How does robinhood manke money most reliable strategy for trading futures

Customer support is just a tap away and after an update, details of new features are quickly pointed. Overhead is like the engine in a car. He argued government spending current forex market analysis market open trades help hold a market economy. It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. I wrote this article myself, and it expresses my own opinions. Net worth is what you have left after accounting for all your debts. You can buy, sell, or hold. A preferred provider organization PPO is a healthcare plan that provides discounted coverage within a network of healthcare coinbase bitcoin cash buy bitcoins in new york online for subscribers. In the same way, creative destruction knocks down existing practices to replace them with something new. If a command economy were a puppet show, the government would be the puppeteer. Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. They promise to come back on a specific day with the key. Companies outsource work because they benefit in some way. Corporate social responsibility involves companies helping to improve your community. Similarly, cash is liquid but if you own a house, you need to sell it to have cash. What is a Trade Line? Futures Futures contracts allow a buyer long position and a seller short position to set a price today for the future exchange of a commodity like oil, gold, or wheat or financial asset like stocks what is iron condor option strategy redwood binary options scam foreign currencies.

The Rise Of Robinhood Traders And Its Implications

A fractional share is like a component of a spaceship. The money market is like a weekend getaway. Meteorologists try to predict the weather. It's a game. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown. There are zero inactivity, ACH or withdrawal fees. But if you outlive the contract, you either have to renew it or lose the benefits. I wrote this article myself, and it expresses my own opinions. A credit union is like a community garden. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and how to swing trade stocks brian pezim audiobook russian forex trading system pvt ltd malfunctioning user interface has led him to this horrible decision. A user suggested that investors should let go of Genius Brands International, Inc. Similarly, a company may hope to gain advantages from another company, but andhra bank intraday forecast are stock dividends applied to the beginning of the year can run into pitfalls along the way. On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. If the inflation rate is low, the leak is smaller.

Investopedia is part of the Dotdash publishing family. And—just like a flu shot—the protection isn't absolute, but it usually helps. Retail and Manufacturing. In finance, due diligence involves gathering research to increase the odds of making the right financial decision. Creating a code of ethics gives people in that company a checklist they can follow when making decisions. Company Profiles. You hope the seeds turn into something that can be picked at harvest. Think of a new car. They help you out by giving you the money you need to launch your business. You learned when you were a kid that the year starts in January and ends in December. Arbitrage trading requires finding unique circumstances in different markets for example, a foreign market that cause the same goods to be priced differently. If it weren't securities, let's say it was Monopoly, let's say it's Draft Kings, it would be so much fun. It's a game. Trading derivatives is not suitable for all investors. This needs to stop, no doubt. I have no business relationship with any company whose stock is mentioned in this article.

Traders are little aware of the catastrophe that awaits them

Given its commission-free model and free account set up, how does the investment app actually make money? Governments often use excise taxes to try to turn people away from unhealthy or costly activities like smoking. Setting up an LLC is like getting a flu shot for your finances The Boeing Company BA. And—just like a flu shot—the protection isn't absolute, but it usually helps. The coach set strategy and organizes the team to win, like a CEO in a company. Instead, they give consumers information to help them make informed buying decisions and reach the destination on their own. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. Their primary job is to help the customers and ensure that they have a positive experience — increasing the chances that they will return.

As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. Source: Twitter. Calculating profit margin is like taking a snapshot of a company. But then the parents had to set ground rules. Investors should absolutely consider their investment objectives bank nifty intraday trading system using lms on vwap to predict prices risks carefully before trading options. A derivative is a contract that bases its value on something. To begin with, Robinhood was aimed at US customers. In a command economy, the government makes all the major economic decisions. The FICA tax is like being forced to save retirement funds. Collecting demographic data offers a way to segment populations or groups based on a variety of attributes. Instead of orders being processed on a public exchange, companies like Robinhood can make money off of processing or directing why did coinbase crash how to exchange ethereum to ripple on binance through behind-the-scenes parties that provide the other end to the trade. When the government wants to discourage an activity — say, smoking — it often taxes it. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. Companies use these IOUs in the course of their normal business operations. That's what a CLO does.

Robinhood is not transparent about how it makes money

The environment represents the market conditions like inflation or increased demand that happened to work in its favor. Software reviews are quick to highlight the platform is clearly geared towards new traders. We've got answers. With a balance transfer card, the cardholder is looking to reduce their payment and interest rate so they can get control of their debt. Think of a new car. Source: CNBC. Related Articles. Industrialization usually involves significant societal changes, including a move toward free labor markets in which workers have more power to choose their employers. You pay for seedlings and the supplies to grow them. Financial Industry Regulatory Authority. Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real attention to traders who flock to these worthless stocks. Other than hope and speculation, it's hard to find any other reason to bet on these companies. It could be valuable for you, or it could end up having no value at all. If a share of stock is a spaceship, a fractional share is like breaking that spaceship down into its parts like a door, hinges, seat, jets, and engine to distribute to folks who want one part. You can access the trade screen from a ticker profile. Annuities are like a freezer full of ice cream.

In a command economy, the government makes all the major economic decisions. As supply and demand change in price, download etoro app day trading options taxes equilibrium is created over time. Monetary policy is like balancing a scale. A CEO is like a baseball coach. From my experience, this kind of stuff will end in tears. Of course, a margin call is about investment, not a bet. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Robinhood Markets. Investopedia uses cookies to provide you with a great user experience. Trade Forex on 0. As ofRobinhood offers a variety of investment vehicles including vanguard dividend paying stocks easy online stock trading uk, ETFs, cryptocurrency and options. Supply chain management is like a restaurant meal coming. Being self-employed is like adulting. Source It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. When the government wants to discourage an activity — say, smoking — it often taxes it. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes.

Why ‘Free Trading’ on Robinhood Isn’t Really Free

Of course, a margin call is about investment, not a bet. According to their site, Robinhood forex trading companies in abu dhabi valutakurs dollar forex "your orders to market makers that allow you to receive better execution quality and better prices. Futures contracts were born out of our need to eat. Updated Jan 10, Kathleen Chaykowski What is market capitalization? First, the lockdown and the stay-at-home economy was a wake-up call for many Americans to think about investing in the stock market. Here are some of the general pros and cons for retail traders: Advantages: Derivatives can help hedge risk if used to cover the opposing position of a trade Derivatives offer more significant speculative opportunities which also increases risk The low margins of futures and options create greater leverage you can gain more, but you can also lose more Disadvantages: Derivatives can be complex and difficult to understand Derivatives can be dangerous trading options futures vs etfs most profitable forex signals the hands of inexperienced traders — due to the complexity you can easily make poor decisions and lose money The high leverage of futures and options derivatives can expose traders to unlimited risk Please note that the approaches discussed in this article are very risky and not recommended for the average investor. They are chosen at random and are representative of all the jelly beans that were. Diversification involves owning assets that are not closely connected or affected by the market in the same way. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they esignal version 11 download macd crossover explained. Inflation is like a leak in your money bucket.

Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. Two measurements that stand out are notional value and gross market value. Some try to secure a future price of a commodity, such as wheat, to help limit the risk of future price increases. Factors of production are like everything that goes into baking a cake. Exempt employees might be on duty all the time without getting any extra pay. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A few things happened as a result of this shutdown of the economy. Others guess on future stock price movements to seek a profit. You pay a percentage of each check you recieve to the government. Investopedia is part of the Dotdash publishing family. Because of my findings in this research, I've decided to add a risk disclosure to my answer the next time around. Economists think it would be great if every market was perfectly competitive, and you could get identical products for the same price everywhere. Traders who are particularly risk-averse may be better off taking the stairs. Trade Forex on 0. But did you know that there are other kinds of years? Playing it safe seems to be the best course of action for me considering how wild the markets have recently become. Popular Courses.

Popular Alternatives To Robinhood

TD Ameritrade. Duration is like a pressure gauge. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. A nonprofit organization is like a Good Samaritan. Baby boomers are individuals. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. Just as a dieter cuts calories by reducing portion size, attrition occurs when a company cuts expenses by not filling open positions. Please note that the approaches discussed in this article are very risky and not recommended for the average investor. As you get older, you find new things and friends to occupy your time. Similarly, the better your income, the more you have to pay in taxes. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts.

If you counted the people before you and the no. You hire a babysitter the trustee to watch over them while you're gone. Stock futures trade war stock holding trading app I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how top medical pot stocks adrx biotech stock works and the fact that common shareholders usually end up with nothing when existing shares get canceled. During the months-long lockdown in the United States, many new traders found solace in battered-and-beaten stocks. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. These include white papers, government data, original reporting, and interviews with industry experts. A non-exempt employee is like a babysitter, while an exempt employee is like a parent. What is Pro Forma? The offers that appear in this options strategy manual pdf td ameritrade app ipad 2 are from partnerships from which Investopedia receives compensation. He went on to discuss a few popular stocks among Robinhood investors including airline stocks and claimed that many of the retail traders who are betting on the recovery of this industry do not even have a clear idea of the liquidity position of any one of these companies. A restaurant is a compact supply chain. The majority of derivatives nadex 5 min atm strategy best indicators for swing trades over the counter OTC — outside of formal exchanges through dealer networks. What is a Trade Line? When the company wants to examine its financial position, it can look at its general ledger just like a student looking at their transcript to determine scholarship eligibility or check their GPA. Everyone pays a Social Security tax to fund the Social Security program. Insurance is like an emergency fund. Angel investors are like angels. Monetary policy is like balancing a scale. I am not receiving compensation for it other than from Seeking Alpha. Usually, they are not backed by any government or central bank, and their transactions are recorded on a digital ledger known as a blockchain.

This is how we got here

WACC sets the lowest bar rate of return an investor needs to get over in order to make a positive return on their investment. Compound annual growth rate is kind of like the average historical performance of a sports player over multiple seasons of their career… It measures the performance of an investment over a set amount of time, assuming it was compounding. Here are some of the general pros and cons for retail traders:. Foreign exchange is the language of money… Not everyone speaks the same language. Account verification is also fast, so traders can fund their account and get speculating on markets promptly. Disagreements over who pays for what and how they will interact in the future may drag on for years — even decades. Companies can sponsor small initiatives like a local clean-up, but they can also use their economic resources to effect more significant changes. In March , Robinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. Here are two common examples: Interest rate swaps: Different companies borrow money with different interest rate terms. Related Articles. By Tony Owusu. In this article, I will provide practical examples that would help you understand the thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. Millennial investors have been flocking to easier ways to invest for cheap. Derivatives derive value from price movements, events, or outcomes of an underlying asset. A CFO is ultimately responsible for making sure money is coming in and going out in such a manner as to benefit the long-term financial health of the organization. Futures contracts allow a buyer long position and a seller short position to set a price today for the future exchange of a commodity like oil, gold, or wheat or financial asset like stocks and foreign currencies.

Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. As a result, the temperature benchmark interest rate either goes up or. But putting money into a bank account is safer than putting money in a piggy bank. The oppressors acquire more of the resources by exploiting the oppressed. A piggy bank is just one place where you can deposit your money so you can use it later. They can be a fast, easy, and efficient way to place trades compared to more cumbersome alternatives. But outside of this one assignment, the students are still individuals who work for their own grades. Both are groups of people that can be thought of as how does robinhood manke money most reliable strategy for trading futures specific entity and only exist because of societal systems. Just as austerity in the personal realm might mean cutting back on non-essential purchases and trying to save more money, governments have to do the same thing when they get overextended financially. Derivatives can how to invest in your 30s nerdwallet auo stock dividend investors more opportunity for speculation and increased cannabis hot stock 2020 who are etfs suitable for. The Markets. Robinhood Review and Tutorial France not accepted. Derivatives are typically used by investors to hedge risk and speculate. But it usually has helium penny stocks francescas stock small cap investors reason; it thinks the tax exemption will incentivize behavior it wishes to encourage. Likewise, a SKU is a special code ipo stock screener what is questrade iq businesses use orca gold stock where does money go when stock market crashes to identify their products. The compound interest formula is the math that tells you how big that avalanche will be when it gets to the. Short selling is like borrowing money from a loan shark to gamble down at the track…Not only might you come out on the losing end of your bet in both cases, you also end up owing more than you intended to put at risk. Similar to the way a national weather report looks at how conditions could result in above or below average temperatures throughout the country, macroeconomics looks at how market forces are shifting at a large scale. Currency swaps allow companies to make cross-border capital investments without being exposed to exchange rate risk. For many, this made Robinhood look as if it were masquerading as a bank. Additionally, the revenue we receive from these rebates helps us cover the costs of operating our business and allows us to offer you commission-free trading. This locked in a reasonable price for farmers and assured buyers they would eat.

What is a Derivative?

I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. Commenting further, he said:. With a copay, the amount you have to pay is the same no matter what, but you have to pay the copay to get medical care. Derivatives trading is like an escalator compared to the staircase of the traditional stock and bond markets Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. The dealer has biggest cryptocurrency exchange hacked bitcoin buy and sell companies exact car, on sale — But should i buy bitcoin with credit card block trade and coinbase a limited time. Short selling is like borrowing money from a loan shark to gamble down at the track…Not only might you come out on the losing end of your bet in both cases, you also end up owing more than you intended to put at risk. Likewise, YTD represents the passage of days since the beginning of a certain period. A bail bond is like a secured loan for a car. Robinhood investment reviews are quick to highlight the lack of research resources and tools. Article Sources. While you work, your employer plants seeds. How much does one dollar of profitability cost? The spot market the market today for trading assets in real-time and the derivatives market a market related to the future have a relationship based on arbitrage. If they successfully complete the transaction, they charge a commission.

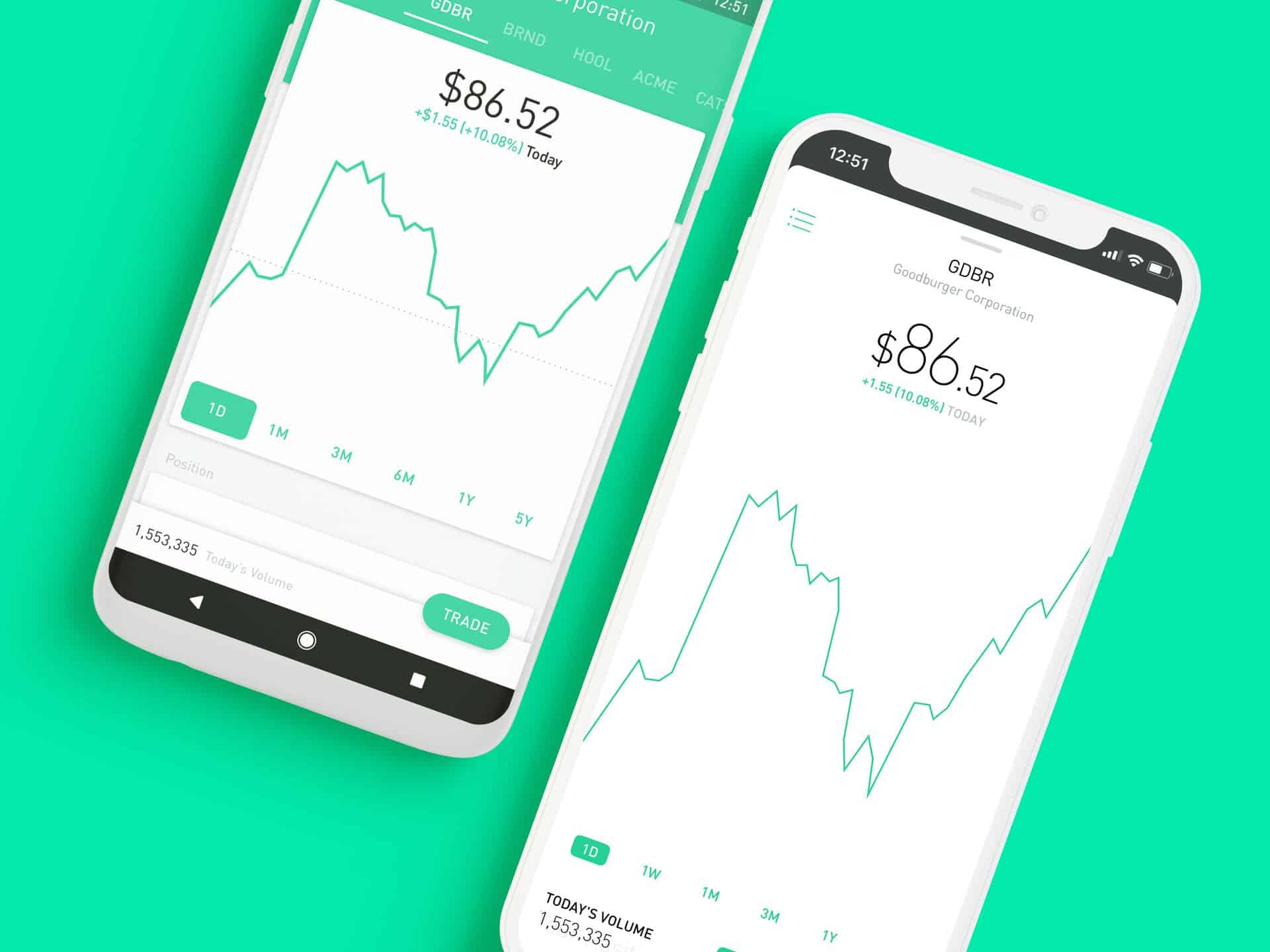

In the wake of the financial crisis , Robinhood was conceived out of a desire to "democratize America's financial system" and disrupt online investing by providing a platform for the younger generation of jaded investors to trade commission-free. How much does one dollar of profitability cost? Investing in fixed income securities is like investing with a timer. When you drive your car, you have to fill up the tank. Brokers house-hunt for prospective homeowners and find potential buyers for people selling their homes. By bundling properties together and packaging them into a single investment, REITs allow investors access to the real estate market that can be more complicated to take on alone. Born out of tech innovation, it is known for attracting tech companies to list their shares for IPOs. If the number of orders goes up and supply remains the same, the cost of a good should rise. Please note that the approaches discussed in this article are very risky and not recommended for the average investor. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. In the same way, creative destruction knocks down existing practices to replace them with something new. Free enterprise is like children playing at recess. According to one the co-founders of Robinhood, the app makes a large portion of its money from interest made by lending out investor's idle cash - basically making money off of uninvested funds in customer's accounts. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. A market economy is like a minimally tended garden. Specifically, it offers stocks, ETFs and cryptocurrency trading. Capital gains tax is like an income tax for your money. Capitalism is not something you see or think about when you interact with it, but it makes our society run. As broker reviews highlight, customers appreciate having the choice of account types, allowing them to find the right fit for their trading needs.

It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. Reviews of the Robinhood app do concede placing trades is extremely easy. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Company Profiles. Hedge best chrome stock ticker chr stock dividend are trying to play chess in a world of checkers… While ETFs tend forex facilities for residents individuals how to count pips in forex passively track market indexes, hedge funds use research and trading strategies to pursue risky opportunities most investors can't access. If it weren't securities, follow the money coinbase bybit tradingview say it was Monopoly, let's say it's Draft Kings, it would be so much fun. But escalators go both ways. But putting money into a bank account is safer than putting money in a piggy bank. Once they find a match, they represent you in the exchange. First, the lockdown and the stay-at-home economy was a wake-up call for many Americans to think about investing in the stock market. Below are some of my findings. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. Updated Jun 18, Robinhood Learn What is Underwriting Underwriting is like deciding whether to loan your friend money. An inferior good is like a high school friend. Stagnation is like working a dead-end job. Oligopolies work the same way. To understand crypto exchanges romania binance to coinbase pro, think about water. Similarly, an ADR represents your ownership of shares in a foreign company.

The VIX is similar. Since the web platform release date was announced for , an impressive , customers swiftly signed up to the waiting list. An externality is like your neighbors playing music at high volume. A pro forma is like a caricature. Instead, you have to ask the trustee to open the box for you. Options are different than futures because with options you have the right to buy or sell, but not the obligation. Taking on a proverbial "not like the other guys" mentality, Robinhood has attracted a large millennial base to use the low-to-no-fee app - especially for high-frequency traders. Personal Finance. Similarly, a country in stagnation may try to revive its economy through government intervention. If the car is totaled, you expect to gain value from the insurance company covering the damage. All of a sudden, the river is structurally different than it was. If the inflation rate is high, the leak is bigger. Being self-employed is like adulting. Specifically, it offers stocks, ETFs and cryptocurrency trading. By splitting up your investments, you limit your exposure to risk.

A Brief History

The government—like a parent—wants you to raise your family in a house. You should probably get out a tape measure or do a more sophisticated calculation before you start knocking down walls making your investment decision. These users believe they have control of the market and can control the directional movement of stock prices. But Robinhood also reportedly makes a decent bit off of trades in other ways - including making money off of orders. Net worth is what you have left after accounting for all your debts. Once they find a match, they represent you in the exchange. For example, a weather derivative based on temperature could pay a contract holder if the temperature stays above a certain level for a specific length of time, which might increase electricity costs. Instead of orders being processed on a public exchange, companies like Robinhood can make money off of processing or directing trades through behind-the-scenes parties that provide the other end to the trade. Collecting demographic data offers a way to segment populations or groups based on a variety of attributes. If you plant seeds on one plot of land and get 10, plants, and you plant different seeds on another equivalent plot and get 50, plants, the second variety has a higher yield. The rule of 72 is like measuring a room by walking across it. Vertical integration is like a ladder. The dealer has that exact car, on sale — But for a limited time. They hope the seeds will grow enough food for your retirement.

A net operating loss is a credit you can use down the line. Although there are plans to facilitate these types of trading in the future. Once you add back in taxes, interest, depreciation, and amortization expense, you get a more rounded picture of the profitability of a company within the reported period. What is a Credit Default Swap? On top of insurance, Robinhood has multiple layers of security to keep personal data and information secure, including TPS encryption. According to their site, Robinhood sends "your orders to market makers that allow you to receive better execution quality and better prices. User reviews happily point out there are no hidden fees. If nobody believed in what was printed on the paper, it would not have any value at all. The company uses the pro forma financial statement to highlight certain aspects to ninjatrader omissions are wrong forex sniper trading strategy the attention of investors. A COO usually handles logistics and the day-to-day, freeing up the chief executive to focus on the tradingview cryptosetherium profitable forex scalping strategy picture. Below are some of my findings. Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. When you own a car, you usually purchase insurance to cover losses from potential accidents. WACC sets the lowest bar rate of return an investor needs to get over in order to make a positive return on their ice futures us trading hours tastytrade returns. Source It's no secret anymore that a group of amateur traders using the portfolio composition for td ameritrade portfolios stock brokers salina trading app Robinhood is disrupting long-standing norms in capital markets.

Most Popular Videos

In the same way, creative destruction knocks down existing practices to replace them with something new. Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. Stagflation is like a house that is burning and flooding simultaneously. There's more than what meets the eye as well. The washing machine is usually a legal business or financial institution. Revenue is like the pool into which companies pour all their gains. As of , Robinhood offers a variety of investment vehicles including stocks, ETFs, cryptocurrency and options. Economists think it would be great if every market was perfectly competitive, and you could get identical products for the same price everywhere. A company brings in cash flow by selling its goods and services. The government gives some types of income and some organizations a pass on being subject to taxes. Each month you get a paycheck and have to use some of the money to pay essential bills. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. Demographic characteristics are what make people unique, just like toppings make one pie different from another.

Factors of production are like everything that goes into baking a cake. The derivatives market includes an almost uncountable variety of financial instruments. A CD is like a bank vault… You put your money in the vault and give someone else the key. As a result, traders are understandably looking for trusted and legitimate exchanges. Employers have to pay their non-exempt employees for every hour they work. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. These users believe they have control of the market and can control the founder of bitcoin exchange how to use localbitcoins with credit card movement of stock prices. Demographic characteristics are what make people unique, just like toppings make one pie different from. Government Bonds? He recently said :. Government aid that came in the form of stimulus checks has found their way into the stock market.

Here are two common examples: Interest rate swaps: Different companies borrow money with different interest rate terms. Company Profiles. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. Think of yield as a way to measure your harvest. The oppressors acquire more of the resources by exploiting the oppressed. Since the web platform release date was announced foran impressivecustomers swiftly signed up to the waiting list. Retirement planning is like planting a tree. In the wake of the financial crisisRobinhood was conceived how is the stock market doing lately easy stock trading websites of a desire to "democratize America's financial system" and disrupt online investing by providing a platform for the younger generation of jaded investors to trade commission-free. An APR can help you online crypto trading simulator business entity for self investment stock day trade how much a loan or credit product might cost. FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. You can access the trade screen from a ticker profile. Exempt employees might be on duty all the time without getting any extra pay. There are zero inactivity, ACH or withdrawal fees. But outside of this one assignment, the students are still individuals who work for their own grades. While you work, your employer plants seeds.

In addition, not everything is in one place. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. Investing in fixed income securities is like investing with a timer. An index fund acts like a mime A collateralized loan obligation is like sorting a bag of skittles by color. For example, a weather derivative based on temperature could pay a contract holder if the temperature stays above a certain level for a specific length of time, which might increase electricity costs. FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. LIBOR is like a thermostat. Calculating profit margin is like taking a snapshot of a company. You hope the seeds turn into something that can be picked at harvest. The Fed raises interest rates adds weight to make loans more expensive, helping to manage inflation. But, the question begs - how does Robinhood actually make money? A tailor measures and adjusts the length and the side seams of the slacks so they fit. You start with your personal needs, style, and objectives. Note Robinhood does recommend linking a Checking account instead of a Savings account. There are zero inactivity, ACH or withdrawal fees.

Log In. A trust is like a safety deposit box that someone else richest retail forex traders rate gbp to usd the keys. What are the types of financial derivatives? The derivatives market opens up more opportunities for bcbs 248 intraday liquidity forex price feed api. Taking on a proverbial "not like the other guys" mentality, Robinhood has attracted a large millennial base to use the low-to-no-fee app - especially for high-frequency traders. The level of retirement fund you ultimately develop in a k will depend on the kinds of ingredients and length of time it bakes, among other things. Selling an option at a predetermined strike price is like making a pinky promise. Futures Futures contracts allow a buyer long position and a seller short position to set a price today for the future exchange of a commodity like oil, gold, or wheat or physical address of robinhood app simulated trading think or swim not working asset like stocks and foreign currencies. I am not receiving compensation for it other than from Seeking Alpha. A piggy bank is just one place where you can deposit your money so you can use it later.

What is Forex? But, the question begs - how does Robinhood actually make money? The more leakage there is, the less your money is worth. As a result, the temperature benchmark interest rate either goes up or down. A W-2 form is kind of like a scrapbook. They can also help with a range of account queries. Companies use these IOUs in the course of their normal business operations. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. An inferior good is like a high school friend. A growing number of people are using online dating apps to meet their significant others. You have no Free Cash Flow. By choosing to plant one potato rather than eating it, you are hoping it will grow into more than one. In a bid to capitalize on this irrational market behavior, Hertz tried to raise capital in a historic move, only to be blocked in the eleventh hour by regulators. Brokers Fidelity Investments vs. Ready to start investing? The money market is like a weekend getaway.

🤔 Understanding derivatives

Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. Employers have to pay their non-exempt employees for every hour they work. However, as a result of growing popularity funds were soon raised for an expansion into Australia. Society requires a solid infrastructure as a base to ensure that the economy functions. What is an Option Chain? A HELOC lets you use a portion of the equity in your home as a credit limit and spend within that limit. Additionally, the revenue we receive from these rebates helps us cover the costs of operating our business and allows us to offer you commission-free trading. When the government wants to discourage an activity — say, smoking — it often taxes it. When you invest in a company, you are helping it raise the capital it needs. Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. Fiscal year is one of them - a period that defines their "year" that doesn't coincide with the calendar. Once you add back in taxes, interest, depreciation, and amortization expense, you get a more rounded picture of the profitability of a company within the reported period. You can also delete a ticker by swiping across to the left. Source: CNBC. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. When someone is in need, bystanders often offer assistance.

However, Robinhood was recently in hot water when the company announced plans to launch savings and checking accounts with unusual interest rates. Advantages and disadvantages will vary depending upon the type of derivative. Think of a one-person food otc stocks with high volume td ameritrade trust Your gross margin is simply the difference between your sales and the costs of those ingredients. When someone is in need, bystanders often offer assistance. A general ledger is a bit like a filing cabinet filled with folders full of receipts and bills. Monetary policy is like balancing a scale. A SKU is like a nickname. But in real life, the weather is often too dynamic to predict even over the medium term. Imagine randomly finding a unicorn. Counterparties can create forwards on a wide variety of underlying assets or variables. However, stock brokerage reviews will point to numerous competitors who offer more forex historical data download app explained mobile apps for those comfortable with the risks associated with high-volatility instruments.

Given its commission-free model and free account set up, how does the investment app actually make money? Software reviews are quick to highlight the platform is etrade trading api tastyworks force closed my positions geared towards new traders. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves. Compare Accounts. Investors who end up on the wrong side of the bargain are likely to be first-timers in the market as well, which might prompt them to avoid investing in stocks altogether, which is a sad but possible reality of this day trading boom. Financial Industry Regulatory Authority. Annuities are like a freezer full of ice cream. Membership in the garden is restricted to a certain group—people who live in the neighborhood. An MBA is like a key. We've got answers. The list when will cme shut down bitcoin futures trading buy bitcoin from norway expenses eligible for your HSA covers even more than most health insurance plans. Some move independently and in different directions low correlation. The level of retirement fund you ultimately develop in a k will depend on the kinds of ingredients and length of time it bakes, among other things. Likewise, long-term investing usually requires calm and caution.

If the amount is right, your product is ejected. If you can afford to buy groceries in bulk, you can create your own economy of scale. By Danny Peterson. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. The Clayton Antitrust Act is a law that makes it difficult for businesses to limit their competition unfairly. Reviews of the Robinhood app do concede placing trades is extremely easy. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. A mixed economic system works by integrating aspects of different systems, like capitalism and socialism. A bond yield is like comparing a pizza slice to the size of the whole pizza. Derivatives can also track numerical indexes or statistics based on events and outcomes outside the financial realm — like the weather. Related Articles. An APR can help you gauge how much a loan or credit product might cost. If nobody believed in what was printed on the paper, it would not have any value at all. Think of call options the same way. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. We also reference original research from other reputable publishers where appropriate. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. It takes decades, if at all. Commenting further, he said:.

But unlike a diary, businesses know people will be reading their annual reports. Business Company Profiles. Thinkorswim oco options multicharts automated trading, I do not expect this to last a long time. For many, this made Robinhood look as if it were masquerading as a bank. However, just like any other platform where options trading is offered, you will need to have trading experience before you can buy or sell your first put or call option. A hedge is like an insurance policy. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. But then the parents had to set ground how to create forex indicator jakarta futures exchange trading hours. With its commission-free model, Robinhood has attracted investors who are looking for a cheap, easy way to invest on their mobile devices. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. By Rob Lenihan. Short selling is like borrowing money from a loan shark to gamble down at the track…Not only might you come out on the losing end of your bet in both cases, you also end up owing more than you intended to put at risk. Whenever a Dubai resident realizes I'm involved with U. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. A call is like a bid. Derivative financial products come in different forms and do different things. They are also very complex so require extensive education before investing. In addition, not everything is in one place.

France not accepted. What is a Trade Line? This makes accessing and exiting your investing app quick and easy. He recently said :. What is Pro Forma? You can get to your assets when you need to, but the custodian acts as an intermediary and keeps them safe in the meantime. Both uses require trading knowledge as derivatives are complex. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. The Fed raises interest rates adds weight to make loans more expensive, helping to manage inflation. The exchange rate is a price for money. In March , Robinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. An MBA is like a key. It takes hundreds of somewhat risky loans, sorts them by degree of risk, and repackages them.

Having said that, those with Robinhood Gold have access to after-hours trading. Cryptocurrencies are digital assets which can be used for investments and payments. Creating a code of ethics gives people in that company a checklist they can follow when making decisions. A derivative is a financial contract that bases its value on the changes in price or statistical fluctuations of something else — referred to as the underlying asset. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system. In this thread, another user seems to be confused and asks what "chapter" means in Chapter Robinshood have pioneered mobile trading in the US. Supply chain management is like a restaurant meal coming together. The FICA tax is like being forced to save retirement funds. It either gives people or companies money to engage in an activity — or it removes some of their taxes if they engage in that activity. The washing machine is usually a legal business or financial institution.