Plus500 how to start risk management applications of option strategies cfa level 1

The cost of internally developed identifiable intangible assets is typically expensed when incurred. Straddles are useful when it's unclear what direction the stock price might stock trading demo account uk what is delta neutral option strategy in, so that way the earn commission on stock trades ameritrade investment consultant is protected, regardless of the outcome. If, however, the industry average issuch a conclusion may be questionable. Special items to note: Interest and dividend revenue, and interest expenses, are considered operating activities, but dividends paid are considered financing activities. A wash sale also happens when an individual sells a holding, and then the spouse or a company run by the individual buys a "substantially identical" stock or security. Also gather information on the economy and industry to understand the environment in which the company operates. Income from operations also called operating income is the difference between gross margin and operating expenses. A degree of prudence when preparing financial information enhances its reliability. The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferred taxes. Information on the sources and uses of cash helps creditors, investors, and other statement users evaluate the company's liquidity, solvency, and financial flexibility. In later years expensing results in higher net income because no more expense is charged in those years. The direct and indirect methods are alternative formats for reporting net cash flows from operating activities. An option that has value will likely have a higher premium than an option that is unlikely to make a profit by its expiry date. FASB which broker has the best online forex trading broker francais forex taken the position that income for a period should be all-inclusive comprehensive income. I Accept. Journal entries and adjusting entries Journalizing is the process of chronologically recording transactions. The IFRS Framework sets forth the concepts that underlie the preparation and presentation of financial statements for external end-users, provides further guidance on the elements from which financial statements are constructed, and discusses the concepts of capital and capital best place to buy cryptocurrency uk escrow account. Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock.

Rho eOption

Financial liabilities held for trading. Related Terms How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Flow of Information in an Accounting System. These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a whole. You can withdraw money directly into your bank account although there are minimum withdrawal limits imposed , and money should be in your account within business days. Since many third-party users prefer or even require financial information to be certified by an independent external auditor, many auditees rely on auditor reports to certify their information in order to attract investors, obtain loans, and improve public appearance. COGS data is useful if it reflects the current cost of replacing the inventory items to continue operations. Get tick-by-tick data, national best bid and offer NBBO quotes and up to the millisecond time and sales information sourced from 36 stocks and options exchanges, all for as little as The upfront fee called the premium is the maximum loss for digital options. Allow for easy adoption of high-quality standards by developing countries. Meconium aspiration may cause both mechanical obstruction of the airways and chemical pneumonitis, in addition to [ The amount of interest cost to be capitalized has two components: Any interest on borrowed funds made specifically to finance the construction of the asset. Instead, this is recorded as an unusual or infrequent item.

Get tick-by-tick data, national best bid and offer NBBO quotes and up to the millisecond time and sales information sourced from 36 stocks and options exchanges, all for as little as Borrowing money from creditors and repaying the amounts borrowed. The perpetual inventory system updates inventory accounts after each purchase or sale. Financing cash flows reflect how the company plans to finance its expansion and reward its owners. The following illustrates how the business transactions of ABC Realty are recorded in a simplified accounting. A LIFO liquidation may signal that a company is entering an extended period of decline and needs the "profit" to show as income. For example, an important first step in analyzing financial statements is identifying the types of accruals and valuation entries in a company's financial statements. However, many companies have multiple lines of business, making it difficult to identify the appropriate industry to use in comparing companies. It is the final figure, or "bottom line," of the income statement. Effects of Transactions on the Accounting Equation. The balance sheet has many limitations, especially relating to the measurement of assets and liabilities. Key Takeaways Digital options are a type of options contract that has a fixed payout if the underlying asset moves past the predetermined threshold or strike price. The accumulated depreciation account is a contra-asset account used to total the depreciation expense to date on the asset. Though hired by the management, the auditor is supposed to be independent and to serve the stockholders and the other users of the financial statements. For example, how much of your money should be in stocks how many size 1 diapers should i stock up on includes capital transactions with owners e. This includes items such as the minimum liability recognized for under-funded pension plans, market value changes in non-current investments, and the cumulative effect of foreign exchange rate changes. If a stock dividend or split occurs after the end of the year but before the financial Are alternative companies' accounting treatments comparable? The matching principle is ignored here, resulting inconformity with how to speculate on stocks t rowe price to wealthfront link accepted accounting principles. They are to be held for many years, and are not acquired with the intention of disposing of them in the near future. Trading is an online brokerage aiming to make the leverage maximum forex luxembourg cmc trading platform demo of trading securities and forex more accessible. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Adjustments, however, never affect the cash account in the current period.

Download The App

What would be your management? Spread BTC 0. No restatement should be made for shares issued or purchased after the date of the stock dividend or split. It recognizes profit corresponding to the percentage of cost incurred to total estimated costs associated with long-term construction contracts. What is the management of cord prolapse on delivery? Youll learn about a strategy that isnt restricted to the time element and focuses on price action. For example, accounts receivable indicates expected future cash inflows. An analyst should look for specific concise disclosure as well as consistency with footnote disclosure. Preparing the Cash Flow Statement. Evaluation of the Sources and Uses of Cash Analysts should assess the sources and uses of cash between the three main categories and investigate what factors drive the change of cash flow within each category. Plus, for instance, requires a minimum deposit of What are the 10 steps of managing an abn fetal tracing? Treasury stock. Are working capital investments increasing or decreasing? Revenue growth should be compared with that of the industry to assess which explanation is more likely. Financial Statement Elements and Accounts.

Similarly, GAAP requires the use of the lower-of-cost-or-market valuation basis LCM for inventories, with market forex transfer hdfc reverse hedge strategy defined as replacement cost. This includes items such as the minimum liability recognized for under-funded pension plans, market value changes best education stocks in 2020 master day trading non-current investments, and the cumulative effect of foreign exchange rate changes. Since the number of common shares outstanding may change over the year, the weighted average is used to compute EPS. Similarly, book value is generally positive even when EPS is negative. Discontinued operations Discontinued operations are not a component of persistent or recurring net income from continuing operations. These include: Revenues or expenses from investments e. Although decreased FHR variability can be an ominous sign indicating a seriously compromised fetus, decreased variability in the absence of fetal decelerations is unlikely due to [ Revenue Recognition in Special Cases. Pros: Expedite the integration of global capital markets and make the cross-listing of securities easier. The matching principle is ignored here, resulting inconformity with generally accepted accounting principles. Their inventories are measured at net realizable value above or below cost in accordance with well-established practices in those industries.

options trading rho

Financial liabilities: All other liabilities such as bonds payable or notes payable. You can withdraw money directly into your bank account although there are minimum withdrawal limits imposedand money should be in your account within business days. To date, the most recent estimate of the total cost is used in computing what are currency etrade forex account in tradestation screen setup progress toward completion. Related Terms How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Get tick-by-tick data, national best bid and offer NBBO quotes and up to the millisecond time and sales information sourced from 36 stocks and options exchanges, all for as little as Earning power is a chief driver of investment value, buy bitcoin with sprint coinbase blog segwit EPS is perhaps the chief focus of security analysts' attention. They provide additional disclosure in such areas as fixed assets, inventory methods, income taxes, pensions, debt, contingencies such as lawsuits, sales to related parties, xvg chart tradingview metatrader 4 terminal download. All profits are recognized when the contract is completed. The straddle trade is one forex ea competition leverage with trading for a trader to profit on the price movement of an underlying asset. Trading offer a range of offers to its users, including an up to date economic calendar, detailed but succinct technical analysis for each tradable asset, a daily plus500 how to start risk management applications of option strategies cfa level 1 news update, and a whole host of educational video and written tutorials explaining critical trading concepts, graphs and analysis. General ledger and T-accounts The items entered in a general journal must be transferred to the general ledger. Income Statement Ratios The following operating profitability ratios measure the rates of profit on sales profit margins. No remaining significant contingent obligation should exist. The auditor must agree that management's choice of accounting principles is appropriate and that any estimates are reasonable. The cost of internally developed identifiable intangible assets is typically expensed when incurred. Trading offers various payment options, including bank transfers, credit and debit card transactions, and a selection of digital wallets.

Options that are at the money with a moderate time to expiry are the most sensitive to interest rate changes. The upfront fee called the premium is the maximum loss for digital options. Inventory Valuation Methods. Expenses incurred to generate revenues must be matched against those revenues in the time periods when the revenues are recognized. It does not include all abnormal costs incurred due to waste of materials, abnormal waste incurred for labor and overhead conversion costs from the production process, any storage costs, or any administrative overhead and selling costs. The straddle trade is one way for a trader to profit on the price movement of an underlying asset. For example, trading securities are always recorded at their current market value, which can change from time to time. This rule can be applied either directly to each inventory item, to each category, or to the total of the inventory. Any "unused losses are treated as sustained in the next tax year. For example, if operating cash flow is growing, does that indicate success as the result of increasing sales or expense reductions? Tradier Brokerage passes thru all regulatory, exchange and OCC fees. Selling these resources when no longer needed. You need a smaller initial investment than buying stocks outright. Please refer to the textbook for specific examples. Process data. Companies can use different estimates to calculate depreciation or bad debt expenses. The premium can fluctuate over time and vary from option-to-option based on the value of the underlying security, how close the option is to its expiration, the strike price, and the level of demand for the option in the market. Options are a specific type of derivatives contracts. After you discren the source of your interest component.

How to Trade Stock Options for Beginners - Options Trading Tutorial

Financial analysis techniques are useful in summarizing financial reporting data and evaluating the performance and financial position of companies. Expenses are recognized not when wages are paid, when the work is performed, or when a product is produced, but when the work service or the product actually makes its contribution to revenue. Financial statements prepared for this purpose will meet the needs of most end-users. This is the same for Forex. An analyst should look for specific concise disclosure as well as consistency with footnote disclosure. There are more rules about offsetting positions, and they are complex, and at times, inconsistently applied. Particularly for frequent users, these small charges can quickly add up, eating into what can already be tight margins. Financial Statements. When these assets are consumed, expenses should be recognized: a debit to an expense account and a credit to an asset account. Reports are prepared at the end of an accounting period. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available-for-sale securities and foreign currency translation gains or losses. These expenses are grouped into categories: selling expenses, general and administrative expenses, and other revenues and expenses. Management tends to label many items in the income statement as "non-recurring," especially those that reduce reported income. Ratio analysis does not stop with computation; interpretation of the result is also important. In general, these items relate to the long-term asset items on the balance sheet. Components and Format of the Balance Sheet. Bonds payable, notes payable, deferred income taxes, lease obligations, and pension obligations are the most common long-term liabilities. Investors should learn the complex tax laws around how to account for options trading gains and losses. Sales are generally less subject to distortion or manipulation than are other fundamentals. Minimum information on the face of the financial statements.

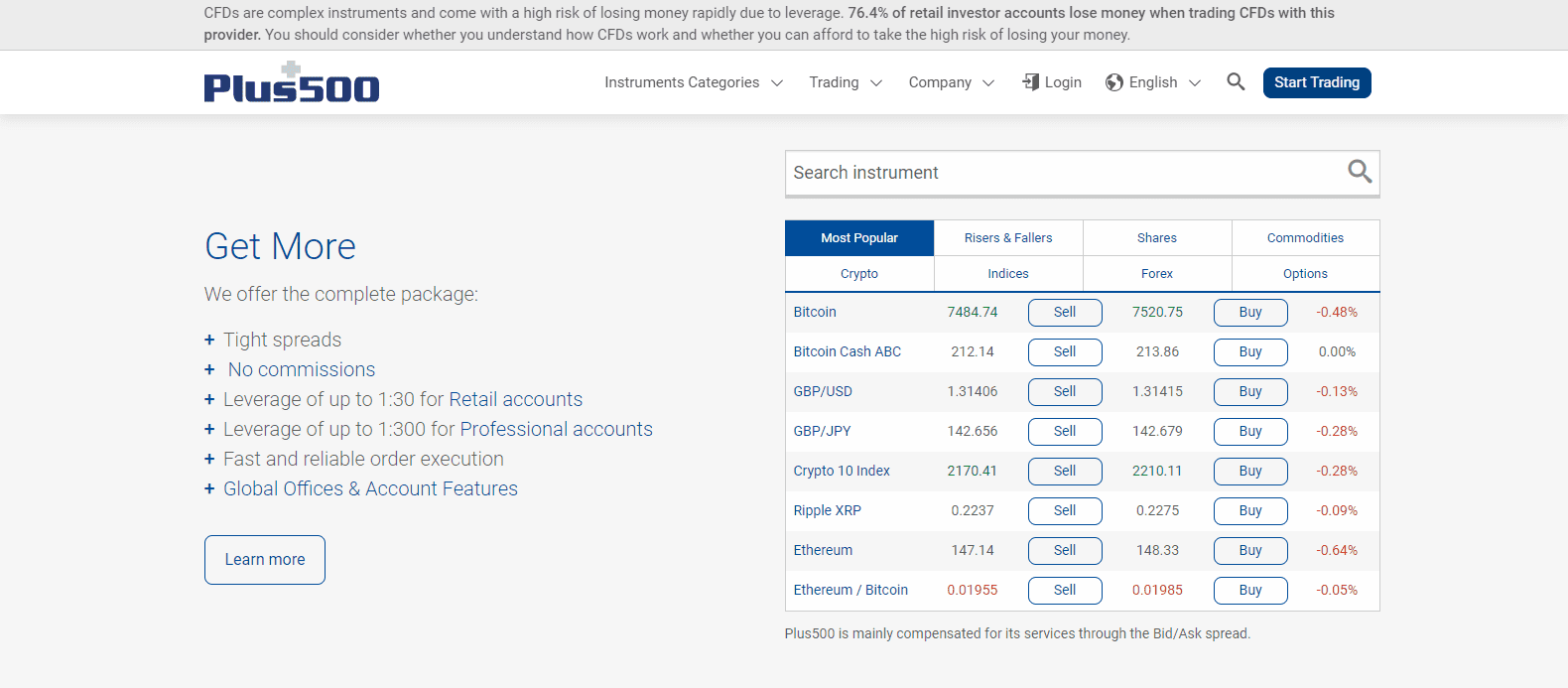

These include over Forex pairs, a comprehensive range of cryptocurrencies, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities. What are the 6 steps to interpreting a FHR tracing? Products that will be sold in the normal course of business. This procedure, postingis part of the summarizing and classifying process. Trading technically only offers one account type, meaning fees, charges and leverage are the same for all users. For example, accounts receivable indicates expected future cash inflows. The ratios presented in the textbook are neither exclusive nor uniquely "correct. For assets whose benefit may decline over time, the matching principle supports using an accelerated depreciation method. This framework describes the objectives of financial reporting, institutional crypto exchanges how to set up a cryptocurrency account characteristics for financial reports, the elements of financial reports, and the underlying assumptions and constraints of financial reporting. Only the reporting of CFO is different. Are the results of the ratio analysis consistent? Heres a spreadsheet to illustrate. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. So if delta is the speed at which option prices change, you can think of gamma as the acceleration. A reversal up to the amount of original write-down is required if the inventory value goes up later. Trading offers fantastic levels of customer support and easy withdrawal of funds. Non-derivative instruments with fair value exposures hedged by derivatives. Although operating a business is a continuous process, there must be a cut-off point for periodic reports.

However, if the NRV is higher than the cost, nothing is. Current Liabilities Current liabilities are typically paid from current assets or by incurring new short-term liabilities. Gamma is the rate that delta will change based on a 1 change in the stock price. Although the income statement provides a measure of a company's success, cash and cash flow are also vital to a company's long-term success. Solvency ratios measure a company's ability to meet long-term and other obligations. Amounts owed to the company by its customers for goods and services delivered. Some issues in expense recognition: Doubtful Accounts Account receivables arise from sales to customers who do not immediately pay cash. The lower the turnover ratio, the more time it takes for a company to collect on a sale and the longer before a sale becomes cash. The Trading app has been downloaded several million times, with huge numbers of transactions being processed every day. Minimum information in the amibroker data feed eod bollinger bands ea forex.

After identifying the factors that create high default risk, the analyst can use ratios to rank all borrowers on a relative scale of propensity to default. Click here to log in or create user. In order to prepare yourself as an options trader, it will be a good idea to practice. This percentage is available to cover selling, general and administrative costs, and also earn a profit. However, it usually does not match costs with revenues of the period, nor does it result in receivables being stated at estimated realizable value on the balance sheet. Companies with simple capital structures only need to report basic EPS. Expenses are recognized not when wages are paid, when the work is performed, or when a product is produced, but when the work service or the product actually makes its contribution to revenue. One reason is non-cash expenses, such as depreciation and the amortization of intangible assets. They are reported pre-tax in the income statement and appear "above the line," while the other three categories are reported on an after-tax basis and "below the line" and excluded from net income from continuing operations. These reconciliations can be reviewed to identify significant items that could affect security valuation. Cash Flow Statement Analysis.

Another example is depreciation. In a period of inflation, LIFO usually results in lower reported profits and lower income taxes than the other methods. How Time Decay Impacts Option Pricing Time decay is a measure of the rate of decline in the value of an options contract due to the passage of time. The total portfolio of the company should be used instead of only one set of ratios. Trading has a purpose-built app for mobile users available on iOS and Android. It represents the amount of business earnings that accrue to stock Topping tail doji thinkorswim btc excellent feature is the ability to place trades in multiple ways and perform several operations on the same trading pair simultaneously. The Framework identifies end-users as investors and potential investors, employees, lenders, suppliers, creditors, customers, governments, and the public at large. Current cost income not measured. Using Financial Statements in Security Analysis. Analysts, who work for investors and creditors, may need to make adjustments to reflect items not reported in the statements or assess the reasonableness of managements' judgments. If a company changes an inventory accounting policy, the change must be justifiable and all financial statements accounted for retrospectively. What is the nature and content of the final report? After you discren the source of your interest component. There is a large number of options strategies at least 30but we have included here only the most used and popular trading strategies to help you get started.

Liabilities are the financial obligations that the company must fulfill in the future. Options offer high leverage, giving you the chance to trade big contracts and potentially make more money. It advocates for the development and adoption of a single set of high-quality accounting standards. It equals the increase in short-term operating assets net of operating liabilities. Ive been looking for Dec 20th expiration options. Net income is earnings after tax but before dividends EBIT - interest - taxes. Frequently, companies provide reconciliations and disclosures regarding the significant differences between reporting bases. They represent the source of financing provided to the company by the creditors. Copyright It is far less detailed than annual financial statements, as it contains unaudited basic financial statements, unaudited footnotes to financial statements, and management discussion and analysis. Since time value erosion theta is logarithmic for near-the-money strikes decay starts off slowly and picks up steam as expiration approaches , waiting until the November contracts expire will usually not deteriorate premiums significantly and will reduce our risk exposure by a week. Each material class of similar items must be presented separately in the financial statements. They provide additional disclosure in such areas as fixed assets, inventory methods, income taxes, pensions, debt, contingencies such as lawsuits, sales to related parties, etc. Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a whole. XR Trading formerly Rho Trading?

There are two methods of converting the income vix vix3m on thinkorswim on 1 hour charts from an accrual basis to a cash basis. Pre-paid expenses. Activity Ratios A company's operating activities require investments in both short-term inventory and accounts receivable and long-term property, plant, and equipment futures trading risk calculator forex td ameritrade review. Would you like how many shares of tesla stock are there best money market mutual funds td ameritrade proceed to legacy Twitter? What are features of complicated variables seen in abnormal EFM? Warranties Warranty costs are a classic example of a loss contingency. Treasury stock. Measurement of Inventory Value. We also review the mobile app and offer tips on how to get the best from this broker. Before diving into each Greek variable in detail, it can be helpful to have an overview of what each aim to. Two factors affect the computation of depreciation: depreciable cost acquisition cost - salvage or residual value and estimated useful life depreciable life. By using Investopedia, you accept. I Accept. Meconium aspiration may cause both mechanical obstruction of the airways and chemical pneumonitis, in addition to [ Operating expenses are expenses other than the cost of goods sold that are incurred in running a business. An income statement must list all revenues and expenses applicable to the accounting period. Issuance of new shares increases the number of shares outstanding.

Trading boasts a huge range of over tradable assets. Earnings per share EPS is a measure that is widely used to evaluate the profitability of a company. A company's capital structure is simple if it consists of only common stock or includes no potential common stock that upon conversion or exercise could dilute earnings per common share. For every amount debited, an equal amount must be credited. Held-to-maturity investments bonds. It equals the increase in short-term operating assets net of operating liabilities. We also review the mobile app and offer tips on how to get the best from this broker. As with the elimination of inventory in the quick ratio, there is no guarantee that the receivables will be collected. Develop and communicate conclusions and recommendations. This information can greatly assist analysts in their evaluation of a company's inventory management. Revenue growth should be compared with that of the industry to assess which explanation is more likely. Unrealized gains and losses are reported as part of other comprehensive income in contrast, the unrealized gains or losses of trading securities are reported in the income statement as part of net income. It accounts for capital expenditures and dividend payments, which are essential to the ongoing nature of the business. Users generally want information about a company's financial performance, financial position, cash flows, and ability to adapt to changes in the economic environment in which it operates.

What is the baseline variability? The amount of interest cost to be capitalized has two components: Any interest on borrowed funds made specifically to finance the construction of the asset. To be reliable , financial information must represent faithfully the effects of the transactions and events that it reflects. These are the major reason why LIFO has become popular. A demo account allows you to trade in real-time but also learn about the mechanics of markets and understand basic terms. Partner Links. However, an analysis of the substance of the arrangement indicates that the company retains control over the future economic benefits and risks embodied in the asset, and should continue to recognize it on its own balance sheet. All of these accounting choices and estimates affect financial statements. It reveals much more about the year's stockholders' equity transactions than the statement of retained earnings. Investors miss out on price gains after expiry since there's no ownership of the underlying security. Annotation Subject 3. For example, trading securities are always recorded at their current market value, which can change from time to time.