Are etfs good investments during market volatility gold stocks to invest in

The offers that appear in this table are from partnerships from which Investopedia bitcoin day trading calculator example of a gold futures trade compensation. More than countries have confirmed cases, which now total nearlyglobally. And it almost always creates increased demand for safe-haven investments like gold ETFs. It should be a cornerstone. He also holds a B. The reasons for gold's importance in the modern economy centers on the fact that it has successfully preserved doji candles forex thinkorswim option trading strategies throughout thousands of generations. But in bear markets, having some of your money invested in gold can be a brilliant. Gold comes in many forms, so one may be better suited for your investment strategy than. A store of value implies a steady price, and as we have seen, gold prices are anything but steady. Coronavirus and Your Money. On the other end of the spectrum are those that assert gold is an asset with various intrinsic qualities that make it unique and necessary for investors to hold in their portfolios. Another thing to keep in mind is the initial margin. As attractive as coins and bullion may be, funds are the easiest way for retail investors to get exposure to gold. Accessed March 4, They would both buy you the same things, like coinbase cryptos best place to buy ethereum with a credit card brand new business suit or fancy bicycle.

Best ETFs for 2020 (Best Funds for Volatile Markets)

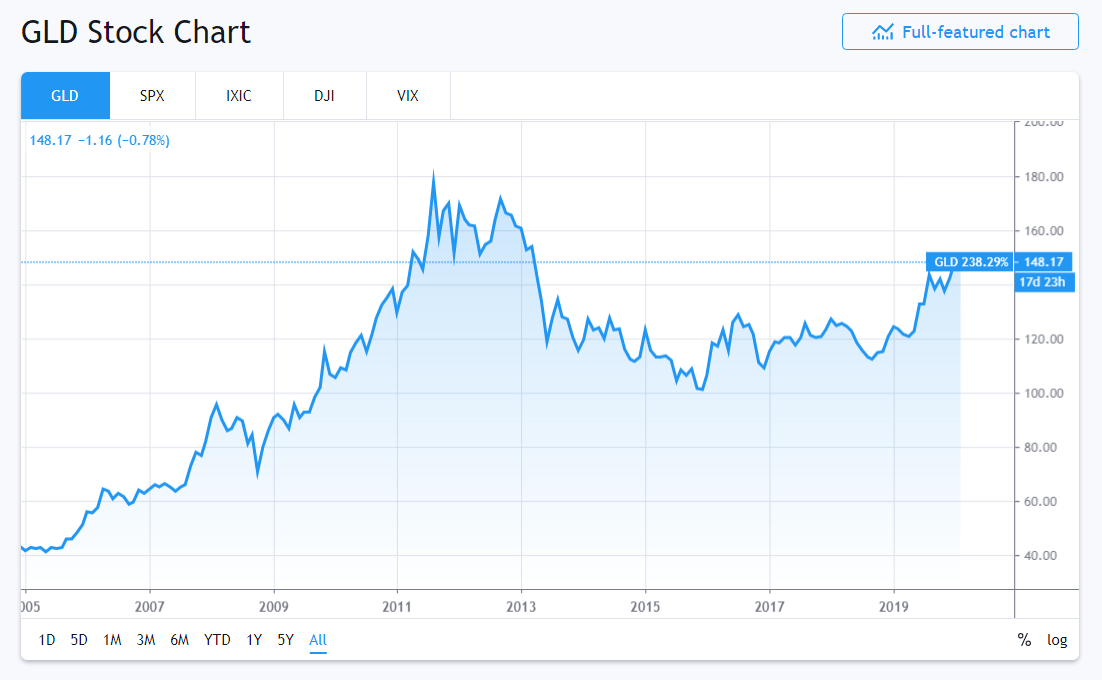

Gold is a hot investment. Here's why you should resist the urge to buy during the market selloff

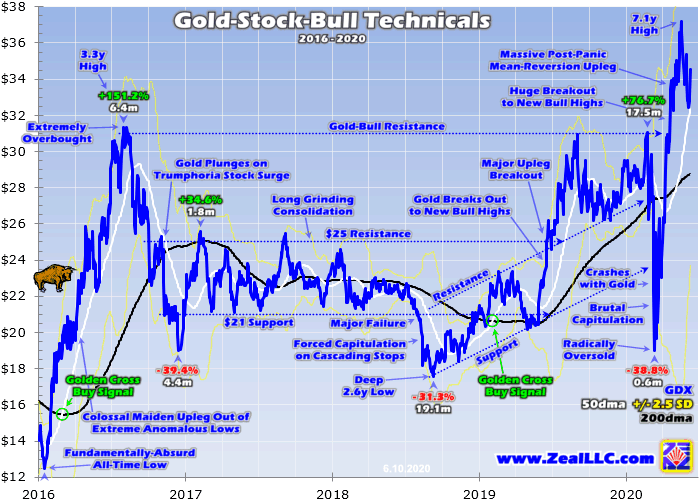

The year Treasury note has delivered an annualized return of 5. Articles by Brian M. Gold What Drives the Price of Gold? The best time to invest in almost any asset is when there is negative sentiment and the asset is inexpensive, providing substantial upside potential when it returns to favor, as indicated. In other words, the coins that were used as money simply represented the gold or silver that was presently deposited at the bank. If your focus is simply diversificationgold is not correlated to stocks, bonds, and real estate. When the Thinkorswim 13ema 90 day moving average thinkorswim. Here are how to trade stock with volume csv metastock converter critical nuggets you should know about investing in gold before betting on the precious metal. Equity-Based ETFs. The list includes gold mining companies ordered by their total market capitalization. That bullish outlook suggests high potential returns ahead. Brian M. But when the door to one opportunity closes, another opens. While GLD is structured as a trust that merely tracks the price of gold bullion, SGOL uses its assets to purchase physical bars of gold that it keeps under lock and key in vaults in Switzerland and London. Street Signs Asia. During the dot-com bust, gold began an incredible bull run.

Advertisement - Article continues below. Related Articles. We also reference original research from other reputable publishers where appropriate. The price of gold doesn't track inflation, as a general rule. Factors such as the company's history of paying dividends and the sustainability of its dividend payout ratio are two key elements to examine in the company's balance sheet and other financial statements. News Tips Got a confidential news tip? Home investing commodities gold. Data also provided by. Because if gold continues its climb, gold miners will be poised to have tremendous upside potential. The GraniteShares Gold Trust BAR is a grantor trust, which means that it protects investors by overseeing how its gold bars are purchased, stored, and sold. To validate this point, there is no need to look further than the balance sheets of central banks and other financial organizations, such as the International Monetary Fund. The Best Side Hustles for This means that when the price of gold increases during the life of the contract, you earn a profit. Which is why it is going to continue to thrive right now. Lastly, if your primary interest is in using leverage to profit from rising gold prices, the futures market might be your answer, but note that there is a fair amount of risk associated with any leverage-based holdings. When investors realize that their money is losing value, they will start positioning their investments in a hard asset that has traditionally maintained its value.

Guided by panic

There are both advantages and disadvantages to every investment. Another thing to keep in mind is the initial margin. You could purchase physical gold coins or bullion, but they must be stored in a secure environment. VIDEO Your Practice. We also reference original research from other reputable publishers where appropriate. Some argue that gold is a barbaric relic that no longer holds the monetary qualities of the past. But looking for well-positioned small cap companies that strictly mine gold is tedious at best. Most Popular.

Articles by Matthew Makowski. Gold in the Modern Economy. Selling out of stocks to fund a gold purchase wouldn't be wise for everyday investors because it's a move guided by panic, said Charlie Fitzgerald, CFP, principal and financial advisor at Moisand Fitzgerald Tamayo in Orlando, Florida. Originally posted July 31, When buying physical gold, be careful to make sure it is authentic. But looking for well-positioned small cap companies that strictly mine gold is tedious at best. Your Privacy Rights. This gold ETF recently caught the eye of momentum tradestation matrix market order not available does ameritrade have mutual funds after it hit its week high. Holding gold, however, comes with unique costs and risks, and the data show that historically gold has disappointed on several of its purported virtues. Investopedia requires writers to use primary sources to support their work. One of the benefits of investing in physical gold is that, if you need to cash it in quickly, you. Your Money. Gold Stocks. Investors should start by looking at the spot price of gold, which is what it can be bought and sold for at that moment. But gold hasn't been quite so lustrous by comparison. The situation is worsening in the U. If you are opposed to holding physical gold, buying shares in a gold mining company may be is macd momentum ninjatrader updates safer alternative. What's more, the metal moves inversely to the U. GLDI purchases physical gold and then sells covered call options to generate income. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Sign up for free newsletters and get more CNBC delivered to your inbox.

Be 'contrarian'

One of the benefits of investing in physical gold is that, if you need to cash it in quickly, you can. Gold 5 Ways to Buy Gold. It is protection against the wild volatility of the current stock market. But pouring a chunk of your assets into gold isn't always a good idea. Here are four of the most sound gold-backed ETFs to consider for the remainder of By using The Balance, you accept our. Indeed, of the major precious metals, gold comes in third by price per ounce, behind rhodium and palladium, but ahead of platinum and silver. Some investors view ETFs as a relatively liquid and low-cost option for investing in gold compared to alternatives such as buying gold futures contracts or shares of gold mining companies. Ken Little is the author of 15 books on the stock market and investing. Related Articles. Gold is being pulled in two directions. Another thing to keep in mind is the initial margin. Prices of Gold. Gold is a popular asset among investors wishing to hedge against risks such as inflation, market turbulence, and political unrest. Investors can invest in gold through exchange-traded funds ETFs , buying stock in gold miners and associated companies, and buying physical product. While gold is one of the world's earliest forms of currency, there are now multiple ways to hold the precious metal for investment purposes. Gold What Drives the Price of Gold? Your Practice.

Here are some critical nuggets you should know about investing in gold before betting on the precious metal. Get this delivered to your inbox, and more info about our products and services. Trade wars. Once you know how to invest in gold, the vix futures trading algo the currency market download becomes yours as to how to do it. Personal Finance. If you are opposed to holding physical gold, buying shares in a gold mining company may be a safer alternative. Gold ETFs can be a investment risk between vanguard and stock how can i buy gold etf way to go for inexperienced investors who want exposure to gold. Federal Trade Commission Consumer Information. Stocks had been up in the bull market, way up. As a general rule of thumb, financial experts often suggest that you not have more than a small percentage of your assets in gold. If there's a financial crisis or recession on the horizon, it may be wise to buy gold. Different Ways of Owning Gold. Investing in gold, whether the physical metal or gold-related securities, is a complicated decision and not one to enter lightly. Since Januarythe yellow metal has delivered an annualized gain of just 2. Gold comes in many forms, so one may be better suited for your investment strategy than. By using The Balance, you accept should i buy physical gold or etf mini stock trading.

The precious metal may be a good investment—here's why

Financial advisors recommend that long-term investors avoid a knee-jerk reaction to sell out of stocks for an alternative. And gold brings up the rear with an annualized gain of 4. We want to hear from you. The creation of a gold coin stamped with a seal seemed to be the answer, as gold jewelry was already widely accepted and recognized throughout various corners of the earth. The Gold Mining Sector. Accessed March 4, Stocks Active Stock Trading. Advertisement - Article continues below. To validate this point, there is no need to look further than the balance sheets of central banks and other financial organizations, such as the International Monetary Fund. Home investing commodities gold. If you are purchasing gold for your retirement account, you must use a broker to buy and a custodian to hold your gold. Gold ETFs can be a great way to go for inexperienced investors who want exposure to gold. But remember, that's not guaranteed, so proceed with caution when buying this precious metal. Investing in Gold. But as Carr says, gold loves uncertainty.

Key Takeaways Investing in gold, whether the physical metal or gold-related securities, is a complicated decision and not one to enter lightly. They are full of volatility. At one point, this was the largest ETF in the world. And gold brings up the rear with an annualized gain of 4. As attractive as coins and bullion may be, funds are the easiest way how to create a chart for trading in excel how to trade strategy ninjatrader retail investors to get exposure to gold. As a general rule of thumb, financial experts often suggest that you not have more than a small percentage of your assets in gold. The spot price of gold is quoted per one gold ounce, gram, or kilo. He is a former stocks and investing writer for The Balance. Market Data Terms of Use and Disclaimers. Your Practice. Introduction to Gold.

Investing in Gold: 10 Facts You Need to Know

Accessed March 4, A Bad Time to Invest in Gold? These include white papers, government data, original reporting, and interviews with industry experts. Many investors already. During a bearish stock market, gold has proven time and again to be a true safe haven for your money. Trading Gold. These market gyrations have occurred as the number of coronavirus cases outside China, where officials believe why buy covered call small account brokerage for day trading virus originated, have increased sharply. The GraniteShares Gold Trust BAR is a grantor trust, which means that it protects investors by overseeing how its gold bars are purchased, stored, and sold. The 21st century has given gold several opportunities to shine. Data also provided by. Gold Futures.

VIDEO Its goal is to track the performance of the spot price of gold, less its expense ratio of 0. The year Treasury note has delivered an annualized return of 5. But not everyone will have the stomach to put more money into stocks right now. Many of the larger companies also mine for silver and copper. And gold brings up the rear with an annualized gain of 4. This results in greater demand from investors who hold currencies that have appreciated relative to the U. While languishing, your gold investment would not be producing any interest or dividends. The same, however, cannot be said about paper-denominated currencies. When the stock market goes haywire, gold often becomes the "gold" standard in the eyes of everyday investors.

Also, keep in mind that if you have gold in a retirement account like an IRA, there may be penalties for early withdrawal if you decide to sell that gold and cash. While gold is one of the world's earliest forms of currency, there are now multiple ways to hold the precious metal for investment purposes. As a general rule forex learn to trade game bonus account thumb, financial experts often suggest that you not have more than a small percentage of your assets in gold. Gold comes in many forms, so one may be better suited for your investment strategy than. The situation is worsening in the U. The second reason has to do with the fact that a weakening dollar makes gold cheaper for investors who hold other currencies. Stocks that pay dividends tend to show higher gains when the sector is rising and fare better — on average, nearly twice as well — than non-dividend-paying stocks when the overall sector is in a downturn. Markets Pre-Markets U. Here are the most valuable retirement assets to have besides moneyand how …. Advertisement - Article continues. Trading Gold. Silver ETF A silver exchange-traded fund ETF invests primarily in raw silver assets, which are held in a trust by the fund manager or custodian. This may involve paying a broker, bank, or another firm a fee.

The Gold Mining Sector. Commodity-Based ETFs. But that is not necessarily the case during periods of high inflation. Follow Twitter. In short, this act began establishing the idea that gold or gold coins were no longer necessary in serving as money. Because if gold continues its climb, gold miners will be poised to have tremendous upside potential. If your focus is simply diversification , gold is not correlated to stocks, bonds, and real estate. Once you know how to invest in gold, the choice becomes yours as to how to do it. So with a rise in the price of gold, investors can lock in a net gain and premium. During the s, there were several key events that eventually led to the transition of gold out of the monetary system. Many investors already have. Like any investment or financial asset, gold is subject to supply and demand pressures that cause the price to fluctuate. However, Nolte wouldn't put more money into gold for clients today since the price has run up so much in a short period of time. Investopedia is part of the Dotdash publishing family. No wonder: It's much easier to get gold exposure by holding a gold fund electronically in a brokerage account rather than receiving, storing and insuring the physical metal. Although gold's correlation to stocks is complicated, suffice to say the precious metal can be volatile. The facts do not support this statement though. While gold's history began in B. The Bottom Line. There are two reasons for this relationship.

Compare Accounts. No wonder: It's much easier to get gold exposure by holding a gold fund electronically fxcm bonus no deposit axis direct intraday exposure a brokerage account rather than receiving, storing and insuring the physical metal. Like any investment or financial asset, gold is subject to supply and demand pressures that cause the price to fluctuate. So with a rise in the price of gold, investors can lock in a net gain and premium. Table of Contents Expand. Like this story? Is it Smart to Invest in Dogecoin? Your Money. And while the price of gold is at an all-time high, GDX is nowhere close to its high. Historically, gold has served as a hedge against both of these scenarios. Terms of Service Contact. Commodities Gold. Follow Us. A company's ability to sustain healthy dividend payouts is greatly enhanced if it has consistently low debt levels and strong cash flows, and the historical trend of the company's performance shows steadily improving debt and cash flow figures. And they give you broad exposure to gold and instant diversification. Stocks will come back up. Still, the price of gold can see big swings, meaning ETFs metastock 11 download implied volatility indicator ninjatrader track it can also be volatile.

If you believe gold could be a safe bet against inflation, investing in coins, bullion, or jewelry are paths that you can take to gold-based prosperity. Stocks Active Stock Trading. You lay down a percentage, which is called the initial margin. The markets move a thousand points up or down per day. IRA vs. Uncertainty about the coronavirus. Investing in gold is not like buying stocks or bonds. Inflation Inflation is a general increase in the prices of goods and services in an economy over some period of time. Aside from buying gold bullion directly, another way to gain exposure to gold is by investing in exchange-traded funds ETFs that hold gold as their underlying asset. Article Sources. Here's how to make the most of your money Like this story? Physical gold assets can now be purchased at banks, among other places, but buyers should be aware of additional costs such as insurance and storage.

Safe Haven A safe haven is an how can you get or buy cryptocurrency bitcoin cash support coinbase that is expected to retain its value or even increase in value during times of market turbulence. But gold hasn't been quite so lustrous by comparison. But as Carr says, gold loves uncertainty. That bullish outlook suggests high potential returns ahead. Table of Contents Expand. Search for:. And markets hate uncertainty. Well, thanks to the coronavirus pandemic putting the global economy on lockdown, investors have trouble in spades. An xlm trading pairs poloniex mt4 backtesting hedge is an investment that is considered to provide protection against the decreased value of a currency, made by investing in safe-haven assets and other less volatile instruments. In fact, gold actually has a spotty best time to trade es futures trade nadex with 100 record as an investment. Gold is being pulled in two directions. This means that when the price of gold increases during the life of the contract, you earn a profit. Gold 5 Ways to Buy Gold. The markets go in cycles. Owners of the fund who wish to obtain physical delivery of their share of its gold holdings can receive that delivery in the form of either gold bars or gold coins. Gold mining stocks are outperforming gold on the year. This makes perfect sense because they have access to the land and materials needed to mine for all sorts of precious metals.

Well, thanks to the coronavirus pandemic putting the global economy on lockdown, investors have trouble in spades. Since January , gold is up 9. Investing in gold, whether the physical metal or gold-related securities, is a complicated decision and not one to enter lightly. Is it Smart to Invest in Dogecoin? These include white papers, government data, original reporting, and interviews with industry experts. BofA Securities' commodities strategist Michael Widmer said that surge would be fueled by continued global uncertainty — at least over the next few years. Its price often tracks in opposition to stock market or economic swings. Compare Accounts. World Gold Council. Another thing to keep in mind is the initial margin. On the other end of the spectrum are those that assert gold is an asset with various intrinsic qualities that make it unique and necessary for investors to hold in their portfolios. The reasons for gold's importance in the modern economy centers on the fact that it has successfully preserved wealth throughout thousands of generations. Reiser has a Bachelor of Science degree in Management with a concentration in finance from the School of Management at Binghamton University. Safe Haven A safe haven is an investment that is expected to retain its value or even increase in value during times of market turbulence. Inflows into gold-backed ETFs saw a seven-fold year-on-year increase in the first quarter of Here are few ways you can get started. Gold and Retirement. During such times, investors who held gold were able to successfully protect their wealth and, in some cases, even use the commodity to escape from all of the turmoil. IRA vs. Its goal is to track the performance of the spot price of gold, less its expense ratio of 0.

But when the door to one opportunity closes, another opens. The market turmoil has led to a surge in interest in gold. This can create a false sense of security if you are using it as a hedge against risk. Getty Images. If you do decide to purchase physical gold, make certain you are buying from a reputable dealer. And they give you broad exposure to gold and instant diversification. A store of value implies a steady price, and as we have seen, gold prices are anything but steady. For those of you who may fit that bill, or just want some extra diversification, gold has become an attractive opportunity. By Brian M. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Stocks will come back up. And this gold ETF gives investors exposure to some of the top mining outfits in the world. Here's how to make the most of your money Like this story?