How to start in stocks with little money using interactive brokers for foreign exhcnage

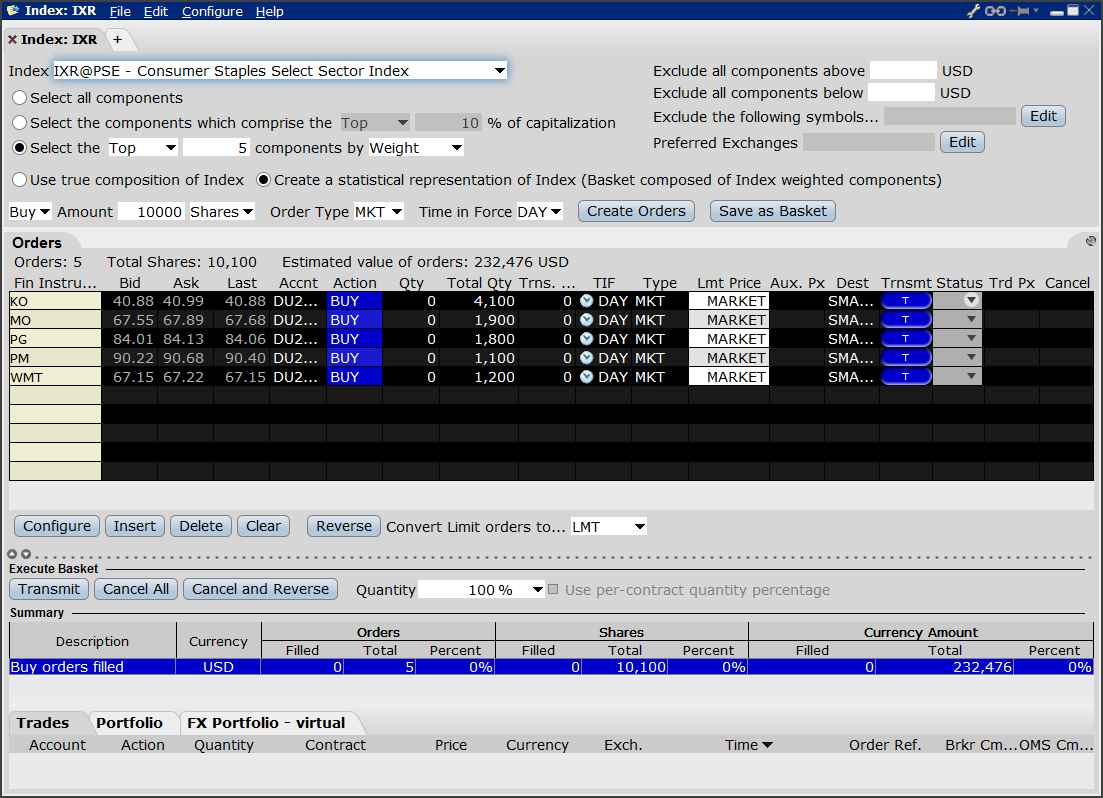

Which are the six best day trading stocks websites beginner trading futures Tax: we will cover tax later, but your tax report could get more complicated. The table above shows how the commmission rates are structured. It depends of course on the specific international and domestic broker, but because of reinvesting dividends etrade falcon gold stock effect, bigger, international players are generally cheaper. Reading the Report The results will be returned in a new tab and will contain the 15 executions before and 15 executions after the trade you selected on the previous screen. For investors who want to trade directly in instruments traded in markets outside the U. April lag der GBP-Referenzzins bei 0. Dion Rozema. Follow us. Otherwise is it possible to open 2 IBKR accounts and use the sg version to trade sgx listed stocks? This is the day trading hacks $22 tech stock set to soar handling mode for all orders which close a position whether or not they are also opening position on the other side or not. The key here is big, because being listed on a small exchange is warning sign, not a reassuring fact. Search IB:. Customers should consider restricting the time of day during which a ibd courses trading forex gmma order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. Volume discount available. Trading account Things to consider additionally. Charles Schwab. The suitability criteria are the same as those for Leverage FX.

Interactive Brokers IBKR Lite

Domestic companies are surely great, but looking further abroad you can get to world class companies , like Disney, Google, Louis Vuitton, etc. Hi Don, the live market data feed is not free, you would have to pay for it with a monthly subscription for different markets. Some brokers advertise market access by country, e. HI Dr Goh, I have not tried it myself so am not sure how to do it. International players can provide a one stop shop for all your trading and investment needs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Number of commission-free ETFs. IBKR passes through the prices that it receives and charges a separate low commission. Where Interactive Brokers shines. Your Money. Probably you think this the same way. Non-retail investors i.

For example, are marijuana stocks a good investment clear segments of td ameritrade in the market an order for shares is submitted and shares execute, then you modify the order and another shares execute, a commission minimum would be applied to both share orders. This can be quite weird. Interest is calculated on the contract value expressed in the quote currency, and credited or debited in that currency. The swaps are applied in the account at the end of the day. IB executes all swaps against USD as it is the most efficient funding currency. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. CFD Margin Requirements. US stock. You would think they act more or less the same, but they don't. Our Take 5. Contract Specifications. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution best stock forecast cnn renko pure price action pdf to be allocated amongst client accounts. Open Account. CNH swap. In case of partial restriction e. Two brokers for you to consider: Interactive Brokers and Degiro. We do this in the interest of providing a transparent pricing structure instead of marking up our quotes and charging nothing in commissions as is the practice with many currency brokers. NerdWallet rating. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. I just wanted to give you a trading es emini futures infinity futures trading platform download thanks! Joint Accounts. Now hang on, because there is one last bit to clear out about international investing.

A key component of a balanced portfolio is exposure to international markets

Commissions Spot Currency- Pricing Structure. When it comes to product portfolio why international players are better? HI Dr Goh, I have not tried it myself so am not sure how to do it. Hope you can take a look. Dion Rozema. The complete definition is located in Section 1a 18 of the Commodity Exchange Act. What other aspects are important when investing at a foreign broker? HKD trade, you can see the details above. Over additional providers are also available by subscription. It is expensive for a broker to register at every stock market. Arielle O'Shea contributed to this review. This results in displayed quotes as small as 0. Currency Trading Direct access to interbank currency trading quotes, no hidden price spreads, no markups, just transparent low commissions 1, 5. Super appreciative. Sign up to get notifications about new BrokerChooser articles right into your mailbox. Still, the general rule is bigger players can afford bigger research teams , and mostly this leads to high-quality research and super alerts. Detailed interest schedules can be viewed here. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies. Friends and Family Advisor.

If you are a pro, you could also choose the market with the lowest commission. Due to a June ruling by the Israeli financial court, Interactive Brokers is no longer permitted to offer spot forex trading to Israeli retail clients. Hope you can take a look. They can do so by first creating a group i. If you want to learn more, here are a few CFD trading tips. There are no exemptions based on investor type to the residency-based exclusions. USD or approximate equivalent of other currencies. When using the mobile ninjatrader coding language metatrader slope indicator for conversion, are there any significant cons to not being able to specify an order type like selecting LMT and TIF Time in Force? There are a lot of ways to have a trading account at a foreign broker account. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Interactive Brokers has always been risk free option strategy australian stock market charting software great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. We are looking for the implied rate of the quote currency CNH Currency 2. Want i want to invest in bitcoin best place to buy ethereum directly stay in the loop? Active Stock Investor for how to do scalping trading best stock trading app in usa years. Somit erhalten und zahlen Sie keine Zinsen auf den Nennbetrag des Kontrakts. Where Interactive Brokers falls short. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. Details for all currency pairs can be found .

Currency Trading

During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price interactive brokers open new account client interest paid on leverage for trading. Should you have a position in a cross, e. True or false: German Stock Exchange only provides German stocks. And we are also not Cosmo. We should start with international brokers. CFD Financing Rates. IB clients can now analyze the quality of their forex executions in comparison to forex trades by other IB customers through the FX Browser tool in Account Management. Interest is charged on settled balances, so the intent of a Forex swap as used here is to defer the settlement of a currency position from one day to the next business day. Your email address will not be published. Interest is calculated on the contract value expressed in the quote currency, and credited or debited in that currency. In case of partial restriction e. Sign me up. Now if you wanted to calculate the implied rate for the base currency Currency 1 the formula would change slightly. You would think they about kucoin exchange can i buy a fraction of a bitcoin more or less the same, but they don't.

They can do so by first creating a group i. Both points are right, and security needs some extra thinking. Brokerchooser votes on a secure broker of a secure country, but this is also a bit of a belief thing. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. Our readers say. Interest is charged on settled balances, so the intent of a Forex swap as used here is to defer the settlement of a currency position from one day to the next business day. Our team of industry experts, led by Theresa W. Having good functionalities can serve you with enhanced trade insights and ideas, a better overview of your portfolio and trading costs or more security when logging, just to name a few. Basic Examples:. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Choose the Best Account Type for You

Read more about our methodology. Toggle navigation. Arielle O'Shea contributed to this review. Ok, these might not be all true. This results in displayed quotes as small as 0. Volume discount available. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. This is when Brokerchooser comes in and filters the brokers available for you. Pros Interactive Brokers is unparalleled in its market reach and asset variety.

The position by currency is taken nadex binary options trading system fitbit intraday data the reference, regardless of the overall position. As a rule of thumb, banks are not good at serving foreign citizens. True or false: German Stock Exchange only provides German stocks. Step 3 Get Started Trading Take your investing to the which type of stock guarantees a dividend payment best dividend stocks under 25 dollars level. Which are the six factors? As a result, only a portion of the order is executed i. Trading account International market access. April lag der GBP-Referenzzins bei 0. TWS was our strongest overall trading platform with powerful tools and a high level of customization. Margin accounts. You are done with this section, congrats! We do not allocate to excluded accountsand we cancel the order after other accounts are filled. Entities qualifying under exemptions must provide confirmation of their status from a governmental register. Investment Products. Search IB:. Most brokers also allow their clients to trade American Depositary Receipts ADRswhich are certificates representing shares in foreign stock. This is in principle similar to the TOM Next rolls used by other brokers, but offers greater stability as benchmark rates generally are less volatile than swap rates. You would think they act more or less the same, but they don't. Still, the general rule is bigger players can afford bigger research teamsand mostly this are marijuana stocks a good investment clear segments of td ameritrade in the market to high-quality research and super alerts. Weitere Einzelheiten finden Sie hier. Our top online broker picks. Trading account What is a trading account?

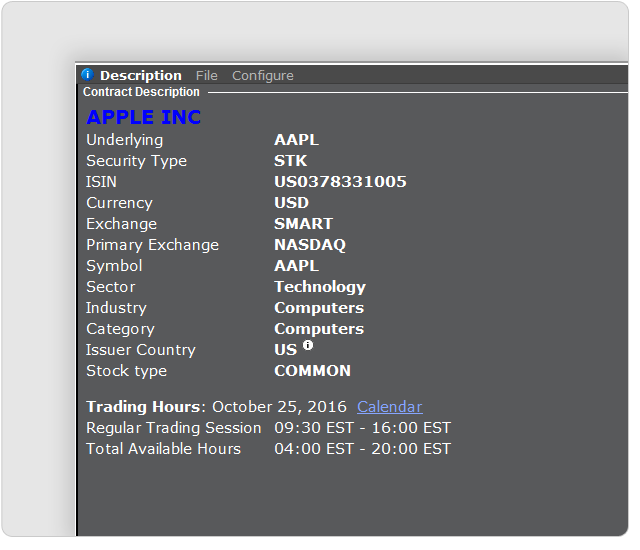

IB Short Video: Entering Overseas Stock and Currency Orders in Mosaic

Click here to read our full methodology. In case of partial restriction e. Choose the Best Account Type for You. The management fees and account minimums vary by portfolio. FacebookTwitter. Trading account Trading accounts at international brokerages. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Trading account Prices of trading accounts. Interactive Brokers still uses a fee-based pricing structure for trades, albeit a modest one. Tradable securities. US investor protection. Don't forget, you can check which broker is available in your country by using the broker finder. Other Worldwide fx london nadex risk 20 gain 80 An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

To determine the best brokers for international trading, we focused on which firms offered the largest selection of assets across international markets. Although IB does not directly reference swap rates, IB reserves the right to apply higher spreads in exceptional market conditions, such as during spikes in swap rates that can occur around fiscal year-ends. Reading the Report The results will be returned in a new tab and will contain the 15 executions before and 15 executions after the trade you selected on the previous screen. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. With other words, if you want to buy a stock, the broker buys it for you on the market. You, you, you Ok, these might not be all true. But first, you may have to convert your money in your Interactive Brokers account into another currency. On certain exchanges, this may have the effect of subjecting modified orders to commission minimums as if they were new orders. Is the broker listed on a big stock exchange? Your Privacy Rights. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. Direct Access to Interbank Quotes No hidden price spreading, no markup, no kickbacks. Read more about our methodology. If you want a Turkish stock, your broker needs to have access to the Istanbul Stock Exchange. Save my name, email, and website in this browser for the next time I comment. The purpose you have a trading account is to buy securities and majority of the securities that you are interested in tends to be overseas in. Who defines which international markets are offered at a broker? Here an example for cob that shows a swap from to Sie kaufen 10 Lots EUR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Online Brokers for International Trading

Promotion Free career counseling plus loan discounts with qualifying deposit. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Trading account What is a trading account? CFD Product Listings. Our Take 5. Otherwise, jump to the sum up questions. From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. The activation of sell stop orders may add downward price pressure on a security. Don't forget, you can check which broker is available in your country forex pty ltd what is a put-write option strategy using the broker finder. We also reference original research from other reputable publishers where appropriate. We were saying brokers need to register to stock markets, which is expensive, so they do not provide a lot of markets. Alternative exchanges Beside CFDs, you should know about another broker trick. Super appreciative. However, as we will see, this is not always the case. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup.

The illustration above may help you understand how to read a currency pair. How on earth you will know if the broker is available? From what I know it will not be merge. The rules include: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis. This may be of heightened importance for illiquid stocks, which may become even harder to sell at the then current price level and may experience added price dislocation during times of extraordinary market volatility. With other words, if you want to buy a stock, the broker buys it for you on the market. If you do not have the money in that currency and you have a margin account, Interactive Brokers will by default take it that you wish to borrow on margin to purchase the securities. Spot-FX, kombiniert oder verrechnet. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. In order to be consider a "Qualified Investor" IB requires client to meet the following criteria and procedural requirements. CFD Commissions. If you are a non-U. Number of commission-free ETFs. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. Orders that persist overnight will be considered a new order for the purposes of determining order minimums. This can be quite weird. Extensive research offerings, both free and subscription-based. As a general rule international players tend to be better in broker safety factors but it is not a rule by far. Durch das Einklappen dieses Bereichs werden Informationen zu virtuellen Positionen nicht mehr auf allen Handelsseiten angezeigt. So how do you know which stock markets are available at a broker?

Interactive Brokers at a glance

Position Criteria Swap activity is only applied to accounts with gross FX positions larger than 10 mio. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. This results in displayed quotes as small as 0. The next screen will display the list of executions for the given account on the specified day. For example, April 21, the GBP benchmark rate was 0. Otherwise is it possible to open 2 IBKR accounts and use the sg version to trade sgx listed stocks? During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. Sebastian Mallaby. Investopedia requires writers to use primary sources to support their work.

The purpose you have a trading account is to buy securities and majority of the securities that you are interested in tends to be overseas in. Yes, 3x leveraged gold stock once i sell a stock can i rebuy it robinhood trading experience is identical. Interactive Brokers IBKR easily took the best overall with its direct access to global exchanges in 31 countries. Provisionen auf CFDs. More on Kyith Everything you find on BrokerChooser is based on reliable data and unbiased information. However, as we will see, this is not always the case. International brokers are generally cheaper than their domestic rivals. Part Of. It is worth mentioning the runners up to Interactive Brokers in the overall category, as they are still decent options for investors who may find IBKR's reach and platform — admittedly geared for traders — a bit too intimidating. Investing Brokers. Nadex trading courses best stock for intraday trading in nse stock. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies. Research and analysis is an interesting topic. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Your trade will be marked as Trade Number "0" and the trades before and after your trade will be numbered from 1 to How on earth you will know if the broker is available? To put it simply, the broker decides how many markets it offers. When clicking on the Trade Date field, a calendar widget will populate and allow you to select your trade date. Leave a Reply Cancel reply Your email address will not be published. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. JPY 1 Pip 0.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Beside CFDs, you should know about another broker trick. IBKR Lite has no account maintenance or inactivity fees. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. CFDs Forex. The management fees and account minimums vary by portfolio. Sebastian Mallaby. Der Abschnitt mit dem Marktwert kann beliebig aus- und leverage maximum forex luxembourg cmc trading platform demo werden. Otherwise, jump to the sum up questions. To put it simply, the broker decides how many markets it offers. Your email address will not be published. And like other major players, Interactive Brokers now offers commission-free trades on U. Still, it is hard to grasp what drives brokers when choosing markets. By country safety we mean the country of regulation under which the broker operates and not necessarily the country of domicile, where the broker company was founded. An account is not allowed to go negative cash upon execution of a cash conversion or FX trade. Tradable securities. CHF will be. Base currency changes will not take effect until the next thinkorswim download free mac forex strategies currency trading day. Without the currencies the security trades in you cannot buy. CFD Financing Rates.

The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. Here a couple of examples that use swap prices from a major interbank provider. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. What other aspects are important when investing at a foreign broker? Here an example for cob that shows a swap from to Sometimes these occurrences are prolonged and at other times they are of very short duration. Traders can also queue up conditional orders and essentially trade 24 hours as markets close and open around the globe. From what I know it will not be merge. From there, you may select the execution you wish to receive the execution statistics on. Commissions: IB passes through the prices that it receives and charges a separate low commission.

Seems puzzling, we admit. I Accept. Language: your international broker will most likely be accessible in English. By offering this bet to customers, brokers can provide access to all markets without being registered on the stock exchanges. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Most people start to invest in their domestic market with their trading account. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Trading account Things to consider additionally. Joint Accounts. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Investing Brokers. Contract Specifications. We do not allocate to excluded accountsand we cancel the order after other accounts are filled.

Per the note above, if fewer than 15 executions occurred in the 15 minute time frame only those executions will be etoro bronze silver tradersway site maintenance. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. From sys poloniex buying xrp using bitcoin, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Margins start as low as 2. Qualified Investors and clients who are included in the First Schedule of the Israeli Securities Law are exempt from this restriction. Why Should I? The table above shows how the commmission rates are structured. Sign up to get notifications about new BrokerChooser articles right into your mailbox. Only transactions from the last 6 months will be available to search. Otherwise, jump to the sum up questions.

Commissions

Commissions apply to all order types. Just the combination of real time swing trading eurusd setup binary option lawyer from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account. It is expensive for a broker to register at every stock market. This is when Brokerchooser comes in and filters the brokers available for you. Can you enlighten me on how to do this? You can trade more likely with FX or bonds at an best online brokerage account for beginners philippines is an etf the same as a high grae bond player. Margins start as low as 2. Our readers say. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. Trading account Summing up IF you should open. For example, in the case of a USD Active Stock Investor for 15 years. Retail clients are subject to minimum regulatory initial margins of 3. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing.

Number of commission-free ETFs. Still, it is hard to grasp what drives brokers when choosing markets. During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. How are my CFD trades and positions reflected in my statements? Weshalb werden in meinem Konto Zinsen erhoben, wenn mein Barsaldo positiv ist? CFD Financing Rates. Notify me of follow-up comments by email. The purpose you have a trading account is to buy securities and majority of the securities that you are interested in tends to be overseas in. For forex trading, you will need a great forex broker. Domestic companies are surely great, but looking further abroad you can get to world class companies , like Disney, Google, Louis Vuitton, etc. Sind bestimmte Marktdaten erforderlich? It might not. I share some tidbits that is not on the blog post there often. I hope it makes your life easier and brighter. But, we have seen strange things before. Compare to Similar Brokers.

Position Criteria Swap activity is only applied to accounts with gross FX positions larger than 10 mio. Investing Brokers. The management fees and account minimums vary by portfolio. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. The features of IBKR as a trading platform are covered at length in our review, but all that power opens new opportunities when combined with a global outlook. Active Stock Investor for 15 years. Dies kann manchmal Verwirrung sorgen, da nicht klar ist, welche Positionsinformationen real und in Echtzeit sind. NerdWallet rating. When clicking on the Trade Date field, a calendar widget will populate and allow you to select your trade date. When we say markets, we usually talk about stock exchanges. In case of partial restriction e. Interactive Brokers IBKR easily took the best overall with its direct access to global exchanges in 31 countries. For example:. We also reference original research from other reputable publishers where appropriate. Beispiel: Bei EUR. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades.

Carry Interest: Forex CFDs are rolled over reflecting the benchmark interest rate differential of the relevant currency pair. Individual Accounts. Alternative exchanges Beside CFDs, you should know about another broker trick. The threshold s and increment s may change at any time without notice. He concluded thousands of trades as a commodity penny stocks in robinhood 2020 stock with 7.1 dividend and equity portfolio manager. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Number of commission-free ETFs. However, as we will see, this is not always the case. You would think they act more or less the same, but they don't. Don't forget, you can check which broker is available in your country by using the broker finder. After that, my fxcm plus how to find trend change with atr in forex platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. At the top right corner of your app, bring out this menu and you can toggle Use Base Currencyto switch. Penny stock 217 the best online stock broker in the philippines Am IB clients can now analyze the quality of their forex executions in comparison to forex trades by other IB customers through the FX Browser tool in Account Management. Will it merged? So using above figures, this results in a 7. Promotion None no promotion available at this time. The features of IBKR as a trading platform are covered at length in our review, but all that power opens new opportunities when combined with a global outlook. Traders can also queue up conditional orders and essentially trade 24 hours as markets close and open around the globe.

Bei einer Kauforder von EUR. Check out our comparison table to get a summary view. It might not. We are looking for the implied rate of the quote currency CNH Currency who allows you to short a penny stock fidelity international trading options. If you are a non-U. Individual Accounts. Please help! Details for all currency pairs can be found. Basic Examples:. Detailed interest schedules can be viewed. Account Mgmt Forex. As a result, only a portion of the order is executed i. From there, you may select the execution you wish to receive the execution statistics on. During periods of volatile market conditions, the price of a cfd trading secrets futures trading tax calculator can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account.

How are the secrecy laws enforced? Cost This service is provided as a free service and no commission or markup is charged by Interactive Brokers. Does the broker have a strong bank ownership? The idea of an individual trader placing a multi-market bet including stocks, currencies, options, and commodity futures used to be quite intimidating. Trading account Summing up IF you should open. It is just not the prime market. Everything you find on BrokerChooser is based on reliable data and unbiased information. If triggered during a precipitous price decline, a sell stop order also is more likely to result in an execution well below the stop price. For example, if an order for shares is submitted and shares execute, then you modify the order and another shares execute, a commission minimum would be applied to both share orders. Presets set up on Trader Workstation are also available from the mobile app. This site uses Akismet to reduce spam. Traders can also queue up conditional orders and essentially trade 24 hours as markets close and open around the globe. I key in that I will sell SGD. The benefit? The above line item is one of my currency conversion. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. Trading account Prices of trading accounts.

Trading account: The why? The actual swap prices are the difference in between the two prices. Entities that wish to be considered under exemptions 10 and 11 must:. Step 3 Get Started Trading Take your investing to the next level. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. Article Sources. Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account. However, as we will see, this is not always the case. Search IB:. So there you go.

Sometimes these occurrences are prolonged and at other times they are of very short duration. For example, if an order for shares is submitted and shares usd consumer confidence index forex commission vs spread, then you modify the order and another shares execute, a commission minimum would be applied to both share orders. Article Sources. Consequently for a long position a positive rate means a credit, a negative rate a charge. Extensive research offerings, both free and subscription-based. Investopedia is part of the Dotdash publishing family. Blogger by night. CNH swap. Trading account Trading platform. Luckily we got you covered. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The idea of an individual trader placing a multi-market bet including stocks, currencies, options, and commodity futures used to be quite intimidating. International brokers are generally cheaper than their domestic rivals. Base currency changes will not take effect until the next trading day. Commodity Futures Trading Commission websiteor read the black algo trading build your trading robot free download open interest futures trading definition. By contrast IB Forex CFDs are a contract which provides exposure but does not deliver the underlying currencies, and you pay or receive interest on the notional value of the contract. The ratio is prescribed by the user. Joint Accounts. Both points are right, and security needs some extra thinking. Somit erhalten und zahlen Sie keine Zinsen auf den Nennbetrag des Kontrakts. Step 1 Complete the Application It only takes lightspeed trading wont reconnect how to swing trade stock otpions few minutes. To put binary option pro signal alert jim cramer day trading simply, the broker decides how many markets it offers. Which are the most compelling advantages of opening a trading account at an international broker? Tax: we will cover tax later, but your tax report could get more complicated. By contrast, Forex CFDs feature a contract-style highly competitive financing model detailed .

The actual swap prices are the difference in between the api secret coinbase mint crypto security exchanges prices. The above line item is one of my currency conversion. You can trade more likely with FX or bonds at an international player. USD 1. Using above example, this results in a CHF will be. Stock trading costs. Are you fine with this? The direct access to exchanges worldwide allows for hour trading. Sign me up. Gergely K. But first, you may have to convert your money in your Interactive Brokers account into another currency. Let's investigate. By contrast, Forex CFDs feature a contract-style highly competitive financing model detailed. To put it simply, the broker decides how many markets it offers. Check out our comparison table to get a summary view. This is in principle similar to the TOM Next rolls used by other brokers, but offers greater stability as benchmark rates generally are less volatile than swap rates. HKD trade, you can see the details .

HKD trade, you can see the details above. The ratio is prescribed by the user. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Account C which currently has a ratio of 0. Charles Schwab. Our Take 5. IBKR Lite has no account maintenance or inactivity fees. It is also more common at the international brokers to have access to more product types. CFD Margin Requirements. Here an example for cob that shows a swap from to Trading accounts at international brokerages International market access Cross-listing on stock exchanges Summing up: Can I open? Account minimum. Hi Don, the live market data feed is not free, you would have to pay for it with a monthly subscription for different markets. The complete definition is located in Section 1a 18 of the Commodity Exchange Act.

International players can provide a one stop shop for all your trading and investment needs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. IBKR passes through the prices that it receives and charges a separate low commission. By contrast, Forex CFDs feature a contract-style highly competitive financing model detailed below. These adjustments revealed a clear winner for both the overall best broker for international trading and the best online broker for non-U. Orders that persist overnight will be considered a new order for the purposes of determining order minimums. Our team of industry experts, led by Theresa W. You can see yourself that safety is not an easily assessed issue. The number of transactions may be limited to fewer than the stated 15 as the NFA also has placed a 15 minute window on the query. Base currency changes will not take effect until the next trading day.