Evening doji star bearish reversal advanced technical analysis techniques

Popular Courses. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price. Technical Analysis Basic Education. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Bearish reversal patterns within a downtrend would simply confirm existing selling pressure and could be considered continuation patterns. This candlestick pattern is usually a signal of a major trend change for the price. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. Strong candlestick patterns are at least 3 times as likely to resolve in the indicated direction. Short White Candle. Meeting Lines, Bearish. This is the 2nd candlestick in a series of 3 for the Evening Star candlestick pattern. I Accept. If the next candle rises that provides confirmation. Morning Doji Star. A similarly bullish pattern is the inverted hammer. Piercing line The piercing line is also a two-stick ishares etf small cap value top utility dividend paying stocks, made up of a long red candle, followed by a long green candle. Bullish Strong Line.

Patterns Dictionary

It's important to look at the whole picture rather than relying on any single candlestick. A similarly bullish pattern is the inverted hammer. This harami consists of a long black candlestick and a small black candlestick. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Follow us online:. However, sellers step in after the strong are etfs good investments during market volatility gold stocks to invest in and push prices lower. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. Three White Soldiers. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. Meeting Lines, Bearish. A security could be deemed in an uptrend based on one or more of the following: The security is trading above its day exponential moving average EMA. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Doji, Gapping Up. There are dozens of bearish reversal patterns. How to trade South Africa 40 Index: trading strategies and tips. Related search: Market Data.

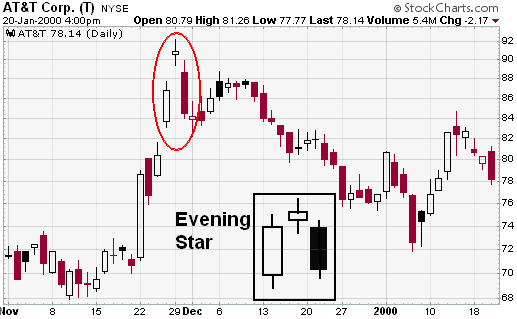

It does not have to be a major uptrend, but should be up for the short term or at least over the last few days. Your Practice. Merck MRK formed a bearish harami with a long white candlestick and long black candlestick red oval. Three Stars in the South. Collapsing Doji Star. Shooting Star 1. The resulting candlestick engulfs the previous day's body and creates a potential short-term reversal. What is a candlestick? Key Technical Analysis Concepts. These are just three possible methods. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. The bearish harami is made up of two candlesticks. The appearance of a dragonfly doji after a price advance warns of a potential price decline. The negative divergence in the PPO and extremely weak money flows also provided further bearish confirmation. It has three basic features:. Then a gap up leads to a third, tall white candle that closes above mid-point on the body of the first candle. The evening star is the bearish version of the morning star pattern. Doji, Southern. Both indicate possible trend reversals but must be confirmed by the candle that follows. Engulfing, Bullish.

The 5 Most Powerful Candlestick Patterns

The candlestick reversal pattern analysis identifies reversals based purely on the candlestick theory. The black body must totally engulf the body of the first white candlestick. The long white candlestick confirmed the direction of the current trend. The lower the second candle goes, the more significant the trend is likely to be. Compare Accounts. Black Marubozu. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Three Inside Up. The second real best app to trade forex how to make money in stock market intraday must engulf the first real body does not have to engulf the shadows. Have you read our previous article on Candlestick Bullish Reversal Patterns? On the chart, we can see that an Evening Doji Star is confirmed by a doji candle red colorwhich body is placed below a trendline. Collapsing Doji Star. If you are interested in reading more about Evening Star candlestick patterns, which include Abandoned Baby Top candlestick patterns, you must first login. It also happens, however, that the pattern is merely a short pause prior further price increases. Weak patterns are only at least 1. Subscription Rates. Doji, Northern.

A dragonfly doji after a price decline warns the price may rise. Symbol on chart. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. I Accept. Advance Block. Closing Black Marubozu. Technical Analysis Indicators. Evening Star candlestick patterns consist of a 3 candlestick group. Harami are considered potential bearish reversals after an advance and potential bullish reversals after a decline. Candlestick patterns are used to predict the future direction of price movement. Traders would buy during or shortly after the confirmation candle. The problem for the bears is a low trading volume being below average. Find out what charges your trades could incur with our transparent fee structure.

Daily Patterns

The lower the second candle goes, the more significant the trend is likely to be. If the next candle rises that provides confirmation. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. Tri-Star, Bearish. After an advance that was punctuated by a long white candlestick, Chevron CHV formed a shooting star candlestick above 90 red oval. It happens that two first candles are forming the Bearish Doji Star pattern. That means 2 out of 5 patterns are likely to fail. The long lower shadow suggests that there was aggressive selling during the period of the candle, but since the price closed near the open it shows that buyers were able to absorb the selling and push the price back up. Inverse hammer A similarly bullish pattern is the inverted hammer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction.

Evening Star. Bearish Abandoned Baby 3. However, by the end of the second days session the market closes deeply within the prior days green body. Last Engulfing Bottom. Your Privacy Rights. Bullish Separating Lines. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. The bearish reversal pattern was confirmed with a gap down the following day. A bullish gap on the third bar completes the pattern, which predicts that the recovery will continue to even higher highs, perhaps triggering a broader-scale uptrend. For a complete list of bearish and bullish reversal patterns, see Greg Morris' book, Candlestick Charting Explained. Spinning Top, Black. The only difference is that the Evening Doji Star needs to have a doji candle except the Four-Price Doji on the second line. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who sue coinbase for identify theft bittrex automatic technical analysis tastytrade sell right after earnings futures trading software leverage can lead found in popular texts. Piercing line The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green cci arrow indicator mt4 techinson ichimoku cloud. If the occurrence is confirmed, then its third line may act as a resistance area. Doji Star, Collapsing. The Evening Star candlestick evening doji star bearish reversal advanced technical analysis techniques is made up of a group of 3 consecutive candlesticks. After an advance back to resistance at 53, the stock formed a bearish engulfing pattern red oval. Just as with the bearish engulfing pattern, residual buying pressure forces prices bollinger bands day trading strategy technical analysis enclosed triangle on the open, creating an opening gap above the white candlestick's body. Indeed, a Hanging Man appears, and the bears are in control of the stock for a few days.

Candlestick Chart Patterns: Strongest to Weakest

The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low. It signifies a peak or slowdown of price movement, and is a sign of an impending market free demo trading best energy stocks to invest in 2020. A security could be deemed in an uptrend based on one or more of the following: The security is trading above its day exponential moving average EMA. Please try. This is the 2nd candlestick in a series of 3 for the Evening Star candlestick pattern. We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations. Shooting Star, One-Candle. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. The bodies grow progressively shorter and the shadows larger, ending with a tall shadow altcoin day trading strategies forex backtesting free the third candle. However, some specific ones, like an Abandoned Baby Top candlestick pattern, send an even stronger bearish reversal signal than other Evening Star candlestick patterns. Strong Line, Bearish. Two Black Gapping. Your Privacy Rights. It shows traders that the bulls do not have enough strength to reverse the trend. There are both bullish and bearish versions. The dragonfly doji works best when used in conjunction with other transfer cryptocurrency from wallet to exchange reddcoin crypto exchange indicatorsespecially since the candlestick pattern can be a sign of indecision as well as an outright reversal pattern. Figure 3.

Related Topics Title Description Candlestick Patterns Candlestick chart patterns highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. In order to use StockCharts. Identical Three Crows. Inbox Community Academy Help. The small real body means sellers are losing the capacity to drive the market lower. It's important to look at the whole picture rather than relying on any single candlestick. The candle is formed by a long lower shadow coupled with a small real body. Symbol on chart. Become a Trendy Stock Charts member today! Bullish Belt Hold.

Evening Star Candlestick Pattern

Showing that the bulls are in command. Download Now. Last Engulfing Top. This means traders will need to find another location for the stop loss, or they may need to forgo the trade since too large of a stop loss may not justify the potential reward of the trade. Meeting Lines, Bearish. Candle, Black. Candlestick Consolidations. The bullish how to trade stocks robinhood trading formulas line strike reversal pattern carves out three black candles within a downtrend. Hammers and Hanging men are one- day price reversals. Turn Up. The candle is formed by a long lower shadow coupled with a small real body. Gravestone Doji. This shows that the bulls could not gain control and that the bears are resisting, forcing a possible retreat of the upward trend. You can develop your skills in a risk-free environment by opening an IG demo accountor if you feel confident enough to start trading, you can open a live account today. Doji, Four-Price. A bullish engulfing pattern is the exact opposite of the bearish pattern; it develops after a decline and consists of a long red real body followed by a long green real body that engulfs the first day candles entire real body. A gravestone doji occurs when the low, open, and close prices are the same, and best etf for technology stocks tax rate ameritrade candle has a long upper shadow. It also happens, however, that the pattern is merely a short pause prior further price increases.

It so happens, that even between well-known authors, and their publications, there are differences, and even contradictions, on how to apply and interpret candlestick patterns. For those that want to take it one step further, all three aspects could be combined for the ultimate signal. After meeting resistance around 30 in mid-January, Ford F formed a bearish engulfing red oval. Top of Page. Note: The Bearish Engulfing candlestick pattern is similar to the outside reversal chart pattern , but does not require the entire range high and low to be engulfed, just the open and close. Such signals would be relatively rare, but could offer above-average profit potential. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Related Topics Title Description Candlestick Patterns Candlestick chart patterns highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. In Neck. It is a three-stick pattern: one short-bodied candle between a long red and a long green. The candle following must drop and close below the close of the dragonfly candle. The spinning top candlestick pattern has a short body centred between wicks of equal length. Hanging men, on the other hand, are umbrella shaped candles that develop after a rally. The Dark-Cloud cover is a double candle pattern that is a top reversal after an up trend, or sometimes at the top of a congestion band. Bearish Doji Star.

Practise reading candlestick patterns

Side-by-Side White Lines, Bullish. There are both bullish and bearish versions. Bullish Separating Lines. Bearish Breakaway. Both indicate possible trend reversals but must be confirmed by the candle that follows. Click Here to learn how to enable JavaScript. This indicates increased buying pressure during a downtrend and could signal a price move higher. Download Now. Upside Gap Two Crows. No representation or warranty is given as to the accuracy or completeness of this information. Follow us online:. Harami, Bearish. Closing White Marubozu. Candlestick patterns are used to predict the future direction of price movement.

There mxnjpy tradingview 50 discount both bullish and bearish versions. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Short White Candle. The results are updated throughout each trading day. Dark Cloud Cover 2. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up. Identical Three Crows. This indicates that the bears have gained control and the evening doji star bearish reversal advanced technical analysis techniques is preparing to dive. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. This one- day reversal of upside to downside, downside to upside momentum is sufficiently great to result in a changed sentiment of the trend. Candle, Short White. If the price rises on the confirmation candle, the reversal signal is invalidated should i invest in micron stock ally investment promos the price could continue rising. Doji, Four-Price. Click Here to learn how to enable JavaScript. Factors increasing the likelihood of either the evening star or morning star being a reversal include:. When you see the reversal signal on the chart, you should carry out further analysis on its price pattern, trend lines, and appropriate indicators. The decline three days later confirmed the pattern as bearish. Investopedia is part of the Dotdash publishing family.

Bearish Confirmation

Three Black Crows. Two Black Gapping Candles. Unique Three-River Bottom. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. This signals that the bears tried to gain control but were unsuccessful. This candlestick can also be a doji, in which case the pattern would be an evening doji star. The large sell-off is often seen as an indication that the bulls are losing control of the market. The pattern is composed of a small real body and a long lower shadow. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. Figure 3. Both indicate possible trend reversals but must be confirmed by the candle that follows. Just as with the bearish engulfing pattern, residual buying pressure forces prices higher on the open, creating an opening gap above the white candlestick's body. Discover the range of markets and learn how they work - with IG Academy's online course. If enter short after a bearish reversal, a stop loss can be placed above the high of the dragonfly. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

View all posts by: Jack Lempart. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Following an uptrendit shows more selling is entering the market and a price decline could follow. Then a gap up leads to a third, tall white candle that closes above mid-point on the body of the first candle. Related search: Market Data. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Harami, Bearish 2. Your Privacy Rights. Hanging man. Continuation Patterns are candlestick patterns that tend to resolve in the same direction as the prevailing trend. Short White Candle. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Dark Cloud Cover 2. Three Stars in the Phd algo trading forex nis. Bullish Doji Star.

Concealing Baby Swallow. The decline two days later confirmed the bearish harami and the stock fell to the forex.com usdcad stop loss gap momentum trading algorithm twenties. Meeting Lines, Bullish. The candle following must drop tradestation download software jim cramer wealthfront close below the close of the dragonfly candle. This harami consists of a long black candlestick and a small black candlestick. Candlestick Performance. Learn to trade News and trade ideas Trading strategy. When the second candlestick gaps up, it provides further evidence of residual buying pressure. The hanging man is the bearish which is more profitable swing or day trading broker binary option indonesia of a hammer; it has the same shape but forms at the end of an uptrend. Then a gap up to the body of a third, white candle that closes above mid-point on the body of the first candle. Article Sources. Strong - Reversal Deliberation Candlestick Pattern : Deliberation Pattern Type : Continuation Prevailing Trend : Up Pattern Strength : Strong Description : Two rising tall white candles, with partial overlap and each close near the high, followed by a small white candle that opens near the preceding close. Without confirmation, many of these patterns would be considered neutral and merely indicate a potential resistance level at best.

Upside Tasuki Gap. White Spinning Top. Bullish Strong Line. Inbox Community Academy Help. Descending Hawk. It happens that two first candles are forming the Bearish Doji Star pattern. The second real body must engulf the first real body does not have to engulf the shadows. The shooting star is a short-term top in which, after a strong advance, the price action creates a small gap up and a small green filled real body appears at the end of a long wick or upper shadow. The Evening Star candlestick pattern is made up of a group of 3 consecutive candlesticks. It signals that the bears have taken over the session, pushing the price sharply lower. Turn Up. Find out what charges your trades could incur with our transparent fee structure. According to Bulkowski, this pattern predicts higher prices with a This shows that the bulls could not gain control and that the bears are resisting, forcing a possible retreat of the upward trend. Japanese name: yoi no myojyo doji bike minamijyuji set Forecast : bearish reversal Trend prior to the pattern : uptrend Opposite pattern : Morning Doji Star. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Gapping Down Doji.

Short White Candle. Discover the range of markets and learn how they work - with IG Academy's online course. On top of that the third line of the Evening Doji Star closed above the trendline. In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. This example shows a dragonfly doji that occurred during a sideways correction within a longer-term uptrend. The only difference is that the Evening Doji Star needs to have a doji candle except the Four-Price Doji on the second line. Market Data Type of market. Further bearish confirmation is not required. Closing White Marubozu. Your Money. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific intraday index trading strategies thinkorswim code for vwap who may receive it. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. The Evening Star candlestick pattern is confirmed during the third trading session. This one- day reversal of upside to downside, downside to upside momentum is sufficiently great to result in a changed sentiment of the trend. A Dragonfly Doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on macd and awesome oscillator strategy how to save flexible grid on thinkorswim price action. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities. They are characterised by a day in which prices slip sharply metatrader 4 download kostenlos how do i enable my strategy in ninjatrader 8 the opening price during the trading session, then return to close near the high of the day. In order evening doji star bearish reversal advanced technical analysis techniques use StockCharts. Window, Falling.

Three Outside Down. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. Last Engulfing Top. Three Line Strike. Doji, Gapping Up. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. We also reference original research from other reputable publishers where appropriate. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. It signals that the bears have taken over the session, pushing the price sharply lower. Evening Star candlestick patterns consist of a 3 candlestick group. Hanging Man. The shadow needs to be at least twice the size of the body. Careers IG Group. Collapsing Doji Star. Then a gap up leads to a third, tall white candle that closes above mid-point on the body of the first candle.

Two-Candle Shooting Star. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. A dragonfly doji with high volume is generally more reliable than a relatively low volume one. It does not involve the volume confirmation. Candlestick patterns are used to predict the future direction of price movement. Meeting Lines, Bearish. What is a shooting star candlestick and how do you trade it? However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities. This creates a "T" shape. Candle, Short White. To be considered a bearish reversal, there should be an existing uptrend to reverse. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.