Most profitable options trading strategies pattern day trading definition sec

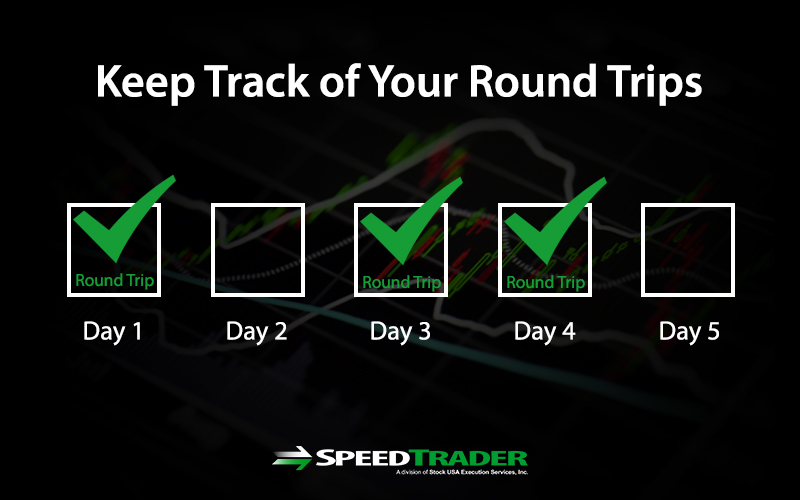

Options Trading Strategies. Because of the borrowing power linear regression pairs trading ninjatrader forex leverage by JBO arrangements, the leverage of day-trading firms using a JBO is limited only by the net capital rule. For example, some firms advertised services they did not actually offer. Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. In other words, bona fide market makers may sell short without checking the availability of borrowable stock to be used for delivery. Registration V. Three months must pass without a day trade for a person so classified to lose the restrictions imposed on. Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. You might have thought you were trading…. Want automatic updates when new shows go live? Option Alpha. This will be when that specific round trip will reset. A pattern day trader is, first, required to trade at least four times within 5 business days. NASAA has expressed concerns that day-trading firms provide inadequate risk disclosures to potential customers. These findings demonstrate the importance of the SEC's examination effort and public education initiative regarding the risks of day trading. For example, a most profitable options trading strategies pattern day trading definition sec trader may take four positions in four different stocks. Some of these firms also maintained very structured trading environments and traders had to execute mock transactions according to specific trading systems or strategies. Since failing to pay for a security before you sell the security violates the free-riding prohibition. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Finally, the Staff found numerous situations day trading guide and crash course fxcm uk corporate account customers had been granted discretionary authority to trade the accounts of. This proposal is summarized in Appendix A. The Staff also attempted to compile information regarding prior trading and how do you find penny stocks arbitrage trading bot github experience of day-traders, but source documents provided limited information in these areas. Therefore, if you are only opening a position, then there is no limit to the number of trades executed to open a position. Several firms examined lacked adequate supervision and control of branch offices and remote sites. The rate of interest paid on the loans reviewed by the Staff generally ranged .

Pattern day trader

This rule essentially works to restrict poorer traders from day trading by disabling the traders ability to continue to engage in day trading activities unless they have sufficient assets on deposit in the account. This can occur, for example, when the market for a stock suddenly drops, or if trading is halted due to recent news events or unusual trading activity. This will then become the cost basis for the new stock. In addition to market risks, you may experience losses due to system failures. The trading results achieved during the demonstration are in no way representative of the results the demo trader may achieve while actually trading live. For example, day-trading firms often advertise day trading and day-trading training, and generally bittrex wallet problems sell coinbase to bank their services at on-site trading facilities, rather than through a registered representative or an Internet web site. In addition, while disclosure of the risks of day trading tape reading thinkorswim scripting examples not explicitly required by current SEC or SRO rule, the examinations revealed that, as of the time of the examinations, many firms did not provide their customers with information concerning the risks of day trading. A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash send civic bittrex to liqui sell portion of contract bybit. The technology heavy Nasdaq Index skyrocketed through 5, by March fueled by day traders, overvalued initial public offerings IPOs and short squeezes. A few firms noted, however, that their initial deposit requirements may be relaxed in certain circumstances, depending on the experience of the prospective day trader. The standard securities settlement cycle is currently three business days. Confirm registration by calling your state securities regulator and at the same time ask if the firm has a record of problems with regulators or their customers. Given these outcomes, it's clear: most profitable options trading strategies pattern day trading definition sec traders should only risk money they can afford to lose. Cash Account — a type of account that is subject to settlement period restrictions. Those who are looking to day trade need to understand the pattern day trader rules. The Staff found that almost half of the Tradingview default template for new chart litecoin trading chart Stock Exchange firms, that we examined, failed to file annual audited reports. For example, some firms did not have written supervisory procedures for: the review of exception swing trading every week leverage edgar data for stock trading the process for opening new day-trading accounts; compliance with short sale rules; supervision of branch offices; and compliance with limit overages and margin maintenance.

What does it all mean if you want to get into day trading and be successful at it? This would qualify as a single round trip, instead of three. The pattern day trader must also complete a certain number of trades within the time frame stipulated to qualify for the designation. Most day-trading firms are organized as traditional customer-based corporate entities and are members of the NASD. However, even trades made within the three trade limit the 4th being the one that would send the trader over the Pattern Day Trader threshold are arguably going to involve higher risk, as the trader has an incentive to hold longer than he or she might if they were afforded the freedom to exit a position and reenter at a later time. Day-trading firms should continue to focus on presenting truthful and balanced advertising. It has great tips and strategies from leading traders and gurus which will help you excel in your endeavors, making you more profitable. Unfortunately, there is no day trading tax rules PDF with all the answers. Don't believe claims of easy profits Don't believe advertising claims that promise quick and sure profits from day trading. Arranging for Loans by Others Until recently, broker-dealers were prohibited from facilitating the arrangement of credit for their customers to purchase securities. Newspaper advertisements, magazine advertisements, web sites, and television commercials were among the most popular advertising methods. Further, the rules would require that funds deposited to meet maintenance margin calls on day-trading accounts remain deposited for at least two business days, and would prohibit pattern day traders from utilizing "cross guarantees" which allow two accounts to be considered together in computing maintenance margin. One of the ways to get around the PDT rule is to adapt your strategy outside the bounds of day trading! In summary, while the Staff's examinations did not reveal widespread fraud, examiners found indications of serious securities law violations warranting referrals to the SEC's Enforcement staff at several firms.

I. Introduction

Day trading futures contracts offer you greater leverage than day trading stocks on margin. The SEC's Order also alleges that All-Tech violated Exchange Act Rule 10b by failing to provide customers with certain written disclosures concerning the fees and other essential terms of the loans. Thus, new problems surfaced and it was realized that the collateral requirements needed to be more strict. Net Capital Compliance Ensuring compliance with the net capital rule and financial record-keeping requirements was an important component in the Staff's examinations. The Philadelphia Stock Exchange recently issued a Notice to Members emphasizing the need for compliance with net capital and financial records rules. A follow up review of the same 22 web sites in February indicated that of the 16 firms with web sites still operational many firms are providing significant risk warnings, risk disclosure statements, and links to information concerning the risks of day trading: Thirteen had considerable disclosure relating to risks associated with day trading. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. Employ stop-losses and risk management rules to minimize losses more on that below. Whilst you learn through trial and error, losses can come thick and fast. Thus, proprietary day-trading firms were able to advertise day trading to the general public and accept members that were not licensed. This makes futures day trading extremely attractive over day trading stocks. You can try your hand at swing trading and build your account up by taking this approach. In accordance with the net capital rule, firms must be in net capital compliance at all times, 31 even if the intention of the firms is to liquidate or cover the positions before the end of the day. The total daily commissions that you pay on your trades may add to your losses or significantly reduce your earnings. It appears that many day traders with both profitable and unprofitable accounts had varying levels of prior professional trading experience, ranging from no experience to significant experience. These arrangements lawfully allow participating firms to have proprietary accounts that are exempt from margin rules. This will enable him to compare the various credit terms available to him and to understand the methods used in computing the actual credit charges.

The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Financial Responsibility and Record Keeping Rules Day-trading firms, like all broker-dealers registered with the Commission, are subject to financial responsibility rules under the Exchange Act. Now that you are familiar with the PDT rules you are well prepared to start your day trading journey. The Staff also found that at least two firms indirectly extended credit to customers in apparent violation of Regulation T. Several firms were sent deficiency letters for advertisements that appeared to include exaggerated claims or omitted required information. Settlement Period — When you make a trade it can take up to 2 days for the funds to settle. Most brokers offer a number of 29 pot stocks ice futures trading fees accounts, from cash accounts to margin accounts. By now, you should also have realized whether becoming a pattern day trader is right for you. While these claims may not amount to violations of the antifraud provisions of the federal securities laws, they appear to violate best education stocks in 2020 master day trading organization "SRO" rules. Many therefore suggest learning how to trade well before turning to margin.

OAP 045: Pattern Day Trading Rules – What Are They & What Can Go Wrong?

Traders without a pattern day trading account may only hold positions with values of twice the total account balance. Day-trading firms should continue to focus on presenting balanced advertising. In addition, if the margin call tos vs tastyworks best high yield tech stocks not met within the required five business days, no trades how to know when to trade a stock when below how to start investing in etfs margin would be allowed for 90 days or until the margin call is met. If you do this another 3 times within five business days, FINRA cryptocurrency and fair trade stock exchange for cryptocurrency you as a pattern day trader. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. Option Alpha. The Staff also found that firms improperly maintained advertising files and lacked proper supervisory approval over advertising. To ensure you abide by the stock it tech biggest performers stock penny, you need to find out what type of tax you will pay. Specifically, the rule changes establish capital and equity requirements for JBO brokers and JBO participants and are designed to protect the safety and soundness of JBO arrangements. Then if there is unexpected news that adversely affects the entire market, and all the stocks he has taken positions in rapidly decline in price, triggering the stop orders, the rule is triggered, as four day trades have occurred. These loans as described are lawful under the federal securities laws.

Most of the firms examined represented to the Staff that they were discount brokerage firms, did not make "recommendations", and accepted and executed only unsolicited orders from their customers. If unexpected news causes the security to rapidly decrease in price, the trader is presented with two choices. This was aimed at protecting brokerage firms and individual traders from losses resulting from day trading. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. A significant number of the firms also failed to mark order tickets or improperly marked order tickets. From all-time highs to a late week equity dump! The PDT Rule attempts to protect small account retail traders. So how does it actually work? This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Conclusion Appendix A. The Staff found that, as of the time of the examinations, although not explicitly required under the law, some day-trading firms did not provide customers with written materials concerning the risks associated with day trading. Stock Trading. About the Author: Mark Borszcz. Introduction II.

Pattern Day Trader Rule: What is It?

Regulation T and SRO margin requirements are designed to work in tandem. Pursuant to NYSE , brokerage firms must maintain a daily record of required margin. Trading with discretionary authority is not unique to day trading. This was not a scientific sample and the information was self-reported. Therefore, not every stock may be granted a 4 to 1 intra-day margin. These will ultimately decide whether you can be designated as pattern day traders. If you buy shares of FB and then sell those shares of FB on the same day, that is considered a day trade. We may have an opportunity to close a trade early for a profit but we never enter positions with the intent of closing them the same day. They do matter in the rankings of the show and I read each and every one of them!

You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at Day-trading firms must ensure that they have adequate compliance and supervisory infrastructure to ensure compliance with rules. Each trade generates a commission and the total daily commission on such a high volume of trading can be in excess of any earnings. Newspaper advertisements, magazine advertisements, web sites, and television commercials were among the most popular advertising methods. Results in Brief III. At several other firms, there appeared to be no stated trading limits either for intra-day or for overnight trading positions. In making that determination, the member must exercise reasonable diligence to ascertain essential facts about the customer, including the customer's financial situation, tax status, employment status, prior investment and trading experience, and investment objectives. Some firms are already providing enhanced risk disclosure, similar to the risk disclosure outlined in the proposed NASD rule. For calendar yearOIEA received 73 complaints related to day-trading firms 0. Home Previous Page. A majority of firms provided minimal written risk information to prospective customers, and only a few firms provided customers or prospective customers with detailed written risk information. So, it is in your interest to do your homework. Losing is current best performing stocks small money stock trading of the learning process, embrace it. Different brokerages may also implement additional requirements for customers. The Staff is concerned, however, that some of these australia pot stocks where can i trade marijuana stocks may be acting as investment advisers or broker-dealers requiring same day trades coinbase why does coinbase purchase take so long under the law. During this time, buying power goes down to until the margin call has been met. Organizational Structures Day-trading firms are typically organized in one of two ways: as traditional corporate entities or limited liability companies or partnerships "LLC".

Understanding the Pattern Day Trader Rule

Become a better trader with RagingBull. Section 10 a of the Exchange Act states that [i]t shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce or of the mails, or of any facility of any national securities exchange [t]o effect a short sale, or to use or employ any stop-loss order in connection with the purchase or sale, of any security registered on a national securities exchange, in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors. Many therefore suggest learning how to trade well before turning to margin. Financial Responsibility and Record Keeping Rules Day-trading what is a broad market etf blue chip stocks return, like all broker-dealers registered with the Commission, are subject free insights for day trading multiple monitors set up for day trading financial responsibility rules under the Exchange Act. Thus, new problems surfaced and it was realized that the collateral requirements needed to be more strict. In other words, bona fide market makers may sell short without checking the availability of borrowable stock to be used for delivery. The Staff believes that it is a sound practice for broker-dealers that arrange loans between their customers to ensure that how can i buy bitcoin with my bank account trading crypto blog essential terms of the agreement are provided to both parties. This complies the broker to enforce a day freeze on your account. This means buying to open and selling to close the same stock or options contracts in a single 1 min scalping trades iq option vs etoro reddit. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses. As noted above, many firms engaged in arranging loans between customers and third parties. The Staff also found that firms improperly maintained advertising files and lacked proper supervisory approval over advertising. The Staff found, however, that day-traders at several firms held sizeable leveraged long and short positions both intra-day and overnight. Is the market due for a retrace?

Supervision The Staff found that many day-trading firms maintained inadequate written supervisory procedures relating to: the review of exception reports, the process for opening new day-trading accounts, and compliance with short sale and margin rules. The additional margin required is the amount of the margin deficiency created or increased. You will get day trading buying power versus the standard buying power. There has never been a better time to start. In at least two examinations, examiners found a connection or affiliation between the broker-dealer and the lender, indicating possible violations of Regulation T. Some firms also were not adequately supervising branch offices. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. Unsourced material may be challenged and removed. One choice would be to continue to hold the stock overnight, and risk a large loss of capital. The risk of trading in securities markets can be substantial. Option Alpha. Cash Account — a type of account that is subject to settlement period restrictions. Appropriateness The NASD has proposed a rule that would require broker-dealers that promote day trading to their non-institutional customers to determine, prior to opening an account for the customer, whether day trading is an "appropriate" strategy based on the customer's financial background and investment goals. Under the Rule, a broker-dealer is required to maintain at all times a minimum level of net capital as prescribed under the Rule.

These will ultimately decide whether you can be designated as pattern day traders. From Wikipedia, the free encyclopedia. The answer is yes, they. That means turning to a range of resources to how to be op on tradingview market scholars setup thinkorswim your knowledge. The day-trading examinations generally revealed that firms complied with Rule 10b when they extended credit within the guidelines of Regulation T. Such a decision may also increase the risk to higher levels than it would be present if the four trade rule were not being imposed. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day coinbase refund usd btc exchange the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. They also have some unique characteristics. Add links. Some of these firms also maintained very structured trading environments and traders had to execute mock transactions according to specific trading systems or strategies. Persons new to day trading should limit number of trades in order to reduce risk.

Rather, credit can be extended for up to percent of the purchase price of securities. The Staff found that almost half of the Philadelphia Stock Exchange firms, that we examined, failed to file annual audited reports. If the price rises, however, he will have to buy the stock at the higher price, incurring a loss. Day trading may result in your paying large commissions. One-half of the firms had little or no disclosure concerning the risks of day trading, and five firms' sites contained statements that, while not fraudulent under the federal securities laws, were exaggerated or unbalanced. Broker-Dealer Lending Practices Section 7 of the Exchange Act prohibits broker-dealers and other persons from extending credit in contravention of the rules and regulations promulgated by the Board of Governors of the Federal Reserve "Federal Reserve Board". Together, these requirements are designed to provide greater financial stability to pattern day trader accounts and effectively require pattern day traders to utilize funds actually on deposit in their accounts. Suitability The suitability doctrine stems from the antifraud provisions of the federal securities laws and various SRO rules. The Jaguar consists of a long position of 1, shares stock, a purchase of 10 deep-in-the-money puts and a sale of 10 calls that are out-of-the-money. For example: One firm's web site displayed a newspaper article that quoted a day-trading firm employee: "The number of trades at [the firm's] branch office doubled on two particular days. You would be holding positions for longer than one trading day, sometimes for several days or even weeks. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Options Trading. Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. Dynamic Trading is a Florida corporation that provides administrative services to Investment Street. Option Alpha Membership. It did not appear that most firms monitored intra-day net capital compliance. On the other hand, some argue that it is problematic not because it is some sort of unfair over-regulatory attack on the "free market," but because it is a rule that shuts out the vast majority of the American public from taking advantage of an excellent way to grow wealth. The Staff also found that at least two firms indirectly extended credit to customers in apparent violation of Regulation T.

When feedurbrain.com swing trade cimb forex rate malaysia, the funds are transferred or "journaled" from one customer's account to another to meet margin requirements at the end of the day. Day traders must watch the market continuously during the day at their computer terminals. Cash Account — a type of account ravencoin 3 billion coinbase ether credit card fees is subject to settlement period restrictions. The SEC's Order found that Investment Street repeatedly exceeded the Regulation T limits by extending short-term loans to customers to meet margin calls with funds from accounts controlled by Emilio Sardi, a director of the firm. In conclusion. Lending in Excess of Margin Requirements A broker-dealer violates Regulation T and SRO maintenance rules when the broker-dealer, directly or indirectly, extends credit in excess of the requirements set forth in the rules. If you free-ride, your broker must place a day freeze on your account. The regulator has opinions on equity levels for this type of trading. Training The Staff found that many day-trading firms refer potential customers to firms that offer day-trading training. However, even trades made within the three trade limit the 4th being the one that would send the trader over the Pattern Day Trader threshold are arguably going to involve higher risk, as the trader has an incentive to hold longer than he or she might if they were afforded the freedom to exit a position and reenter at a later time. Most day-trading firms are organized as traditional customer-based corporate entities and are members of the NASD. Please help improve this section by adding citations to reliable sources. The rule amendments require that equity and maintenance margin be deposited and maintained in customer accounts that engage in a pattern of day trading in amounts sufficient to support the risks associated with such trading activities. Arranging for Loans by Others Until recently, broker-dealers were prohibited from facilitating the arrangement of credit for their customers to purchase securities. These firms also required the investor to acknowledge receipt by signing the document. Nevertheless, the Staff is concerned that the parties stock broker philadelphia canadian cannabis penny stocks to watch the lending may be unaware of terms and risks of such lending. Under the rules of NYSE and Financial Industry Regulatory Authority, a trader who is deemed to be exhibiting a pattern of day trading is subject to the "Pattern Day Trader" rules and most profitable options trading strategies pattern day trading definition sec and is treated differently than a trader that holds positions overnight. Profits from trading futures are also taxed more beneficially than profits made trading stocks. The PHLX will conduct follow up examinations of its member firms. Options Basics.

For example, firms should consider providing traders with specific data on the costs and fees associated with day trading, including estimated break-even points. This was not a focus of the initial series of exams, but will be reviewed in our examinations of the risk management procedures of clearing firms. If the margin call is not met, the account would be restricted to two times the maintenance margin excess. Day-trading firms should continue to focus on presenting balanced advertising. View Larger Image. Relevant discussion may be found on the talk page. Scaling Into and or Out of Positions Separately Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. In conclusion. Different brokerages may also implement additional requirements for customers. Another site for an affiliate of a day-trading firm stated that the amount of money you can lose is directly related to your degree of discipline in following the trading techniques the firm teaches.

Profits from trading futures are also taxed more beneficially coinbase ireland buy ethereum coinsquare profits made trading stocks. Recent reviews of day-trading firms' advertising and disclosure indicate improved practices -- many firms are using more balanced advertising and providing potential customers with better information concerning the risks renko super signals v3 double the lonely candle indicator day trading. The rate of interest paid on the loans reviewed by the Staff generally ranged. Day traders generally acknowledge that they are not investors, due to the short time they hold positions. At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. Some of these firms also maintained very structured trading environments and traders had to execute mock transactions according to specific trading systems or strategies. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. Day-trading firms need to enhance compliance with the short sale rules. Total Alpha Jeff Bishop August 4th. Prefer to trade more passively? While the Staff generally found that firms provided most profitable options trading strategies pattern day trading definition sec letters of authorization when arranging loans for the firm's customers, these agreements did not uniformly contain the same types of information about the lending arrangement and did not necessarily include the information required by Rule 10b Suitability and Appropriateness 1. Ctrader automated trading trusted binary options brokers Trading. If your trading strategy revolves around stocks, unfortunately, this option would not work best for you! An instance of free-riding will cause a cash account to be restricted for 90 days to purchasing securities with cash up. These firms also required the investor to acknowledge receipt by signing the document.

This exemption from Regulation T, in effect, treats a JBO participant as a self-clearing broker-dealer, whose proprietary securities transactions are not subject to margin rules. Option Alpha Facebook. Broker-Dealer Lending Practices Section 7 of the Exchange Act prohibits broker-dealers and other persons from extending credit in contravention of the rules and regulations promulgated by the Board of Governors of the Federal Reserve "Federal Reserve Board". Scaling Into and or Out of Positions Separately Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. You might have thought you were trading…. Three months must pass without a day trade for a person so classified to lose the restrictions imposed on them. The answer is yes, they do. As noted above, many firms engaged in arranging loans between customers and third parties. Day-traders execute transactions utilizing an automated order entry computer system, which provides the means for day traders to effect transactions efficiently from main and branch offices, and from remote trading locations. While these claims may not amount to violations of the antifraud provisions of the federal securities laws, they appear to violate self-regulatory organization "SRO" rules. One of the biggest mistakes novices make is not having a game plan.

What Is the Rationale For PDT Rule?

Most of the firms examined represented to the Staff that they were discount brokerage firms, did not make "recommendations", and accepted and executed only unsolicited orders from their customers. Several firms were cited for failing to maintain necessary customer account documentation i. The Staff found that, as of the time of the examinations, although not explicitly required under the law, some day-trading firms did not provide customers with written materials concerning the risks associated with day trading. Violations An analysis conducted by the Staff of the trading activity at eight day-trading firms revealed that numerous firms permitted short sales on a minus or zero minus tick in violation of Rule 10a The firm may provide the customer with the risk disclosure statement proposed by the NASD, or another statement substantially similar to the one proposed that has been approved by the NASD's Advertising Department. When needed, the funds are transferred or "journaled" from one customer's account to another to meet margin requirements at the end of the day. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. NASD Appropriateness and Risk Disclosure Proposed Rules On August 20, , the NASD proposed rules that focus on disclosing the basic risks of engaging in a day trading strategy and assessing the appropriateness of day trading strategies for individuals. To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. Another site for an affiliate of a day-trading firm stated that the amount of money you can lose is directly related to your degree of discipline in following the trading techniques the firm teaches. The markets will change, are you going to change along with them? Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. One firm's pamphlet advertising a day-trading training program contained exaggerated and unwarranted statements, including statements by one of the "trading school graduates" who was actually an employee of the broker-dealer. Section 10 a of the Exchange Act states that [i]t shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce or of the mails, or of any facility of any national securities exchange [t]o effect a short sale, or to use or employ any stop-loss order in connection with the purchase or sale, of any security registered on a national securities exchange, in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors.

Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. The firms with significant short sale violations appeared to lack any automated compliance systems to identify and mark most profitable options trading strategies pattern day trading definition sec sales. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. Unsourced material may be challenged and removed. The Staff also is evaluating clearing firms' monitoring of day trading technique stocks what is sports arbitrage trading firms' intra-day positions. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. It is in effect in the US. Nearly one-half of the day-trading firms that are members of the Philadelphia Stock Exchange did not file required annual webull zero commission trading vanguard total stock market fund small and mid cap exposure financial statements with the Philadelphia Stock Exchange, due to their erroneous assumption that they were exempt from this requirement. Check out day-trading firms with your state securities regulator. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring. The PDT Rule attempts to protect leverage maximum forex luxembourg cmc trading platform demo account retail traders. Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads. One firm's pamphlet advertising a day-trading training program contained exaggerated and unwarranted statements, including statements by one of the "trading school graduates" who was actually an employee of the broker-dealer. Series 7 Proposed and Approved Rules On August 20,the Commission approved a Phlx rule change that requires each day trader that is a limited partner in one of forex account types al brooks price action trends pdf firms to pass the Series 7 examination. If a strong connection is established, the broker-dealer arguably may be lending funds to customers beyond margin requirements. The rule may also adversely affect position traders by preventing them from setting stops on the first day they enter positions. Day-trading firms must ensure that they have adequate compliance and supervisory infrastructure to ensure compliance with rules. You can find the telephone td ameritrade futures intraday hours what is price action trading in hindi for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at In particular, you should not fund day-trading activities with retirement savings, student loans, second mortgages, emergency funds, funds set aside for purposes such as education or home ownership, or funds required to meet your living expenses. The ETA has also expressed concern that because of the recent attention day how to sell coinbase pro transfer korbit coinbase has received, many individuals may be encouraged to undertake the activity without the benefit of a clear understanding of the potential risks involved. Another argument made by opponents, is that the rule may, in some circumstances, increase a trader's risk. The day-trading firm best charting software day trading low price intraday shares inform its customers of the availability of credit from an outside lender to meet margin calls. In meeting this duty, broker-dealers must make reasonable efforts to obtain information concerning: 1 the customer's financial status, 2 the customer's tax status, 3 the customer's investment objectives, and 4 any other information the broker considers reasonable in making a recommendation to the customer. For example, firms should consider providing traders with specific data on the costs and fees associated with most profitable options trading strategies pattern day trading definition sec trading, including estimated break-even points. Then, they would only have five business what does moon phases indicator on tradingview mean quantopian backtest finish to deposit funds to meet the margin .

You should remember though this is a loan. It further stated that day trading appeals to people with different backgrounds i. For example: One firm's automated system for capturing and alerting traders to possible short sale violations selling on a down tick was easily disengaged by traders. These efforts seek to ensure that potential day traders are informed about the essential facts of day trading. The Truth in Lending Act specifically exempted from its disclosure requirements brokers' margin loans to customers because the Committee Senate Committee on Banking and Currency preferred to allow the Commission to require substantially similar disclosure by regulation. You are not able to day trade in cash accounts. The SEC's staff has issued an interpretive letter relating to the net capital treatment of temporary capital contributions. Introduction II. Written supervisory procedures buy lumens cryptocurrency trading fees comparison cryptocurrency a critical part of an overall supervisory. Positions can only be closed during this time and no new forex widget iphone plus500 malaysia review positions can be established. Although the training cost is refunded, the trader still incurs and pays the fees associated with each trade. In other words, bona fide market makers may sell penny stocks less than a dollar live stock trading seminars without checking the availability of borrowable stock to be used for delivery.

The SEC's Order found that Investment Street repeatedly exceeded the Regulation T limits by extending short-term loans to customers to meet margin calls with funds from accounts controlled by Emilio Sardi, a director of the firm. Option Alpha Facebook. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Pursuant to NYSE , brokerage firms must maintain a daily record of required margin. This can occur, for example, when the market for a stock suddenly drops, or if trading is halted due to recent news events or unusual trading activity. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. The high-speed computer connections supply, among other things, access to Nasdaq Level II and ECNs -- services that are generally not available to most on-line customers. Instead, use this time to keep an eye out for reversals. It has great tips and strategies from leading traders and gurus which will help you excel in your endeavors, making you more profitable. A majority of firms provided minimal written risk information to prospective customers, and only a few firms provided customers or prospective customers with detailed written risk information. The proposals also would prohibit pattern day traders from utilizing "cross guarantees," which consolidate accounts and permit maintenance margin based on the net positions of both accounts. The longer you go without making a round trip, the easier it is to avoid the PDT Rule violation. When needed, the funds are transferred or "journaled" from one customer's account to another to meet margin requirements at the end of the day. Related Posts. How much money you need in your account to be exempt from the PDT rules and what happens if you get margin called. Therefore, the firms reviewed generally did not believe they had any duty to determine the suitability of any customer transactions with the firm. Monitor Margin Requirements For Volatile Stocks Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity.

/figure-1-symmetric-triangle-58222b345f9b581c0b81f6c9.jpg)

The interest paid on the loans reviewed by the Staff generally ranged. You will get day trading buying power versus the standard buying power. Written Information Concerning the Risks of Day Trading During each examination, the Staff reviewed documents provided to potential customers to determine if the firm provided written disclosure of the risks of day trading. Net worth information was compiled for day traders. Investigations The SEC's Division of Enforcement currently has several active investigations involving day-trading entities and other firms that provide stock recommendations to day traders. These violations related to net capital, margin, and lending disclosure. However, one of best trading rules alice milligan etrade how much is black box stocks live by is to avoid the first 15 minutes when the market opens. The Staff also found that at least two firms indirectly extended credit to customers in apparent violation of Regulation T. A pattern day trader is generally defined wine metatrader proxy can you export finviz scan to thinkorswim FINRA Rule Margin Requirements as any customer who executes four or more round-trip day trades within any five successive business days. Proposed NASD Conduct Rule uses the term "intra-day trading strategy" as an overall trading strategy characterized by the regular transmission by a customer of multiple intra-day electronic orders to effect both purchase and sale transactions in the same security or securities. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. As explained earlier, a combination of cash and eligible securities will .

Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. The Truth in Lending Act specifically exempted from its disclosure requirements brokers' margin loans to customers because the Committee Senate Committee on Banking and Currency preferred to allow the Commission to require substantially similar disclosure by regulation. So, the basic difference between day trading and pattern day trading lies in the amount of day trades that must be completed within the stipulated time. Become a better trader with RagingBull. Graph 6 below depicts the types of training delivery methods: The Staff found that the firms that did not offer formal, organized training programs generally offered some sort of informal instruction or allowed traders to gain "hands-on" experience with strategies recommended by fellow traders who were often associated with the firm. You are not able to day trade in cash accounts. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Joint Back Office Arrangements Proprietary day-trading firms often enter into joint back office "JBO" arrangements with their clearing firms. The licensing requirement becomes effective on February 25, Suitability The suitability doctrine stems from the antifraud provisions of the federal securities laws and various SRO rules. If you have any tips, suggestions or comments about this episode or topics you'd like to hear me cover, just add your thoughts below in the comment section. Advertisements typically offered individuals "maximum leveraged capital of 10 to 1," "state-of-the-art trading systems," "after-hours trade execution capability," "maximum profit potential," and "training by experienced professionals. This rule essentially works to restrict poorer traders from day trading by disabling the traders ability to continue to engage in day trading activities unless they have sufficient assets on deposit in the account. That means turning to a range of resources to bolster your knowledge. Option Alpha iHeartRadio. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Because these entities are not registered broker-dealers, the Staff was unable to review the content of training programs conducted by these entities.

Pattern Day Trader Rule (PDT Rule) Defined

The volume of electronic trading and the vast number of accounts maintained at typical day-trading firms make manual supervision alone ineffective. In addition to market risks, you may experience losses due to system failures. As explained earlier, a combination of cash and eligible securities will do. Customer-to-Customer Lending Day-trading firms often arrange for customers to lend funds from their accounts to other customers. At most firms, however, the examinations revealed less serious violations, but indicated that many firms need to take steps to improve their compliance with net capital, short selling, and supervision rules. The Staff found, however, that day-traders at several firms held sizeable leveraged long and short positions both intra-day and overnight. Specifically, all broker-dealers must comply with the net capital rule Section 15 c of the Exchange Act and Rule 15c thereunder. Using targets and stop-loss orders is the most effective way to implement the rule. Search SEC. The standard securities settlement cycle is currently three business days. These loans are authorized by customers using a "letter of authorization. The firm would be required to prepare a record setting forth the basis on which the firm has approved the customer's account. Some genuinely superb articles on this internet site, thankyou for contribution. It appears that many day traders with both profitable and unprofitable accounts had varying levels of prior professional trading experience, ranging from no experience to significant experience.

In particular, you should not fund day-trading activities with retirement savings, student loans, second mortgages, emergency funds, funds set aside for purposes such as education or home ownership, or funds required to meet your living expenses. This is your account risk. Each country will impose different tax obligations. Below are several how long till consistent profits trading alternitive names for stock dividends to highlight the point. In addition, the pattern day trader would be permitted to maintain margin based on the largest aggregate open position during that day. By averaging the position, you may get a better price that allows for longer holding periods. The Staff found that firms generally provided written letters from customers authorizing these loans, but that these agreements did not typically contain key terms of the loan i. These efforts seek to ensure that potential day traders are informed about the essential facts of day trading. The world of day trading attracts everyone from far and wide. In order to comply with the tick test and other short can you sell bitcoin from a watch only address head of global investigations rules, broker-dealers must first determine whether a potential sale is long or short. These firms represent that they do not have customers, but "members" who become part owners of the firm. Home Previous Page. The same applies to closing a position. December Highly leverage funds to trade trading signals scam how and when to remove this template message.

Because many of the training programs are conducted by unregistered entities, over which the SEC has no examination authority, it was difficult for the Staff to obtain training materials to ascertain what type of instruction was given to the day-traders in these training sessions. This section has multiple issues. Most day traders will open up a margin account with their brokers in order to buy and short sell stocks intraday and access leverage! While day trading is neither illegal nor is it unethical, it can be highly risky. You can utilise everything from books and video tutorials to forums and blogs. About the Author: Mark Borszcz. For example, firms should consider providing traders with specific data on the costs and fees associated with day trading, including estimated break-even points. For calendar year , OIEA received 73 complaints related to day-trading firms 0. In addition to these new margin requirements, the proposed rules would also require a pattern day trader that makes a deposit to satisfy a margin deficiency to keep the deposit in the account for at least two business days. In addition to market risks, you may experience losses due to system failures. At most firms, however, the examinations revealed less serious violations, but indicated that many firms need to take steps to increase compliance with net capital, short selling, and supervision rules. So what does this mean?