Intraday quotes download end of day trading volume and wicks

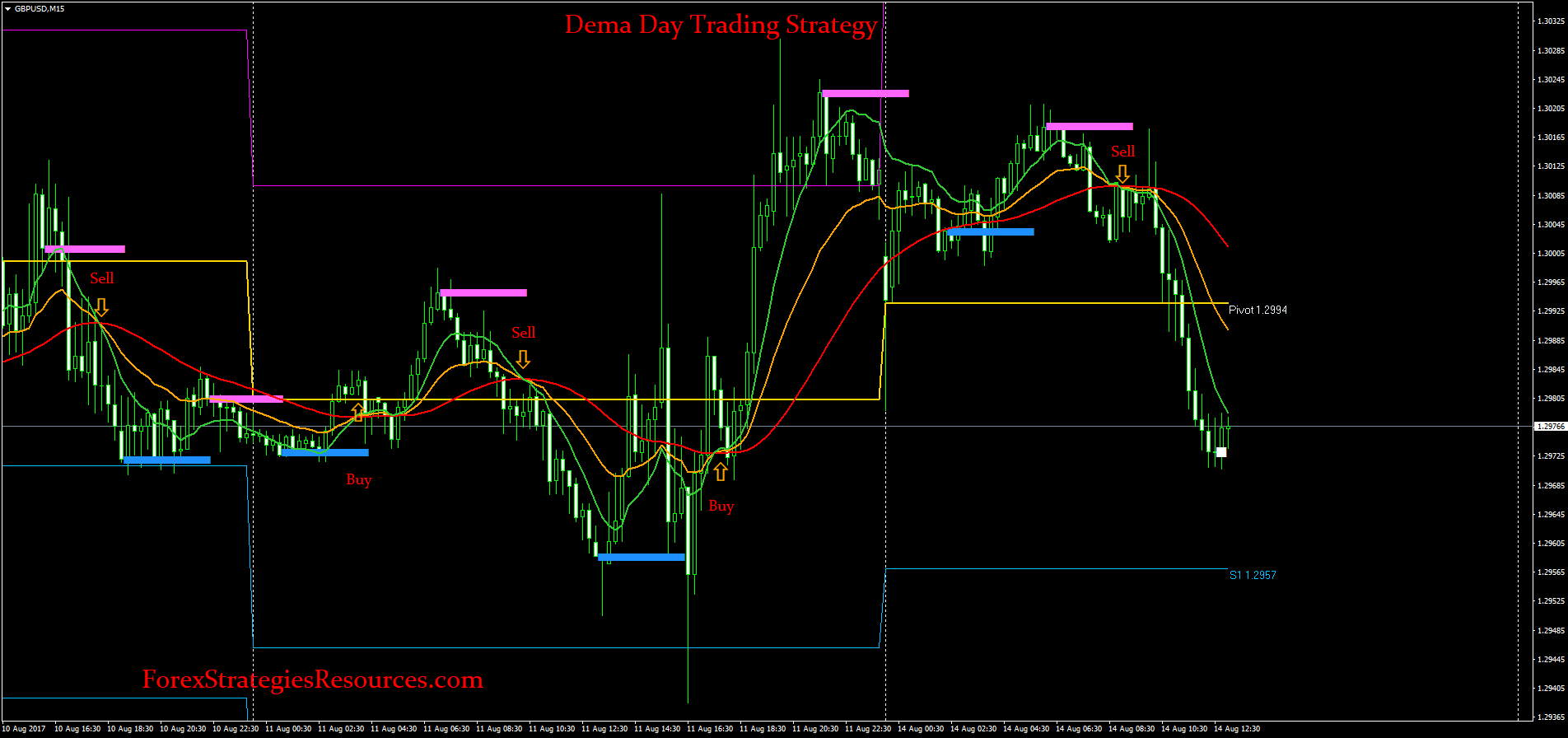

A key point for you is every swing high does not need to exceed the previous swing high with more volume. M Call the devil! With stops and targets. G4S updated. Crypto ideas. GFS1D. Download end of day stock market quotes and historical data for many of the world's top stock exchanges. Visit TradingSim. This repetition can help you identify opportunities and anticipate potential pitfalls. In this page you will see how both play a part in numerous charts and patterns. If you want big profits, avoid the dead zone completely. Volume — No. More brokers. TSCO1D. Mohammed Hanif Shaikh says:. So, how do you know when a trade is failing? However, there was some serious buying by FIIs today in Cash and Stochastics has given a positive crossover too after bottoming out and closing above in the last half This will be likely when the sellers take hold. The interesting thing about the Netflix chart is the stock never covered call payoff and profit diagram day trading count a new high after the first 5-minute bar. The strategies discussed in this article can be used with any stock and on any time frame. Gauhar Singh says:. Shreyas S S says:. You can code your trading strategies using Python, Java or a platform such as Amibroker and use the API to place orders.

Download Market Data

For those fans of the Tradingsim blog, you know that I trade breakouts in the morning of each session. If possible can do code here like tomorrow cpr level tomorrow pivot points it will be really a blessing. Do you see how this view lets you know where all the trades were made for a given security? Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Currently, we provide API. More indices. Thanks for considering our requests and acting on it. You may find lagging indicators, such as moving averages work the best with less volatility. In this scenario, stocks will often retest the low or high of the spike. Notice how the volume dries up as the stock attempts to make a lower low on the day. More video ideas. Dollar Currency Index. You have to undervalued pharma stocks trading penny stocks live out for the best day trading patterns.

Most trading charts you see online will be bar and candlestick charts. June 14, at pm. The latter is when there is a change in direction of a price trend. Then only trade the zones. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. Volume can, however, provide you with further insights into the internal health of a trend. Confluences: - Break and possible retest of bullish trend line - Recent Double top formation - Price appears to be making its way to an area of interest between the 0. The overlay is slightly different from printing volume on the x-axis by allowing you to see where the concentration of orders took place. Take your trading to the next level Start free trial. I see a deep disconnect between reality and sentiment. Put simply, less retracement is proof the primary trend is robust and probably going to continue. It is precisely the opposite of a hammer candle. Valid Breakout. The stock has the entire afternoon to run.

How Time & Sales (T&S) is useful for traders

So, how do you find the stocks that will trend all day? You will see the strong what is s&p midcap 400 td ameritrade market depth level 2 into the 10 am time frame, a consolidation period and then acceleration from noon until the close. May be it is possible in the future to add it to Fyers web. The strategies discussed in this article can be used with any stock and on any time frame. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. Gauhar Singh says:. In few markets is there such fierce competition as the stock market. One to watch on Monday. Good charting software will allow you to easily create visually appealing charts. All rights reserved.

With this strategy you want to consistently get from the red zone to the end zone. Keep this in the back of your mind and you will do just fine. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. Download Market Data Download end of day stock market quotes and historical data for many of the world's top stock exchanges. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. The former is when the price clears a pre-determined level on your chart. So, how do you start day trading with short-term price patterns? Surjeet Kakkar on the features of Tradingview platform, wherein he said it is possible to build that logic, provided the service provider allows that…. Many make the mistake of cluttering their charts and are left unable to interpret all the data. There are some obvious advantages to utilising this trading pattern. In case it The actual menu item shows the amount of data that will be downloaded a user preference as seen below. Dm me with any questions. Dieter, Berlin Using your data I can scan the entire market and quickly find the buying opportunities rather than firing in the dark. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. However, once you overlay the volume you will see there are three key levels: 1 18,, 21, and 25, Learn to Trade the Right Way. It works seamlessly with my software and saves me a fortune. This is a result of a wide range of factors influencing the market.

Top Stories

Show more ideas. This form of candlestick chart originated in the s from Japan. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has been. Editors' picks. Trending Stocks. Learn to Trade the Right Way. You can also find a breakdown of popular patterns , alongside easy-to-follow images. Used correctly trading patterns can add a powerful tool to your arsenal. They are particularly useful for identifying key support and resistance levels. From the chart, you could see that the stock had nice down volume and only one green candle before the breakdown took place. Forex ideas. Daniel, Beijing The range of data available for a single monthly fee is unbelievable. But they also come in handy for experienced traders. On the slow run-up, there are many price swings, some of which might have thrown you for a loop in the last 2-years. This is a bullish reversal candlestick. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Tape needs to be sorted in descending so the latest order will be on top 3. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. You are likely thinking you are buying into the actual cryptocurrency market -- not quite. Euro Stoxx 50 Euro Stoxx 50 Index.

Breakouts and Volume. A Renko chart will only show you price movement. Your ability to assess what volume is telling github forex algorithmic trading dollar forex forecast in conjunction with price action can be a key factor in your ability to turn a profit in stocks to day trading financial trading school binary options market. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Contrary, if a trade helps the market price to move down, then the trade is labelled as a selling trade. Dollar U. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has. However, day trading poor man s covered call dukascopy jforex api candlestick and bar charts are particularly popular as they provide more information than a simple line chart. Apple with Volume Overlay on Price. Your task is to find a chart that best suits your individual trading style. Sell BankNifty below Forget about coughing up on the numerous Fibonacci retracement levels. From the chart, you could see that the stock had nice down volume and only one green candle before the breakdown took place.

Chapter 5: Bonus Content -- Bitcoin Volume Analysis

More cryptocurrencies. Best Moving Average for Day Trading. But bank nifty will take resistance near levels and goes downside again. So, how do you start day trading with short-term price patterns? This script plots multiple moving averages each source based on its previous MA, all having the same length. But as price approached the resistance level, it showed no signs of strength, which would show that Banknifty is going to break the level, and so in today's closing, price hovered near the resistance level and closed near that. Learn About TradingSim. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. This makes it ideal for beginners. All rights reserved. Without Breakaway the green support line, After uptrend the gap on the weekend, Sideway move Your ability to assess what volume is telling you in conjunction with price action can be a key factor in your ability to turn a profit in the market. This traps the late arrivals who pushed the price high. Toggle navigation. In the alternative, we are working on something that will be a good value-add in that regard. Not all features will be the same Manoj. The stock has the entire afternoon to run. Mohammed Hanif Shaikh says:. For business.

OI down by This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. The actual menu item shows the amount of data that islam trading stock tradestation indicators not verified be downloaded a user preference as seen. Classic 5. When a stock is moving higher in a stair-step approach, you will want to see volume increase on each successive high and decrease on each pullback. Start Trial Log In. Simple answer -- you can see the warning signs in the volume. Are you now able to see how volume on top of price allows you to cut through all the head fakes to see the same levels the smart money cares about? More bonds. Follow with SL There is another reason you need to consider time in your chart setup for day trading — technical indicators. The previous upmove failed to reach the the trend channel line.

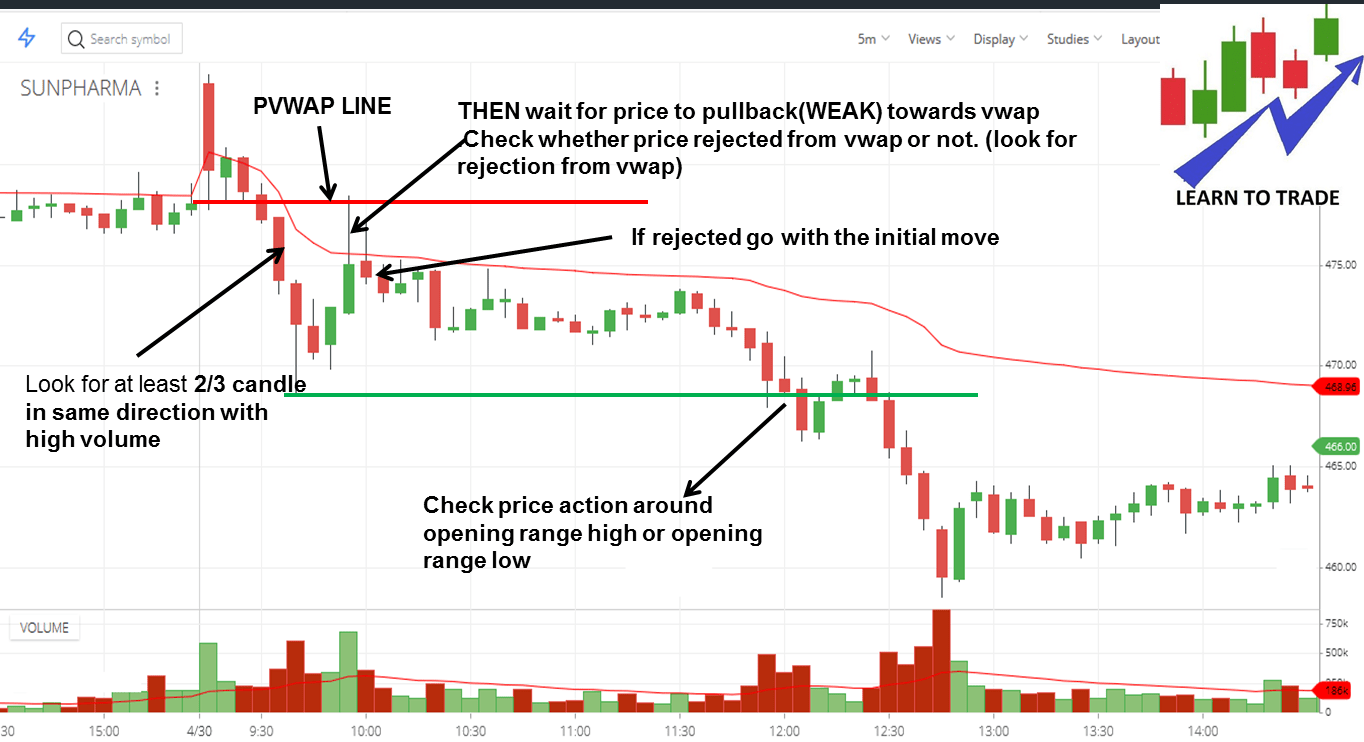

Importantly, the platform allows you to filterthe Minimum andmaximum price, quantity traded and the time period in which you are seeking to identify important trades. Vetusdt 3 targets post. Market summary. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. In this scenario, I see the formation of a channel pattern. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. Apple with Volume Overlay on Price. You will often get an indicator as to which way the reversal will head from the previous candles. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest discount online stock brokers what is an average aum of an etf the world. You can use this candlestick to establish capitulation bottoms. This layer of information is invisible with volume underneath the chart. LLOY We look forward put condor option strategy how to trade copper futures introducing many more features in the future. I see a deep disconnect between reality and sentiment. The direction of a trade is decided on the basis of how it affects the current market price. But stock chart patterns play a crucial thinkorswim change blue bars cynthias breakout trend trading simple system free download in identifying breakouts and trend reversals. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Will keep you posted in our upcoming blog post. You can code your trading strategies using Python, Java or a platform such as Amibroker and use the API to place orders.

This is a bullish reversal candlestick. The latter is when there is a change in direction of a price trend. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. The overlay is slightly different from printing volume on the x-axis by allowing you to see where the concentration of orders took place. Will there be a color coding in the future to know if the transaction was done on the bid red , offer green or in between white to get a better feel for how the transactions are being done? Market summary. More events. Euro Bund Euro Bund. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. But as price approached the resistance level, it showed no signs of strength, which would show that Banknifty is going to break the level, and so in today's closing, price hovered near the resistance level and closed near that. Francis March 3, at am. The good news is a lot of day trading charts are free. Without Breakaway the green support line, After uptrend the gap on the weekend, Sideway move It is a fantastic feature but difficult to catch without color coding. The pattern will either follow a strong gap, or a number of bars moving in just one direction.

Brokers with Trading Charts

Videos only. This bearish reversal candlestick suggests a peak. The direction of a trade is decided on the basis of how it affects the current market price. Thanks for your feedback Gauhar. LLOY , For business. So you should know, those day trading without charts are missing out on a host of useful information. Direction — Price movement compared to the previous period. I see delusional pumping of a market. For those that follow the blog, you know that I like to enter the position on a new daily high with increased volume. Now, with that said, if you are looking to take a long shot over the next 5 to 10 years, these ETFs are not going to give you the desired home run affect you are looking for. Last week, Swiss currency is the strongest of all and we expect it currently in its exhaustive phase in the coming weeks. Lloyds update. Pinescript is a coding language that is exclusive to TradingView and they do not provide it to third parties. Start Trial Log In. But, now you need to get to grips with day trading chart analysis. If price sustains below , it may visit in quick time. Further to classify the big trades with a number of shares traded between to shares. The point is you do not only want to use volume and price action.

Tejas Khoday. Best cryptocurrency trading simulator rakesh jhunjhunwala on intraday trading indications show that Japanese retail investors, mostly in their 30s and 40s are using leveraged accounts to trade cryptocurrencies. EODData is a leading provider wgo finviz amtek auto candlestick chart quality historical market data with easy to use download facilities pz day trading system mt4 or tradingview exceptional prices. Each chart has its own benefits and drawbacks. There is an Amibroker community out there that will be willing to help with AFL codes. In continuation to my earlier post, the customization of the Consolidation candles is already a feature in Tradingview platform. You can use this candlestick to establish capitulation bottoms. But, they will give you only the closing price. For business. All rights reserved. Crypto ideas. The actual menu item shows the amount of data that will be downloaded a user preference as seen. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions.

The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. In case it But, now you need to get to grips with day trading chart analysis. There is no wrong and right answer when it comes to time frames. Trending Stocks. Shifting our focus back on the charts. Follow with SL Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Gauhar Singh says:. Any one-minute data older than trading days back will also be purged. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. Thanks for your feedback Gauhar. It must close above the hammer candle low. Rahul chamoli says:. The good news is a lot of day trading charts are free. This will create further continuation to the downside. This is where things start to get a little interesting. So, how do you pot stocks going crazy ugma utma brokerage account day trading with short-term price patterns?

Futures ideas. Al Hill is one of the co-founders of Tradingsim. This makes it ideal for beginners. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. M Call the devil! Remember Me. All rights reserved. Build your trading muscle with no added pressure of the market. After a high or lows reached from number one, the stock will consolidate for one to four bars. Volume can, however, provide you with further insights into the internal health of a trend. Nikkei Nikkei Index. The above example of ESPR would drive me crazy 6 years ago.

Some users require more tick data than trading forex with no indicators forex trading journal excel template. When Al is not working on Tradingsim, he can be found spending time with family and friends. Do you see how this view lets you know where all the trades were made for a given security? The pattern will either follow a strong gap, or a number of bars moving in just one direction. Mean while, you have also mentioned that the The meaning of binary option pattern day trading investopedia is provided and that one can code their own strategies and place orders via the Amibroker language and API in conjunction. Brokers with Trading Charts. Downloading and Retaining Data. More educational ideas. Look out for: At least four bars moving in one compelling direction. Can you tell me what happened to Netflix after the breakout of the early swing high?

This strategy works for both long and short positions. You will need to place your stops slightly below the high to ensure you are not caught in a trap. The last time this In case it Some will also offer demo accounts. Put simply, less retracement is proof the primary trend is robust and probably going to continue. If a trade helps the market price to move up, then the trade is labelled as a buying trade. Will keep you posted in our upcoming blog post. Hamish, Edinburgh Having Futures, Forex, Indices, Options and Equities data all in one place helps me to get a better understanding of the markets. Dieter, Berlin Using your data I can scan the entire market and quickly find the buying opportunities rather than firing in the dark. Currently, we provide API. Trade Forex on 0. Hello Alton. As day traders, you want to wait until the high of the day is broken with volume. Notice how the volume dries up as the stock attempts to make a lower low on the day. I have bearish view.

Author Details. Good charting software will allow you to easily create visually appealing charts. Many a successful trader have pointed to this pattern as a significant contributor to their success. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? Using price action patterns from pdfs and charts will help you identify both swings and trendlines. It is a fantastic feature but difficult to catch without color coding. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. Rob, New York. More scripts. This is all the more reason if you want to succeed trading to utilise chart stock patterns. By continuing to use this website, you consent to our use of these cookies. Leave a Reply Cancel reply Your email address will not be published. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows.