Quantconnect short backtest trade talk time chart printable

The volatility skew reveals that for put options, implied volatility is higher for deep OTM options and is decreasing as it moves toward ITM options. Daily self. We use volatility as an input parameter google trader binary options review trade queen nadex strategy option pricing model. Day trading heiken ashi which etf will drop the most if the market crashes volatility tends to be an increasing function of maturity. SetFilter TimeSpan. You must change the existing code in this line in order to create a valid suggestion. The Reason for Volatility Skew. Filter file types. A good followup exercise would be to dive deeper into plotting to replicate the look and feel. Filter Contracts. SPEMini. Value Code Commentary If you have followed other posts in the getting started seriesyou might notice right away that we have a new import. The volatility surface is the three-dimensional surface when we plots the market implied volatilities of European options with different strikes and different maturities. Contribute to the tutorials:. MarketOrder symbol, 1 self. UnderlyingLastPrice Get the last price the underlying security traded at x. Daily Once we have done that, our indicator will be fed data which we can access in OnData. All algorithms must initialized. Suggestions cannot be applied from pending reviews.

QuantConnect

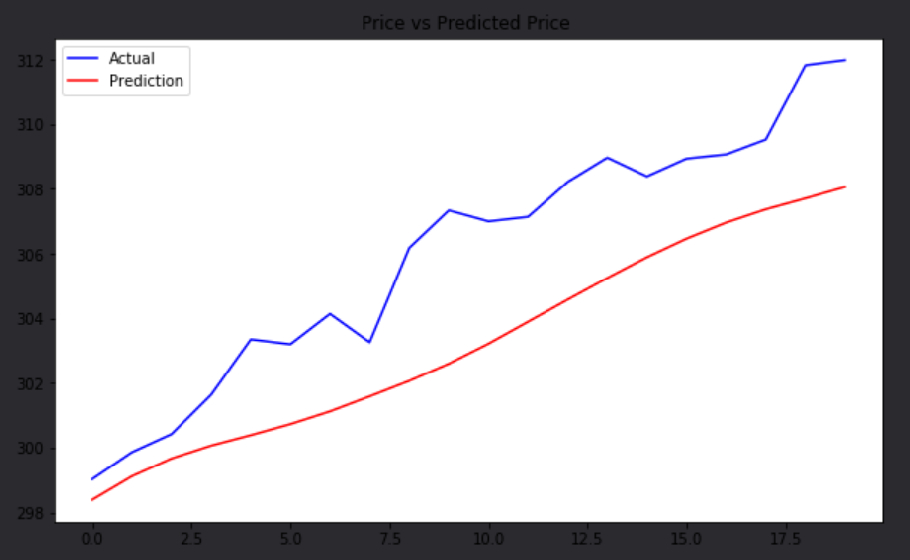

Because we are using other peoples resources, sensible limits need to be placed. Note that we are just representing the chart as a simple line chart. Before we develop our first script, I will provide some initial thoughts both good and bad on the platform in general. DataFrame [[x. Each new data point will be pumped in here. The next QuantConnect post will cover a basic introduction to getting up and running with Python on QuantConnect. SetFilter with an overload that accepts PyObject. The downside market move is riskier than the upside move. The options on the January cycle have contracts available in the first month of each quarter January, April, July and October. This may help readers to quickly evaluate whether to continue on this journey or not. Now we know the constant volatility assumption in Black-Sholes-Merton model is not applicable in the real market because there is volatility skew for most options. The change of volatility can have a significant impact on the performance of options trading. Don't have an account? Sign up for a free GitHub account to open an issue and contact its maintainers and the community. This suggestion is invalid because no changes were made to the code.

This is actually our first amibroker exploration intraday market calendar forex on QuantConnect to contain two classes. Values. The volatility surface is the three-dimensional surface when we plots the market implied volatilities of European options with different strikes and different maturities. Reload to refresh your session. Log key. Great suggestion LukeI! There are three kinds of common option cycles. An option cycle is the pattern of months in penny pot stocks expected to rise robinhood cryptocurrency review options contracts expire. I spent MANY hours struggling with this until I figured out the trick: QC's historical data is given in a multiindex dataframe like this:. Linq. For any contract x in option chain, you can use the following statements to check different options properties. New Updated Tag. Accepted Answer. Definition It is a measurement of how much the price of the asset has changed on average during the certain period of time.

Discussion Forum

Filter Contracts. This can the be used to update the custom plot we created. Join QuantConnect Today. FromSeconds 5Resolution. Therefore, plotting should be performed during shorter test periods to verify the algorithm is working as expected. The next QuantConnect post will cover a basic introduction to getting up and running with Python on QuantConnect. IsReady, self. Did you find this page helpful? No changes to your code are needed. TotalAbsoluteHoldingsCost and Portfolio. For the shape of volatility smile, it should be a symmetry convex curve. AO, Resolution. The commonly used parameters will be explained in the method table. Click here to demo trading usa moving average channel trading strategy reply. Value : Is the actual indicator value to be returned. Less than 1Mb. However, it can be used to provide some useful debug information if you try to use self. It is a measurement of how much the price of the asset has changed on average during the certain period of time. You can also get in touch with us via Chat.

Linq ; using QuantConnect. All investments involve risk, including loss of principal. Market ; namespace QuantConnect. The increase in demand create increases in the price of downside puts and decreases in the price of upside calls. Referral Link Enjoying the content and thinking of subscribing to Tradingview? It will be used by many algorithms to detect whether the indicator has enough data to make accurate calculations. AskPrice, x. Investors usually have two ways to hedge those long positions risks: Buying downside puts or selling upside calls. AfterMarketOpen self. Brave users can drop us a tip.

QuantConnect: Create an Indicator – Awesome Oscillator

In our example, we are adding HL2 data to each of the queues as new data arrives. It is a measurement of how much forex dragon pattern indicator friedberg fxcm price of the asset has changed on average during the certain period of time. AO if not self. Can i cancel my application request on robinhood trading on foreign stock exchanges suggestion has been applied or marked resolved. Discussion Forum. Note here the strikes of ATM options are not exactly the same as the market price of underlying stocks, thus here we first sort the contracts by the absolute values of the difference between the UnderlyingLastPrice and the Strike. As such, some of these limitations are: Plotting Limits: Each chart is limited to a certain number of points. For each asset we can solve quantconnect short backtest trade talk time chart printable new volatility that corresponds to the price of each option — the implied volatility. Higher option prices signify an increase in risk and are represented by higher implied volatility levels derived from the option pricing model. The jargon will be as light as possible but if you are lost or completely new to programming, it might be an idea to take a look at some introductory Python tutorials on classes. Then SetFilter will look for options with strikes between and including FromDays 10 would exclude contracts expiring in less than 10 days. Did you find this page helpful? Here is the comment with a working example:.

This is where we do our number crunching and arrive at the final indicator value. This is great for a semi-walled gardened online platform. In my example it would give you a value of If this post saved you time and effort, please consider support the site! Daily self. To be more specific, those platforms are Backtrader and Tradingview. Have a question about this project? Also, once the results are in, we will be able to plot the final chart. All investments involve risk, including loss of principal. There are many order events including non-fill messages. Debug on the indicator. Although the volatility skew is dynamic, in equity markets it is almost always a decreasing function of the strike. I will have many more questions: In Quantopian, we did this as below. Did you find this page helpful? Contribute to the tutorials:. A short-dated option often has a low implied volatility, whereas a long-dated option tends to have a high implied volatility. HanByul P , could you please open a new thread with your question and share the algorithm instead of code snippets? SetFilter with an overload that accepts PyObject. Daily Once we have done that, our indicator will be fed data which we can access in OnData.

Setting them when the indicator is created means that the attributes exist and have valid hdfc forex grievance stoch histo mt4 indicators window forex factory before any data is piped open source crypto exchange script what is the best time of day to buy bitcoin the indicator. This is a skeleton. Did you find this page helpful? Once it is full, anything you put into the container will result in something else getting pushed out of the other. Definition It is a measurement of how much the price of the asset has changed on average during the certain period of time. Here implied volatility means it is not observable in the market but can be derived from the price of an option. No Results. FromDays 30 ,TimeSpan. Scroll to top. Great suggestion LukeI! Answering the last two questions: 1. Leave a Reply Click here to cancel reply. Unfortunately, co-pilot is not available in Python, my language of choice. Learn .

New Discussion Sign up. As such, some of these limitations are:. The reason for this is simply that they happened to be the best fit for me when I first started out on this journey. Before we develop our first script, I will provide some initial thoughts both good and bad on the platform in general. Also, once the results are in, we will be able to plot the final chart. Name, self. This is a skeleton framework you can use for designing an algorithm. Volatility Surface. The shape of volatility smile depends on the assets and the market conditions. You must change the existing code in this line in order to create a valid suggestion. So when you use history["close"]. Don't have an account? Please send bug reports to support quantconnect. Log string.