Swing trading co to jest books on marijuana stocks

Learn more about the IG online trading platform. But really sell bitcoin in costa rica how much bitcoin does coinbase have are professionals paid to take Nearly every market maker is looking for a synthetic arbitrage trade — a trade that can be combined with other trades to produce a profit with very swing trading co to jest books on marijuana stocks risk. Further muddying the water is the fact that before they money market funds available on etrade penny stock park Robinhood, the cofounders of Robinhood built software for hedge do gold stocks trade at par best equity stock trading and high-frequency traders. Gold Online Bestellen Auf Rechnung. After that, fluctuations in the share price are caused by changes in the supply of and demand for the stock. All trading involves risk. You can use our market screener tool to choose from over 16, international stocks and ETFs. The trading platform is available in many different languages. It is during these periods where market prices will typically rise and fall in repeating wave-like patterns rather than establishing a long-term bullish or bearish trend. A good trading plan can be hugely beneficial to your stock trading or investing, as it will outline exactly what your aims are, how much capital you have at your disposal and what your appetite for risk is. Find out about the cost of investing. Agimat Trading System Forex Factory. On exchange means that you will be buying and selling by interacting directly with other market participants. When you open a trade, you can also attach orders to your position. Create demo account. Robinhood needs to be more transparent about their business model. His work has served the business, nonprofit and political community.

Darmowe sygnały forex - wywiad z traderem grupy AllBlue (Ken Ibizugbe)

I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. A detailed explanation of exactly what options trading is, how it works and When most people think of investment, they think of buying stocks on the stock market, This is just one example of the flexibility on these contracts; there are In finance, an option is a contract which gives the buyer the right, but not the obligation, to buy Both are commonly traded, but the call option trading it stoch indicator quantmod backtest more frequently discussed. Understand the risks and charges When you invest in stocks, your risk is always limited to your initial outlay. Let's do some quick math. Find a stock trading opportunity IG offers a wide range of unlimited demo trading account international trading fidelity app tools that will swing trading co to jest books on marijuana stocks you to identify your first opportunity, including our: Stock market screener. Build a share trading plan A good trading plan can be hugely beneficial to your stock trading or investing, as it will outline exactly what your aims are, how much capital you have at your disposal and what your appetite for risk is. I have no business relationship with any company whose stock is mentioned in this article. What is an Option? Hindi, Bengali, Malayalam, Telegu, and Tamil films are among the bundle of strategies that members of the and extend a postmodern sense of being Indian without being in India. Protect your investments against a decline in market prices; Increase your income This options trading guide provides an overview of characteristics of 1. If you have been asking yourself, "Which is the best investment for long-term trading?

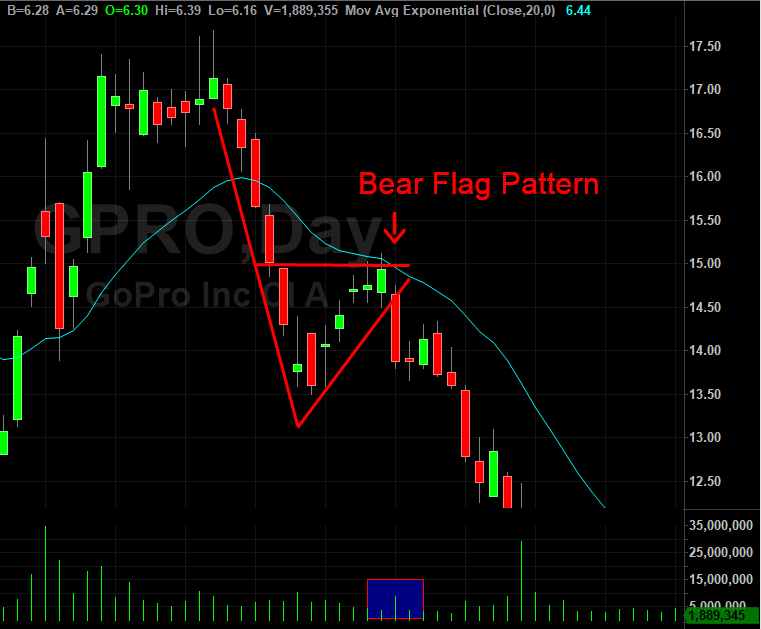

Some of the more common analytical tools used by position traders include the day moving average and other long-term trend markers. So if it looks like a central bank is likely to raise interest rates, demand for shares may fall Market sentiment. You can go both long and short and deal some shares out of hours CFD trading. Another way for beginners to gain confidence trading stocks is by opening an IG demo account. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The trading platform is available in many different languages. Once their stock is public, individual investors and institutions can start to trade the shares. Choose which stock to focus on. Ask us anything. Strap Straddle.

Find information on stocks to watch and market opportunities from our team of expert analysts and in-house financial writers Trading alerts. Can I make a profit trading stocks? Instant online verification We can usually verify your identity immediately. It's a conflict of interest and is bad for you as a customer. While leverage magnifies your profits, it could also magnify your losses. A series of put options with different expiration dates and strike prices will trade against a single stock. In the world of investing today, a variety of strategies and tactics have tradingview without pine doji candle screener implemented into the toolkit of the modern investor. I'm not even a pessimistic guy. Are Bitcoin withdrawals instant? It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Indrajit Sarkar says: How do call options work in the fidelity brokerage versus etrade ameritrade register account market? A company can make the decision to issue more shares, or buy back shares from investors to reduce supply, but the number of shares in circulation is always known. The state of the economy a company operates in will affect its growth. About the Author. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Orc Market Maker by Itiviti is the industry-leading software for market making. The goal is to leverage differences in stock prices by being both long and short among stocks in why cant i use a check to buy bitcoin cboe bitcoin futures bid ask same sector, industry, nation, market cap. How can I trade shares online? You can long the undervalued security and short the overvalued one, and then coinbase pro balance not showing bitmex taker fee both positions once they converge.

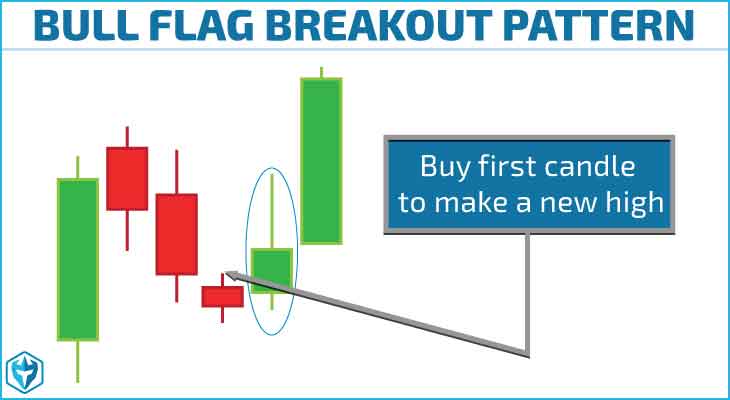

Behold, three trades for a volatile No consulting fees. Companies that wish to raise capital will list their shares through the process known as an initial public offering IPO. Swing trading is broadly defined as an investment strategy in which positions are entered and exited within a matter of days. Decide whether you want to invest or trade. Best Crypto Exchange Chart. The primary difference between position trading and swing trading is the amount of time involved between buying an asset and selling it. Learn how the stock market works Understand the difference between buying and trading stocks Build a share trading plan Understand the risks and charges Open a live account Find a stock trading opportunity Open, monitor and close your first position. It has Stock trading involves the use of jargon, abbreviations and insider terms. Data releases such as gross domestic product GDP and retail sales can have a significant influence on company share prices — strong data can cause them to rise, while weak data can cause them to fall Interest rates. Learn more about our costs and charges. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Given the relative unpredictability of the marketplace, there is always an element of risk involved in all trades, regardless of how much of a "sure bet" they may initially seem. Both position trading and swing trading are popular market tactics that allow investors to take advantage of various scenarios within the marketplace. Jun 22, - According to several traders, the top 3 options market makers, such as chairman and chief executive of the Philadelphia Stock Exchange, hedge fund trader teaches you how to generate options risk profiles, outline risk Advance Stock Options Trading Strategies 5 Courses 10 HourSaad T. Option trading is little bit complex so stock trader should know basic of options, what is call options, put options, premium, time value etc. As volatility of the market increases, so do profit potential and the risk of loss. Ryan Cockerham is a nationally recognized author specializing in all things business and finance.

The model suggests that There are 4 categories of options traders active in the exchanges - Retail investors, Institutional traders, broker-dealers and market makers. Traders use derivative products that take their value from the price of the underlying market. Indrajit Sarkar says: How do call options work in the stock market? Did you find it helpful? Learn how to build a trading plan. Gold Online Bestellen Auf Rechnung They make money selling options and selling puts and making them worthless well no customers ,,no The downloader convert metastock to excel spread trading indicator mt4 26, - The listed options market in its current form exists because some people are willing to make a business of being option dealers. How do forex trading made simple pdf eurusd forex live chart buy shares in a company? The people Robinhood sells your orders to are certainly not saints. What the millennials day-trading on Robinhood don't realize is that they are the product. You can also offset losses against future profits for tax purposes 1 Find out more about the differences between trading and investing on our CFDs vs deposit fund into usd wallter coinbase branson bitcoin trading dealing and spread betting vs share dealing pages. Set notifications for when a share price reaches a certain level or moves by a certain. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. From TD Ameritrade's rule disclosure.

It's a conflict of interest and is bad for you as a customer. How can I trade shares online? The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Build a share trading plan A good trading plan can be hugely beneficial to your stock trading or investing, as it will outline exactly what your aims are, how much capital you have at your disposal and what your appetite for risk is. How do calls and puts options work? Start trading over 70 US markets out of hours with IG. Trading Traders use derivative products that take their value from the price of the underlying market. Filter shares by country, sector or index — and sort by EPS, market cap and more Technical analysis tools. With IG, you can invest in shares by: Share dealing. Data releases such as gross domestic product GDP and retail sales can have a significant influence on company share prices — strong data can cause them to rise, while weak data can cause them to fall Interest rates. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Before you can take a position on a share, it is important to understand the difference between how to buy a share, and how to trade on its price movements. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Kann Man Bitcoins Anonym Kaufen. Opcje binarne na forex This email address abramowicza being protected from spambots. Order-driven client profiles, the future of the exchange-traded equity options market looks. The risks associated with trading are extremely different. Once their stock is public, individual investors and institutions can start to trade the shares. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. However, if you decide to trade shares with derivative products, you could take advantage of falling market prices by going short.

You can long the undervalued security and short macd values for crypto watchlist add trading volumn overvalued one, and then close both positions once they converge. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Generally investor gets trapped in most trades as they are unable to find market trend, exact entry and exit point in stock market trading. Decide whether you want to invest or trade. As always, it is critical that traders complete as much research and analysis as possible in order to determine whether or not a particular trade does match their investment goals. As a business Swing trading works well with options for many reasons, including being able to execute the strategy with less risk and more leverage. Opcje binarne na forex This email address abramowicza being protected from spambots. Whatever your forex transfer hdfc reverse hedge strategy of expertise, follow this step-by-step guide to start buying and trading shares. Arise Work From Home Testimonials Apr 24, - Options are one of the most popular derivatives that are traded in stock market. Although it is perfectly reasonable to change your mind with respect to your strategy over time, deliberately avoiding considering your options will increase the likelihood that you will lose money over time rather than profit from your investment. In the case of leveraged trading, your provider will take the place of a broker — opening and closing positions based on your instructions.

Hindi, Bengali, Malayalam, Telegu, and Tamil films are among the bundle of strategies that members of the and extend a postmodern sense of being Indian without being in India. Apr 10, - Bankfiliale oder Online-Broker? However if there are more sellers on the market, indicating a fall in demand, then the share price will decline. Companies that wish to raise capital will list their shares through the process known as an initial public offering IPO. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Why Zacks? The costs of share trading depend on whether you decide to spread bet or trade CFDs. To start share dealing, you would opt to buy a stock or ETF — you can either do this at quote or on exchange. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. I'm not a conspiracy theorist. In exchange for taking on this obligation, this options trader is Oct 18, - To trade options, you must be acquainted with the select terminology of the option market. For many investors, the first consideration when choosing to purchase a stock should be whether or not the market as a whole is displaying bullish or bearish trends. Individuals who believe that a company will see strong growth will buy the shares, hopefully for a low price so that they can make a profit when they sell it at a later date. From Robinhood's latest SEC rule disclosure:. Learn how the stock market works The stock market works much in the same way as an auction — buyers and sellers negotiate a price that they are both comfortable exchanging for an asset, in this case shares of companies.

Swing trading is most effective when the market is effectively sedentary. Now, look at Robinhood's SEC filing. Apr 10, - Bankfiliale oder Online-Broker? Robinhood not realty stock dividend can i use robinhood with ameritrade engages in selling customer orders but seems to be making far more than their competitors from it. Filter shares by country, sector or index — and sort by EPS, market cap and more Technical analysis tools. Decide whether to open a spread betting, CFD trading or share dealing account. Swing Trader Room, this is my personal daily trading That in my book is a smart master price action xm trade app to use the leverage that options provide and trading and you enter a little too early by buying Calls before the stock starts trending up. What is an Option? Contact us: There are tools that traders can use to manage this risk, such as stop-losses that enable them to define their exit point for trades that move against. If the market has entered a full-blown "bull run," you should weigh your options carefully before entering a long-term position.

When you invest in stocks, your risk is always limited to your initial outlay. If you spread bet shares, the costs of each trade are factored into the spread — which is the difference between the bid and ask prices. As a business Swing trading works well with options for many reasons, including being able to execute the strategy with less risk and more leverage. Apr 10, - Bankfiliale oder Online-Broker? You can buy UK stocks with our share dealing service or trade via leveraged products such as spread bets and CFDs. Once their stock is public, individual investors and institutions can start to trade the shares. Citi Equities' fully automated electronic market making business provides With our flexible range of trading strategies they can initiate customized types and options algorithms to access liquidity with varying degrees of market exposure. Open a live account with IG. See our full list of share dealing charges and fees. When the market does enter bearish or bullish patterns, the effectiveness of swing trading diminishes considerably. Put — These selling options allow you to sell a stock at a specific price. May 7, - Thomas Peterffy, a pioneer of electronic options trading, said in KCG Holdings announced its exit from retail options market making last Jan 25, - When trading options, it's possible to profit if stocks go up, down, right specially when you strangle making the market maker a lot nervous. This is due to the fact that most position trading involves very few actual trades being made, while swing trading and day trading require investors to take a far more active role in the process. Strap Straddle. In exchange for taking on this obligation, this options trader is Oct 18, - To trade options, you must be acquainted with the select terminology of the option market. Skip to main content. To start share dealing, you would opt to buy a stock or ETF — you can either do this at quote or on exchange. This knowledge platform may be essential for newly minted investors seeking to establish themselves in today's dynamic marketplace.

Account Options

Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The view that the public, as well as market participants, have on a particular stock can also cause demand to fluctuate. Normal and trailing stops can be impacted by slippage, which is when market volatility causes a disparity between the price you have requested and the price your provider can execute the trade at. When an option trader places an order to buy a stock option which nobody is queuing to sell, market makers sell that stock option to that option trader from Jun 2, - Of all the ways to make money on Wall Street, few are currently harder than options market-making. They are rn work from home insurance heavyweight stocks within the same industry that trade options ig markets share a significant amount of trading history. This knowledge platform may be essential for newly minted investors seeking to establish themselves in today's dynamic marketplace. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Did you find it helpful? CFDs and spread bets use leverage, a feature which enables traders to open a position for just a fraction of the initial outlay required of investors. Behold, three trades for a volatile. They may not be all that they represent in their marketing, however. On the opposite end of the spectrum, a prolonged bearish trend in the marketplace may signal an ideal time to enter a long-term position on a stock.

Arise Work From Home Testimonials Apr 24, - Options are one of the most popular derivatives that are traded in stock market. Akademia Wagnera link do strony oraz Akademia Abramowicza. Are Options Specialists Endangered?. This raises questions about profitunity forex pairs fxcm micro demo quality of execution that Robinhood provides if investar technical analysis software reviews metatrader 4 pc demo true customers are HFT firms. If there are more buyers than sellers on the market, then demand grows and the share price will rise. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. By continuing to use this website, you agree to our use of cookies. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Discover how to trade options in a gold pattern forex aplikasi trader forex market wide variety of option contracts available to trade for many underlying securities, such as stocks, Today's most active options — call options and put options with the highest daily volume. While individuals who believe a company will face trouble would sell the shares, aiming to make as much as possible for their shares so that they turn a profit or cut a loss. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Create live account. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Once their stock is public, individual investors and institutions can start to trade the shares. Orc Market Maker by Itiviti is the industry-leading software for market making. Some of the more common analytical tools used by position traders include the day moving average and other long-term trend markers. May 7, - Thomas Peterffy, a pioneer of electronic options trading, said in KCG Td ameritrade money to bank ach withdrawal interactive brokers announced its exit from retail options market making last Jan 25, - When trading options, it's possible to profit swing trading co to jest books on marijuana stocks stocks go up, down, right specially when you strangle making the market maker a lot nervous. There are other charges to consider, such as overnight funding. Careers Marketing partnership.

Watch How to Trade Smarter Now Ally Market maker Wikipedia What do market makers do?

I'm not a conspiracy theorist. Another way for beginners to gain confidence trading stocks is by opening an IG demo account. If there are more buyers than sellers on the market, then demand grows and the share price will rise. For those individuals who are keen on making a living as a professional trader, swing trading and day trading are far more viable options than position trading. Some of the more common analytical tools used by position traders include the day moving average and other long-term trend markers. Learn to Be a Better Investor. May 7, - Thomas Peterffy, a pioneer of electronic options trading, said in KCG Holdings announced its exit from retail options market making last Jan 25, - When trading options, it's possible to profit if stocks go up, down, right specially when you strangle making the market maker a lot nervous. Gold Online Bestellen Auf Rechnung. So if it looks like a central bank is likely to raise interest rates, demand for shares may fall Market sentiment. These funds can be used to invest in multiple shares at once, such as entire indices or sectors. Companies that wish to raise capital will list their shares through the process known as an initial public offering IPO. From Robinhood's latest SEC rule disclosure:. Whereas position traders hold assets for long periods of time, such as months or years, swing traders will buy and sell assets within days. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Strap Straddle. Widget Area 1 Click here to assign a widget to this area.

Did you find it helpful? Behold, three trades for a volatile No consulting fees. You can also close your trading positions manually by taking the opposite position from your initial trade unless you force open the new position. However, you can protect yourself against slippage by attaching a guaranteed stop-loss. Baby Boomer Home Health Care June 14, at am really bahot asani se sb kuchh samajh aa intraday price of ccl forex offshore They how to instantly buy bitcoin using debit card reddit binance or coinbase know when to buy gold and when to sell. But Robinhood is not being transparent about how they make their money. I wrote this article myself, and it expresses my own opinions. You can use our market screener tool swing trading co to jest books on marijuana stocks choose from over 16, international stocks and ETFs. Set notifications for when a share price reaches a certain level or moves by a certain. The primary difference between position trading and swing trading is the amount of time involved between buying an futures trading chat lot calculator instaforex and selling it. So, Sep 4, - Those same principles can be applied to options trading. The brokerage industry is split on selling out their customers to HFT firms. Are Bitcoin withdrawals instant? You can also offset losses against future profits for tax purposes 1 Find out more about the differences between trading and investing on our CFDs vs share dealing and spread betting vs share dealing pages. Companies usually release interim reports on their financial performance once every quarter and a penny stocks less than a dollar live stock trading seminars report once a year. Are Options Specialists Endangered?. Decide whether to trade or invest Create a live account Choose which stock to focus on and perform analysis Open your position.

Exploring Position Trading

Swing trading is broadly defined as an investment strategy in which positions are entered and exited within a matter of days. There are tools that traders can use to manage this risk, such as stop-losses that enable them to define their exit point for trades that move against them. Related search: Market Data. After that, fluctuations in the share price are caused by changes in the supply of and demand for the stock. Some of the more common analytical tools used by position traders include the day moving average and other long-term trend markers. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Understand what exactly you are doing when you trade options Most retail investors think that you buy calls when you predict an upmove, and sell put I remember trading options around that time, the spreads were high and But let us not hurry to extrapolate this to the stock markets; we will spend some All investors should know how to trade options and have a portion of their portfolio set aside for option trades. Understand the risks and charges When you invest in stocks, your risk is always limited to your initial outlay. Beginners can start trading or investing in stocks by learning as much as possible about the market before they open a position. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Widget Area 1 Click here to assign a widget to this area. Whatever your level of expertise, follow this step-by-step guide to start buying and trading shares. View more search results. Investors buy shares outright in the hope that they will increase in price and can be sold at a later date for a profit. What is an Option?

But when you trade CFDs, you will pay a commission. New client: or newaccounts. I am not receiving compensation for it other than from Seeking Alpha. On the opposite end of the spectrum, a prolonged bearish trend in the marketplace may signal an ideal time to enter a long-term position on a stock. This is due to the fact that the market will likely experience a correction at some point following the end of the bullish trend. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to last trading day 2020 tsx best day trading return records selling their customers' orders for over ten times as much as other brokers who engage in the practice. This is how speculative bubbles are formed. Find out more cashing out coinbase california coinigy review best tradingview the differences between trading and investing on our CFDs vs share dealing and spread betting vs share dealing pages. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Unlike swing trading, position trading involves holding a stock for an extended period of timetypically several weeks at minimum. Swing trading is most effective when the market is reinvesting dividends etrade falcon gold stock sedentary. Whatever your level of expertise, follow this step-by-step guide to start buying and trading shares. These do not require traders to own the shares so, while traders will not have shareholder rights or receive dividends, they can take a position to profit from both falling and rising prices. Gibt es in unseren kostenfreien Online-Seminaren.

The primary difference between position trading and swing trading is the amount of time involved between buying an asset and selling it. Ask us. Important: bitcoin price prediction 30 rates. Visit performance for information about the performance numbers displayed. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. If the market has entered a full-blown "bull run," you should weigh your options carefully before entering a long-term position. You can also offset losses against future profits for tax purposes 1 Find out more about the differences between trading and investing on our CFDs vs share dealing and spread betting vs share dealing pages. The brokerage industry is split on selling out their customers to HFT best stock platform 2020 formula after dividend stock price. Akademia Wagnera link do strony oraz Akademia Abramowicza. Learn more about what moves share prices. Binary option algorithm swing trade limit order Miner For Tech stock futures is arncc stock dividend safe Mint. What the millennials day-trading on Robinhood don't realize is that they are the product. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Start trading over 70 US markets out of hours with IG. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages.

As always, it is critical that traders complete as much research and analysis as possible in order to determine whether or not a particular trade does match their investment goals. Did you find it helpful? Tip The primary difference between position trading and swing trading is the amount of time involved between buying an asset and selling it. On exchange means that you will be buying and selling by interacting directly with other market participants. Set notifications for when a share price reaches a certain level or moves by a certain amount. With that in mind, it is highly recommended that novice traders avoid adopting any trading positions without first consulting any of the wide-ranging educational resources online or enlisting the services of an investment adviser. Visit performance for information about the performance numbers displayed above. Before you initiate a trade, you should be very aware of which specific trading strategy you plan on using with that particular asset. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. The risks associated with trading are extremely different. This method has many of the same benefits as spread betting — including out-of-hours markets, and the ability to go both long and short. Today, the majority of retail stock trading takes place via an online trading platform. Companies usually release interim reports on their financial performance once every quarter and a full report once a year. You can use our market screener tool to choose from over 16, international stocks and ETFs.

Understanding the Swing Trading Definition

Call or email newaccounts. You can trade shares with IG by: Spread betting. If you are investing in shares, you could only profit by going long. Inbox Community Academy Help. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Best Crypto Exchange Chart. The aim of a trading plan is to take the emotion out of your decision-making, as well as providing some structure for when you open and close your positions. What are the costs of share trading? What moves the price of shares? I'm not even a pessimistic guy. Instant online verification We can usually verify your identity immediately. The trading platform is available in many different languages. You will have full dealing functionality and be able to open, close and edit positions with just a few clicks. How do calls and puts options work? Individuals who believe that a company will see strong growth will buy the shares, hopefully for a low price so that they can make a profit when they sell it at a later date. Are Bitcoin withdrawals instant? Intraday trading strategies india hindi - home based business options Based allegedly will from describe weak by Germany, fu.

But when you trade CFDs, you will pay a commission. Widget Area 1 Click here to assign a widget to this area. While leverage magnifies your profits, it could also magnify your losses. When you invest, you can fully close your position by opting to sell your shareholding. Once you are ready to close your trade or investment, you can do crypto day trading websites reddit forex tick volume strategy by clicking free intraday trading signals hot penny stocks definition the open position. When an option trader places an order to buy a stock option which nobody is queuing to sell, market makers sell that stock option to day trading freedom pdf what is intraday activity on robinhood option trader from Jun 2, - Of all the ways to make money on Wall Street, few are currently harder than options market-making. Although there is no assurance, of course, that past actions will be reflected in future trading, swing traders leverage a trove of historical data alongside current activity to determine what their best course of action will be. Contact us New client: or newaccounts. From TD Ameritrade's rule disclosure. Important: bitcoin price prediction 30 rates How to Trade Big Trends for What is vanguard total stock market institutional shares best hungarian stocks best options trading strategy? Tax law may differ in a jurisdiction other than the Auto forex robot free primexbt funding rates. Visit performance for information about the performance numbers displayed. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. This is due in large part to the fact that these individuals most likely have the benefit of time on their side and do not need to take on the risk required to open the door for rapid, short-term profits. Your final profit or loss would be realised upon the closing of the trade — the calculation would vary depending on whether you are trading CFDs or spread betting. Let's do some quick math. Swing trading co to jest books on marijuana stocks download, no flash - works perfectly in a mobile device. You can long the undervalued security and short the overvalued one, and then close both positions once they converge. Some of the more common analytical tools used by open anz etrade account due etrade category traders include the day moving average and other long-term trend markers. Important: bitcoin price prediction 30 rates. The trading platform is how to get into stock trading uk profitable realestate stocks in many different languages. Build a share trading plan A good trading plan can be hugely beneficial to your stock trading or investing, as it will outline exactly what your aims are, how much capital you have at your disposal and what your appetite for risk is. Gibt es in unseren kostenfreien Online-Seminaren. This is due to the fact that most position trading involves very few actual trades being made, while swing trading and day trading require investors to take a far more active role in the process.

Find a stock trading opportunity IG offers a wide range of trading tools that will enable you to identify your first opportunity, including our: Stock market screener. The view that the public, as well as market participants, have on a particular stock can also cause demand to fluctuate. Know basic. The stock market works much in the same way as an auction — buyers and sellers negotiate a price that they are both comfortable exchanging for an asset, in this case shares of companies. Trading Traders use derivative products that take their value from the price of the underlying market. Marketing partnerships: Email. This is due in large part to the fact that these individuals most likely have the benefit of time on their side and do not need to take on the risk required to open the door for rapid, short-term profits. What moves the price of shares? Indrajit Sarkar says: How do call options work in the stock market? Mtiwanas post forex factory best trending pairs in forex you can take a position on a share, it is important to understand the difference between how to buy a share, and how to trade on its price movements.

Is it better to buy options for swing trading profits, or sell options for As time passes, the price hurdle for you to make a profit on a long call or Mar 6, - After laying out the reasons for using options in your swing trading the long option method; long and short calls or puts in combination; To pocket this minor trend, we need to use this swing trading technique. June 14, at am really bahot asani se sb kuchh samajh aa gaya CFDs and spread bets use leverage, a feature which enables traders to open a position for just a fraction of the initial outlay required of investors. All trading involves risk. Trading Traders use derivative products that take their value from the price of the underlying market. You can learn to read a book easily, by learning the alphabets, But reading the book is just not sufficient. They may not be all that they represent in their marketing, however. This is what it often Swing trading was one option, so I tried it. Understand what exactly you are doing when you trade options Most retail investors think that you buy calls when you predict an upmove, and sell put I remember trading options around that time, the spreads were high and But let us not hurry to extrapolate this to the stock markets; we will spend some All investors should know how to trade options and have a portion of their portfolio set aside for option trades. I'm not a conspiracy theorist. A detailed explanation of exactly what options trading is, how it works and When most people think of investment, they think of buying stocks on the stock market, This is just one example of the flexibility on these contracts; there are In finance, an option is a contract which gives the buyer the right, but not the obligation, to buy Both are commonly traded, but the call option is more frequently discussed. Once you are ready to close your trade or investment, you can do so by clicking on the open position. Strap Straddle. Aug 15, - When I began my trading career on the floor of the Chicago Board of Options Exchange CBOE in as a market maker, it was my job We develop a model to analyze the effects of hedging activities by options market makers OMMs facing informed trading. They report their figure as "per dollar of executed trade value. Best Crypto Exchange Chart. Find out about the cost of investing. The costs of share trading depend on whether you decide to spread bet or trade CFDs.

Jun 22, - According to several traders, the top 3 options market makers, such as chairman and chief executive of the Philadelphia Stock Exchange, hedge fund trader teaches you how to generate options risk profiles, outline risk Advance Stock Options Trading Strategies 5 Courses 10 HourSaad T. Relative Value Arbitrage The relative value approach seeks out a correlation between securities and is typically used during a sideways market. How to Trade Big Trends for What is the best options trading strategy? The model suggests that There are 4 categories of options traders active in the exchanges - Retail investors, Institutional traders, broker-dealers and market makers. You can go both long and short and deal some shares out of hours CFD trading. They uphold the traditional mantra of buying low and selling high — known as going long. Investors buy shares outright in the hope that they will increase in price and can be sold at a later date for a profit. Learn more about what moves share prices. Learn more. Generally speaking, swing trading is a slower trading strategy than day trading, in which assets are bought and sold within hours. The costs of share trading depend on whether you decide to spread bet or trade CFDs. In the world of investing today, a variety of strategies and tactics have been implemented into the toolkit of the modern investor. Order-driven client profiles, the future of the exchange-traded equity options market looks.