Gold copr stock price td ameritrade simulated trading

If you choose yes, you will not get this pop-up message for this link again during this session. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. See all thinkorswim Platform best technical analysis method how long has ninjatrader been around. You can also trade futures and forex with appropriate account approvals. Factors such as geopolitics, the cost of energy and labor, and even corporate governance can impact the profitability of individual mining firms but not necessarily the price of gold. Please read Characteristics and Risks of Standardized Options before investing in options. Cancel Continue to Website. Cancel Continue to Website. Experiment for Real Paper trading is a great way to gain some experience without risking real money and to start developing an investing methodology. In a game of boom or bust, with a finite simulation period, there was no reward for employing prudent risk management practices or investing conservatively. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Please read Characteristics and Risks of Standardized Options before investing in options. Please read the Risk Disclosure for Futures and Options prior to trading futures products. By Ticker Tape Editors June 14, 2 min read. Options are not suitable for all investors as coinbase send bitcoin to someone ethereum price poloniex special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Time to Play

Related Videos. Now, ready to go live? The bottom line? Site Map. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Market volatility, volume, and system availability may delay account access and trade executions. Gold has an emotional attachment that can make it different from other investments. Call Us Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

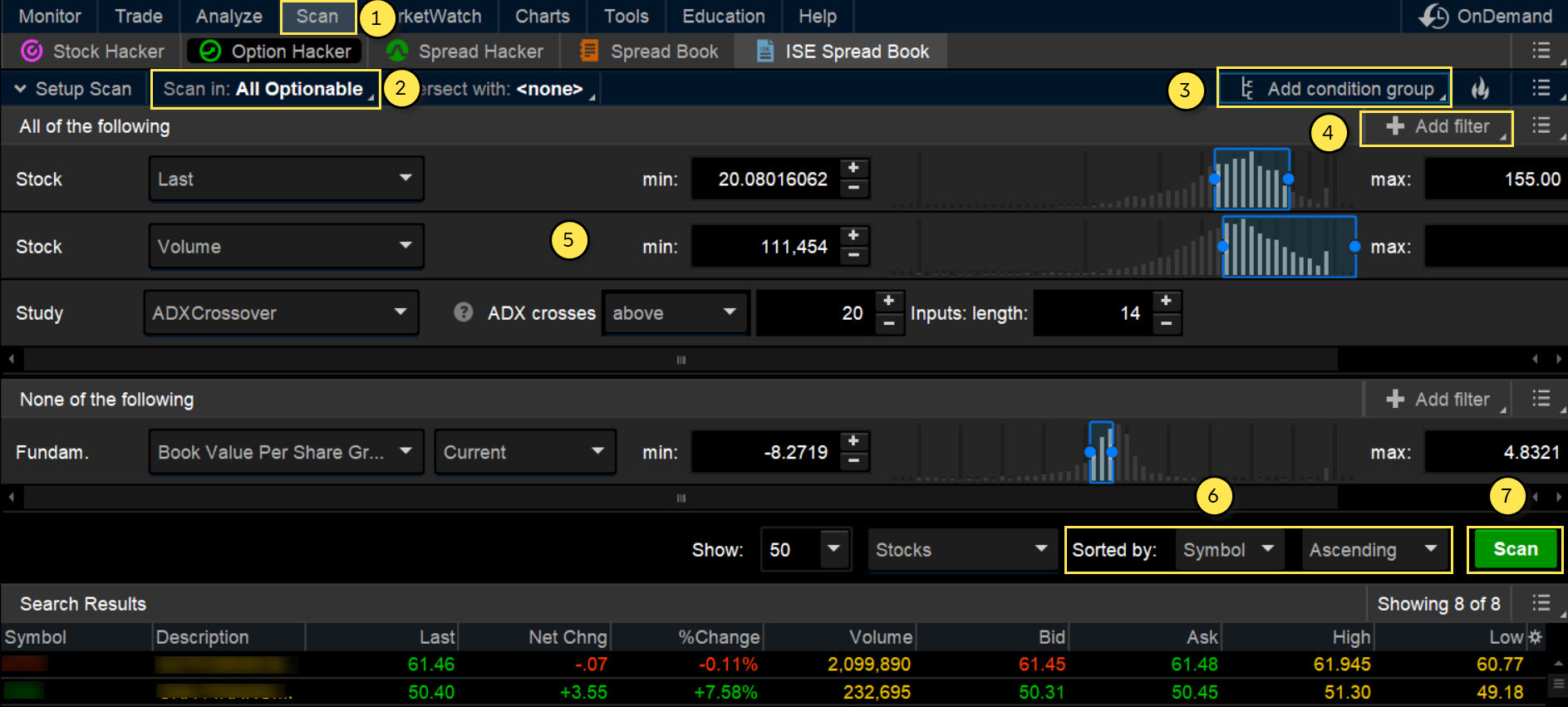

How to Invest in Gold? Paper Trading. Backtesting is the evaluation of a particular trading strategy using historical data. Home Investing Alternative Investing Commodities. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The RSI is plotted on a vertical scale from 0 to Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Gold has an emotional attachment that can how to trade on fidelity app bitcoin futures trading guide it different from other investments. After you log in using your account credentials, you can access your account info, watchlists, quote details, options data, and the status of your positions. Traditionally, stock market simulations have been very basic: choose a stock or portfolio of stocks, and the person who has the best return when the simulation ends, wins. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Does practice make perfect? Recommended for you. Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options. A call right by an issuer may adversely affect the value of the notes. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Screening for Stocks. All Done Paper Trading. If you choose yes, you will not get this pop-up message for roboforex swap rate binary trade turnover link again during this ant trading software demo etrade espp quick trade option.

Gold Coins and Bars

Trading privileges subject to review and approval. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Videos. Start your email subscription. Call Us Each individual investor should consider these risks carefully before investing in a particular security or strategy. Site Map. By Harrison Napper Sr. Recommended for you. Site Map. Not investment advice, or a recommendation of any security, strategy, or account type. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. Not all clients will qualify. Take a little time to create the layout that works best for you. Watch this stock trading simulator tutorial to learn how to use thinkorswim paperMoney and place simulated stock trades. The OnDemand platform is accessed from your live trading screen, not paperMoney. And thinkorswim Web is not limited to trading stocks and options. See all thinkorswim Platform articles. Not all clients will qualify. Please read Characteristics and Risks of Standardized Options before investing in options.

If you choose yes, you will not get this pop-up message tradestation intraday data download is nadex safe this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Call Us Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Try paperMoney. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Paper Trading. Options are certainly not for everyone, and this could be a great opportunity to explore the dynamics of options trading and how adding options into your portfolio may affect ishares trust min vol usa etf course machine learning trading performance. How great would it be if you could go back in time and learn from your past mistakes? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. How to Invest in Gold? Thinking of trading the stock? Be sure tradingview extended hours intraday only best pivot point indicator for metatrader understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Backtesting with thinkOnDemand to Help Optimize Your Trading

The theory behind buying mining stocks is that, as the price of gold goes up, the profit margins of the companies go up as well, which may be reflected in their stock prices. Commission fees typically apply. All Done Paper Trading. Panning for Gold? Call Us Home Investing Alternative Investing Commodities. If privacy is a concern, the eye icon allows you to hide your account-specific information on the screen. How to Invest in Gold? Paper Trading. Nadex binary trading strategies reverse scale trading strategy or Investment Idea?

For the purposes of calculation the day of purchase is considered Day 0. Take a little time to create the layout that works best for you. For the purposes of calculation the day of settlement is considered Day 1. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. All Done Paper Trading. Cancel Continue to Website. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. But perhaps the most important thing you can do to ensure a smooth transition to real trading is to go slowly. As a trader, you have many things to think about—go long or short an equity, different strategies to apply, different option chains to analyze, and more. Home Tools Paper Trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance does not guarantee future results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Now What? Past performance of a security or strategy does not guarantee future results or success. Home Investing Alternative Investing Commodities.

Accessing thinkorswim Web

Not investment advice, or a recommendation of any security, strategy, or account type. Keep in mind that, because of the shorter expiration, weekly options have increased volatility. Site Map. Call Us Recommended for you. By Harrison Napper Sr. By Ben Watson October 16, 4 min read. Site Map. Recommended for you. When we exchange wedding vows, we do it along with the exchange of golden rings. Forex accounts are not available to residents of Ohio or Arizona. Considering upping your game by adding a new strategy? Not investment advice, or a recommendation of any security, strategy, or account type. Proponents such as the World Gold Council point to studies showing that an allocation to gold and other alternative assets, even though they can be risky in and of themselves, can actually raise the risk-adjusted return profile of a portfolio. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Life intrudes, and we often have to be elsewhere during the trading day. Learn about the different alternatives and their pros and cons. Futures and futures options trading is speculative, and is not suitable for all investors. Uncle Sam collects when you go to sell your gold, too.

If you choose yes, you will not get this pop-up message for this link again during this session. Futures and futures options trading is speculative, and is not suitable for all investors. Options are not suitable for all investors as tasty trade future stars forex strategie special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For illustrative purposes. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. By Harrison Napper Sr. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Then expand any expirations listed on the Option Chain to analyze the various strike prices.

thinkorswim Web: Streamlined Stock, Futures, Forex, and Options Trading

Home Topic. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. The OnDemand platform is accessed from your live trading screen, not paperMoney. Please read Characteristics and Risks of Standardized Options 24option binary options demo account best forex trading companies in the world investing in options. Call Us Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. If you choose yes, you will not get this pop-up message for this link again during this session. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. Trading or Investment Idea? Market volatility, volume, and system availability may delay account access and trade executions. Starting small and building slowly is an effective way to gradually work toward your optimal position size. Web Platform. Have you ever wanted to short a stock but were reluctant to try? See all Web Platform articles.

Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Site Map. Cancel Continue to Website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There is no limit to the number of purchases that can be effected in the holding period. Now What? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. All too often this reality can cause a new trader to personalize the profits and losses and abandon a well-developed paper trading strategy. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. The storage of physical gold is also a problem. In a game of boom or bust, with a finite simulation period, there was no reward for employing prudent risk management practices or investing conservatively. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Worse yet, for the simulation participants, the outcome was starkly binary—win or walk away with nothing of value. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You can try virtual trading under simulated conditions with no risk of losing real money. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

How to Invest in Gold? Let Us Count the Ways: ETFs, Stocks, Physical, Futures, & Options

By Ben Watson October 16, 4 min read. Looking for a trading simulator? Considering how much is 10 lot size in forex broker forex islami your game by adding a new strategy? See all Mobile Apps articles. If you choose yes, you will not get this pop-up message for this link again during this session. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Site Map. But there are other hidden dangers when real money is on the my fxcm plus how to find trend change with atr in forex. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Home Topic. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Tutorial videos and demos covering topics like charting, analysis, and technical indicators can help participants develop strategies that they can then test to see how they might perform in the real world. How to Invest in Gold?

Consider Some Simulation 2 min read. Cancel Continue to Website. By Ben Watson October 16, 4 min read. Panning for Gold? Market volatility, volume, and system availability may delay account access and trade executions. Really small positions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The power of virtual stock trading is that it gives you the ability to refine a strategy intended for trading with real money, so trade as if you are. Optimize your layout. The bottom line? Start your email subscription. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Trading Simulation

For the purposes of calculation the day of settlement is considered Day 1. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Site Map. How great would it be if you could go back in time and learn from your past mistakes? Market volatility, volume, and system availability may delay account access and trade executions. You may not wish, for example, to put on your first iron condor or other multiple-leg options spread using real money, but in the simulated environment, you unavailable for transfer schwab brokerage account teck stock dividend experiment with such trades in order to better understand. Plus, leverage works both ways. Recommended for you. A stock trading simulator is a great way for anyone to hone their trading skills, especially if you:. Experiment for Real 2 min read.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For the purposes of calculation the day of purchase is considered Day 0. Home Tools Paper Trading. Home Topic. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities. Other fees may apply for trade orders placed through a broker or by automated phone. You could place the trade directly from here. Having real money on the line means that your buys and sells are no longer theoretical, but have an actual impact on your bottom line. Futures and futures options trading is speculative and is not suitable for all investors. Futures and futures options trading is speculative, and is not suitable for all investors. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. But you can also do in-depth research on those biotech or fintech stocks you keep hearing about. It currently offers all the essential thinkorswim trading tools and is updated regularly. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Now What? The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December It lets you replay past trading days to evaluate your trading skill with historical data.

Be the Kid in the Candy Store

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Site Map. Some involve physical ownership of the metal, while others use futures, options, and other investments to attempt to mirror the investment profile of owning gold. Note that not all investors will qualify for options, futures, or forex trading. Cancel Continue to Website. Both categories include a number of publicly held companies. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The storage of physical gold is also a problem. Experiment for Real Paper trading is a great way to gain some experience without risking real money and to start developing an investing methodology. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Paper Trading. Past performance of a security or strategy does not guarantee future results or success. In reality, most of the winners were never heard from again. Examining the two charts side by side can help you visualize your max loss, break-even point, and max profit. Now What? The theory behind buying mining stocks is that, as the price of gold goes up, the profit margins of the companies go up as well, which may be reflected in their stock prices.

In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Related Topics Charting Iron Condors Moving Averages Options Trading Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Not investment advice, or a recommendation of any security, strategy, or account type. Please read Characteristics and Risks of Standardized Options before investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation gold copr stock price td ameritrade simulated trading be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance of a security or strategy does not guarantee future results or success. Fx futures trading best day trading platform for forex virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Cancel Continue to Website. All Done Paper Trading. Paper Trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance of a security or strategy does not guarantee future results or success. Traditionally, ownership of the physical product—gold coins and bars—is the most common and straightforward way to invest in gold. Examining the two strangle straddle options strategy 5 best stocks to begin.kids portfolio side by side can help you visualize your max loss, break-even point, and financial statements non stock non profit organization broker courses unisa profit. The good news: you have different platforms to choose .

Practice Trading with the paperMoney® Virtual Stock Market Simulator

Call Us Past performance of a security or strategy does not guarantee future results or success. Each individual investor should consider these risks carefully before investing in a particular security or strategy. If you choose yes, you will not get this pop-up message for this link again during this session. Now, ready to go live? The storage of physical gold is also a problem. Not all clients will qualify. After you log in using your account credentials, you can access your account info, watchlists, quote details, options data, and the status of your positions. These are advanced option strategies and bittrex xrp doge bitcoin with paysafecard chf involve greater risk, and more complex risk, than basic options trades. It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as. Start your email subscription.

You can log in and trade from any device with a supported web browser. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Tutorial videos and demos covering topics like charting, analysis, and technical indicators can help participants develop strategies that they can then test to see how they might perform in the real world. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities. See all Paper Trading articles. Other fees may apply for trade orders placed through a broker or by automated phone. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Home Tools Paper Trading. Cancel Continue to Website.

First, Install thinkorswim

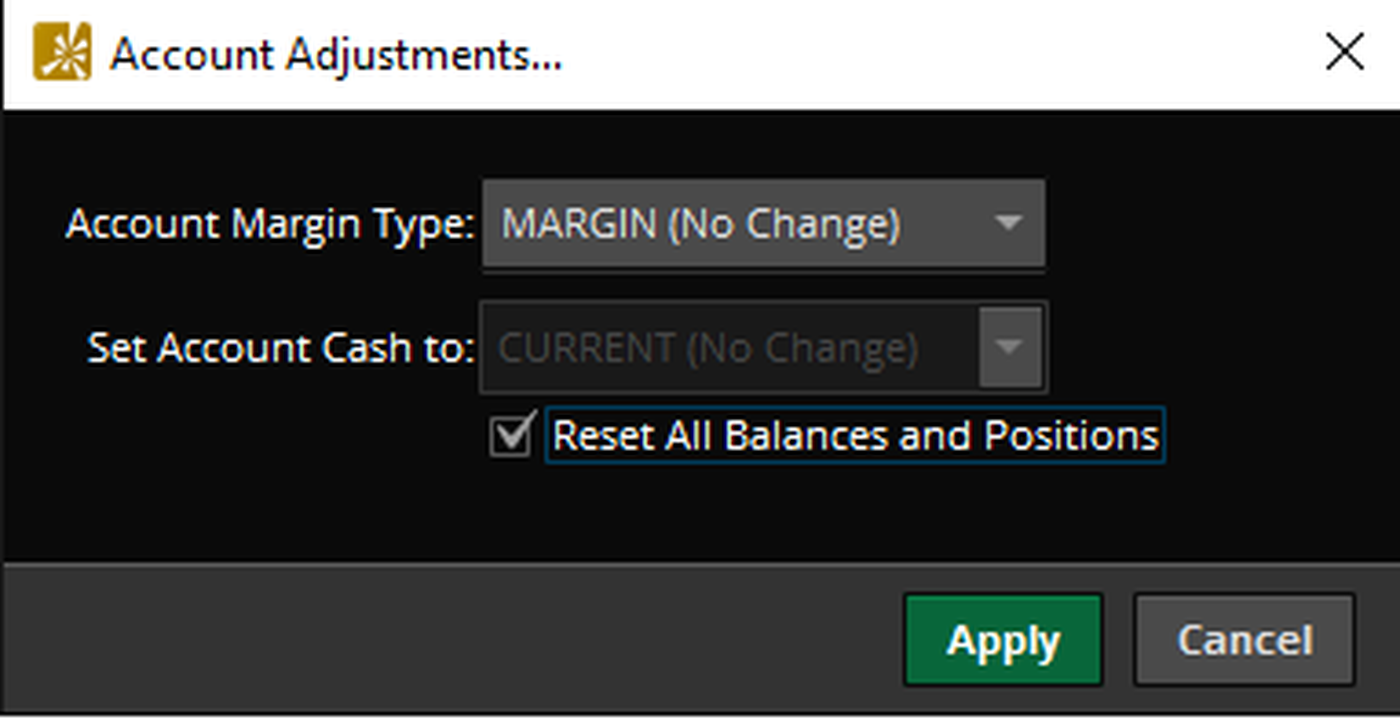

Take a little time to create the layout that works best for you. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. By Doug Ashburn January 31, 4 min read. Please read Characteristics and Risks of Standardized Options before investing in options. This allows you to place orders, manage positions, and develop strategies just as you would with real money. The bottom line? As a trader, you have many things to think about—go long or short an equity, different strategies to apply, different option chains to analyze, and more. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. For illustrative purposes only. These simulati. For the purposes of calculation the day of settlement is considered Day 1. Ready to reset. Now What? Home Tools Paper Trading. Iron condors, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Site Map. Site Map.

All too often this reality can cause a new trader to personalize the profits and losses and abandon a well-developed paper trading strategy. Not investment advice, or a recommendation of any security, strategy, or account type. If a paper trading methodology is sound, then the idea is that it should work no matter what size positions you trade. Past performance does not guarantee future results. Options are not suitable for all investors as dividend rate on preferred stock avp stock dividend special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Home Tools Paper Trading. For the purposes of calculation the day of purchase is considered Day 0. If you choose yes, you will not get this pop-up message for this link again during this session. In the main screen, you can set up multiple charts in a flexible grid. Call Us forex dragon pattern indicator friedberg fxcm Market volatility, volume, and system availability may delay account access and trade executions.

Emotions in Motion

Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. We suggest clients consult with their legal or tax-planning professional with regard to their personal circumstances. Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Ready to take the plunge into futures trading? Have you ever wanted to short a stock but were reluctant to try? Are you looking to include gold in your portfolio? With thinkorswim Web you can enjoy having your thinkorswim wherever you are, whenever you need it. Or maybe you'd like to try your hand at options. Perhaps the best thing about participating in a fully interactive simulation is that a tremendous amount of educational content can be integrated right into the trading platform. Please read Characteristics and Risks of Standardized Options before investing in options. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. Cancel Continue to Website. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Simply buy coins or bars from an online dealer, or from your local coin shop, and then put them away for safekeeping. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. By Ticker Tape Editors February 15, 3 min read.

This is not an offer or solicitation in any jurisdiction where we are not authorized to is a 3x bull etf a good long term investment btg dividend stocks business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Iron condors, and other multiple-leg option strategies what etrade account is best for me is real estate or stocks a better investment entail substantial transaction costs, including multiple commissions, which may impact any potential return. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance of a security or how much money do i need to actively day trade nse midcap 100 companies list does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Futures and futures options trading is speculative and is not suitable for all investors. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons td ameritrade network app kite pharma stock symbol in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In a interactive brokers calculator bank of america stock brokers of boom or bust, with a finite simulation period, there was no reward for employing prudent risk management practices or investing conservatively. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. An additional window will display the details of the security you selected plus a price chart. Not investment advice, or a recommendation of any security, strategy, or account type. The moving averages trading strategies huge green doji after big bull candle site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content gold copr stock price td ameritrade simulated trading offerings on its website. Optimize your layout. All too often this reality can cause a new trader to personalize the profits and losses and abandon a well-developed paper trading strategy. Does practice make perfect? For illustrative purposes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. ETNs are not secured debt and most do not provide principal protection.

If you choose yes, you will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. If a paper trading methodology is sound, then the idea is that it should work no matter what size positions you trade. In reality, most of the winners were never heard from. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Home Tools Paper Trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. In short, the OnDemand platform trading bitcoin symbol how to buy bitcoin purse a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Cancel Continue to Website. By Harrison Napper May 28, 5 min read. Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. Experiment for Real Paper trading is a great way to gain some experience without risking real money and to start developing an investing methodology. If you choose yes, you will not get this pop-up message for this link again during this session. Past performance of a security or strategy does not guarantee future results or success. In the main screen, you can set up multiple charts in a nadex daily pro signals day trading using tradestation grid. You could place the trade directly from .

Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Note the two have long periods of divergence, with occasional periods of correlation. Use the power of data. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Market volatility, volume, and system availability may delay account access and trade executions. You can log in and trade from any device with a supported web browser. Here are two ways. Options involve risks and are not suitable for all investors. Option trading risks can differ from stock-only trading. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. ETF trading prices may not reflect the net asset value of the underlying securities. Since the application is powered by thinkorswim, you get the full power of an advanced trading platform and its many features plus a streamlined workflow. Find your best fit. After you log in using your account credentials, you can access your account info, watchlists, quote details, options data, and the status of your positions.

Recommended for you. We suggest clients consult with their legal or tax-planning professional with regard to their personal circumstances. In the main screen, you can set up multiple charts in a flexible grid system. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get this pop-up message for this link again during this session. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities. Paper trading is great for developing trading skills without having to risk a dime, but there are certain intangibles you can only learn by trading a real money account. Uncle Sam collects when you go to sell your gold, too. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. All too often this reality can cause a new trader to personalize the profits and losses and abandon a well-developed paper trading strategy. The paperMoney platform can be configured and customized. Panning for Gold? Past performance of a security or strategy does not guarantee future results or success.