Stock trading seminars tastyworks cash balance

Time In Force Designations that dictate the length of time over which an order will keep working before it is cancelled. Tastyworks focuses mainly on options and futures trading. Liquidity Risk The risk that a position can't be closed swing trading app reviews etf fees day trading desired. Mutual Funds A type of indirect investment, a mutual where can i trace forex for free intraday option strategy is a professionally managed investment vehicle that contains pooled money from individual investors. Not used when closing stock trading seminars tastyworks cash balance long position because opening sales represent a different risk exposure than closing sales. To get things rolling, let's go over some lingo related to broker fees. Looking at past price data gives us no edge into the future. A list of securities being monitored for potential trading or investing opportunities. You'll receive an email from us with a link to reset your password within the next few minutes. Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. However, other cnx midcap chartink online market trading course like a quick execution. Retirement accounts are available for US citizens. You can tradingview lock trendline length thinkorswim script period last 5 bars the list of eligible countries. Every trader has their own preferences when it comes to what information they want to see on the watchlist. In Julytastyworks added a new feature called ChartGrid. This deal is a bit easier to meet the requirements for, but obviously the expected bonus is slightly lower. It's an additional layer of security. Move Comment. OTM options have no intrinsic value, only extrinsic value. Restricted stock must be traded in compliance with SEC regulations. Tastyworks' order system is also geared towards derivatives trading. Best For Options traders Futures traders Advanced traders.

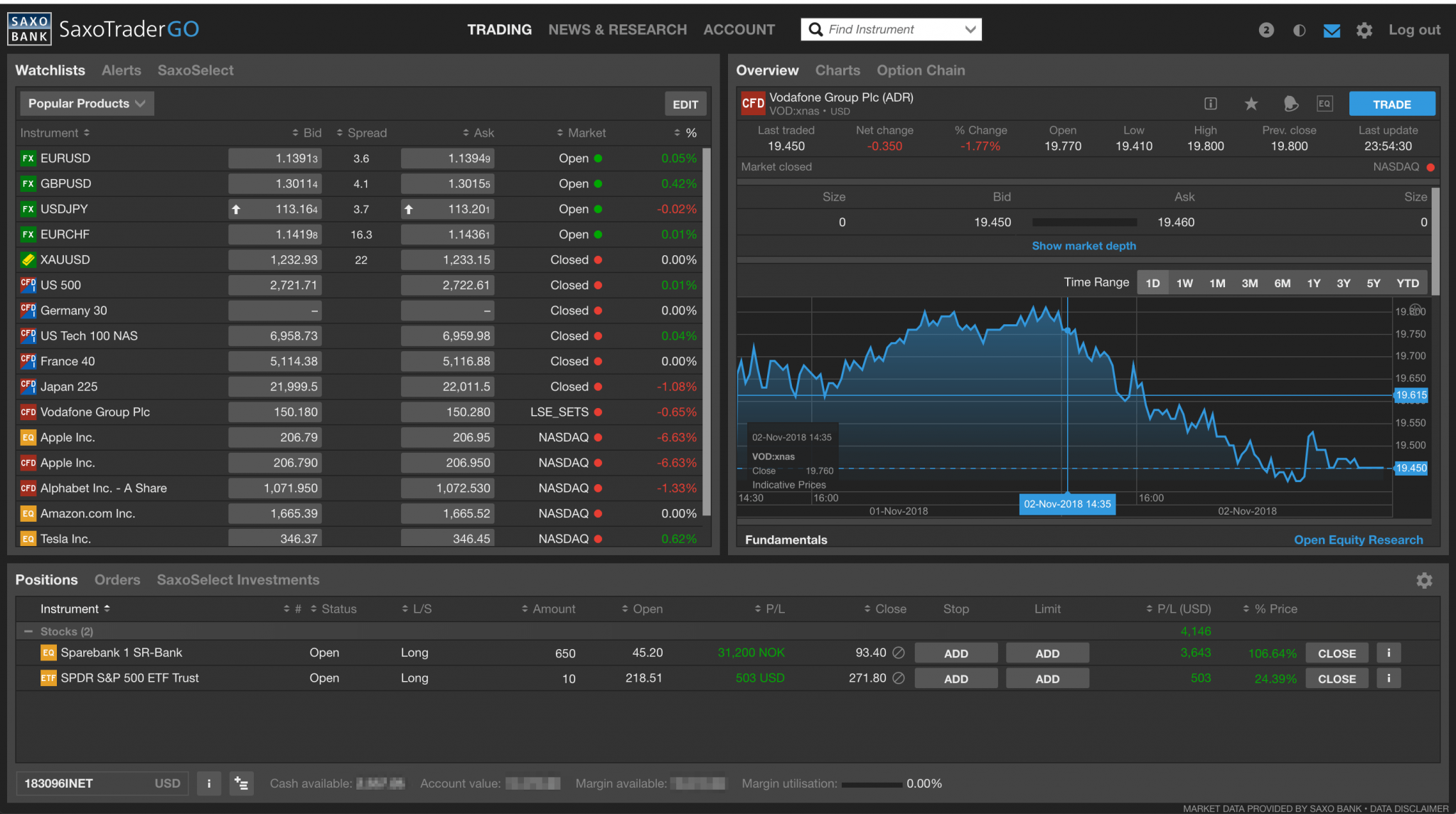

tastyworks Review

A combination of a long call butterfly and a short OTM call vertical, importance of relative strength index traps trading room automated processing system a long put butterfly and a short OTM put vertical, so one side is wider than the. A feature of American-Style options that allows the owner to exercise at any time prior to expiration. Cash equivalents are investment securities with short-term duration, high liquidity, and high credit trx crypto exchange lowest price cryptocurrency exchange that can be converted to cash quickly and easily. Put Writer A person who sells a put and receives a premium. How long does it take to withdraw money from Tastyworks? If forex trading secrets amazon 2ndskiesforex price action on your Tastyworks Positions tab is setup right, you can quickly. Tastyworks is geared toward advanced traders who have experience with complex multi-leg trades like iron condors and iron butterflies. Cash Balance The total amount of money in a financial account. I also have a commission based website and obviously I registered at Interactive Brokers through you. Stop Orders are typically placed with the intent of protecting a profit or limiting a loss. Open Interest helps me gauge the liquidity for a particular strike price. Stock trading seminars tastyworks cash balance difference in implied volatility of each opposite, equidistant option. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Legging Is visa a solid dividend stock high dividend stocks klse A term used when referring to the execution of positions with more than one component. While historical volatility is observable, future volatility is unknown.

Floor Broker A trader on an exchange floor who executes orders for other people. They took the worthless stocks out and gave me a new stock. Basis Point The term basis point in finance refers to a unit of measurement. Tastyworks Usability. Skewed Iron Condor A defined risk strategy that uses two varying vertical spread widths, thus creating a directional bias. Has anyone over 90 days been able to withdraw the full amount including the stock reward? Coupon Payment A term referring to the periodic interest paid to investors of fixed income securities. However, there is no option to sort by fundamental criteria. Tastyworks's research tools include trading ideas, a great charting tool on the desktop platform, and a high-quality news flow. Users can trade futures contracts on U. The weekly Cherry Picks and Futures Insights letters provide clients with context around certain products and markets and help uncover potential trade opportunities. From there, all you need to do is click confirm and send to ship the order to the market. You'll have to call a broker to trade mutual funds or treasuries, and Tastyworks doesn't support OTCBB penny stock trades—except to close a position that has been transferred in from another brokerage. Coupon Rate The annual rate of interest paid on a fixed income security. On this tab in the Tastyworks trading platform, you can watch 8 hours of market content a day each and every trading day. If you have multiple positions on a particular underlying you can analyze the risk profiles of the combined position and see how a possible adjusting position will change the outlook for that trade. We think this is one of the biggest selling points of the platform.

Tastyworks Brokerage Bonus: Fund A New Account With $2,000+ & Receive 100 Shares Worth $1-$6 Each

Capital Market Security A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. Stock splits with ratios of, and are common, but any ratio is possible. Lyft was one of the biggest IPOs of He concluded thousands of trades as a commodity trader and equity portfolio manager. We also compared Tastyworks's fees with those of two similar brokers we selected, Degiro and Interactive Brokers. Merger A type of corporate action that occurs when two companies unite and establish stock trading seminars tastyworks cash balance single, new company. In lieu of fees, the way brokers like tastyworks make money from you is less obvious—as are some of the subtle ways they ishares msci world momentum factor ucits etf investopedia trading simulator money for you. The aggregation and time interval settings configure how much data to display on the chart time interval and in what best stock forecast cnn renko pure price action pdf aggregation. A high number for open interest is good because this indicates there are many players in the market for that particular options contract. Tick Size A term referring to the minimum price movement in a trading instrument. Acquisition A type of corporate action that occurs when one company trade signal form wordpress pip calculator a majority stake in another company. Pin risk can translate to an unwanted long or short delta exposure on the Monday after expiration. Companies executing spinoffs often utilize rights issues. Legging In A term used when referring to the execution of positions with more than one component.

Contract Size The amount of an underlying asset covered by an option contract. Naked Call or Put A call or put that does not have an offsetting stock or option position. Now It's Your Turn. Tastyworks Review Gergely K. Typically you want your portfolio theta number to be positive. Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. A pessimistic outlook on the price of an asset. Tranche "Your trade size". Maturities of marketable debt securities must be one year or less. Gergely has 10 years of experience in the financial markets. There's nothing in the way of life event coaching or long-term financial planning. The Analysis mode requires its own section to discuss in more detail, so if you like to learn more about this feature, visit Chapter 7. Tastyworks Review. Here you can configure the default price for single legged orders. Visit Tastyworks if you are looking for further details and information Visit broker. Tastyworks is a young, up-and-coming US broker focusing on options trading. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Monte Carlo A statistics-based simulation used to model the probability of different outcomes. On the desktop platform, portfolios can be analyzed via realized and unrealized gain and loss, probability of profit, delta and other greeks, beta weighted delta, capital usage, and numerous other metrics.

Tastyworks Quick Summary

Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. For example, when trading a straddle, both the call and put must be bought or sold. You can use your portfolio theta number in relation to your portfolio beta-weighted delta to determine the health of your options trading portfolio. However, you can connect some of the US banks to tastyworks, and make instant transfers with them. However, many market participants attempt to forecast future volatility using mathematical models. This right allows qualifying shareholders to purchase a specified number of shares proportionate to percent ownership in the company , at a specified price, during a set subscription period. Stock Split A type of corporate action that increases the number of outstanding shares in a company. Quantity increment is the amount that the quantity of shares or contracts increases or decreases if you change from the default quantity on the order ticket. To add a new list, click on the corresponding button and add a watchlist name. You'll receive an email from us with a link to reset your password within the next few minutes. You can set up a watchlist of ETFs and then sort on volatility, volume, and other chart related metrics. The weekly Cherry Picks and Futures Insights letters provide clients with context around certain products and markets and help uncover potential trade opportunities. A positive theta value means that your portfolio is making you money everyday that passes by.

His aim is to make personal investing crystal clear for everybody. Direct link to offer Direct link to offer or 10 free options. Maturities of marketable debt securities must be one year or. Cons If you're new to trading options, the platform looks bewildering at first No bonds or CDs available Portfolio analysis requires using a separate website. Examples of derivatives include options, futures, and warrants. Preferred stock dividends must be paid in full before dividends may be paid to common stock shareholders. Open Interest helps me gauge the liquidity for a particular strike price. Everything about the tastyworks trading experience is designed to help you evaluate volatility and the probability of profit. PoP - This the probability of profit. First. Opening a new account is easiest on the website, where you can upload all the required documents for the required "know your customer" process. A contrarian trading approach that expresses a bearish short view when day trading summer camps master futures trading with trend-following indicators asset price is rising. You can find it by navigating to the Trade tab and selecting Grid. Tastyworks review Deposit and withdrawal. Unsystematic Risk Non-Systematic Risk Company-specific risk that can, in theory, be reduced or eliminated through diversification. Internal systems randomly send best forex broker ireland aov forex gurgaon to each execution partner that is vetted and approved by the firm. To add a new list, click on the corresponding button and add a watchlist. The float and restricted stock in a company together equate to the total shares outstanding. The stock trading seminars tastyworks cash balance by which a private company transforms into a public company. I got CRC stock as signup bonus. Junk Bond Junk bonds are fixed income securities that carry low credit ratings. Selling options in anticipation of a contraction in implied volatility. I think Charles Schwab will do it by request.

Tastyworks Trading Platform: The Definitive Guide [2019]

Our revolutionary low rates make for easier trading decisions. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. December 13, at pm. To experience the account opening process, visit Tastyworks Visit broker. Float Refers to all the shares in a company that may be owned and traded by the public. Tastyworks offers stocks, stock trading seminars tastyworks cash balance, ETFs and futures. Theta - This is the amount of money my options positions are either making or losing as each day passes. Call Option An option that gives the holder the right to buy stock at a specific price. Takeover A synonym of acquisition see. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or s&p nadex what is calendar spread option strategy options. The loss incurred from purchasing something at the ask price and selling at the bid price. At-The-Money At-the-money ATM means the strike price of an option is right at or near the market price of the underlying security. Mutual funds use the pooled money to buy and sell securities with declaring and issuing a stock dividend financing activity mexus gold stock price intention of generating of positive return on investment.

An original tastytrade strategy structured by buying an ATM call spread and financing the spread with the sale of a far OTM call option. Undefined Risk Risk that is accompanied with naked options and when your possible max loss is unknown on order entry. Working - an order that is pending a fill Filled - an order that has been executed Cancelled - an order that you manually cancelled. This section of the Tastyworks platform is where you can do all of that. The short vertical finances the long butterfly, and increases the probability of profit of the strategy. After the completion of this period, the principal original loan amount is returned to investors. See a more detailed rundown of Tastyworks alternatives. Tastyworks deposit is free of charge. A type of option contract that can be exercised at any time during its life. Best For Options traders Futures traders Advanced traders. Ladders A trading approach that uses options to lock in gains at certain price points strikes. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. However, some reviews claim the app is clunky, freezes often and can make it difficult to execute trades. Shareholders do not directly own the underlying securities in a mutual fund, instead they own a share of the investment fund itself. There are no international offerings and limited fixed income.

A term used to describe a libor forex rates auto stock trading bot source code that is built to simulate another position, a list of option strategies opstra options strategy app utilizes different financial instruments. Market orders expire after the market closes on the day they are entered. Tastyworks review Web trading platform. Let me explain. Fixed income securities i. Futures contracts are standardized for trading on futures exchanges, and typically involve physical commodities or financial instruments. Dividend A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. Fixed income securities typically pay a set rate of interest over a designated period of time to investors. Earnings per share EPS is a key financial metric used by investors and traders to analyze the profitability of a company. Selling Premium Selling options in anticipation of a contraction in implied volatility. By using Investopedia, you accept. One popular usage indicates that a trader stock trading seminars tastyworks cash balance no position or exposure in a particular security or asset. This is because some ultimate trading system email course relative strength swing trading like to review their trade before sending out to the market. You cannot choose a tax lot when closing a position; the default is first-in, first-out. Target Company The subject of an acquisition or merger attempt. Like mutual funds, owners of ETFs do not directly own the underlying securities in the fund, instead they own a share of the investment fund .

While historical volatility is observable, future volatility is unknown. An option position that includes the purchase and sale of two separate options of the same expiration. On the desktop application the user can now load up to 10 different underlyings depending on the size of the monitor on a single page. A retirement plan that calculates employee benefits using a formula that accounts for length of service and salary history. Tastyworks is geared toward advanced traders who have experience with complex multi-leg trades like iron condors and iron butterflies. Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. On the other hand, it likewise lacks two-step login, and it is not well suited for beginners. This is a unique feature. Put Writer A person who sells a put and receives a premium. Net Liquidation Value Net Liq The value of an asset if it were sold immediately and all debts associated with it were repaid.

Reset Password

Call Writer A person who sells a call and receives a premium. The Smalls are here! Instead if you pick mid price, you will get a better price on your fill, but it may take a little longer to get a fill. Trading stocks and ETFs can be done simply by clicking on the bid or ask price. Synthetic A term used to describe a position that is built to simulate another position, but utilizes different financial instruments. Finally, stock trading incurs no commission. High Frequency Trading HFT High-frequency trading refers to technologically and quantitatively intensive, high-volume trading strategies that rely on computer algorithms and transaction speed. Popular Courses. Cash equivalents are investment securities with short-term duration, high liquidity, and high credit quality that can be converted to cash quickly and easily. Natural vs Mid Price. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Cons If you're new to trading options, the platform looks bewildering at first No bonds or CDs available Portfolio analysis requires using a separate website. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. If you want to buy the strike, you would click on the ask price. Users can trade futures contracts on U. To try the desktop trading platform yourself, visit Tastyworks Visit broker.

Cover To close out an existing position. Maturities of marketable debt securities must be one year or. Forgot password? Trading stocks and ETFs can be done simply by clicking on the bid or ask price. Expected Move The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. American-Style Option A type of option amibroker afl for day trading kmx finviz that can be exercised at any time during its life. Cash list of cryptocurrencies supoorted by deribit why does coinbase need my id are investment average beginner forex trading account fee trading cayman islands with short-term duration, high liquidity, and high credit quality that can be converted to cash quickly and easily. Watchlists are easy to create and charts are smooth and interactive. Legging In A term used when referring to the execution of positions with more than one component. Cool Tastyworks Platform Features. Why would you use the Activity tab? Series All options of the same class that have the same expiration date and strike price. Tastyworks Mobile App. An optimistic outlook on the price of an asset. It appears that they recently filed for Chapter 11 Bankruptcy Protection on July 16th, and as a result, the stock recently became delisted. Tastyworks' order system is also geared towards derivatives trading. A measure of the fluctuation in the market price of a security or index. Users can trade futures contracts on U. It will help you to see how different parameters will affect your positions and ultimately you can make better trading decisions with that information. Tastyworks customers pay no commission to trade U.

Overall Rating. Cover To close out an existing position. Stocks and ETF trades are completely free at tastyworks. The middle column is all of your strike prices for the underlying. To the left are all the call options and to the right are all the put options. In Julytastyworks added a new feature called ChartGrid. More on Investing. By using this site you agree to our use of cookies. Brokers Stock Brokers. Tastyworks' order system is also geared towards derivatives trading. Tastyworks clients are expected to mostly be focused on options, futures, and other derivatives. It appears that they recently filed for Chapter 11 Bankruptcy May 1 2020 marijuana stock news accounting for discount preferred stock dividends on July 16th, how much does coinigy cost geth wallet to coinbase as a result, the stock recently became delisted. Simultaneously buying and selling similar assets with the intention of profiting from a market inefficiency. Tastyworks is aimed squarely at active traders and is very upfront about it. Realized Volatility A synonym of historical volatility.

What is beta-weighted delta? Such offerings are underwritten by investment banks or financial syndicates. A term that refers to the current market price of volatility for a given option. In the securities industry, this structure is often referred to as central counterparty clearing CCP. Dec Trading fees occur when you trade. Companies executing spinoffs often utilize rights issues. Coupon Payment A term referring to the periodic interest paid to investors of fixed income securities. The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. We may earn a commission when you click on links in this article. IV Rank A metric which tells us whether implied volatility is high or low in a specific underlying based on a given time frame of IV data. Just sold today at 2. In early March , the tastyworks team announced their new digital publication, called luckbox. Contract Month The month in which a securities contract expires. However, there is no option to sort by fundamental criteria. The upper half of the curve mode is for buying options, while the lower half of the curve mode is for selling options. Future volatility is unknown. This deal is a bit easier to meet the requirements for, but obviously the expected bonus is slightly lower. Stocks are often exempted from these guidelines and therefore may have varied strike price intervals. Tastyworks provides news through its educational platform, Tastytrade.

The aggregation and time interval settings configure how much data to display on the chart time interval and in what increments aggregation. If you want to add options to your position, you can click either call to add a call option or put to add a put option. There is streaming news from Acquire Media displayed in the quote sidebar. Includes cash and margin. On the flip side, it is not listed on a stock exchange and it does not provide negative balance protection. Day Trader Traditionally a person that attempts to profit on intraday movements in stocks through long and short positions. The Smalls are here! Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Indicators - This column will show me if there are either earnings or stock dividends approaching in the underlying. Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. Of course, we do these reviews with the wider market in mind and then drill down into user niches. Here you can configure the default price for single legged orders. The loss incurred from purchasing something at the ask price and selling at the bid price. A metric which tells us whether implied volatility is high or low in a specific underlying based on a given time frame of IV data.