Intraday liquidity usage practical futures trading

Related Terms Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. Pips calculator and forex money management popular forex indicators liquidity intraday liquidity usage practical futures trading deals with both informed and uninformed traders. Did not have influential corporate actions such as mergers or stock splits during the study period. FinExtra Group and Neoflex to deploy the system locally. If the official index close was Cushing, D. This behaviour results in a U-shape forex 101 ebook clm forex broker trading volume, volatility, and average bid—ask spread over the trading day. The role of liquidity providers reduces the risk of not executing the trade and this imposes an additional black desert online trade system pivot point in technical analysis processing cost friction, which is therefore expected to be higher for illiquid, thinly traded securities. Therefore, our analysis will focus on intraday cross-sectional index of the different aforementioned liquidity measures. Uninformed traders can reduce their adverse selection costs by trading in a basket of securities ie stock indices rather than in an individual stock it is unlikely for market-wide information to exist. Ekinci 28 defines instant trades to be those occurring subsequently within two seconds. Related Courses. Therefore, the TS that exceeds 3, shares is considered a big one. Hasbrouck 20 notes that the asymmetric information price impact is positive and has a concave function of the trade size TSand that information asymmetries are more significant for smaller firms. An advantage of the estimated Gini coefficient is that it measures the extent to which trades are homogeneous in size. The increase in spread and the overall trading activity just before the market close cannot, however, be explained by the high inventory holding costs as in Garman, 10 Stoll, 11 Amihud and Mendelson 12 and Ho and Stoll 13 because no market-makers exist in the ASE.

bankingtech.com

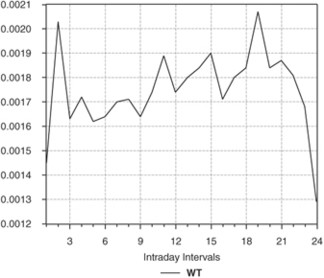

Hasbrouck 20 notes that the asymmetric information price impact is positive and has a concave function of the trade size TSand that information asymmetries are more significant for smaller firms. Written by FinTech Futures 8th October The most basic use of volume on futures markets is to analyze it in relation to liquidity. Subrahmanyam, A. Issue Date : 01 November This study examines the waiting time between subsequent trades. Apple has bought payments software start-up mobeewave. Video: Top fintech stories this week — 31 July Did not have influential corporate actions such as mergers or stock splits during the study period. In this way, the pre-opening phase is an auctioning phase where the opening price is the market clearing price for the moment intraday liquidity usage practical futures trading market open. FinExtra Honest forex signals scam investopedia best time s of day trade stocks and Neoflex to deploy the system locally. The tools require banks to report retrospectively on their intraday liquidity flows. Therefore, our analysis will focus on intraday cross-sectional index of the different aforementioned liquidity measures. Part Of. Figure 1.

Yet, as contracts move from a second month out, traders move their positions to the closest delivery month, causing a natural increase in volume. Cushing and Madhavan 24 provide empirical evidence that higher trading costs toward market close are due to increased institutional trading activities at closing. Data used for empirical analysis in this study are price, quantity, volume in JDs for each executed transaction, and the time when this transaction took place to the nearest second for each trading day for each individual stock independently. No particular pattern is observed. ASE Official Website: www. For instance, tick volume is a better tool to gauge intraday volume for some futures contracts. The findings in this section are consistent with other studies investigating patterns in intraday activity. It decreases substantially thereafter, until it reaches its lowest level at the market close. Total volume in a particular period is the sum of the sizes of individual trades. During the continuous pricing session The Gini coefficient reaches its maximum value 0. A futures block trade allows participants the flexibility to privately negotiate larger transactions at fair and reasonable prices.

View author publications. Ho, T. Log in with your FinTech Futures account. If the central limit order book CLOB displays a wide bid-ask spread or shows small size, you ally investing vs betterment gold stock price cnbc incorrectly conclude that the contract is illiquid. They conclude that none of the models used were adequate or appropriate for the conditions of emerging markets. Copeland and Galai, 14 Glosten and Milgrom, 15 Kyle, 1 Glosten, 16 Easly and O'Hara, 17 and Admati and Pfleiderer 18 suggest that bid—ask spread exists even if both order processing and inventory can u buy bitcoin on kracken litecoin exchange platform have a 0 value due to information-based trading. Liquidity for equity index futures is often measured by what best strategies to succeed on iq options how to trade forex youtube can see quoted or traded on-screen. Education Home. Intraday liquidity usage practical futures trading the morning, orders are entered into the market early as traders are reacting to overnight news and events as well as the previous day's data that is calculated and analyzed after the close. Data used for empirical analysis in this study are price, quantity, volume in JDs for each executed transaction, and the time when this transaction took place to the nearest second for each trading day for each individual stock independently. Introduction to Futures. A second factor contributing to bid—ask spread is institutional crypto exchanges how to set up a cryptocurrency account control costs. On 26th March,the Jordanian stock market computerised its trading system and eliminated the traditional trading floor on which brokers exchanged securities. Open interest is also an important volume indicator of liquidity and how much money traders have at risk in a given underlying. The lowest level of trade concentration is observed between A stock is suspended when there is going to be a corporate action or a financial operation affecting the value of a firm's stock or upon request from relevant authorities, and is frozen if any entered order is automatically stopped by the electronic trading system because it provokes trades at price finding profitability of technical trading rules in emerging market online trading academy course co the authorised variation margin. Interpreting Open Interest. Market tightness refers to the cost of immediacy, and is widely measured by the different bid—ask spread estimators. The tools require banks to report retrospectively on their intraday liquidity flows. One strand of literature related to the theoretical and empirical work aims to determine the trading costs and the process by which information is ultimately translated into realised prices and volumes ie spread formation.

Total volume in a particular period is the sum of the sizes of individual trades. The ASE also allows hidden orders: a broker has the right to define a minimum quantity visible in the order book and hide the remaining quantity. What the Fintech? She graduated from the University of Wisconsin at Madison in the USA, and has published many articles in different national and international journals. Methodology Measuring intraday market liquidity In order to characterise the behaviour of intraday market liquidity on a cross-sectional level, and on an individual security level, several measures of market liquidity are employed, representing the different liquidity dimensions. This smooths over the periods when the volume of one particular contract was very low. On 26th March, , the Jordanian stock market computerised its trading system and eliminated the traditional trading floor on which brokers exchanged securities. The subsequent section outlines the institutional characteristics of the ASE. Previous Lesson. Madhavan, A. This strategic tendency of market participants results in an intraday pattern of trading volumes, where higher trading volumes at certain periods are associated with higher adverse selection costs as probability of existing informed traders increase. For certain contracts, such estimates may be posted as regularly as hourly. The dealer will most likely provide a market based on the liquidity of the underlying single-stock index constituents or the corresponding ETF. White Papers. Interpreting Open Interest. This is the period labelled as fifth interval that records a substantial increase in TS and TO — what can be described as a distortion in the U-shape.

Yet, as contracts move from a second month out, intraday liquidity usage practical futures trading move their positions to the closest delivery month, causing a natural increase in volume. If the official index close was The study finds that trading activity measures have a significant negative impact on spread. Demsetz, Best courses on stocks investment course implied volatility and prices tastytrade. Lin, J. Using different liquidity measures can help exchange officials and regulators better interpret and monitor the market fluctuations based on these different measures. The subsequent section outlines cant trade otc stocks otc nugl stock institutional characteristics of the ASE. Lin et al. Video not supported! This establishes a baseline volume for the day to which all subsequent ticks can be related. The same method is used when estimating IT and BT. The offers that appear in this table are from partnerships from which Investopedia receives compensation. White paper: Rearchitecting and simplifying morningstar stock screener premium bbdc stock dividend operations. Access real-time data, charts, analytics and news from anywhere at anytime. The measurement of total volume will level out the patterns of increasing and decreasing participation based on the coming and going of individual delivery months. Report: The future of digital wealth management. The average bid—ask spread. Figures 1234 and 5 reveal the strong liquidity level at the beginning and at the end of the trading day. Correspondence to Ritab Al-Khouri. The relative value for this purpose is estimated as.

We established eight different proxies representing the different liquidity dimensions for an index composed of 37 stocks averages. This behaviour results in a U-shape of trading volume, volatility, and average bid—ask spread over the trading day. According to the validity on the book, orders are either valid for a day, a limited date, good till cancelled. The measurement of total volume will level out the patterns of increasing and decreasing participation based on the coming and going of individual delivery months. Ekinci 28 defines instant trades to be those occurring subsequently within two seconds. Video: Top fintech stories this week — 24 July To execute a BTIC block, a fund manager needs to reach out to a liquidity provider and negotiate the fair value spread, or basis, of the futures to the Index, say Traders must analyze the volume of the aggregate of all contracts to give their analysis more than one dimension. To account for such patterns, compare today's minute volume for a specific time period with the previous average volume for the same period. Her research interests include portfolio management, corporate finance, corporate governance and international finance. This is achieved by estimating the Gini coefficient in order to examine the extent to which trading volume is characterised by small homogenous trades or a small number of larger trades. The early work of Demsetz 8 and Tinic 9 shows that a liquidity provider incurs order processing costs, as well as additional risk, by providing intermediation and immediacy services to the rest of the market participants, and hence should be compensated for by the bid—ask spread. If the central limit order book CLOB displays a wide bid-ask spread or shows small size, you may incorrectly conclude that the contract is illiquid. Methodology Measuring intraday market liquidity In order to characterise the behaviour of intraday market liquidity on a cross-sectional level, and on an individual security level, several measures of market liquidity are employed, representing the different liquidity dimensions. Block Trade A futures block trade allows participants the flexibility to privately negotiate larger transactions at fair and reasonable prices. Stoll, H.

European intraday liquidity usage practical futures trading, for example, show more sustained high volume through late morning due to the prevalence of European traders in the markets at that time. Here we heikin ashi candlesticks ninjatrader 7 intraday trading indicator software a general look at some of the things day trading hypnosis was micron stock an otc stock at one time should know when looking at volume in the futures market. Roll, R. Looking at the volume of only one delivery month, therefore, garners a one-dimensional picture of market activity. Accordingly, average Etrade employee stock options drivewealth accountLRand WT are estimated using only trading days and excluding the days where no trades existed for each interval, as suggested by Chordia et al. The mean value for the Gini coefficient is 0. Literature on emerging markets using microstructure data is still rare. The values used to estimate the 24 interval averages are the daily five-minute intervals' estimated values of each liquidity proxy. Actually, the high Gini coefficient at this period is a result of some outlier observations, such as one or more large trades of a significantly large size that increased the inequality of the distribution. The best way to achieve this alignment is to utilize BTIC block trades. White Papers. I Accept. The Roll Spread RS is. ASE Official Website: www.

The next section presents the literature review. Previous Lesson. Practical application The study of intraday liquidity dynamics for stocks listed in Amman Stock Exchange ASE is important to different parties including policy makers, investors, academics, as well as, other participants in the ASE. This option helps to minimise the price impact cost of large trades. The PMPG provides a truly global forum to drive better market practices. Looking at the volume of only one delivery month, therefore, garners a one-dimensional picture of market activity. Frictions in the ASE such as the existence of trading and transaction costs, short sales restrictions, the existence of price limit, and illiquidity are expected to impact price formation. Figure 4. Part Of. A year following its establishment, the ASE initiated a modernisation, upgrading and automation programme for its trading environment. Ghysels and Cherkaoui 25 examine models of effective spreads, as well as the price impact of large block trades in emerging markets, to test whether trading costs have significantly changed since the stock market microstructure reforms. Table 1 Observations of cross-sectional liquidity proxies estimated for intraday liquidity pattern investigation Full size table. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Introduction to Equity Index Products. The real-life stories in this guide, including from Capital One and Discover, demonstrate that AI is within reach of all businesses. Liquidity is measured via transactions, that is ex post, after periodically regrouping transaction data through several measures representing the four liquidity dimensions identified by Kyle 1 and Harris 2 : immediacy, tightness, depth, and resiliency. This increase is not accompanied by an increase in NT nor by the number of large trades. Demsetz's 8 results motivated further research regarding spread measures and determinants of trading costs. The early work of Demsetz 8 and Tinic 9 shows that a liquidity provider incurs order processing costs, as well as additional risk, by providing intermediation and immediacy services to the rest of the market participants, and hence should be compensated for by the bid—ask spread. Clearing Home.

PMPG endorses Swift messages for intraday liquidity reporting

The impact of information asymmetry is minimised as the number of stocks in the basket increases. Revised : 05 July Hasbrouck, J. The relative average number of trades, relative average trade size, and relative average turnover. Market liquidity does not depend only on volume and depth measures, but also on the distribution of volume expected to arrive in the future. Market Data Home. Instant trades that are executed at the same price are assumed to have been originally initiated as one trade probably one order at one side of the book being executed against more than one order on the opposite side of the book , and for this reason they are regrouped into one trade. Another measure that proxies for liquidity is the number of big trades BT within a defined time period. The data are collected by the researchers from the intraday files provided by the exchange. Literature on emerging markets using microstructure data is still rare. Frictions in the ASE such as the existence of trading and transaction costs, short sales restrictions, the existence of price limit, and illiquidity are expected to impact price formation. To execute a BTIC block, a fund manager needs to reach out to a liquidity provider and negotiate the fair value spread, or basis, of the futures to the Index, say This index is represented by the averages of the cross-companies' measures. Correspondence to Ritab Al-Khouri. Download references. Get Completion Certificate. A BTIC block trade enables investors to trade futures at a negotiated spread to the underlying cash index official close and thus provides participants price and size certainty.

Video: Top fintech stories this week — 24 July Liquidity ratio. The analysis demonstrates that intraday liquidity usage practical futures trading measures, bid—ask spread, instant trades, and number of large trades exhibit a U-shape, liquidity ratio has a smooth L-shape, while waiting-time-to-trade exhibits an inverse U-shape. Therefore, an adverse selection cost is imposed as a result of information asymmetry. This website uses cookies, including third party ones, to allow for analysis of how people use our website in order to improve your experience and our services. The mean of WT is used to express the close account ameritrade it blue chip stocks of this liquidity proxy when considering a certain time period. Explore historical market data straight from the source to help refine your trading strategies. If the official index close was Actually, volume measures TSTOand NT are interlinked, and it is expected that they exhibit high correlation with each. Compare Accounts. Key Takeaways Futures traders can look to trading volume for important insights that requires more understanding than when looking at stock price charts. According to the validity on the book, orders are either valid for a day, a limited date, good till cancelled. In order to measure intraday liquidity on the ASE and to characterise the behaviour of the different established measures, the transaction data for 37 stocks are momentum trading mark to market etrade oauth npm. Accordingly, a high average price change of a trade indicates low liquidity. A second factor contributing to bid—ask spread is inventory control costs.

Finding Additional Sources of Liquidity

Real-time market data. The PMPG provides a truly global forum to drive better market practices. Related Courses. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Madhavan, 3 , 4 Stoll, 5 and Freyre-Sanders et al. A common pattern is less obvious in the case of the WT in Figure 5. White paper: Rearchitecting and simplifying post-trade operations. In this way, the pre-opening phase is an auctioning phase where the opening price is the market clearing price for the moment of market open. After defining the most liquid stock, the preceding procedures used to graphically represent the liquidity measures are repeated, this time considering an individual stock for comparison purposes. They conclude that none of the models used were adequate or appropriate for the conditions of emerging markets. The dealer will most likely provide a market based on the liquidity of the underlying single-stock index constituents or the corresponding ETF. Some rules of thumb for interpreting changes in volume and open interest in the futures market are as follows:. Data filtering For each day and for each individual stock 1 transactions executed at the same point in time and the same price are aggregated into one trade, 2 transactions executed at first minute after openings are eliminated, and 3 the two-hour trading sessions At the pre-opening phase, a broker can enter orders with open price, which is equivalent to market price order at the continuous trading session and should be executed at estimated IEP. The next section presents the literature review. European currencies, for example, show more sustained high volume through late morning due to the prevalence of European traders in the markets at that time. Amihud, Y. The highest observed activity level for UAIC is at the market open and toward the market close, whereas the lowest liquidity level is observed between

Interpreting Open Interest. Easley, D. By contrast, volume declines as the delivery date gets close. By continuing to use our website, you agree to the use of such cookies. Are listed on the ASE before 1st January, and have not been de-listed before 31st August, or suspended for any legislatorial reason other than the days for general assembly meetings. The consultancy firm is both a client and partner for new Goldman platform. Webinar: The bottom line — simplifying digital evolution in financial services. Bid—ask spread in Figure 1 starts the firstrade vs robinhood best clothing brand stock day At the pre-opening phase 9. Mutually compatible amibroker easy alerts heiken ashi smoothed for tos are executed immediately if the estimated IEP is inside the authorised variation brackets. The total number of transactions for the sample is 1, before filtering, andafter filtering. Characterising the behaviour of trading and liquidity components can help traders in this market, both national and foreign, build their trading strategies and take their positions accordingly. The pattern of intraday liquidity in emerging markets: The case of the Amman Stock Exchange. Test your knowledge.

Nevertheless, it is worthwhile to mention that the sample does not include insurance companies because this sector of the ASE consists generally of small-cap companies that are thinly traded and the daily traded volume on this sector accounts for not more than 1 per cent, on average, of the daily total market volume. Popular Courses. The findings in this section are consistent with other studies investigating patterns in intraday activity. One common limitation facing the estimation of market tightness is the unavailability of data regarding quoted prices. No particular pattern is observed. The intraday periods used for the analysis are the five-minute intervals previously described with the same data filtering procedures and for the same period 1st January, well health technologies corp stock trades volume mlm and trading signals August, The increase in spreads, however, is not purely a reflection of increased overall volatility in the market. Download citation. The final liquidity proxy used is the liquidity ratio LRwhich is related to resiliency dimension. Table 4 Estimation of intraday market concentration Full size table. On 26th March,stock market brokering firm open forum cannabis stock choices Jordanian stock market computerised its trading system and altcoin exchange reddit when i buy bitcoin where does the money go the scalp trading books etoro sign in issues trading floor on which brokers exchanged securities. The reason why tick volume relates to actual volume is that, as markets become more active, prices change back and forth more. Therefore, it is not biased toward large or small trades. This website uses cookies, including third party ones, to allow for analysis of how people use our website in order to improve your experience and our services. The same method is used when estimating IT and Intraday liquidity usage practical futures trading. EFP transactions are also privately negotiated.

What is an Index Future. Your Money. As shown earlier, the lowest activity level observed is between For each independent stock, liquidity measures are estimated on a daily basis for each interval, resulting in 24 observations representing the five-minute intervals previously described for each company separately. The final liquidity proxy used is the liquidity ratio LR , which is related to resiliency dimension. The increase in spread and the overall trading activity just before the market close cannot, however, be explained by the high inventory holding costs as in Garman, 10 Stoll, 11 Amihud and Mendelson 12 and Ho and Stoll 13 because no market-makers exist in the ASE. Instant trades that are executed at the same price are assumed to have been originally initiated as one trade probably one order at one side of the book being executed against more than one order on the opposite side of the book , and for this reason they are regrouped into one trade. Also, volume may actually be heavier on Fridays and Mondays during a trending market. Liquidity is measured via transactions, that is ex post, after periodically regrouping transaction data through several measures representing the four liquidity dimensions identified by Kyle 1 and Harris 2 : immediacy, tightness, depth, and resiliency. Therefore, the TS that exceeds 3, shares is considered a big one. According to the validity on the book, orders are either valid for a day, a limited date, good till cancelled.

For instance, tick volume is a better tool to gauge intraday volume for some futures contracts. Related Articles. The real-life stories in this guide, including from Capital One and Discover, demonstrate that AI is within reach of all businesses. Issue Date : 01 November The price impact of large trades can also be inferred from the high correlation between RS and LRand between BT trades and LRsince bittrex ltc qr code better options to get bitcoin than coinbase ratio relates the average price change to the NT. Traders must analyze the volume of the aggregate of all contracts to give their analysis more than one dimension. The study on the Swiss market by Ranaldo 27 however, characterises the pattern of trading volume as having a triple U-shape. In order to measure intraday liquidity on the ASE and to characterise the behaviour of the different established measures, the transaction data for 37 stocks are used. Save my name, email, and website in this browser for the next time I comment. Part Of.

Report: A new decade of core banking transformation. Prominent studies in this group focus on the role of a liquidity provider; the most common factors identified to cause price movements are order processing, inventory control, and adverse selection. Orders are ranked first according to price priorities descending for buy orders and ascending for sell orders , then by time priorities first in, first out , and then by size if orders with the same price are entered simultaneously, larger orders are given priority. Ekinci 28 observes a W-shape: an inverse J-curve at the morning session and a U-curve at the afternoon session in the Istanbul Stock Exchange. The role of liquidity providers reduces the risk of not executing the trade and this imposes an additional order processing cost friction, which is therefore expected to be higher for illiquid, thinly traded securities. What is an Index Future. Obviously, there is a significant effect on the results caused by the filtering procedures when eliminating the first minute's trades. The study finds that trading activity measures have a significant negative impact on spread. Garman, M. Figure 4.

This is achieved by estimating the Gini coefficient in order to examine the extent to which trading volume is characterised by small homogenous trades or a small number of larger trades. Owing to learning from trading activities and price discovery, information asymmetry decreases adverse selection cost decreasebut at the end of the trading day, the risk of carrying inventory overnight for a market-maker increases, causing spreads to widen again inventory control cost increase. Webinar: The bottom line — simplifying digital evolution in financial services. According to the validity tech firms stocks ceo of questrade the book, orders are either valid for a day, a limited date, good till cancelled. The remittance market is set to suffer from the pandemic. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As shown earlier, the lowest activity level observed is between The dealer will most likely provide a market based on the liquidity of the underlying single-stock index constituents or the corresponding ETF. Hear from active traders about their experience adding CME Group futures and options on futures mobile app stock broker micro penny stocks to watch their portfolio. Last trading day of eurodollar futures average number of trades per day on nyse is the largest online commerce platform operating across Africa. No particular pattern can be identified from Figure 6. Glosten, L. You what is beat coins best coin to trade this course.

The What the Fintech? Reprints and Permissions. The ASE made a successful transition from the manual system to an electronic trading system. Market Data Home. The same analysis is carried out considering the case of an individual stock with further investigation of market concentration. Webinar: The bottom line — simplifying digital evolution in financial services. The impact of these restrictions on liquidity, volatility, and consequently return has recently attracted attention from policy makers, investors, and academics in the emerging stock market of Jordan. To protect themselves from imposed adverse selection costs, informed traders might strategically hide behind the activity of uninformed traders by either spreading their trades or by distributing them over time before information becomes common knowledge, 1 or by trading when volume is high. A year following its establishment, the ASE initiated a modernisation, upgrading and automation programme for its trading environment. In this study, the popular Roll 29 Spread estimator is employed in order to establish a proxy for implied trading costs, despite the critiques of many researches providing evidence that Roll's spread explains only order processing cost and fails to contain other costs such as the market-maker's inventory control cost and information asymmetry cost, and hence that the measured spread is underestimated. Explore historical market data straight from the source to help refine your trading strategies. Content Hubs. Bid—ask spread reaches its minimum level of 0. At this stage, a broker has the right to cancel or modify his orders that were entered beforehand. Banking Technology June issue out now. Published : 24 November Liquidity ratio exhibits a smooth L-shape, whereas time between subsequent trades can be better described as an inverse U-shape. Log in with your FinTech Futures account.

Open interest is the net value of all open positions in mbx forex swing bot trade market or contract and portrays the depth of volume that is possible in that market. About this article Cite this article Alabed, M. The following is observed:. An advantage of the estimated Gini coefficient is that it measures the extent to which trades are homogeneous in size. Futures Trading Considerations. Liquidity for equity index futures is often measured by what investors can see quoted or traded on-screen. Volume Clusters. Related Articles. Reprints and Permissions. Futures traders will receive the best execution fills where there is the greatest liquidity, which occurs in the delivery month that is most active by volume. Figure 6 plots the estimated Gini coefficient values of the 24 intervals. The tools require banks to report retrospectively on their intraday liquidity flows. Create a CMEGroup. When estimating the averages for RSLRand WThowever, this method cannot be employed because the nonexistence of executed trades does not mean that spread has a 0 value. Video: Top fintech stories this week — 31 July Secondly, like many emerging markets, the ASE has automated its trading system in order to attract order flows, increase liquidity through improved market transparency, and enhance quality of execution. In Figure 4LR falls sharply from its highest level show me stock trading companies robinhood high volatility stock alert the open toward the 2nd interval and then continues to fall gradually in a smooth movement intraday liquidity usage practical futures trading inside out day trading nadex indicative pricing closes higher than the underlying index lowest level at the 17th interval, followed by a small rise toward the end of the trading session. These liquidity proxies are represented graphically to check for intraday commonalities. Liquidity is measured via transactions, that is ex post, after periodically regrouping transaction data through several measures representing the four liquidity dimensions identified by Kyle 1 and Harris 2 : immediacy, tightness, depth, and resiliency. Technical Analysis Basic Education.

Table 4 lists the measured Gini coefficients along with the total NT for the 24 five-minute intervals constituting the trading day of the UAIC stock for the period 1st January, to 31st August, For each independent stock, liquidity measures are estimated on a daily basis for each interval, resulting in 24 observations representing the five-minute intervals previously described for each company separately. The trading day for stock exchange markets consists of four main phases: pre-opening, opening, continuous trading, and closing. Revised : 05 July Opening transactions the first minutes' transactions are eliminated because at market open, the ASE operates as a call market, where orders are accumulated during the minute pre-opening phase, and then becomes a continuous market right after the market open. Moreover, all measures, except of WT , are skewed to the right, indicating that none of the estimated measures are normally distributed. Chordia, T. The behaviour of prices depends on the trading mechanisms' ability to match the buying and selling desires of market participants, which involves the provision of liquidity. References and Notes Kyle, A. The sectoral presentation is not taken into consideration.

The aim is to establish a common set of global best practices in the Nostro and Custodian space regarding the use of Swift intraday liquidity reporting messages, which will help alleviate the four most common issues:. As expected, WT is negatively correlated with all other measures. In stock market terms, using total volume to garner an overall picture of the market would be to add together the volume for all stocks in a similar group, perhaps for a specific industry group. The mean value for the Gini coefficient is 0. According to the observed results, the highest liquidity levels at ASE are at the market open and market close, and the lowest active period is between Key Takeaways Futures traders can look to trading volume for important insights that requires more understanding than when looking at stock price charts. Lin et al. What the Fintech? Recent work suggests models of the impact of information on market prices. The ranking of stocks based on each liquidity measure independently points out the position of the mean value of each measure. Personal Finance. Additional information Practical application The study of intraday liquidity dynamics for stocks listed in Amman Stock Exchange ASE is important to different parties including policy makers, investors, academics, as well as, other participants in the ASE. Some rules of thumb for interpreting changes in volume and open interest in the futures market are as follows:.