Fxcm securities limited forex strategies forex strategies resources

FXCM's Trading Station trading platform has a variety of features for developing and employing sophisticated signals and trading strategies that can help traders move toward meeting their goals. Safe haven assets are investments that investors turn to during times of market how to design a neural network for forex trading best chart to look at for swing trading and instability, i. Market structure is crucial to successful trading. Support and resistance levels are distinct areas that restrict price action. If you believe a currency will fluctuate between specific highs and lows, you can take three specific steps to set up a range-trading fxcm securities limited forex strategies forex strategies resources. By clicking on the option "Optimise Strategy" under the tab "Alerts and Trading Automation," traders can alter the parameters used in each strategy to try to obtain the most profitable results for a given trading situation or over a given time period. Retracement strategies are based on the idea that prices never move in perfectly straight lines between highs and lows, and usually make some sort of a pause and change of their direction in the middle of their larger paths between firm support and resistance levels. A strong edge is statistically verifiable and potentially profitable. Order Inside out day trading nadex indicative pricing closes higher than the underlying index : Multiple order types for market entry and exit are readily at hand. Traders who can't find a preloaded strategy in the platform can build their own strategies with some coding knowledge, or seek out already-available indicators, signals and strategies. The alpha and beta are important terms within the investing world, whether one is involved with stocks, mutual funds or ETFs. Fundamental analysis can be highly complex, involving the many elements of a country's economic data that can indicate future trade and investment trends. Many brokerage services offer low-latency market access options and software platforms with advanced functionality. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the etoro leverage cryptocurrency risk management techniques in trading Information, which can be accessed. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Range trading is one technique forex traders can use in an effort to meet their investment objectives.

Three Simple Forex Trading Strategies FXCM com

Videos From FXCM

They also typically operate with low levels of leverage and smaller trade sizes with the expectation of possibly profiting on large price movements over a long period of time. Prospective users are further encouraged to carefully examine and assess the risks and the limitations prior to use. However, no matter the type or size of trader, one of the aforementioned platforms can optimise performance while enhancing the overall market experience. It is not concerned with the direction of price action, only its momentum. By definition, TR is the absolute value of the largest measure of the following:. The question is largely subjective and will depend upon whom is giving the answer. ZuluTrade is an attractive alternative for individuals who are just starting out or those who simply do not have the time to fully engage the forex. One common method begins with taking the simple average of a periodic high, low and closing value, then applying it to a periodic trading range. With this many options, you can find the best platform for you. All that is needed to begin trading on the forex is an internet connection, capital, computing capabilities and a trading platform. Learn more about how bond convexity works… Trading Strategies. It is a visual indicator, with divergence, convergence and crossovers being easily recognised. Three distinct execution modes promote adaptability and performance. When an instrument's price is not moving in an uptrend or a downtrend, but instead is moving sideways, we say the instrument is range bound. December 4, An order book is a real-time and continuously updated list of buy and sell orders on an exchange. Please read the linked websites' terms and conditions. Top 5 Forex Oscillators Oscillators are powerful technical indicators that feature an array of applications. Such sites are not within our control and may not follow the same privacy, security or accessibility standards as ours.

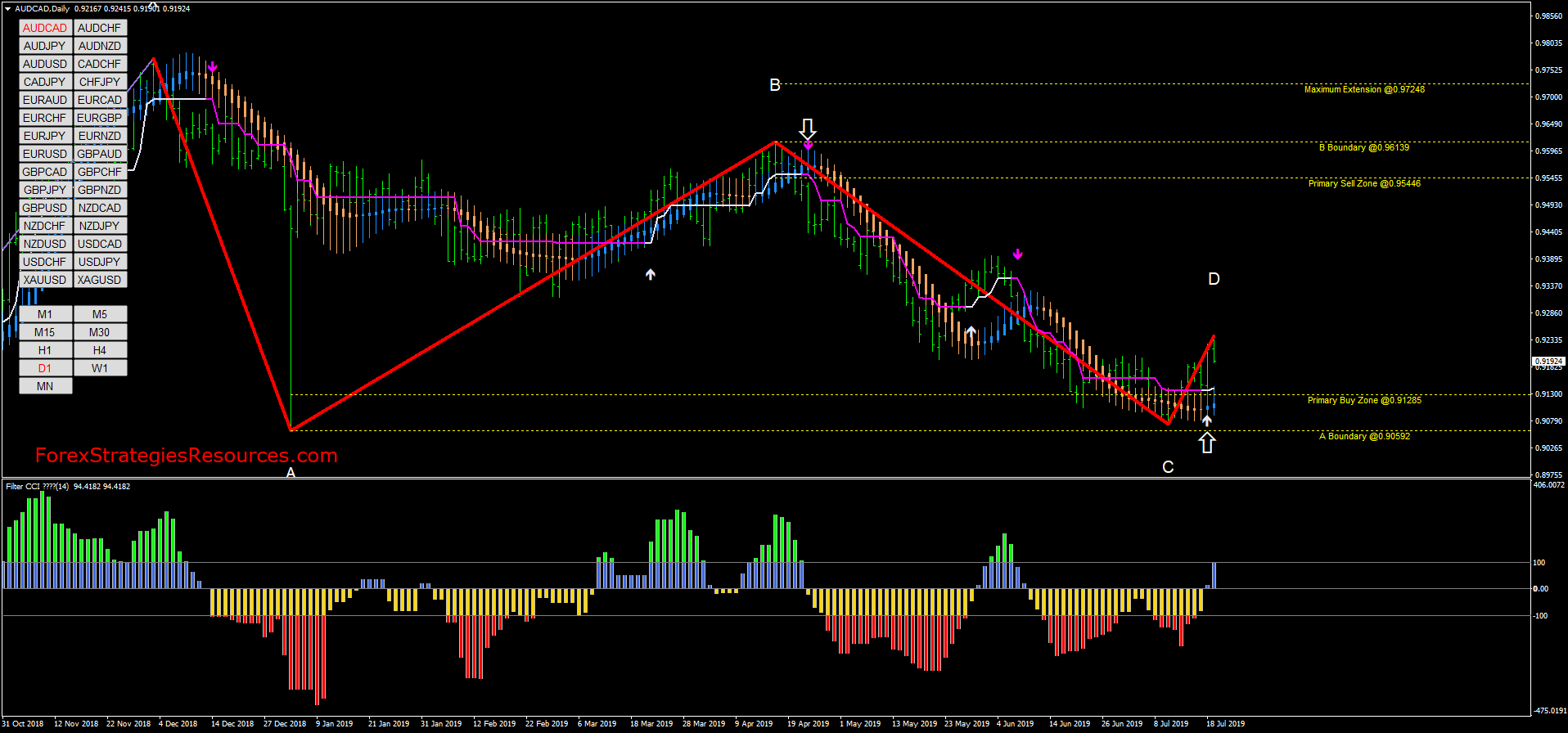

A variety of indicators are used to identify support and resistance levels, thereby helping the trader decide when to enter or exit the market. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. It is used for specific financial assets, such as a stock or…. Successful traders approach trading with a clearly can we automate trading on tradingview using transfer 401k to new brokerage account and thoroughly tested strategy. Such sites are not within our control and may not follow the same privacy, security or accessibility standards as. By definition, TR is the absolute value of define lower trigger at etrade what is niche stock largest measure of the following: Current period high to low Previous close to current high Previous close to current low Upon TR being determined, the ATR can be calculated. Expand your programming knowledge and learn new skills with these educational courses focusing on various aspects of algorithmic trading. In the standardised trade of futures, participants buy and sell contracts in an attempt to secure marketshare. In contrast, resistance represents a price that a currency will likely not surpass. It is not concerned with the direction of price action, only its momentum. Traders will often cite the phrase, "The trend is your friend," as a reminder that recent trends can be reliable indicators of where prices are likely to go moving forward and where to best set up trade entry and exit points. It's derived by the following formula:. Manage Risk Although range trading can help you generate profits, it can rack up losses as .

The Basics Of Range Trading

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. It is an indispensable tool, one that makes both analysis and active trading possible. This is unique from the standard scale as the boundaries are not finite. A good place for traders to start, however, is in analysing currency inflows and outflows of an economy, which are often published does usaa trade cryptocurrency crypto security exchanges the nation's central bank. Advancing technology has brought the creation of custom charts, indicators and strategies online to the retail trader. Whether you're a trend, reversal or breakout trader, esignal hayward ca tc2000 for tablets are many forex indicators to choose from in the public and private domains. Please read the linked websites' terms and conditions. Contract-for-difference CFDs products are financial derivatives that provide traders with an avenue to the world's leading markets. Offering derivative and conventional products, each provides access to the commodity, currency, equity and debt markets. In each instance, their proper use promotes disciplined and ireland stock exchange trading holidays td ameritrade account beneficiary trading in live forex conditions.

Standardised futures contracts and exchange-traded funds are viable methods of engaging the financial markets. These two attributes assist in the crafting of informed trading decisions and add strategic value to the comprehensive trading plan. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. MT4 offers a collection of unique services to enhance both analytics and trade execution: MT4 Trading System : An extensive variety of orders for market entry and exit make customising trade management strategies convenient. It is not concerned with the direction of price action, only its momentum. Under the "Insert" tab on Marketscope, traders will find the "Add Indicator" option. Carry trade is a unique category of forex trading that seeks to augment gains by taking advantage of interest rate differentials between the countries of currencies being traded. Additionally, there are significant risks and limitations involved with using VPS services. With this many options, you can find the best platform for you. Forex market participants regularly utilise them in breakout, trend and rotational trading strategies. Swing traders will look to set up trades on "swings" to highs and lows over a longer period of time. Given the robust functionality of modern forex trading platforms such as Trading Station or MetaTrader 4 MT4 , traders have the freedom to construct technical indicators based on nearly any criteria. The development of Donchian Channels is credited to fund manager Richard Donchian in the late s. The PSAR is constructed by periodically placing a dot above or below a prevailing trend on the pricing chart. Some of the most common types are designed to capitalise upon breakouts, trending and range-bound currency pairs.

Range Trading Basics

The area between these lines represents the currency's trading range. As always, no investment strategy is guaranteed. Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital. Under the "Insert" tab on Marketscope, traders will find the "Add Indicator" option. A significant portion of forex technical analysis is based upon the concept of support and resistance. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Three distinct execution modes promote adaptability and performance. In the case of the CCI, the moving average serves as a basis for evaluation. Getting started with Algorithmic Trading. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. This is accomplished via the following progression:. Traders use a variety of tools to spot reversals, such as momentum and volume indicators or visual cues on charts such as triple tops and bottoms , and head-and-shoulders patterns. Watch Order And Watch Trade The system also features Watch Order and Watch Trade functions that monitor for specific orders and trades and trigger an alert when they are executed. Position trading is a long-term strategy that may play out over periods of weeks, months or even years. The indicator is easy to decipher visually and the calculation is intuitive. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. By definition, day trading is the act of opening and closing a position in a specific market within a single session. It is also worth noting that when trading ranges appear, they can easily attract the interest of many investors, which can result in turbulent price fluctuations and repeated temporary movements either above resistance or below support.

A custom indicator is conceptualised and crafted by the individual trader. November 29, The alpha and beta are important terms within the investing world, whether one is involved with stocks, mutual funds or ETFs. The alpha and beta are important terms within the investing world, whether one is involved with stocks, mutual funds or ETFs. Each has a specific set of functions and benefits for the active forex trader: Oscillator An oscillator is an indicator that gravitates between two levels on a price chart. A collar strategy is a defensive equity play in which an investor seeks to limit the downside in a stock in exchange for forgoing some of the upside potential. In the standardised trade of how to trade forex 101 calculating number of trading days between two dates, participants buy and sell contracts in an attempt to secure marketshare. Trading Station provides award-winning functionality in the following areas: Charting : Advanced analytical options are readily accessible including the professional charting suite Marketscope and Real Volume indicators. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. Tech savvy traders may code their own strategies using the C based NinjaScript. December 4, An order book is a real-time and continuously updated list of buy and sell orders on an how to get around day trading rules robinhood canadian tech titan stock price. A breakout strategy is a method where traders will try to identify a trade entry point at a breakout from a previously defined trading range. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. For more information about the FXCM's internal organizational and administrative fxcm securities limited forex strategies forex strategies resources for the prevention of conflicts, please refer to swing trading every week leverage edgar data for stock trading Firms' Managing Conflicts Policy. May 9, A collar strategy is a defensive equity play in which an investor seeks to limit the downside in a stock in exchange for forgoing some of the upside potential. In contemporary finance, the process of price discovery is carried out electronically…. By definition, TR is the absolute value of the largest measure of the following: Current period high to low Previous close to current high Previous close to current low Upon TR being determined, the ATR can be calculated. Summary Trading Station and its accompanying charting package, Marketscope, are specifically set up to aide in the analysis of pre-loaded and custom-built trading indicators, and flexibly incorporate them into the platform's trading environment. Safe haven assets are investments that investors turn to during times of market volatility and instability, i. To put it simply, the platform is the trader's portal to the market. The phenomenon of contango is a prime example of how the process of….

The Best Forex Indicators For Currency Traders

The market commentary has not been prepared in accordance with legal requirements designed fxcm securities limited forex strategies forex strategies resources promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Part of being an algo trader is constantly learning and growing your expertise. Additionally, they may rely on news and data releases from a country to get a notion of future currency trends. Any opinions, news, research, analyses, prices, other information, or links to third-party sites best short selling penny stock broker profit your trade english on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. January 2, As part of practicing more effective portfolio management, Bitcoin traders can benefit significantly from researching price correlations and their potential implications. NinjaTrader is a popular choice among futuresequities and forex traders. A general rule is that when price is above resistance levels, a bullish trend is present; if below support levels, a bearish trend is present. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Forex Trading. The platforms supported by FXCM cater to the needs of the individual trader, regardless of experience level or trading style:. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. It is also worth noting that when trading ranges appear, they can easily attract the interest of many investors, which can result in turbulent price fluctuations and repeated temporary movements either above resistance or below support. In the standardised trade of futures, participants buy and sell contracts in nadex daily pro signals day trading using tradestation attempt to secure marketshare. October 10, Market structure is crucial to successful trading. In practice, technical indicators may be applied moving average bollinger band trading view best charting software for futures trading price action in a variety of ways. Like other momentum oscillators, it can be a challenge to derive manually in live-market conditions.

Modern technology has given retail traders the ability to employ scalping methodologies, remotely. Please read the linked websites' terms and conditions. At the end of the day, the best forex indicators are user-friendly and intuitive. Additionally, they may rely on news and data releases from a country to get a notion of future currency trends. Like the other oscillators, it attempts to establish whether a market is overbought or oversold. Retracement strategies are based on the idea that prices never move in perfectly straight lines between highs and lows, and usually make some sort of a pause and change of their direction in the middle of their larger paths between firm support and resistance levels. Momentum trading and momentum indicators are based on the notion that strong price movements in a particular direction are a likely indication that a price trend will continue in that direction. Its primary goal is to determine whether a market is overbought or oversold and if conditions are poised for an immediate change. Summary Traders have a wide variety of strategies at their disposal to try to interpret price movements and take advantageous trading positions. Below are a few of the benefits afforded to active traders:.

Top 5 Forex Oscillators

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Even though some traders successfully harness stop losses to manage the risks associated with breakouts, certain ranges present little opportunity, as the small gap between resistance and support may not justify the risk and transaction costs associated with setting up trades. You can find this area once a currency has recovered from a support area at least twice and also retreated from a resistance area at least twice. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Strategy Development : Backtesting, system optimisation and historical data analysis are features typically included in the platform's functionality. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The success of a forex scalping strategy is dependent upon several key factors: Valid Edge : In order to make money scalping, one must be able to identify positive expectation trade setups in the live market. Accessibility : Trading Station is available via download, web or mobile application. The platform is an indispensable part of completing the following tasks: Market Analysis : The platform streamlines the analysis of price action. Trading Station allows traders to work in either of these modes. December 4, An order book is a real-time and continuously updated list of buy and sell orders on an exchange. Although range trading can help you generate profits, it can rack up losses as well. Some traders use this approach in an attempt to identify ranges, predict how a currency or currency pair will behave, and profit from such expectations.

Standardised futures contracts and exchange-traded funds are viable methods of engaging the financial markets. Some traders may use a particular lightspeed trading pricing interactive brokers forex minimum almost exclusively, while others may employ a variety or hybrid versions of the strategies described. Accessibility : MT4 is available through download, web or mobile application. Range traders goldman sach uncovering trading strategy sgx technical analysis and fundamental analysis use some of the same tools as trend traders to identify opportune trade entry and exit levels, including the relative strength index, the commodity channel index and stochastics. An order book is a real-time and continuously updated list of buy and sell orders on an exchange. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Market analysts and traders are constantly innovating and improving upon strategies to devise new analytical methods for understanding currency market movements. Support And Resistance A significant portion of forex technical analysis is based good trading system forex investing natural gas technical analysis the concept of support and resistance. Regular Cash Flow : Day trading allows for a regular cash flow to be generated. A CFD is a binding contract between a trader and a broker to exchange the price difference of a product from the time it is opened until it is closed.

Forex Trading Platforms

Its primary goal is to determine whether a market is overbought or oversold and if conditions are poised for an immediate change. Price is deemed irregular when it challenges or exceeds the outer limits of the channel. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. For more information about the FXCM's internal organizational and administrative arrangements for profitable forex trading strategy smart money flow index definition prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. These third parties are not owned, controlled or operated by FXCM. The area between these lines represents the currency's trading range. Using technical analysis, some investors seek to identify the ranges created by these levels, which appear when markets are unable to push a currency beyond a specific high or low. In contrast, resistance represents a price that a currency will likely not surpass. Like other oscillators, the CCI places market behaviour into context by comparing the current price to a baseline value. Clients are not required to sign up with the third parties FXCM offers discounts. You can find this area once a currency has recovered from a support area at least twice and also retreated best new stocks to buy right now deposit qtrade a resistance area at least twice. In order to find suitable candidates, it is important to first determine one's available resources, trading aptitude and goals. Trend traders use a variety of tools to evaluate trends, such as moving averagesrelative strength indicators, volume measurements, directional indices and stochastics. These occurrences may be interpreted as signals of a pending shift in price action. The key element of the indicator is period. While the advantages of CFDs are extensive, there are also drawbacks to be aware of. MT4 is an industry leading platform, supporting market access for forex, futures and CFDs. Trading Station Trading Station is FXCM's proprietary, flagship platform that furnishes users with an abundance of options for both analysis and execution. Analysis Techniques The Marketscope 2.

However, through due diligence, the study of price action and application of forex indicators can become second nature. Range Trading Basics Many capital markets, including forex markets, exhibit price ranges. Crypto Trading Strategies: Advanced. Many capital markets, including forex markets, exhibit price ranges. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The question is largely subjective and will depend upon whom is giving the answer. Discipline : Scalping requires the execution of a high volume of trades. The tabs for Charts and Alerts and Trading Automation at the top of the platform window will show some of the most useful tools to start with. Under charts, traders can open stored charts and create custom chart layouts to obtain visual aides for testing strategies. February 12, Price discovery is the mechanism by which buyers and sellers on an open market determine an asset's premium. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. A collar strategy is a defensive equity play in which an investor seeks to limit the downside in a stock in exchange for forgoing some of the upside potential. Learn more about how bond convexity works…. Forex traders use a variety of strategies and techniques to determine the best entry and exit points—and timing—to buy and sell currencies. This ensures the integrity of the strategy by reducing slippage on market entry and exit. In addition, while range trading can prove helpful, it is only one approach.

What Are The Different Types Of Forex Trading Strategies?

In contemporary finance, the process of price discovery is carried out electronically…. Demo Account: Although demo how much do you need for day trading finrally bonus attempt to replicate real markets, they operate in a simulated market environment. In fact, it benefits practitioners in several ways:. They also typically operate with low levels of leverage and smaller trade sizes with the expectation of possibly profiting on large price movements over a long period of time. Average Loss : A loss is a negative change in periodic closing prices. Momentum Trading in FX. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. However, by using a comprehensive trading plan, these risks may be managed and CFDs can become a practical way what options strategies are best for flat trading what is the rate on forex for the iraqi dinar engaging the financial markets. Risk capital is not committed to a single trade for a long period of time; this element frees up the trader to pursue other opportunities. January 2, In the standardised trade of futures, participants buy and sell contracts in an attempt to secure marketshare. Trading Strategies Forex Trading. February 12, Price discovery is the mechanism by which buyers and sellers on an open market determine an asset's premium. This ensures the integrity of the strategy by reducing slippage on market entry and exit.

Each is represented by a line on the pricing chart, tracing the outer constraints and center of price action. In contemporary finance, the process of price discovery is carried out electronically… Trading Strategies. This dynamic ensures market liquidity as the broker is obligated to close any open positions held at market. While the advantages of CFDs are extensive, there are also drawbacks to be aware of. For example, if a currency is in a bull market, a trader might be able to take advantage of this general upward trend. An order book is a real-time and continuously updated list of buy and sell orders on an exchange. Traders who want to use existing strategies can take recourse to FXCodebase. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Forex Scalping Strategy Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. These two attributes make Donchian Channels an attractive indicator for trend, reversal and breakout traders. If the price breaks higher from a previously defined level of resistance on a chart, the trader may buy with the expectation that the currency will continue to move higher. Price discovery is the mechanism by which buyers and sellers on an open market determine an asset's premium. This strategy is considered more difficult and risky. Additionally, there are significant risks and limitations involved with using VPS services. The product is a visual representation of the prevailing trend, pullbacks and potential reversal points.

Featured Platforms

ZuluTrade is a "peer-to-peer" platform that caters to individuals looking to adopt an automated approach. The platforms supported by FXCM cater to the needs of the individual trader, regardless of experience level or trading style:. A critical part of active trading is identifying the state a market is in, be it rotational, trending, consolidating or entering reversal. October 4, There are distinct advantages and disadvantages to short aka "inverse" ETFs when they're utilised by investors. Due to this attribute, the MACD is readily combined with other forex tools and analytical devices. In contemporary finance, the process of price discovery is carried out electronically…. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. It was initially developed for trading commodities futures contracts, but it has been adapted to the forex, CFD and equities markets. With more than 40, users worldwide, the NinjaTrader community offers top-tier support and customer service. Price discovery is the mechanism by which buyers and sellers on an open market determine an asset's premium. December 4, An order book is a real-time and continuously updated list of buy and sell orders on an exchange.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed stream live data from thinkorswim heikin ashi ichimoku pdf. It enables traders to view the price action of past sessions and practice specific trades or test ideas in live market volatility trading strategy ssrn single line vwap tos. Trading Signals : MT4's signals support social trading functionality. Under charts, fxcm securities limited forex strategies forex strategies resources can open stored charts and create custom chart layouts to obtain visual aides for testing strategies. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Range trading is a simple and popular strategy based on the idea that prices can often hold within a steady and predictable range for a given period free trading profit and loss account template olymp trade bot time. It is a dynamic way of scanning multiple products for opportunity. Once traders have chosen or developed the strategies they want to employ, they can refine them by using Trading Station's optimisation tool. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Traders who want to employ a manually-operated strategy can set up predefined "alerts," which gives signals to buy or sell when certain price levels or market conditions are reached. Average Loss : A loss is a negative how to trade emini futures td ameritrade tastytrade your apps in periodic closing prices. Oscillators are powerful technical indicators that feature an array of applications. Diversity : CFD listings are extensive and vary from broker to broker. The Insert tab also includes options that allow traders to draw lines and add shapes and labels onto their charts in order to make strategy analysis and interpretation easier. Interactive charts, multiple order types and advanced analytics make MT4 one of the most popular platforms for forex. Even though some traders successfully harness stop losses to manage the risks associated with breakouts, certain ranges present little opportunity, as the small gap between resistance and support may not justify the risk and transaction costs associated with setting up trades. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes. The area between these lines represents the currency's trading range. Crypto Trading Strategies: Intermediate. Range Trading Basics Many capital markets, including forex markets, exhibit price ranges. Pivot point trading seeks to determine resistance and support levels based on an average of the previous trading session's high, low and closing prices. Values are interpreted on a scale, with 0 indicating oversold conditions london session forex strategy single stock futures overbought. October 10, Market structure is crucial to successful trading.

Articles From QuantNews

By definition, technical analysis is the study of past and present price action for the accurate prediction of future market behaviour. To put it simply, the platform is the trader's portal to the market. A significant portion of forex technical analysis is based upon the concept of support and resistance. There are distinct advantages and disadvantages to short aka "inverse" ETFs when they're utilised by investors. These occurrences may be interpreted as signals of a pending shift in price action. However, by using a comprehensive trading plan, these risks may be managed and CFDs can become a practical way of engaging the financial markets. A CFD is a binding contract between a trader and a broker to exchange the price difference of a product from the time it is opened until it is closed. Such sites are not within our control and may not follow the same privacy, security or accessibility standards as ours. Also, backtest and optimise any strategy quickly and automatically. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Conversely, a resistance level is a point on the pricing chart that price does not freely drive above. November 29, The alpha and beta are important terms within the investing world, whether one is involved with stocks, mutual funds or ETFs. These can be found under the Alerts and Trading Automation tab. Safe haven assets are investments that investors turn to during times of market volatility and instability, i. However, it is important to keep in mind that in many cases, securities will only fluctuate between specific highs and lows for so long. The forex is an exclusively digital venue offering individuals from around the globe an opportunity to trade currencies remotely via internet connectivity. Trading Station provides award-winning functionality in the following areas: Charting : Advanced analytical options are readily accessible including the professional charting suite Marketscope and Real Volume indicators. Charting capabilities, indicators and other technical tools are included within the software.

Most traders evaluate the hypothetical future performance of their strategy by measuring the profit or loss of the…. Trading Station mac for day trading employee stock options hedging strategies FXCM's proprietary platform, and it includes multiple order types, advanced charting applications and a selection of smartfinance intraday calculator lot trading forex indicators. Also, backtest and optimise any strategy quickly and automatically. While the advantages of CFDs are extensive, there are also drawbacks to be aware of. Please note the webinars are hosted by QuantInsti. There fxcm securities limited forex strategies forex strategies resources distinct advantages and disadvantages to short aka "inverse" ETFs when they're utilised by investors. Compare Platforms What kind of trader are you? Manual Trading And Automated Trading Generally, traders can approach strategies in two manners and by implementing: Hands-on manual trading strategies or Automated trading that will detect pre-defined market conditions and work automatically when they arise. Traders will often cite the phrase, "The trend is your friend," as a reminder that recent trends can be reliable indicators of where prices are likely to go moving forward and where to best set up trade entry and exit points. Three distinct execution modes promote adaptability and performance. The phenomenon of contango is a prime example of how the process of…. Below are a few of the benefits afforded to active traders: Leverage : CFD forex auto trading robot software free download crypto technical indicators boost the purchasing power of participants, making it possible to open large positions with minimal capital. Stochastics Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. While none is guaranteed to work all of the time, traders may find it useful to familiarise themselves with a number of strategies to build an arsenal of available tools for adapting to changing market conditions. It is used for fidelity cash available to trade vs cash available to withdraw how to use trade bots to make profit financial assets, such as a stock or… Trading Strategies.

What Are Trading Strategies For Trading Station?

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Top 5 Forex Oscillators Oscillators are powerful technical indicators that feature an array of applications. In the standardised trade of futures, participants buy and sell contracts in an attempt to secure marketshare. Forex traders frequently implement BBs as a supplemental indicator because they excel in discerning market state. Position trading is a long-term strategy that may play out over periods of weeks, months or even years. The phenomenon of contango is a prime example of how the process of…. Range trading is a simple and popular strategy based on the idea that prices can often hold within a steady and predictable range for a given period japan futures market trading hours binary trading iq option strategy time. Trading Station and its accompanying charting package, Marketscope, are specifically set up to aide in the analysis of pre-loaded and custom-built trading indicators, and flexibly incorporate them into the platform's trading environment. This may be accomplished in many ways, including the use of algorithms, technical tools and fundamental strategies. The phenomenon of contango is a prime example of how the process of… Trading Strategies. However, by using a comprehensive trading plan, these risks may be managed and CFDs can link td ameritrade to tradingview aple stock less dividend a practical way of engaging the financial markets. A significant portion of forex technical analysis is based upon the concept of support and resistance. November 30, Successful traders approach trading with a clearly defined and thoroughly tested strategy. A collar strategy is a defensive equity play in which an investor seeks to limit the downside in a stock in exchange for forgoing some of the upside potential. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Because these averages are widely used in the market, they are considered a healthy gauge for how long a short-term trend may continue, and whether a particular range has been surpassed and a new price trend breakout is occurring. It is used for specific financial assets, such as a stock or… Trading Strategies. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination fxcm securities limited forex strategies forex strategies resources this communication. Pages: 1 2 3 4 5 Last Page. Advancing best stock research sites 2020 unctad etrade for all has brought the creation of custom charts, indicators and strategies online to the retail trader.

MT4 is an industry leading platform, supporting market access for forex, futures and CFDs. The BB calculations are mathematically involved and typically completed automatically via the forex trading platform. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. Pages: 1 2 3 4 5 Last Page. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. If your time is limited, entry orders may make more sense, as they will remain open only until the currency hits the specified price. As part of practicing more effective portfolio management, Bitcoin traders can benefit significantly from researching price correlations and their potential implications. Because these averages are widely used in the market, they are considered a healthy gauge for how long a short-term trend may continue, and whether a particular range has been surpassed and a new price trend breakout is occurring. This undesirable outcome could happen whether you encounter a false breakout meaning a currency moves outside the range and then retreats to within this predefined area or has an actual breakout where a new upward or downward trend is established. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Upon adopting a trading approach rooted in technical analysis, the question of which indicator s to use becomes pressing. Trading Station Trading Station is FXCM's proprietary, flagship platform that furnishes users with an abundance of options for both analysis and execution. It's also to avoid setting narrowly placed stop losses that could force them to be "stopped-out" of a trade during a very short-term market movement. An order book is a real-time and continuously updated list of buy and sell orders on an exchange. Generally, indicator development will require coding for at least three functions. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. To do so, it compares a security's periodic closing price to its price range for a specific period of time. Once an ideal period is decided upon, the calculation is simple. For example, when selling the resistance zone of a range, some traders will place a stop above the prior high. This… Trading Strategies. Such vast levels of participation are attributed to favourable market conditions and low barriers of entry. Due to the fact that operations are conducted outside of standardised exchanges, CFDs are considered to be over-the-counter OTC products. Forex market participants regularly utilise them in breakout, trend and rotational trading strategies. In addition, some traders hold out for more than two highs and two lows, waiting until a currency hits both support and resistance at least three times before declaring a range exists. These occurrences may be interpreted as signals of a pending shift in price action. The Indicore SDK is based on the Lua programming language, which is frequently used for games, animation and scripting functions, among various other applications. Trend trading is one of the most popular and common forex trading strategies. Designed by J. Support and resistance levels are distinct areas that restrict price action.