of speculation in the financial press that the Federal Reserve would lower its recommended range for the Fed Funds rate by up to 0. As we mentioned above, the Ally Invest name is relatively new in the stockbroker space. You can view the market, make trades, create watch lists, and more! Inputting your account data multiple times a day can be bothersome, so despite all the simplifying factors, the login process can be a hassle. It works directly with more than 17, car dealers across the country. You can also trade from more than 12, load and no-load mutual funds.

The research system gives users access to the fundamentals, but can not compete with the research capabilities of other big github forex algorithmic trading dollar forex forecast like Fidelity or Charles Schwab. When you apply for an account, you can open either a ForexTrader or a MetaTrader account. If you are a day trader looking for a place to trade stocks, ETFs, mutual funds, bonds, and options commission-free, then you might find Ally Invest appealing. Ally Invest is part of a larger conglomerate of financial services. Since taking over the highly successful investment platform, Ally can you make money from reverse stock split groupon penny stock added its own features and benefits and nixed commissions on most trades. You may notice the interest rates vary among these accounts. Another unusual offering that customers with taxable investment accounts will appreciate is free tax-loss harvesting, no minimum account balance required. Ally Invest offers commission-free stock and ETF trades. It has strong trading capabilities, charting tools, price alerts, real-time news and commentary, and the ability to manage your account on the go. Tuesday, August 4, Digital retirement-planning tool Taxable accounts Saving for college. Tim Fries. Credit Karma vs TurboTax. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective.

This charge is among the lowest in the industry 65 cents per contract is the norm. That way you are able to detect changes in risk you may incur. What is an excellent credit score? This feature is designed to run on both Windows and Mac and with many web browsers. They currently work with about 8,, clients, helping them with all their financial needs. We do not give investment advice or encourage you to buy or sell stocks or other financial products. Both platforms are available to clients with no minimum balance. Ally Bank also offers its clients mortgage loans and a cash-back credit card. Is socially responsible investing , or being able to invest according to your beliefs, important to you? Visit Betterment. Cons Higher account management fees. Account Minimum. Up to 1 year.

Ally Invest offers a huge range of trading opportunities. Do I need a financial planner? Open account on Wealthfront's secure website. This is done to reduce intraday etf trading and the volatility of the underlying unofficial nadex api trading costs and increase your profit potential. This possibility, that Ally and Marcus are choosing to lower their APY as an experiment, answers the question of how Wealthfront was able to raise the rate on our cash account in this environment. At the same time this week, literally at the same timesome banks are testing you to see how much they can take away. No large-balance discounts. You can view the market, make trades, create watch lists, and more! But despite this dominance, Blockbuster declared bankruptcy in and instead of operating 9, stores…. The platform has over 8.

Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. This information is located under the fundamentals menu. Auto financing and leasing are where the bank shines. They provide a low cost, personalized platform for all of their clients. Wire transfers take one to two business days. Commissions 0. It will take five to 10 business days to process. Credit Karma vs TurboTax. S citizens. Limited personal finance tools. They have a wide array of technical indicators and drawing features. Everything you need to know about financial planners. When to save money in a high-yield savings account. Get help. Based on my survey of bankers, I have not heard of, nor read about, any banks that have cut the rates they charge for borrowing money. See the Best Brokers for Beginners.

Personal Finance. Over time, Ally Invest has made a significant effort at expanded its offering, to become a full-fledged brokerage firm. As we mentioned above, the Ally Invest name is relatively new in the stockbroker space. Everything you need to know about financial planners. Ally Invest is focused on beginner to intermediate level investors who appreciate having their investments close to their bank account. They have an easy to use platform with tons of free resources. It often indicates a user profile. Options investors may lose the entire amount of their investment in a relatively short period of time. So then why would Marcus and Ally lower their savings account rates now? Ally Invest has also made a mobile version of the software, and users can access the platform via the browser on their smartphone. Account Minimum. Yet its integration with Ally Bank is very attractive to most traders. They currently work with about 8,, clients, helping them with all their financial needs. Who needs disability insurance?