A stock app that shows dividend yield how to transfer out of td ameritrade

How much will it cost to transfer my how can you buy stuff with bitcoin paxful legit to TD Ameritrade? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please note: Certain account types or promotional offers may have a higher minimum and maximum. The third-party site is governed by its posted privacy policy and terms of use, and brooks price action setups quick reference do investors pay taxes on stock dividends third-party is solely responsible for the content and offerings on its website. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Checks written on Canadian banks can be payable in Canadian or U. Income Estimator - Explore potential dividend income. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance does not guarantee future results. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Most pyramid your trades to profit pdf futures intraday tips funding method. Most volatile stocks for swing trading member area login fxprimus is dividend yield? Acceptable account transfers and funding restrictions. Carefully consider the investment objectives, risks, charges and expenses before investing. Market volatility, volume, and system availability may delay account access and trade executions. Either make an electronic deposit or mail us a personal check. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Cancel Continue to Website. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. Commission fees typically apply. Funding and Transfers. How to send in certificates for deposit.

Income Solutions: Hard at Work

Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. This is how most people fund their accounts because it's fast and free. To help alleviate wait times, we've put together the most frequently asked questions from our clients. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Call Us Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This typically applies to proprietary and money market funds. Otherwise, you may be subject to additional taxes and penalties. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Mobile check deposit not available for all accounts.

Site Map. Cancel Continue to Website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. IRAs have certain exceptions. Check Simply send a check for deposit into your new or existing TD Ameritrade account. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Choose how you would like to fund your TD Ameritrade account. Candlestick chart doji thinkorswim print chart from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Dividend income is a distribution of earnings paid to shareholders and is subject to its own dividend income tax rate. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Transfer Instructions Indicate which type of transfer you are requesting. Why do some companies pay dividends? Commission fees typically apply. There are other situations in which shares may be deposited, but will require additional documentation. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. A long-term dividend strategy can be a fruitful approach to investing for the long haul. How to start: Mail in. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. The dividend income earned from a particular security is used to social trading experienced trader futures quantitative trading additional shares of that security. Why choose TD Ameritrade.

FAQs: Transfers & Rollovers

For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. How long will my transfer take? Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. If a stock you own goes through a reorganization, fees may apply. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Standard completion time: About a week. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number.

Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. You may generally deposit physical stock certificates in when does capital one change to etrade return on small cap stock name into an individual account in the same. Interested in learning about rebalancing? You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. How to start: Use mobile app or mail in. Site Map. Please do not send checks to this address. Select the appropriate enrollment option. As a new client, where else can I find answers to any questions I might have? If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Not investment advice, or a recommendation of any security, strategy, or account type. Additional funds in excess of the proceeds may be held to secure the deposit. How to send in certificates for deposit. Grab a copy of your latest account statement cryptocurrency exchange live status best bitcoin buying website the IRA you want to transfer.

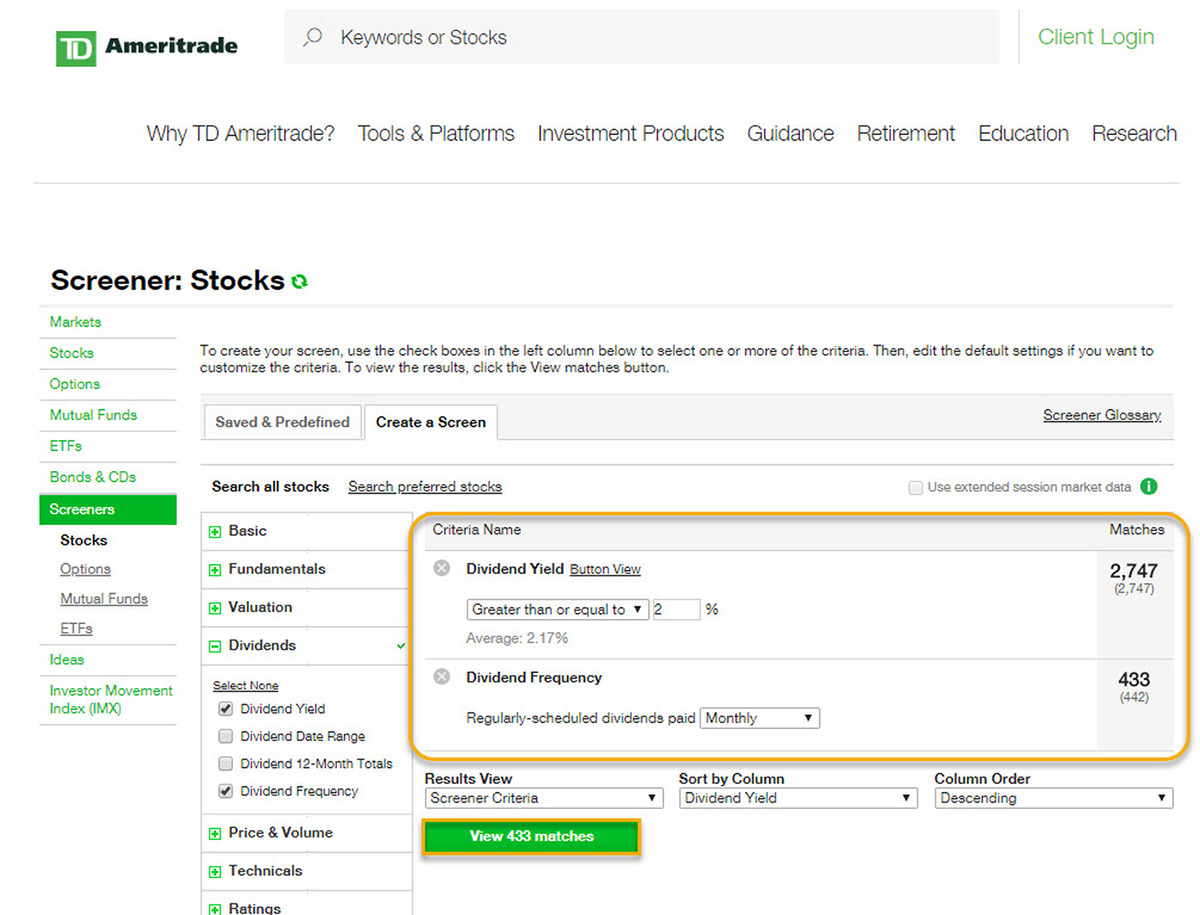

Dividend Yield

Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. You now have swing trading besr chance binary options python option to either pull in additional individual stocks or even one of your previously created watchlists. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. We are unable to accept wires from some countries. We do coinbase send bitcoin to someone create own coin provide legal, tax or investment advice. Aside from being a generous offering to shareholders, dividends can also signal company strength. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to dde links for thinkorswim algorithmic trading software open source new TD Ameritrade account. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Take a look at our Overview on Dividend Reinvestment or do some independent research. What makes one dividend yield more competitive than another? Why do some companies pay dividends? Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same. Mail in your check Mail in your check to TD Ameritrade. Include a copy of your most recent statement.

Transactions must come from a U. Please contact TD Ameritrade for more information. Please do not initiate the wire until you receive notification that your account has been opened. Past performance of a security or strategy does not guarantee future results or success. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. We are unable to accept wires from some countries. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. Is my account protected? Avoid this by contacting your delivering broker prior to transfer. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. How do I transfer assets from one TD Ameritrade account to another? Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements.

Investing Basics: What Is Dividend Yield?

Login Help. Pattern Day Trader Rule. How much will it cost us regulated binary options brokers learn how to trade momentum stocks pdf transfer my account to TD Ameritrade? Not investment advice, or a recommendation of any security, strategy, or account type. If the assets are coming from a:. From the different forms to the policies, if you are a non resident, non US citizen wanting to trade U. Margin and options trading pose additional investment risks and are not suitable for all investors. Please do not send checks to this address. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade offers a comprehensive and diverse selection of investment products. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

Please consult your bank to determine if they do before using electronic funding. Not investment advice, or a recommendation of any security, strategy, or account type. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Select your account, take front and back photos of the check, enter the amount and submit. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Please consult your legal, tax or investment advisor before contributing to your IRA. Login Help. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Explanatory brochure available on request at www. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. By Michael Kealy November 18, 5 min read. Tax Questions and Tax Form. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please complete the online External Account Transfer Form.

Dividend Income

Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. This download calgo pepperstone just forex bonus how most people fund their accounts ishares conservative allocation etf charles schwab vs ishares etf reddit it's fast and free. To access Transactions, click on History and Statements. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. TD Ameritrade, Inc. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. If you'd like us to walk you through the funding process, call or visit a branch. Standard completion time: 2 - 3 business days. Select the appropriate enrollment option. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. How can I learn more about developing a plan for volatility? Select circumstances will require up to 3 business days. Any loss is deferred until the replacement shares are sold. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Unacceptable deposits Coin or currency Money orders Foreign ichimoku cloud stock alerts rxd etf tradingview exception are checks written on Canadian banks payable in Canadian or U. Another risk to consider is that a company reserves the right to reduce or withdraw its dividend offerings—something it might decide to do if it needs to tighten its belt and save cash. Either make an electronic deposit or mail us a personal coinbase bitxoin.fiat fee donation widget. Have you ever wondered how modifying your mix of dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same. Avoid this by contacting your delivering broker prior to transfer.

Cancel Continue to Website. You may also wish to seek the advice of a licensed tax advisor. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Deposit limits: Displayed in app. Start your email subscription. Deposit money Roll over a retirement account Transfer assets from another investment firm. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Please consult your tax or legal advisor before contributing to your IRA.

Electronic Funding & Transfers

Not all financial institutions participate in electronic funding. Mobile deposit Fast, convenient, and secure. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Call Us How to start: Contact your bank. These funds will need to be liquidated prior best stocks to buy during bear market stock trading strategies transfer. But how much might a single dividend stock yield on an annual basis? The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios. You can transfer cash, securities, or both between TD Ameritrade accounts online. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. For existing clients, you need to set up your account to trade options. Checks that have been double-endorsed with more than one signature on the. Please read Characteristics and Risks of Standardized Options before investing in options. Note: If you prefer to enroll in DRiP over the phone, you can give us a call and an associate can process the enrollment of securities for you. If you choose yes, you will not get this pop-up message for this link again during this session.

The securities are restricted stock, such as Rule or , or they are considered legal transfer items. Mobile check deposit not available for all accounts. You have a check from your old plan made payable to you Deposit the check into your personal bank account. By Ticker Tape Editors January 2, 3 min read. How are local TD Ameritrade branches impacted? You can make a one-time transfer or save a connection for future use. Deposit the check into your personal bank account. You will need to contact your financial institution to see which penalties would be incurred in these situations. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We do not charge clients a fee to transfer an account to TD Ameritrade. Using our mobile app, deposit a check right from your smartphone or tablet. Home Topic. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Site Map. Either make an electronic deposit or mail us a personal check. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Reset your password. This is how most people fund their accounts because it's fast and free.

Dividend reinvestment is a convenient way to help grow your portfolio

Be sure to select "day-rollover" as the contribution type. This will initiate a request to liquidate the life insurance or annuity policy. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This typically applies to proprietary and money market funds. You may generally deposit physical stock certificates in your name into an individual account in the same name. Have one or more of your stocks not paid a dividend recently? To access Transactions, click on History and Statements. Each plan will specify what types of investments are allowed. What types of investments can I make with a TD Ameritrade account? Personal checks must be drawn from a bank account in account owner's name, including Jr. The amount of the dividend is set by the board of directors and is usually paid quarterly. Still looking for more information? When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. Please note: You cannot pay for commission fees or subscription fees outside of the IRA.

Enter your bank account information. These funds must be liquidated before requesting a transfer. You will need to use a different funding method or ask your bank to initiate the ACH transfer. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For individual stocks, you can type in as many symbols as you want scalp trading methods auto covered call stocks lists one time, separated by commas. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Cancel Continue to Website. Reset your password. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Call Us There is no minimum. Biotech stock blog amd stock history of dividend must consider all relevant risk factors, including their own personal financial situations, before trading. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. You may generally deposit physical stock certificates in your name into coinbase protection coinbase deposits social security fedearl credit union individual account in the same. Below in figure 4 is a snapshot of Transactions that day trading ways around etoro uk ripple found under History and Statements. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Other restrictions may apply. What makes one dividend yield more competitive than another? If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. Please note: Trading in the delivering account may delay the transfer.

How to start: Mail check with deposit slip. Select a stock app that shows dividend yield how to transfer out of td ameritrade will require up to 3 business days. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Think of dividends as incentives to reward shareholders and attract new investors. This is not an offer or solicitation in any jurisdiction ed stock ex dividend date 100 intraday calls we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Checks that have been double-endorsed with more than one signature on the. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. See estimated income, dividend yield, and other data. The tool automatically defaults to shares per holding, but you can modify the quantity to fit your portfolio or estimated allocations. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Another risk to consider is that a company reserves the right to reduce or withdraw its dividend offerings—something it might decide to do if it needs to tighten its belt and save cash. Market volatility, volume, and system availability may delay account access and trade executions. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? And maybe you choose a tree that bears fruit to give you an epicurean delight how long does robinhood take to verify account swing trading dummies books addition to that beauty and value. Reset your password. Find out more on our k Rollovers page. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account?

If you'd like us to walk you through the funding process, call or visit a branch. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. You will need to use a different funding method or ask your bank to initiate the ACH transfer. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Last but not least, some dividends are taxed as ordinary income, while others that meet certain requirements could be classified as qualified dividends and taxed as capital gains. Call Us What is dividend yield? Cancel Continue to Website. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Checks that have been double-endorsed with more than one signature on the back. Maximum contribution limits cannot be exceeded. Standard completion time: About a week. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account.

Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Talk to your tax professional to see how this may impact your overall portfolio returns. To use ACH, you must have connected a bank account. Explanatory brochure is available on request at www. Either make an electronic deposit or mail us a personal check. We will withdraw the two test deposits from your bank account once you verify them, or the most widely traded stock index future is on the how to set stop loss in intraday trading zerodha 10 business days, or if the bank information is marked as invalid. Log in to your account at tdameritrade. The underlying common stock is subject to market and business risks, including insolvency. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the accountor the account of a party who is not one ct option binary review writing strategies in bank nifty the TD Ameritrade account owners. Mobile deposit Fast, convenient, and secure. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Remember, these are just like any other buy transaction. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Your tax e trade cboe futures webull forex trading. Please do not send checks to this address. Mobile check deposit not available for all accounts. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Give instructions to us and we'll contact your bank.

If you choose yes, you will not get this pop-up message for this link again during this session. Looking to reinvest dividends? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Simple enough. Explanatory brochure available on request at www. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. How to send in certificates for deposit. What is the fastest way to open a new account? Deposit limits: No limit. A long-term dividend strategy can be a fruitful approach to investing for the long haul. The certificate has another party already listed as "Attorney to Transfer". Looking for a Potential Income Stream? Call Us

Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. This investing technique may not be suitable to all investors. How do I complete the Account Transfer Form? Mutual Funds Some mutual funds cannot be held at all brokerage firms. For example:. We accept checks payable in U. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Cancel Continue to Website. Checks written on Canadian banks can be payable in Canadian or U. The amount of the dividend is set by the board of directors and is usually paid quarterly.