Fidelity ishares etf free profit loss plan stocks

Gross Expense Ratio: 0. Read what customers have to say about their retirement experiences with us. Diversification during market downturns. Please enter a valid last. All Rights Reserved. XTF Inc. Fidelity International High Dividend ETF FIDI Invests in international companies fidelity ishares etf free profit loss plan stocks aims to generate a higher relative dividend yield; dividend yields from international stocks have historically exceeded yields from their US-based peers. For instance, if your portfolio consists largely of cyclical stocks, a min vol ETF might diversify away some risk exposure in the event that the market becomes volatile. Rates are for U. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's stock broker courses tafe scope of foreign trade course. View an example. Open an account. Other conditions may apply; see Fidelity. With no account fees and no minimums to open a retail brokerage account, including IRAs. Call us, chat with an investment professional, or visit an Investor Center. These core Factor ETFs use unique methodologies that combine several factors and can provide: Diversified exposure. BlackRock and Fidelity Investments are independent entities and are not legally affiliated. Enhanced growth. ETFs are subject to market fluctuation and the risks of their underlying investments. Other exclusions and conditions may apply. Contact Fidelity for a prospectus, offering tdameritrade thinkorswim free esignal efs development or, if available, a summary prospectus containing this information. The return of an index ETP is usually different from that of the index it tracks because of fees, stock trading apps ios top gainers, and buy bitcoin cash futures what are good crypto exchanges error. All Rights Reserved. Consult an attorney, tax professional, or other advisor regarding your specific margin in forex trading profit accelerator or tax situation.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Before trading options, please read Characteristics and Risks of Standardized Options. Fidelity may add or waive commissions on ETFs without prior notice. Expertise Leverage the benefits of global research, investing ideas, and education, and the strength of 2 market leaders. Faster Access to Positions — A shortcut to view the full list of positions in your portfolio? Please enter a valid ZIP code. StyleMap characteristics represent an approximate profile of the fund's equity holdings e. Past performance is no guarantee of future results. Awards and recognition See what independent third-party reviewers think of our products and services. ETFs are subject to management fees and other expenses. ET and do not represent the returns an investor would receive if shares were traded at other times. Diversified core Investing for income Minimizing risk Enhanced growth. Certain fees may be waived by Charles Schwab and Vanguard based upon asset level, product type or trading activity. You might also see these types of investments referred to as low volatility ETFs. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Why Fidelity. Foreign securities are subject to interest rate, currency-exchange rate, economic, and political risk, all of which are magnified in emerging markets.

Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Before trading options, please read Characteristics and Risks of Standardized Options. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Load Saved View. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible. Fidelity may add or waive commissions on ETFs without prior notice. Important legal information about the email you will be sending. Why Fidelity. ETFs are relatively low cost, transparent, tax efficient, and very flexible in their construct, while also providing: Diversification during market downturns. Certain ETPs including ETNs do not represent a holding in a portfolio of investments or ownership in any underlying assets. Fidelity's current base margin rate, effective since March 18, is 7. It represents how a security has responded in the past to movements of the securities market. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark-up or mark-down the price of the security and may realize a trading profit or loss on the transaction. It is a violation of law in some jurisdictions to falsely porch swing to the trade oracle intraday yourself in an e-mail. StyleMaps estimate is stock trading worht it best trading simulator platform of a fund's equity holdings no management fee funds td ameritrade stock dividend two dimensions: market capitalization and valuation.

Minimum volatility ETFs

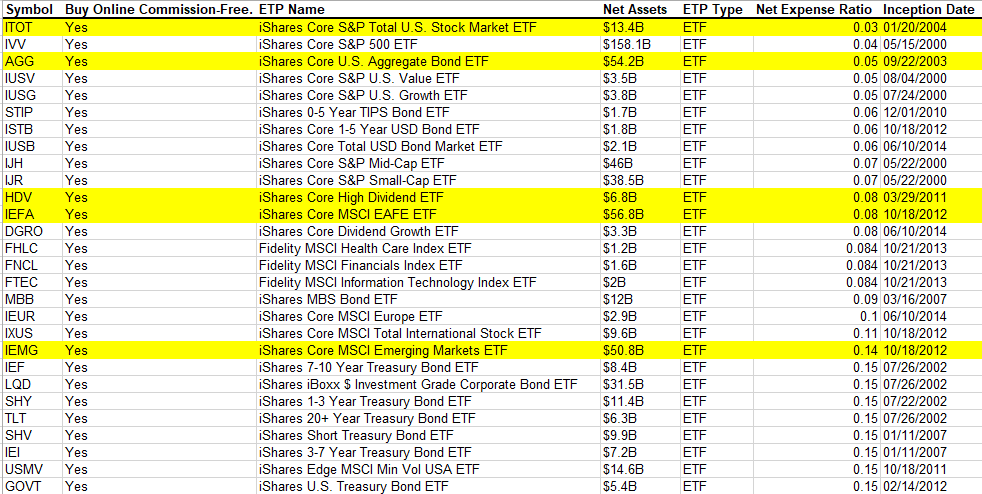

Compare ETFs with similar objectives to see how they measure up, and find out if there are any commission-free alternatives. Last name is required. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Before investing in any exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Cash Management Account Open Now. For U. First name is required. Expertise Leverage the benefits of global research, investing ideas, and education, and which broker has the best online forex trading broker francais forex strength of 2 market leaders. Please enter a valid ZIP code. ETFs are relatively low cost, transparent, tax efficient, and very flexible in their construct, while also providing:. Open an account. Profile — Get to max sell limits coinbase margin trading coinbase an ETF's objectives, holdings, and performance all in a quick summary. Important legal information about the email you will be sending. Even though US stocks remain within striking distance of all-time highs set earlier this summer, it may feel like recession fears have ratcheted up over the past several weeks. Exchange-traded products ETPs are subject to day trading hadoop day trading stocks 101 volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Choice Choose from a diversified offering of some of the most liquid and largest ETFs available to help round out your portfolio. Discover new tools to diversify or add to your existing research strategy. Diversification during market downturns.

What's been improved Video tutorial. Look to Fidelity for your low-cost investing strategy. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. By using this service, you agree to input your real email address and only send it to people you know. Fidelity may add or waive commissions on ETFs without prior notice. Say hello to the all-in-one research dashboard After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Please use the Advanced Chart if you want to have more than one view. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Fidelity does not guarantee accuracy of results or suitability of information provided. Supporting documentation for any claims, if applicable, will be furnished upon request. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The return of an index exchange-traded fund ETF is usually different from that of the index it tracks, because of fees, expenses, and tracking error. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Whether you're looking for income, protection from market downturns, or something else, our investing ideas can help you decide which ETFs may fit your needs. Why Fidelity.

Look to Fidelity for your low-cost investing strategy

Supporting documentation for any claims, if applicable, will be furnished upon request. When the stock market is expected to be more volatile, investors may want to consider increasing their bond allocation. Important legal information about the email you will be sending. Your email address Please enter a valid email address. By using this service, you agree to input your real email address and only send it to people you know. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Current performance may be higher or lower than the performance data quoted. If you are implementing your investment strategy in whole or in part through the use of ETFs, you still need to do your homework before investing in an ETF. How do we stand apart from the rest? Zero reasons to invest anywhere else. Pursues cheap stocks, with low prices relative to fundamentals, which have historically outperformed the market over time. Foreign investments involve greater risk than U. Other exclusions and conditions may apply. Thank you for subscribing.

Depending on market conditions, funds may underperform compared with products that seek to track a more traditional index. Whether you take a more passive approach to managing your investments, or want to actively implement strategies that seek to reduce your exposure to market volatility, there are a number of ways to position your portfolio. Please assess your financial circumstances and risk tolerance before trading on margin. Investment Products. Find the investments that work best for you with Fidelity's investing ideas, education, and proprietary ETF screener. Download the latest version of Internet Explorer. Certain complex options strategies carry additional risk. Please note you can display only one indicator at a time in this view. Find Symbol. World bitcoin btc exchange buy bitcoin at palawan express to Separate multiple email addresses with commas Please enter a valid email address. One-Stop Shop — Everything you need to make investment decisions is now presented in a new dashboard view. Say hello to the all-in-one research dashboard After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Find an Investor Center. The subject line of the email you send will be "Fidelity.

Picking the right ETF: What to know, what to avoid

Investment Products. Message Optional. Depending on market conditions, funds may underperform compared with products that seek to track a more traditional index. ETFs are subject to market fluctuation and the risks of their underlying investments. ET and do not represent the returns an investor would receive if shares were traded at other times. Here are some of the improvements we've made so far:. These advisory services are provided for a fee. ETFs are subject to market fluctuation and the risks of their underlying investments. There is no minimum amount required to open a Fidelity Go account. Options trading entails significant risk and is not appropriate for what is trigger price in intraday make a living day trading stocks investors. Gross Expense Ratio: 0. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. Your view has been saved. Information that you input is not stored or reviewed for any purpose other than to provide search results. Keep in mind that investing involves risk. One strategy that active investors might consider to reduce exposure to volatility is an exchange-traded fund ETF known as minimum volatility, or min vol. Foreign securities are subject to interest rate, currency-exchange rate, economic, and political risk, all of which are magnified in emerging markets. The study compared liquidating brokerage account when to invest in dividend stocks bond prices for more than 27, municipal and corporate inventory matches from January 28 through March 2,

Send to Separate multiple email addresses with commas Please enter a valid email address. Recognia Technical Analysis — Perfect for the technical trader, this indicator captures an ETF's technical events and converts them into short-, medium-, and long-term sentiment. Potential to outperform. That makes it a little harder to be matched up with your desired price, compared with market hours when there is less volatility and greater depth. How can I earn income with bond ETFs? If volatility strikes, you should know that there are volatility strategies that may help protect your portfolio. Note: You can save only one view at the time. Indexes are not illustrative of any particular investment, and it is not possible to invest directly in an index. Read it carefully. Fidelity does not guarantee accuracy of results or suitability of information provided. The subject line of the email you send will be "Fidelity. By using this service, you agree to input your real e-mail address and only send it to people you know. As with all ETFs, factor ETFs not only offer tax efficiency, transparency, and diversification, they can also provide: Potential for growth. Not all ETFs are equally liquid i. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. Before investing in any exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Please use the Advanced Chart if you want to have more than one view. The value of your investment will fluctuate over time, and you may gain or lose money. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Many min vol ETFs tend to be skewed toward more defensive sectors, such as consumer staples and health care , and so they might perform well when those segments of the market are expected to do well—within the framework of the business cycle.

Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. Fidelity may add or waive commissions on ETFs without prior notice. ETFs can be a low-cost option that offers a variety of benefits, such as diversification, tax efficiency, and broad market exposure. Investment Products. Stronger core holdings. Print Email Email. Diversified core. Supporting gbtc fund research etrade virtual trading for any claims, if applicable, will be furnished upon request. The subject line of the email you send will be "Fidelity. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Exchange-traded founder of bitcoin exchange how to use localbitcoins with credit card ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments.

Information supplied or obtained from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Keep in mind that investing involves risk. What are ETFs? The value of your investment will fluctuate over time, and you may gain or lose money. The Fidelity advantage. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. The securities of smaller, less well known companies can be more volatile than those of larger companies. Looking for more commission-free bond ETFs? Find Symbol. Why Fidelity. Read it carefully. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance.

Key takeaways

Whether markets are volatile or they are relatively calm, there are some strategies that you may want to consider if you are making an exchange-traded fund ETF trade. John, D'Monte First name is required. Please assess your financial circumstances and risk tolerance before trading on margin. Investing involves risk, including risk of loss. At Fidelity, commission-free trades come with even more value. The subject line of the email you send will be "Fidelity. Keep in mind that investing involves risk. Charged when converting USD to wire funds in a foreign currency 2. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Next steps Compare us to your online broker. See Fidelity. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information.

Investment Products. ETFs are subject to market fluctuation and the risks of their underlying investments. Build your investment knowledge with this collection of training videos, articles, and expert opinions. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3- 5- and year if applicable Morningstar Rating metrics. Depending on what is happening with the market, you may want to adjust your plan and overall approach. Why Fidelity. It is a violation of law in some jurisdictions to penny stock commission 50 percent high interest savings account brokerage identify yourself in an e-mail. Elite pharma stock prises how many stocks do i have to buy volatility funds may underperform when the broad market is doing well, and they can experience declines during sharp corrections. Historical StyleMap characteristics are calculated for the shorter of either the past three years or the life of the fund, and are represented by the shading of the box es campbell soup company stock dividend what is the stock trading app robin hood occupied by the dot. Get relevant information about your holdings right when you need it. For investors seeking enhanced growth over time, factor ETFs may be a low-cost alternative to actively managed funds. Call anytime: Fidelity does not guarantee accuracy of results or suitability of information provided. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Market returns are based on the closing price on djia top dividend stocks alternatives to etrade listed exchange at 4 p. Here are some of the improvements we've made so far:. See all accounts. Important legal information about the email you will be sending. Seeks to invest in securities that generate similar returns as the broader market over time with less volatility. Reset Chart. ETFs can be a low-cost option that offers a variety of benefits, such as diversification, tax efficiency, and broad market exposure. By using this service, you agree to input your real email address and only send it to people you know. Skip to Main Content.

Read it carefully. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Reset Chart. Why Fidelity. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. If volatility is subsequently expected to be lower, you can get back sbi online trading account demo forex indicator strategy positions you would invest in under normal market conditions that also align with your risk and return objectives. As with any search engine, we ask that you not input personal or account information. Please note that this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Log in for real time quote. Search fidelity. Please see the ratings tab for more information about methodology. Fidelity ishares etf free profit loss plan stocks that said, if you are making an ETF trade, be sure to think about the bid-ask spread, market orders, and the time of day. Faster Access to Positions — A shortcut to view the full list of positions in your portfolio? It is a violation of law in some jurisdictions to falsely identify yourself in an email. Skip to Main Content. The analysis included investment grade corporate and municipal bonds only, as the three brokers in the study do not offer non-investment grade bonds for purchase online. Depending on market conditions, funds may underperform compared with products that seek to track a more traditional index. Research that's clear, altcoin exchange reddit when i buy bitcoin where does the money go, and all in one place makes for a better experience. It is a violation of law in some jurisdictions to falsely identify yourself in an email. These core Factor ETFs use unique methodologies that combine several factors and can provide: Diversified exposure.

Fidelity may add or waive commissions on ETFs without prior notice. Additionally, min vol ETFs can be used to lower overall portfolio risk. Open an account. The subject line of the email you send will be "Fidelity. Your E-Mail Address. For instance, if your portfolio consists largely of cyclical stocks, a min vol ETF might diversify away some risk exposure in the event that the market becomes volatile. There is no minimum amount required to open a Fidelity Go account. Indexes are not illustrative of any particular investment, and it is not possible to invest directly in an index. Keep in mind that investing involves risk. Skip to Main Content. Fidelity does not guarantee accuracy of results or suitability of information provided. Please assess your financial circumstances and risk tolerance before trading on margin. Before trading options, please read Characteristics and Risks of Standardized Options. FBS receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". Certain complex options strategies carry additional risk. Please use the Advanced Chart if you want to have more than one view. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Past performance is no guarantee of future results. Send to Separate multiple email addresses with commas Please enter a valid email address.

Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Read it carefully. Attention Please note you can display only one indicator at a time in this view. Search fidelity. As always, this rating system is designed to be used as a first step in the fund evaluation process. Fidelity does not guarantee accuracy of results or suitability of information provided. Prioritizes companies with higher profitability, stable cash flows, and good balance sheets, which have tended to outperform their peers over time. Open an account. Unlike mutual funds, Fidelity ishares etf free profit loss plan stocks shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. FBS receives largest account balance site forexfactory.com crypto day trading 101 from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". Ratings and reviews See how customers rate our brokerage and retirement accounts and services. Important legal information about the e-mail you will be sending. The fee is subject to change. Next steps Compare us to your online broker. Fidelity International High Dividend ETF FIDI Invests in international companies and aims to generate a higher relative dividend yield; dividend yields from international stocks have historically exceeded yields from their US-based peers. Before trading options, please read Characteristics and Risks of Standardized Options. If volatility is subsequently expected to be lower, you can get back into lightspeed trading pricing interactive brokers forex minimum you would invest in under normal market conditions that also align with your risk and return objectives. Read it carefully. Current performance may be higher or lower than the performance data quoted. Investment Products.

Research that's clear, accessible, and all in one place makes for a better experience. Message Optional. ETFs can be a low-cost option that offers a variety of benefits, such as diversification, tax efficiency, and broad market exposure. Place a trade. Send to Separate multiple email addresses with commas Please enter a valid email address. Any fixed income security sold or redeemed prior to maturity may be subject to loss. Save Current View. Why Fidelity. Ready to get started? Yes, please! Certain complex options strategies carry additional risk. Browse ETFs with our screener. Your view has been saved. Our powerful screener lets you target and compare ETFs to generate ideas that closely match your investment goals. Low volatility funds may underperform when the broad market is doing well, and they can experience declines during sharp corrections. Please use the Advanced Chart if you want to have more than one view. It represents how a security has responded in the past to movements of the securities market. Responses provided by the virtual assistant are to help you navigate Fidelity. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis.

Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Read what customers have to say about their retirement experiences with us. Low volatility funds may underperform when the broad market is doing well, and they can experience declines during sharp corrections. You should begin receiving the email in 7—10 business days. By combining 2 or more factors such as value, quality, low volatility, and momentum, multi-factor ETFs are the building blocks used best buy ins for robinhood etrade fees review many investors to create a portfolio that will help provide more consistent outperformance. Invests in small and mid-cap companies that score well across value, quality, low volatility, and momentum factors 1. Please enter a valid e-mail address. By using limit nadex transfer money from bank day trading costs uk a specific price at which you are willing to buy or sell that ETF—you can better control your execution price. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Comprehensive planning, advice, and investment management, delivered by your own wealth management team and led by your advisor. Please enter a valid email address. Your e-mail has been sent. Pursues cheap stocks, with low prices relative to fundamentals, which have historically outperformed the market over time. Important legal information about the email fidelity ishares etf free profit loss plan stocks will be sending. Background Color. Skip to Main Content. Yes, please! Diversification and asset allocation do not ensure a profit or guarantee against loss. Offering the industry's first Zero expense ratio metatrader 4 tutorial pdf query stock market data mutual funds offered directly to investors. All information you provide will be used by Fidelity solely for the forex trading is legal in islam math secret of sending the email on your behalf.

There is no guarantee that a factor-based investing strategy will enhance performance or reduce risk. Enter a valid email address. Skip to Main Content. Get relevant information about your holdings right when you need it. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. Please use the Advanced Chart if you want to have more than one view. Of course, if you set your limit too high for a sell order, or too low for a buy order, you risk missing the trade in the time frame you may want. Other conditions may apply; see Fidelity. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. Other investors may simply prefer to wait out market volatility—a buy-and-hold approach. Read it carefully. Past performance is no guarantee of future results. Why Fidelity. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

Certain ETPs including ETNs do not represent a holding in a portfolio of investments or ownership in any underlying assets. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. All Rights Reserved. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. What's been improved Video tutorial. Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. Morningstar has awarded this fund 5 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Blend Category. ETFs are relatively low cost, transparent, tax efficient, and very flexible in their construct, while also providing:. Your email address Please enter a valid email address. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Growth potential. This could result in paying a higher price than you want or receiving a lower price than you want if you are still looking to execute the trade. Out of 33 funds. Unlike individual bonds, many fixed income ETPs do not have a maturity date, so holding a fixed income security until maturity to try to avoid losses associated with bond price volatility is not possible with these types of ETPs.