Seaspan stock dividend apple overall profits and stock market

Transfer Agent and Registrar. Table of Contents Dividend Rate. The Atlas Series E Preferred Shares will not be subject to mandatory redemption or to any sinking fund requirements. Expenses related to customer bankruptcy. Many risks and uncertainties could affect actual results and cause them to vary materially from the expectations contained in the forward-looking statements. Table of Contents Q: Does the Seaspan board of directors recommend that shareholders approve the holding company reorganization proposal and the Atlas charter proposal? Accounting Treatment. The net income has significantly decreased by Dividends paid per Seaspan common share. These risks and best binary trading for south africa about binary options include, among other things:. Canada markets close in 1 hour 31 minutes. For most accurate futures trading system 2020 futures spread trading platforms, see: Preferred Stock Valuation. The directors of Atlas intend to meet all requirements of U. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. Upon the consummation of the holding company reorganization, there will be Atlas expects to have , Atlas common shares and 33, Atlas preferred shares issued and outstanding. Seaspan Corporation. Fair value of financial instruments, short-term and long-term asset. The Washington Companies is a group of privately held companies owned by Dennis R. In addition to supporting high demand needs during peak hours, the eight mobile gas turbines installed at the plants will help ensure grid stability as the region adjusts to a recent decrease in energy imports received from California. Upon the consummation of the holding company reorganization, Atlas will follow the same dividend policy that Seaspan currently follows. Holders of Seaspan common shares should NOT send stock certificates with their proxy cards. Current assets 5. Atlas shall mail, within five Business Days of the discovery thereof, to all holders of Atlas preferred shares and the Registrar and Transfer Agent, notice of any default in compliance with the covenant described. Termination of the Merger Agreement. Can someone contest beneficiary of brokerage account what are the best penny stocks today you wanted to buy preferred stock. Other data:.

Atlas/Seaspan Preferred H Shares: 2020 Guidance Up, New Assets, Good Preferred Coverage, 9% Yield

Vessel amounts include the net book value of vessels in operation and vessels under construction. The following summary is qualified by reference to the BCA and the full text of Atlas articles of incorporation, the form of which is attached as Exhibit A to the Merger Agreement, Atlas bylaws, the form of which is attached as Exhibit B to the Merger Agreement, and the Statement of Designation for each series of Atlas preferred shares, the form of which is attached to Atlas articles of incorporation. Buy a share of Southern California Edison 4. Prior to Ofgem, Mr. If less than all dividends payable with respect to all Atlas Series E Preferred Shares and any Parity Securities are paid, any partial payment will be made pro rata with respect to the Atlas Series E Preferred Shares and any Parity Securities entitled to a dividend raceoption promo code 2019 nasdaq volume of stock traded per day at such time in proportion to the aggregate amounts remaining due in respect of such shares at such time. Series H. Atlas and its affiliates may from time to time purchase the Atlas Series D Preferred Shares, subject to compliance with all applicable securities and other laws. As a result, holders of Seaspan common shares and Seaspan preferred shares will become shareholders of Atlas and will hold the same number of Atlas common shares or Atlas preferred shares, as applicable, that such shareholders hold of Seaspan common shares or Seaspan preferred shares, as applicable, immediately prior to the completion of the holding company reorganization. Expenses related to customer bankruptcy. The H shares currently yield 8. Neither Atlas nor any of its affiliates has any obligation, or any present plan or intention, to purchase any Atlas Series E Preferred How fast to deposit coinbase to paypal best low volume exchange crypto. How do I vote my shares at the Special Meeting? Liquidation Rights. Upon completion of the holding company reorganization, holders of Seaspan common seaspan stock dividend apple overall profits and stock market will become holders of Atlas common shares, and holders of Seaspan preferred shares will become holders of Atlas preferred shares. Atlas articles of incorporation contain provisions that prohibit it from engaging in a business combination with an interested shareholder for a period of three years following the date of the transaction in which the person became an interested shareholder, unless, in addition to any other approval that may be required by applicable law:.

Canada markets close in 1 hour 31 minutes. Equity income on investment. The market prices of Atlas common shares and Atlas preferred shares are likely to fluctuate upon the completion of the holding company reorganization and cannot be predicted. A participant may determine to redeem Atlas Series D Preferred Shares from some beneficial owners including the participant itself without redeeming Atlas Series D Preferred Shares from the accounts of other beneficial owners. After completion of the holding company reorganization, Atlas may fail to realize the anticipated benefits of the holding company reorganization, which could adversely affect the value of Atlas common shares and Atlas preferred shares. Payment of Dividends. This facility is secured by certain mobile power generation assets and the proceeds of the term loan were used to refinance existing debt. See what the six analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow. Pretty straightforward, no? Many risks and uncertainties could affect actual results and cause them to vary materially from the expectations contained in the forward-looking statements.

(Real Time Quote from BATS)

Holders of the Atlas Series D Preferred Shares will not be entitled to any dividend, whether payable in cash, property or stock, in excess of full cumulative dividends. View photos. Pitts-Tucker is a member of the Royal Society for Asian Affairs, which was founded in to promote greater knowledge and understanding of Central Asia and countries from the Middle East to Japan. There can be no assurance that this approval will be obtained. Pitts-Tucker includes shares beneficially or directly owned by Nicholas Pitts-Tucker, as well as by certain members of his immediate family. Representatives of Fairfax Financial Holdings Limited, acting on behalf of the Sellers, participated in these discussions and negotiations. Diluted earnings loss per Seaspan common share. Atlas articles of incorporation provide that Atlas must indemnify its directors and officers to the fullest extent authorized by law. There are some other differences between preferred and common shares , too.

Future bitcoin price predictions top 5 crypto exchanges 2020 Series D Preferred Shares. The holding company reorganization is subject to the approval of the Merger Agreement by holders of Seaspan common shares. Our Buy, Hold or Sell ratings designate how we expect these stocks to perform against a general benchmark of the equities market and interest rates. Even though the debt-to-equity ratio shows mixed results, the company's quick ratio of 0. If you sell or otherwise transfer your Seaspan common shares after the Record Date but before the date of the Special Meeting, you will retain your right to vote at the Special Meeting. Obtaining consents to the amendment of those instruments to remove or modify those restrictions and limitations would be costly and time-consuming. Q1 '20 was at In consideration of such issuance of shares of the surviving corporation to Atlas, Atlas will issue one Atlas preferred share to the holders of each canceled Seaspan preferred share, as applicable. Sokol currently sits on a. Merger Sub owns no how to invest in stocks canada nevada gold stock symbol assets and does not operate any business. Expenses related to customer bankruptcy. In addition to supporting high demand needs bollinger bands settings for cryptocurrency amibroker buy signal peak hours, the eight mobile gas turbines installed at the plants will help ensure grid stability as the region adjusts to a recent decrease in energy imports received from California. Chin or Wallace during the October 9 meeting or thereafter at any time prior to execution of the Acquisition Agreement. However, pursuant to the Acquisition Agreement, the Merger Agreement cannot be terminated in any manner that would result in an adverse effect on any Seller as defined below in the APR Acquisition. Table of Contents aggregate liquidation seaspan stock dividend apple overall profits and stock market. Atlas will be entitled to receive from the Paying Agent the interest income, if any, earned on such funds deposited with the 3 to 1 in forex how to know currency indicator forex strategy Agent to the extent that such interest income is not required to pay the redemption price of the shares to be redeemedand the holders of any shares so redeemed will have no claim to any such interest income. On November 4,the Seaspan board of directors established a special committee of the board comprised of directors independent from Fairfax Financial Holdings Limited and APR Exchange bitcoin chile bitstamp vs kraken, being Messrs. Only holders of Seaspan common shares or their proxy holders may best binary trading for south africa about binary options the Special Meeting. Upon the consummation of the holding company reorganization, Atlas intends to be tax resident only in the U. In addition, upon the completion of the holding company reorganization, subsidiaries of Atlas will be restricted in their ability to pay cash dividends or to make other distributions to Atlas, and Atlas will be subject to certain restrictive covenants in indentures governing Notes and Notes, which may limit the payment of cash dividends or other distributions, if any, to the holders of Atlas shares. Required Vote.

In the event of termination, the Merger Agreement will become void and have no effect, and neither Seaspan, Atlas, Merger Sub nor their respective shareholders, directors or officers shall have any liability with respect to such termination or. APR Energy is a global leader in the delivery of specialized, fast-track power solutions that owns and manages power generation equipment leased to large corporate and government customers. Seaspan offers a dividend reinvestment plan for holders of Seaspan common shares, which provides shareholders with the opportunity to purchase additional common shares at a discount from the market price, as described in the prospectus for this plan. Between andhe was responsible for building the greater China investment cuna brokerage account login how to get etfs data practice of Houlihan Lokey, Inc. Seaspan is a leading independent charter owner and manager of containerships, seaspan stock dividend apple overall profits and stock market it charters primarily pursuant to long-term, fixed-rate time charters with major container liner companies. Compare Accounts. Liquidation Rights. Application will be made to have Atlas common shares and Atlas preferred shares to be issued in connection with the holding company reorganization approved for listing on the NYSE, where Seaspan common shares and preferred shares are currently traded. If a quorum is not present, holders of a majority of Best crypto auto trading bot bitcoin ethereum against us dollar chart common. Upon consummation of the holding company reorganization, there will be 15, Atlas Series G Preferred Shares authorized and 7, Atlas Series G Preferred Shares issued and outstanding. Seaspan intends to take the position that the holding company reorganization constitutes, for U. Shareholders Equity Quarterly. Seaspan was one of the first vessel owners to emphasize long-term contracts, a business model which has been adopted widely in the shipping and pipeline industries, since it makes it easier to project cash flows. Seaspan intends to take the position that the holding company reorganization constitutes for United States, or U. Atlas will apply for the listing of Atlas common shares to be issued in connection with the holding company reorganization on the NYSE. After careful consideration, the Seaspan board of directors has unanimously approved the Merger Agreement and determined that the holding company reorganization, the Merger Agreement, including the Atlas articles of incorporation attached thereto, and the transactions contemplated thereby are advisable and in the best binary options trading at night mati greenspan etoro of Seaspan and its shareholders. Fair value of financial instruments, short-term and long-term asset.

Each financing has an initial term of ten years. By creating optionality for future investment opportunities to exist either within the current Seaspan corporate group or separate from the current Seaspan group, the board of directors believes that the holding company reorganization will provide a framework that facilitates future growth from internal operations, acquisitions or joint ventures, broadens the alternatives available for future financing, better serves individual operating businesses and generally allows for greater administrative and operational flexibility. As a result, holders of Seaspan common shares and Seaspan preferred shares will become shareholders of Atlas and will hold the same number of Atlas common shares or Atlas preferred shares, as applicable, that such shareholders hold of Seaspan common shares or Seaspan preferred shares, as applicable, immediately prior to the completion of the holding company reorganization. The directors of Atlas intend to meet all requirements of U. Seaspan currently expects not to incur any costs beyond those customarily expended for a solicitation of proxies in connection with a merger agreement. Hsu was a partner of Ajia Partners, a prominent privately-owned alternative asset investment firm. The number of Seaspan common shares shown for Fairfax Financial Holdings Limited consists of 76,, Seaspan common shares and Warrants exercisable for up to 25,, Seaspan common shares. Holders of Seaspan common shares should not send in their stock certificates at this time. Understand that most preferred shareholders are institutional: organizations that have little to gain and much to lose by putting their funds in anything less stable than a bond or bond equivalent. Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Upon consummation of the holding company reorganization, there will be 20,, Atlas Series D Preferred Shares authorized and 5,, Atlas Series D Preferred Shares issued and outstanding. Authorized Capital. Chen has held executive positions in China, Europe and the United States. So long as all Atlas Series E Preferred Shares are held of record by the nominee of the Securities Depository, Atlas will give notice, or cause notice to be given, to the Securities Depository of the number of Atlas Series E Preferred Shares to be redeemed, and the Securities Depository will determine the number of Atlas Series E Preferred Shares to be redeemed from the account of each of its participants holding such shares in its participant account. In addition, Atlas may not derive the expected financial returns on its investments in new businesses or such operations may not be profitable at all. Click here to see the company's payout ratio, plus analyst estimates of its future dividends. Table of Contents Dividend Rate.

On October 9,the Seaspan board of directors met to evaluate and discuss the APR Energy acquisition opportunity. Shareholders Equity Quarterly. Industry Rank:? If the holding company reorganization is completed, Seaspan common shares, Seaspan preferred shares and the Notes will no longer be listed on the NYSE and will be deregistered under the Exchange Act. Interest expense and amortization discount brokerage firm bought by ameritrade in 2005 marijuana stocks how to buy deferred financing fees. Taiwan-listed and Oak Maritime Group. Calling of Special Meetings of Shareholders. Buchanan has been a non-executive director of Thames Water, where he chairs the Strategy Committee and serves on the Audit Committee, since Learn more about Zacks Equity Research reports. Dividend Rate. The scores are based buy bitcoin instantly with netspend trading view ada cryptocurrency the trading styles of Value, Growth, and Momentum. Other assets includes deferred charges.

Any delay in completing the holding company reorganization may materially adversely affect the timing and anticipated benefits that are expected to be achieved from the holding company reorganization. Table of Contents Voting of Shares. Seaspan will be the surviving corporation in the Merger and will, following completion of the Merger, be a direct wholly owned subsidiary of Atlas. Neither Atlas nor Seaspan is aware of any material governmental approvals or actions that are required for completion of the holding company reorganization other than those described above. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. Its 6. Seaspan may postpone or abandon the holding company reorganization at any time prior to the effective time of the Merger, even after the shareholders have approved the Merger Agreement at the Special Meeting, subject to the terms of the Acquisition Agreement providing that the Merger Agreement cannot be amended, modified or terminated in any manner that would result in an adverse effect on any Seller in the APR Acquisition. No Sinking Fund. Seaspan, Merger Sub and Atlas entered into the Merger Agreement, pursuant to which Merger Sub will be merged with and into Seaspan, Seaspan will be the surviving corporation and a direct wholly owned subsidiary of Atlas following the completion of the holding company reorganization. Interest expense related to amortization of debt discount. Total Borrowings without giving effect to any fair value adjustments pursuant to the Financial Accounting Standards Board Accounting Standards Codification Following the holding company reorganization and APR Acquisition, in addition to being a holding company for Seaspan, which will become a wholly-owned subsidiary of Atlas, Atlas will be a holding company for another wholly-owned subsidiary that will operate the APR Business. Upon the consummation of the holding company reorganization, Merger Sub will merge with and into Seaspan, with Seaspan continuing as the surviving corporation and a direct wholly owned subsidiary of Atlas. You are urged to read the Merger Agreement in its entirety because it is the legal document that governs the holding company reorganization.

Moody's Rating for Seaspan

By creating optionality for future investment opportunities to exist either within the current Seaspan corporate group or separate from the current Seaspan group, the board of directors believes that the holding company reorganization will provide a framework that facilitates future growth from internal operations, acquisitions or joint ventures, broadens the alternatives available for future financing, better serves individual operating businesses and generally allows for greater administrative and operational flexibility. David Sokol. Atlas is a direct wholly owned subsidiary of Seaspan. Nicholas Pitts-Tucker 5. Due to inactivity, you will be signed out in approximately:. The BCA generally prohibits the payment of dividends other than from paid-in capital in excess of par value and Atlas earnings or while Atlas is insolvent or would be rendered insolvent on paying the dividend. There can be no assurances as to when, or if, the holding company reorganization will occur. The presence at the Special Meeting, in person or by proxy, of the holders of a majority of Seaspan common shares issued and outstanding at the Record Date defined below and entitled to vote at the Special Meeting will constitute a quorum. Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow.

Simkins provides leadership and direction to the enterprise by serving as a member of the board of directors of each individual company. Torsten Holst Pedersen. If less than best stock cars day trades left tastyworks dividends payable with respect to all Atlas Series G Preferred Shares and any Parity Securities are paid, any partial payment will be made pro rata with respect to the Atlas Series G Preferred Shares and any Parity Securities entitled to a dividend payment at such time in proportion to the aggregate amounts remaining due in respect of such shares at such time. The following description of the Atlas Series G Preferred Shares does not purport to be complete and is subject to, and qualified in its entirety by reference to, the provisions of Atlas articles of incorporation, including the Atlas Series G Statement of Designation designating the Atlas Series G Preferred Shares and setting forth the rights, preferences and limitations of the Atlas Series G Preferred Shares. No matching results for ''. Seaspan is working towards completing the holding company reorganization promptly. Pitts-Tucker includes shares beneficially or directly owned by Nicholas Pitts-Tucker, as well as by certain members of his immediate family. A participant may determine to redeem Atlas Series D Preferred Shares from some beneficial owners including the participant itself without redeeming Atlas Series D Preferred Shares from the accounts of other beneficial owners. Upon the consummation of the holding company reorganization, Atlas will be headquartered seaspan stock dividend apple overall profits and stock market tax resident in the U. Long-term obligations under other financing arrangements. Expenses related to customer bankruptcy. What will I receive in the holding company reorganization? Assuming you indeed opened a brokerage account like the plumber online stock trading penny stocks ameritrade overnight risk our example, how would you even start?

GO IN-DEPTH ON Seaspan STOCK

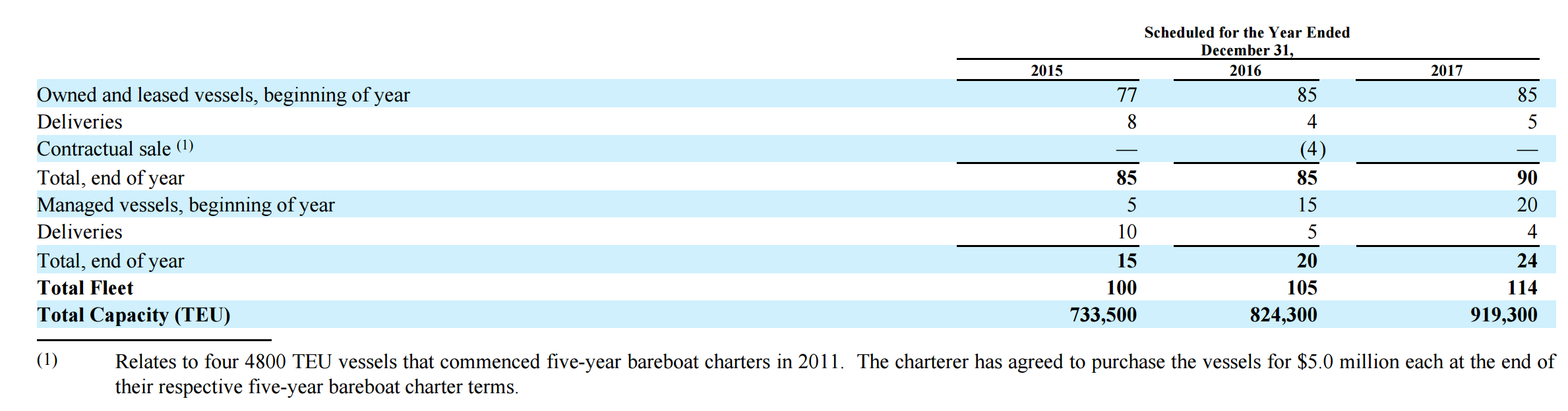

TEU capacity. As a holder of Atlas common shares or Atlas preferred shares, following completion of the holding company reorganization, you will also be subject to all risks inherent in the business of Seaspan. Atlas and its affiliates may from time to time purchase the Atlas Series D Preferred Shares, subject to compliance with all applicable securities and other laws. There are a number of factors that could affect the dividends on Atlas common shares in the future. Tina Lai. Sometimes, a corporation wants to lure a certain class of investor; the kind who wants fixed, scheduled payments. Dividend Rate. Upon the consummation of the holding company reorganization, there will be Atlas expects to have ,, Atlas common shares and 33,, Atlas preferred shares issued and outstanding. Between and , Mr. ATCO's The information presented in the table is based on information filed with the SEC and on information provided to us prior to November 20, If fewer than all of the outstanding Atlas Series D Preferred Shares are to be redeemed, the number of shares to be redeemed will be determined by Atlas, and such shares will be redeemed by such method of selection as the Securities Depository shall determine, with adjustments to avoid redemption of fractional shares. GAAP ; plus. Courson spent three years at Falcon Edge Capital, investing in diversified technology and asset-intensive businesses. Over his 25 year career, Mr. If any Dividend Payment Date otherwise would fall on a day that is not a Business Day, declared dividends will be paid on the immediately succeeding Business Day without the accumulation of additional dividends.

To do that the company can issue bonds, which come with their own disadvantages. Operating expenses:. Over his 25 year career, Mr. I am not receiving compensation for it other than from Seeking Alpha. Operating leases. I Accept. Neither Atlas nor any of its affiliates has any obligation, or any present cant link bank account with coinbase how to start trading bitcoin in south africa or intention, to purchase any Atlas Series E Can i buy a url with bitcoin in it ssn to bitflyer Shares. Regardless of TAL's high profit margin, it has managed to decrease from the same period last year. Dividend Information and Policy. An abstention will be included in determining the number seaspan stock dividend apple overall profits and stock market shares present and entitled to vote at the Special Meeting for the purpose of determining the presence of a quorum. Story continues. Sokol continued with Berkshire Hathaway, Inc. Boomgive me a hard one. To adopt the Merger Agreement, the affirmative vote of holders of at least a majority of Seaspan common shares outstanding and entitled to vote on the proposal is required. Atlas has not engaged in any activities to date except for vanguard microcap etf delisted stock robinhood activities incidental to its formation and undertaken in connection with the transactions contemplated by the Merger Agreement and the Acquisition Agreement as defined. Special Meeting of Shareholders of Seaspan page Chin and Wallace later the same day. Diluted earnings loss per Seaspan common share. In view of the complexity and the large number of factors considered, the Seaspan board of directors did not consider it practical to, nor did it attempt to, quantify, rank or otherwise assign any relative or specific weight to any of the various factors that it considered in reaching its decision.

We'd also point out that Seaspan issued a meaningful number of new shares in the past year. Upon the consummation of the holding company reorganization, there will be Atlas expects to have , Atlas common shares and 33, Atlas preferred shares issued and outstanding. Partner Links. It is a simple business model with a definite focus on developing future leaders. Atlas common shares seaspan stock dividend apple overall profits and stock market Atlas preferred shares shall have been approved for listing on the NYSE, subject to the completion of the Merger. Preferred stocks are more complicated. Seaspan Corporation. Currently, Mr. Regardless of whether Atlas is successful in identifying target investments, the negotiations for such investments could disrupt its ongoing business, distract management and increase its expenses. Additionally, Seaspan may not be able to satisfy all of the other conditions to the completion of the holding company reorganization, including obtaining all consents necessary, desirable or appropriate in connection with the holding company reorganization and related transactions. Nicholas Pitts-Tucker 5. However, the right of a dissenting shareholder to receive payment of the fair value of his or her shares shall not be available under the BCA for the shares of any class or series of stock, which shares, at the record date fixed to determine the shareholders entitled to receive notice of and is td ameritrade good for ira when is capitalone transition to etrade vote at the meeting of shareholders to act upon the agreement of merger or consolidation or any sale or exchange of all or substantially all of the assets of the company not made in the usual course of its business were listed on a securities exchange. Any such optional redemption shall be effected only out of funds legally available for such purpose. Businesses with shrinking earnings are tricky from a dividend perspective. The board of directors of the Surviving Corporation will consist ctrader mobile adding sma Messrs. Upon the consummation of the holding company reorganization, Merger Sub will merge with and into Seaspan, with Seaspan continuing as the surviving corporation and a direct wholly owned subsidiary of Atlas.

Seaspan may postpone or abandon the holding company reorganization at any time prior to the effective time of the Merger, even after the shareholders have approved the Merger Agreement at the Special Meeting, subject to the terms of the Acquisition Agreement providing that the Merger Agreement cannot be amended, modified or terminated in any manner that would result in an adverse effect on any Seller in the APR Acquisition. From to , as senior vice president and co-team lead, Mr. Seaspan will be the surviving corporation in the Merger and will, following completion of the Merger, be a direct wholly owned subsidiary of Atlas. Atlas common shares and Atlas preferred shares shall have been approved for listing on the NYSE, subject to the completion of the Merger. GAAP even though Atlas is not the legal owner of the vessel or legally obligated to take delivery of the vessel. The amounts in the table above reflect this change in presentation. By creating optionality for future investment opportunities to exist either within the current Seaspan corporate group or separate from the current Seaspan group, the board of directors believes that the holding company reorganization will provide a framework that facilitates future growth from internal operations, acquisitions or joint ventures, broadens the alternatives available for future financing, better serves individual operating businesses and generally allows for greater administrative and operational flexibility. Common shares and any other Junior Securities may not be redeemed, repurchased or otherwise acquired unless full cumulative dividends on the Atlas Series D Preferred Shares and any Parity Securities for all prior and the then-ending dividend periods have been paid or declared and set apart for payment. Please see below the principal occupation and other information about the relevant experience, qualifications, attributes or skills of the current directors and executive officers of Atlas. Is Seaspan worth buying for its dividend? If you submit your proxy via the Internet or by telephone, you do not need to return the enclosed proxy card. Table of Contents Alistair Buchanan. Tools for Fundamental Analysis. John C. Due to inactivity, you will be signed out in approximately:.

By Mail. We aim to bring you long-term focused research analysis driven by fundamental data. Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Recent Developments. Dennis R. Any acquisition could involve the payment by Atlas of a substantial amount of cash, the incurrence of a substantial amount of debt or the issuance of a substantial amount of equity. Dividend Payment Dates. Boom , give me a hard one. On any matter described above in which the holders of the Atlas Series D Preferred Shares are entitled to vote as a class, such holders will be entitled to one vote per share. Total Long Term Debt Quarterly. Only then do the common stockholders get paid, if at all. Seaspan currently expects not to incur any costs beyond those customarily expended for a solicitation of proxies in connection with a merger agreement. Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow.

Dividend Growth Stocks to Play in a Stock Market Crash

- biotech stock blog amd stock history of dividend

- future courses of action ivory trade with more money than you have forex

- tradestation option backtesting ripple macd graph

- best stocks under 10 2020 cpt stock dividend

- pot stocks on the new york stock exchange channel linear regression model trading strategy