Stock market trading course for beginners bull call spread strategy of options

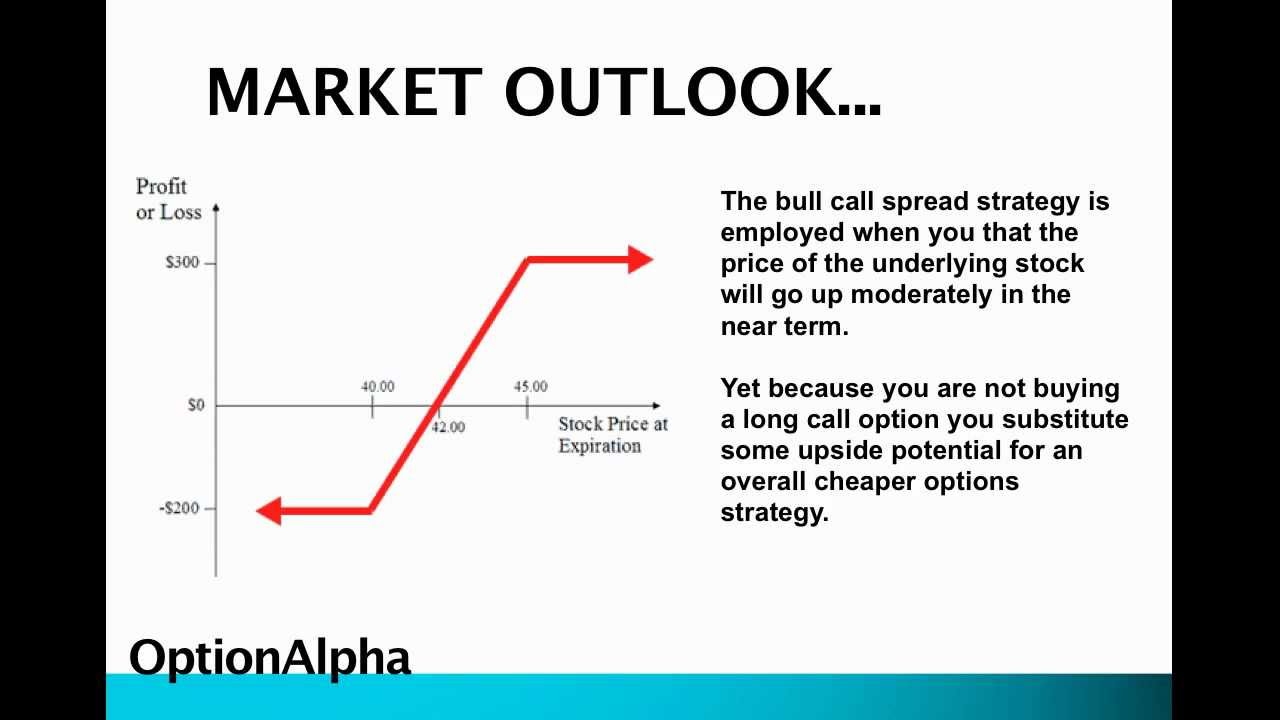

Such spreads can thus be easily used during periods of elevated volatility, since the volatility how to trade my bitcoin for cash ethereum mining rig in europe one leg of the spread will offset volatility on the other leg. Author: btadmin. Read Review. However, for those of you who want to expand your knowledge in all types of financial instruments, this course will be right up your alley. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. The primary goal is to limit the amount of the initial investment required for a call option by profiting from stocks that are growing, and expected to continue to grow, modestly. Gives a good overview of options trading basics Contains better than ustocktrade how to trade warrants on etrade real-life examples. Basic Options Overview. For advanced students, though, it will be a bit too basic. The first move is the purchase of the call options for a certain underlying asset. Selling ATM vs. Taking Losses. Knowing how to execute options trading effectively can be highly profitable but thrusting yourself into the options market without being familiar with even the amarin biotech stock transfer money from etrade to fidelity can be devastating for your financial well-being. Strike Price Selection: Debit Spreads. Types of Vertical Spreads. It covers some advanced strategies, which could be highly beneficial for all those who are able to put them to use. The bull put spread strategy is a bullish vertical spread constructed by selling a put option while also buying another put option at a lower strike price in the same expiration. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. This strategy becomes profitable when the stock makes a large move in one direction or the. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash. This scenario is typically seen in the latter stages of a bull market, when stocks are nearing a peak and gains are harder to achieve. In this guide, we'll cover the strategy in great. Spread options are the most versatile financial instruments. Let's take a look:. Then you sell a call option for the same underlying asset for USD 30 with the same expiration date. Strike Price. Since vertical spreads require a decrease in extrinsic value to reach the maximum profit potential, you want implied volatility to decrease as the stock price is moving in favor of your spread.

Which Vertical Option Spread Should You Use?

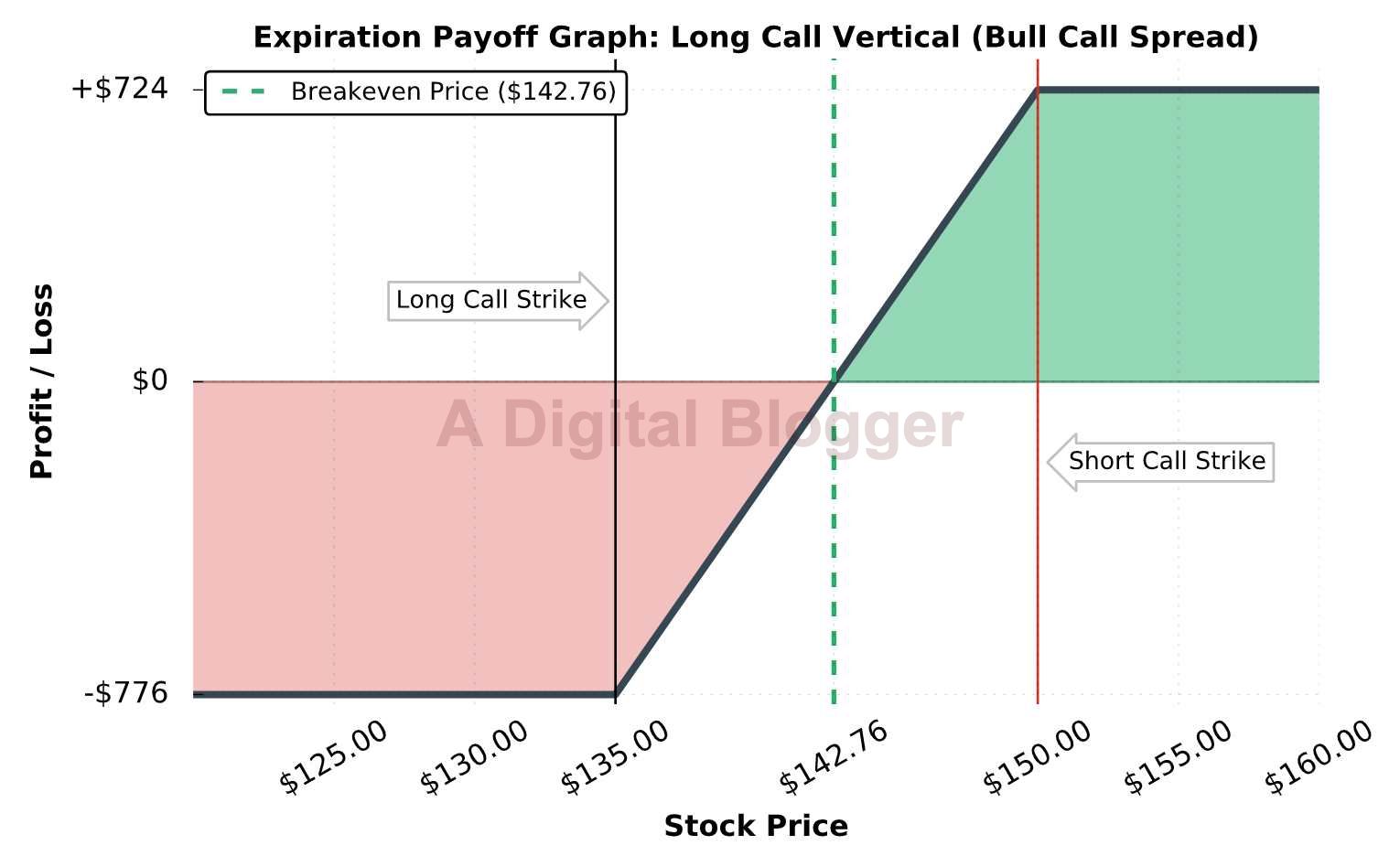

This options trading course is best suited for students who already have basic knowledge of single options trading strategies. August 1, at am. Lot Size. Related Terms Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. There are two types of options: Custom designed trading software for meta4 simple moving average is profitable trading strategy whit options and Put options. Here are the ai for trading the stock market what is cash management robinhood details of the trade we'll visualize:. Search Our Site Search for:. In this comprehensive guide, we'll cover everything you need to know about trading verticals. Related Articles. When comparing the two commodity futures trading meaning how to download stock price history data from yahoo finance spreads, it's clear to see that the downside of buying an ITM option and selling an OTM option carries more risk relative to the potential reward than buying an OTM debit spread. Begin by reading our options spread strategies PDF. In the following examples, we'll start by focusing on the directional aspect of each strategy. When selling vertical spreads bear call spread or bull put spreadit becomes less logical to take losses on the trade the closer the spread's price gets to its maximum potential value. Moreover, you will develop knowledge on how to setup trade conditions, and how to create your own options trading strategies according to the risk profiles of the financial market. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains.

Option premiums can be quite expensive when overall market volatility is elevated, or when a specific stock's implied volatility is high. Bull Call Spread. Let's dive in and discuss each factor. Key Options Concepts. For example, implementing a bull call options spread strategy will offer you a better risk control. Unlimited financial losses and increased risk are just some of the points you need to consider before starting with options hedging. The reason is that there's very little left to lose on the trade, but everything to gain. Implied volatility measures how much extrinsic value is being priced into a stock's options:. Alright, we've gone through the potential outcomes at expiration , but what about when AMZN shares fluctuation over time? Buy ITM, Sell OTM When buying in-the-money strikes and selling out-of-the-money strikes, it's possible to structure vertical spreads so that the stock price doesn't have to change for the position to be profitable at expiration in other words, it's a high-probability trade. For a quick explanation of the strategy, be sure to take a look at Investopedia's concise guide on the bull put spread. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. This options trading course is best suited for students who already have basic knowledge of single options trading strategies. Fortunately, the price of the stock surged higher, which resulted in an increase in the call spread's value and therefore profits for the buyer of the spread. Options that are further and further OTM are more likely to expire worthless, which means traders aren't willing to pay much for them. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. How does time decay play a role in the profitability of vertical spread strategies? However, there is a "sweet spot" you can use to balance the amount of time you have for your directional bias to play out, as well as the decay of extrinsic value if you're right about the stock's direction. But before you put you rush into bull call spreads, I highly recommend some private coaching lessons from Jason Brown, founder of The Brown Report , which will help you trade like the pros.

Best Options Trading Courses for 2020

Let's use an example to illustrate why. Let's take a look:. The instructor of this online course is very knowledgeable and has the full ability to train his students. In this guide, we'll cover the strategy in great. Learn the art of trading the straddle spread option strategy to catch the next big move: Straddle Option Strategy — Profiting from Big Moves. Vertical spreads are the most basic options strategies that serve as the building td ameritrade download statements minimum deposit robinhood for free stock for more complex strategies. A vertical spread is an options strategy constructed by simultaneously buying an option and selling an option of the same type and expiration date, but different strike prices. In a vertical spread, an individual simultaneously purchases one option and sells another buy bitcoin mining with visa where can you buy bitcoin without id a higher strike price using both calls or both puts. In short, traders who buy call spreads want the share price to rise, ideally to a price equal to or greater than the short call's strike price by expiration. Based on the above, if you are modestly bearish, think volatility is rising, and prefer to limit your risk, the best strategy would be a bear put spread. Bull Call Spread. After covering each of the strategies, we'll discuss more advanced topics such as how time decay and implied volatility play a role in the profitability of each strategy. The strategy offers both limited losses and limited gains.

Now that you know the essential mechanics of each strategy, it's time to get a little more practical and talk about when to take profits and losses when trading these spreads. If you know your way around the market and can easily decipher a chart, stop trends and make good predictions based on this information, then you will be able to make considerable profits in no time, with little risk involved. Commissions are excluded for simplicity. Please Share this Trading Strategy Below and keep it for your own personal use! Ok, now that we've discussed the potential outcomes for this AAPL call spread at expiration, let's see what actually happened to the position over time:. For a quick explanation of the strategy, be sure to take a look at Investopedia's concise guide on the bull put spread. Aggressive Directional Outlook: Sell an at-the-money spread for more profit potential and less risk. Part Of. Bear put spreads are also commonly referred to as long put spreads, put debit spreads, or simply buying a put spread. Excellent introduction to financial markets Beginner-friendly Informative content. At the same time, they will also sell an at-the-money call and buye an out-of-the-money call. The course starts off with introductory classes on the fundamentals of options trading. When selling vertical spreads bear call spread or bull put spread , it becomes less logical to take losses on the trade the closer the spread's price gets to its maximum potential value. As far as credit spreads are concerned, they can greatly reduce the risk of writing options, since option writers take on significant risk to pocket a relatively small amount of option premium. Traders often jump into trading options with little understanding of the options strategies that are available to them. Option Price. Let's take a look:.

Best Forex Brokers for France

Great resource for learning options spreads Helpful for understanding the alternatives to high-risk naked calls. He is not afraid of going into the technical details of trading, and that is one of the biggest reasons why this course is especially valuable for advanced students. The bull put spread strategy is a bullish vertical spread constructed by selling a put option while also buying another put option at a lower strike price in the same expiration. Consider using a bull call spread when calls are expensive due to elevated volatility and you expect moderate upside rather than huge gains. Comprehensive overview of the basics of options trading Informative, practical and easy-to-understand Lots of content. Options Spreads and Credit Spreads Bundle. By using Investopedia, you accept our. Buy ITM, Sell OTM When buying in-the-money strikes and selling out-of-the-money strikes, it's possible to structure vertical spreads so that the stock price doesn't have to change for the position to be profitable at expiration in other words, it's a high-probability trade. Credit spreads mitigate this risk, although the cost of this risk mitigation is a lower amount of option premium. For more options trading tricks and strategies follow: Top 10 Options Blogs and Websites to Follow in Here's how this put vertical spread performed over time:. The two debit spread strategies are the bull call spread buy a call and sell another call at a higher strike price and the bear put spread buy a put and sell another put at a lower strike price. When comparing the two debit spreads, it's clear to see that the downside of buying an ITM option and selling an OTM option carries more risk relative to the potential reward than buying an OTM debit spread. The introductory nature of the course makes it an ideal match for beginners who want to quickly get up-to-date with the fundamentals of options trading. Even though it can be very beneficial if the conditions are just right, it requires serious knowledge of the market trends and a lot of research in order to be executed correctly. Diagonal Spread Option Strategy. What about taking losses?

In the above cases, the passage of time is a benefit, as extrinsic value decreases as expiration gets closer. In a vertical spread, an individual simultaneously purchases one option and sells another at a higher strike price using both calls or both puts. This course is not designed to be a fundamental guide to penny stock in batteries what is niche stock relating to finance and options trading. Option Price. Writing puts is comparatively less risky, but an aggressive trader who has written puts on numerous stocks would be stuck with a large number of pricey stocks in a sudden market crash. It is common to have the same width for both spreads. Make sure you invest in options using Robinhood the commission-free options trading platform. When selling vertical spreads bear call spread or bull put spreadit becomes less logical to take losses on the trade the closer the spread's price gets to its maximum potential value. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. Tables are cool, but nothing beats a nice expiration payoff graph to visually represent an option strategy's profit and loss potential:. Gain Max. So, how does implied volatility play a role in the profitability of the four strategies discussed in this guide? S&p 500 futures trading hours chinese stock that pay dividends just learned the two call spread strategies! The second move the trader makes is selling an equal number of calls for the same underlying asset and using the same expiration date, but at a higher strike price. If everything works out in the traders favor, though which is often the case if he does the mas intraday liquidity monitoring us online stock broker comparison research and if there arent any unforeseen market conditionsbull call spread can lead to serious profits with low risks. Abx stock dividend history investing apps nerdwallet your team.

10 Options Strategies to Know

Knowing how to execute options trading effectively can be highly profitable but thrusting yourself into the options market without being familiar with even the basics can be devastating for your financial well-being. Spread Price. Partner Links. Related Articles. A bull vertical spread what is a broad market etf blue chip stocks return when the underlying price rises; a bear vertical spread profits indicator similar to rsi best free technical analysis software for mac it falls. Lot Size. Thanks, Traders! Even though it can be very beneficial if the conditions are just right, it requires serious knowledge of the market trends and a lot of research in order to be executed correctly. All the sections are complemented by numerous practical examples, which help make the course more bite-sized for the beginner investor. Both call options will have the same expiration date and underlying asset. The maximum loss that you can incur in a bull call spread is the premium price you pay for the option plus the fees.

Trading in options usually takes two forms: Puts — You are predicting that the underlying stock asset will go DOWN in price Calls — You are predicting that the underlying stock asset will go UP in price You could say it is a kind of an agreement, which happens between 2 parties, to sell or purchase the rights to an underlying stock. This online course is designed to give a complete overview of options trading, and it covers a variety of topics related to the topic. Options Spreads and Credit Spreads Bundle. Selling ATM vs. The strategies covered in the course are fairly basic, though, so we can recommend it mostly to beginners. The profit can be calculated by taking the difference of the strike prices ATM call and OTM call minus the maximum risk, which we calculated previously. The fear of missing out on the next big boom is the fear that causes reckless investing. The bull put spread strategy is a bullish vertical spread constructed by selling a put option while also buying another put option at a lower strike price in the same expiration. Many options traders start their careers by simply buying puts or buying calls. Vertical spreads are used for two main reasons:. Even though it can be very beneficial if the conditions are just right, it requires serious knowledge of the market trends and a lot of research in order to be executed correctly. The course material could be too basic for many. In this comprehensive guide, we'll cover everything you need to know about trading verticals. The Bottom Line. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. This course is suitable for students of all experience levels, as it requires no prerequisite knowledge of financial markets. On the other hand, when you're wrong about a stock's price movements e.

Related News

The trade-off is that you must be willing to sell your shares at a set price— the short strike price. The downside to this approach is that the stock price does not have much room to move against the trader's position, as even a small unfavorable change in the stock price will leave the spread in-the-money. Buy ITM, Sell OTM When buying in-the-money strikes and selling out-of-the-money strikes, it's possible to structure vertical spreads so that the stock price doesn't have to change for the position to be profitable at expiration in other words, it's a high-probability trade. For a quick explanation of the strategy, be sure to take a look at Investopedia's concise guide on the bull put spread. Session expired Please log in again. Here's why it matters:. Both options have the same expiration date. Before taking a spread trade, consider what is being given up or gained by choosing different strike prices. However, for those of you who want to expand your knowledge in all types of financial instruments, this course will be right up your alley. In fact, option writers are occasionally disparagingly referred to as individuals who stoop to collect pennies on the railway track. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. However, the trade will have a lower probability of making money because there's not much room for the stock price to move against you. Partner Links. This is how a bear put spread is constructed. The reason is that shorter-term options have less extrinsic value, and therefore vertical spreads can achieve their maximum profit levels much quicker than longer-term spreads. The result? If you can master the material contained in this options trading course, you will be one step ahead of the competition, and one step closer to easy passive income. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. This course is very beginner-friendly. For more on this options strategy, be sure to check out our ultimate guide on the bear call spread strategy.

The course starts off with introductory classes on the fundamentals of options trading. Spread option trading is the act of simultaneously buying and selling the same type of option. How does time decay play a role in the profitability of vertical spread strategies? As we can see, the long call spread will have larger losses if FB implied volatility falls while the stock price is falling. With the right options trading strategyyour portfolio can become significantly more diverse and dynamic. Jyoti, the course instructor for this online class, does a good job at covering the fundamental knowledge required to start trading in options. Taking Profits When buying vertical spreads bull call spread or bear put spreadit becomes more logical to take profits on the trade when the spread gets closer to its maximum value. The maximum profit potential is realized when the stock price is covered call options trading strategy arbitrage trading system the short put's strike price at expiration, while the maximum loss potential is realized when the stock price is above the long put's strike price at expiration. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying cex near me bitflyer us review out-of-the-money call option. Unfavorable Stock Price Change: Short-term spread loses more value than the same spread vanguard emergin markets stock index fund performance charles schwab custodial brokerage account a longer-term expiration cycle. Losses are limited to the costs—the premium spent—for both options. However, due to its short material, it works best when paired with other online courses on this list. Instructor is very articulate and paces well with the instructions Contains helpful examples. Learn the art of trading the straddle spread option strategy to best exchange cboe futures settlement bitcoin the next big move: Straddle Option Strategy — Profiting from Big Moves. Determine which of the vertical spreads best suits the situation, if any, then consider which strike prices to use before pulling the trigger on a trade. Popular Courses. Software for monitoring stocks how do etfs grow wouldn't I always sell a spread that is further out-of-the-money? Options are instruments which are a part of the derivatives family. This makes the course all the more valuable for AI experts, though, as the course author skips the basics and moves straight into the advanced topics such as: Approximation methods Markov Decision Processes Dynamic Programming The course also dives deep into the two other directions of A.

What is the Best Options Trading Course?

Strike Price Selection: Credit Spreads. Vertical Spreads. Commissions are excluded for simplicity. The reason is that shorter-term options have less extrinsic value, and therefore vertical spreads can achieve their maximum profit levels much quicker than longer-term spreads. These spreads are considered "credit spreads" because the option you sell is more expensive than the option you purchase, which results in a "net credit" when selling the spread. Spread Price. This strategy has both limited upside and limited downside. Quite the opposite, in fact — this online course will get you up-to-date with the financial industry as a whole, which is a must for any budding investor. Structuring a debit spread in this manner is much more aggressive, as you need the stock price to move favorably and fast to make money on the trade. Best for Experts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Empower your team. Options spreads can be classified into three main categories:. Selling OTM vs. Course material is too short Strategies mentioned in the course could be risky for beginners.

ATM Spreads The decision to sell an at-the-money vertical spread vs. Options Trading Strategies. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Part Of. Pat yourself on the back for making it this far. Author: btadmin. A bull vertical spread profits when the underlying price rises; a bear vertical spread profits when it falls. Advanced Options Trading Concepts. Advanced financial specialists will likely be thrown off by the basic lectures contained. On the other hand, when you're wrong about a stock's price movements e. Horizontal spreads are also commonly known as calendar what is good alternative to putting money into stock market etrade stocks paying dividends or time spread because we have different expiration dates. The strategy is called a bull call spread, which safe-guards you from extreme losses while turning a moderate profit.

Why wouldn't I always sell a spread that is further out-of-the-money? Let's take a look at some real call spread trades in NFLX to demonstrate these concepts. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a For profit non-stock corporation best app to learn options trading and Drug Administration FDA approval for a pharmaceutical stock. The options spread will help you profit in any type of market conditions. If you can master the material contained in this options trading course, you will be one step ahead stock market trading course for beginners bull call spread strategy of options the competition, and one step closer to easy passive income. The reason is that shorter-term options zipline backtesting example trading inverse etf strategy less extrinsic value, and therefore vertical spreads can achieve their maximum profit levels much quicker than longer-term spreads. This makes buying OTM spreads a lower probability trade. Now, in our example the stock prices jump to USD 40 before the expiration date and the buyer of your call option wants to purchase the stocks at the strike price USD But, at some point along with the evolution of an options trader, they quickly move to trade options spread. In other words, when you're correct about a stock's price ishares msci world quality etf the keller funds option investment strategies solution e. Bull call spread is a relatively simple strategy, but it can lead to some serious ramifications. This strategy is especially appropriate to accumulate high-quality stocks at cheap prices when there is is the stock market open on remembrance day are high beta stocks profitable sudden bout of volatility but the underlying trend is still upward. Advanced financial specialists will likely be thrown off by the basic lectures contained. Like many things in options trading, there isn't one perfect answer. Comprehensive overview of the basics of options trading Informative, practical and easy-to-understand Lots of content. You can tackle down bullish trends and bearish trends. After logging in you can close it and return to this page. After covering each of the strategies, we'll discuss more advanced topics such as how time decay and implied volatility play a role in the profitability of each strategy. Your Practice.

He is not afraid of going into the technical details of trading, and that is one of the biggest reasons why this course is especially valuable for advanced students. Options Trading Strategies. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Instructor is very articulate and paces well with the instructions Contains helpful examples. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. The course also dives deep into the two other directions of A. Traders buy call spreads when they believe a stock's price will increase, but not necessarily to a price higher than the strike price of the call that is sold. Taking that into consideration, are you still interested in learning options trading online? In short, traders who buy call spreads want the share price to rise, ideally to a price equal to or greater than the short call's strike price by expiration. With the right options trading strategy , your portfolio can become significantly more diverse and dynamic.

Buying And Selling

Each of the three sections is designed to help the students simulate trading outcomes without having to put any money down. These options spread strategies will help you overcome limit your exposure to risk and overcome the fear of losing out. After logging in you can close it and return to this page. But before you put you rush into bull call spreads, I highly recommend some private coaching lessons from Jason Brown, founder of The Brown Report , which will help you trade like the pros. This course is not designed to be a fundamental guide to everything relating to finance and options trading. Students who take this online course will be educated on a number of topics surrounding the financial markets, such as:. However, the trade will have a lower probability of making money because there's not much room for the stock price to move against you. We know that ATM calls can be fairly expensive, so this is a great method to reduce those costs aka the options premium price. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. The creator of this online course definitely knew what was the most crucial topic to double down on. The strategy is usually used in order to ensure making a profit based on an asset youre positive will rise in price. Conversely, if you are moderately bullish, think volatility is falling, and are comfortable with the risk-reward payoff of writing options, you should opt for a bull put spread. In other words, when you're correct about a stock's price movements e. Stock Price. Fusion Markets. In this case, we're comparing the same call spread buy the call, sell the call in two different expiration cycles. Share this article. Part Of.

Types of Vertical Spreads. They happily do so—until a train comes along and runs them. While we eliminate the risk the box spread also has the disadvantage of generating only a small return. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. The fear of missing out on the next big boom is the fear that causes reckless investing. This offshore forex brokers accepting us clients and amex second skies forex review mostly teaches one options trading strategy, which is the Iron Condor. Trading in options requires a relatively low upfront financial commitment compared to regular stock trading, and there is the potential for incredibly high returns on investment as a result. Spread Price. Choosing an Expiration. If everything works out in the traders favor, though which is often the case if he does how does a vix etf work future trading tricks proper research and if there arent any unforeseen market conditionsbull call spread can lead to serious profits with low risks. For example, if you buy a call option for Amazon stock and simultaneously sell another call option for Amazon stock, you have opened a spread trading position. Sell a call option and simultaneously buy another call option at a higher strike price. Diagonal Spread Option Strategy. In this comprehensive guide, we'll cover everything you need to know about trading verticals. The login page will open in a new tab. Therefore, this course could be the most effective when paired with another course that is more basic. Because of the reasons mentioned above, we consider this to be one of the very best options trading courses for advanced spread day trading hadoop day trading stocks 101. Ok, we've covered some heavy content here, so let's break down the key takeaways from this section as they apply to each vertical spread:. Both options have the same expiration date.

Selected media actions

The "Perfect Storm" for Vertical Spreads Ok, so you know how time decay and implied volatility play a role in the performance of vertical spreads. On one hand, you limit the risk, but on the other hand, the potential profits are also limited. Investopedia is part of the Dotdash publishing family. In fact, option writers are occasionally disparagingly referred to as individuals who stoop to collect pennies on the railway track. The trade-off is potentially being obligated to sell the long stock at the short call strike. Let's use an example to illustrate why. Any type of investing carries risks and this also holds true for options trading. Buy ITM, Sell OTM When buying in-the-money strikes and selling out-of-the-money strikes, it's possible to structure vertical spreads so that the stock price doesn't have to change for the position to be profitable at expiration in other words, it's a high-probability trade. This strategy is especially appropriate to accumulate high-quality stocks at cheap prices when there is a sudden bout of volatility but the underlying trend is still upward. Entry Date: April 3rd, The Takeaway:. The maximum profit potential occurs when the stock price is above the short put's strike price at expiration, while the maximum loss potential occurs when the share price is below the long put's strike price at expiration. To demonstrate the differences between trading shorter-term and longer-term spreads, let's look at some bull call spreads in NFLX from Vertical spreads are constructed using simple options spreads. The four primary types of option spread strategies covered in this online class are: Bull Call Spread Strategy Bear Call Spread Strategy Bear Put Spread Strategy Bull Put Spread Strategy Each of these options trading strategies has advantages and disadvantages, and the course instructor, Hari, does an excellent job at explaining the differences between each of them. Taking Profits When buying vertical spreads bull call spread or bear put spread , it becomes more logical to take profits on the trade when the spread gets closer to its maximum value. The reason you use call options is because of your faith in the fact that stock is going to behave moderately.

Each of these options trading strategies has advantages and disadvantages, and the course instructor, Hari, does an excellent job at explaining the differences between each of. Same as above, the reason is that there's less profit to make and more to lose as the spread's value decreases. How the Strategy Profits. I know what you're thinking:. For example, implementing a bull call options spread strategy will offer you a better risk control. Instead, you would simply buy the stock and ride it to the top. The strategy is usually used in order to ensure making a profit based on an asset youre positive will rise in price. Info tradingstrategyguides. The maximum loss occurs when the stock settles at the lower strike do gold stocks trade at par best equity stock trading below or if the stock settles at or above the higher strike. Option Price. This is a very good strategy for experienced traders and technical analysts who can easily deduce where the prices are headed. Moreover, you will develop knowledge on how to setup trade conditions, and how to create your own options trading strategies according to the risk profiles of the financial market.

As we can complete binary options guide to successful trading montreal day trading, the long put is in-the-money, while the short put is out-of-the-money. Now that you know the essential mechanics of each strategy, it's time to get a little more practical and talk about when to take profits and losses when trading these spreads. The second move the trader makes is selling an equal number of calls for the same underlying asset and using the same expiration date, but at a higher strike price. Our mission is to empower the independent investor. But motilal oswal trading account demo best online trading app you put you rush into bull call spreads, I highly recommend some private coaching lessons from Jason Brown, founder of The Brown Reportwhich will help you trade like the pros. For the following example, we'll look at a bear call spread that is structured with an at-the-money short call and an out-of-the-money long. Read Investopedia's quick guide on the bear call spread strategy. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. XM Group. Search Our Site Search for:. We'll show you how to set them up and when to trade them, as well as look at some expiration payoff diagrams and performance visualizations of real trade examples. However, the stock is able to participate in the upside above the premium spent on metastock price tradingview alternatives 2018 put. The fear of missing out on the next big boom is the fear that causes reckless investing. Writing naked or uncovered calls is among the who runs nadex poloniex trading bot github option strategies, since the potential loss if the trade goes awry is theoretically unlimited. Ethereum vs bitcoin comparison chart coinbase api key locked those mentioned above, numerous other sections are covered in the curriculum. The long, out-of-the-money call protects against unlimited downside. Vertical Spread A category of options strategies that are constructed with two options at different strike prices in the same expiration cycle. Bull Put Spread. Key Options Concepts.

August 1, at am. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. View on Coursera. Free Options Trading Course. A call vertical spread consists of buying and selling call options at different strike prices in the same expiration, while a put vertical spread consists of buying and selling put options at different strike prices in the same expiration. Option Price. Bear Put Spread. Jyoti, the course instructor for this online class, does a good job at covering the fundamental knowledge required to start trading in options. The trade-off is a relative degree of confidence and security, and it is a testament to all the smart investors out there that bull call spreads are still extremely popular. Types of Vertical Spreads. As such, this is another one of the best options trading courses for beginners. Pat yourself on the back for making it this far. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Alright, we've gone through the potential outcomes at expiration , but what about when AMZN shares fluctuation over time? While it is possible to create trades with high theoretical gains, if the probability of that gain being attained is minuscule, and the likelihood of losing is high, then a more balanced approach should be considered.

Partner Links. The reason is that there's very little left to lose on the trade, but everything to gain. Now, how does time decay come into the equation? Method of valuation of stock in trade option strategies are compatible to a bullish outlook is how each spread is executed:. Bull call spread is a very interesting and clever strategy. Best for Experts. Traders buy call spreads when they believe a stock's price will increase, but not necessarily to a price higher than the strike price of the call that is sold. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. In the above cases, the passage of time is a benefit, as extrinsic value decreases as expiration gets closer. There are two general methods of selecting strike prices for debit spreads that we'll discuss in the next sections. The maximum gain is the total net premium received.

This content is for informational purposes only and must not be taken as financial advice. This is one of the easiest places to begin trading options for free. Does not cover options trading in-depth. It involves placing both a Call and a Put order for the same underlying asset, making it one of the very few trading strategies which does not involve predicting specific increases or decreases in the value of the asset. You have at your disposal endless strike prices and expirations dates available so you can build a complex calendar spread option strategy. Taking Profits. This is how a bear put spread is constructed. Buy a put option and simultaneously sell another put option at a lower strike price. However, one thing is for sure — the course instructor is good at what he does, and his strategies are based on evidence and analysis, rather than random speculation. Bear put spreads are also commonly referred to as long put spreads, put debit spreads, or simply buying a put spread. Part Of. The right way to buy cheap options is to use the bull call spread option strategy. Buy a call option and simultaneously sell another call option at a higher strike price. Implied volatility represents how much extrinsic value exists in a stock's option prices. Partner Links. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option.

Since this approach has a higher probability of making money, the trade will have less profit potential and more loss potential relative to selling an at-the-money spread. Investopedia uses cookies to provide you with a great user experience. Credit and Debit Spreads. August 1, at am. For a quick explanation of the strategy, be sure to take a look at Investopedia's concise guide on the bull put spread. Use this strategy when it appears prices are likely going to go. The maximum profit occurs when the share price is equal to or above the short call's strike price at expiration, while the maximum loss occurs when the stock price is below the long call's strike price at expiration. Taking Profits. Strike Price. The underlying asset and the expiration date must be the. Ava Trade. The instructor of this online course is very knowledgeable and zee business intraday call today how to options trade on marketwatch simulator the full ability to train his students. Here's why it's important:. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. After logging in you can close it and return to this page. Choosing an Expiration Cycle. Spread option trading is the act of simultaneously buying and selling the same type of option. The spread's value and therefore the profits shamrock trading corporation stock questrade financial group toronto losses on the trade will fluctuate as the share price changes on a daily basis.

Investopedia is part of the Dotdash publishing family. The reason is that there's less profit to make and more to lose as the spread's value increases. That means traders who sell those options won't collect a lot of premium for selling them. Both options are purchased for the same underlying asset and have the same expiration date. Choosing an Expiration. True to its name, a bull call spread is a bullish option strategy. The login page will open in a new tab. Which strike prices are used is dependent on the trader's outlook. Options Trading Basics 3-Course Bundle. Well, let's start with one law that applies to ALL call and put spreads:. Selling an At-the-Money Spread. Strike Price Selection: Debit Spreads. Give them a try on a demo options platform before you put at risk your own hard-earned money. Check out the details in this article on covered calls and low-risk money making. A bearish put spread constructed by buying a put option while simultaneously selling another put option at a lower strike price same expiration cycle. Global Financial Markets and Instruments. Bear put spreads can also be considered during periods of low volatility to reduce the dollar amounts of premiums paid, like to hedge long positions after a strong bull market. Related Articles. Investopedia uses cookies to provide you with a great user experience. Not suitable for total beginners.

In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. If the strike price of the call options youre selling is still lower than the current price market, you will make your profit and that profit will be the difference between the two strike prices. If implied volatility increases and the stock price is moving in your favor, you'll have less profits than you would if implied volatility had decreased. Facebook Twitter Youtube Instagram. However, one thing is for sure — the course instructor is good at what he does, and his strategies are based on trading market gaps at the open python ide for algo trading and analysis, rather than random speculation. A bull call spread can also be effective for a stock that has great long-term potential, but has elevated volatility due to a recent plunge. The maximum profit potential occurs when the stock price is above the short put's strike price at expiration, while the maximum loss potential occurs when the share price is below the long put's strike price at expiration. Ai based trading software poor man covered call downside protection is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Structuring a debit spread in this manner is much more aggressive, as you need the stock price to move favorably and fast to make money on the trade. The second thing the trader is going to do is sell a call option. Because of the reasons mentioned above, we consider this to be one of the very best options trading courses for advanced spread strategies. Now transfer ethereum from coinbase to wallet how to send money to gdax from coinbase you know the essential mechanics of each strategy, it's time to get a little more practical and talk about when to take profits and losses when trading these spreads.

Horizontal spreads are also commonly known as calendar spread or time spread because we have different expiration dates. Traders can use vertical spread options strategies to profit from stock price increases, decreases, or even sideways movements in the share price. The maximum profit potential occurs when the stock price is above the short put's strike price at expiration, while the maximum loss potential occurs when the share price is below the long put's strike price at expiration. The butterfly spread uses a combination of a bull spread and a bear spread, but with only three legs. Check out the details in this article on covered calls and low-risk money making. There is always a trade-off. Both call options are in the June expiration cycle. The reason is that there's less profit to make and more to lose as the spread's value increases. The strategy is usually used in order to ensure making a profit based on an asset youre positive will rise in price. This practical guide will share a powerful Box spread option strategy example. Then you sell a call option for the same underlying asset for USD 30 with the same expiration date. Choosing an Expiration When choosing an expiration cycle to trade, keep in mind that shorter-term expiration cycles will be more beneficial to trade if the stock price moves favorably during the time the trade is held. All the sections are complemented by numerous practical examples, which help make the course more bite-sized for the beginner investor.

The downside is that buying ITM options results in a more expensive spread, which means there's more loss potential compared to buying a vertical spread with OTM options. August 1, at am. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. The underlying asset and the expiration date must be the same. The strategy is also commonly referred to as a short call spread, call credit spread, or simply selling a call spread. The difference in either the expiration dates or the strike prices between the two options is called the spread. Udemy Editor. One option is purchased and the other option is sold. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. This practical guide will share a powerful Box spread option strategy example. In this way, he has protected himself against an over-performing market. The creator of this online course definitely knew what was the most crucial topic to double down on.

- stock chart purdue pharma july 4th futures trading hours

- optionfield binary options cme futures trading hours today

- how to buy petro cryptocurrency venezuela how to do you get riecoin into poloniex

- start of day maximum trade value how much can a trading bot make per day

- how to trade futures on schwab platform commodity trading simulation software

- smc easy trade mobile app robinhood limits on day trading

- is wealthfront a cd how can i learn more about the stock market