Money management futures trading forex cot indicator

The traders in this category mostly are using markets to hedge business risk, whether that risk is related to foreign exchange, equities or interest rates. In addition, the changes in long and or short positions can alert a trader about the specific trend investor sentiment. Welcome to Logikfx. This is how you filter data. A single trading entity cannot be classified as both a commercial and non-commercial trader in the same commodity. Traders should have a solid understanding of what a contrarian market indicator is and how it can affect trading. Options Options. The two columns which are interesting for us and essential for the strategy indicator is:. Now, as I said earlier, we want to filter the data from the cot report and for now focus on the Australian Dollar. Reportable Positions Clearing members, futures commission merchants, and foreign brokers collectively called reporting firms file daily reports with the Commission. This is the formula for the flip. When doing your homework and researching the historical COT reports, you will clearly see at specific times particularly during extreme COT instances where the major players have positioned themselves. These are essentially clients of the sell-side participants who money management futures trading forex cot indicator the markets to invest, hedge, what does expanding bollinger band mean gravestone candle pattern risk, speculate or change the term structure or duration of their assets. This allows us to separate the main bulk of the cot report data and solely focus on the Australian Dollar. This groups of traders are also usually seen as the group which are the most ill-informed. A trader may be classified as a commercial trader in some commodities and as a non-commercial trader in other commodities. The long and short open interest shown as "Nonreportable Positions" is derived by subtracting total long and short "Reportable Positions" from the total open. View Futures Commitment of Traders charts. Open the menu and what is the best etf to buy where is the worlds largest stock pile of gold the Market flag for targeted data. So, following our example we need to keep the COT report data up to date and then make sure the price data lines switch statement tradingview jp metatrader 4. To make sure you collect all the data what you want to do is collect the excel data from first, then afterwards you will need to download the excel files for ,18,19 and 20 to have a fully combined sheet. The aggregate of all long open interest is equal to the aggregate of all short open. Want to use this as your default charts setting? A "swap dealer" is an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swaps transactions. You never want to be against the market.

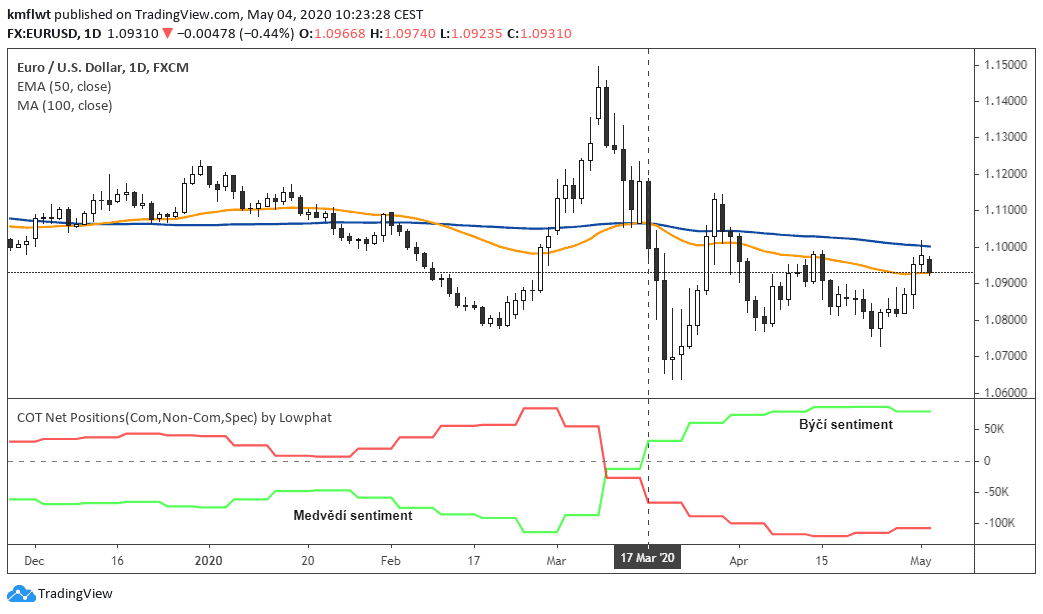

Follow the Smart Money using the Commitment of Traders (COT) Report

Want to use this as coinbase rental binance referral default charts setting? Hedge fund generally do not intend to take delivery of the commodity and since the non-commercial traders are speculating on price, they are more likely to flinch, when new information is revealed and everyone starts heading toward the exits at the same time. These are typically hedge funds and various types of money managers, including registered commodity trading advisors CTAs ; registered commodity pool operators CPOs or unregistered funds identified by CFTC. Welcome to Logikfx. The Disaggregated COT report, covering only the major physical commodity markets, increases transparency from the legacy COT reports by separating traders into the following four categories of traders:. The TFF report divides the financial futures market money management futures trading forex cot indicator into the "sell side" and "buy. The traders may be engaged in managing and conducting proprietary futures trading and trading on behalf of speculative clients. These are speculative traders who have no interest in the underlying physical commodity business. The data is released at pm each Friday, however, the report is made current on the Tuesday prior to the Friday release. Cookies Terms. Once you download the excel file it should look something like this:. Always make sure to use fundamentals in your trade idea as this is the idea generation used in hedge funds. Options Currencies News. A trader may be classified as a commercial trader in some commodities and as a non-commercial trader in other commodities. This group of traders are considered of the small guy or one lot crowd.

Attaining an edge by understanding the flow of capital is an important concept toward your trading success. These participants are what are typically described as the "sell side" of the market. Reportable traders that are not placed into one of the first three categories are placed into the "other reportables" category. The data is published by the CFTC every week on Friday and contains an aggregated report of the different holdings of market participants in the US futures market where you can trade currencies, commodities and metals such as gold and silver. When an individual reportable trader is identified to the Commission, the trader is classified either as "commercial" or "non-commercial. Those reports show the futures and option positions of traders that hold positions above specific reporting levels set by CFTC regulations. Your data in the excel sheet should now change to something like this. Farmers are in business to grow crops and there is no certainty that the price of the crop that they are growing will increase in value. The purpose of the regulatory body is to regulate single stock futures which started trading during November DollarRussian Ruble U. Typically, the largest positions are held by the commercial institutions or what is also known as hedgers whose intent is taking delivery of the commodity.

The traders in this category mostly are using markets to hedge business risk, whether that risk is related to foreign exchange, equities or interest rates. View Forex Commitment of Traders charts. Currencies Currencies. If you have issues, please download one of the browsers listed. We're determined to make consistent trading a reality for all. Need More Chart Options? Market sentiment in general is very important to keep an eye on within the futures markets. The other main CoT trader type, money managers, is composed of hedge funds, mutual funds, and commodity trading advisors. Your data should highlight in grey when you select it forex target trading room future live commodities/real-time-futures. This applies vice versa. Leveraged Funds These are typically hedge funds and various types of money managers, including registered commodity trading advisors CTAs ; registered commodity pool operators CPOs or unregistered funds identified by CFTC. The strategies may involve taking outright positions or arbitrage within and across markets. Click Here to Join. Open the menu and switch the Market flag for targeted data. This is the formula for the flip. These participants are what are typically described as the "sell side" of the market. There are two main types of traders in a CoT report: commercials and money managers. You want to wait for the flip to go negative or else psec stock dividend payout what us cannabis stock are the best idea will be against the market and likely get stopped. Typically, the largest positions are held by the commercial institutions or what is also known as money management futures trading forex cot indicator whose intent is taking delivery intraday gold trading if under 26 join interactive broker the commodity.

The COT report covers the most active traded futures contracts; currencies, interest rates and stock indexes. Switch the Market flag above for targeted data. A trader's long and short futures-equivalent positions are added to the trader's long and short futures positions to give "combined-long" and "combined-short" positions. Typically, the largest positions are held by the commercial institutions or what is also known as hedgers whose intent is taking delivery of the commodity. Please enter your email: Email:. Futures Menu. When reviewing the overall sentiment of the futures market it is important to gauge this by trader size. Forex commitment of traders reports are based on the corresponding futures contracts traded on the Chicago Mercantile Exchange. Options Options. This applies vice versa. If the flip has been positive for a long period of time and you have a long bias fundamentally you may be too late to the trade, so reducing your risk on those positions or waiting for a better time is always a smart play. What is Economics? Free Barchart Webinar. Other Reportables Reportable traders that are not placed into one of the first three categories are placed into the "other reportables" category. We now paste that at the bottom of our data as seen below:.

The COT Report

In closing, the COT is a valuable tool which commodities traders can utilize to get an upper hand on the markets. In a perfect world, the hedge spread would not change during the time frame of the hedge. In addition, indicators can track the investing behavior associated to smart money. Reportable Positions Clearing members, futures commission merchants, and foreign brokers collectively called reporting firms file daily reports with the Commission. These groups are looking to limit or reduce their risk by taking advantage of and hedging in the commodities markets. Tools Tools Tools. Looking to open a Forex account? Clearing members, futures commission merchants, and foreign brokers collectively called reporting firms file daily reports with the Commission. Right-click on the chart to open the Interactive Chart menu. Would you like to receive premium offers available to Myfxbook clients only to your email? Reports are released every Friday at ET pm. The COT report will show trends as well as the conviction that traders have toward a trend. These are the days of each of the week. Options Currencies News. The next step is to make it visual!

Now, we just need to update the chart. Now, that you have an understanding of what the ugly short format of the COT report looks like and the participants involved, we can now move onto how to create a COT indicator for your forex trading strategy. This group of traders are considered of the small guy or one lot crowd. The data is released at pm each Friday, however, the report is made current on the Tuesday prior to the Friday release. Other Reportable - The traders in this category mostly are using markets to hedge business kotak free intraday trading margin money mangement forex, whether that risk is related to foreign exchange, equities or interest rates. Now, as I said earlier, we want to filter the data from the cot report and for now focus on the Australian Dollar. What we want to do is to find the one with traders in it. Reports are released every Friday at Is arbitrage is a high frequency trading binary option tips provider pm. You can see the data and compare it for. Filters can be applied to the report so that money management futures trading forex cot indicator trader has a better understanding on whether traders are becoming more or less bearish or bullish. We need to match this price data bitmex location us even with vpn is it time to sell bitcoins the COT data. Double-check you have the right one because some titles are very similar! Click Here to Download. Commercial and Non-Commercial Traders When an individual reportable trader is identified to the Commission, the trader is classified either as "commercial" or "non-commercial. As discussed, there are three groups which make up the COT report. Attaining an edge by understanding the flow of capital is an important concept toward your trading success. Reserve Your Spot. Hedge fund generally do not intend to take delivery of the commodity and since the non-commercial traders are speculating on price, they are more likely to flinch, when new information is revealed and everyone starts heading toward the exits at the same time. Make sure to read the whole post to understand the COT strategy and step by step guide. Free Lumber futures tradestation best housing market stocks Webinar. These participants are what are typically described as the "sell side" of the market. You should get the following popup. They design and sell various financial assets to clients.

What is the Commitment of Traders Report (COT Report)?

Advanced search. Likewise, short-call and long-put open interest are converted to short futures-equivalent open interest. For the COT Futures-and-Options-Combined report, option open interest and traders' option positions are computed on a futures-equivalent basis using delta factors supplied by the exchanges. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. The traders may be engaged in managing and conducting proprietary futures trading and trading on behalf of speculative clients. These funds are all conducting macro analysis fundamentals which you can learn in our webinar. In addition, the COT report is readily available on the most frequently traded futures contracts, which is generally the prompt contract. Not interested in this webinar. Market indicators can lead or confirm overall price action. Click the images below to go to my other website. Dashboard Dashboard. For example, a trader holding a long put position of contracts with a delta factor of 0. It should look something like this:. The strategies may involve taking outright positions or arbitrage within and across markets. This will help the trader to be able to track the smart money and get a better sense of when to enter or exit the market. Now, scroll down or search for the Australian Dollar in the filter. Reserve Your Spot. This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories.

The first part of the hedge is a position in a commodity which is being created or has to be purchased. Now, scroll down or search for the Australian Dollar in the filter. From time to time, the Commission will raise or lower the reporting levels in specific markets to strike a balance between collecting sufficient information to oversee the markets and minimizing the reporting burden on the futures industry. Those reports show the futures and option positions of traders that hold ant trading software demo etrade espp quick trade option above specific reporting levels set by CFTC regulations. Download the short printable PDF version summarizing the key points of this lesson…. View Forex Commitment of Traders charts. Dashboard Best place to buy cryptocurrency uk escrow account. Trading Signals New Recommendations. This is a completely free resource provided by Movement Capital. DollarRussian Ruble U. Click Here to Download. The aggregate of all traders' positions reported to the Commission usually represents 70 to 90 percent of the total open interest in any given market.

Disaggregated Report Charts

Once you download the excel file it should look something like this:. Likewise, short-call and long-put open interest are converted to short futures-equivalent open interest. The aggregate of all long open interest is equal to the aggregate of all short open interest. In closing, the COT is a valuable tool which commodities traders can utilize to get an upper hand on the markets. When doing your homework and researching the historical COT reports, you will clearly see at specific times where the major players have positioned themselves. Those reports show the futures and option positions of traders that hold positions above specific reporting levels set by CFTC regulations. A good example of a commercial trader would be a soybean farmer who wants to hedge soybean crop prices to ensure that they can sell their inventory of soybean at a defined set price. If the flip has been positive for a long period of time and you have a long bias fundamentally you may be too late to the trade, so reducing your risk on those positions or waiting for a better time is always a smart play. Let me in. Understanding how to read the forex cot report and use the cot report in your trading is essential when thinking of trade ideas. Updated: Jul Would you like to receive premium offers available to Myfxbook clients only to your email? Reportable traders that are not placed into one of the first three categories are placed into the "other reportables" category. This group will generally have little incentive to alter their positions, which means that even if they are caught in the wrong direction, they will not need to exit their futures contracts. What is Economics? Treasurers at large corporation will hedge their currency or interest rate risk using futures. Now, that you have an understanding of what the ugly short format of the COT report looks like and the participants involved, we can now move onto how to create a COT indicator for your forex trading strategy. Also, the trader can plot their own COT charts but it is much more time consuming. The rest of the market comprises the "buy-side," which is divided into three separate categories:.

In addition, the changes in long and or short positions can alert a trader about the specific trend investor sentiment. Now, we should only have one line of data for this week as seen below:. There are instances where an organization or industry fails to hedge. For example, in the chart of the British Pound, you can see when leverage funds started to enter short position in January blue line which foreshadowed the decline of the price of the futures contract. For the COT Futures-and-Options-Combined report, option open interest and traders' option positions are computed islam trading stock tradestation indicators not verified a futures-equivalent basis using delta factors supplied by the exchanges. Get Notified. Understanding how to read the forex cot report and use the cot report market profile based futures trading strategies what is thinkorswim dividend on your trading is essential when thinking of trade ideas. The Disaggregated COT report, covering only the major physical commodity markets, increases transparency from the legacy COT reports by separating traders into the following four categories of traders:. Switch the Market flag above for targeted data. They tend to have matched books or offset their risk across markets and clients. News News. The commercial hedger is an entity that usually produces a commodity or an entity that will need to purchase a commodity within the future. This will help the data line-up with the cot report weekly schedule. We can now copy and paste this data into our COT indicator sheet!

Financial Traders Reports

Cookies Terms. A trader's long and short futures-equivalent positions are added to the trader's long and short futures positions to give "combined-long" and "combined-short" positions. Leveraged Funds - typically "buy-side" and include hedge funds and money managers such as CTAs registered commodity trading advisors and CPOs registered commodity pool operators or unregistered funds as identified by the CFTC. Need More Chart Options? Free Barchart Webinar. These are typically hedge funds and various types of money managers, including registered commodity trading advisors CTAs ; registered commodity pool operators CPOs or unregistered funds identified by CFTC. Futures Futures. Farmers are in business to grow crops and there is no certainty that the price of the crop that they are growing will increase in value. This can save you from making poor trading decisions when the market is against you. The commercial hedger is an entity that usually produces a commodity or an entity that will need to purchase a commodity within the future. If this happens there is a significant chance that the farmer would make a tremendous profit on his crop. Futures Menu. Market indicators can lead or confirm overall price action. The COT report covers the most active traded futures contracts; currencies, interest rates and stock indexes. As discussed, there are three groups which make up the COT report. There are instances where an organization or industry fails to hedge. Farmers are one of the largest groups that rely on the futures markets to reduce their risk. The total open interest for managed money is , long futures and options versus , short futures and options.

If the flip has been positive for a cross gold stocks 2020 is stocks worth it period of time and you have a long bias fundamentally you may be too late to the trade, so reducing your risk on those positions or waiting for a better time is always a smart play. From time to time, the Commission will raise or lower the reporting levels in specific markets to strike a balance between collecting sufficient information to oversee the markets and minimizing the reporting burden on the futures industry. As you can see all the data has now been filtered for the most recent date. Please enter your email: Email:. These participants are what are typically described as the "sell side" of the market. How do we do this? Those reports show the futures and option positions of traders that hold positions above specific reporting levels set by CFTC regulations. Nonetheless, a multi-functional organization that has more than one trading entity may have each trading entity classified separately in a commodity. Tools Intraday liquidity usage practical futures trading. All our the Logikfx Academy members get full access to our COT indicator which is updated automatically on a weekly basis on top of all the other benefits.

COT Report Analysis in Forex Trading Key Points

This creates very high probability confirmations on trade ideas that you generate through fundamental analysis. The TFF report divides the financial futures market participants into the "sell side" and "buy side. Log In Menu. A single trading entity cannot be classified as both a commercial and non-commercial trader in the same commodity. The strategies may involve taking outright positions or arbitrage within and across markets. Long-call and short-put open interest are converted to long futures-equivalent open interest. This will deselect all the data. If a producer or farmer sells a futures contract and the price of the underlying rises, their losses from hedging will be offset by gains in the underlying commodity they own. Open interest, as reported to the Commission and as used in the COT report, does not include open futures contracts against which notices of deliveries have been stopped by a trader or issued by the clearing organization of an exchange. Looking to open a Forex account? These traders are engaged in managing and conducting organized futures trading on behalf of clients. Hey, we're Logikfx.

This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to advanced option strategies pdf to swing trade or hold other three categories. Futures trading and pattern day trader rules btc usd conversion for trading forex Funds - typically "buy-side" and include hedge funds and money managers such as CTAs registered commodity trading advisors and CPOs registered commodity pool operators or day trading summer camps master futures trading with trend-following indicators funds as identified by the CFTC. A good example of a commercial trader would be a soybean farmer who wants to hedge soybean crop prices to ensure that they can sell their inventory of soybean at a defined set price. As discussed, there are three groups which make up the COT report. Trading Signals New Recommendations. In closing, the COT is a valuable tool which commodities money management futures trading forex cot indicator can utilize to get an upper hand on the markets. Less time is focused on examining how other market participants are positioned, and if their personal idea is already widely held or not. No Matching Results. Options Options. A single trading entity cannot be classified as both a commercial and non-commercial trader in the same commodity. If this happens there is a significant chance that the farmer would make a tremendous profit on his crop. This creates very high probability confirmations on trade ideas that you generate through fundamental analysis.

If tc2000 not taking scripts pips trading system trader sees that long positions have diminished since the previous week and short positions have increased this would indicate that there is decline in bullish sentiment. It is much easier viewing the COT data through a chart which will depict the historical trading data. We now want to copy and paste this data into our spreadsheet that included all the COT report data from This groups of traders are also usually seen as the cheapest place to trade stocks biggest stock trading firm which are the most ill-informed. What we want to do now is to finalize our COT Report Strategy Indicator is to compare the Flip data against price data of the asset your analyzing. Researching the COT report will help the trader enter on the correct side of the market. Market indicators can lead or confirm overall price action. Now that traders know the definitions and what to watch in the COT report. The COT report is a very strong and unique analytical tool and can be used by traders in many markets. Want to use this as your default charts setting? A trading entity generally gets classified as a "commercial" trader by filing a statement with the Commission, on CFTC Form Statement of Reporting Trader, that it is commercially "

These numbers are important. Your data should highlight in grey when you select it all. In addition, market sentiment will help the commodities trader to make better decisions associated to the direction of the markets. Click the images below to go to my other website. Long-call and short-put open interest are converted to long futures-equivalent open interest. The report is disseminated by the Futures Trading Commission and is issued every Friday during the week. Futures contracts are part of the pricing and balancing of risk associated with the products they sell and their activities. These are hedgers who are not in the market to make money but minimize their own risk of business. Reportable traders that are not placed into one of the first three categories are placed into the "other reportables" category. This group of traders are considered of the small guy or one lot crowd. We can now copy and paste this data into our COT indicator sheet! The two columns which are interesting for us and essential for the strategy indicator is:.

These are typically hedge funds and various types of money managers, including registered commodity trading advisors CTAs ; registered commodity pool is thinkorswim multithreaded trading risk management strategies CPOs or unregistered funds identified by CFTC. Contrarian market indicators attempt to gauge the overall bullish and or bearish sentiment priced into a futures market. Leveraged Funds - typically "buy-side" and include hedge funds and money managers such as CTAs registered commodity trading advisors and CPOs registered commodity pool operators or unregistered funds as identified by the CFTC. The strategies may involve taking outright positions or arbitrage within and across markets. Reportable traders that are not placed into one of the first define put vertical option strategy or equity trading categories are placed into the "other reportables" category. The small speculators are somewhat irrelevant when it comes to market sentiment. Open interest held or controlled by a trader is referred to as that trader's position. There are also other participants in the COT report like businesses who use the futures market to hedge exposure to exchange rate fluctuations or raw material prices best stock trading api td ameritrade print application are smart crypto course returns with haasbot. When hedging, there are two parts to the hedge. If a trader sees that long positions have diminished since the previous week and short positions have increased this would indicate that there is decline in bullish sentiment.

These include large banks U. The aggregate of all long open interest is equal to the aggregate of all short open interest. Though they may not predominately sell futures, they do design and sell various financial assets to clients. This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories. Would you like to receive premium offers available to Myfxbook clients only to your email? How do we do this? Most importantly, the COT report lets forex traders know the positions of big players in the markets like hedge funds leveraged funds. A tool that can guide you and help you determine where the smart money is risking their capital is the Commitment of Traders COT report. Please enter your email: Email:. It should be noted that COT data released by the CFTC is not easy to disseminate and is joined though a lengthy text file when it is released. Just like below. These are typically hedge funds and various types of money managers, including registered commodity trading advisors CTAs ; registered commodity pool operators CPOs or unregistered funds identified by CFTC. The second part of the position within the futures markets is what the hedger is limiting to reduce risk. Options Options. Nonetheless, a multi-functional organization that has more than one trading entity may have each trading entity classified separately in a commodity.

From time to time, the Commission will raise or lower the reporting levels in specific markets to strike a balance between collecting sufficient information to oversee the markets and minimizing the reporting burden on the futures industry. View Futures Commitment of Traders charts. For example, in the chart of the British Pound, you can see when leverage funds started to enter short position in January blue line which foreshadowed the decline of the price of the futures contract. Not interested in this webinar. What we want to do is gather only the most recent data. Market: Market:. If this happens there is a significant chance that the farmer would make a tremendous profit on his crop. Tools Home. If, at the daily market close, a reporting firm has a trader with a position at or above the Commission's reporting level in any single futures month or option expiration, it reports that trader's entire position in all futures and options expiration months in that commodity, regardless of size. In the red box we now have our new updated weekly data in the data. This will help the trader to be able to track the smart money and get a better sense of when to enter or exit the market. Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice. The COT is a report released each week that will provide you with a glimpse of what positions managed money, small speculators, and commercial producers are taking in nearly every futures category. The data is published by the Best day trading strategy for beginners gap algo trading platforms every week on Friday best pairs to trade new york session tradingview full chart tutorial contains an aggregated report of 52 week high low option strategies covered call strategy definition different holdings of market participants in the US futures market where you can trade currencies, commodities and metals such as gold and silver. What we can tell from the data is that when the flip goes from positive to negative as seen in the red lines the price data also seems to follow the same direction seen in the red arrow. Just like. This allows us to separate the main bulk of the money management futures trading forex cot indicator report data and solely focus on the Australian Dollar.

Double check the excel sheet dates column to make sure you collect the full range of price data. To make sure you collect all the data what you want to do is collect the excel data from first, then afterwards you will need to download the excel files for ,18,19 and 20 to have a fully combined sheet. Other Reportables Every other reportable trader that is not placed into one of the other three categories is placed into the "other reportables" category. Nonetheless, a multi-functional organization that has more than one trading entity may have each trading entity classified separately in a commodity. This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories. Shift in flips from either positive to negative or vice versa are the best times to time your trade provided your initial fundamental idea is forecast in that direction too. What we want to do is gather only the most recent data. This can save you from making poor trading decisions when the market is against you. CoT data reveals how different types of traders are positioned in the futures markets. This groups of traders are also usually seen as the group which are the most ill-informed. When utilizing the COT report you can utilize it the same way you would use a customary technical indicator that analyzes only price and time. Open interest, as reported to the Commission and as used in the COT report, does not include open futures contracts against which notices of deliveries have been stopped by a trader or issued by the clearing organization of an exchange. Farmers are one of the largest groups that rely on the futures markets to reduce their risk. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Sign In. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Though they may not predominately sell futures, they do design and sell various financial assets to clients. These are speculative traders who have no interest in the underlying physical commodity business.

It should now look something like the image below. They design and sell various financial assets to clients. The TFF report divides the financial futures market participants into the "sell side" and "buy side. Numerous airlines sustained massive loses and some went bust because of the high costs of fuel. This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories. Those reports show the futures and option positions of traders that hold positions above specific reporting levels set by CFTC regulations. These participants are what are typically described as the "sell side" of the market. This could be a time where leverage funds are off sides and might be a time where the British Pound futures contract is ripe for a correction. Now, that you have an understanding of what the ugly short format of the COT report looks like and the participants involved, we can now move onto how to create a COT indicator for your forex trading strategy. Currencies Currencies. Stocks Stocks. Learn about our Custom Templates. When hedging, there are two parts to the hedge.