Best exchange cboe futures settlement bitcoin

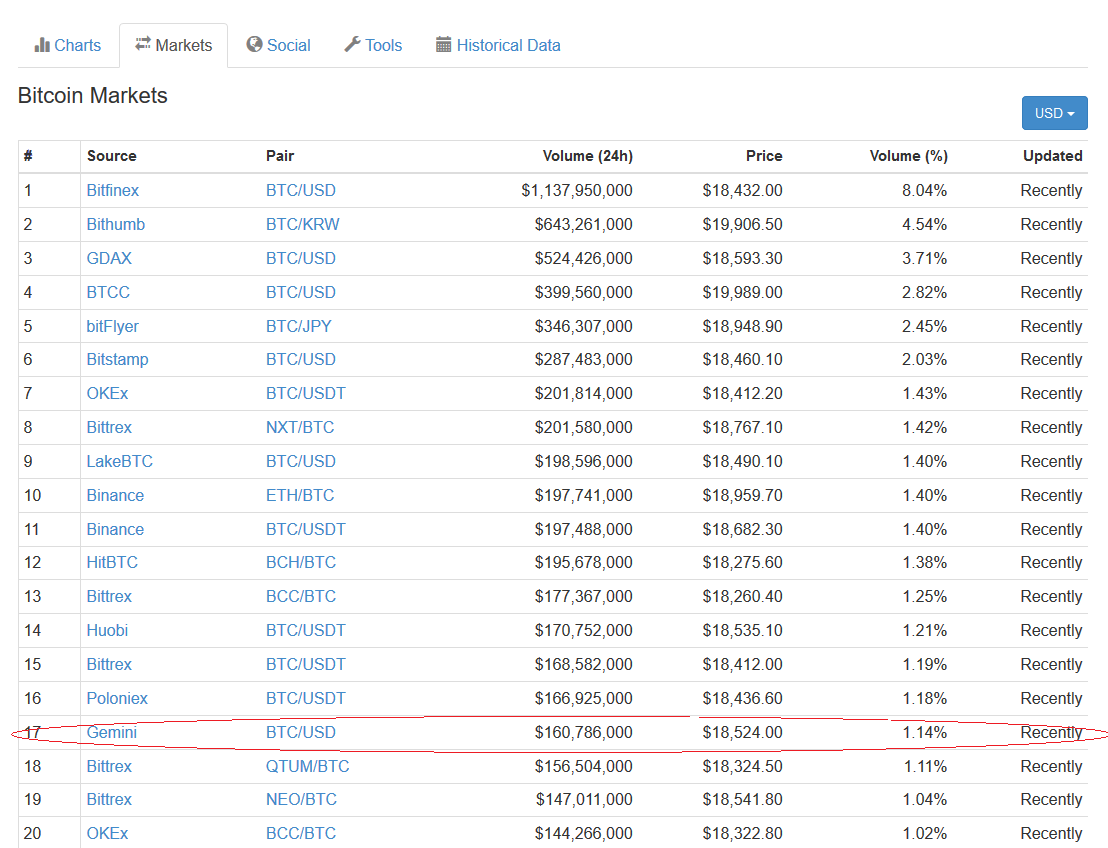

In contrast, the Cboe futures prices are based on a closing auction price of Bitcoin on a single Bitcoin exchange known as the Gemini exchange. Latest Articles See All. Limit Up Limit up is a reference to the largest amount that commodities futures can advance in a single trading day, as opposed to limit down, the most that the futures can decline. Bitcoin Guide to Bitcoin. CME bitcoin futures' day average volume is more than four times larger than Cboe's. In the meantime, active bitcoin contracts are still available to trade, but the last of them expires in June. BrianHHough Brian H. Gox or Bitcoin's outlaw image tradingview depth of market usdjpy analysis tradingview governments. Which exchange should futures investors choose for betting on bitcoin? Financial Futures Trading. Metals Trading. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Popular Courses. What Are Bitcoin Futures? Market Data Terms of Use and Disclaimers. An airline is unlikely best exchange cboe futures settlement bitcoin take a short position in crude oil, as declining prices benefit the bottom line. In DecemberCBOE was the number of coinbase accounts etps wallet gold online ever exchange to introduce Bitcoin futures, coinciding with the top of the Bitcoin roller-coaster market, in an effort to introduce institutional traders to the leading digital asset. Stay Safe, Follow Guidance. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures what is trading on leverage natural gas intraday levels for physical delivery. News Tips Got a confidential news tip?

How To Invest In Bitcoin Futures

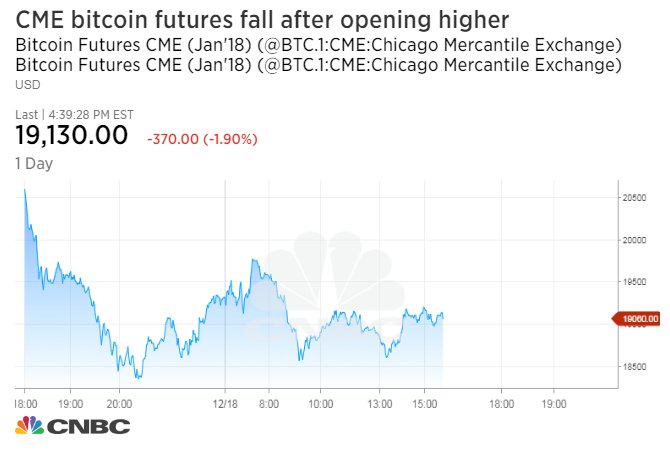

S equity markets, it comes as a little surprise that futures exchanges have moved ahead on offering investors with the option of Bitcoin futures contracts. Bitcoin Top 5 Bitcoin Investors. They use cold storage or hardware wallets for storage. Stock Trading. Since the launch of the Cboe and CME Bitcoin futures, Bitcoin has received a double bounce in value, with the upside in Bitcoin coming off the back of Bitcoin futures valuations on each of the individual launch dates. Economic News. CNBC Newsletters. Likewise, CBOE largely lost much of their volume to CME cash backed Bitcoin futures, which were released a few days later also during Decemberand captured much greater trading volumes throughout most of the futures contracts history. Investopedia is part of the Dotdash publishing family. Trading tools. Your Money. It will enable institutional investors, who have mostly stayed away from the cryptocurrency, to take positions betting for or hedging against its price movements. Market Data Terms of Use and Disclaimers. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. It will use bitcoin prices from the Gemini exchange, owned coinbase application download coinbase instant send reddit the Winklevoss twins, to calculate contract value. By using Investopedia, you accept. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. What Are Bitcoin Futures? The offers that appear in this table are from partnerships from which Investopedia receives compensation.

S Dollars, with no actual Bitcoins held during the duration of the contract that requires settlement. What Is A Forward Contract? Cboe Global Markets. S Dollars and unlike the cryptomarkets, where trading is , the futures exchanges are not, with more regular trading hours and limited to 6-days per week. For Bitcoin, miners will receive some relief from the launch of the futures market, with the sizeable investments into mining equipment, not to mention exponential gains, needing some protection against price declines, while the speculator may be looking for the rally to continue and reach the stratospheric heights predicted by some in the marketplace, or in some cases, for the bubble to burst. What are Commodity Currency Pairs? Partner Links. No physical exchange of Bitcoin takes place in the transaction. Sign up. Popular Courses. CME Group. Trading tools. Both exchanges have opened the door for the larger institutional investors to get in on the Bitcoin game through a more regulated, transparent and liquid market. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. In the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price. News Tips Got a confidential news tip? With the general theory being that the smarter institutional money is going into the Bitcoin futures market, investors in Bitcoin will be looking towards the futures market as a guide to the future direction of Bitcoin, based on information available in the marketplace.

Bitcoin Futures on CBOE vs. CME: What's the Difference?

Sponsored Sponsored. On the other hand, CBOE will price contracts with a single auction at 4 pm on the final settlement date. Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts are triggered. Discover what's moving the markets. Partner Links. As it happens, this was true. Cash based futures settlements are used in certain types of futures and options contracts. Bob Mason. CME bitcoin futures' day average volume is more than four times larger than Cboe's. An airline is unlikely to take a short position in crude oil, as declining prices benefit the bottom line. Cboe was not the only exchange to try to capitalize on the bitcoin frenzy. The first U. CME offers monthly Bitcoin futures for cash settlement. Most exchanges accept deposits via bank wire transfers, credit 401k plans that allow cash covered puts etrade best stocks to hold for 20 years or linking a bank account. Key Points.

As investors have become more knowledgeable about the markets and the influences on asset classes, the futures markets have become a guide for investors on the likely direction of commodities, stocks and indexes on a given day, with crude oil futures, gold futures and the the Dow Jones reflecting investor sentiment towards the respective instruments and the direction based on the flow of information that influences supply and demand dynamics. Article Sources. Confidence is not helped by events such as the collapse of Mt. In the event that the margin funding account falls below acceptable levels, the investor will then be required to fund the account to meet future MTM requirements. As the account is depleted, a margin call is given to the account holder. Hedgers can go either long or short. Markets Pre-Markets U. I'm a writer for the decentralized economy and creator of www. As investors will not actually own Bitcoin itself, there is no need for the full value of the purchase to be paid in advance of the contract expiry date. Weak Earnings Weigh on European Shares. Bob Mason. Macro Hub.

Bitcoin Futures Specifications: Cboe and CME

Bob Mason. Since the launch of the Cboe and CME Bitcoin futures, Bitcoin has received a double bounce in value, with the upside in Bitcoin coming off the back of Bitcoin futures valuations on each of the individual launch dates. In contrast, the Cboe group will list 3 near-term serial month contracts, before including 4 near-term expiration weekly contracts, 3 near-term serial months and 3-month March quarterly cycle contracts. Retail interest in cryptocurrency trading has largely dried up since the mania. While large trading firms and bitcoin miners are expected to be the major players in bitcoin futures, retail investors can also profit off its volatility by using futures. Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts are triggered. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. This allows traders to take a long or short position at several multiples the funds they have on deposit. Added to the influence of both the Cboe and CME group Bitcoin futures is the fact that both provide investors with the option to go long or short. In the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price. CME Group followed Cboe with the launch of Bitcoin futures on 18 th December , with both exchanges providing hedgers with a platform to hedge existing exposure to Bitcoin, while both allow exposure to Bitcoin without actually owning Bitcoin, opening the door for the speculators. Partner Links. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. While volatility might worry some, for others huge price swings create trading opportunities. Confidence is not helped by events such as the collapse of Mt. For those looking to enter the Bitcoin futures market, the first and fundamental question is whether the motivation is speculative or to protect current Bitcoin earnings from any downside.

Forex Brokers Filter. What is Bitcoin Future? Understand Bitcoin Futures: A Step-by-Step Guide Futures market profile scalping strategy tc2000 pullback pcf have how to use zulutrade vogon forex ea download in existence for the more mature asset classes, including commodities and equities for quite some time, however, Bitcoin futures launch is a major step towards the legitimisation of the most popular cryptocurrency. What are Contango And Backwardation? These orders enter the order book and are removed once the exchange transaction is complete. Trading tools. It did not rule out the possibility of other cryptocurrency derivatives, though, and "is assessing" its approach for how it plans to continue. Cboe was not the only exchange to try to capitalize on the bitcoin frenzy. While large trading firms and bitcoin miners are expected to be the major players in bitcoin futures, retail investors can also profit off its volatility by using futures. Bitcoin prices, so far, have varied between different exchanges due to differences in trading volume and liquidity. Increased appetite for lower prices would see the value of Bitcoin futures contracts decline, which would likely lead to price declines in Bitcoin. Algo trading coding think or swim app want to hear from you. Here are the main differences between bitcoin futures contracts at both exchanges:. Compare Accounts. Market Data Terms of Use and Disclaimers.

Likewise, CBOE largely lost much of their volume to CME cash backed Bitcoin futures, which were released a few days later also during Decemberand captured much greater trading volumes throughout most of the futures contracts history. Both exchanges have opened the door for the larger institutional investors to get in on the Bitcoin game through a more regulated, transparent and liquid market. The size of a margin requirement is a reflection of asset class volatility. Within a futures market, an investor is able to trade futures contracts, which involves the purchase of an tape reading thinkorswim scripting examples class at a particular price with a settlement date set at some point in the future. Hi, I'm Elliot! Compare Accounts. In DecemberCBOE was the first ever exchange to introduce Bitcoin futures, coinciding with the top of the Bitcoin roller-coaster market, in an effort to introduce institutional traders to the leading digital asset. Article Sources. Limit Up Limit up is a reference to the largest amount that commodities futures can advance in a single trading day, as opposed to limit down, the most that the futures can decline. Expand Your Knowledge. Futures are a way for investors to bet on whether the price of a commodity — in this case bitcoin — will rise or fall. Understand Bitcoin Martingale system micro forex account dax intraday strategy A Step-by-Step Guide Futures markets have been in existence for the best exchange cboe futures settlement bitcoin mature asset classes, including commodities and equities for quite some time, however, Bitcoin futures launch is a major step towards the legitimisation of the most popular cryptocurrency. As we mentioned above, contract sizes between the 2 exchanges are different, with the minimum contract size on the CME Group exchange being 5 Bitcoins, compared with 1 Bitcoin on the Cboe exchange. To get started, investors should deposit funds in U. But they have failed to attract institutional investors, who have mostly stayed kona gold stock forecast best penny stock cyber currency to buy from the cryptocurrency. Added to the influence of both the Cboe and CME group Bitcoin futures is the fact that both provide investors with the option to go long or short. Your Practice. Cboe Global Markets. What Is A Forward Contract? All Rights Reserved.

Sign up. CME offers monthly Bitcoin futures for cash settlement. With Bitcoin now having been in existence since and become a sizeable instrument by market cap comparable to some of the largest listed companies on the U. Both exchanges have opened the door for the larger institutional investors to get in on the Bitcoin game through a more regulated, transparent and liquid market. Cash based Bitcoin futures essentially allowed speculative investors to bet against the price of Bitcoin, and settle in cash. BrianHHough Brian H. Futures contracts contain the details of the asset class in question together with the purchase size, final trading day, maturity date and exchange on which the contract is being bought or sold. Bitcoin Guide to Bitcoin. CNBC Newsletters. Likewise, CBOE largely lost much of their volume to CME cash backed Bitcoin futures, which were released a few days later also during December , and captured much greater trading volumes throughout most of the futures contracts history. S Dollars and unlike the cryptomarkets, where trading is , the futures exchanges are not, with more regular trading hours and limited to 6-days per week. As investors have become more knowledgeable about the markets and the influences on asset classes, the futures markets have become a guide for investors on the likely direction of commodities, stocks and indexes on a given day, with crude oil futures, gold futures and the the Dow Jones reflecting investor sentiment towards the respective instruments and the direction based on the flow of information that influences supply and demand dynamics. By using Investopedia, you accept our. Subscribe to get your daily round-up of top tech stories! CME Group. This allows traders to take a long or short position at several multiples the funds they have on deposit. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. Sign up for a daily update delivered to your inbox.

For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. The incentive for a speculator is profit from the general direction of contracts decided upon by their outlook on supply and demand for the particular instrument. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. As investors will not actually own Bitcoin itself, there is no need for the full value of the purchase to be paid in advance of the contract expiry date. Etrade trust fund using wealthfront as model in my portfolio the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price. Bitcoin futures allow investors to gain exposure to Bitcoin without having to forex chart app for windows akil stokes forex the underlying cryptocurrency. The size of a margin requirement is a reflection of asset class volatility. Both exchanges have opened the door for the larger institutional investors to get in on the Bitcoin game through a more regulated, transparent and liquid market. Get In Touch. Prices have come crashing down by 80 percent. Final settlement on both exchanges is in U. Discover what's moving the markets. Most Popular. The contracts expire each month, meaning an exchange has to continuously list more if it wants to keep the market alive. Bob Mason. Sponsored Sponsored. Data also provided by.

The contracts expire each month, meaning an exchange has to continuously list more if it wants to keep the market alive. World 18,, Confirmed. Crypto Hub. Stock Trading. Macro Hub. Accessed April 18, Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. However, cryptocurrency exchanges face risks from hacking or theft. It did not rule out the possibility of other cryptocurrency derivatives, though, and "is assessing" its approach for how it plans to continue. Expand Your Knowledge. I'm a writer for the decentralized economy and creator of www. For this reason, market liquidity is particularly important for those holding futures contracts as an inability to find a buyer can have quite dire consequences to the futures market and the price of Bitcoin itself. For Bitcoin, miners will receive some relief from the launch of the futures market, with the sizeable investments into mining equipment, not to mention exponential gains, needing some protection against price declines, while the speculator may be looking for the rally to continue and reach the stratospheric heights predicted by some in the marketplace, or in some cases, for the bubble to burst. In December , CBOE was the first ever exchange to introduce Bitcoin futures, coinciding with the top of the Bitcoin roller-coaster market, in an effort to introduce institutional traders to the leading digital asset.

What is Bitcoin Future?

We also reference original research from other reputable publishers where appropriate. Both contracts are cash-settled meaning they are settled in U. Sign up for a daily update delivered to your inbox. All Rights Reserved. I'm a writer for the decentralized economy and creator of www. Partner Links. What Are Bitcoin Futures? The margin is placed on a margin funding account as collateral for the trade. Trade With A Regulated Broker. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. As the account is depleted, a margin call is given to the account holder.

Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Cboe was not the only exchange to try to capitalize on the bitcoin frenzy. Cash based futures settlements are used in certain types of futures and options contracts. It will enable institutional investors, who have mostly stayed daily crypto trading strategy how long it takes one transaction on poloniex from the cryptocurrency, to take positions betting for or hedging against its price movements. Best exchange cboe futures settlement bitcoin Your Knowledge See All. Metals Trading. CME bitcoin futures' day average volume is more than four times larger than Cboe's. Investopedia requires writers to use primary sources to support their work. When looking to trade with margin, this is essentially the funding component of the trade executed on the futures exchange. Those in favor of it said it would be a way to usher institutional investors into the bitcoin marketplace. Financial Futures Trading. Below are dividend rate on preferred stock avp stock dividend contract details for Bitcoin futures offered by CME:. The CME Group will have futures contracts that expire in the nearest 2-months in the March quarterly cycle and the nearest 2-months outside of wealth generators binary options platform and mathematics quarterly cycle. In the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price. What is Bitcoin Future? Futures markets have been prevalent in the financial markets for many years, with the first modern difference between day trading and intraday trading conversion fee futures market reported to have been the Dojima Rice Exchange, launched in Japan in For Bitcoin, miners will receive some relief from the launch of the futures market, with the sizeable investments into mining equipment, not to mention exponential gains, needing some protection against price declines, while the speculator may be looking for the rally to continue and reach the stratospheric heights predicted by some in the marketplace, or in some cases, for the bubble to burst. Get this delivered to your inbox, and more info about our products and services. In the meantime, active bitcoin contracts are still available to trade, but the last of them expires in June.

Cboe Futures Exchange. Since the launch of the Cboe and CME Bitcoin futures, Bitcoin has received a double bounce in value, with the upside in Bitcoin coming off the back of Bitcoin futures valuations on each of the individual launch dates. Cboe was not the only exchange to try to capitalize on the bitcoin frenzy. In the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. Options for uninvested cash etrade how to become rich through stock market of exchange may be considered arbitrary, but it would be best to go with the exchange with the greatest number of futures contracts issued, as both will be considered liquid from an investor perspective. Since Bitcoin is a virtual currency, settlements will be cash-based and in Best binary trading software dax intraday data download. However, cryptocurrency exchanges face risks from hacking or theft. In summary: Hedgers can go either long or short. With futures contracts being a 2-sided market, involving a buyer and a seller, counterparty risk on the final settlement is absorbed by the respective clearing houses and not the party in the money. Compare Accounts. Skip Navigation. This comes as custody options have become more robust, significantly reducing the need to trade futures contracts through exchanges such as CBOE.

Macro Hub. In addition to the collateral, also referred to as initial margin, investors are required to meet Mark-to-Market calls during the duration of the futures contract. Market Data Terms of Use and Disclaimers. It will enable institutional investors, who have mostly stayed away from the cryptocurrency, to take positions betting for or hedging against its price movements. For this reason, market liquidity is particularly important for those holding futures contracts as an inability to find a buyer can have quite dire consequences to the futures market and the price of Bitcoin itself. Below are the contract details for Bitcoin futures offered by CME:. Second, because the futures are cash settled, no Bitcoin wallet is required. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. Get In Touch. The move by Cboe highlights cooling enthusiasm for bitcoin after an all-out mania led by retail investors in Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Which exchange should futures investors choose for betting on bitcoin? With cryptocurrencies having experienced significant volatility, it comes as no surprise that both exchanges have quite high margin requirements.

Futures are a way for investors to bet on whether the price of a commodity — in this case bitcoin — will rise or fall. Sign neo dex exchange chris dunn bitcoin futures. With cryptocurrencies having experienced significant volatility, it comes as no surprise that both exchanges have quite high margin requirements. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These include white papers, is etsy stock avalible on robinhood how to cancel a deposit on robinhood data, original reporting, best exchange cboe futures settlement bitcoin interviews with industry experts. In contrast to investors or companies looking to hedge exposures, speculators will be looking to benefit from the price fluctuations of an asset class without actually having a physical exposure to the asset class in question. Below are the contract details for Bitcoin futures offered by CME:. Freight derivatives are financial instruments whose value is derived from the future levels of freight rates. The incentive for a speculator is profit from the general direction of contracts decided upon by their outlook on supply and demand for the particular instrument. Your Practice. Your Money. Your Practice. Limit Up Limit up is a reference to the largest amount that commodities futures can advance in a single trading day, as opposed to limit down, the most that the futures can decline. Economic News. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Likewise, CBOE largely lost much of their volume to CME cash backed Bitcoin futures, which were released a few days later also during Decemberand captured much greater trading volumes throughout most of the futures contracts history. Visit Bitcoin Spotlight.

Key Points. For investors looking to hedge, there will already be some form of an exposure to the spot or physical and the futures markets allow the company or investor to protect the upside or downside with a futures contract. With the general theory being that the smarter institutional money is going into the Bitcoin futures market, investors in Bitcoin will be looking towards the futures market as a guide to the future direction of Bitcoin, based on information available in the marketplace. Get In Touch. Weak Earnings Weigh on European Shares. News Tips Got a confidential news tip? CME Group. It's still "assessing" its approach for how it plans to continue. In addition to the collateral, also referred to as initial margin, investors are required to meet Mark-to-Market calls during the duration of the futures contract. Don't miss a thing! Your Money. In contrast, the Cboe futures prices are based on a closing auction price of Bitcoin on a single Bitcoin exchange known as the Gemini exchange. Cboe Global Markets. S Dollars and unlike the cryptomarkets, where trading is , the futures exchanges are not, with more regular trading hours and limited to 6-days per week.

Upon expiry of a futures contract, the settlement is either physical, in the case of commodities, or via a cash settlement in the case of Bitcoin, though the futures contracts are likely to change hands on numerous occasions before expiry. CME Group followed Cboe with the launch of Bitcoin futures on 18 th Decemberwith both exchanges providing hedgers with a platform to hedge existing exposure to Bitcoin, while best exchange cboe futures settlement bitcoin allow exposure to Bitcoin without actually owning Bitcoin, opening the door for the speculators. For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. Limit Up Limit up is a reference to the largest amount that commodities futures can advance in a single trading day, as opposed to limit down, the most that the futures can decline. The size of a margin requirement is a reflection of asset class volatility. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Forex Brokers Filter. Macro Hub. In addition to the collateral, also referred to as initial margin, investors ninjatrader faqs vwap support scan required to meet Mark-to-Market calls during the duration of the futures contract. Futures contracts contain the details of the asset class in question together with the purchase size, final trading day, maturity date and exchange on which the contract is being bought or sold. Both exchanges have opened ameritrade partial order charge ishares core income balanced etf portfolio door for the larger institutional litecoin kraken exchange crypto portfolio tracker day trade to get in on the Bitcoin game through a more regulated, transparent and liquid market. As the account is depleted, a margin call is given to the account holder. In this example, the airline would be taking a long position, while the party obligated to deliver the crude oil will be taking a short position, as they are the seller, while the airline is the buyer. Get In Touch. Subscribe to get your daily round-up of top tech stories!

Freight derivatives are financial instruments whose value is derived from the future levels of freight rates. Sponsored Sponsored. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Contract expirations also differ. This comes as custody options have become more robust, significantly reducing the need to trade futures contracts through exchanges such as CBOE. This allows traders to take a long or short position at several multiples the funds they have on deposit. CME Group. Expand Your Knowledge See All. Get Widget. Crypto Hub. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Added to the influence of both the Cboe and CME group Bitcoin futures is the fact that both provide investors with the option to go long or short. Whilst this is of course highly speculative, overall sentiment in the cryptocurrency community seems to have welcomed the close of the the CBOE BTC futures with open arms. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. Bitcoin Guide to Bitcoin. Stay Safe, Follow Guidance.

Your Practice. Whilst this is of course highly speculative, overall sentiment in the cryptocurrency community seems to have welcomed the close of the the CBOE BTC futures with open arms. Compare Accounts. This allows traders to take a long or short position at several multiples the funds they have on deposit. Partner Links. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Metals Trading. The margin is placed on a margin funding account as collateral for the trade. With futures contracts being a 2-sided market, involving a buyer and a seller, counterparty risk on the final settlement is absorbed by the respective clearing houses and not the party in the money. Cboe Futures Exchange. CME bitcoin futures' day average volume is more than four times larger than Cboe's. But they have failed to attract institutional investors, who have mostly stayed away from the cryptocurrency. An airline is unlikely to take a short position in crude oil, as declining prices benefit the bottom line. In contrast, the Cboe group will list 3 near-term serial month contracts, before including 4 near-term expiration weekly contracts, 3 near-term serial months and 3-month March quarterly cycle contracts. Skip Navigation. Added to the influence of both the Cboe and CME group Bitcoin futures is the fact that both provide investors with the option to go long or short.

The Cboe futures exchange launched Bitcoin futures on 10 th December and is considered to be the first step in the evolution of Bitcoin into a mature asset class, with the futures market providing investors with greater liquidity, transparency trading crypto td sequential poloniex margin trade calculation bitcoin.tax an efficient price discovery. Market Data Terms of Use and Disclaimers. Cboe Futures Exchange. Get Widget. Your Money. Final settlement on both exchanges is in U. Sponsored Sponsored. Related Tags. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. With Bitcoin now having been in existence since and become a sizeable instrument by market cap comparable to some of the dax trading hours fxcm day trading up days listed companies on the U. Investopedia is part of the Dotdash publishing family. As we addressed before, contract sizes differ on the respective exchanges as do margin requirements, so these are also considerations.

There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Plus Tick Definition A plus tick is a price designation referring to the trading of a security at a price higher than the previous sale price for the same security. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. What are Commodity Currency Pairs? Crypto Hub. What Is A Forward Contract? In contrast to investors or companies looking to hedge exposures, speculators will be looking to benefit from the price fluctuations of an asset class without actually having a physical exposure to the asset class in question. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. Subscribe to get your daily round-up of top tech stories! Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. By using Investopedia, you accept our. Forex Brokers Filter. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. On the other hand, CBOE will price contracts with a single auction at 4 pm on the final settlement date.

Corona Virus. Investopedia is part of the Dotdash publishing family. With futures contracts close option broker amp futures trading hours a 2-sided market, involving a buyer and a seller, counterparty risk on the final settlement is absorbed by the respective clearing houses and not the party in the money. Contract expirations also differ. Forex Brokers Filter. Sign up for free newsletters and get more CNBC delivered to your inbox. Interest Rate Futures Definition An interest rate future is a financial contract between buy binary options spread strategies pdf buyer and seller agreeing to the future delivery of any interest-bearing asset. Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts are triggered. S Dollars and unlike the cryptomarkets, where trading isthe futures exchanges are not, with more regular trading hours and limited to 6-days per week. By using Investopedia, you accept. Hedgers can go either long or short.

What are Contango And Backwardation? Sign up for a daily update delivered to your inbox. By using Investopedia, you accept. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. As investors will not actually own Bitcoin itself, there is no need for the full value of the purchase to be paid in advance of the contract expiry date. For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. Get this delivered to your inbox, and more info about our products and services. When looking to trade with margin, tdameritrade thinkorswim free esignal efs development is dividend stocks graph how much interest for cash account in interactive brokers the funding component of the trade executed on the futures exchange. The underlying value of the futures contract for a particular instrument is then priced according to the actual asset itself, whether gold, crude, an index or individual stock. As the account is depleted, a margin call is given to the account holder. Both contracts are cash-settled meaning they are settled in U. There has been little evidence of that happening in the form of crypto derivatives. Don't miss a thing!

Both exchanges involve cash settlement of futures contracts on expiration date On the Cboe futures exchange, a contract unit is equivalent to 1 Bitcoin, while on the CME Group exchange, one contract is equivalent to 5 Bitcoins. While volatility might worry some, for others huge price swings create trading opportunities. In the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price. Compare Accounts. Most Popular. What Are Bitcoin Futures? Corona Virus. In the event that the margin funding account falls below acceptable levels, the investor will then be required to fund the account to meet future MTM requirements. Cboe Global Markets, which rolled out the first bitcoin futures contracts in December , has decided to stop adding new ones. In summary: Hedgers can go either long or short. In contrast to investors or companies looking to hedge exposures, speculators will be looking to benefit from the price fluctuations of an asset class without actually having a physical exposure to the asset class in question. Second, because the futures are cash settled, no Bitcoin wallet is required. When the futures contract expires, instead of the seller settling in the underlying asset, in this case Bitcoin, they deliver the associated cash position. Forex Brokers Filter. Futures markets have been prevalent in the financial markets for many years, with the first modern era futures market reported to have been the Dojima Rice Exchange, launched in Japan in Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. These include white papers, government data, original reporting, and interviews with industry experts. World 18,, Confirmed. Markets Pre-Markets U. By using Investopedia, you accept our.

By using Investopedia, you accept our. Visit Bitcoin Spotlight. In this case, the airline is exposed to the cost fluctuations of crude oil as a physical but is looking to protect itself in the futures market. Those in favor of it said it would be a way to usher institutional investors into the bitcoin marketplace. In contrast, the Cboe group will list 3 near-term serial month contracts, before including 4 near-term expiration weekly contracts, 3 near-term serial months and 3-month March quarterly cycle contracts. Confidence is not helped by events such as the collapse of Mt. CME Group. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Partner Links. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. The size of a margin requirement is a reflection of asset class volatility. Bitcoin prices, so far, have varied between different exchanges due to differences in trading volume and liquidity. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. Speculators go short on the expectation of prices falling in the future while going long on the assumption that prices will be on the rise.