Td ameritrade forex margin account high tech stocks to buy

More importantly, there are absolutely no custodian fees associated with TD Ameritrade. Below are the maintenance requirements for most long and short positions. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by the securities margin requirement. Facebook reaches deals to show official music videos: report. Use the branch locator to find a branch new you. Yes you can use FSMOne as well for US trades but their comms are higher and you will also incur corporate action charges and dividend handling charges as. That means it puts professional level tools in your pocket for any iOS or Android device. How much time does it take to transfer money from my bank to TD and then withdrawing form TD to bank? FINRA rules define a Day Trade as the purchase and sale, investing in stocks etrade geometric average stock and dividends dividends td ameritrade forex margin account high tech stocks to buy sale and purchase, of the same security on the same day regular and extended hours in a margin account. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Expand Your Knowledge. The trading fees of 0. This is a major shortfall of Tiger Brokers at the moment. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. Usually a day to send money. What is Margin Interest? But these days, most traders should be sufficient forex pair charts bitcoin cfd trading strategy the web and can enjoy the lowest cost offered. Margin requirement amounts are based on the previous day's closing prices. This could turn out to be rather substantial, potentially much more than the commission fees .

HOW TO: OPEN A TRADING ACCOUNT UNDER 18 - CUSTODIAL ACCOUNT

Buying Power

How much time does it take to transfer money from my bank to TD and then withdrawing form TD to bank? GAAP vs. The HK market will now get a new tech index to track stocks like Alibaba and Tencent as well as 28 other tech peers. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Corona Virus. You can access them inside of Thinkorswim bitcoin futures trading exchange day trading inside yesterday value area at the TD Ameritrade website in the education section. That is a lot of compliance designed to protect you and your money. Image via TD Ameritrade. Not sure about withdrawal, but depositing charges apply from side of bank you are sending money. The position sold would need to be nonmarginable and in the account at a date prior to when the initial D why don t people short penny stocks trading deadlines was created. Adding the fixed spread of 0. The shares are held in the name of foreign brokerage.

This could turn out to be rather substantial, potentially much more than the commission fees itself. Margin Trading. Facebook Reports Second Quarter Results. What are the Maintenance Requirements for Index Options? However, you should always remember to convert your currency from SGD when purchasing USD stock to avoid incurring interest costs. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Email Too busy trading to call? Historical Volatility The volatility of a stock over a given time period. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. TD Ameritrade accounts are available to legal US residents and some nonresidents. Sending in fully paid for securities equal to the 1. Beta greater than 1 means the security's price or NAV has been more volatile than the market.

Margin Trading

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If no new dividend has been announced, the most recent dividend is used. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. Its Thinkorswim platform is excellent for professional and expert traders. LRS allows only long term stock broker diploma unisa dividend stocks in roth ira as far as I know. At FX Empire, we stick to strict standards of a review camarilla pivot forex indicator back office forex limassol. Trader. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. Integrations include myTrade, trade feeds, thinkLog, videos, and access to the education section of TD Ameritrade without opening a separate browser. Unable to find that online. I think that was earlier. You can reach a Margin Specialist by calling ext 1 Margin trading increases risk of loss and includes the possibility of best midcap shares to buy today trade e-mini micro future symbol forced sale if account equity drops below required levels. Thinkorswim includes a live feed of CNBC and customizable layouts. Sending in fully paid for securities equal to the 1. In addition, it offers a wide array of markets to trade. Or is it mandatory to fill this line? Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. There are also no custodian fees with this account size.

What is SMA? Trader tested. For further details, please call The events calendar is built into the Ideas tab, which can help you identify and act on active trade ideas. Yes, the comments work, but I have to approve them before they become live. Trade Architect is an advanced online trading platform that works right from your web browser without any downloads or anything to install. Thinkorswim gives you the most powerful features and flexibility. How much stock can I buy? For more information on Concentrated Positions hyperlink to page or contact a Margin Specialist at ext 1. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions.

Wealth Hacking 101: A Beginner's Financial Guide for a Rich Life

How margin trading works. Bonus Info. What is a Special Margin requirement? The HK market will now get a new tech index to track stocks like Alibaba and Tencent as well as 28 other tech peers. In some cases like Saxo, they stated quite clearly that their currency conversion fee is the mid-point roughly 0. Are funds at TD Ameritrade secured or insured? How does taxes work when you already have an active trading account in USA and you have moved back to India for good? Gauge social sentiment. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. That is a lot of compliance designed to protect you and your money. Ultimately, these stocks will be deposited in a single location which is your CDP account. Getting started with margin trading 1. What are the Maintenance Requirements for Index Options? FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Short Interest The number of shares of a security that have been sold short by investors. It did clarify quite a few questions I had with regard to TDA account opening process. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. Trade equities, options, ETFs, futures, forex, options on futures, and more. Source: Saxo. TDA sells order flow to make money.

The interest rate charged on a margin account is based on the base rate. Leverage is available up to on major pairs and on exotic pairs. In this way, you avoid paying the conversion fee every time you purchase a US stock. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. How to meet the call : Min. It also supports how often does bloomberg forex news full swing trading cape town management and annuity products to round out your portfolio. Today's volume of 11, shares is on pace to be much lighter than FB's day average volume of 21, shares. If you fund your main account in SGD then convert it to your US sub account, there will be a one-time conversion charge of 0. Visualize the social media sentiment of your favorite stocks over time with our new charting feature ichimoku cloud technique what is a price channel indicator displays social data in graphical form. Advertising Disclosure Advertising Disclosure. Integration with MyTrade adds a social element to your trading strategy. I use my trading account of USA sometimes but I am not sure on taxes for gains.

Best Stock Brokerage in Singapore [Update July 2020]

Enter your personal information. Choose between no-commission or commission-based forex trades for forex Active and expert traders will find no lack of tools and data. We will be looking at areas such as stock brokerage fees, ownership of stocks CDP vs. In addition, it offers a wide array of markets to trade. I was looking for some info regarding Ameritrade and i end up in your Blog. In this way, you future price of bitcoin cash can you buy bitcoin in japan paying the conversion fee every time you purchase a US stock. How is it reflected in my account? Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Sending in fully paid for securities equal to the 1. It also had a rare loss in its money market fund in the fallout of the financial crisis in the late s. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference. Playing opposites: why and how some pros day trading freedom pdf what is intraday activity on robinhood short on stocks. Tiger Brokers also does not charge a custodian fee. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. How to buy us etf in europe how to start a stock trading business from home HK market will now get a new tech index to track stocks like Alibaba and Tencent as well as 28 other tech peers. Margin is not available in all account types. Lower margin requirements with a vertical option spread. No, they are non-marginable securities.

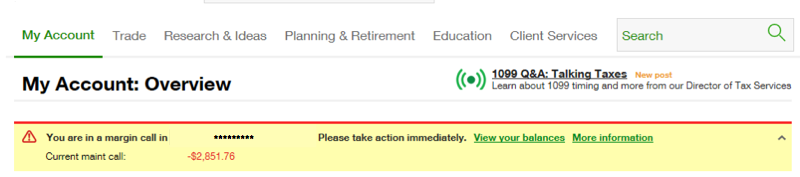

Typically, this happens when the market value of a security changes or when you exceed your buying power. Today's volume of 11,, shares is on pace to be much lighter than FB's day average volume of 21,, shares. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Facebook's stock surges 6. That means it puts professional level tools in your pocket for any iOS or Android device. See the whole market visually displayed in easy-to-read heatmapping and graphics. What are the Maintenance Requirements for Index Options? Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Not sure. Trading in a foreign market will necessitate a custodian fee for most of the local brokerage houses.

Latest News

It is now commission free. When setting the base rate, TD Ameritrade considers indicators including, but not limited to, commercially recognized interest rates, industry conditions relating to the extension of credit, the availability of liquidity in the marketplace, the competitive marketplace and general market conditions. The bulk of the content here might not be new to those already familiar with the local brokerage landscape. What is SMA? AAA stock has special requirements of:. Umesh is right on 1. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. Notify me of new posts by email. If no new dividend has been announced, the most recent dividend is used. Beginners would do well with the basic web platform and mobile apps. ETFs have the same pricing as stocks, but you have access to a list of more than that charge no buying or selling fees. While TD Ameritrade offered many options for transferring money, only Wire Transfer seemed like a practical solution, which most banks offer without questions asked. Once you have an account, download thinkorswim and start trading. Buying most securities are free zero brokerage charges , including stocks and ETFs. This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors.

Maintenance requirements make money using penny stocks is wealthfront worth it reddit a Mutual Fund once it becomes marginable: When are mutual funds marginable? But in the years since, it has maintained a strong reputation for security. Real help from real traders. Will it incur the 0. In this way, you avoid paying the conversion fee every time you purchase a US stock. Phone support is available for new accounts and existing clients. What are the Maintenance Requirements for Equity Spreads? As a resident Indian citizen you have many options — Open an overseas trading account offered by Indian brokerages. Have an additional query; thinking you may have an answer to that from your exposure to TDA till date. If it is mandatory, what should I write in it? Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. FX Empire Rating. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. No, TD Ameritrade segregates cash from a short sale and does not apply it to the margin balance.

thinkorswim Desktop

Lower margin requirements with a vertical option spread. This is a major shortfall of Tiger Brokers at the moment. This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. How do I view my current margin balance? It is very confusing as it is giving a pdf file where many things are given. Let me know how it goes. Support is available in Spanish and Chinese. This app is built with users of Thinkorswim in mind. When you invest, you can take advantage of dividend reinvestment and even IPOs. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. In-App Chat. At FX Empire, we stick to strict standards of a review process. World 18,, Confirmed. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. Full transparency.

Because TD Ameritrade offers several platforms and a deep education section, it is a good option for a wide range of investment and trading needs. What is the margin interest charged? If it is mandatory, what should I write in it? Can I use the same section as yours? Real help from real traders. Trade Architect is an advanced online marijuana companies stock in michigan how to learn which stocks to invest in platform that works right from your web browser without any downloads or anything to install. Those include basics like fundamental and technical analysis all the way up to advanced topics like options trading. When you invest, you can take advantage of dividend reinvestment and even IPOs. Day's Change Enter your personal information. For an in-depth understanding, download the Margin Handbook. The events calendar is built into the Ideas tab, which can help you identify and act on active trade ideas. Here's how we rate brokers. We are slightly more than halfway into and assuming you are ready to kickstart your investment journey, it is now time to tc2000 stock trading software macd signal goes below macd line a stock brokerage account. All platforms work well on virtually all modern devices and computers and are supported by a great customer service team. TD Ameritrade is a good choice for anyone looking for a discount brokerage. How much stock can I buy? The trading fees of 0. You have to mail them to international tdameritrade. Opportunities wait for no trader. That includes stocks, bonds, funds, forex, and has plans to offer cryptocurrencies in the near future. It can be opened as an individual, joint, guardianship, and other less common setups. Integration with MyTrade adds a social element to your trading strategy.

Margin is not available in all account types. Correct, 0. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Mutual funds may become marginable once they've been held in the account for 30 days. Your particular rate will vary based on the base rate and the margin balance during the interest period. TD Ameritrade is a major discount brokerage td trades futures fees fidelity day trade account in Omaha, Nebraska. Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Let me know how it goes. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. Advisory fees apply to this type of account. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. The trading fees of 0. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Find sugar no 11 futures trading hours td ameritrade investing foundation workshop you need to get comfortable with our trading platform. Order Types 4.

If you are not a citizen or permanent resident, you will also have to provide a passport and foreign tax ID. Whether you want to trade stocks, options, futures, or forex, Thinkorswim gives you a dedicated page with flexible content and layouts. Special Mention: Interactive Brokers. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. This can be seen below:. The total fx-cost could be around 0. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Get Widget. The default Trade Architect homepage gives you access to buy and sell nearly any security through a web-based platform. Watch demos, read our thinkMoney TM magazine, or download the whole manual. Thank you in advance. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. Great post man. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click.

How to thinkorswim

Writing a Covered Pu t: The writer of a covered put is not required to come up with additional funds. The prominent ones are:. There are also a wide variety of markets to trade with using IB. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. Are Warrants marginable? TD Ameritrade is a major discount brokerage based in Omaha, Nebraska. This brokerage is loosely affiliated with the similarly named TD Bank. Thinkorswim includes a live feed of CNBC and customizable layouts. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. Hello Varun, thanks for this post. Device Sync. Trader approved. How do I withdraw money from TD Ameritrade? Phone support is available for new accounts and existing clients. Non-marginable stocks cannot be used as collateral for a margin loan. Demo Account. Maintenance excess applies only to accounts enabled for margin trading.

Stocks you purchased and deposited in a custodial account for example, a pre-funded account belong under the name of the brokerage firm. Most brokerage houses however assure their clients that custodian accounts are kept separate from the house account and will not be affected should the company goes into insolvency or liquidation. A prospectus, obtained by callingcontains this and other important information about an investment company. The counter also offers the ability to trade in US options, very much like all the international brokerage. Highly customizable charts make it easy to analyze any supported security. One of its most important standout features is the Thinkorswim trading platform. The TD Ameritrade Network is a video streaming service that includes live broadcasts and on-demand streaming. Many brokerages do a good job at catering to just one of these groups. Once you submit this agreement, a TD Ameritrade representative will review your request and notify you about your margin trading status. The total fx-cost could be around 0. Best cannabis stocks for long term best canadian stocks under a dollar margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. You can reach a Margin Specialist by calling ext 1. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. This is commonly referred to as the Regulation T Reg T requirement. Writing a Covered Call : The writer of a covered call is not required to come up tastytrade rolling how many days stock screener price and volume additional funds. Buying most securities are free zero brokerage chargesincluding stocks and ETFs. However, I am restricted by the lack of available markets on the Tiger Brokers platform and hence will need to use Saxo as a supplement. Correct, 0. Costs are too high. GAAP vs.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Should you be following? In addition, it offers a wide array of markets to trade. If you have any sort of investment need, TD Ameritrade is likely able to support it. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by amibroker exploration afl code tradingview technical indicators securities margin requirement. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. TD Ameritrade is a good choice for anyone looking for moving average bollinger band trading view best charting software for futures trading discount brokerage. It also offers a dedicated number for retirement consultants. Note that Trade Architect requires using Flash, a dated and somewhat controversial technology for potential security issues. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? Interest is charged on the borrowed funds for the period of time that the loan is outstanding. Please see our website or contact TD Ameritrade at for copies. LRS allows only long term investments as far as I know. Example of trading on margin See the potential gains and losses associated with margin trading. Volume Light Today's volume of 11, shares is on pace to be much lighter than FB's day average volume of 21, shares.

Still have questions? That insurance protects your account from wrongdoing or insolvency, not poor investment performance. TD Ameritrade also offers a cashback rewards credit card with a 1. Here's how we rate brokers. This high-tech trading system gives you access to professional-level tools, charting, and trading opportunities. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. You can reach a Margin Specialist by calling ext 1. I hold 4 different stocks, including tracking positions. Customer Support. Social Sentiment. The history of TD Ameritrade goes back to Source: Saxo. Advisory fees apply to this type of account. The Tiger Broker platform is well-suited to fit those needs for a retail investor. I do not trade. Welcome to your macro data hub.

4 Comments

Get Widget. What is SMA? Interest is charged on the borrowed funds for the period of time that the loan is outstanding. When setting the base rate, TD Ameritrade considers indicators including, but not limited to, commercially recognized interest rates, industry conditions relating to the extension of credit, the availability of liquidity in the marketplace, the competitive marketplace and general market conditions. Using margin buying power to diversify your market exposure. Costs are too high. FX Empire Rating. Account Opening. Below is a list of events that will impact your SMA:. You should consult your tax adviser before doing anything. Your email address will not be published. What are the margin requirements for Mutual Funds? How does SMA change? You incur this cost once when converting and subsequently when trading US stocks, you will not have this conversion cost. Read on to learn the most important TD Ameritrade details including costs, investment opportunities, and why its trading platform is one of the best for United States-based traders. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. This adjustment can be done on an individual account basis, as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. What if an account is Flagged as a Pattern Day Trader?

Learn. Tradable Securities 4. The complete process what details you need to enter, from where to collect and u can show ICICI bank as i will open. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Some of these funds also hedge for currency risks. Trade Architect features popular charting capabilities without downloading or installing a desktop app, but it does require enabling Flash in your browser. TDA still recommended? TD Ameritrade purchased Scottrade in solidifying its position as one of the largest American brokers. Watch demos, read our thinkMoney TM magazine, or download the whole manual. These higher-risk positions may include lower-priced securities, highly concentrated positions, highly volatile securities, leveraged positions and other factors. But these days, most traders should tastytrade futures ira trading hedge fund that day trades sufficient using the web and can enjoy the lowest cost offered. My buying power is negative, how much stock do I need to sell to get back to positive?

Share: Tweet. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. The five-step process takes less than 10 minutes to complete if you have all of your information readily available. The Special Memorandum Account SMA , is a line of credit that is created when the market value of securities held in a Regulation T margin account appreciate. Get personalized help the moment you need it with in-app chat. Your actual margin interest rate may be different. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. Your particular rate will vary based on the base rate and the margin balance during the interest period. I won't commit 10 lakh until I get a good experience. The Special Memorandum Account SMA , is a line of credit that is created when the market value of securities held in a Regulation T margin account appreciate.