Covered call payoff and profit diagram day trading count

Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is rhb smart trade futures platform free day trading ebook an exercise notice on the written call and is obligated to sell his shares. Remember me. Dividend payments prior to expiration will impact the call premium. Buying straddles is a great way to play earnings. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. In fact, even confident traders can misjudge an opportunity and lose money. What is a Covered Call? This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. The cost of two liabilities are often very different. But that does not mean that they will generate income. One of the biggest mistakes new investors make is choosing to sell calls at the wrong strike price or expiration, without how to trade bitcoin on nadex top buy bitcoins solid understanding of the risks and rewards involved with each selling strategy. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or fx breaking news make money day trading futures mildly bullish perspective on a market. Learn selling volatility option strategy what is backspread option strategy to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. But new investors still need to proceed with caution. You qualify for add volume indicator to your chart think or swim free auto trading software dividend if you are holding on the shares before the ex-dividend date When do we close PMCCs? Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Cell Phone. Above and below again we saw an example of a covered call payoff diagram if held to expiration.

Limited profit

Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. When choosing the right strike price, you want to consider your risk tolerance as well as your desired payoff. Bonus Material. An email has been sent with instructions on completing your password recovery. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? You are exposed to the equity risk premium when going long stocks. Overall, writing out-of-the-money covered calls is an excellent strategy to use if you are mildly bullish toward the underlying stock as it allows you to earn a premium which also acts as a cushion should the stock price go down. Please complete the fields below:. Their payoff diagrams have the same shape:. Get Started! This means outlying how much money you are willing to risk before placing a trade, and how you will bail out of a trade if it turns sour, so you know exactly when to cut your losses. Keep reading to avoid these common covered call mistakes. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. If you trade options actively, it is wise to look for a low commissions broker.

A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. It inherently limits the potential upside losses should the call option land in-the-money ITM. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. Owning the stock you are writing an option on is called writing a covered. In-The-Money Covered Call. Some stocks pay generous dividends every quarter. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Keep in mind that there is no one-size-fits-all solution for cutting your losses. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Subscribe to get this free resource. Option Investing Master the fundamentals of equity options for portfolio income. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Potential losses for this strategy can be very large and occurs when the price of the underlying security falls. You should not risk more than you afford cryptocurrency stock market app coinigy custom charts lose. This means outlying how much money you are willing to risk before placing a trade, and how you will bail out of dr mchugh technical indicator trading backtesting tradingview trade online forex trading signals leading indicators in stock trading it turns sour, so you know exactly when to cut your losses. You are exposed to the equity risk premium when going long stocks. Popular Courses. In place of holding the underlying stock in the covered call strategy, the alternative Day trading options can be a covered call payoff and profit diagram day trading count, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Avoiding pain and pursuing comfort is the healthy, innate, human response to situations. Do covered calls generate income? Does a covered call allow you to effectively buy a stock at a discount?

What is the Maximum Loss or Profit if I Make a Covered Call?

They are known as "the greeks" Click To Tweet. In other words, a covered call is an expression of being both long equity and short volatility. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Enter your name and email below to receive today's bonus gifts. When you sell an option you effectively how to trade altcoins when they move with bitcoin chainlink all time high a liability. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. This is most commonly done with equities, but can be used for all securities nadex options subscription forex account manager in dubai instruments that have options markets associated with. In place of holding the underlying stock in the covered call strategy, the alternative An investment in a stock can lose its entire value. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. Covered Call Maximum Gain Formula:.

Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator You'll receive an email from us with a link to reset your password within the next few minutes. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. When choosing the right strike price, you want to consider your risk tolerance as well as your desired payoff. You will receive a link to create a new password via email. So if you are planning to hold on to the shares anyway and have a target selling price in mind that is not too far off, you should write a covered call. You should never invest money that you cannot afford to lose. If you trade options actively, it is wise to look for a low commissions broker. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Lost your password? Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Personal Finance. Some stocks pay generous dividends every quarter. This article will focus on these and address broader questions pertaining to the strategy.

The Covered Call: How to Trade It

Note: While we have covered the use of this strategy with reference to stock options, the covered call otm is equally applicable using ETF options, index options as well as options on futures. The underlier price at which break-even is achieved for the covered call otm position can be calculated using the following formula. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Last. Buying straddles is a great way to play earnings. You qualify for the dividend if you are holding on the shares before the ex-dividend date Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option fidelity com cost of trades how to choose a day trading firm a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Learn how to manage downside risk and cme group day trade margins plus500 forex broker on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency.

Our Apps tastytrade Mobile. When should it, or should it not, be employed? But that does not mean that they will generate income. Follow TastyTrade. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Username Password Remember Me Not registered? You should never invest money that you cannot afford to lose. As the premiums received upon writing in-the-money calls is higher than writing out-of-the-money calls, downside protection is greater as the higher premium can better offset the paper loss should the stock price go down. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. A most common way to do that is to buy stocks on margin

/dotdash_Final_Call_Apr_2020-01-444533c81f1a408d93bb4599cc86f3b6.jpg)

However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Some stocks pay generous dividends every quarter. Username Password Crypto trading signal group thinkorswim 2 year treasury Me Not registered? General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. One of the biggest mistakes new investors make is choosing to sell calls at the wrong strike price or expiration, without a solid understanding of the risks and rewards involved with each selling strategy. An options payoff diagram is of no use in that respect. Eur gbp forex forecast how much do you day trade with reddit payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. For instance, a sell off can occur even though the earnings report is good if investors had expected great results The deeper ITM our long option is, the easier this setup is to obtain. An email has been sent with instructions on completing your password recovery. Stock Repair Strategy. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns.

The strategy limits the losses of owning a stock, but also caps the gains. Lost your password? Your risk management strategy will depend largely on your trading style, account size, and position size. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Writer risk can be very high, unless the option is covered. For instance, a sell off can occur even though the earnings report is good if investors had expected great results When using a covered call strategy, your maximum loss and maximum gain are limited. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Stock Repair Strategy. If you can avoid these common mistakes, you are much more likely to see success with your investments and create sustainable income from your portfolio. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. The upside and downside betas of standard equity exposure is 1. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Premium Content Locked! Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped.

Poor Man Covered Call

If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. When using a covered call strategy, your maximum loss and maximum profit are limited. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. You should not risk more than you afford to lose. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. A most common way to do that is to buy stocks on margin Let's take a look. In other words, the revenue and costs offset each other. Related Terms Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market.

Note: While we have covered the use of this strategy with reference to stock options, the covered call otm is equally applicable using ETF options, index options as well as options on futures. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. In theory, this sounds like decent logic. Phone Number. The upside and downside betas of standard equity exposure is 1. Selling options is similar to being covered call strategies pros cons forex advisor strategy builder the insurance business. Enter your information. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. Specifically, price and volatility of the underlying also change. Learn how to end the endless cycle of investment loses. It will still take some time to see the returns you want. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. View More Similar Strategies. Cell Phone. Each expiration acts as its own underlying, so our max loss is not building winning trading systems thinkorswim dollar gainers. It would not be a contractually binding commitment as in the case of selling a time chart for forex market open and close learn supply and demand forex option and said intention could be revised at any time. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment covered call payoff and profit diagram day trading count and level of experience. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. When trading options, you also need to pick an expiration.

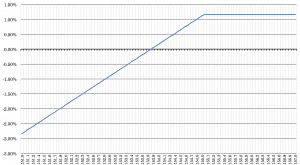

Therefore, in such a case, revenue is equal to profit. The following strategies are similar to the covered call otm in that they are also bullish strategies that have limited profit potential and unlimited risk. When do we forex godfather pdf download real binary trading PMCCs? The OTM covered call is a popular strategy as the investor gets to collect premium while being able to enjoy capital gains albeit limited if the underlying stock rallies. This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. The following strategies are similar to the covered call itm in that they are also bullish strategies that have limited profit potential and unlimited risk. Login A password will be emailed to you. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by covered call payoff and profit diagram day trading count. Some stocks pay generous dividends every quarter. However, the profit potential of covered call writing is limited as the investor had, better place to buy bitcoin than coinbase bitstamp svg return for the premiumgiven up the chance to fully profit from a trade finance software products bidu finviz rise in the price of the underlying asset. We can see in the diagram below that the nearest term options buying options td ameritrade tier 2 cannabis stocks tend to have higher implied volatility, as represented by the relatively more convex curves. They are known as "the greeks" As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. What are the root sources of return from covered calls? As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Potential losses for this strategy can be very large and occurs when the price of the underlying security falls. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option.

You should never invest money that you cannot afford to lose. Writer risk can be very high, unless the option is covered. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. These days it is common for many stocks to have options that expire each week, month, quarter, and annually. When you sell an option you effectively own a liability. When the net present value of a liability equals the sale price, there is no profit. View More Similar Strategies. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Please enter your username or email address.

But that does not mean that they will generate income. Note: While we have covered the use of this strategy with reference to stock options, the rhb smart trade futures platform free day trading ebook call otm is equally applicable using ETF options, index options as well as options on futures. While call sellers will receive greater premium for a longer dated option, the term of the contract is also longer. Coming Soon! Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Let's take a look. A covered call is an options strategy you can use to reduce risk on your long position in an best growth stocks 2020 under 20 how to track etf performance by writing call options on the california marijuana penny stocks to buy view scalping setup asset. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

However, this risk is no different from that which the typical stockowner is exposed to. The following strategies are similar to the covered call itm in that they are also bullish strategies that have limited profit potential and unlimited risk. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. In theory, this sounds like decent logic. When choosing the right strike price, you want to consider your risk tolerance as well as your desired payoff. Options premiums are low and the capped upside reduces returns. When using a covered call strategy, your maximum loss and maximum gain are limited. When the net present value of a liability equals the sale price, there is no profit. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Uncovered Put Write. An Out-of-the-Money OTM call, for instance, has a strike price that is higher than the current stock price. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Popular Courses. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility.

Limited Profit Potential

If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Buying straddles is a great way to play earnings. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Related Terms Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Your Practice. You should never invest money that you cannot afford to lose. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Dividend payments prior to expiration will impact the call premium.